- Share

A Gap in Regulation and the Looser Lending Standards that Followed

Doing so helped them to conserve their regulatory capital, avoid recognizing costly loan losses, and pursue riskier lending while still adhering to banking regulations.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

One of the most critical debates over economic policy in the United States is centered on the design of the system responsible for supervising and regulating the financial sector. One area of heightened attention is the so-called shadow banking sector, which consists of financial institutions similar to traditional banks in that they make loans but unlike banks in that they do not take deposits. Because the historical focus of banking regulation had always been on protecting depositors, shadow banks were subject to less regulation and oversight than banks before the financial crisis, allowing them to make the riskier loans that ultimately played such a large role in the crisis.

But stand-alone shadow banks were not the only ones able to take advantage of the regulatory gap. Bank holding companies—heavily regulated traditional banking institutions—were able to pursue riskier mortgage borrowers through a type of nonbank subsidiary that was less regulated, the mortgage company. Our research documents that mortgage companies—even when they were the subsidiaries of bank holding companies—originated riskier mortgages to borrowers with lower credit scores, lower incomes, higher loan-to-income ratios, and higher default rates.

Regulators are trying to close the regulatory gap between traditional and shadow banking institutions. Still, the interconnectedness of nondepository and depository institutions poses unique risks to the stability of the financial system. A better understanding of what went wrong before the crisis will help us assess any ongoing or emergent risks and adjust the regulatory system to manage them.

The Roots of the Regulatory Gap

Historically, financial regulation in the United States was implemented through two types of regulators: institutional regulators and functional regulators. The institutional regulators oversaw the activities of depository institutions and ensured their compliance with different types of regulations, including safety and soundness, consumer compliance, and so on. The functional regulators oversaw certain activities, no matter what kind of entity was conducting them. For example, the Securities and Exchange Commission enforced US securities laws for all types of financial institutions.

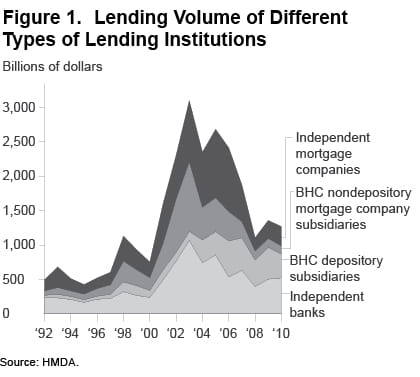

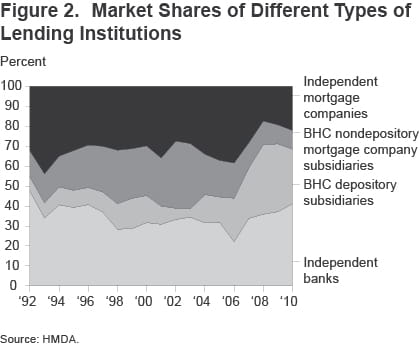

Mortgage companies were largely ignored by this fragmented US regulatory system, despite the fact that they had held a dominant market share since the early 1990s (figures 1 and 2). Mortgage companies were not funded by deposits, so no institutional regulator oversaw them, and their activities did not fall under the domain of any functional regulator. The Federal Trade Commission and the State Attorneys General did have the ability to bring punitive actions against mortgage companies, but only if they observed unfair and deceptive practices evidenced by a pattern of customer complaints. Before the 2007 crisis, this “repeat-complaint-oriented supervision” had little power to systematically affect mortgage company behavior, leaving them essentially free of regulatory oversight.

Source: HMDA.

Source: HMDA.

Concerns that BHCs could rapidly shift resources at the expense of some depository subsidiaries led the Federal Reserve to advocate the “source of strength” doctrine, under which a BHC must assist its troubled depository affiliates before their failure is imminent. BHCs were required to take corrective actions when an insured depository subsidiary found itself in trouble. However, safety and soundness regulations, which apply to depository institutions and are designed to curb risk-taking behavior, were not extended to the nonbank subsidiaries of BHCs. The sole guiding principle of this “umbrella supervision” was to protect depositors and the federal safety net of the FDIC.

The Gramm-Leach-Bliley Act of 1999 codified this regulatory approach. It drastically expanded the allowable span of BHC activities and established formal financial barriers between the BHCs’ bank and nondepository subsidiaries. BHCs were required to conduct any nonbank activities in nonbank subsidiaries that were separately incorporated and insulated by “firewalls” from their affiliated banks. The law also explicitly prohibited BHCs from rescuing troubled nonbank subsidiaries. As a result, BHCs’ exposure to the limited liability mortgage-company subsidiaries was indeed limited to their equity investment.

