- Share

Good News and Bad News on Small Business Lending in 2014

Last year brought better news for U.S. small businesses. Reports indicate that, in the aggregate, the financial condition of small businesses has improved, and the lending environment has become friendlier to small firms seeking credit. In turn, lending is on the rise.

But if the news is better, then the apt question is, "Better than what?" Certainly, the upbeat tone of data released in recent months indicates that trends are moving in the right direction. At the same time, some of that progress represents just a fraction of the ground lost during the recession.

The views expressed in this report are those of the author(s) and are not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System.

While large business loans have soared to record levels, small business lending is losing ground

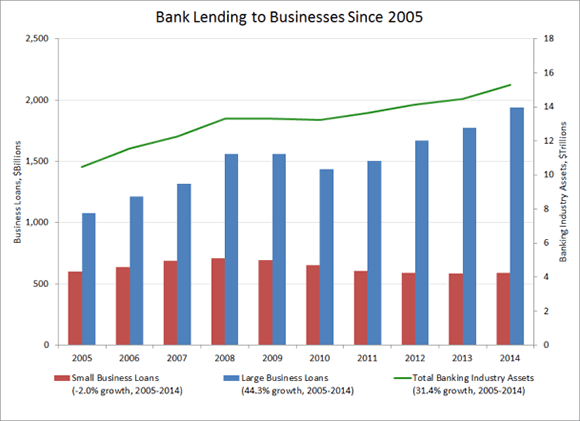

Using bank loans under $1 million as a proxy for small business lending, we can estimate the impact of the recession on small business credit. Figure 1 charts bank lending to businesses during the past 10 years. The data show that the volume of small loans, those under $1 million, dropped significantly between 2008 and 2012, and has barely recovered. Small business loans now stand 17 percent below the peak reached prior to the recession. While small commercial and industrial loans grew 3.4 percent over the past year, this modest improvement does not provide strong assurances about the health of lending in this space. In contrast, lending to larger businesses (loans greater than $1 million) bounced back quickly and loans outstanding are now more than 24 percent higher than pre-recession levels.

Many small businesses are still recovering from the recession and demand for loans is tepid

The decline in small loan originations appears to be a result of several factors. Data provide evidence that through the recession and the post-recession period, the supply of credit was limited and demand for credit weakened. (For more detail, see “Why Small Business Lending Isn’t What It Used to Be.”) Though supply-side constraints appear to be easing, demand for credit remains somewhat soft. Two surveys of small business owners — the monthly National Federation of Independent Businesses (NFIB) survey and the quarterly Wells Fargo/Gallup survey— provide perspective on why this might be the case.

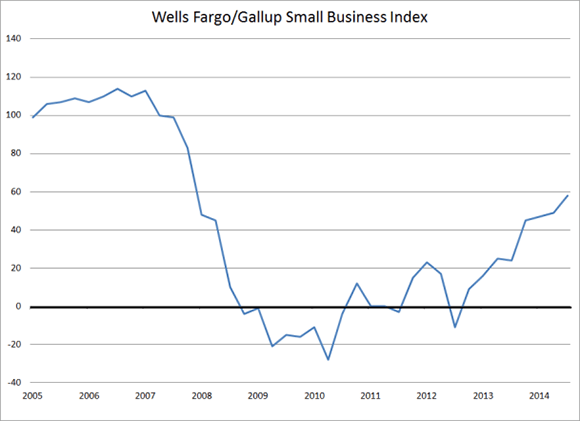

Both surveys show that optimism among small business owners has made gains in the past few years, but has not yet reached levels observed between late 2005 and early 2007. The NFIB Optimism index stood at 100.7 in October of 2006, fell to 81 in March 2009, and now stands at 96.1. In a similar display of strengthening but still tenuous optimism, the Wells Fargo/Gallup Small Business Index reached a high of 114 in late 2006, and sank to a low of -28 in 2010. As shown in Figure 2, the most recent reading was 58.

