- Share

The Great Resignation and the Paycheck Protection Program

A prominent feature of the US labor markets during the recovery from the COVID-19 recession was a high level of worker separations in the form of quits. This phenomenon, sometimes referred to as the Great Resignation, cannot be fully explained by the strength of the recovery. We show that firms that employ fewer than 250 individuals played a disproportionately larger role in generating excess quits during this episode. We further argue that the availability of Paycheck Protection Program funds might have prevented some “usual” reallocation from happening early on and thus subsequently created a pent-up demand for labor market reallocation later in the recovery.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

More than 4 million US workers per month have quit their jobs, on average, since August 2021, according to data from the Job Openings and Labor Turnover Survey (JOLTS). In fact, high quits rates have been a significant feature of the US labor market over the past 12 months: The quits rate—the quits level as a percent of total private sector employment—has been at or above 3 percent since April 2021, the highest levels recorded in the history of the JOLTS. The popular narrative attributes this high rate, also known as “the Great Resignation,” to workers’ general dissatisfaction and reevaluation of job amenities such as work–life balance after the lockdowns experienced during the SARS-CoV-2 (COVID-19) pandemic.1 This narrative ignores the fact that episodes of high quits rates have accompanied prior fast recoveries (Hobijn, 2022) and that high quits rates were common in the manufacturing sector in the 1960s and 1970s (Gittleman, 2022).

In this Economic Commentary, we argue that despite the earlier episodes of high quits rates, the current episode is somewhat unique and cannot be fully explained by exceptionally tight labor markets. We further show that small firms played an important role in generating excess quits during this period. We present some evidence that this pattern can be partially explained by the widespread use of the Paycheck Protection Program implemented during the pandemic. Our analysis provides an alternative narrative of the Great Resignation: It appears that pandemic-era policies that were intended to mitigate widespread dislocations in the labor market, and indeed reduced labor market reallocation early on, potentially led to pent-up reallocation later in the recovery.

Labor Market Tightness and Quits

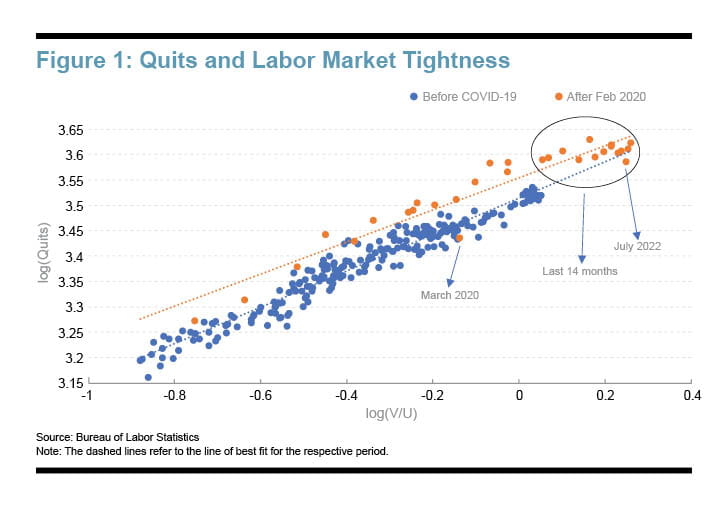

Quits are highly correlated with the state of the labor market. When labor demand (relative to available supply) is high, there are more opportunities for some workers to find better matches. In this sense, it is not surprising to see high levels of quits during the recovery period from the COVID-19-induced recession. One defining feature of the labor market over the past recovery has been the historically high level of labor market tightness as measured by the number of vacancies (job openings) divided by the number of unemployed job seekers currently searching for work. Over the past year, there have been more job openings than the number of unemployed job seekers, as Figure 1 shows. Hence, as Hobijn (2022) argues, it may not be unusual to observe historically high levels of quits at the same time. However, Figure1 suggests that there may be other factors in addition to the tight labor market at play this time around.

