- Share

When States Default: Lessons from Law and History

This Commentary discusses how a severe fiscal crisis at the state level could impact the interests of the state’s public pension holders. Drawing lessons from the relevant laws, historical precedents, and the case of Arkansas after its default in 1933, I argue that in spite of the protections that exist, no public retirement system is completely immune toimpairment if the money runs out.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

In most states, local governments have a contractual obligation to provide predetermined benefits (pension and healthcare) to their public employees when they retire. These future benefits are to be paid from the governments’ and public employees’ accumulated annual contributions to a public pension fund, as well as the returns the contributions generate when invested.

The Great Recession had a detrimental impact on this arrangement. States and local governments reduced their employer contributions in response to tight budget constraints, and as a result, most pension funds don’t have the assets they need to cover their liabilities. The dire state of public pensions increases the likelihood that, at some point in the future, retirees may find themselves competing with other stakeholders for the same tax dollars in the appropriations process. Bondholders will also insist on being repaid, and residents will still need roads, sewers, water, and education.

In this Economic Commentary, I examine how a fiscal crisis might be handled if a state were to repudiate all its obligations. I discuss the legal protections that apply for retirees dependent on public pensions and the extent to which those protections might withstand a fiscal crisis and the competing claims of bondholders. Drawing on legal precedents and the experience of Arkansas after its default in 1933, I argue that in spite of the protections that exist, no public retirement system is completely immune to impairment if the money runs out.

Public Pensions Present and Future

Millions of people’s retirements depend on the benefits state and local governments have promised them. According to the 2015 Annual Survey of Public Pensions, the 6,299 state and local pension funds in the United States paid $266 billion in benefits to 9.97 million retirees and received contributions from 14.72 million active employees. Nearly a quarter of this population is not covered by Social Security.1

When states and local governments reduced their employer contributions to their public pension funds during the Great Recession, they in effect borrowed from those pension funds. If governments hope to meet their contractual obligations to their employees, they must pay these delayed pension contributions back at some point. To envision the impact of these reductions on a pension fund, imagine skipping a contribution to your personal 401(k) account. To offset the skipped payment, you have to make an extra contribution in the future and you have to make up for the lost return you could have earned if you had made a timely payment.

