- Share

Do Longer Expansions Lead to More Severe Recessions?

We are now in one of the longest expansions on record. The recession that preceded that expansion was one of the worst in history. Are those two facts related? Some economists suggest they are, while others suggest it’s the other way around: Longer expansions lead to more severe recessions. We assess the evidence for these two hypotheses. We find clear evidence for the former and little for the latter. Deeper recessions are often followed by stronger recoveries, while longer and stronger expansions are not followed by deeper recessions.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The most recent US business cycle has been remarkable in both its recession and expansion phases. The recession—the Great Recession that lasted from late 2007 to mid-2009—was the most severe of the postwar period. The expansion, which we are currently in, has been uncommonly long and strong. It’s been going on for 114 months, making it the second-longest in history, just 6 months short of the longest expansion based on NBER recession dates.1 And during that time, the unemployment rate has fallen from 9.9 percent to 3.7 percent, the largest improvement in the labor market during an expansion on record.

The outsized proportions of the recession and expansion have rekindled interest in the question of whether features of recessions and expansions such as duration and intensity are correlated. For example, does the depth of a recession translate into the strength of the expansion that follows? Or does the length or strength of an expansion mean anything about the severity of the next recession, when it eventually occurs? If there are clear relationships, these features could have some predictive power about the next phase of the cycle.

