- Share

Consumers and COVID-19: A Real-Time Survey

We summarize the results from an ongoing survey that asks consumers questions related to the recent coronavirus outbreak, including their expectations for how the economy is likely to be affected by the outbreak and how their own behavior has changed in response to it. The survey began in early March, providing a window into how consumers’ responses have evolved in real time since the early days of the acknowledged spread of COVID-19 in the United States. In updating and charting the survey’s findings on the Cleveland Fed’s website going forward, we seek to inform policymakers and researchers about consumers’ beliefs during a time of high uncertainty and unprecedented policy responses.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The novel coronavirus that causes COVID-19 and the virus’s spread across the globe have caused human suffering and significant loss of life in the United States and around the world. The virus and the steps taken to slow its spread have produced large-scale economic disruptions and job losses. A growing body of economic literature seeks to jointly model the dynamics of the pandemic and the economy in order to quantify the impacts of the virus and related mitigation efforts and to predict how events may play out.1

Because consumers play a central role in the US economy, their beliefs and expectations are likely to be crucial for understanding the economy’s response to the pandemic.2 Using results from an ongoing survey maintained at the Federal Reserve Bank of Cleveland, Dietrich et al. (2020) present evidence that consumers’ beliefs evolved over time to expect a large decline in output as the pandemic unfolded. In the context of a theoretical model, Dietrich et al. (2020) show that such revisions to beliefs can amplify the economic costs of the pandemic in the near term.

In this Commentary, we summarize some of the key findings from this ongoing survey, whose first waves are described in greater detail in Dietrich et al. (2020), with the primary intention of making the survey’s results easily understandable in conjunction with publishing the results of the survey on the Cleveland Fed’s public website. The survey has a number of useful and unique features, including its focus on questions related to the recent coronavirus outbreak, its daily frequency, and its timeliness: It’s been running in real time since the early days of the acknowledged spread of COVID-19 in the United States. In updating the survey’s findings on the Cleveland Fed’s external website going forward, we seek to inform policymakers and researchers about consumers’ beliefs during a time of high uncertainty and unprecedented policy responses.

