- Share

The Effect of the 2017 Tax Reform on Investment

The 2017 tax reform affected investment through many channels. I use a macroeconomic model to estimate the overall effect. That estimate suggests that, because the different provisions worked in different directions, the initial impact of the tax reform on investment was small. The same model predicts that the tax reform will hold investment down in the medium term.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

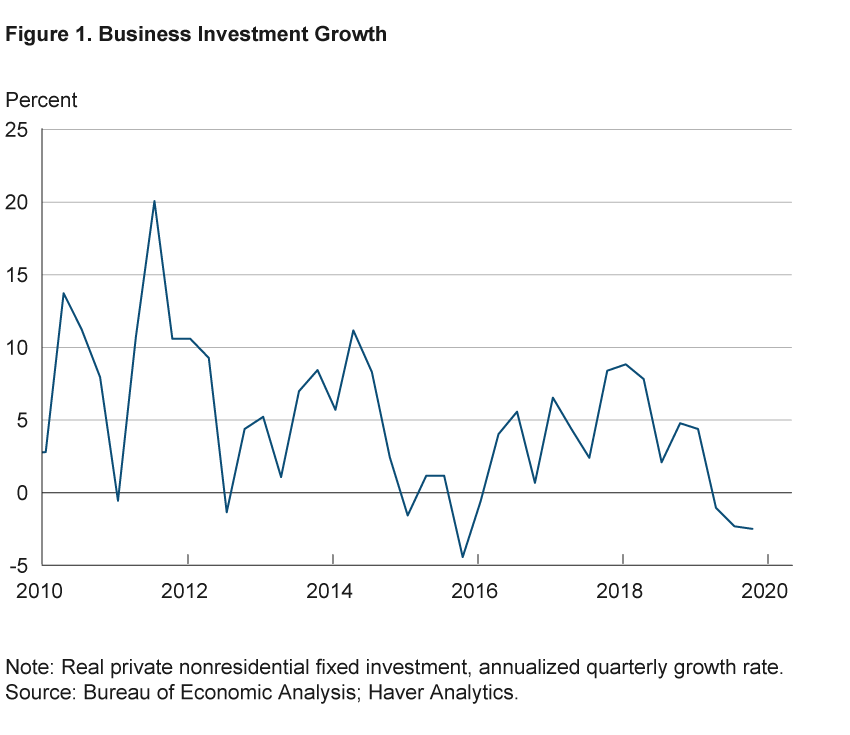

The Tax Cuts and Jobs Act, introduced at the end of 2017, was a complex tax reform that included tax cuts for individuals and businesses. One of the anticipated effects of the reform was to stimulate investment (Council of Economic Advisers, 2017). Business investment, however, grew more slowly after the tax reform than before it (figure 1). The average quarterly growth rate of business investment was 2.8 percent in 2018–2019, lower than the rates in 2016–2017 (4.0 percent), 2013–2017 (3.9 percent), or 2010–2017 (5.5 percent). Even taking into account that other economic factors, such as changes in trade policy and a global economic slowdown, may have held investment down, these data suggest that the stimulus provided by the tax reform was not large.

In this Commentary, I explain why the effect of the tax reform on investment may have been limited. I study various channels through which the tax reform affected investment. I focus on the tax-reform provisions that likely had the most important effect on investment: the tax cuts for corporations, individuals, and pass-through businesses; the increase in the first-year bonus depreciation; the scheduled amortization of R&D expenses; and the limit on interest deductibility. I explain how each of these provisions would be expected to affect investment, and I report the net aggregate effect of all provisions according to a macroeconomic model.

