- Share

The Anchoring of US Inflation Expectations Since 2012

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Introduction

It is generally agreed that expectations of future inflation play a key role in determining current inflation. Inflation expectations also serve as important guideposts for policymakers by helping them determine whether current inflation readings may have a more lasting influence on the inflation outlook. If inflation expectations are well-anchored in the sense that they exhibit stable behavior at levels consistent with a central bank’s stated inflation target, then this situation would indicate credibility in a central bank’s monetary policy. Such credibility can help a central bank achieve its goals by mitigating the magnitude and persistence of shocks buffeting the economy. However, if inflation expectations move materially and persistently above or below the range consistent with the inflation target, then this situation would be an impediment to the central bank’s achieving its goals. Consequently, it is important to gauge and monitor the extent of inflation expectations’ anchoring to prevent expectations from becoming entrenched away from a target which can be costly and difficult for a central bank to correct.

In this Economic Commentary we focus on the anchoring of US inflation expectations since the FOMC’s January 25, 2012, announcement of a 2 percent inflation target. An important contribution of the analysis is the development of a new measure of expectations’ anchoring that combines two measures that have previously been studied separately, the deviation of a consensus forecast from an inflation target and forecaster disagreement. We use our new measure to examine the evolution of the anchoring of US inflation expectations from the FOMC’s announced inflation target through the pandemic and the recent inflation surge.

We apply our anchoring measure to expectations of personal consumption expenditures (PCE) price inflation from the US Survey of Professional Forecasters (SPF) at a medium-run (five-year) and a longer-run (five-year/five-year forward) horizon. While the FOMC’s January 2012 announcement had little initial impact on the anchoring of expectations at either horizon, there was improved anchoring during 2011 that is suggestive of a possible anticipatory effect. Prior to the pandemic, both expectations series generally showed an ongoing improvement in anchoring that principally reflected decreasing forecaster disagreement about the inflation outlook. Recently, longer-run inflation expectations have remained well-anchored. In contrast, the anchoring of medium-run expectations weakened significantly during the pandemic, mostly because consensus forecasts at this horizon steadily exceeded the 2 percent inflation target. However, there was a notable retracing of this weakness in 2023:Q1 that was maintained through the latest published 2023:Q2 survey.

The Anchoring of Inflation Expectations: Concept and Measures

Bems et al. (2021) have recently provided a useful overview of various issues related to the anchoring of inflation expectations. As they note, there is no widely agreed-upon definition of anchored inflation expectations despite the extensive use of the term and its much-cited importance. There is, however, general agreement about the properties that well-anchored inflation expectations should display. Drawing upon studies that have explored the issue of inflation expectations’ anchoring, Bems et al. (2021) identify three such properties that may include reference to an inflation target. If inflation expectations are well-anchored, then

- Longer-run forecasts of inflation should be centered close to the explicit or implicit target (see also Bernanke, 2007; Demertzis et al., 2012; Kumar et al., 2015)

- Revisions of longer-run forecasts should be small and result in the mean of longer-run forecasts displaying stability over time

- The dispersion of individual inflation forecasts (disagreement) should be low (see also Capistrán and Ramos-Francia, 2010; Dovern et al., 2012; Ehrman, 2015; Kumar et al., 2015; Naggert, Rich and Tracy, 2021)

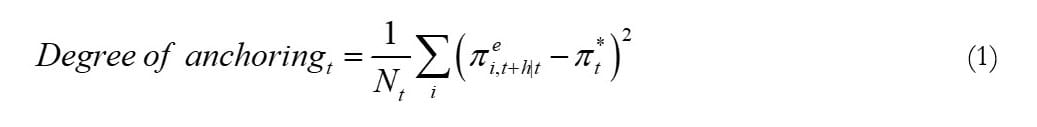

Following the previous discussion, we propose the following measure to capture the extent of inflation expectations’ anchoring at the individual level:1

where  denotes the inflation forecast of individual made at time for horizon

denotes the inflation forecast of individual made at time for horizon![]() are the number of survey respondents at time , and

are the number of survey respondents at time , and![]() denotes the inflation target at time .

denotes the inflation target at time .

