- Share

Do Oil Prices Predict Inflation?

Some analysts pay particular attention to oil prices, thinking they might give an advance signal of changes in inflation. However, using a variety of statistical tests, we find that adding oil prices does little to improve forecasts of CPI inflation. Our results suggest that higher oil prices today do not necessarily signal higher CPI inflation next year, although they do help to explain short-term movements in the CPI.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

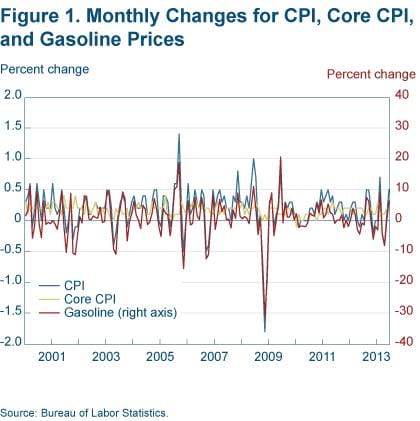

People pay a lot of attention to inflation and expend a great deal of effort trying to predict what prices will do in the future. Some pay particular attention to oil prices, thinking that they might give an advance signal of changes in inflation. After all, gasoline prices do constitute a significant part of the Consumer Price Index (CPI)—about 6 percent in 2012—so changes in oil prices would be expected to affect inflation as measured by the CPI. Oil is also required to produce or deliver most goods and services, so rising oil prices may feed through to their prices as well. In fact, in the data there is a rather high degree of comovement between changes in gasoline prices and the CPI (figure 1).

In this Economic Commentary, we put the possible relationship between oil prices and inflation to the test. In particular, we compare the forecast value of oil to a number of other variables such as economic slack, underlying (core) inflation, and survey measures of expected inflation, assessing oil’s ability to improve the forecast of inflation as measured either by the CPI or the core CPI (which excludes energy and food prices). We look at how well oil helps to predict annual inflation four quarters ahead—or doesn’t. Using a variety of statistical tests, our analysis shows that adding oil prices does little to improve forecasts of CPI inflation and does an even worse job at improving forecasts of core CPI inflation.

Forecasting CPI Inflation with and without Oil Prices

Our study follows in the footsteps of a study done previously by economists at the Federal Reserve Bank of Cleveland, “ Simple Ways to Forecast Inflation: What Works Best ,” where several models were compared in terms of their ability to forecast future inflation. Here, we extend that analysis by including oil as a forecasting variable in similar models.

We consider oil’s ability to forecast both the CPI and the core CPI. We look at both inflation measures for a couple of reasons. First, since oil is included in the CPI but not in the core CPI, comparing the power of oil to predict each measure could be informative. Second, core measures of inflation have become increasingly important to the FOMC over time, especially for filtering out the near-term effects of transitory movements, so it’s worth exploring anything that might improve forecasts of those measures.

We constructed a variety of forecasts using a number of variables. Some variations use only past inflation to forecast future inflation, some include the inflation forecasts of professionals or consumers, some include oil prices, and some include various combinations of these.1 One variant simply assumes that next year’s inflation will be the same as this year’s (the so-called naive forecast). Each variation of the model was run once to produce a forecast for the CPI and once for the core CPI.

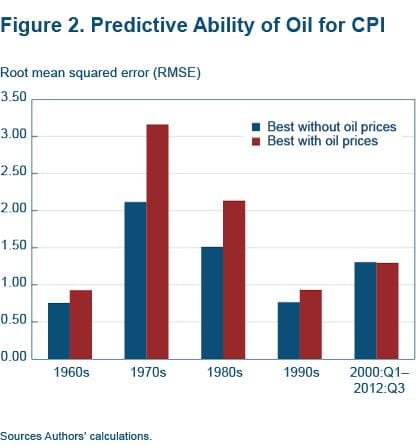

To compare the accuracy of our various models, we computed the root mean squared error (RMSE) statistic for each forecast. As a measure of forecast error, an RMSE of zero indicates a perfect performance. The lower the RMSE is, the smaller the average squared deviation between the forecasted values and the realized ones. In short, smaller RMSEs reflect better predictions on average.

