- Share

The College Wage Premium

The return on educational investments has risen substantially in the past 30 years. While the primary focus has been on the college wage premium, new evidence shows that the value of going to college is affected by a host of other important educational decisions, each of which has a potential large effect on future earnings. This Commentary examines the impact of two of these other decisions on earnings: the choice of a college major and the pursuit of an advanced degree. In some cases, differences in the college major premium are as large as the college wage premium itself.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

It is well documented that college graduates earn significantly higher wages on average than those with only a high school diploma. The college wage premium has been a central focus for researchers because it is both large and growing. Current data indicate that college degree holders enjoy an 84 percent increase in earnings over their high-school-educated counterparts.

Given this large disparity in earnings, some may argue that the greatest decision facing young people today is whether to go to (and complete) college. However, a growing literature has begun to suggest that the decision to go to college is just one of a sequence of educational investment decisions, each of which has a large effect on potential earnings.

At the forefront of this literature is the choice of a college major. The availability of new data has highlighted the wide variation in wages across college majors, which in many cases is as large as the college wage premium itself. Additionally, advanced degrees yield a wage premium beyond what is awarded for a bachelor’s degree. This evidence implies that the gravity of the college decision is perhaps equally matched by the decisions one makes while in college as well as after college.

This Commentary takes a more detailed look at the college wage premium, with a focus on how the premium is affected by these supplemental educational investment decisions. Two consequential decisions beside the college decision are discussed in particular: the choice of a college major and the pursuit of an advanced degree.

Trends in the College Wage Premium

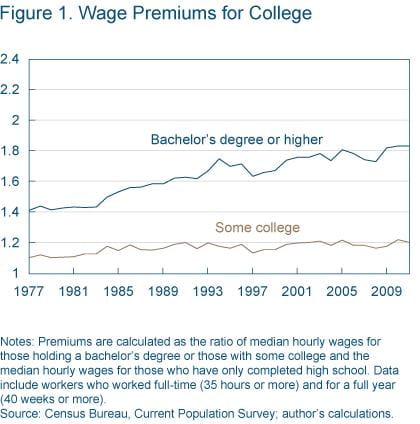

The college wage premium is calculated as the ratio of the median hourly wage for those holding a bachelor’s degree and the median hourly wage for those who have only completed high school. This statistic for full-time workers is plotted in figure 1. These data show that the college wage premium increased rapidly through the 1980s and early part of the 1990s, rising from 40 percent to upwards of 70 percent. Since the late 1990s, the premium has experienced a much slower rate of growth, drifting at times below and above 80 percent. Importantly though, the premium has persisted at historically high levels through the 2000s, becoming an enduring feature of the U.S. wage structure.

Notes: Premiums are calculated as the ratio of median hourly wages for those holding a bachelor's degree or those with some college and the median hourly wages for those who have only completed high school. Data include workers who worked full-time (35 hours or more) and for a full year (40 weeks or more).

Source: Census Bureau, Current Population Survey; author's calculations.

Figure 1 also highlights the importance of college completion by showing the wage premium for those with only some college but lacking a four-year degree. The premium for these workers has experienced little to no growth over the last 30 years, where at the median they have about 15 percent to 20 percent higher earnings.

Collectively, these results show that over the last three decades, the value of college has increased substantially, with all of the gains going to those who actually complete the four-degree.

Advanced Degree Premium

The standard assessment of the college wage premium is somewhat misleading because counted among four-year degree holders are those who also have an advanced degree. Including these individuals in the analysis may overstate these returns, much in the same way that including high school dropouts in the high school graduate pool would.