The measure in (1) relates to the variability of inflation forecasts and is the average deviation (or distance) of the individual inflation forecasts from the inflation target. The intuition behind this measure is that the degree of anchoring of inflation expectations is improving (worsening) as this average deviation becomes smaller (larger). In the extreme, when this deviation equals zero, then each individual reported forecast coincides with the inflation target.

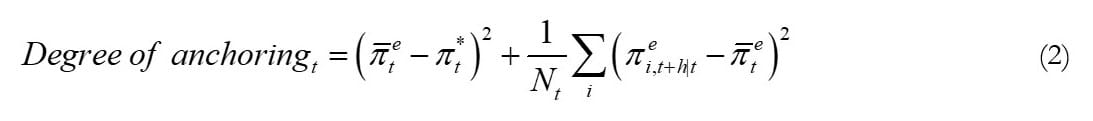

As shown in the appendix, the measure in (1) can be decomposed as follows:

where ![]() denotes the consensus forecast given by the average of the

denotes the consensus forecast given by the average of the ![]() individual forecasts,

individual forecasts, ![]() . That is, our proposed anchoring measure is a combination of two subcomponents that each capture aspects of forecast behavior associated with expectations’ anchoring. The first subcomponent is the deviation (or distance) between the consensus forecast and the inflation target. The second subcomponent is the dispersion of individual forecasts—the average deviation (or distance) of the individual forecasts from the consensus forecast—and represents a standard measure of disagreement. As previously discussed, well-anchored inflation expectations are associated with forecasts that are close, on average, to the inflation target and close to each other (low disagreement). This condition requires each subcomponent in (2) to be small.

. That is, our proposed anchoring measure is a combination of two subcomponents that each capture aspects of forecast behavior associated with expectations’ anchoring. The first subcomponent is the deviation (or distance) between the consensus forecast and the inflation target. The second subcomponent is the dispersion of individual forecasts—the average deviation (or distance) of the individual forecasts from the consensus forecast—and represents a standard measure of disagreement. As previously discussed, well-anchored inflation expectations are associated with forecasts that are close, on average, to the inflation target and close to each other (low disagreement). This condition requires each subcomponent in (2) to be small.

There are several attractive features of (2) worth highlighting. While the deviation of a consensus forecast from an inflation target and forecaster disagreement each describe important aspects of forecast behavior, studies using these objects as measures of expectations’ anchoring typically examine them on an individual basis. As Bems et al. (2021) note, this latter consideration is problematic because neither proposed measure is sufficient for capturing the full extent of anchoring. For example, a set of inflation forecasts could be highly dispersed but have an average value equal to the inflation target. Although expectations would look strongly anchored from the perspective of the alignment between the consensus forecast and the target, there would be significant forecaster disagreement. An example at the other extreme would be a set of identical inflation forecasts centered at a value far away from the target. Although expectations would look strongly anchored from the perspective of forecaster disagreement, there would be notable divergence between the consensus forecast and the target.2 Consequently, an advantage of (2) is that it incorporates two dimensions of forecast behavior and generates a measure of expectations’ anchoring that is broader in coverage and more robust.3

Related to the previous point is the issue of how to combine alternative measures of inflation anchoring. The measure in (2) is simply additive in the two anchoring subcomponents and does not involve the use of transformations or arbitrary combination schemes. This contrasts with Bems et al. (2021), who also recognize the disadvantages of analyzing anchoring measures separately but attempt to remedy this shortcoming by constructing a summary index that averages across a standardized transformation of each measure. While this approach may be reasonable, other weighting schemes can be selected that would generate different summary indexes and thereby make the ability to draw reliable conclusions about the behavior of expectations’ anchoring challenging.

The decomposition in (2) also provides insights into the sources for movements in the anchoring of inflation expectations and the role of monetary policy. The announcement of an explicit quantitative inflation target and enhanced central bank credibility should act to strengthen expectations’ anchoring by improving the alignment between the consensus forecast and the inflation target. In addition, greater transparency and improved communication about the central bank’s forecast, its reaction function, and the course of monetary policy can also act to strengthen expectations’ anchoring by reducing disagreement across forecasters, though this consideration is likely more relevant for a longer-run outlook for inflation than it is for a five-year outlook.