Corporate Tax Cuts

The corporate tax cuts enacted through the Tax Cuts and Jobs Act included two provisions: a permanent cut in the corporate tax rate and a transitional provision on corporate earnings held overseas. The income tax rate for C corporations (corporations that are taxed separately from their owners) was permanently reduced from 35 percent to 21 percent. In addition, the tax system changed; C corporations are now taxed on only their domestic income, while they were previously taxed on their worldwide income. Under the old tax system, foreign earnings were taxed at the time of repatriation. To transition to the new tax system, corporations became subject to a one-time tax on their earnings held overseas. The one-time transitional tax rate (15.5 percent on liquid assets and 8 percent on illiquid assets) was lower than the tax rate under the old tax regime (35 percent).

Contrary to the expectations of some observers, the permanent cut in the corporate tax rate may have held investment down rather than stimulated it. The reason has to do with how companies finance their investment and what expenses they can deduct from their taxable income. Partly for reasons relating to the tax system, companies tend to finance most of their investment through debt. Companies that borrow to finance investment can deduct their interest expenses. In addition, companies can deduct their investment expenses at a faster rate than the economic depreciation rate of capital, using bonus depreciation or other forms of accelerated depreciation. The combination of the two tax shields (interest deductibility and accelerated depreciation) works as an investment subsidy: As companies expand their borrowing and investment, the present value of their tax liabilities decreases, making investment cheaper. The value of the two tax shields and the size of the subsidy both increase with the corporate tax rate. A cut in the corporate tax rate, then, decreases the subsidy and discourages investment.1

To better understand why the corporate income tax can work as an investment subsidy, consider a simplified version of a firm’s investment-choice problem (see the appendix for the details). As the firm expands the level of its investment, its capital stock increases and the marginal product of the capital decreases. To maximize profits, the firm has to expand its investment level up to the point where the marginal product of capital equals the user cost of capital, which is the unit cost of using capital for one year, also known as “capital rental.” For clarity, let k* denote the investment level that the firm would choose in the absence of corporate taxation. When we add corporate taxation, the firm’s investment choice depends on the deductions allowed by the tax system. If the tax system did not allow any interest deductibility or accelerated depreciation, a corporate income tax would raise the user cost of capital. To restore the equality between the marginal product and the user cost, the firm would have to lower its investment level below k*. In other words, the corporate income tax would work as a tax on investment. The current US tax system, however, allows interest deductibility and accelerated depreciation. Interest deductibility lowers the user cost of capital enough to bring the investment level back to k*; that is, it makes the corporate income tax neutral with respect to its effect on investment. Accelerated depreciation further lowers the user cost of capital, leading to an investment level greater than k*. In other words, the corporate income tax ends up working as an investment subsidy.

The result that a cut in the corporate tax rate decreases investment can be mitigated or overturned by a mechanism working through the borrowing rate faced by corporations: The tax cut can lower the borrowing rate, thereby lowering the user cost of capital and, all other things held constant, raising the investment level. The strength of this borrowing-rate mechanism depends on how the tax cut affects the general level of interest rates in the economy, the rate of return required by lenders, and the credit risk of borrowers. In the macroeconomic model that we use in this article, the borrowing-rate mechanism is not strong enough to overturn the result that a tax rate cut decreases investment.

Unlike the Tax Cuts and Jobs Act’s cut in the corporate tax rate, the act’s transitional provision on corporate earnings held overseas likely stimulated investment. Since the earnings held overseas were subject to a high tax rate under the old tax system and became subject to a lower tax rate, the transitional provision amounted to a lump-sum tax cut for corporations. Its main effect was to strengthen the balance sheets of corporations and lower their credit risks, much like a windfall gain. This way, the provision decreased corporate credit spreads and borrowing rates. A lower corporate borrowing rate meant a lower user cost of capital, an effect that worked to stimulate investment. The size of this effect was likely small, though, as corporate credit spreads were already low before the tax reform and could not decline much further.

Other Provisions

Besides the corporate tax cuts, the other tax-reform provisions that had the most important effects on investment were the tax cuts for individuals and pass-through businesses, the increase in the first-year bonus depreciation, the scheduled amortization of R&D expenses, and the limit on interest deductibility.