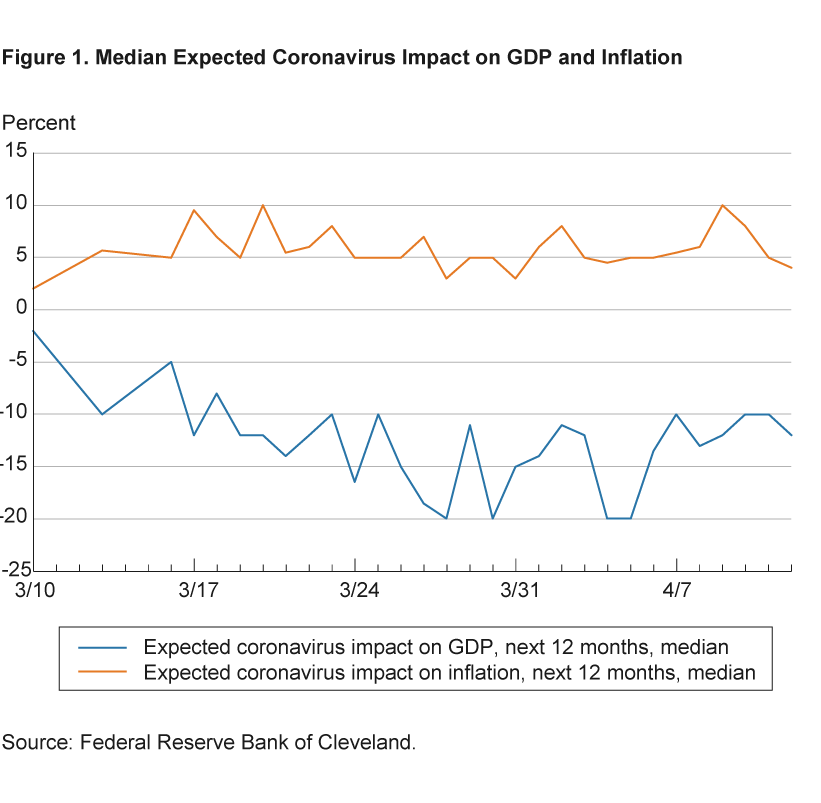

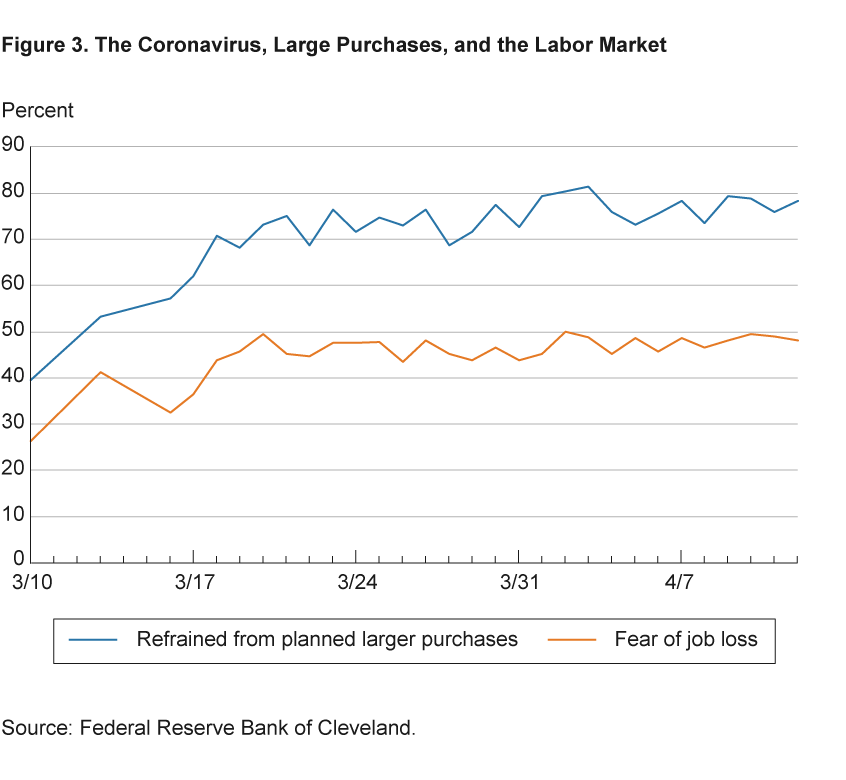

Between early March and early April 2020, as COVID-19 spread across the United States, we saw a marked shift in consumers’ beliefs about the effects the virus would have on the economy: Consumers came to expect that the coronavirus would have a larger negative impact on economic activity as measured by GDP than they had previously anticipated. Over the same time period, consumers expected the coronavirus would put upward pressure on inflation. We also saw marked increases in the percentage of consumers reporting that they had postponed planned larger purchases, changed their financial planning, or feared that they would lose their jobs. By early April, half of our survey respondents reported a fear of job loss as a result of the coronavirus.

Survey Design

The survey results presented below are part of a larger project that focuses on the beliefs of individual US consumers (see Dietrich et al. 2020). The survey is administered on the Qualtrics survey platform, and Qualtrics recruits a nationally representative sample of participants to provide responses. All respondents are required to be US residents, fluent in English, and 18 or older.

The survey began on March 10, 2020, and we continue to survey individuals at a daily frequency through the present and for the foreseeable future. This survey period is of great interest because the extent of the outbreak was not clear in early March. For example, the World Health Organization (WHO) did not announce that this novel coronavirus was a pandemic—which helped to underscore the severity of the outbreak in many people’s minds—until March 11, 2020.3 As of the first day of the survey, the United States had fewer than 1,000 confirmed cases.4 We obtain survey responses of between 50 and 208 individuals each day. Dietrich et al. (2020) present information on some of the background characteristics of the survey respondents. The sampling methodology uses repeated cross sections; we do not have a panel aspect to the survey to follow individuals’ beliefs over time. Finally, individuals in the survey are anonymized to ensure confidentiality.

Most of the questions of interest for this Commentary, laid out in the next section, require respondents to answer by selecting either “Yes” or “No.” By contrast, the results reported below for the effects of the COVID-19 outbreak on GDP and inflation are based on respondents’ point forecasts, for which respondents use a short-answer format to write in their estimates. While the survey also collects information related to individuals’ density forecasts (i.e., the probabilities that individuals assign to different potential outcomes), we do not use it here.

