- Share

Community Issues and Insights

Community Issues Survey

“We have rental assistance to help people get into housing but cannot issue it because the housing available must comply with fair market rents and [the available units] are mostly over that standard. As a result, people remain homeless longer.”—Community service provider in Ohio who responded to the September 2025 survey

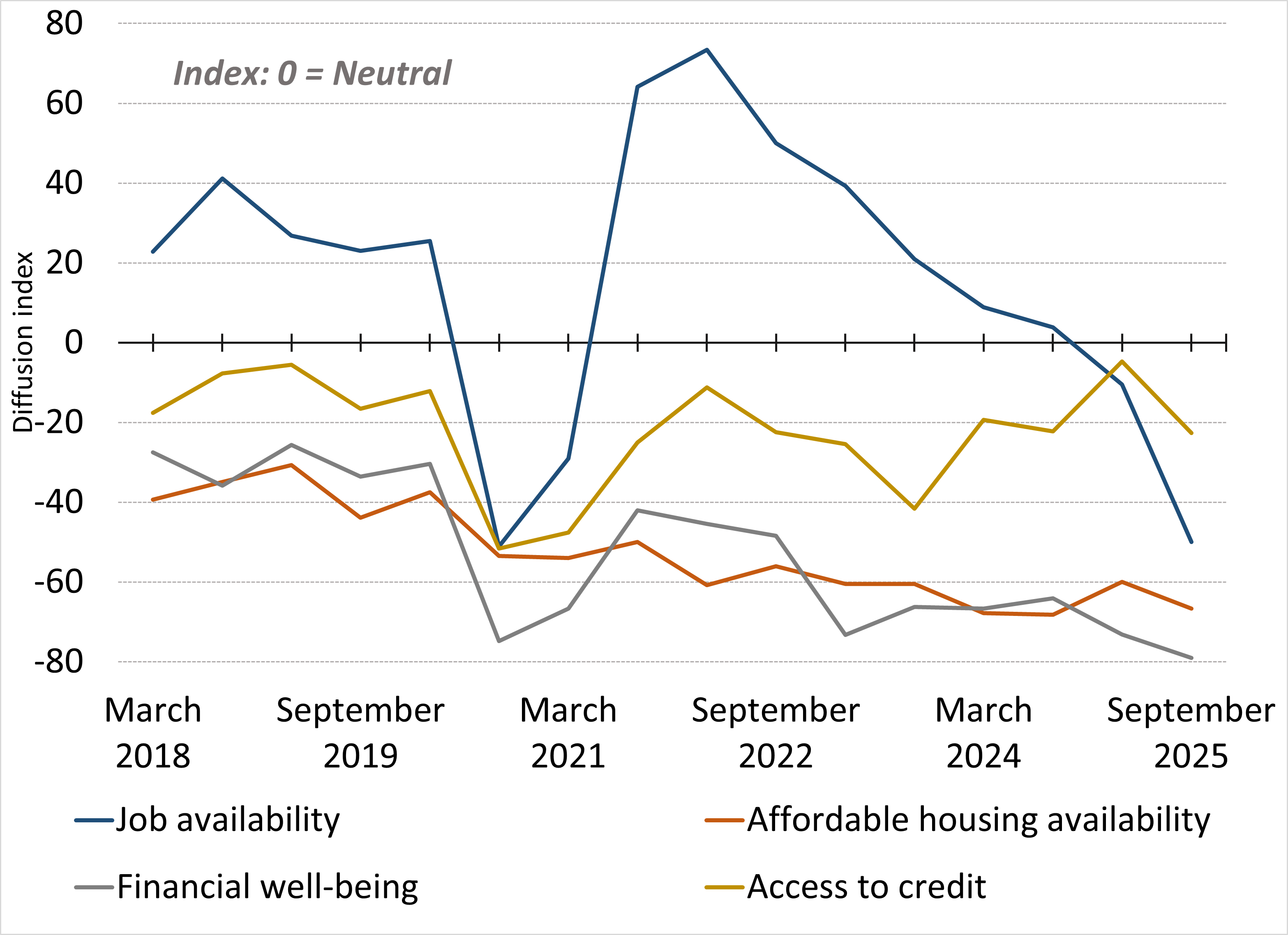

Twice a year, the Community Development Department at the Cleveland Fed administers the Community Issues Survey (CIS). Its goal is to collect information such as the quote above from direct service providers to monitor economic conditions and identify issues impacting low- and moderate-income (LMI) households in the region. Respondents are asked about jobs, housing, financial well-being, access to credit, and other issues that have a significant impact on the welfare of the communities they serve.

Key Findings from the September 2025 Survey

- Job availability: A majority of respondents (57 percent) said that job availability for low- and moderate-income (LMI) workers had decreased in the past six months, a share that increased sharply from the March 2025 survey (27 percent). Only 7 percent of respondents said that there had been an increase in job availability for LMI workers (lowest share since the survey series began in March 2018).

- Affordable housing availability: Seventy percent of respondents said that the availability of affordable housing had continued to decrease over the past six months. This share has exceeded 50 percent since the March 2022 survey.

- Financial well-being and access to credit: Eighty percent of respondents reported that financial well-being for LMI people had decreased over the past six months, while 77 percent said that access to credit had been unchanged during the same period.

- Top concerns for LMI households: Respondents’ top concerns were the continued impact of price increases on households’ budgets, rising rents, and the shortage of affordable housing, in that order.

- Top concerns for nonprofit organizations: Nonprofit organizations reported that demand for their services remains high, consistent with previous surveys, while a growing share of respondents said that funding and capacity had decreased (45 percent and 33 percent, respectively). Many nonprofit organizations noted uncertainty regarding future funding, which had affected their staffing decisions.

Low- and Moderate-Income (LMI) Indices

These indices reflect changes in economic conditions in LMI communities. In the indices referenced here, each response to a survey question is categorized as “increased,” “decreased,” or “no change.” More information on how the indices are constructed can be found in the report.