The scatter plot in Figure 1 presents the monthly data on quits (log(quits)) and labor market tightness (log(job openings/unemployed)) since the beginning of the data series (December 2000), and the data since March 2020 are presented in a different color than the rest. As we see from the figure, datapoints prior to the COVID-19 shock were clustered very neatly along a linear line of best fit,2 implying a tight positive correlation between quits and labor market tightness. That is, quits were high when the labor market was tight, and they were low when the labor market was slack. Since the beginning of the pandemic, this relationship broadly stayed the same qualitatively. As the market became tighter, we experienced more quits on average. However, since February 2020, observed quits were significantly higher than what would have been predicted by the corresponding market tightness based on their prepandemic relationship. All but two data points during this episode (March 2020 and July 2022) lie above the prepandemic line of best fit, implying that the level of quits the United States experienced during 2021–2022 cannot be attributable to only a tight labor market.

Quits from Small Firms

It is informative to examine the breakdown of the aggregate quits rates by firms of different sizes using data from the Bureau of Labor Statistics (BLS). Quits are reported separately for six different sizes of firms based on numbers of employees 1–9, 10–49, 50–249, 250–999, 1,000–4,999, and 5000 or more workers. Firms that employ fewer than 500 workers are conventionally considered “small” businesses. Since the BLS classification for this series does not readily provide data below this threshold of 500, we will consider an alternative breakdown for understanding small versus large firms. We aggregate the three smallest sizes of firms and refer to this group as the “small firms,” that is, all firms that employ fewer than 250 workers. In contrast, the “large firm” group will be all firms that employ 1,000 or more workers.

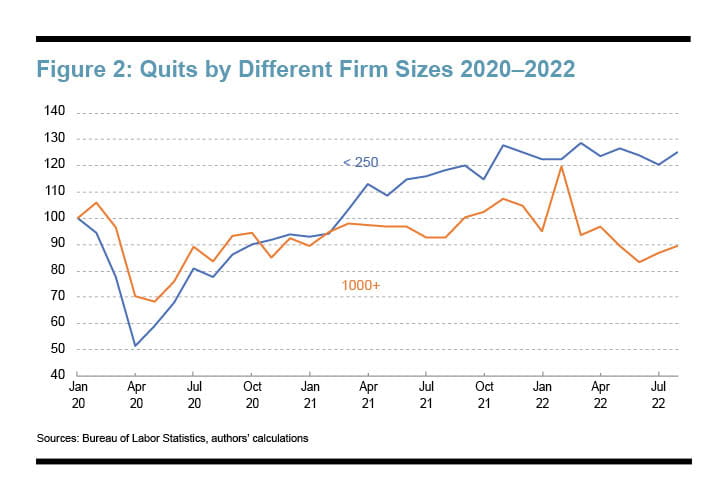

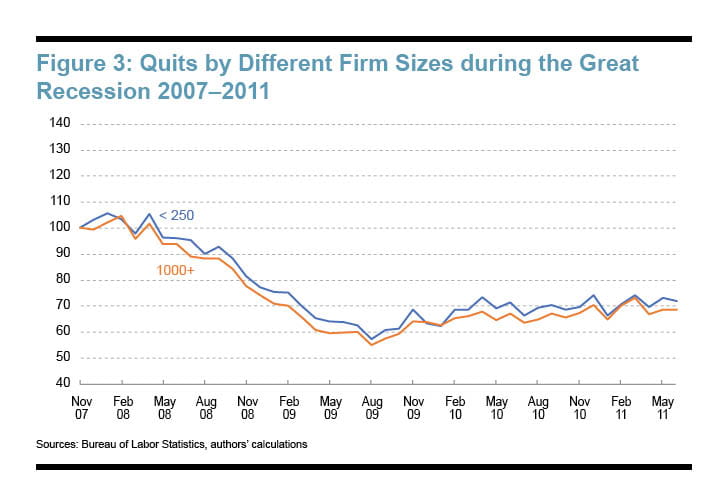

Figure 2 presents the level of quits since January 2020 for small and large firms using the groupings just described, normalizing the level for January 2020 to 100 for ease of comparison. At the onset of the COVID-19 pandemic until May 2020, quits collapsed at both small and large firms, declining by almost 50 percent for small firms and 32 percent for large firms. As the labor market started to recover, quits recovered to their prepandemic levels and increased beyond that for small businesses, while large firms continued to experience quits that were in line with prepandemic levels. Hence, this figure highlights an important feature of the aggregate quits data during the Great Resignation period: Despite the presence of a large and sudden aggregate shock, small firms behaved differently than large firms and were primarily responsible for the excess quits seen during the subsequent recovery from the pandemic recession. Note that this divergence between firms of different sizes seems to be specific to the current recovery and was not a feature of the Great Recession (see Figure 3).