Tax Cuts for Individuals and Pass-Through Businesses

Statutory income tax rates for individuals were cut by about 3 percentage points, but itemized deductions were simultaneously reduced. All in all, the effective marginal tax rate on labor income decreased by about 2.2 percentage points (Congressional Budget Office, 2018, Table B1). The tax rates for owners of pass-through businesses (sole proprietorships, partnerships, and S corporations) were similarly cut, since income from pass-through businesses is taxed at the individual level. In addition, owners of pass-through businesses can now deduct 20 percent of their pass-through income (subject to an income limit). These provisions are temporary and scheduled to expire in 2026.

The tax cuts for individuals likely had a positive impact on investment. Individual income tax cuts raise the after-tax wage rate received by workers. Economic models predict that households respond to higher wages by raising their labor supply and consumption demand. In turn, an increase in household consumption demand raises the profitability of investment projects and encourages firms to expand their investment. This effect might be mitigated by a decrease in the before-tax wage rate and an increase in the capital rental that would encourage firms to substitute labor for capital, thereby accommodating the increase in labor supply.

The size of this mechanism is uncertain. The key source of uncertainty is the effect of the tax cuts on the labor supply. This effect depends on what economists refer to as the “Frisch elasticity of labor supply,” which measures the percentage increase in hours worked induced by a 1 percent increase in the after-tax wage rate, holding constant the marginal utility of wealth. Estimates of the Frisch elasticity vary widely in the research literature, ranging from 0.1 to more than 1 (Reichling and Whalen, 2012). With a Frisch elasticity of 0.5, hours worked would increase by 0.5 percent in response to a 1 percent increase in the after-tax wage rate. Then, a tax rate cut of 2.2 percentage points (from 33 percent to 30.8 percent) would imply an increase of 3.3 percent in the after-tax wage rate and an increase of 1.65 percent in hours worked. Different values of the Frisch elasticity would imply proportionally different percentage increases in hours worked. For instance, a Frisch elasticity of 0.1 would imply an increase of 0.33 percent in hours worked, while a Frisch elasticity of 1 would imply an increase of 3.3 percent in hours worked, an amount 10 times larger. The large uncertainty around the effect of the tax cuts on the labor supply directly translates into large uncertainty around the effect of the tax cuts on investment.

The tax cuts for owners of pass-through businesses had effects similar to the ones of the corporate tax cuts, as described earlier. On the one hand, for these businesses, the cut in the income tax rate may have held their investment down. On the other hand, the tax cuts decreased the credit risk for pass-through businesses, their credit spread, and borrowing rate, leading to a lower user cost of capital and a higher investment level. The net effect depended on the decline in the borrowing rate for pass-through businesses. In the macroeconomic model that we use in this article, the borrowing rate did not decline much, so the tax cuts for pass-through businesses ended up decreasing investment.

Bonus Depreciation and Amortization

Two provisions that likely had significant implications for investment were the increase in the first-year bonus depreciation and the scheduled amortization of R&D expenses. The first-year bonus depreciation for certain business assets (mainly equipment and software) was increased from 50 percent to 100 percent; that is, businesses can now deduct 100 percent of the asset cost in the first year the asset is placed in service.

The bonus depreciation will be phased out gradually between 2023 and 2026 and will expire after that time. While currently R&D expenses can be immediately expensed (i.e., treated as an expense and immediately deducted from income), starting in 2022 they will need to be amortized over five years.

Economic theory indicates that these two provisions had opposite effects on investment since they had opposite effects on how fast businesses can depreciate their capital. When businesses are allowed to depreciate their capital more quickly, their user cost of capital decreases (Hall and Jorgenson, 1967; Creedy and Gemmell, 2015). As the user cost decreases, profit-maximizing businesses increase their investment level and capital stock, driving the marginal product of capital down to the point where the equality between marginal product and user cost is restored. In other words, allowing businesses to depreciate their capital more quickly stimulates investment.2 The increase in the bonus depreciation allowed a faster depreciation of equipment and software, so it likely led to an investment increase in these two types of capital. In contrast, the scheduled switch from expensing to amortizing R&D expenses amounts to requiring businesses to depreciate R&D more slowly, so it will likely lead to a decrease in investment in R&D.