Consumer Responses and Expectations

We walk through the key questions asked in the initial survey by Dietrich et al. (2020) and show the associated time series of responses in figures. However, the main contribution of this Commentary comes through our ongoing surveys and sharing of the most up-to-date results on the Cleveland Fed’s website. We encourage readers to view the most recent data online, data which, as the pandemic progresses, may differ from the results described below.

For economic activity and inflation, we use two-part questions to assess respondents’ beliefs regarding the effects of the COVID-19 outbreak.5 Our economic activity questions are preceded by an introductory paragraph:

- Since January 2020 the coronavirus (COVID-19) is spreading with human infections around the world. Besides causing human suffering, this might also affect economic activity. We now want to know your personal expectations on this topic. Of course, no one can know the future. These questions have no right or wrong answers—we are interested in your views and opinions.

- In your view, within 12 months from today, will the overall economic impact of the coronavirus be positive or negative? This would include direct effects and indirect effects.

After selecting “Positive” or “Negative,” respondents are next asked the following question and given a text box to type an answer, for which the wording in brackets follows from their previous choice:

- What do you expect the overall economic impact of the coronavirus to be over the next 12 months? Please give your best guess. I expect the overall economic impact of the coronavirus to be [positive/negative] ___ percent of GDP.

Our survey procedure for inflation was similar. We first asked respondents to choose “Higher” or “Lower” in response to the following question:

- Over the next 12 months do you think that the coronavirus will cause inflation to be higher or lower?

Respondents then typed an answer in a text box in response to the following:

- How much [higher/lower] do you expect the rate of inflation to be over the next 12 months because of coronavirus? Please give your best guess. I expect the rate of inflation to be ___ percentage points [higher/lower] because of coronavirus.

We plot the evolution of the median across consumers’ responses to these two questions in figure 1.6 Consumers tended to expect that the coronavirus outbreak would result in higher inflation over the next 12 months. In our initial survey, the median expected impact of the coronavirus on inflation was +2 percentage points. Thereafter, consumers expected a somewhat larger effect of the coronavirus on inflation, with the effect fluctuating around +5 percentage points. By contrast, expectations for the effect on economic activity over the next 12 months have changed dramatically since early March. In our initial survey, the median expected impact of the coronavirus on GDP was −2 percent. By early April, the median expected impact was as large as −20 percent—an order of magnitude larger than the first reading.7

Over the same period, professional forecasters have reduced their expectations for GDP growth in the first half of 2020, and in many cases this reduction also resulted in reducing the Q4/Q4 GDP growth rate. At the time of this writing, many forecasters expected a deeply negative reading on GDP growth in the second quarter of 2020, with many estimates in the range of −20 percent to −30 percent at a quarterly annualized rate. However, many professional forecasters have also reduced their forecasts for inflation in 2020 over this same time period in light of the declines in economic activity occurring because of the coronavirus. These forecasts likely rely on the stylized fact that large declines in economic activity, as usually occur at the start of recessions, have historically coincided with declines in inflation via Phillips curve effects.8

How can one explain consumers’ beliefs that the coronavirus will lead to a large decline in GDP and an increase in inflation? While a decline in economic activity is consistent with social distancing measures that have closed nonessential businesses in many parts of the country, consumers may expect that supply constraints generated by the coronavirus outbreak will eventually push up prices. Dietrich et al. (2020) propose a model in which the pandemic resembles an anticipated adverse supply shock, and the combination of uncertainty around the economic costs of the pandemic and arriving news related to the pandemic leads to a dramatic reduction in spending. Consumers’ expectations for declining economic activity and rising inflation may also simply reflect widespread pessimism about the economy in light of the coronavirus outbreak. This interpretation aligns with the findings in Kamdar (2019) that “optimistic” consumers expect rising activity and declining inflation.