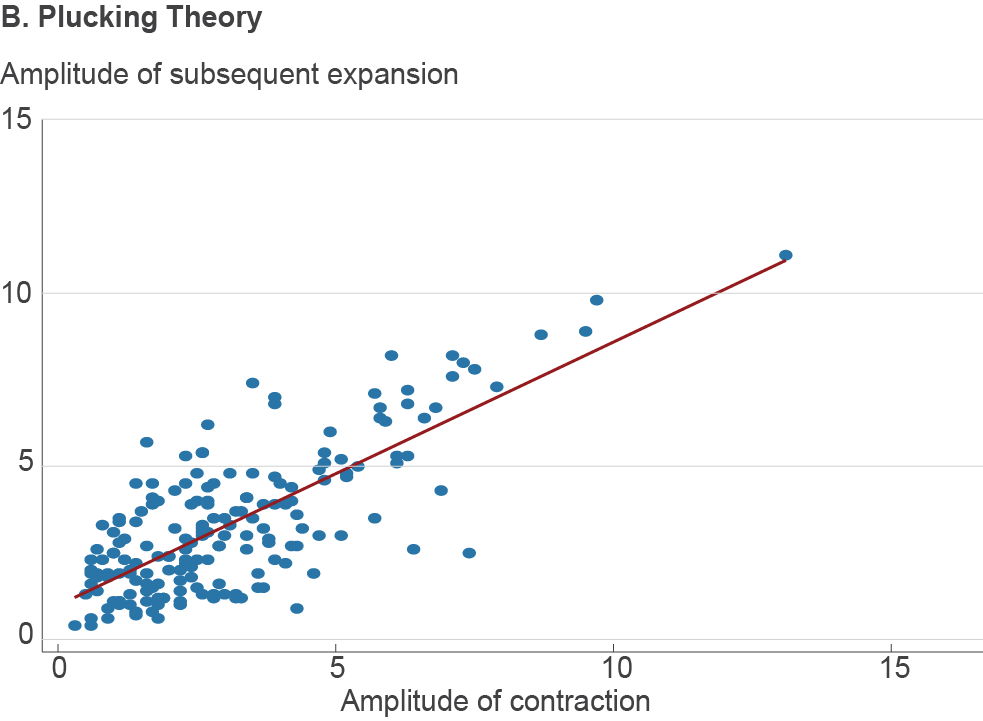

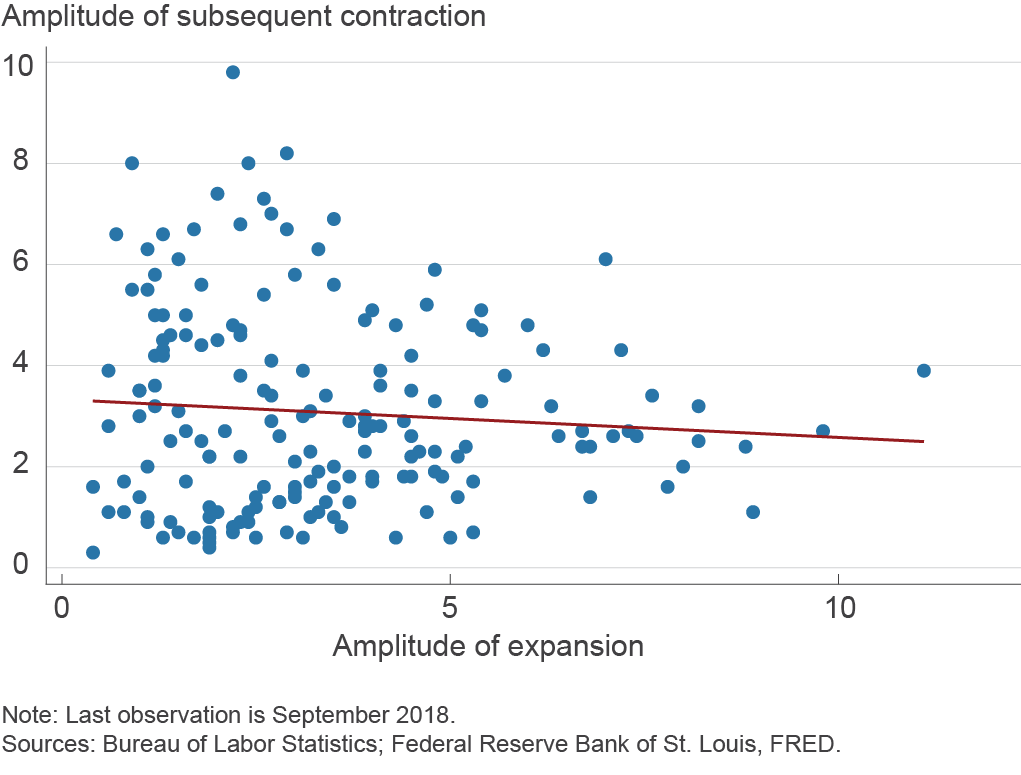

In this Economic Commentary, we assess the evidence for two alternative hypotheses that economists have developed related to this question, each of which makes different predictions. The plucking theory predicts deep downturns will be followed by strong expansions. The forest fire theory predicts long expansions will be followed by severe recessions. We find clear evidence for the plucking theory and little for the forest fire theory in the aggregate and state-level data.

Links between Recessions and Expansions: Two Theories

Macroeconomists have sought to understand the nature of the business cycles for a long time, and they have attributed cyclical changes in the economy to many different causes including financial shocks, fluctuations in aggregate demand, total factor productivity, and uncertainty about some underlying economic fundamental. Two recent studies have investigated the links between expansions and recessions, proposing different models and coming to different conclusions. Jackson and Tebaldi (2017) focus on the link between the duration of an expansion and the severity of the recession that follows. Dupraz, Nakamura, and Steinsson (2017) focus on the relationship between the severity of the recession and the strength of the subsequent expansion.

The Forest Fire Theory

Jackson and Tebaldi (2017)2 speculate that the duration of expansionary spells is related to the severity of subsequent recessions, likening the mechanism behind the relationship to the conditions that affect the severity of forest fires. With forest fires, long spells without any wild fires lead to substantial accumulation of dry debris that will fuel a fire, and the greater the accumulation, the more severe the wild fire. Analogously, the authors reason that during business cycle expansions inefficient relationships (“matches”) build up between various actors in the economy (such as employers and employees, companies and their suppliers, etc.), as both sides face competition when aggregate conditions are good and are less able to turn down available matches. When a negative shock hits and aggregate conditions worsen, marginally productive matches will turn unproductive and dissolve. The longer the expansion, the larger the pool of “at-risk” relationships.