Figure 2 suggests that small firms as a group not only experienced drastic declines in their quit rates during the early phase of the pandemic but also accounted for the excess quits observed during the recovery. Since quits serve as a mechanism for the labor market to reallocate workers across different firms, unprecedented declines like those experienced during the beginning of the pandemic could have created a pent-up demand for reallocation during the recovery phase. However, based on the data depicted in Figures 2 and 3, this appears to be the case mainly for small businesses in the current episode. This pattern suggests that the key to understanding the drivers of the Great Resignation requires carefully examining reallocation patterns at small businesses specifically.

Quits and the Paycheck Protection Program

One potential reason for this pattern we see in the data might be related to an important policy response designed to address the effects of the pandemic on small businesses early on, namely, the Paycheck Protection Program (PPP). This program was enacted into law by the US Congress and was one of the largest elements of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020.3 Even though it was initially designed as a government-backed loan program for small businesses, the PPP effectively became a grant program for recipient firms as long as the grants received were used as the program intended and appropriate records were submitted.4 Therefore, the PPP could be interpreted as a government subsidy for small businesses to keep their payroll levels constant in the face of the uncertainty presented by the pandemic and the virus transmission mitigation efforts instituted by state, federal, and local authorities. This program might explain why small businesses experienced relatively low levels of separations including quits near the onset of the pandemic. It is also conceivable that as the labor market improved, more workers found themselves working in jobs that normally would have been eliminated in the absence of the PPP. In other words, the PPP might have prevented some quits at small firms early on, either through job elimination or the lack of opportunity for workers to find different jobs that better aligned with their needs; however, during the recovery the previously low levels of quits and the increased opportunity for workers to obtain jobs that better align with their needs would have resulted in excess quits at these small firms beyond what historical patterns of reallocation would have predicted.

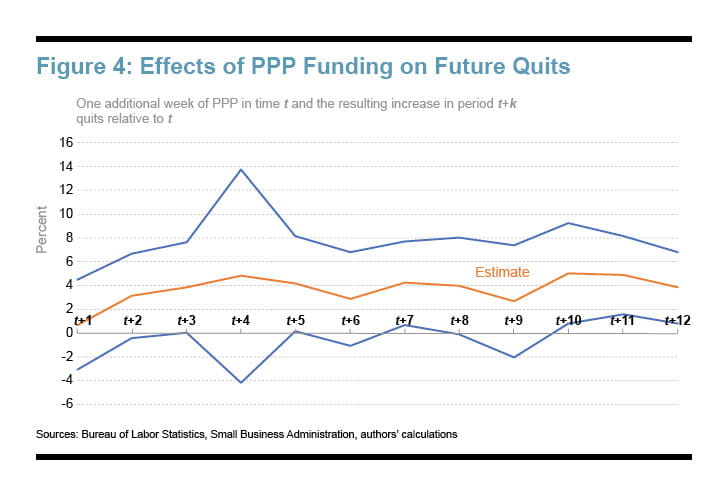

We evaluate this hypothesis using JOLTS data for quits at the industry level. Unfortunately, JOLTS does not provide publicly available data on quits with a joint breakdown by industry and firm size. However, industry-level utilization of PPP loans provides useful information on variation over time. We can use these differences both across industries and within industries to understand the effects of the PPP on future reallocation as measured by future quits. Our analysis suggests that, in fact, additional utilization of PPP dollars was associated with excess quits several months after receiving PPP funds. In particular, we look at how much an additional week of PPP funding at time t is associated with a change in the level of quits between t and t+k periods, where k stands for months.5 Note that the main power of the empirical specification comes from the variation across industries in their utilization rates of PPP funding around the trough of employment in the pandemic, April through May 2020.6 We find that PPP funds equivalent to one additional week of payrolls might have increased quits somewhere between 2 percent to 5 percent over the following 12 months. This is the case after controlling for differences in industries and time periods when the quits rate is measured. Figure 4 plots the dynamics of this relationship with point estimates (orange) and the corresponding 90 percent confidence intervals (blue) and shows statistically significant effects later in the horizon. The average industry received PPP funds equivalent to 7.5 weeks of average payrolls in April 2020, and the largest disbursement was around 10.5 weeks. Our estimates suggest that compared to the average industry, the one that has received the largest amount would have experienced 6 percent to 15 percent higher quits over the following 12 months. This is an economically meaningful effect. For comparison, observe that throughout 2021, the average difference in quits between small firms versus large firms was about 15 percent (Figure 2).

