- Share

College Endowments

This Economic Commentary documents the large dispersion in the value of college endowments across institutions and also shows how endowment values have changed over time. It also provides information on the number of institutions that may be affected by the new federal “endowment tax” and how that number may fluctuate over time.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The Tax Cuts and Jobs Act (Public Law 115-97) was signed into law by President Trump on December 22, 2017. Among the law’s numerous provisions is a new 1.4 percent tax on the investment income of private colleges and universities enrolling at least 500 students and with assets of at least $500,000 per student.1

Opinions on this “endowment tax” vary. Some commentators argue that it makes it more difficult for colleges and universities to fulfill their educational missions,2 while others3 feel that it rightly incentivizes them to spend endowment funds on beneficial research and teaching rather than receiving tax advantages to invest their endowments in risky assets.

No matter what the case may be, now is an opportune time to take a deeper look at college endowments. What are endowments, and what is their purpose? How have the values of endowments at US colleges fluctuated over time, and what is their distribution currently?4 How many colleges will be affected by the new law? I consider these questions using data on college endowments from the National Center for Education Statistics’ Integrated Postsecondary Education Data System.

What Are Endowments, and Why Do Colleges Have Them?

In general, a college endowment is a collection of assets that is held in perpetuity and generates interest income, dividends, or capital gains that the college uses as a funding source. While people often refer to “the” endowment of a particular college, most endowments comprise a collection of numerous smaller endowments that have specific requirements attached. These smaller endowments may endow, for example, professorships, scholarships, or lecture series. There are also “quasi-endowments” or “funds functioning as endowments.” Colleges treat these funds in the same way as traditional endowments even though there is not an explicit agreement with a donor to hold the funds in perpetuity.

Apart from donor restrictions, another factor limiting endowment spending is the Uniform Prudent Management of Institutional Funds Act (UPMIFA) in place in most states. These state laws establish guidelines on endowment spending by nonprofit organizations. The UPMIFA in many states presumes that it is imprudent for an institution to spend more than 7 percent of its endowment in a year.

Why do colleges have endowments? Why not encourage donations that can be spent over a finite time horizon? The answer is not obvious, and a number of explanations have been proposed. One set of explanations relates to the idea that endowments may provide intergenerational equity, or the assurance that future students will have a comparable level of resources as today’s students. A second set of explanations is related to the idea that endowments provide a means of saving for times of need. But as Hansmann (1990) points out, both sets of explanations are potentially problematic. For example, if the economy grows over time or if there will be additional contributions to endowments in the future, then future generations may already be more advantaged than current ones as it is. Moreover, spending by colleges and universities today may pay off into the future, benefiting future generations. Furthermore, there is a question of why colleges do not simply borrow in times of need, perhaps using their land and buildings as collateral.

A third set of explanations suggests that college endowments may have meaning apart from the actual use of the funds. For example, they may provide a simple yardstick for the public or members of a university’s governing board for measuring the “success” of a university. Relatedly, a large endowment may be a signal of prestige. These explanations are bolstered by the results of Brown, Dimmock, Kang, and Weisbenner (2014), who find evidence that universities reduce payouts from their endowments relative to their stated policies following negative shocks to the value of the endowment (so as to preserve the size of the endowment) but generally follow their stated spending policies following positive shocks.

A fourth explanation, which has not received as much attention in the research on endowments, is that endowments might help colleges with fundraising. Simply put, a potential donor may be more likely to donate to a college if he knows his legacy will live on.

IPEDS Endowment Data

I employ data from the National Center for Education Statistics’ Integrated Postsecondary Education Data System (IPEDS) to study college endowments. IPEDS has broad coverage and is roughly a census of higher education, as all colleges participating in federal student financial aid programs are required to complete the survey. IPEDS includes several questions regarding endowments.5 In particular, the survey asks whether an institution has an endowment and, if applicable, what the value of that endowment was at the beginning and end of the fiscal year.6

I use data on the value of endowments at the end of the fiscal year between 2004 and 2016. The sample consists of four-year public and not-for-profit private institutions located in the United States. One fact that complicates the analysis is that university systems can hold endowments at the system level, while individual campuses can hold them as well. When looking at the overall level of endowments, I include all endowments. When looking at endowments on a per-student basis, I exclude endowments held at the system level.

How Much Are College Endowments Worth?