For example, in the labor market, when the aggregate economy is expanding at a healthy clip, as it is currently, unemployment rates might be low and firms might have a hard time finding the best worker for the job they need to fill.3 Firms might go ahead and hire a worker who is not the best fit for the job because the demand for their output is so high that they cannot forgo even a potentially mediocre match with the hope of finding a better one in the future. The longer the boom continues, the greater the number of less-than-optimal matches in employment relationships that accumulate. Then, when the economy eventually is hit with a shock and falls into a recession, the pool of employed workers who risk losing their jobs will be larger.

In this framework, the duration of the expansion predicts the severity of the recession that follows.

The Plucking Theory

Dupraz, Nakamura, and Steinsson (2017) propose a different theory based on the “plucking” model of Milton Friedman (1993). This theory posits that the economy is operating along a ceiling of maximum feasible output most of the time over the business cycle. However, every now and then, it is “plucked down” by a contraction that could be due to supply or demand shocks. In this framework, the size of the “pluck” predicts the size of the subsequent expansion, but the size of the expansion does not necessarily predict the subsequent recession.

Testing the Theories

Jackson and Tebaldi provide evidence from metropolitan area-level data that support their theory. Instead, we test the theory using national and state-level data. We start by defining expansionary and contractionary cycles based on the unemployment rate.4 We use the national unemployment rate statistics from the Bureau of Labor Statistics (BLS), retrieved from FRED. Specifically, we define a business cycle peak as a month in which the unemployment rate is strictly lower than any month in the two years before, and weakly lower than any month in the two years after. Business cycle troughs are defined analogously.5 Using this definition yields nine recessionary episodes in the postwar period and ten expansionary episodes, including the current one. The recessions are similar to NBER-defined recessions with one major difference being that our definition combines the 1980 and 1981–1982 recessions into one. We also measure the amplitude of an expansion or a recession as the change in the national unemployment rate experienced during the respective episode, with the amplitude corresponding to “strength” in an expansion and “severity” in a contraction. Note that based on our measure of amplitudes, the current expansion is the strongest on record with an amplitude of 6.2 (with the unemployment rate falling from 9.9 percent to 3.7 percent).

