- Share

An Unstable Okun’s Law, Not the Best Rule of Thumb

Okun’s law is a statistical relationship between unemployment and GDP that is widely used as a rule of thumb for assessing the unemployment rate—why it might be at a certain level or where it might be headed, for example. Unfortunately, the Okun’s law relationship is not stable over time, which makes it potentially misleading as a rule of thumb.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Rules of thumb can be very useful. At their best, they can help us avoid huge mistakes—testing the bathwater with your elbow to save the baby from a scalding, for example. These rules are not complicated or ambiguous, which allows us to make snap decisions without costly errors. So it’s probably not a surprise that analysts attempt to use simple rules of thumb to describe economic phenomena. However, attempts to describe complex interactions in the economy with overly simple adages can lead to incorrect conclusions.

This Economic Commentary investigates one such rule of thumb, Okun’s law—which describes the empirical relationship between output growth and the unemployment rate—and argues that this heuristic is unstable across time, and as a result not very useful as a forecasting tool.

Okun’s Law in a Nutshell

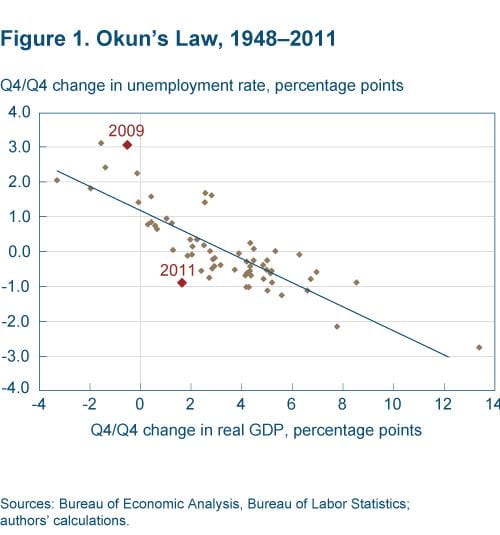

In its simplest form, Okun’s law is a linear regression that suggests there is a relationship between the growth rate of economic output and unemployment. It essentially predicts how much unemployment will decline as output grows by a certain amount or how much the unemployment rate will rise as output declines by a certain amount. Figure 1 traces out this relationship with annual data on real GDP growth and the unemployment rate from 1948 through 2011. The regression line that runs through the scatter plot implies that output growth above 3.4 percent is needed to see a decrease in the unemployment rate.

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics; authors' calculations.

If the simple version of Okun’s law were an accurate representation of the GDP growth–unemployment relationship, the behavior of real GDP growth and the unemployment rate since the onset of the 2007–09 recession would be puzzling. As highlighted in figure 1, real GDP growth contracted 0.5 percentage points during 2009, yet the unemployment rate jumped up a whopping 3.0 percentage points. More recently, the unemployment rate fell from 9.1 percent to 8.3 in 2011, but real GDP grew only 1.6 percent. That growth rate is roughly half of what our rule of thumb would suggest we need just to hold the unemployment rate constant.

As with any rule of thumb, its usefulness hinges on its applicability in a variety of settings and across different time periods. The initial example of the baby’s bathwater is still as true today as it was 100 years ago. For Okun’s rule to be useful as a rule of thumb, the relationship between real GDP growth and the unemployment rate needs to be stable across time. That is, we would need to have a reasonable expectation that today’s relationship between output and the unemployment rate would behave in the same way tomorrow. Unfortunately, that does not appear to be the case, making it harder to draw simple inferences about unemployment rate movements from observed changes in output growth.

Rolling Instability

The deviations from the regression line in figure 1 might be interpreted as the result of unusual circumstances that don’t hold in the long run. These data points could be temporary exceptions to the rule of thumb. For example, in 2009, firms might have shed far more workers than necessary in anticipation of further economic deterioration, but once the outlook appeared to be a little brighter, say in 2011, they could have started bringing their employment levels back in line with expected growth. Or perhaps the sluggishness of real GDP growth in the current recovery might have made employment gains hard to come by, pushing the 2011 data point far from the line. A third story might assume that data revisions will alter the picture for 2011.

Any of these explanations might sound reasonable, but knowing whether they actually hold is not straightforward. To pin down any explanation (or come up with others), we need to investigate the validity of the statistical relationship that is assumed to underlie them.

To assess the validity of Okun’s law, we need to examine how the relationship between output growth and the unemployment rate evolves over time. If the relationship is roughly constant across time, then it is a useful rule of thumb. If the relationship is not stable over time, it is harder to use Okun’s law to assess past movements in unemployment and forecast future movements.