Conclusion

The US labor markets experienced a relatively robust recovery over the past two years. We argue that the surge in quits is higher than what one would expect even in such a tight labor market. Looking beyond the headline numbers for quits suggests that the aggregate pattern might be driven by small firms, and a purely cyclical story cannot explain currently high quits rates. We provide one potential explanation that relies on PPP loans and their utilization by small businesses during the pandemic and the following recovery and show that industries receiving larger PPP loans experienced elevated quits even 12 months after the PPP disbursement, suggesting that the availability of PPP funds might have prevented some “usual” reallocation from happening early on and thus subsequently created a pent-up demand for labor market reallocation. The COVID-19 pandemic introduced other important changes such as prevalence of remote work and shifting tastes for job-related amenities. More work is needed to explore whether these alternative mechanisms and changes could have anything to do with excess quits during this episode.

Footnotes

- See, for instance, The New York Times, “How Quitting a Job Changed My Work-Life Balance.” Return to 1

- The line represents the predicted values from a regression of log(quits) on log of V/U ratio. Return to 2

- See Schweitzer and Borawski (2021a, 2021b) and Tasci Njinju and Braitsch (2022) for details of the PPP and how different industries and states benefited from the program. Return to 3

- See https://www.sba.gov/sites/default/files/2021-12/2021.12.26_Weekly Forgiveness Report_Public-508.pdf. Return to 4

- We run these regressions for up to 12 months, i.e., k=12 in the longest horizon. Return to 5

- More than half of all the PPP funding was already disbursed by May 2020 for an average industry, and the standard deviation of the funding across industries was the largest at the time. For the rest of the time PPP was in operation, the average level of disbursement across industries barely registered a week of payrolls. Return to 6

References

- Gittleman, Maury. 2022. “The ‘Great Resignation’ in Perspective.” Monthly Labor Review, July. https://doi.org/10.21916/mlr.2022.20.

- Hobijn, Bart. 2022. “‘Great Resignations’ Are Common During Fast Recoveries.” FRBSF Economic Letter 2022 (08). https://fedinprint.org/item/fedfel/93909.

- Needelman, Joshua. 2022. “How Quitting a Job Changed My Work-Life Balance.” The New York Times, August 15, 2022, sec. Style. https://www.nytimes.com/2022/08/15/style/quitting-work-life-balance-career.html.

- Schweitzer, Mark E., and Garrett Borawski. 2021a. “Which Industries Received PPP Loans?” Economic Commentary, no. 2021–08 (April). https://doi.org/10.26509/frbc-ec-202108.

- ———. 2021b. “How Well Did PPP Loans Reach Low- and Moderate-Income Communities?” Economic Commentary, no. 2021–13 (May): 1–5. https://doi.org/10.26509/frbc-ec-202113.

- Tasci, Murat, Bezankeng Njinju, and Hana Braitsch. 2021. “PPP Loans & State-Level Employment Growth.” Economic Commentary, no. 2021–20 (November). https://doi.org/10.26509/frbc-ec-202120.

- US Small Business Administration. 2021. “Forgiveness Platform Lender Submission Metrics.” US Small Business Administration. https://www.sba.gov/sites/default/files/2021-12/2021.12.12_Weekly%20Forgiveness%20Report_Public-508.pdf.

Suggested Citation

Şahin, Ayşegül, and Murat Tasci. 2022. “The Great Resignation and the Paycheck Protection Program.” Federal Reserve Bank of Cleveland, Economic Commentary 2022-15. https://doi.org/10.26509/frbc-ec-202215

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International