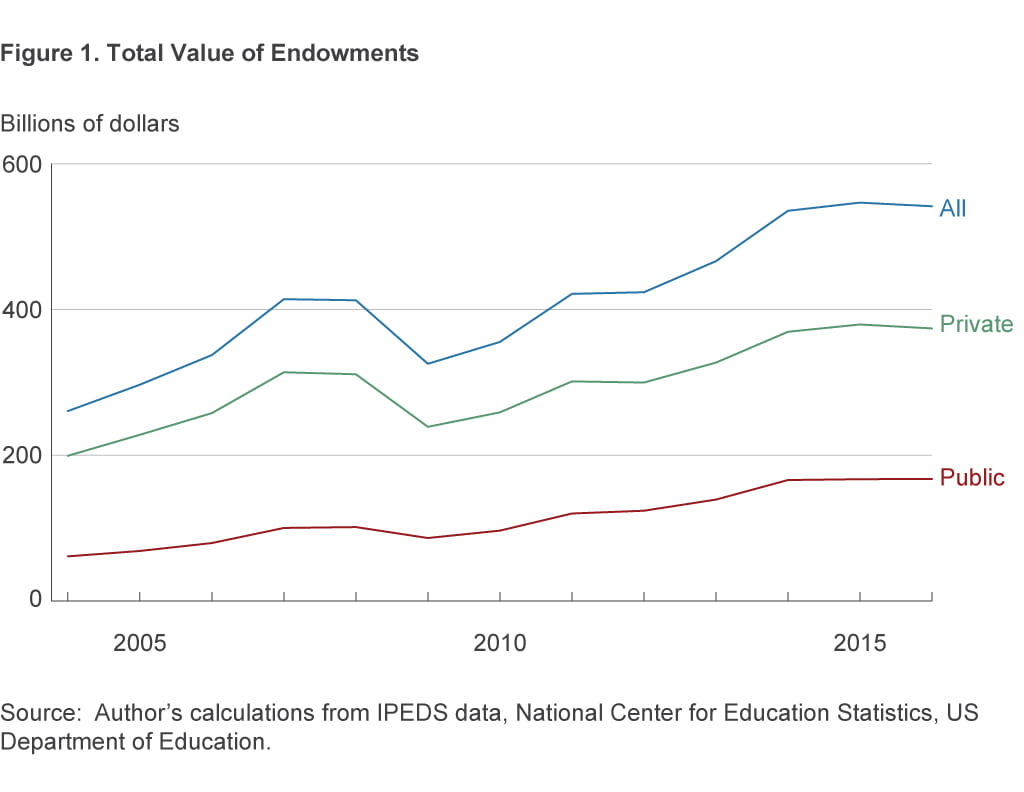

Figure 1 shows how the combined value of endowments has changed over time across all institutions in the sample. The aggregate value of endowments in 2004 was $260.6 billion. Endowments fell by 21 percent from 2008 to 2009 during the financial crisis, but they then rebounded and reached $546.5 billion by 2015 before falling slightly to $541.6 billion in 2016.7 The figure also reveals that the majority of endowment assets are held by private institutions, although public institutions have nontrivial endowments as well.