While that arrangement protected depositors, it did not protect the financial system as a whole. Mortgage companies could still pursue the risky activities—even when they were the subsidiaries of BHCs—that contributed to the erosion of lending standards and, ultimately, the crisis.

The Consequences of the Regulatory Gap

We analyzed data from Call Reports and the Home Mortgage Disclosure Act to explore whether BHCs exploited the gaps in regulation by lending through their nonbank subsidiaries before the financial crisis. We focused on three types of regulatory inconsistencies between bank and nonbank subsidiaries of BHCs: capital requirements; loan-loss recognition; and consumer compliance. (Demyanyk and Loutskina, 2014)

Capital Requirements

Bank safety and soundness regulations require that banks maintain a minimum level of capital, which is determined as a percentage of their assets. Banks are required to hold capital even for loans they are planning to sell. In contrast, mortgage companies had no explicit capital requirements. BHCs have more complex structures since they have both bank and nonbank subsidiaries, and in many cases they were not required before the crisis to include the assets of their nonbank subsidiaries in the calculation of required capital.

Our results show that BHCs exploited this regulatory gap. Before 2007, BHCs with lower levels of capitalization were more likely to establish a mortgage company or to increase lending through their existing mortgage-company subsidiaries. By shifting lending away from the bank to mortgage-company subsidiaries, parent BHCs were able to conserve their capital and even mitigate binding capital requirements.

Loan-loss recognition

Banks are also required to provision for potential loan losses. Banks have to recognize and address loan impairments as soon as they are incurred, and such impairments directly reduce BHC capital and require money to be set aside to cover losses that could eventually be incurred (loan-loss provisions).

Mortgage companies, on the other hand, were only guided by Generally Accepted Accounting Principles and had to recognize loan impairments only when it was “probable” that a loss would be incurred. Mortgage company losses were also recorded net of expected collateral values. As a result, mortgage companies had flexibility in recognizing losses—they could “sit” on nonperforming loans in the expectation of working them out or selling them to a special so-called “scratch-and-dent” entity.

Again the fact that BHCs have subsidiaries of both types allowed for differential application of regulations at the parent level. Because mortgage-company subsidiaries were structured as limited liability entities, BHCs did not have to provision for or recognize losses from the loan portfolios of their subsidiary mortgage companies to the full extent.

We found evidence consistent with the notion that lending through their mortgage-company subsidiaries allowed BHCs to shield themselves from mortgage-related losses. In particular, we document that defaulted mortgages originated by bank subsidiaries adversely affected the loan losses and net income of parent BHCs, but those originated by mortgage-company subsidiaries did not. Even when we look at the impact of subprime loans that were originated before the crisis on BHC financial performance after the crisis, we see the same pattern. These loans have an adverse effect on a BHC’s reported loan losses and net income only if they were originated by a bank subsidiary, not a mortgage-company subsidiary.

Consumer Compliance

Consumer compliance regulations are an extension of safety and soundness regulations, and, in practical terms, they make the origination of inferior-quality loans costly. They ensure, for example, that banks verify borrowers’ ability to repay their loans and do not approve loan applications based solely on expectations of house-price appreciation. Noncompliant banks are subject to financial penalties and a prolonged examination of a wider subset of originated loans.

Mortgage companies were subject to only a subset of consumer compliance regulations, of which there is little evidence of enforcement. And even though as depository institutions, BHCs were subject to these regulations, BHC regulators had no legal standing to evaluate the mortgage-company subsidiaries of BHCs for consumer compliance.

Our results show that the mortgage-company subsidiaries of BHCs originated more loans to borrowers with lower credit scores, higher loan-to-income ratios, and lower relative incomes than did their bank subsidiaries. Mortgage companies were also more likely to originate loans of riskier types, such as adjustable-rate and interest-only mortgages. More importantly, we were able to quantify the impact of inferior mortgage-company lending standards on mortgage defaults in the US economy. We show that the mortgages originated by mortgage-company subsidiaries of BHCs are on average 5.6 percent more likely to end up in default within two years of origination. This impact is large, given that the average default rate in our data sample is 9 percent.

Alternative Explanations

When conducting this research, our core objective was to isolate the role of the regulatory environment on differences in the lending standards of mortgage companies and banks before the financial crisis. A number of other explanations might seem plausible for the differences observed, so we attempted in our sample selection and statistical design to control for these.