Taken together, we argue that our anchoring measure provides a more comprehensive indicator of expectations’ anchoring than existing measures. We apply this measure to data on forecasters’ expectations of US inflation over the last decade to evaluate the effects of events and episodes that may have exerted a meaningful influence on the degree of anchoring. In addition to the 2012 announcement of a 2 percent target for PCE price inflation, the FOMC announced a switch to a flexible average inflation targeting (FAIT) regime in August 2020. There was also a marked slowdown in inflation over the 2015–2016 period and the surge in inflation starting in spring 2021. While we restrict our analysis to US data during a low-inflation environment, the availability of cross-country data during high-inflation episodes offers further, and perhaps even more compelling, opportunities for the application of our anchoring measure.

Inflation Expectations and the Evolution of Anchoring Since 2012

To construct the overall anchoring measure in (1) and the anchoring subcomponents in (2), we focus on the expectations of professional forecasters about PCE inflation from the SPF conducted by the Federal Reserve Bank of Philadelphia. Our analysis considers the point predictions at a five-year horizon and at a five-year/five-year forward horizon.4 In terms of the two horizons, the five-year/five-year forward horizon should act to filter out short- and medium-run movements in inflation that reflect the effects of nonmonetary factors and thereby help to isolate the longer-run movements of inflation expectations influenced by monetary policy. Nevertheless, it is useful to include data from the five-year horizon for comparison purposes.

The SPF is conducted on a quarterly basis, and the participants typically work in research institutions and the financial services industry. The SPF forecast data provide predictions for PCE price inflation at the five-year and the five-year/five-year forward horizons starting in 2007:Q1.5 Survey participation is very similar across the two forecast series. On average, 32 forecasters have participated at the five-year horizon per survey round, while 31 forecasters have participated at the five-year/five-year forward horizon per survey round. The SPF, like other ongoing surveys, has experienced exit and entry of respondents over time, and there are occasional nonresponses by participants to the complete questionnaire.

