- Share

Regional Data, Analysis, and Engagement

Monitoring economic conditions in the Fourth District of the Federal Reserve System to inform monetary policy and improve the public’s understanding of the regional economy.

The region we serve

What is the Fourth District?

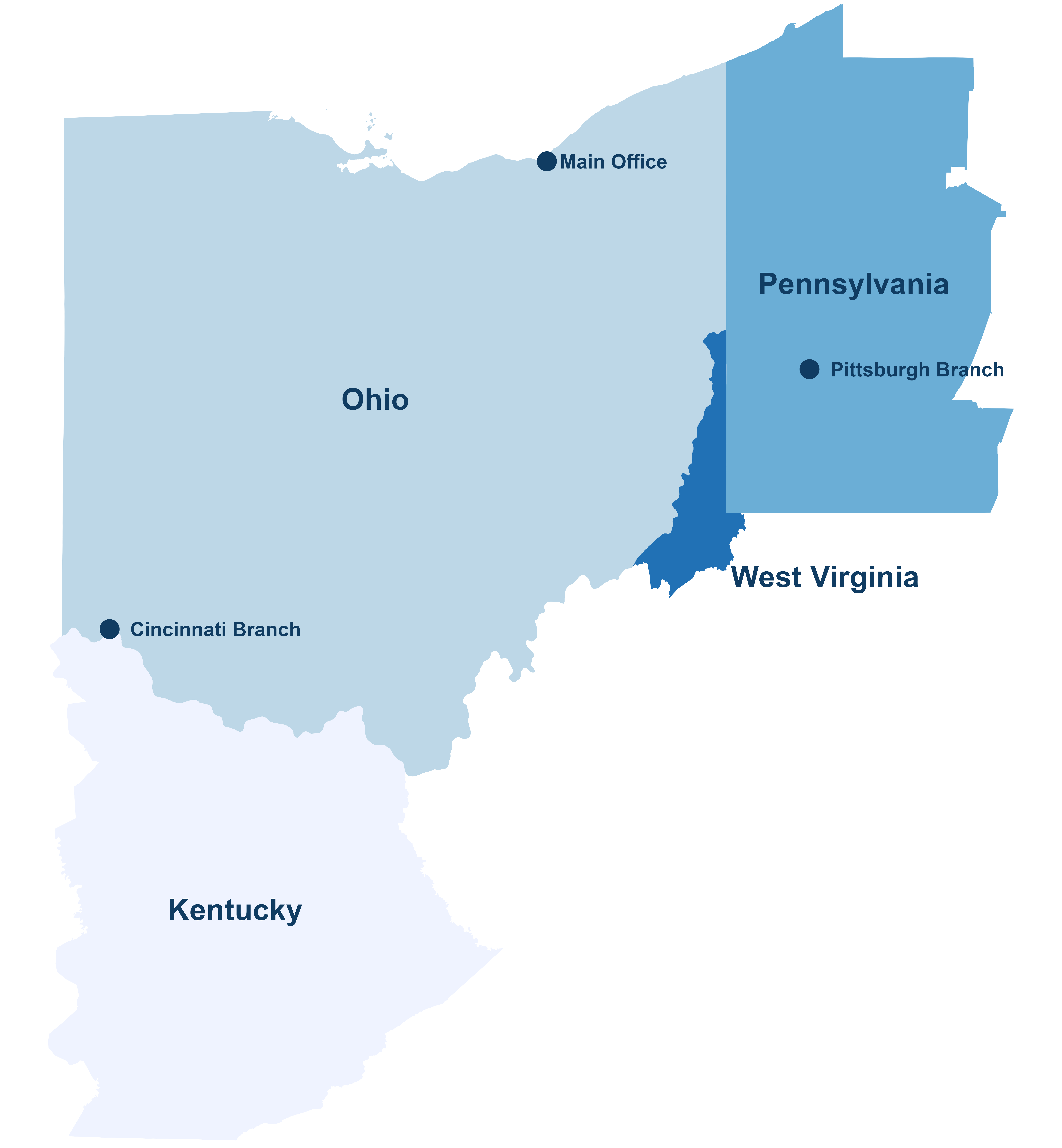

The Federal Reserve System is divided into 12 Districts. The Cleveland Fed serves the Fourth District, which encompasses the entire state of Ohio, 56 counties in eastern Kentucky, 19 counties in western Pennsylvania, and six counties in the northern panhandle of West Virginia. That’s 169 counties, nine major metropolitan statistical areas, and a population of approximately 17 million.

Within the Fourth District’s borders lie a range of industries—from manufacturing, agriculture, and mining to medicine and advanced technology—across a variety of communities, including older industrial cities and rural Appalachian areas.

What we do

Regional analysis

Our regional analysis group monitors the economy in the Federal Reserve’s Fourth District by tracking a variety of data and indicators and by gathering information from business and community leaders.

We regularly survey and interview business contacts to learn more about changes in customer demand, hiring, pricing, and more. We also convene Business Advisory Councils and roundtable discussions throughout the District.

We combine these insights with data to support our president's policymaking responsibilities and improve the public's understanding of how the region’s economy is evolving.

In our research, we analyze quantitative and qualitative data on topics including economic activity and consumer spending, labor and housing markets, household finance, and longer-term demographic and industrial trends. We also provide insightful perspectives on public-policy questions that are important to our region's longer-term economic prosperity.

Meet our regional analysis team

Lisa Barrow

Brian Anderson

Brooke Dirtzu

Julianne Dunn

Jayme V. Gerring

Brett Huettner

Mitchell Isler

Russell Mills

Carol Moseley

Kevin Rinz

Stephan D. Whitaker

View the latest Beige Book

Business Advisory Councils

Business Advisory Council members are recruited annually and represent a cross-section of regional businesses, labor organizations, and economic development organizations to ensure that data collected on the regional economy reflect the views of an array of stakeholders.

Indicators and data

The Cleveland Fed maintains a broad range of indicators and datasets that are available for download, including median CPI, median PCE inflation, inflation expectations, yield curve and GDP growth, and simple monetary policy rules.

Request a speaker

The Cleveland Fed’s Speakers Bureau provides access to experts who can offer insight on a broad range of topics. Fed speakers can give presentations or serve as panelists, providing an exchange of ideas that fosters discussion and encourages audience involvement. We work with professional, business, and civic groups. This free service is available to groups of 25 or more.