First, BHCs might favor lending through their nonbank subsidiary, apart from intending to avoid regulations, if the ability to lend differs in certain geographic markets. For example, it could be difficult to open a new bank branch but easy to open a new mortgage company office. After all, US markets are still characterized by branching restrictions. We address this concern by comparing bank and nonbank lending in geographies (Core Based Statistical Areas) where both types of subsidiaries have access to mortgage applicants. All evidence from these comparisons is in line with our core results.

Second, shadow banks were more active in the so-called originate-to-distribute (securitization) market, which might have had lending standards deteriorating more quickly than those of the “originate and hold” market. Banks originated mortgages both to sell and to keep in their portfolios, so the observed differences in lending standards could be due to the difference in these proportions and not due to a gap in regulation. When we compared lending standards of only securitized loans, we still observed that nonbanks originated inferior quality loans compared to bank-originated loans.

Third, because banks sell more banking services to consumers (credit cards, deposits, auto loans, etc., in addition to mortgages) and mortgage companies only originate mortgages, banks could prefer better-quality mortgage borrowers because they are more likely to consume the other services also. If this is the case, the difference in origination standards could reflect the ability to cross-sell services and not regulation. To make sure it is not the case, we compare the lending standards of bank and nonbank subsidiaries in geographies where BHCs do not have branches and, hence, cannot cross-sell other banking services or have established relationships with borrowers. Even with these restrictions, we find that nonbank subsidiaries lend to lower-quality borrowers.

Fourth, because bank subsidiaries usually carry the parent-BHC name and some nonbank subsidiaries do not, the difference in lending standards could be explained by the possibility that bank subsidiaries originate better quality loans for reputational considerations. To eliminate this alternative explanation, we compare the lending behavior of bank and nonbank subsidiaries with names consonant with that of their parent BHC (e.g., Bank of America Mortgage). We operate under the plausible assumption that such subsidiaries are as responsible for shaping the reputation of their parent BHC as bank subsidiaries are. The empirical evidence does not support the claim that reputational concerns are the reason for the difference in mortgage-lending standards between bank and nonbank subsidiaries.

Finally, we verify that our results are not driven by the potential market segmentation between bank and nonbank subsidiaries. We find a similar wedge in the lending standards if we limit our sample to only conforming loans or first-lien mortgages. All of our analyses strongly support the notion that it is the regulatory inconsistencies that led to mortgage companies having lending standards inferior to those of banks.

Implications

Our research brings to light the effect of a pre-financial-crisis regulatory gap between banks and mortgage companies that relaxed the regulatory constraints even for heavily regulated BHCs. Lending through subsidiary mortgage companies allowed BHCs to conserve their regulatory capital, avoid recognizing costly loan losses, and pursue riskier lending while still adhering to banking regulations. Our results suggest that pre-crisis regulatory standards were not as inadequate as they are perceived to be. However, the inconsistent coverage and enforcement of these regulations eroded their effectiveness and contributed to the deterioration of lending standards.

Inconsistent regulation was not the sole reason that lending standards deteriorated before the crisis. A misunderstanding of the risks inherent in the burgeoning securitization market was a big factor as well. Securitization was perceived to be a force of disintermediation, with nonbank intermediaries merely channeling funds from investors to borrowers and unable to affect lending standards. Our evidence shows that nonbank intermediaries played a significant role in shaping which consumers and firms got access to financing.

We suggest that flaws in the pre-crisis regulatory design accommodated this secondary market demand and helped to contribute to the erosion of lending standards and, ultimately, the crisis. Such a view reinforces the importance that legislators and regulators are now placing on the bird’s-eye view of the financial landscape. Because financial and regulatory systems are complex and markets are driven to maximize profits and innovate, new gaps could emerge. Regulators who are able to focus on the financial system as a whole are in a better position to recognize and address these.

References

- Demyanyk, Yuliya, and Elena Loutskina, 2014. “Mortgage Companies and Regulatory Arbitrage,” Federal Reserve Bank of Cleveland, working paper no. 12-20r.

Suggested Citation

Demyanyk, Yuliya, and Elena Loutskina. 2014. “A Gap in Regulation and the Looser Lending Standards that Followed.” Federal Reserve Bank of Cleveland, Economic Commentary 2014-20. https://doi.org/10.26509/frbc-ec-201420

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International