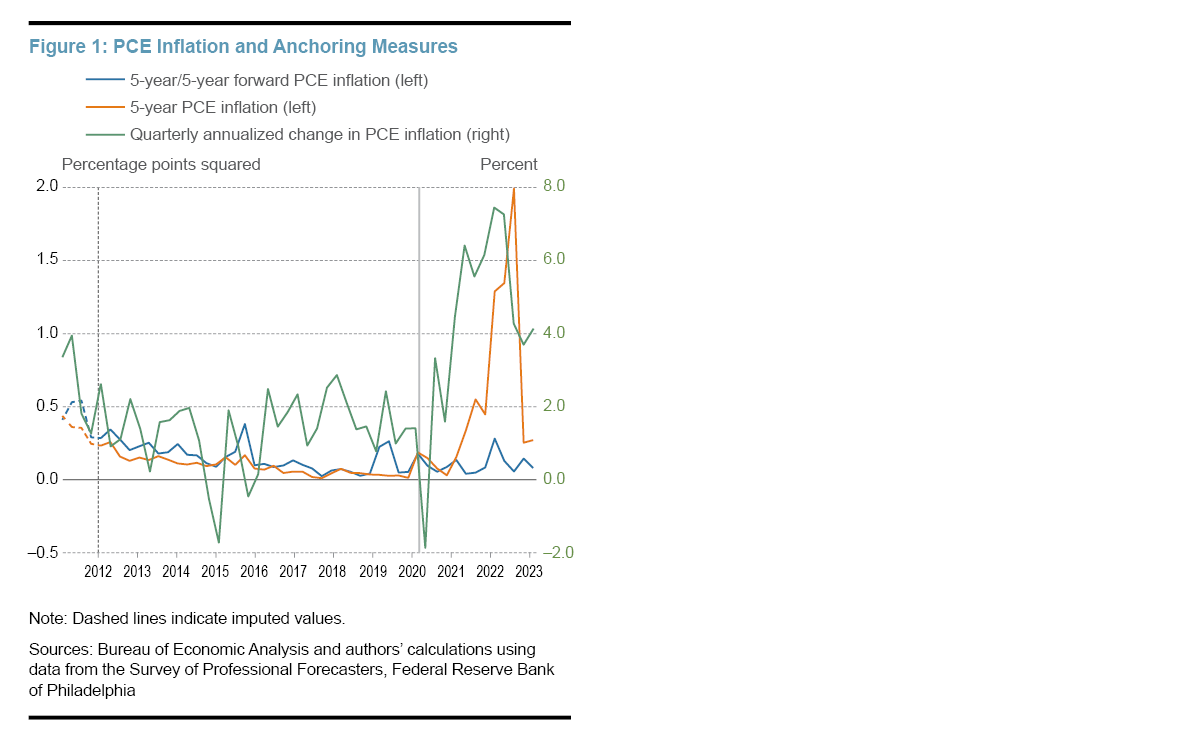

Our discussion initially focuses on the behavior of the overall anchoring measure in (1). Figure 1 shows the evolution of this measure at the five-year and five-year/five-year forward horizons and the quarterly (annualized) growth rate of the PCE index from 2011:Q1 to 2023:Q2; note that the last observation for latter series is currently not available because of publication lags.6 Importantly, the FOMC’s January 25, 2012, announcement of a 2 percent inflation target preceded the January 27 fielding of the 2012:Q1 SPF questionnaire, so respondents were aware of the change in the monetary framework when filling out the survey instrument. In the case of the anchoring measures for 2011:Q1–2011:Q4 depicted by the broken lines, the measures were derived under the assumption that ![]() . While the overall anchoring measures technically cannot be calculated before 2012:Q1, we thought imputing these values would make the beginning of the series easier to interpret. In addition, the values can also be thought of as informing the FOMC about the degree of anchoring to 2 percent prior to formalizing the 2 percent target. We recognize, however, that caution needs to be exercised in discussions of anchoring in the pre-2012 period.

. While the overall anchoring measures technically cannot be calculated before 2012:Q1, we thought imputing these values would make the beginning of the series easier to interpret. In addition, the values can also be thought of as informing the FOMC about the degree of anchoring to 2 percent prior to formalizing the 2 percent target. We recognize, however, that caution needs to be exercised in discussions of anchoring in the pre-2012 period.

A look at the anchoring measures at the beginning of our sample period shows very similar behavior. There is little difference in the degree of anchoring across the two horizons at the time of the 2012 announcement, and there is almost no change in their values immediately following the announcement. However, it is interesting to note that anchoring improved at both horizons during the year preceding the announcement, though it was steadier at the five-year horizon. While the improvement coincided with a slowdown in inflation, it is also suggestive of a possible anticipatory effect. That is, respondents’ forecasts may have assigned an increasing likelihood to the announcement of an explicit inflation target. This view receives some support from the observation that the 2 percent announced target is consistent with FOMC participants’ projections for longer-run PCE inflation elicited since April 2009 in the Summary of Economic Projections and the muted response of the anchoring measures in the aftermath of the 2012 announcement.

When we follow the measure for the next few years through 2014, then there is some improvement, albeit modest, in the anchoring of expectations at both horizons. This evidence is consistent with Detmeister et al. (2015) who also report a delayed response in the anchoring of inflation expectations to the FOMC’s 2012 announcement and could also be viewed as providing support to studies that have found that the introduction of an explicit inflation target can help anchor longer-run inflation expectations (Levin et al., 2004; Gürkaynak et al., 2010).

Looking next at the sample period through 2020:Q4, a period which includes the onset of the pandemic, the two anchoring measures track each other extremely closely. The overall anchoring measures show improvement over this subperiod, with values that often fall close to zero. It is worth noting that this improvement in anchoring takes place against a backdrop in which headline PCE inflation consistently ran below the 2 percent target. Moreover, the shortfalls were acute at times, such as the marked slowdown over the 2015–2016 period resulting from the combination of a collapse in energy prices and a significant appreciation of the dollar. Persistent inflation shortfalls were among the considerations that motivated the FOMC to review its monetary framework and shift to a FAIT regime. However, there appears to be little change in the extent of anchoring at either horizon around the time of the FOMC’s August 27, 2020, announcement of the FAIT regime.