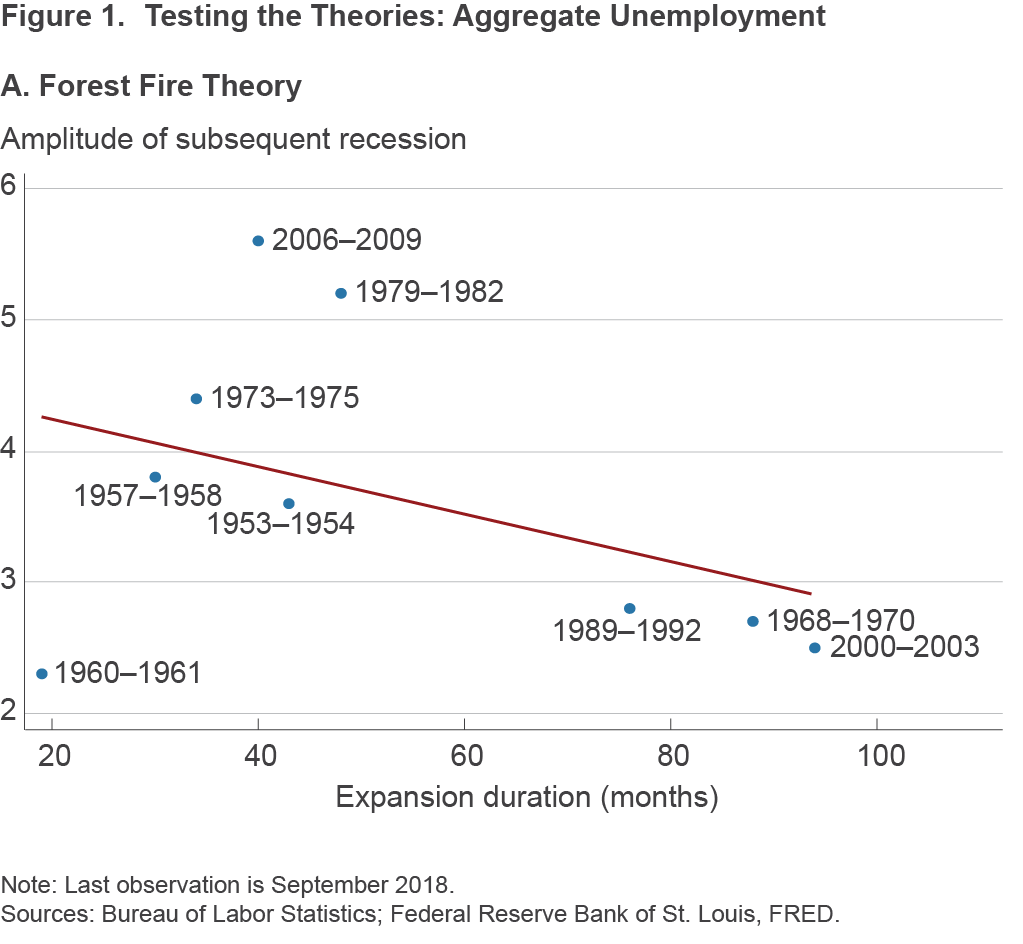

Figure 1a presents the empirical relationship in the national data between expansions and subsequent recessions in a test of the forest fire theory. On the x-axis is the duration of each expansion, excluding the current one, and on the y-axis is the amplitude of the subsequent recession. Data points are labeled with the recession date that followed the expansion. As the slope of the dashed line indicates, there is a slight negative correlation between these two variables; long expansions are associated with milder recessions, but only weakly so (coefficient of –0.018), and the relationship is without statistical significance. Hence, in the national data there is no relationship between the duration of an expansion and the severity of the subsequent recession and no evidence for the forest fire theory. Moreover, if anything, the correlation goes the other way than predicted by Jackson and Tebaldi. For instance, the second-longest expansion in the postwar period (using the unemployment rate metric) occurred from 1992 to 2000, lasted 94 months, and ended with the second-mildest labor market contraction in which the unemployment rate change was 2.5 percentage points.

