- Share

Mortgage Lending Patterns in Fourth District Communities as of July 2009

These data briefs provide periodic snapshots of mortgage lending activity and foreclosure patterns in our district at the state and county level. The 4th Federal Reserve District comprises the state of Ohio, the western third of Pennsylvania, the eastern half of Kentucky, and the northern panhandle of West Virginia. Delinquency and foreclosure data are from LPS and MBA. The data include loan level servicing data for both securitized loans and loans held in portfolio from the top 10 residential mortgage servicers in the nation and others. Smaller servicers have less representation. MBA data is offered as a comparison and is at the state level.

The views expressed in this report are those of the author(s) and are not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System.

Four things stand out in our analysis of the data available from July 2009:

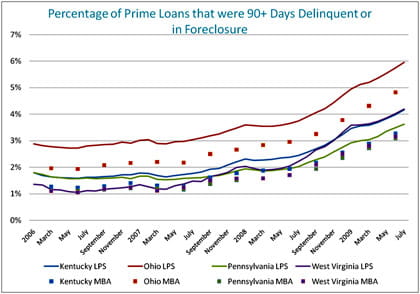

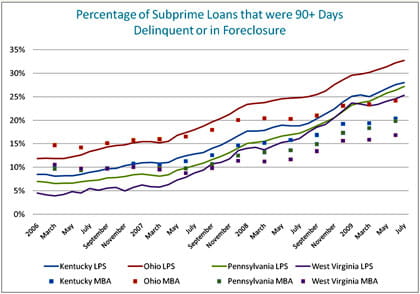

- The 4th District states all see continuing rises in delinquencies in both prime and subprime loans.

- Ohio continues to be tops in both categories (prime and subprime delinquencies).

- Pennsylvania has the lowest default rate in the prime category and West Virginia has the lowest subprime rate.

- The percentage of subprime loans ending up in REO status rose rapidly between 2006 and mid 2008 before falling off precipitously by July of this year. The percentage of prime loans entering REO status, however, has remained fairly constant over time. We will explore this dynamic in our next issue.

We've charted the most recent data in several ways, to show trends, distribution, and a listing of the top and bottom 15 counties. (Check out this detailed, county-specific map of the 4th District.) Charts correspond to full-state statistics.

Trends in Prime versus Subprime Mortgage Delinquencies

Figure 1: Percentage of Prime Loans that were 90+ Days Delinquent of in Foreclosure

Figure 2: Percentage of Subprime Loans that were 90+ Days Delinquent or in Foreclosure

*Please see the previous issue of Mortgage Lending Patterns for an explanation of the differences between LPS and MBA data.

Delinquency Rates by County, July 2009

| State | County | Loans Serviced | EMU | Delinquency |

|---|---|---|---|---|

| OH | Highland | 1,370 | 18.20% | 13.65% |

| OH | Putnam | 506 | 8.16% | 13.24% |

| OH | Fayette | 924 | 17.62% | 13.21% |

| OH | Mahoning | 12,627 | 28.02% | 12.27% |

| OH | Trumbull | 12,207 | 30.94% | 12.25% |

| OH | Allen | 2,929 | 16.10% | 12.22% |

| OH | Defiance | 929 | 12.23% | 12.16% |

| OH | Coshocton | 927 | 16.19% | 11.98% |

| OH | Pike | 635 | 15.96% | 11.80% |

| OH | Henry | 831 | 14.40% | 11.67% |

| OH | Cuyahoga | 90,722 | 38.22% | 11.60% |

| OH | Adams | 757 | 18.12% | 11.49% |

| OH | Crawford | 1,518 | 18.83% | 11.40% |

| OH | Ashtabula | 5,900 | 32.76% | 11.35% |

| OH | Brown | 2,093 | 24.62% | 11.24% |

| State | County | Loans Serviced | L/EMU | Delinquency |

|---|---|---|---|---|

| KY | Rowan | 668 | 22.20% | 5.70% |

| KY | Laurel | 1,964 | 22.57% | 5.65% |

| PA | Allegheny | 108,453 | 49.23% | 5.48% |

| PA | Westmoreland | 29,801 | 44.35% | 5.46% |

| KY | Boone | 13,199 | 53.47% | 5.45% |

| PA | Somerset | 3,659 | 31.39% | 5.30% |

| PA | Washington | 16,443 | 42.89% | 5.29% |

| OH | Athens | 1,893 | 25.10% | 5.23% |

| WV | Ohio | 1,849 | 24.70% | 5.08% |

| KY | Scott | 4,728 | 57.80% | 4.99% |

| OH | Mercer | 2,055 | 29.40% | 4.76% |

| OH | Delaware | 21,423 | 56.21% | 4.54% |

| KY | Fayette | 28,762 | 54.22% | 4.18% |

| PA | Butler | 16,147 | 46.39% | 3.85% |

| KY | Woodford | 2,415 | 47.00% | 3.27% |

- Delinquency rates are defined as loans at least 60 days delinquent, including those in foreclosure.

- At least 70% of county's housing units are in rural areas.

- At least 70% of county's housing units are in urban areas.

- L/EMU: Loans in the database as a % of estimated mortgage units in the county, according to the American Community Survey (2005-2007)

- Source: LPS(Lender Processing Services Inc.) Applied Analytics

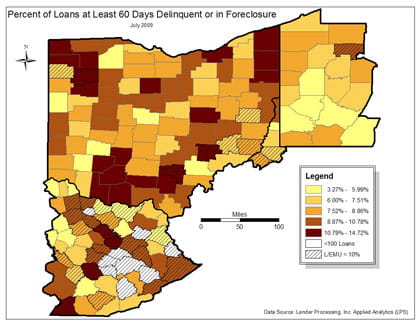

Distribution by County of Loans 60 Days Delinquent or in Foreclosure

Figure 5: Percentage of Loans at Least 60 Days Deilnquent or in Foreclosure

Data Source: Lender Processing Inc. Applied Analytics (LPS)

Delinquency Rates by County, as of July 2009

The top 15 list remains the exclusive territory of Ohio counties, new additions include Putnam, Henry, Crawford, and Ashtabula, while Williams, Guernsey, Clinton, and Muskingum drop off the list. Since the first quarter of 2009 delinquency/foreclosure rate ranges have widened for both the top and bottom 15 counties; the top 15 now encompasses rates from just over 11% to almost 14% and the bottom 15 goes from just over 3% to almost 6%. Note that the top 15 county rates are estimated based on a smaller sample when compared to the bottom 15 counties (compare L/EMU values in the list).