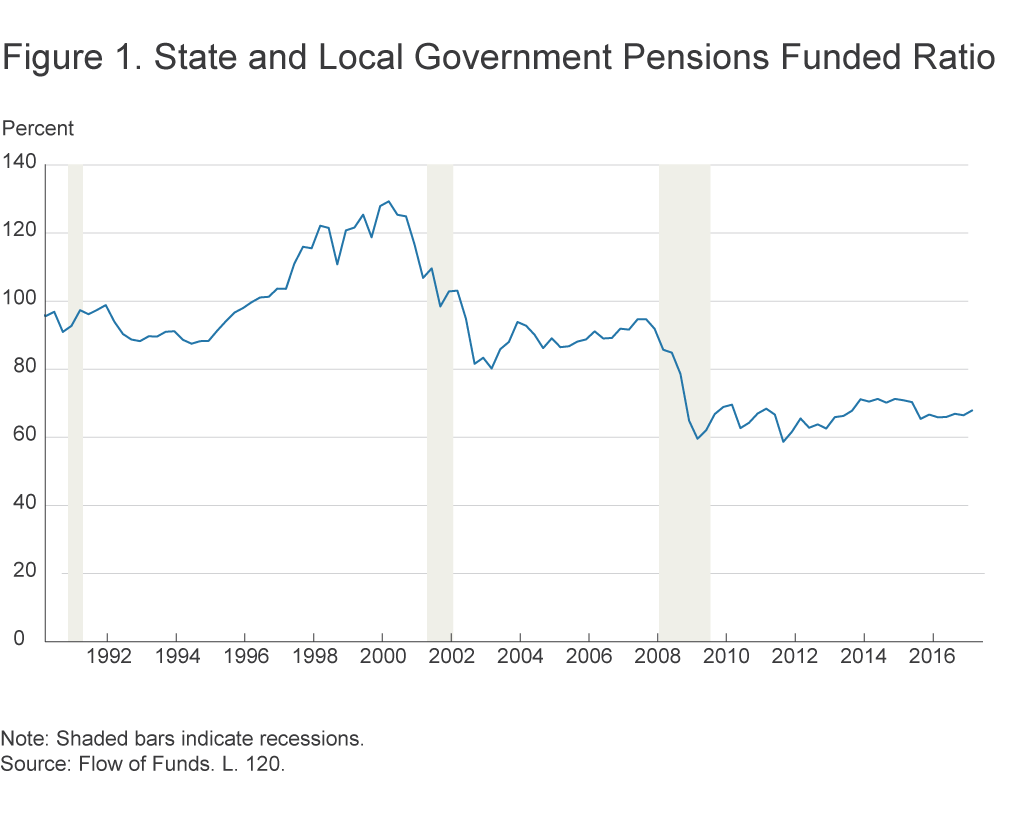

A measure of the problem’s magnitude can be seen in the size of funded pension obligations (that is, the share of pension entitlements covered by assets in hand) in figure 1. Despite employers’ increasing contributions during the recovery and employees’ contributing larger shares of their incomes toward retirement, the funding gap remains wide; as of March 2017, pension funds had about 66 percent of the assets they needed to cover their liabilities, and the unfunded liability is nearly $1.9 trillion.