Limit on Interest Deductibility

The Tax Cuts and Jobs Act introduced a limit on the deductibility of interest expenses. Starting in 2018, businesses can deduct their net interest expenses up to 30 percent of their earnings before interest, taxes, depreciation, and amortization (EBITDA). Starting in 2022, the limit will become even more stringent: 30 percent of their earnings before interest and taxes (EBIT), a measure of earnings that is smaller than EBITDA.

The introduction of this limit likely held investment down. Allowing businesses to deduct their interest expenses lowers their user cost of capital (Fullerton, 1999), and this in turn encourages businesses to invest more. Since interest deductibility lowers the user cost of capital and stimulates investment, limiting interest deductibility has the opposite effect—it raises the user cost of capital and discourages investment.

The uncertainty around the size of this effect is especially large. The limit affects businesses with higher interest expenses more than businesses with lower interest expenses. As businesses with different levels of interest expenses may differ with regard to debt levels, credit risk, industry, and investment behavior, it is difficult to estimate precisely the average effect of the limit across all types of businesses.

Net Aggregate Effect of the Tax Reform

Some provisions worked to stimulate investment, while others worked to hold investment down. What was the net aggregate effect of all provisions? In Occhino (2019), I quantify these effects within a macroeconomic model and relate the results to estimates from other studies, including Barro and Furman (2018) and the Congressional Budget Office (2018).

The model I use is a standard macroeconomic model that captures the aggregate general-equilibrium effects of the tax reform through interest rates. It describes the behavior of households, owners of corporations, owners of pass-through businesses, and the government. Businesses can invest in structures, equipment, and R&D. The tax system allows both interest deductibility and accelerated depreciation of capital. The tax reform affects the business cost of external funds by affecting both the risk-free rate and the credit spread.

I find that the initial effect of the tax reform on the investment level was positive but small, about 0.2 percent in 2018, mainly because the different provisions worked in different directions. For instance, while the individual tax cuts and the increase in the bonus depreciation stimulated investment by 1.5 percent and 2 percent, respectively, the corporate tax rate cut and the limit on interest deductibility depressed investment by 1.2 percent and 1.8 percent, respectively.

The model predicts that the effect of the tax reform on investment will turn negative in the medium term. After 2026, the tax reform is expected to lower investment by about 1.6 percent, mainly because of the switch from expensing to amortization of R&D expenses and the stricter limit on interest deductibility. While the effect of the tax reform on investment in equipment and structures will be negligible, the tax reform will persistently discourage investment in R&D because of the scheduled amortization of R&D expenses.

These estimates depend on many model assumptions and parameter values. For instance, what households and businesses expect about the future of the tax provisions is important for how they respond to the tax reform today. The setting of parameters such as the Frisch elasticity of labor supply is also important for the response. It is, therefore, natural that there is some uncertainty around the estimated effects. One model prediction that is rather robust across a range of assumptions and parameter values is that the effect of the tax reform on investment was small in 2018 and will turn negative in the medium term.

Such a prediction is on the pessimistic side relative to the typical range of predictions given by other macroeconomic models. Every model has its own strength. On the one hand, other models may include economic sectors and mechanisms that my model abstracts from, such as the housing sector, the international sector, or a monetary policy response. On the other hand, my framework accurately models the combination of interest deductibility and the accelerated depreciation of capital, a combination that is crucial to derive valid estimates of the effect of business income tax cuts on investment.