The two anchoring measures display markedly different behavior once we follow the sample period through to the present. While there is considerable attention focused on longer-run inflation expectations and concern that these expectations may become unanchored and move higher, the associated anchoring measure has been broadly stable and remained low. In contrast, the anchoring of medium-run inflation expectations began to weaken with the inflation surge starting in spring 2021 and continued to worsen through 2022 alongside the readings of high inflation.

The respective behavior of the overall anchoring measures at the two horizons is consistent with an outlook by SPF respondents that higher inflation would, in fact, turn out to be transitory, that is, not persisting beyond five years. In particular, the anchoring index for the five-year horizon rose from around 0.5 to slightly over 2.0 during 2022. However, after a series of data releases pointing to signs of a possible moderation in inflation, the 2023:Q1 survey fielded from January 26–February 7 witnessed a dramatic and swift improvement in anchoring as the five-year measure moved down to slightly above 0.25. The anchoring measure remained largely unchanged with the 2023:Q2 survey fielded from April 27–May 9.

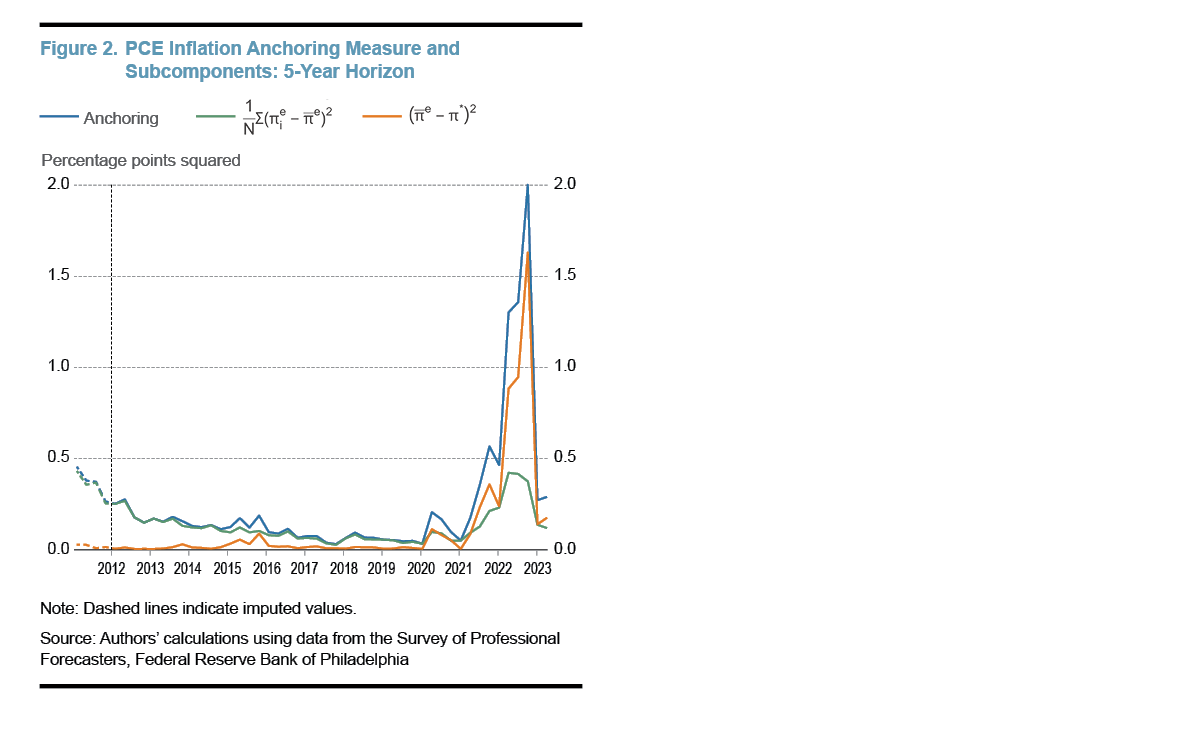

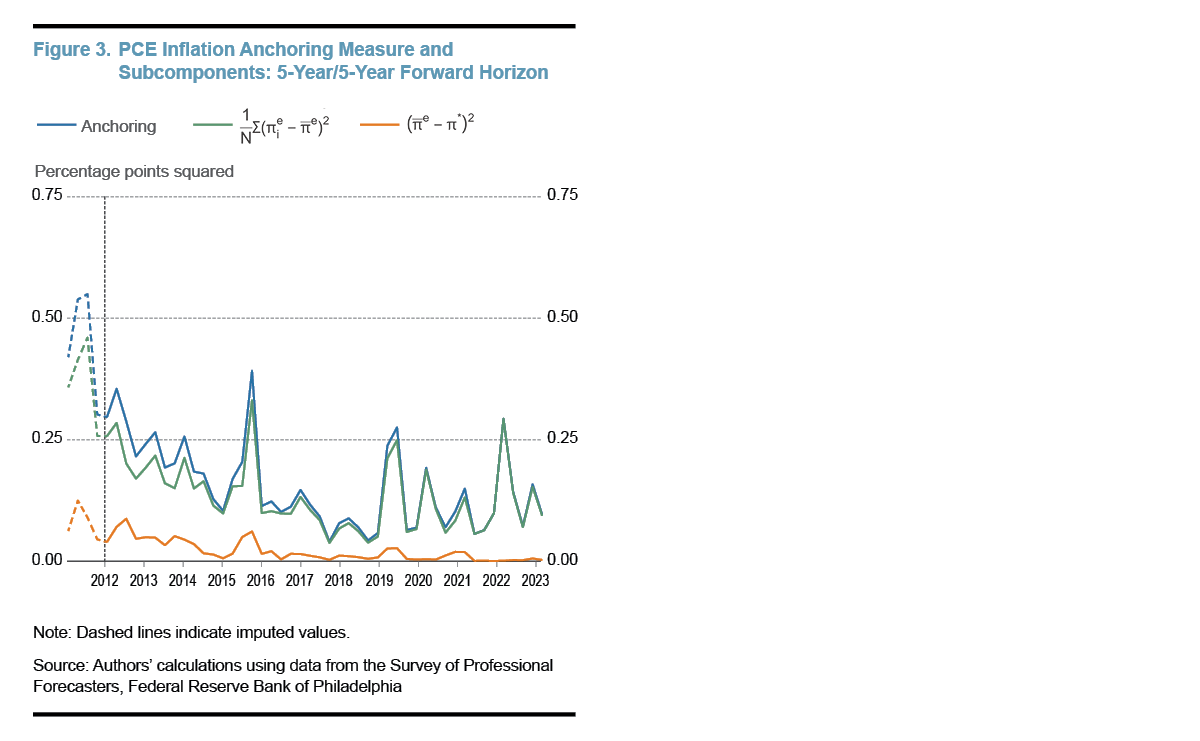

While the anchoring measures in Figure 1 are of obvious interest, we can gain further insights into their behavior by examining the two anchoring subcomponents in (2). Figure 2 and Figure 3 plot these additional series at the five-year and five-year/five-year forward horizons, respectively. Before turning to a more