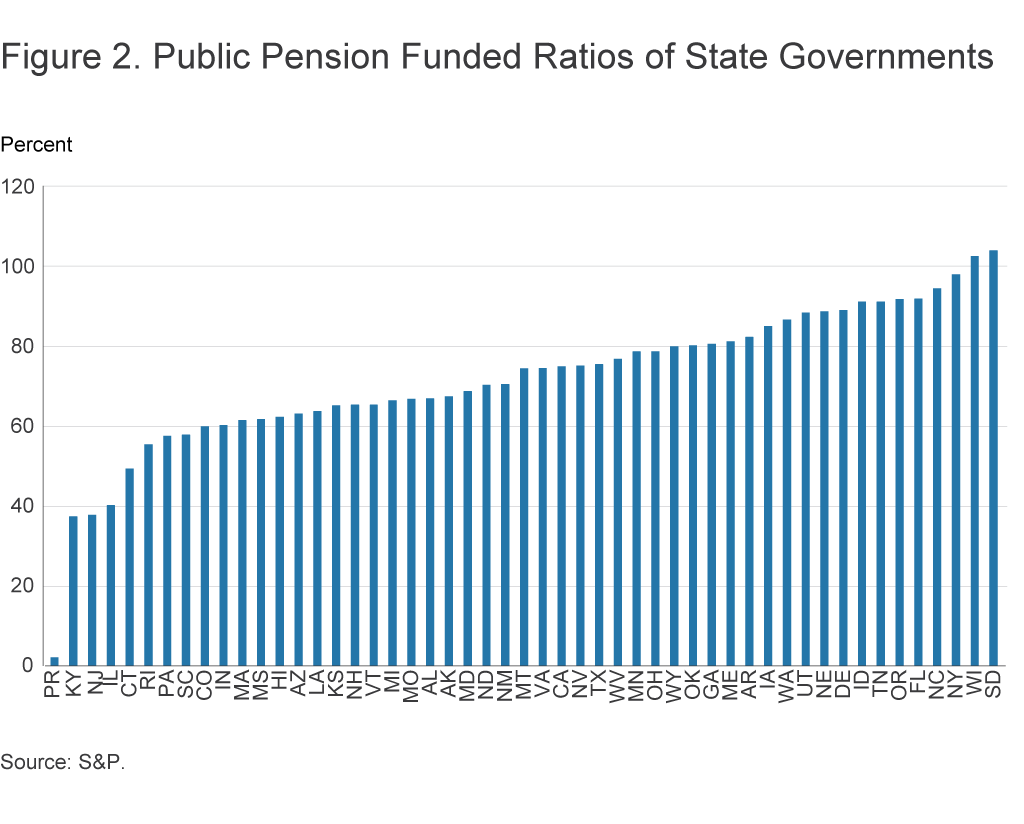

It’s notable that the problem is not evenly spread across the United States. By the end of 2015, public pension funds in Kentucky, New Jersey, and Illinois had 40 percent or less of the assets they needed to meet their obligations to their retirees. Puerto Rico’s funded ratio was an abysmal 1.57 percent (figure 2).

While the money owed to future retirees seems large, governments do not have to pay it in one big contribution. It is acceptable to spread the payments over 30 years (the typical assumption for the amortization period of unfunded liabilities). Yet even these payments can be a burden.