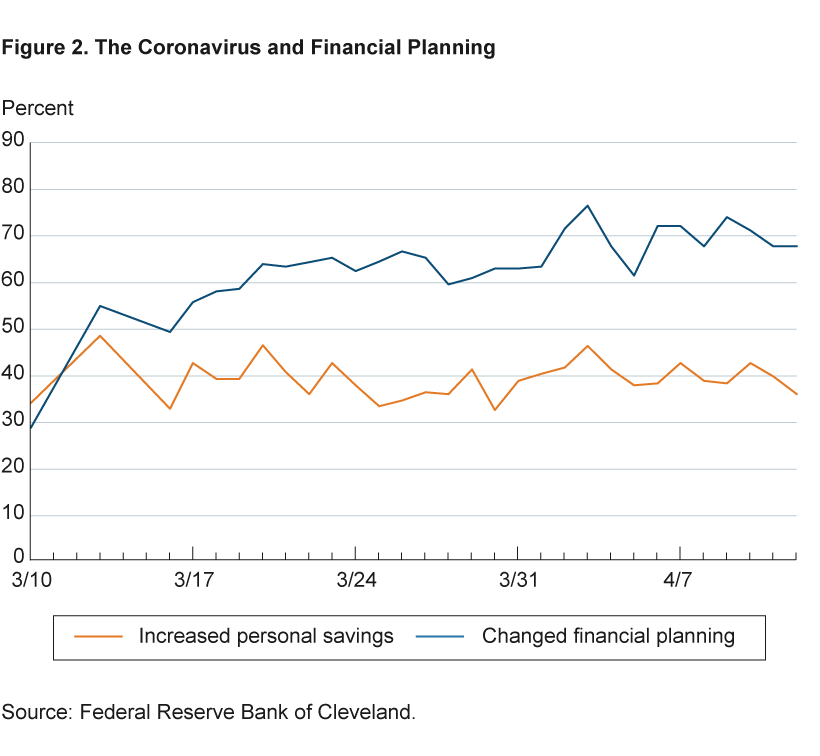

In figure 2, we plot the percentage of consumers who responded “Yes” to the following two questions related to financial planning and the outbreak of the coronavirus:

- Have you increased your personal savings due to the outbreak of the coronavirus?

- Has your financial planning changed due to the outbreak of the coronavirus?

Over our sample, roughly 40 percent of consumers indicated that they had increased their personal savings, perhaps out of precautionary savings motives, and this percentage has held roughly constant even as the coronavirus outbreak has worsened. By contrast, we see a strong increase over time in the percentage of consumers who have changed their financial planning—either voluntarily or out of necessity—as the coronavirus outbreak intensified.

In figure 3, we focus on the labor market and expensive purchases. We plot the percentage of consumers who responded “Yes” to the following:

- Have you refrained from planned larger purchases due to the outbreak of the coronavirus?

- Due to the economic consequences of the coronavirus, do you fear you may lose your job?

In both cases, we see marked increases in the shares of consumers who did not make planned larger purchases or who feared losing their job because of the coronavirus outbreak.9 Among the survey respondents, about half of consumers feared losing their job by early April 2020, double the share who responded that way in early March. These reports reflect a sudden shift in the labor market compared with its status in February 2020, when the Bureau of Labor Statistics calculated a national unemployment rate of 3.5 percent. However, the finding that half of respondents reported fears of losing their job as a result of the economic consequences of the coronavirus is not far from the estimates of some analysts who posit that the unemployment rate could rise to the vicinity of 30.0 percent.10