detailed analysis of the anchoring subcomponents, we briefly return to the earlier discussion about the advantages of studying them in combination rather than on an individual basis. Based on visual inspection of the charts, it appears that the anchoring subcomponents are not providing the same information about the behavior of inflation expectations. This conclusion receives further support from the finding that correlation between the subcomponents is 0.57 at the five-year horizon and 0.79 at the five-year/five-year forward horizon.

If we again initially look at the sample period through 2020:Q4, then we see that the anchoring subcomponents display similar behavior across the forecast horizons. One prominent feature of the data is that changes in the extent of expectations’ anchoring are principally driven by forecaster disagreement. This is evident from the movements in the anchoring measure in (1) largely coinciding with those of forecaster disagreement.

The observed link between inflation expectations’ anchoring and forecaster disagreement is consistent with other studies that have found that the dispersion of inflation forecasts tends to fall after the adoption of an inflation targeting regime (Capistrán and Ramos-Francia, 2010; Brito et al., 2018). The similar behaviors of the anchoring measure in (1) and forecaster disagreement imply that the alignment of the consensus inflation forecast and the inflation target has not been a key driver of the evolution of anchoring of inflation expectations. After a small improvement from 2012–2014, the deviation between the consensus forecast and target has remained largely stable at a value close to zero.