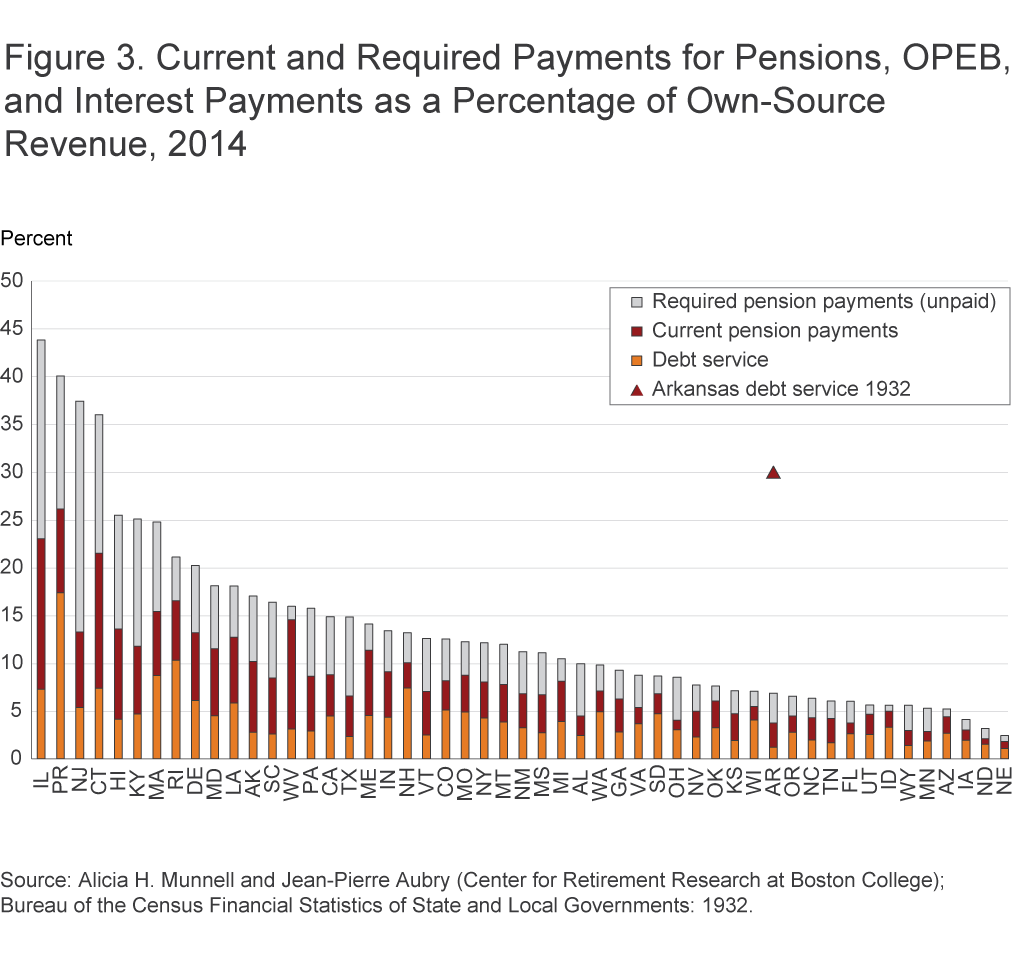

Figure 3 shows that if Illinois, New Jersey, Connecticut, or Puerto Rico had made its 30-year amortizing pension contribution in 2014, the sum of that contribution and the government’s debt service (interest) payment as a share of its own-source revenue (taxes and fees) would have exceeded the debt service burden of the last state to default in our nation’s history: Arkansas. The triangle in figure 3 indicates the debt burden of the state just before its default on its highway bonds in 1932—in the third year of the Great Depression and after a massive collapse in the state’s revenues.

With so many people depending on public pensions and the challenges governments face keeping them fully funded, it’s worth asking how secure pension holders’ benefits would be if a state were to default. I consider an extreme case in which the restructuring of all state obligations is necessary for a sustained recovery, very much like the current situation in Puerto Rico. 2 While a state default may be unlikely, considering how it might play out is a useful exercise, as such a crisis could have significant wealth effects on retirees, creditors holding state bonds, and the citizens who depend on public services such as education, healthcare, and infrastructure.

Protections for Public Pension Benefits

Laws protecting public pension benefits vary from state to state. Table 1 shows that the majority of states either offer explicit protections for past and maybe future benefits in their state constitutions, or they define these benefits as a contract or property, which protects the beneficiaries under the Contract Clause or the Takings Clause of the US Constitution.3 However, these protections might not be strong enough to protect retirees in the event of a state default.

Table 1. Legal Basis for Protection of Public Pension Rights under State Laws

| Legal basisa | Past and future | Past and maybe future | Past only | None |

|---|---|---|---|---|

| State constitution | AK, IL, NY | AZ | HI, LA, MI | |

| Contract | CA, GA, KS, MA, NE, NH, NV, OR, PA, TN, VT, WA, WV | CO, ID, MD, MS, NJ, RI, SC | AL, AR, DE, FL, IA, KY, MO, MT, NC, ND, OK, SD, UT, VA | |

| Property | ME, WY | CT, NM | WI, OH | |

| Promissory estoppelb | MN | |||

| Gratuity | IN,TXc |

a. The legal bases are ranked according to superiority of the protection.

b. Promissory estoppel is the protection of a promise even where no contract has been explicitly stated.

c. In Texas, this gratuity approach applies only to state-administered plans. Accruals in many locally administered plans are protected under the Texas constitution.

Source: Reproduced from table 1 in Munnell and Quinby (2012) as updated by Aubry and Crawford (2017).

The Contract Clause states that “No State shall ... pass any ... Law impairing the Obligation of Contracts.” However, our legal system provides judges with the flexibility to adapt broad constitutional principles to the extreme and exigent necessities of their times. In such times, federal courts typically defer to states’ “police” (sovereign) powers, a decision which essentially allows the state, as a sovereign entity, to resolve an issue as it sees fit.4 The US Supreme Court has made a similar ruling, deciding that “[t]he contract clause must be construed in harmony with the reserved power of the State to safeguard the vital interests of her people. Reservation of such essential sovereign power is read into contracts.”5 In other words, when “vital interests” are at risk, defending contracts may be of secondary importance.

The “vital interests” consideration does not give states free reign. There are limits to the state’s police powers. The Supreme Court has held that “a State is not completely free to consider impairing the obligations of its own contracts on a par with other policy alternatives. Similarly, a State is not free to impose a drastic impairment when an evident and more moderate course would serve its purposes equally well.”6 Still, this precedent suggests that if a state is genuinely unable to raise the money to pay its financial obligations and to perform the basic functions of government (such as public health and safety) at the same time, the Contract Clause may not protect retirees.