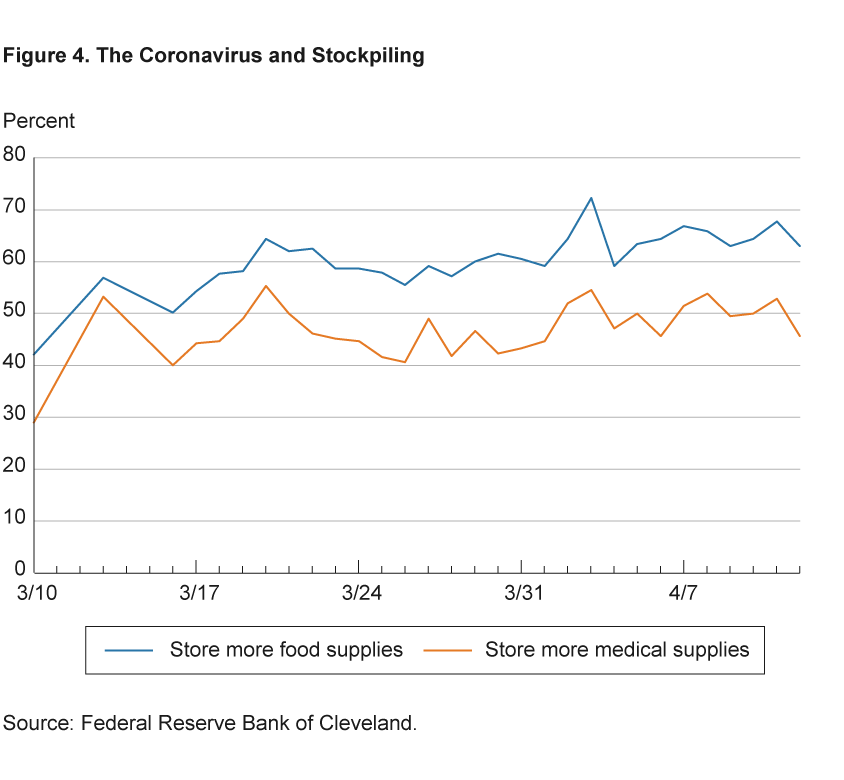

Figure 4 documents the real-time evolution of consumers’ purchasing habits, focusing on food supplies and medical supplies. We plot the percentages of respondents who answered “Yes” to the following questions:

- Since the outbreak of the coronavirus, have you started to store larger quantities of food supplies at home than before?

- Since the outbreak of the coronavirus, have you started to store larger quantities of medical supplies at home than before?

We have seen substantive increases in both measures since early March 2020, in line with press reports and company financial statements regarding consumer stockpiling behavior.

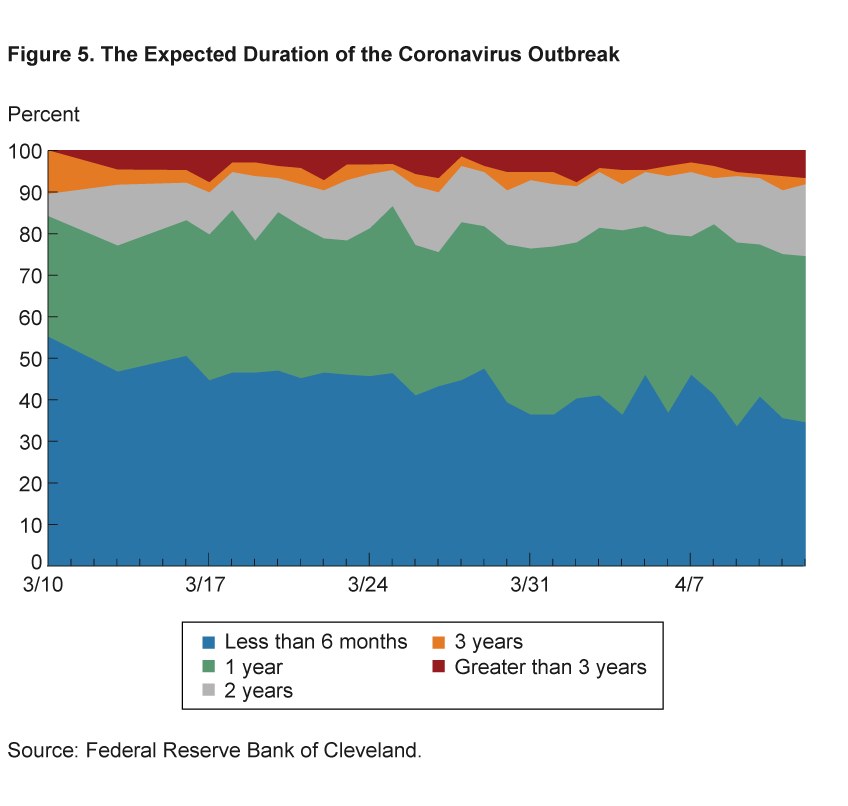

Finally, we show results that reveal consumers’ beliefs about the duration of the coronavirus outbreak.11 The survey poses the following question:

- How many years do you think the coronavirus outbreak will last?