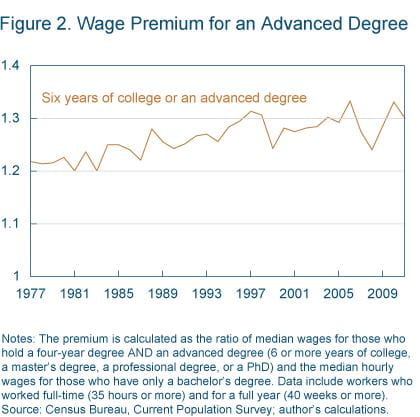

To study the influence of including advanced degrees in the college premium calculation, figure 2 plots the trend in the advanced degree premium, which is the ratio of median wages for those who hold a four-year degree and an advanced degree (6 plus years of college, a master’s degree, professional degree, or PhD) over those with only a bachelor’s degree. Looking from 1977 to the present, advanced degree earners have experienced growth in wages over and above those with only a four-year degree, from around 20 percent in the early 1980s to around 30 percent today.

Notes: The premium is calculated as the ratio of median wages for those who hold a four-year degree AND an advanced degree (6 or more years of college, a master's degree, a professional degree, or a PhD) and the median hourly wages for those who have only a bachelor's degree. Data include workers who worked full-time (35 hours or more) and for a full year (40 weeks or more).

Source: Census Bureau, Current Population Survey; author's calculations.

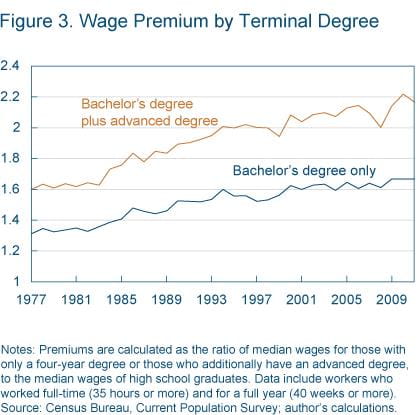

Notes: Premiums are calculated as the ratio of median wages for those with only a four-year degree or those who additionally have an advanced degree, to the median wages of high school graduates. Data include workers who worked full-time (35 hours or more) and for a full year (40 weeks or more).

Source: Census Bureau, Current Populations Survey; author's calculations.

To evaluate the effect of the four-year degree alone, advanced degree holders must be separated from the analysis. Figure 3 plots the wage premium for those with only a four-year degree and those who additionally have an advanced degree (both premiums are with respect to median wages of high school graduates).

Even excluding advanced degree holders, the premium for a four-year degree alone remains extremely high at about 60 percent. Interestingly, once the growth in wages for advanced degree holders is removed, the four-year degree premium has remained flat over the past decade. In other words, it is the growth in the value of advanced degrees that has accounted for all of the growth in the classical measure of the college wage premium since the 2000s.

Major Choice

Beginning in 2009 the American Community Survey (ACS), a large and nationally representative sample of the U.S. population, began collecting information on degree field for bachelor’s degree holders. Previous work studying the effect of the degree field on wages was conducted on much smaller samples and typically for only recent graduates. The availability of this information in the ACS has been an important resource because it yields high statistical power and is representative of the entire labor force.

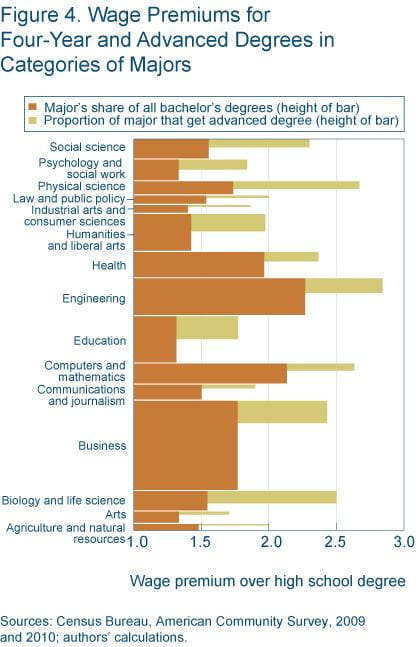

The ACS separates four-year degree fields into more than 170 detailed categories. The detailed categories can be aggregated into 15 broad categories to simplify the analysis. Using data from 2009 and 2010, figure 4 plots the college four-year degree premium and the advanced degree premium for each of these 15 aggregate categories. Figure 4 gives detail on the premiums as well as the proportion of four-year degree holders in each field. The height of the orange bars shows the density of four-year degree holders in each area and the height of the yellow bar shows the fraction in that major field who also hold an advanced degree.