Pensions as property are protected by the Takings Clause of the US Constitution, a clause which affirms that “private property [shall not] be taken for public use, without just compensation.” The academic debate over the meaning of “property” and “taken” aside (Treanor, 2008), the clause has one other key term: “just compensation.” As the Supreme Court noted, “[t]here can, in view of the combination of those two words, be no doubt that the compensation must be a full and perfect equivalent for the property taken.”7 This judicial opinion seems to suggest that the government would always have to compensate for the impairment in pension benefits.

However, takings jurisprudence also recognizes the state’s duty to protect the health, safety, and morality of state residents. Especially in a severe fiscal crisis, a state may invoke its police powers to impose “reasonable” losses on property without providing just compensation. In the case of state retiree benefits, the question of where police powers end and takings subject to just compensation begin can only be addressed after such a case is decided in court.

The final type of public pension protection is the one provided by states’ constitutions, which define public pensions as contractual relationships that cannot be diminished or impaired. On the surface, this definition seems repetitive and superfluous because contracts are already protected by the state and US constitutions. So what is the point?

The crucial point is in the law that applies to states when they repudiate their obligations, in contrast to the law that applies to cities and other instrumentalities of the state when they renege on their liabilities.

The bankruptcy of Detroit in 2013 illustrates this distinction. In Detroit, the federal bankruptcy judge ruled that his court was not bound by the Michigan constitution’s pension protection clause, effectively casting doubt on the usefulness of constitutional protections.

However, such protections may have more teeth when the obligor is a state. The reason is that the bankruptcy law, precedent, and procedure that govern city defaults are fundamentally different from the contract law, precedent, and procedure that govern state defaults. Detroit’s debt restructuring is administered by the federal court under Chapter 9 of the US Bankruptcy Code. Since there is no bankruptcy procedure for states, a default or pension impairment would be first adjudicated in state courts as a contract violation. The state courts’ decisions could still be challenged in federal court, and the Supreme Court could take up the issue especially if lower courts reach conflicting decisions. However, given the tendency of the Supreme Court to defer to state judgment on police-power matters in emergencies, it is plausible that a state court decision would stand. This tendency suggests that when the state creditors and retirees dispute their relative seniority in state court, retirees may be at an advantage if they have an explicit constitutional provision that clearly favors their argument.

Finally, how difficult would it be for the afflicted creditors of a state to seek justice in federal court? As it turns out, it would be very difficult. The 11th Amendment to the US Constitution prohibits the citizens of one state from suing the government of another state, and the Supreme Court has held that this “immunity principle” also bars a citizen of a state from suing that state in federal or state court.8

State Sovereignty and Creditor Protections

Given the legal precedents, it is unclear how the restructuring of state obligations would play out in court. Currently, there is no bankruptcy law similar to Chapter 9, which would clarify the creditor rights in the post-default negotiation process. Whether or not such a law would survive a 10th Amendment review (on whether Congress has the constitutional authority to enact such a law) is debated among legal scholars (Solan, 2012).

In the absence of a bankruptcy process for states, creditors may sue the state under the Contract Clause and obtain a judgment. Should creditors succeed (but recall the difficulty of obtaining such a judgment in extreme and exigent circumstances), the judgment would still be difficult to satisfy given that state assets are immune from execution. The other alternative is to apply for a writ of mandamus to order a state official to levy the necessary taxes to satisfy the creditors. However, the mandamus is available only if there already exists a law that requires the state official to levy a tax for this purpose, but he or she is refusing to do so.9 In other words, a state may have all the legal authority it needs to shed its insurmountable liabilities and force its creditors to accept any deal it offers.

We can put this conclusion to the test by examining the default of the state of Arkansas on its highway bonds in 1933.10 The case of Arkansas is interesting because the state attempted to invoke its sovereign immunity and impose losses on bondholders against their will.11 In the end, the approach did not succeed.