We start testing stability by evaluating the simplest form of Okun’s law, the difference version. It states that the change in the unemployment rate is equal to the sum of the product of the change in real GDP times an estimated coefficient, plus an estimated constant and an error term.

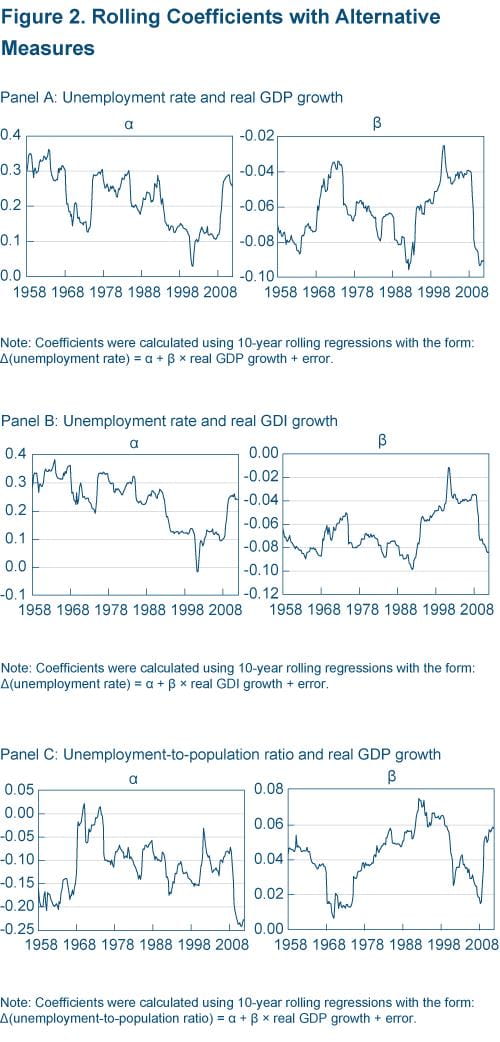

Using quarterly data on the change in the unemployment rate and the annualized quarterly change in real GDP, we estimate the coefficient on real GDP growth and the constant over a period of 10 years. Then we “roll” the estimation period forward one quarter and re-estimate the constant and coefficient over that 10-year period. We proceed this way throughout the sample, stopping at the end of 2011. Then, in figure 2, panel A, we gather up the coefficients and plot the estimates across time. A useful rule of thumb emerges if the estimates of the constant and the coefficient do not vary over time.

Panel A, B, & C: Note: Coefficients were calculated using 10-year rolling regressions with the form: δ(unemployment-to-population ratio) = α + β × real GDP growth + error.

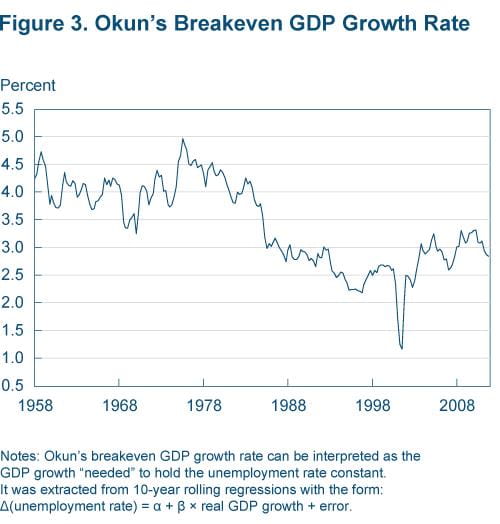

Notes: Okun's breakeven GDP growth rate can be interpreted as the GDP growth "needed" to hold the unemployment rate constatnt. It was extracted from 10-year rolling regressions with the form: δ(unemployment rate) = α + β × real GDP growth + error.

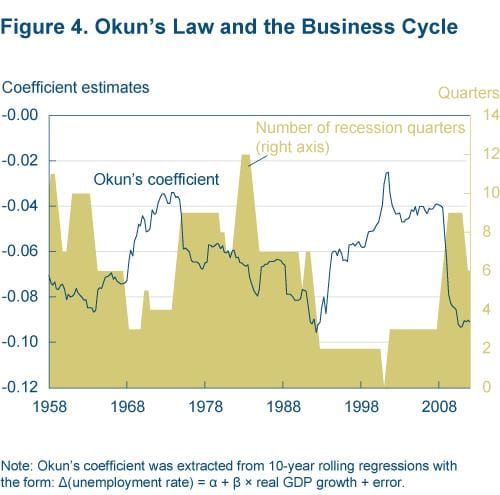

Note: Okun's ceofficient was extracted from 10-year rolling regressions with the form: δ(unemployment rate) = α + β × real GDP growth + error.