Figure 1

Banking Lending to businesses since 2005"

Source: Federal Deposit Insurance Corporation; author’s calculations. Note: All data shown are as of June 30 for the respective year, and include commercial and industrial loans and nonfarm nonresidential loans. Small loans are defined as those with values less than or equal to $1 million. Large loans are those with values that exceed $1 million.

Figure 2

Wells Fargo/Gallup Small Business Index

Source: Wells Fargo/Gallup Small Business Survey.

Relatedly, the financial condition of small firms has improved in recent years, but again, the improvement does not make up for all the ground lost during the recession. The most recent Wells Fargo/Gallup survey reveals that 60 percent of respondents describe their financial situation as "very good" or "somewhat good. " This is a marked improvement from the 48 percent who said so in early 2010, but the newest reading still falls short of the 72 percent who responded positively in late 2007. Responses on business owners’ cash flow rating follow a similar pattern. Most recently, 55 percent of respondents described their cash flow as "very good" or "somewhat good," up from 36 percent in 2010 but below the 62 percent level reached in the fourth quarter of 2007.

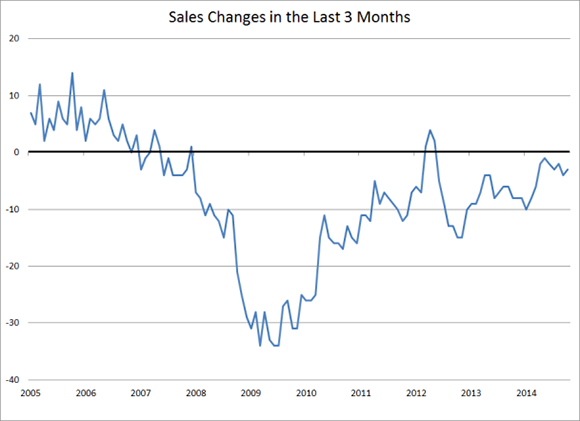

On other measures of financial strength, both surveys indicate that small businesses are faring somewhat better. The latest NFIB survey shows, for example, that the net percentage of businesses reporting higher sales in the prior three months is negative three (-3), indicating that a slightly higher share of businesses saw their sales decline than those that saw them increase (see Figure 3). This is an improvement over the negative 34 (-34) reading from mid-2009, but not yet in line with the positive reading of +11 from mid-2006. Similarly, the Wells Fargo/Gallup survey finds increases in recent and expected future revenues, but in neither case have the measures reached pre-recession highs.

Figure 3

Sales Changes in the Last Three Months

Source: National Federation of Independent Businesses, Small Business Economic Trends

Both surveys reveal weaker demand for credit. Back in early 2007, nearly 40 percent of respondents to the NFIB survey reported they were regular borrowers--that is, they borrowed at least once every 3 months. In October of 2014, only 28 percent said they were. On capital spending, the current NFIB and Wells Fargo/Gallup surveys show similar patterns: higher levels of both recent and planned capital spending, albeit at levels below pre-recession benchmarks.

On the supply side, bank lending standards give us insights on loan availability. The most recent Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) shows small business loan standards are easing. This iteration of the survey asks questions about standards for small business credit relative to the prior decade. More banks reported that standards are tighter now compared to the midpoint of the range of standards over the past decade. Banks reported higher standards for collateral, which could be problematic for those businesses that have not seen a full recovery in real estate values.

A healthy small business sector is important to economic growth

New and small firms serve an important function in our economy. Small businesses account for nearly half of private sector output and employment in the U.S. In addition, small firms – led by new small firms – have posted the highest net job creation rates going back to the 1970s. Coming out of the most recent recession, however, job creation by small businesses has lagged, and the new business formation rate continues to fall. While it is not clear that these trends are driven by weaker borrowing or limited access to loans, it is evident that businesses need adequate credit to succeed and grow. As such, policy makers should not lose sight of the trends related to small business credit, even with the recent positive reports showing improvements.