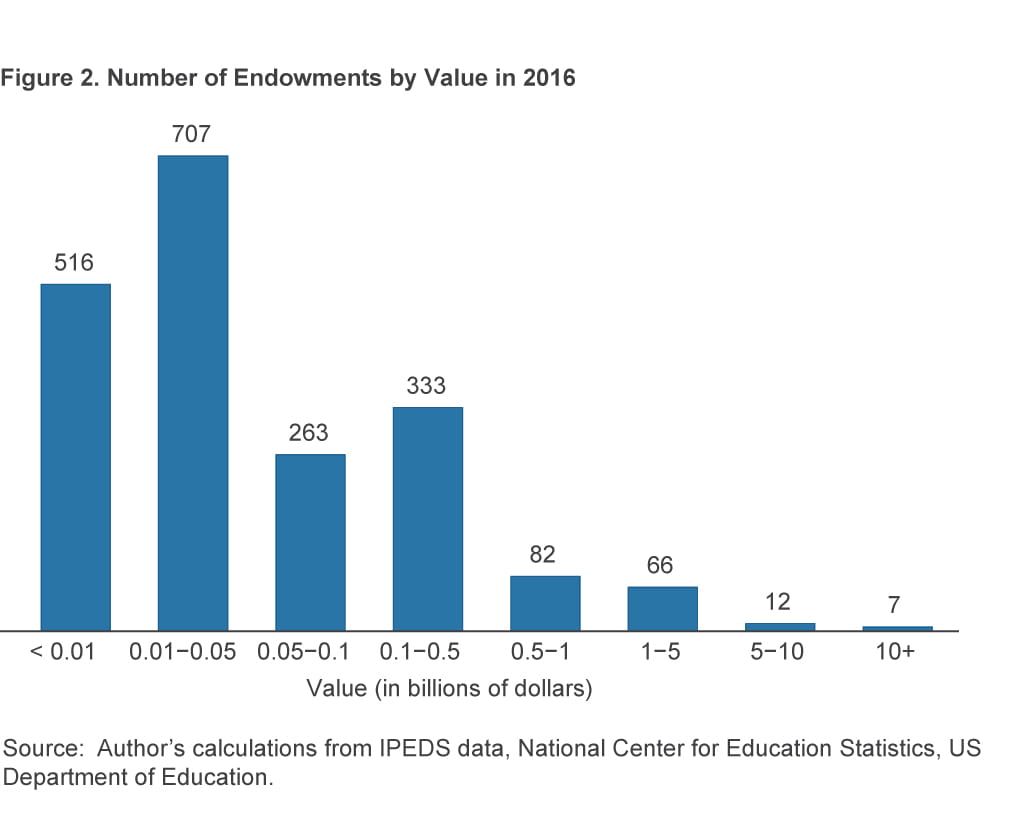

Figure 2 shows the distribution of endowment values across institutions in 2016. There are 2,441 entities in IPEDS in 2016 satisfying the sample criteria listed above. Of these, 126 are missing data on endowments, quite possibly because these institutions do not have endowments. An additional 329 institutions explicitly report that they do not have endowments. Figure 2 shows results for the remaining 1,986 institutions.

Source: Author’s calculations from IPEDS data, National Center for Education Statistics, US Department of Education.

Endowment values are extremely skewed. There are seven institutions with endowments worth more than $10 billion: Harvard ($35.7 billion), Yale ($25.4 billion), the University of Texas System Office ($23.9 billion), Stanford ($22.4 billion), Princeton ($21.7 billion), MIT ($13.2 billion), and the University of Pennsylvania ($10.7 billion). In total, there are 85 institutions with endowments larger than $1 billion. These large endowments receive outsized attention in popular discussions of endowments, but they are not typical cases. As can be seen in the figure, the majority of endowments are several orders of magnitude smaller than the largest endowments. There are 707 endowments worth between $10 million and $50 million, while 516 are worth less than $10 million.