Respondents are required to choose one of the following options: (a) Less than 6 months; (b) 1 year; (c) 2 years; (d) 3 years; (e) More than 3 years. Figure 5 plots the distribution of responses. On March 10, more than half of respondents believed that the coronavirus outbreak would last less than 6 months. Over time, however, respondents’ views have shifted toward a realization that the outbreak could be longer-lasting. Now, only about one-third of respondents expect that the outbreak will last less than 6 months, while the other two-thirds believe it will last 1 year or longer.

Conclusion

This Commentary summarizes the results of surveys of consumers regarding their views on the evolving coronavirus outbreak, based on recent work by Dietrich et al. (2020). It provides background on the survey tool used to produce the outcomes for the Consumers and COVID-19 webpage on the Cleveland Fed’s website. We encourage readers to view the most recent data online, including additional observations, new survey questions that may be added, and access to additional resources.

Footnotes

- The literature is growing rapidly; see, for example, McKibbin and Fernando (2020), Atkeson (2020), Barro, Ursúa, and Wang (2020), Eichenbaum, Rebelo, and Trabandt (2020), Guerrieri et al. (2020), and Alvarez, Argente, and Lippi (2020). Return

- Binder (2020) presents a snapshot of consumers’ views regarding the coronavirus in early March 2020, but the focus of that study is on the interaction between the coronavirus and the initial monetary policy response to it. Barrios and Hochberg (2020) and Allcott et al. (2020) study consumers’ responses to the COVID-19 pandemic through the lens of political polarization. Return

- See World Health Organization (2020). Return

- See Lyons (2020). Return

- We use this two-part structure to ensure that respondents clearly identify whether they believe GDP and inflation are likely to be higher or lower as a result of the coronavirus outbreak and then to capture the extent to which they will be higher or lower. Return

- By focusing on the midpoint of the distribution, the median is immune to outliers in beliefs, as these can dramatically influence the mean (average). Return

- There is a great deal of uncertainty surrounding the expected coronavirus impacts on economic activity and inflation from our survey of consumers, whether we look at forecast dispersion across respondents (which is not always the same as forecast uncertainty; see Rich and Tracy, 2018) or uncertainty measures based on the weights that respondents assign to different potential outcomes for economic activity and inflation (i.e., implied density forecasts). Return

- See Stock and Watson (2010) and Ashley and Verbrugge (2019). Return

- The survey does not ask respondents about the reasons for refraining from planned larger purchases, reasons which could reflect either a lack of opportunity to make such purchases (because businesses were closed) or a pullback in desired spending among consumers because of uncertainty and rising joblessness. Return

- See Bullard (2020) and Faria-e-Castro (2020). Return

- Because the survey is ongoing, new questions are occasionally added whose time series will also appear on the Cleveland Fed’s website. For example, on April 3 the survey began asking respondents the following:

- Have you increased the amount of cash and currency in your wallet or your house due to the outbreak of the coronavirus?

References

- Allcott, Hunt, Levi Boxell, Jacob Conway, Matthew Gentzkow, Michael Thaler, and David Yang. 2020. “Polarization and Public Health: Partisan Differences in Social Distancing during COVID-19.” Unpublished manuscript. https://doi.org/10.3386/w26946.

- Alvarez, Fernando, David Argente, and Francesco Lippi. 2020. “A Simple Planning Problem for COVID-19 Lockdown.” University of Chicago, Becker Friedman Institute for Economics, Working Paper No. 2020-34. http://dx.doi.org/10.2139/ssrn.3569911.

- Ashley, Richard, and Randal J. Verbrugge. 2019. “Variation in the Phillips Curve Relation across Three Phases of the Business Cycle.” Federal Reserve Bank of Cleveland, Working Paper No. 19-09. https://doi.org/10.26509/frbc-wp-201909.

- Atkeson, Andrew. 2020. “What Will Be the Economic Impact of COVID-19 in the US? Rough Estimates of Disease Scenarios.” NBER, Working Paper No. 26867. https://doi.org/10.3386/w26867.

- Barrios, John Manuel, and Yael V. Hochberg. 2020. “Risk Perception through the Lens of Politics in the Time of the COVID-19 Pandemic.” University of Chicago, Becker Friedman Institute for Economics, Working Paper No. 2020-32. https://doi.org/10.2139/ssrn.3568766.