Arkansas’s story began in 1907, when legislators allowed counties to set up road improvement districts at the request of local land owners. Subsequent legislation enabled the districts to issue their own bonds—backed by the revenue stream of property taxes and secured by liens on local private property—to fund their road maintenance and construction activities. After the 1920–1921 recession, the districts ran out of money. The state took charge of state highway construction and maintenance and promised to make the payments on the $64 million ($878 million in 2015 dollars) debt of the road improvement districts as long as funds from state sources were available. In the years leading to its default, the state borrowed an additional $91 million to fund its highway and bridge projects, pledging the highway revenues—from gasoline taxes, license fees, and tolls—as security.

Four years after the stock market crash in 1929, Arkansas ran out of cash and stopped payments on all of its highway bonds. The state proposed to consolidate all state-highway bonds, road-district bonds, and all other notes and claims against the highway commission, totaling approximately $146 million, into one refunding issue with a 3 percent coupon and 25-year maturity. The 3 percent-coupon par bond would have imposed a severe loss on the state’s creditors as the 20-year, 4 percent-coupon New York State Highway Improvement Bonds were yielding 3.75 percent in this period.12

As one might expect, creditors did not like Arkansas’s offer. Road district bondholders refused to exchange their bonds because they did not want to lose their tax liens on property. State-highway and toll-bridge bondholders did not want to accept parity with all the other creditors. Bondholder protection groups formed in major financial centers—the most powerful in New York City—and lawyers threatened lawsuits.

Arkansas Governor Junius Marion Futrell attempted to discourage bondholder lawsuits, saying that the state, as a sovereign entity, was immune to such lawsuits. Yet creditors took advantage of two holes in this immunity argument. First, the restrictions on the jurisdiction of federal courts over states apply to suits brought by individuals but not by other states of the union. It seems like Arkansas legislators were aware of their exposure to such lawsuits, as the General Assembly passed legislation to continue the coupon payments to governmental creditors to prevent them from obtaining judgment against the state.

Second, while a state cannot be sued in federal court, a state official can be prevented from taking an illegal action. That is, if the state is handling the default in a way that violates the rights of the creditors under the US Constitution, the court can issue an injunction to stop a state official from committing an unconstitutional act.13 As it turns out, the legislation to pay governmental creditors created a vulnerability in this regard because it provided preferential treatment to a particular type of creditor at the expense of others with the same seniority.

State bondholders took advantage of this vulnerability and sued the state treasurer in federal court to prevent him from making the coupon payments to states as authorized by the legislature. The restructuring plan, they argued, impaired the priority of their claim, and violated the promise of an earlier law to never let highway revenues drop below a level commensurate with the state’s debt payments. Thus, the bill violated the Contract, Due Process, and Equal Protection Clauses of the US Constitution and the 14th Amendment. The federal court agreed and granted state bondholders a temporary injunction against the use of highway revenues.

Pennsylvania, acting on behalf of its teachers’ retirement fund, which held Arkansas bonds, filed its suit in the US Supreme Court. Pennsylvania argued that Arkansas’s reduction of its gasoline tax and license fees in response to the declining economy violated its promise in earlier legislation to maintain the taxes and fees at a level consistent with full payment of the highway bonds. It asked the Supreme Court to compel Arkansas to raise its taxes. It is doubtful Pennsylvania’s claim would ever have been decided in its favor. In earlier decisions, the US Supreme Court had already ruled that statutory promises are not contracts. Yet, as the governor acknowledged in a newspaper interview, even if the cases did not have merit, they would still tie up the state’s highway funds for an extended period while all the appeals ran their course.

Still, the final blow to the state’s resistance to creditor demands did not come from the judiciary. The federal Public Works Administration (PWA) suspended all its loans to the state until its bond-refunding issues were resolved. One loan held up by the PWA was for the maintenance of the state hospital and another was for the University of Arkansas. The loans were meant to be paid from tax sources other than highway revenues and therefore were not affected by the federal court injunction.

