- Share

Understanding the Federal Reserve’s Structure

Keeping our economy safe and sound since 1913

The Federal Reserve is the central bank of the United States. It's a hybrid System of national offices and regional Districts, including the Cleveland Fed's. Our unique structure supports our mission to foster a safe and stable monetary system that works for all.

Why the Federal Reserve was created

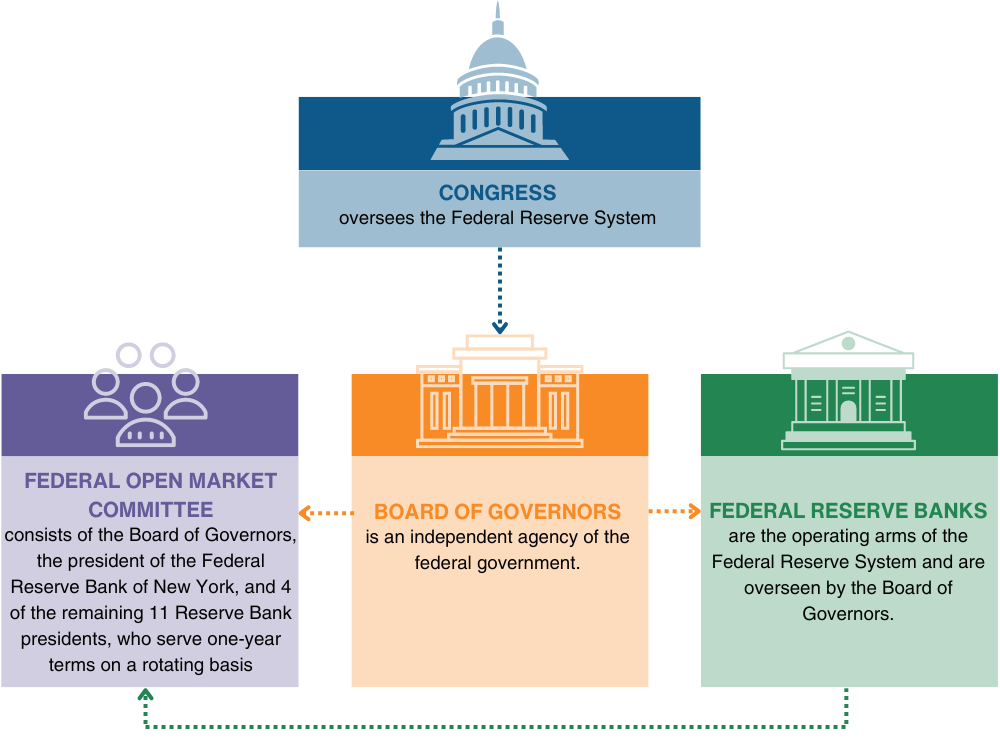

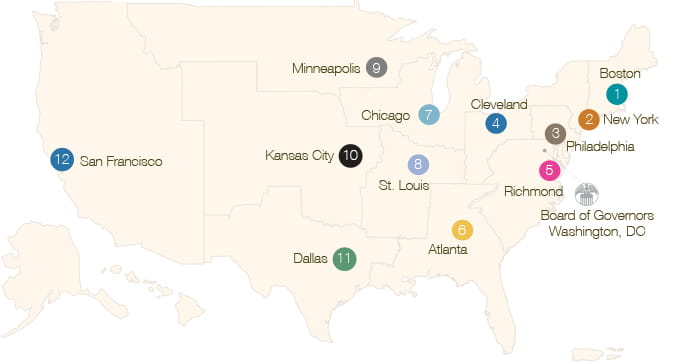

Congress established the Federal Reserve System in 1913 as the central bank to provide the nation with a safer, more flexible, and more stable monetary and financial system. The Federal Reserve System, also referred to as the Fed, includes 12 independent, regional Reserve Banks throughout the United States, the Board of Governors in Washington DC, and the Federal Open Market Committee (FOMC).

The Federal Reserve is the third central bank established in US history. The first and second “banks of the United States” failed in the nineteenth century. The turbulence of the financial markets at the beginning of the twentieth century led to the creation of the Federal Reserve, an innovative, hybrid System of federal and regional entities.