- Barro, Robert J., José F. Ursúa, and Joanna Wang. 2020. “The Coronavirus and the Great Influenza Pandemic: Lessons from the ‘Spanish Flu’ for the Coronavirus’s Potential Effects on Mortality and Economic Activity.” NBER, Working Paper No. 26866. https://www.doi.org/10.3386/w26866.

- Binder, Carola. 2020. “Coronavirus Fears and Macroeconomic Expectations.” Unpublished manuscript. https://doi.org/10.2139/ssrn.3550858.

- Bullard, James. 2020. “Expected US Macroeconomic Performance during the Pandemic Adjustment Period.” Federal Reserve Bank of St. Louis Fed, On the Economy (blog post, March 23). https://www.stlouisfed.org/on-the-economy/2020/march/bullard-expected-us-macroeconomic-performance-pandemic-adjustment-period.

- Dietrich, Alexander M., Keith Kuester, Gernot J. Müller, and Raphael S. Schoenle. 2020. “News and Uncertainty about COVID-19: Survey Evidence and Short-Run Economic Impact.” Federal Reserve Bank of Cleveland, Working Paper No. 20-12. https://doi.org/10.26509/frbc-wp-202012.

- Eichenbaum, Martin S., Sergio Rebelo, and Mathias Trabandt. 2020. “The Macroeconomics of Epidemics.” NBER, Working Paper No. 26882. https://doi.org/10.3386/w26882.

- Faria-e-Castro, Miguel. 2020. “Back-of-the-Envelope Estimates of Next Quarter’s Unemployment Rate.” Federal Reserve Bank of St. Louis, Fed on the Economy (blog post, March 24). https://www.stlouisfed.org/on-the-economy/2020/march/back-envelope-estimates-next-quarters-unemployment-rate.

- Guerrieri, Veronica, Guido Lorenzoni, Ludwig Straub, and Iván Werning. 2020. “Macroeconomic Implications of COVID-19: Can Negative Supply Shocks Cause Demand Shortages?” NBER, Working Paper No. 26918. https://doi.org/10.3386/w26918.

- Kamdar, Rupal. 2019. “The Inattentive Consumer: Sentiment and Expectations.” Unpublished manuscript. https://ideas.repec.org/p/red/sed019/647.html.

- Lyons, Patrick J. 2020. “Coronavirus Briefing: What Happened Today?” The New York Times (March 10). https://www.nytimes.com/2020/03/10/us/coronavirus-today-updates.html (paywall).

- McKibbin, Warwick, and Roshen Fernando. 2020. “The Global Macroeconomic Impacts of COVID-19: Seven Scenarios.” Unpublished manuscript. https://www.brookings.edu/wp-content/uploads/2020/03/20200302_COVID19.pdf.

- Rich, Robert, and Joseph Tracy. 2018. “A Closer Look at the Behavior of Uncertainty and Disagreement: Micro Evidence from the Euro Area.” Federal Reserve Bank of Cleveland, Working Paper No. 18-13. https://doi.org/10.26509/frbc-wp-201813.

- Stock, James H., and Mark W. Watson. 2010. “Modeling Inflation after the Crisis.” Proceedings—Economic Policy Symposium—Jackson Hole, Federal Reserve Bank of Kansas City, 173–220. https://www.kansascityfed.org/publicat/sympos/2010/stock-watson.pdf.

- World Health Organization. 2020. Transcript of “Virtual Press Conference on COVID-19—11 March 2020.” https://www.who.int/docs/default-source/coronaviruse/transcripts/who-audio-emergencies-coronavirus-press-conference-full-and-final-11mar2020.pdf?sfvrsn=cb432bb3_2.

Suggested Citation

Knotek, Edward S., II, Raphael S. Schoenle, Alexander M. Dietrich, Keith Kuester, Gernot J. Müller, Kristian Ove R. Myrseth, and Michael Weber. 2020. “Consumers and COVID-19: A Real-Time Survey.” Federal Reserve Bank of Cleveland, Economic Commentary 2020-08. https://doi.org/10.26509/frbc-ec-202008

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International