The announcement brought Arkansas back to the bargaining table with the New York bondholders’ committee. The governor meanwhile complained to his US senator that the PWA’s involvement was inappropriate and had been engineered by a politically connected financial insider.14 His concern may have merit since the bondholders were open about their political influence and were willing to tell the state negotiators that they could make the Pennsylvania lawsuit go away if the default were resolved to their satisfaction.15

The state and the New York bondholders soon agreed on a deal. The agreement made the powerful New York bondholders practically whole. District bondholders—the junior secured creditors—lost a sizeable chunk. Unsecured creditors such as unpaid contractors lost the most; they received half of their payment in cash, with the other half to be paid in 25 years.

The people of Arkansas also suffered greatly. In 1934, the state agreed to collect 6.5¢ per gallon in gasoline taxes ($1.15 in 2016 dollars; today, Arkansans pay 21.5¢ per gallon) and gave up its control over the use of its highway-related revenues. The schools were kept open only with the assistance of grants that constituted 19 percent of the state’s total revenue that year. In 1939, 43 percent of the state’s own revenues were still dedicated solely to debt payment and road maintenance. Thus, despite our constitutional framework, bondholders were able to reach into the pocket of a sovereign state and dictate how its money would be spent.

The Arkansas confrontation is relevant to our discussion of public pensions because it provides a sense of how much control creditors might exert on a state’s ability to allocate its limited resources to vital matters such as infrastructure spending, education, and healthcare.

Concluding Remarks

Several states owe large sums of money to their public employees in unpaid pension fund contributions. When governments set their budget priorities in the not-too-distant future, there is a chance that pension benefits will compete with other vital interests of the state’s residents. In a hypothetical severe-crisis scenario, the likelihood of governments honoring the promised retirement benefits will depend to some extent on how aggressively the state law protects the promises made to public employees. The protections vary significantly from state to state, but even in the most protective of states, Takings and Contract Clause jurisprudence suggests that public retirement systems could be vulnerable to impairment in a severe fiscal crisis.

As for the creditors, there is considerable ambiguity over what their recovery would be if a state were to subordinate their claims to those of the public employees. Yet the default experience of Arkansas is a testament to the importance of political acumen in post-default negotiations. If creditors identify a weakness in the state’s armor of sovereignty, the resolution process they initiate can be swift and effective, but it can also be very harsh on the residents. Formal and informal contract enforcement mechanisms exist and can be deployed effectively against the state. Namely, bonds accumulate in the hands of the investors with the most clout to extract payment from the state. In situations like the freezing of PWA loans for health and education, the methods may at times be unseemly.

The important lesson is that in the absence of a dedicated judicial process for preserving the governmental functions of a state in debt renegotiations, sovereignty may offer meager protection for the interests of the general public and public employees. In the event of a severe state fiscal crisis, all parties may have to share the burden of putting the state’s fiscal house in order.

Footnotes

- Some state and local entities provide public pensions in place of Social Security (so employees don’t pay Social Security taxes or receive benefits from the system when they retire). Return to 1

- However, because Puerto Rico is a US territory, not a state, its experience does not apply to the states. Territories are subject to “all needful Rules and Regulations” that may be enacted by Congress. Congress passed the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) under this authority. The law does not apply to states, and court rulings under the act’s authority don’t constitute a precedent for states. Return to 2

- See Burns (2011) and Monahan (2017) for a more detailed review of the legal framework. Return to 3

- Justice Oliver Wendell Holmes Jr. wrote in 1894 that police powers are “invented to cover certain acts of the legislature which are seen to be unconstitutional, but which are believed to be necessary.” (Quoted in Barros, 2004.) Return to 4