As you can see, the coefficients are far from stable. To illustrate exactly what this instability means, let’s take our regression equation and solve it for the coefficient on real GDP growth. In effect, we are going to calculate the output growth needed to hold the unemployment rate constant over time. To do so, we set the change in the unemployment rate equal to zero and solve for the coefficient on real GDP growth.

If Okun’s rule were stable across time, then the breakeven output growth rate would be fairly constant. Unfortunately, the output growth needed to hold the unemployment rate constant over time varies quite a bit, exhibiting a sizeable slowdown in the mid-1980s and dipping sharply in the early 2000s (figure 3). Interestingly, that sharp dip coincides with a 10-year window that did not include a recessionary quarter.

This finding agrees with research done by Edward Knotek in 2007, who found that the coefficient on real GDP growth is negatively correlated with the number of regression quarters in the sample period, and hence, the business cycle (see figure 4). This suggests that Okun’s law may hold only during business cycle downturns, and that during long expansions the relationship breaks down (a finding we confirm in an analysis we did in April of this year—see Burgen, Meyer, and Tasci in the recommended readings). Unfortunately, the simplest version of Okun’s law is not stable.

In Search of Stability

The instability of the simple linear form of Okun’s law is well known. Consequently, researchers have looked for other specifications of the law that produce a stable relationship between output growth and changes in the unemployment rate.

A variety of approaches have been explored, ranging from including additional explanatory variables in the equation to the use of regressions that allow for nonlinear changes in the relationship between output growth and changes in unemployment. Other variables tried under the former approach include real Gross Domestic Income (GDI) in the place of real GDP and the employment-to-population ratio in place of the unemployment rate as the summary statistic for labor market health.

The use of real GDI as the variable for output growth centers on the fact that real GDI is conceptually similar to real GDP. In fact, in the absence of measurement error they should be equal. The key difference is that GDP is calculated using expenditure data, while GDI uses an income-based approach. Jeremy Nalewaik suggests that GDI may give us a clearer picture of output growth because it tends to predict GDP revisions and varies more closely with other business cycle indicators (such as industrial production). Yet swapping GDI for GDP in the Okun’s law regressions still yields instability. This is shown in figure 2, panel B, where the coefficients still bounce around a lot and still switch signs in the late 1990s.

One particular feature of the current recovery is that unemployment has been coming down rather quickly relative to the employment-to-population ratio—which hasn’t improved much, if at all, since the end of the recession. This is mostly because labor force participation has been trending down significantly, even after the recession. Failure to account for shifting labor force participation in the simple version of Okun’s law could be a source of the instability. In other words, the rather atypical behavior we have seen in Okun’s law recently may be due to the unemployment rate being the wrong measure of labor market slack. It is for this reason that the employment-to-population ratio is sometimes used in Okun’s law regressions as an alternative measure of labor market slack.

Unfortunately, the employment-to-population ratio yields a result similar to the unemployment rate (figure 2, panel C). The estimates of the coefficients still show substantial variability over time. In the end, the instability evident in all of these specifications of Okun’s law—the simple formulation or the variations—suggests that none of them appears to correspond to what we actually see in the data.

The other approach to solving the instability problem is to adjust the regression so that it allows for nonlinear changes in the relationship between output growth and changes in unemployment over time. One way of doing this is to include lags of both the unemployment rate and real GDP growth in the regression. Edward Knotek performed this test as well, but the alteration did not produce a stable Okun’s law relationship over time.

Another approach to allowing the regression to reflect a changing relationship between output growth and unemployment changes is based on the fact that these measures follow longer-run or structural trends, which change over time. Accounting for these trend changes may solve the instability problem.

The longer-run trend in real GDP growth is often referred to as “potential” GDP—the label indicates that the trend is thought of as a measure of how fast the U.S. economy could grow, given its underlying structural productivity growth and population growth. The difference between how fast output is actually growing and how fast it could grow is commonly referred to as the output “gap.” The idea is that when output is growing below its potential pace, a gap opens up, which should put upward pressure on the unemployment rate (and vice versa).

Similarly, the unemployment rate is thought to have a slow-moving trend, so that an economy running at its potential would still have some unemployment, reflecting normal job churning. This trend unemployment rate is sometimes referred to as the “natural” rate of unemployment or the NAIRU (nonaccelerating inflation rate of unemployment). As the economy moves through a cycle of expansions and contractions around its potential, actual unemployment fluctuates around its own trend too.