How the Federal Reserve works

The Fed’s decentralized structure helps us monitor economic conditions closely and understand the challenges facing communities, industries, and small businesses in different parts of the country. We are nonpartisan and independent by design, insulated from short-term political considerations to work for the longer-run best interests of the US economy.

In times of crisis, we ensure that money keeps flowing through the economy, and we do what we can to soften the impact of the fluctuations of financial markets.

Congress gave the Fed two goals, often called a dual mandate:

- price stability—so that your dollar is worth about the same tomorrow as it is today.

- maximum employment—the highest level of employment the economy can sustain while keeping a stable rate of inflation.

We work toward these goals mainly by influencing interest rates and supporting financial stability.

The Federal Reserve structure and its functions

One of the most unique and important aspects of the Federal Reserve’s decentralized structure is the participation of the American public in the ongoing operations of the 12 Reserve Banks.

There are 12 regional Reserve Banks that work independently with oversight from the Board of Governors in Washington DC. The Reserve Banks are the operating arms of the Federal Reserve System and function within their own geographical Districts. The Fed identifies its districts by number and the city in which its main office is located. The region served by the Federal Reserve Bank of Cleveland is known as the Fourth District.

Each Reserve Bank has a nine-member board of directors that serves as a link between the Federal Reserve and the private sector. Directors come from a range of backgrounds and bring valuable insights into the economic conditions within each District.

Regional Reserve Banks in action

Research and listening inform leadership

Led by its President, each Bank provides monetary policy leadership informed by robust economic research in its areas of specialty and by listening to the perspectives of the people in its District.

Active engagement facilitates learning

Each Bank actively engages with a wide range of regional businesses and community leaders, listening to and learning from the on-the-ground experiences of community members, which come together in reports like the Beige Book.

Supervision supports a safe and sound financial system

Reserve Banks supervise individual financial institutions to ensure that banks are operating in a safe and sound manner. Understanding the financial health, deposit and lending practices of financial institutions in each District help inform the decisions we make in monetary policy and the actions we take.

Innovation enables efficient and accessible payments

Each Regional Bank supports the nation’s payments system, through the circulation of cash throughout the economy, but also work for the US Treasury. Have you ever applied for a passport? Or purchased a souvenir from a national park gift shop using a credit card? If so, you’ve touched applications designed, developed, and managed by the Cleveland Fed’s Treasury Services teams.

Listening to communities to gather insights

Reserve Banks promote consumer protection and community development by engaging with local community members and leaders, including low- to moderate-income (LMI) areas to understand economic conditions and access to economic opportunity. The Cleveland Fed studies workforce development, housing, and small business issues to contribute to the national conversation.

Specialization contributes to the System

Each Regional Bank provides input that benefits all, for instance: The Cleveland Fed is home to the Center for Inflation Research, a leading resource for “all things inflation”, including commentary, research, analysis on inflationary trends and an inflation-related events program.

Board of Governors

The Board of Governors is a federal agency in Washington DC and the governing body of the Federal Reserve System. The Board has seven members, or “governors,” who are nominated by the president of the United States and confirmed by the Senate. These governors guide all aspects of the operations of the Federal Reserve and its five key functions. The Board is accountable to Congress, which designed the Fed to perform its duties free from short-term political influence.

Federal Open Market Committee

The FOMC sets national monetary policy. The committee consists of 12 voting members—the seven governors, the president of the Federal Reserve Bank of New York, and four of the other 11 Reserve Bank presidents who serve one-year terms on a rotating basis.

Fed governors and the Reserve Bank presidents share insights into regional conditions in their Districts. The FOMC meets in Washington DC eight times a year. During the meetings, its members

- review regional financial and economic conditions and release economic projections

- set monetary policy by voting on key decisions about interest rates

- communicate with the public about their decisions

Learn more about the Cleveland Fed

About the Cleveland Fed

Headquartered in Cleveland, with branches in Cincinnati and Pittsburgh, our District is known for manufacturing and our Bank specializes in inflation research and US Treasury payment systems.

Ready to learn more about the Federal Reserve?

Visit federalreserve.gov to view The Fed Explained: What the Central Bank Does that provides further details about the structure, responsibilities, and work of the US central banking system.

Careers

Explore opportunities for meaningful work. View job descriptions, application requirements, our hiring process, and our compensation and benefits.

News and Events

View all news and events from the Federal Reserve Bank of Cleveland.