- Home Building & Loan Assn. v. Blaisdell, 290 US 398 (1934) https://supreme.justia.com/cases/federal/us/290/398/case.html. Also see https://supreme.justia.com/cases/federal/us/379/497/case.html. Return to 5

- United States Trust Co. v. New Jersey, 431 US 1 (1977) https://supreme.justia.com/cases/federal/us/431/1/case.html. Return to 6

- Monongahela Nav. Co. v. United States, 148 US 312 (1893) https://supreme.justia.com/cases/federal/us/148/312/case.html. Return to 7

- Hans v. Louisiana, 134 US 1 (1890) and Alden v. Maine, 527 US 706 (1999) https://supreme.justia.com/cases/federal/us/134/1/ and https://supreme.justia.com/cases/federal/us/527/706/. Return to 8

- Lawall, et al. (2013). Return to 9

- A detailed case study is in Ergungor (2016). Return to 10

- Other states did default after the Revolutionary War and in the nineteenth century, but the Arkansas default is the only case after the adoption of the 14th Amendment and the Jurisdiction and Removal Act of 1875, which extends the Bill of Rights to state governments and gives federal courts jurisdiction over state matters that violate the US Constitution. In other words, the legal environment of the last century is drastically different from the environment of the nineteenth century. Return to 11

- The Commercial and Financial Chronicle, March 24, 1933. Return to 12

- This is an oversimplification of the issue. See Kian (2009). Return to 13

- In a letter to US Senator Caraway of Arkansas, Futrell stated “Funds which, by all the rules of fairness should come to this state are being held up in the Finance Division by Director Mansfield. I am told that Mr. Mansfield is a bond broker, and is or has been connected with the Prudential Life Insurance Company.” In “Much at Stake in Bond Conference,” Arkansas Gazette, December 3, 1933. Return to 14

- A high-level representative of the state in the negotiations told the legislature and the newspapers that “assurance has been given that the bondholders’ [federal] suit and the suit filed against the State by Pennsylvania … would not be permitted to interfere with a new refunding program if one is worked out that would be satisfactory to bondholders.” In “Bond Negotiations Will Be Resumed,” Arkansas Gazette, December 2, 1933. Return to 15

References

- Aubry, Jean-Pierre, and Caroline V. Crawford, 2017. “State and Local Pension Reform Since the Financial Crisis,” Center for Retirement Research at Boston College: State and Local Pension Plans, #54.

- Barros, D. Benjamin, 2004. “The Police Power and the Takings Clause,” University of Miami Law Review, 58(2): 471–524.

- Burns, Debra B., 2011. “Too Big to Fail and Too Big to Pay: States, Their Public-Pension Bills, and the Constitution,” Hastings Constitutional Law Quarterly,39(1): 253–295.

- Ergungor, O. Emre, 2016. “Sovereign Default in the US,” Federal Reserve Bank of Cleveland Working Paper, no. 2016-09.

- Lawall, Francis J., and J. Gregg Miller, 2012. Debt Adjustments for Municipalities Under Chapter 9 of the Bankruptcy Code. Collier Monograph Series.

- Monahan, Amy B., 2017. “When a Promise Is Not a Promise: Chicago-Style Pensions,” UCLA Law Review, 64: 356–413.

- Munnell, Alicia H., and Laura Quinby, 2012. “Legal Constraints on Changes in State and Local Pensions,” Center for Retirement Research at Boston College: State and Local Pension Plans, #25.

- Solan, David E., 2012. “State Bankruptcy: Surviving a Tenth Amendment Challenge,” Golden Gate University Law Review, 42(2): 217–242.

- Treanor, William M., 2008. “Take-ings,” San Diego Law Review, 43: 633–643.

Suggested Citation

Ergungor, O. Emre. 2017. “When States Default: Lessons from Law and History.” Federal Reserve Bank of Cleveland, Economic Commentary 2017-16. https://doi.org/10.26509/frbc-ec-2017016

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International