Using a version of the regression that incorporates these gaps allows for changes in trend output and the trend unemployment rate, which may stabilize the regression coefficients. This line of reasoning implicitly argues that a robust relationship between output and unemployment exists—not between observed output growth and unemployment changes but between the gaps in both. Unfortunately, potential GDP and the natural unemployment rate are unobservable. Economists can only make educated guesses as to what these trends (and therefore the gaps) actually are.

So, while Okun’s relationship may become more stable, it becomes harder to interpret and more nuanced. Instead of uncovering the elasticity of output growth relative to the change in the unemployment rate, the gap version relates a deviation from trend output growth to the unemployment gap. That is to say, if output falls below potential then the unemployment rate will rise above its natural rate. If the coefficient on the output gap is constant when we roll our estimation period across time, then we’ll have a stable version of Okun’s law.

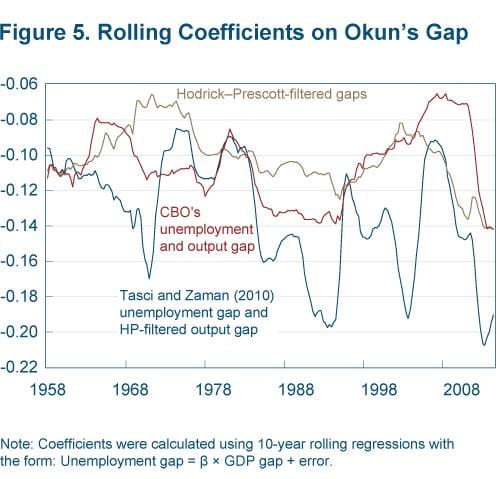

In recognition that gaps are hard to uncover we try a few different estimates: The Congressional Budget Office’s (CBO) estimate of the unemployment and output gaps, gaps created by detrending the observed data (using a Hodrick-Prescott filter), and a measure of the trend in the unemployment rate that takes into account the underlying labor market churn over time (Tasci and Zaman 2010). The coefficient that relates the output gap to the unemployment gap is plotted for each estimate in figure 5.

Note: Coefficients were calculated using 10-year rolling regressions with the form: Unemployment gap = β × GDP gap + error.

Unfortunately, these coefficients also suggest that Okun’s law is still unstable after incorporating information on the gaps. Moreover, the unobserved nature of the true potential GDP or the natural rate of unemployment makes matters worse. While the coefficients for these specifications never change signs over any given sample period, they do vary substantially over time and by the type of gap measure that we use.

Conclusion

We have shown that the simple rule of thumb dubbed Okun’s law is not stable over time. Given this instability, we judge that it’s not an appropriate rule of thumb. The adjustments to the basic form of Okun’s law that we investigated did not stabilize the relationship, and they just added complexity (an undesirable property for a rule of thumb).

There are many reasons why one should expect to see a dynamically changing relationship between output growth and changes in labor market slack. For instance, if one agrees with the idea that unemployment even in good times cannot go down to zero because of normal labor market churn, then there is no reason to expect a significant decline from this level in the unemployment rate as the economy experiences a long stretch of expansion. Figure 4 above confirms this point.

It would be folly to argue that there is no relationship between output growth and the unemployment rate. Unfortunately (for households and policymakers alike), fluctuations in the macroeconomy are more complicated than the simple linear relationship implied by most forms of Okun’s law. As far as we’re concerned, if a rule of thumb has a lot of exceptions, it’s not much of a rule.

Recommended Reading

- “How Useful Is Okun’s Law?” Edward Knotek, 2007. Federal Reserve Bank of Kansas City, Economic Review, no. Q IV, pages 73–103.

- “An Elusive Relation between Unemployment and GDP Growth: Okun’s Law,” by Emily Burgen, Brent Meyer, and Murat Tasci, Federal Reserve Bank of Cleveland, Economic Trends, 2012.

- “Estimating Probabilities of Recession in Real Time Using GDP and GDI," Jeremy J. Nalewaik, 2007. Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series, no. 2007-07.

- “Unemployment after the Recession: A New Natural Rate?” by Murat Tasci and Saeed Zaman, 2010. Federal Reserve Bank of Cleveland, Economic Commentary.

Suggested Citation

Meyer, Brent, and Murat Tasci. 2012. “An Unstable Okun’s Law, Not the Best Rule of Thumb.” Federal Reserve Bank of Cleveland, Economic Commentary 2012-08. https://doi.org/10.26509/frbc-ec-201208

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International