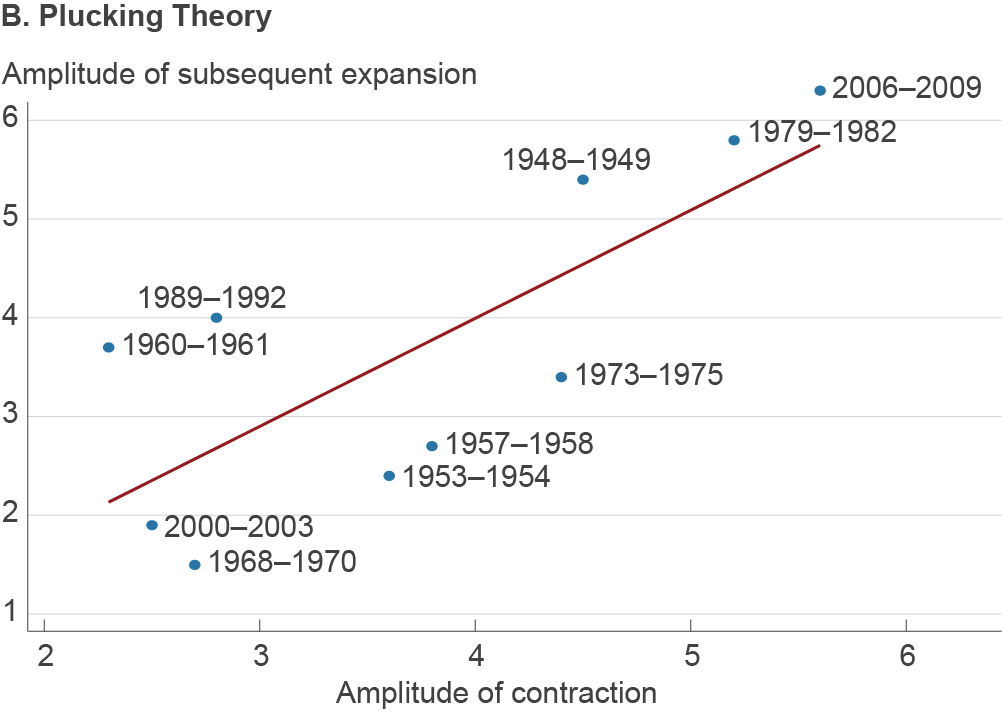

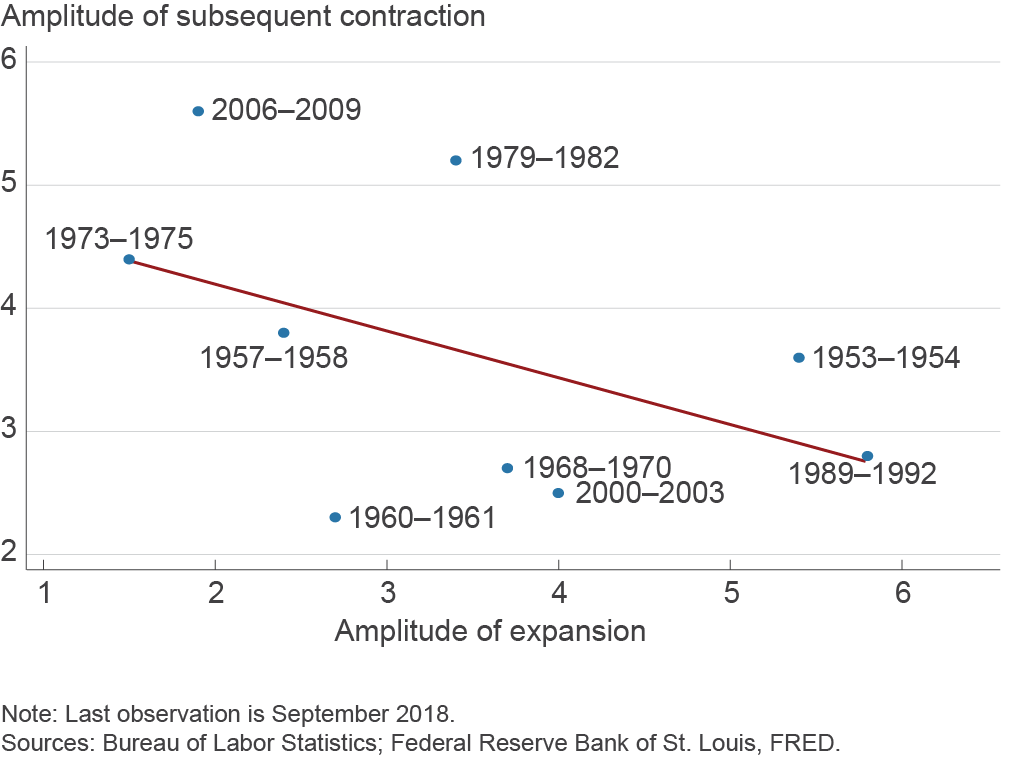

In a simple test of the plucking theory, figure 1b presents the empirical relationship in the national data between the amplitude of a contraction and the amplitude of the subsequent expansion (top panel) and the amplitude of an expansion and the subsequent recession (bottom panel). A simple regression yields a significant positive correlation between the amplitude of a recession and the amplitude of the previous expansion (R2 is 0.58). The correlation between the amplitude of an expansion and the amplitude of the subsequent contraction is significant and negative, but somewhat weaker (R2 is 0.22). Overall, we view the visual evidence presented in figures 1a and 1b as consistent with the “plucking” view.

One major caveat of the analysis with national data is that the sample size is small, potentially limiting the statistical significance of any inferences; for the United States overall, the number of expansions and contractions in the postwar period is fairly modest. Data on the business cycle at the state level has the potential to provide additional observations to test these theories. Several studies on regional business cycles have established that states are subject to regional fluctuations in addition to the national business cycle (Altonji and Ham, 1990; Katz and Blanchard, 1992; and Clark, 1998) and that regional fluctuations provide valuable information about national business cycles (Beraja, Hurst, and Ospina, 2018).