Sources: Census bureau, American Community Survey, 2009 and 2010; authors' calculations.

Sources: Census Bureau, American community Survey, 2009 and 2010; authors' calculations.

Figure 4 indicates that business (including economics) is by far the most popular field (since this is the bar with the largest height among the 15 categories). The largest fractions of advanced degree holders have BAs in either education or business. However, this is due in large part to the fact that these two majors represent a significant share of the bachelor’s degree population. Perhaps more interesting is to look at those fields that have a high (or low) rate of advanced degree holding relative to their population. One example is biological and life science, where more than half of the four-year degree holders go on to receive an advanced degree. This is not surprising if this is the predominate undergraduate degree for medical doctors.

The college major choice has a potentially large effect on the value of a four-year degree. Comparing engineering majors, who have the highest four-year premium at 125 percent, to psychology and social work majors, who have the lowest premium at 40 percent, yields a difference in the college major premium of 85 percent, which is the same size as the traditional measure of the college wage premium.

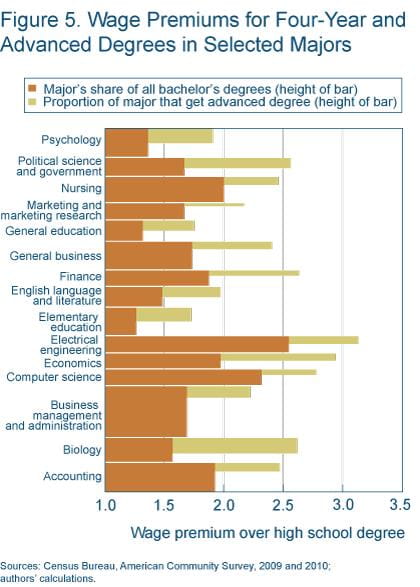

Figure 5 breaks down the returns for the top 15 most popular detailed degree fields. These fields represent about 50 percent of the degrees held by those with a bachelor’s degree. This chart shows again the large variance in returns by degree field as well as large the variation between similarly defined majors. For example, the aggregate category “business” from figure 4 included degrees in business management and administration and finance. Figure 5 shows that finance degree holders at the median have 20 percent higher wages than those with a business management and administration degree. Of the 15 most popular majors, electrical engineering and computer science enjoy the highest premium for a four-year degree.

This evidence shows that the field of study has a large effect on potential earnings. Despite these large differences, it is important to acknowledge that at the median, there is a strong positive benefit for a four-year degree above a high school diploma, regardless of the degree field chosen.

Conclusion

Over the last three decades, the earnings of four-year degree holders have significantly outpaced the earnings of high school graduates and those with some college but lacking a college degree. The sharpest increases occurred during the 1980s and early 1990s, and though they have flattened somewhat in the recent decade, they still persist at a very high level.

The decision to go to college has a profound effect on wages; however, we have seen that both college major and the pursuit of an advanced degree have a critical impact on the value one receives from a college education as well. Other factors affecting the return to college not discussed here include college quality, occupational choices, hours worked, and the relevance of unobserved skills.

Recommended Reading

- “Heterogeneity in Human Capital Investments: High School Curriculum, College Major, and Careers,” Joseph Altonji, Erica Blom, and Costas Meghir, 2011. Unpublished manuscript, Yale University.

- “What’s It Worth? The Economics Value of College Majors,” Anthony P. Carnevale, Jeff Strohl, and Michelle Melton. 2011. Center on Education and the Workforce. Georgetown University.

Suggested Citation

James, Jonathan. 2012. “The College Wage Premium.” Federal Reserve Bank of Cleveland, Economic Commentary 2012-10. https://doi.org/10.26509/frbc-ec-201210

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International