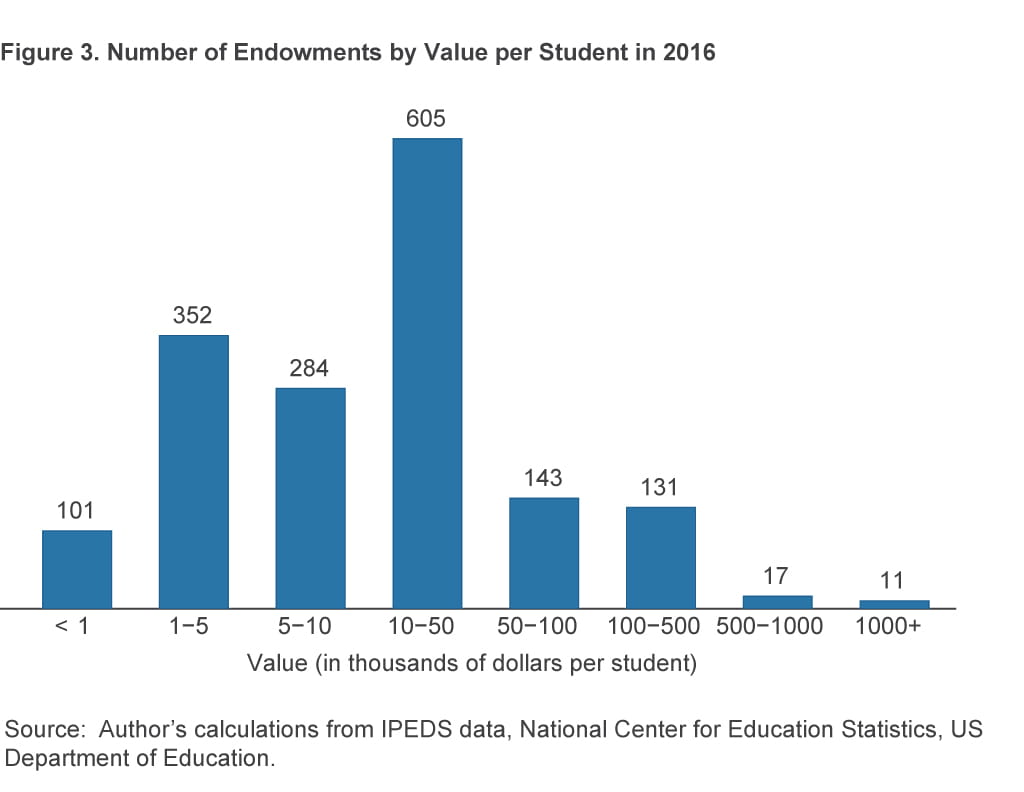

Figure 3 shows per-student endowment values per full-time equivalent student at colleges with at least 500 full-time equivalent students.8 This distribution is not quite as skewed as the overall endowment distribution from figure 1, but it is still quite skewed. The majority of endowments are worth less than $50,000 per student, although there are some that are more than $1,000,000 per student, including the endowments at research universities such as Princeton, Yale, Stanford, and Harvard, as well as at liberal arts colleges such as Williams, Pomona, Swarthmore, and Amherst.

How Many Colleges Are Subject to the New Endowment Tax?

The question of how many colleges will be subject to the new endowment tax is a difficult one to answer. One reason is that colleges might behave strategically to avoid being subject to the tax. For example, colleges with low enrollments may reduce enrollments even further in order to reduce enrollment below 500 students. Other colleges may raise enrollment, or give the appearance of doing so by changing the way they measure it, in order to reduce the endowment per student below $500,000. Colleges may also find other ways of circumventing the law.

Another reason it is difficult to know how many colleges will be subject to the endowment tax is that IPEDS does not measure enrollment in the way described in the new law that introduced the endowment tax. IPEDS includes three enrollment concepts. One is fall enrollment, which is generally measured as enrollment on a particular date in the fall. The second is the 12-month unduplicated headcount, which counts the number of distinct individuals enrolled for credit at any time during the school year. The third is full-time equivalent enrollment, which is based on the total number of credit hours or contact hours taken by all students. However, the law refers to the “daily average number of full-time students attending such institution (with part-time students taken into account on a full-time student equivalent basis).” Although the IPEDS data include a measure of full-time equivalent enrollment, the IPEDS data are not daily averages.

Because “enrollment per student” as defined by the law does not have a clear analog in the IPEDS data, table 1 shows how the number of colleges subject to the law would change under various definitions of “endowment per student.” The result is fairly sensitive to the definition of enrollment used. Depending on the definition used, between 25 and 30 institutions would be subject to the tax.9

| Enrollment concept | Number of colleges |

|---|---|

| Fall enrollment: Full-time and part-time students | 27 |

| Fall enrollment: Full-time students | 30 |

| Full-time equivalent enrollment | 27 |

| Unduplicated headcount | 25 |

Source: Author’s calculations from IPEDS data, National Center for Education Statistics, US Department of Education.