There are, however, several insights about the anchoring subcomponents and their relationships that can be gained after we extend the sample period through to the present. As previously discussed, inflation expectations at the five-year/five-year forward horizon remained relatively well-anchored despite elevated and persistent inflationary pressures. An examination of the anchoring subcomponents indicates that, outside a brief rise in disagreement in 2022, the stability of long-term inflation expectations reflected each anchoring subcomponent displaying stable behavior.

When we look at the deterioration in anchoring at the five-year horizon during 2021–2022, we see a marked change in the source of the movements for the anchoring measure. While there was a notable rise in forecaster disagreement that moved it close to the elevated levels in 2011, the unanchoring of expectations was largely driven by a steady and growing misalignment between the consensus forecast and the 2 percent target. This contrasts, as we discussed above, with the maintained close alignment of the long-term consensus forecast and the inflation target. Turning to the results from the 2023:Q1 survey, we see that the dramatic improvement in anchoring largely resulted from a closer alignment between the consensus forecast and target, with greater consensus among the individual forecasts providing an additional contribution. Turning to the latest survey, we see that the anchoring subcomponents remained largely unchanged in 2023:Q2.

Conclusion

Policy makers and economists generally agree that (longer-run) inflation expectations strongly anchored at a stated inflation target can greatly facilitate a central bank’s ability to meet its goals. This Economic Commentary proposes a new measure to gauge the extent of anchoring of inflation expectations. The proposed measure is a combination of the deviation of a consensus forecast from an inflation target and forecaster disagreement. An attractive feature of our measure is that it summarizes information in the anchoring subcomponents in a particularly convenient manner and allows us to assess their relative importance.

We apply our anchoring measure to professional forecasters’ predictions of PCE inflation since the FOMC’s 2012 announcement of a 2 percent inflation target. We find that the initial effect of the announcement was very limited, though there was a subsequent improvement in the anchoring of both expectations series during the next few years. Our analysis also suggests that, over the period when overall inflation expectations were well-anchored, movements in the extent of expectations’ anchoring are generally driven by changes in forecaster disagreement. When we examine the inflation surge in the post 2020-period, we find that longer-run inflation expectations remained well-anchored. In contrast, there was a dramatic deterioration in the anchoring of medium-run inflation expectations that largely reflected a misalignment between the consensus inflation forecast and the inflation target. This deterioration, however, has largely reversed itself based on the SPF results for the first two quarters of 2023.

Endnotes

- In contrast to our analysis, Bems et al. (2021) focus on developing measures to assess cross-country differences in inflation expectations’ anchoring. Return to 1

- The avoidance of this outcome has been a point of discussion by FOMC policymakers. See Mester (2022). Return to 2

- It is also possible to consider a scenario in which forecaster disagreement and the deviation between the consensus forecast and the target move in opposite directions—for example, the consensus forecast moving closer to (further away from) the target but forecaster disagreement increasing (decreasing)—resulting in conflicting signals about expectations’ anchoring from the individual measures. Return to 3

- The five-year horizon refers to forecasts of inflation over the next five years, while the five-year/five-year forward horizon refers to forecasts over the next six to 10 years. Return to 4

- The SPF does not directly ask for the five-year/five-year forward forecasts but instead calculates them as an implied projection based on reported forecasts of PCE price inflation at five-year and 10-year horizons. We thank Tom Stark of the Federal Reserve Bank of Philadelphia for his assistance with details about the construction of the series. Return to 5

- We excluded the responses of one forecaster (#523) when calculating the anchoring measure at both horizons to control for an outsized composition effect. This forecaster typically reported higher inflation predictions at the five-year/five-year forward horizon and did not participate on a regular basis, resulting in occasional upward spikes in the anchoring measure. While the respondent was much less influential on the anchoring measure at the five-year horizon, we think it preferable to maintain consistency in participation across the two forecast horizons. This is the only example in which the full set of available data was not used in the calculations. Return to 6

References

- Bems, Rudolfs, Francesca Caselli, Francesco Grigoli, and Bertrand Gruss. 2021. “Expectations’ Anchoring and Inflation Persistence.” Journal of International Economics 132 (September): 103516. https://doi.org/10.1016/j.jinteco.2021.103516.