Conclusion

The 2017 tax reform affected investment through many channels. Economic theory indicates that the tax cuts for individuals, the increase in the first-year bonus depreciation, and the provision on corporate earnings held overseas likely stimulated investment, whereas the tax rate cuts for businesses, the scheduled amortization of R&D expenses, and the limit on interest deductibility likely held investment down. This article uses a macroeconomic model to estimate the overall effect. That estimate suggests that, because the different provisions worked in different directions, the initial impact of the tax reform on investment was small. The same model predicts that the tax reform will hold investment down in the medium term as businesses switch from expensing to amortizing R&D expenses and become subject to a stricter limit on interest deductibility.

Footnotes

- “Thus we get a zero marginal effective tax rate either with expensing or with debt finance. As a consequence, we get a negative effective tax rate with expensing and debt finance” (Fullerton, 1999). “The combination of debt finance and excessive tax depreciation can easily result in negative effective corporate tax rates on investment. In the extreme, 100 percent debt financing and expensing result in an effective tax rate equal to –35 percent [minus the statutory tax rate]” (Sullivan, 2012). See Fullerton (1999) for how interest deductibility and accelerated depreciation allowances (as well as other factors such as investment tax credits and inflation) can lead to negative effective marginal tax rates on investment. Return

- Mertens and Ravn (2013) provide empirical evidence on the historical effects of exogenous cuts in the corporate income tax liability. Most of these cuts were driven by increases in depreciation allowances and investment tax credits. Return

References

- Barro, Robert J., and Jason Furman. 2018. “Macroeconomic Effects of the 2017 Tax Reform.” Brookings Papers on Economic Activity, Spring 2018(1), 257-345. https://www.doi.org/10.1353/eca.2018.0003.

- Council of Economic Advisers. 2017. “The Growth Effects of Corporate Tax Reform and Implications for Wages.” CEA Report (October). https://www.whitehouse.gov/briefings-statements/cea-report-growth-effects-corporate-tax-reform-implications-wages/.

- Congressional Budget Office. 2018. “The Budget and Economic Outlook: 2018 to 2028.” Congressional Budget Office, April 2018. https://www.cbo.gov/publication/53651.

- Creedy, John, and Norman Gemmell. 2015. “Taxation and the User Cost of Capital: An Introduction.” Victoria Business School, Working Paper in Public Finance 04/2015.

- Fullerton, Don. 1999. “Marginal Effective Tax Rate.” The Encyclopedia of Taxation and Tax Policy, 270–272, Urban Institute Press, edited by Joseph J. Cordes, Robert D. Ebel, and Jane G. Gravelle.

- Hall, Robert E., and Dale W. Jorgenson. 1967. “Tax Policy and Investment Behavior.” American Economic Review, 57(3), 391–414.

- Mertens, Karel, and Morten O. Ravn. 2013. “The Dynamic Effects of Personal and Corporate Income Tax Changes in the United States.” American Economic Review, 103(4), 1212-1247. https://www.doi.org/10.1257/aer.103.4.1212.

- Occhino, Filippo. 2019. “The Macroeconomic Effects of the Tax Cuts and Jobs Act.” Federal Reserve Bank of Cleveland, Working Paper No. 19-28. https://www.doi.org/10.26509/frbc-wp-201928.

- Reichling, Felix, and Charles Whalen. 2012. “Review of Estimates of the Frisch Elasticity of Labor Supply.” Congressional Budget Office, Working Paper No. 2012-13.

- Sullivan, Martin A. 2012. “Treat Corporate Interest Deductions Like Any Tax Expenditure.” Tax Analysts, (August 6). http://www.taxhistory.org/www/features.nsf/Articles/0BB1F6D13297CC6285257A5200511B3F.

Suggested Citation

Occhino, Filippo. 2020. “The Effect of the 2017 Tax Reform on Investment.” Federal Reserve Bank of Cleveland, Economic Commentary 2020-17. https://doi.org/10.26509/frbc-ec-202017

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International