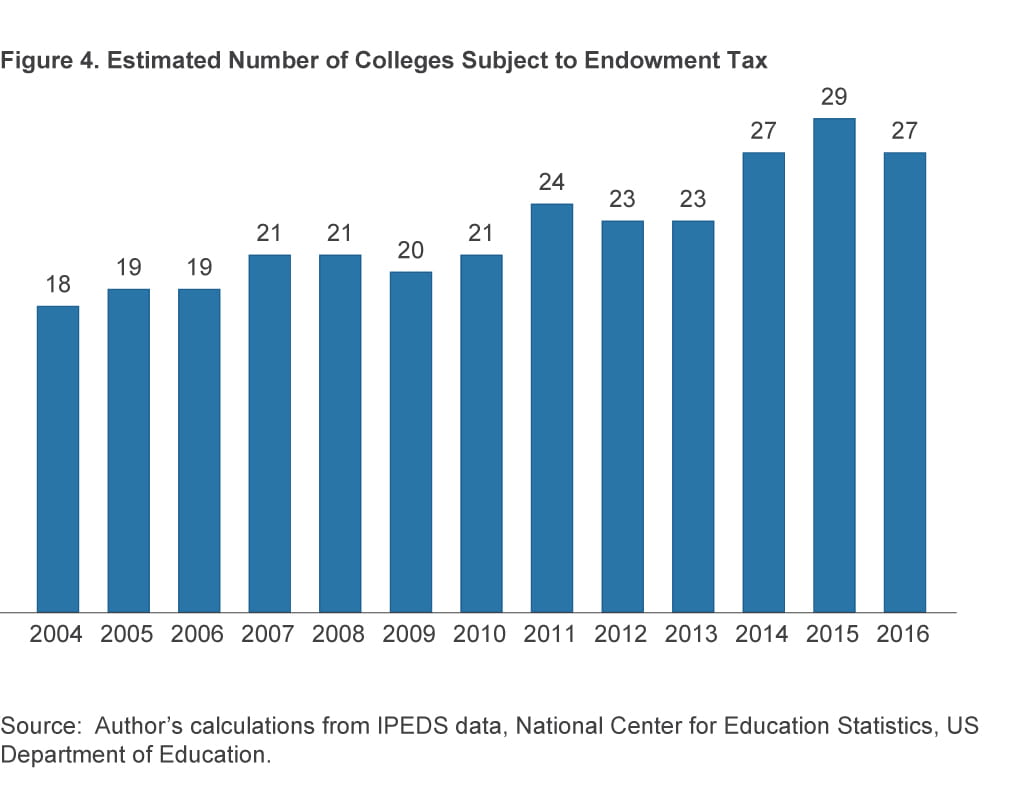

To what extent might the number of colleges affected by the law vary over time with economic circumstances? Figure 4 fixes the definition of endowment per student as endowment per full-time equivalent student, which likely is the closest to what is intended by the law, and shows the change over time in the number of private colleges and universities enrolling more than 500 students and with an endowment above $500,000 per student. There were 18 such colleges in 2004, but the number had risen to 29 in 2015 before falling to 27 in 2016. Additionally, if the $500,000 threshold is not adjusted upward over time, an increasing number of colleges will be subject to the tax as a result of inflation or increases in real endowment values.

Conclusion

Many colleges own endowment assets. The distribution of endowment values is highly skewed, and endowment values fluctuate over time. The new tax on college endowment earnings will affect a relatively small number of colleges for now, although the exact number will depend on implementation details, the overall rate of inflation, changes in real endowment values, and any strategic responses on the part of colleges.

Footnotes

- An additional requirement for the law to apply is that at least 50 percent of the college’s students are located in the United States. Furthermore, the Bipartisan Budget Act of 2018 (Public Law 115-123) changed “500 students” to “500 tuition-paying students” in order to exempt Kentucky’s Berea College, which provides full-tuition scholarships to all students. Return to 1

- McMahon, Harry. 2017. “Leave College Endowments Alone.” Wall Street Journal, Opinion Section (November 29). Return to 2

- Gilbert, Thomas, and Christopher Hrdlicka. 2017. “A Hedge Fund That Has a University.” Wall Street Journal, Opinion Section (November 13). Return to 3

- I use the terms “colleges” and “universities” interchangeably to refer to both colleges and universities. Return to 4

- Much of the other research on college endowments uses data from the NACUBO-Commonfund Study of Endowments, which includes more detailed information on roughly 800 institutions that have voluntarily reported their data. In earlier years, IPEDS asked colleges for a variety of information about endowments, including endowment yields, transfers from the endowment to the current fund, and endowment income. In recent years, the range of questions in IPEDS about endowments is more limited. Return to 5

- Public institutions are also asked about additions to the endowment over the course of the year. Return to 6

- Figure 1 shows nominal endowment values. If the endowment values are deflated by a price index such as the consumer price index, the personal consumption expenditure price index, or the higher education price index, the overall trends are similar although one difference is that there is a sharper drop in 2008 when adjusting for inflation. Return to 7

- Figure 3 includes only endowments held by individual campuses and excludes endowments held at the system level. Another reason the sample size differs between figure 2 and figure 3 is that figure 3 excludes institutions with fewer than 500 students. Return to 8

- I also exclude Berea College, which was discussed in footnote 1. This is why the results of table 1 do not match with the 28 institutions with an endowment of at least $500,000 per student from figure 3. Return to 9

References

- Brown, Jeffrey R., Stephen G. Dimmock, Jun-Koo Kang, and Scott J. Weisbenner. 2014. “How University Endowments Respond to Financial Market Shocks: Evidence and Implications,” American Economic Review, 104(3): 931–962.

- Hansmann, Henry. 1990. “Why Do Universities Have Endowments?” The Journal of Legal Studies, 19(1): 3–42.

Suggested Citation

Hinrichs, Peter L. 2018. “College Endowments.” Federal Reserve Bank of Cleveland, Economic Commentary 2018-04. https://doi.org/10.26509/frbc-ec-201804

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International