We extend the analysis to state-level data by first identifying the peaks and troughs in unemployment rates for every state starting from 1976, when state-level unemployment rate data became available. We use the same definition for identifying the business cycle turning points as we did for the national data. Even though there have been four recessionary episodes in the national data since 1976, about 20 states have had more than four since that time, and most of the state contractions were not necessarily synchronized with the national cycle. These data provide us with somewhat more variation and definitely a larger sample size to analyze.

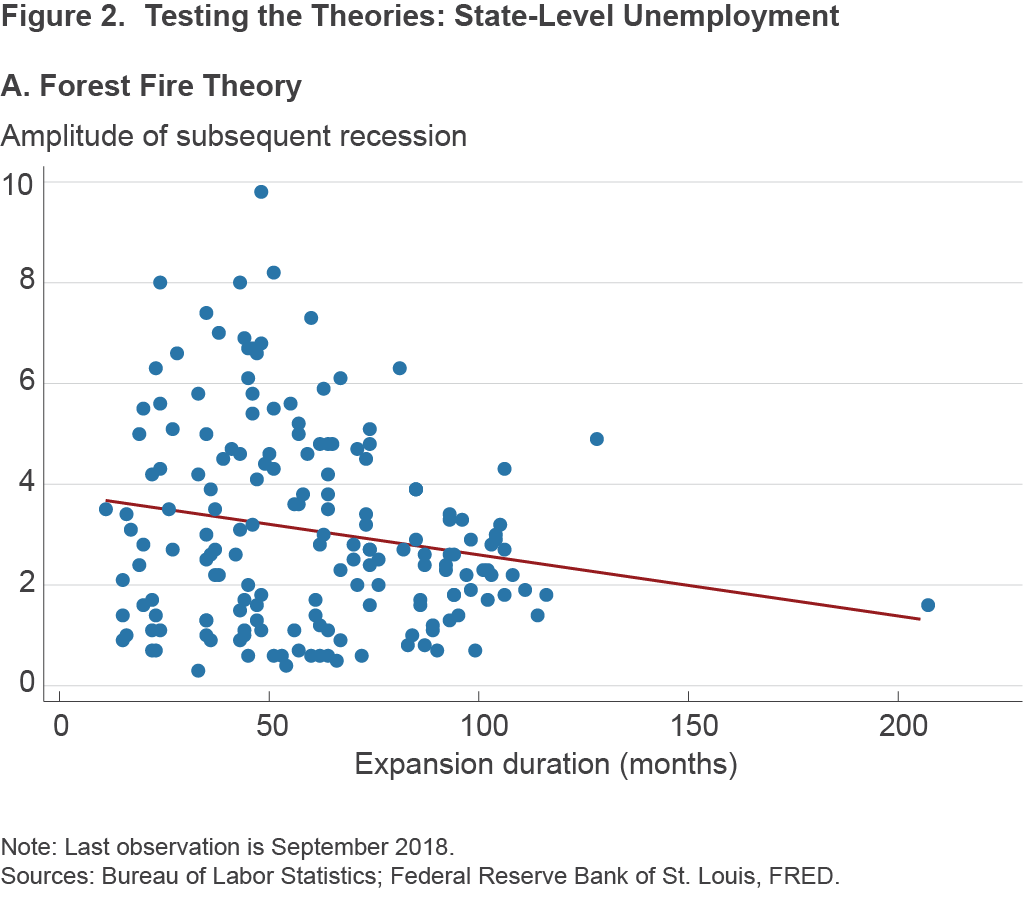

Figure 2a plots the state-level version of figure 1a and shows that the picture is remarkably similar, with more statistical precision. There seems to be a statistically significant but negative relationship between an expansion’s duration and the amplitude of a recession afterward, the opposite of what forest fire theory predicts. Hence, despite Jackson and Tebaldi (2017)’s evidence from metropolitan-area-level data in favor of their theory, our state-level data fail to corroborate the implied relationship in the forest fire theory. Moreover, the economic significance of the empirical relationship in the state-level analysis is rather questionable too. For instance, consider two hypothetical expansions, one lasting 58 months (the median expansion duration at the state level) and one lasting 98 months (the duration at the 90th percentile of the distribution). The former expansion is predicted to have a slightly more severe contraction with an additional 0.5 percentage point increase in the unemployment rate.6