- Bernanke, Ben S. 2007. “Inflation Expectations and Inflation Forecasting, Speech at the Monetary Economics Workshop of the National Bureau of Economic Research Summer Institute, Cambridge, Massachusetts, July 10.” Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/newsevents/speech/bernanke20070710a.htm.

- Brito, Steve, Yan Carriere-Swallow, and Bertrand Gruss. 2018. “Disagreement about Future Inflation: Understanding the Benefits of Inflation Targeting and Transparency.” IMF Working Papers 18 (24): 1–18. https://doi.org/10.5089/9781484339718.001.

- Capistrán, Carlos, and Manuel Ramos-Francia. 2010. “Does Inflation Targeting Affect the Dispersion of Inflation Expectations?” Journal of Money, Credit and Banking 42 (1): 113–134. https://doi.org/10.1111/j.1538-4616.2009.00280.x.

- Demertzis, Maria, Massimiliano Marcellino, and Nicola Viegi. 2012. “A Credibility Proxy: Tracking US Monetary Developments.” The BE Journal of Macroeconomics 12 (1). https://doi.org/10.1515/1935-1690.2442.

- Detmeister, Alan K., Daeus Jorento, Emily Massaro, and Ekaterina V. Peneva. 2015. “Did the Fed’s Announcement of an Inflation Objective Influence Expectations?” FEDS Notes. Board of Governors of the Federal Reserve System. https://doi.org/10.17016/2380-7172.1550.

- Dovern, Jonas, Ulrich Fritsche, and Jiri Slacalek. 2012. “Disagreement Among Forecasters in G7 Countries.” The Review of Economics and Statistics 94 (4): 1081–1096. https://doi.org/10.1162/REST_a_00207.

- Ehrmann, Michael. 2015. “Targeting Inflation from Below: How Do Inflation Expectations Behave?” International Journal of Central Banking 11 (S1): 213–249. https://www.ijcb.org/journal/ijcb15q4a6.htm.

- Gürkaynak, Refet S., Andrew Levin, and Eric Swanson. 2010. “Does Inflation Targeting Anchor Long-Run Inflation Expectations? Evidence from the US, UK, and Sweden.” Journal of the European Economic Association 8 (6): 1208–1242. https://doi.org/10.1111/j.1542-4774.2010.tb00553.x.

- Kumar, Saten, Hassan Afrouzi, Olivier Coibion, and Yuriy Gorodnichenko. 2015. “Inflation Targeting Does Not Anchor Inflation Expectations: Evidence from Firms in New Zealand.” Brookings Papers on Economic Activity 2: 151–225. https://doi.org/10.1353/eca.2015.0007.

- Levin, Andrew T., Fabio M. Natalucci, and Jeremy M. Piger. 2004. “The Macroeconomic Effects of Inflation Targeting.” Review 86 (4). https://doi.org/10.20955/r.86.51-80.

- Mester, Loretta J. 2022. “The Role of Inflation Expectations in Monetary Policymaking, Speech at the European Central Bank Forum on Central Banking: Challenges for Monetary Policy in a Rapidly Changing World, Sintra, Portugal, June 29.” https://www.clevelandfed.org/collections/speeches/2022/sp-20220629-the-role-of-inflation-expectations-in-monetary-policymaking.

- Naggert, Kristoph, Robert W. Rich, and Joseph Tracy. 2021. “Flexible Average Inflation Targeting and Inflation Expectations: A Look at the Reaction by Professional Forecasters.” Economic Commentary, no. 2021-09 (April). https://doi.org/10.26509/frbc-ec-202109.

Suggested Citation

Naggert, Kristoph, Robert W. Rich, and Joseph Tracy. 2023. “The Anchoring of US Inflation Expectations Since 2012.” Federal Reserve Bank of Cleveland, Economic Commentary 2023-11. https://doi.org/10.26509/frbc-ec-202311

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International