Figure 2b plots the state-level version of figure 1b, again testing the evidence for the plucking theory. On the top panel, we see the robust positive correlation between the amplitude of a contraction and the subsequent expansion, this time with more than 180 observations. The bottom panel shows that there is no significant relationship between the amplitude of an expansion and the amplitude of a subsequent contraction. Moreover, the relationship on the top panel gets stronger relative to the national data whereas the relationship on the bottom panel gets even weaker.

Thus, our results in both the national and the state-level data provide evidence in favor of the plucking view: Contraction severity is correlated with the strength of the subsequent expansion, as predicted by the plucking view, but expansion duration is not correlated, positively, with the subsequent contraction’s severity. There is some correlation between expansion duration and contraction severity, but it appears to be negative, a contradiction of the forest fire theory. While the evidence seems strong, one must use caution in interpreting these results, as the nature of business cycles at the state level might be different from that at the national level. Moreover, our empirical analysis does not address the underlying economic mechanisms that are responsible for pushing the economy in one direction or another.

Conclusion

This analysis of historical business cycle data at the national and state level suggests that the strength of the current economic expansion is tied to the severity of the Great Recession, consistent with the plucking view of the business cycle. Contrary to the predictions of the forest fire theory, national and state-level data do not provide much evidence that long expansions are followed by deeper recessions. Although this finding provides some comfort, it is also important to keep in mind that economists have considerable difficulty forecasting recessions, let alone their severity.

Footnotes

- https://www.nber.org/cycles.html Return

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2263501 Return

- The NFIB Small Business Jobs Report indicated that 53 percent of businesses reported having few or no qualified applicants for job openings in 2018:Q3. This marks the highest fraction since the data became available in 1993:Q2. Return

- Results are similar if one uses aggregate GDP to define expansions or recessions. However, using unemployment makes the comparison with the state-level data easier and feasible. Return

- Note that this definition follows Dupraz, Nakamura, and Steinsson (2017). Return

- The mean amplitude of a contraction is about 3 with a large standard deviation (1.96). Return

References

- Altonji, Joseph G., and John C. Ham. 1990. “Variation in Employment Growth in Canada: The Role of External, National, Regional, and Industrial Factors.” Journal of Labor Economics, 8(1, part 2): 198–236.

- Beraja, Martin, Erik Hurst, and Juan Ospina, 2018. “The Aggregate Implications of Regional Business Cycles.” NBER Working Paper no. 21956.

- Katz, Lawrence F., and Olivier J. Blanchard. 1992. “Regional Evolutions.” Brookings Papers on Economic Activity, 1:1–61.

- Clark, Todd E. 1998. “Employment Fluctuations in US Regions and Industries: The Roles of National, Region-Specific, and Industry-Specific Shocks.” Journal of Labor Economics, 16(1): 202–229.

- Dupraz, Stéphane, Emi Nakamura, and Jón Steinsson. 2017. “A Plucking Model of Business Cycles.” Unpublished manuscript.

- Friedman, Milton. 1993. “The ‘Plucking Model’ of Business Cycle Fluctuations Revisited.” Economic Inquiry, April: 171–177.

- Jackson, Matthew O., and Pietro Tebaldi. 2017. “A Forest Fire Theory of the Duration of a Boom and the Size of a Subsequent Bust.” Unpublished manuscript.

Suggested Citation

Tasci, Murat, and Nicholas Zevanove. 2019. “Do Longer Expansions Lead to More Severe Recessions?” Federal Reserve Bank of Cleveland, Economic Commentary 2019-02. https://doi.org/10.26509/frbc-ec-201902

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International