Figure 2 shows the RMSE of the best forecasts of CPI inflation with and without oil prices. Our results suggest that oil prices have little or no predictive value for forecasting CPI inflation, regardless of which forecasting model we add them to. Actually, for almost all of the models we consider, the specifications without oil prices beat the same specifications with oil prices in every time period except the most recent one. In the 2000s, a model with oil generated the most accurate forecast, but the marginal gain in predictive power over the next-best forecast was tiny. (For a list of all of the forecasting models we ran, both with and without oil prices, and their RMSEs, see table 1 in the online extras.)

Forecasting accuracy varies over time: The 1960s was the decade for which inflation was easiest to forecast; the 1990s ran a close second. The hardest decades for forecasting were the 1970s and 1980s. Recall that inflation rose considerably in the 1970s, stayed high in the early 1980s, and then dropped considerably. The 2000s occupy the middle ground between these results. One possible reason why inflation was harder to forecast during the 2000s than during the previous decade is that oil prices became more volatile and spiked in the summer of 2008.

Forecasting Core CPI

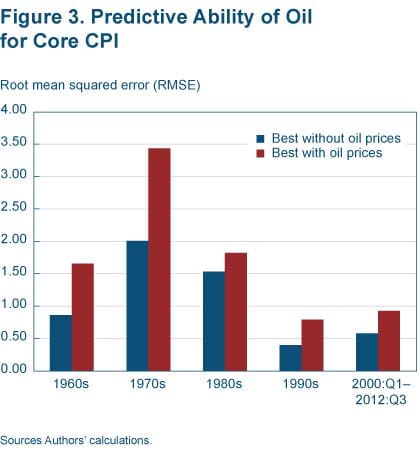

We repeat our analysis, this time using the models to forecast core CPI inflation. Figure 3 shows the results of this exercise. The most apparent difference between figures 2 and 3 is that oil prices do not improve the predictive power of any of the forecasting models in any time period. Oil prices clearly do not perform to the same standard —albeit a very low one—as they did in forecasting CPI inflation. (See table 2 in the online extras for all different forecasting models for core CPI.)

Notice that in the last two periods, we have much more success forecasting core CPI inflation than CPI inflation. For example, the RMSE for the best model forecast of core CPI inflation between 2000 and 2012 is less than half of that of the best model forecast of CPI inflation during that period. The improved forecast accuracy is likely due to the fact that core CPI is not subject to the same short-run fluctuations that afflict the CPI. Another possible reason is related to monetary policy, which may have increasingly focused on underlying price developments rather than the transient factors affecting CPI inflation.

A Final Addition to the Models: Leads of Oil Prices

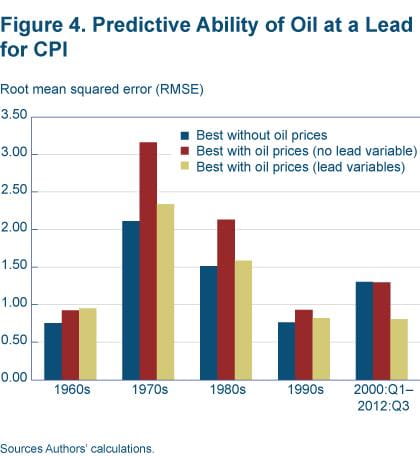

Our forecasting exercises so far have included the current values as well as the lags of all the explanatory variables, as is proper in forecasting (that is, we use the present and past values of those variables at the time the forecasting exercise is conducted). However, increases in the CPI following the wild oil-price swings in 2007 and 2011 suggest that oil prices do affect the CPI at least contemporaneously. So it’s worth checking to see if including oil at a lead (that is, incorporating future oil prices in the model) could improve forecast accuracy.

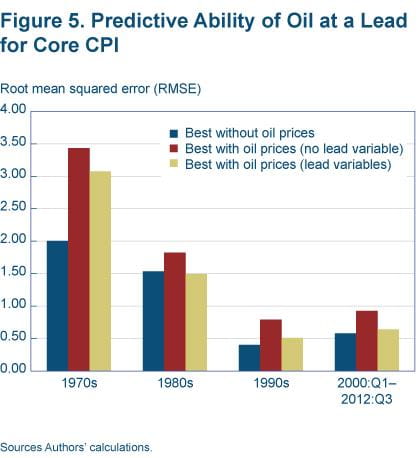

Technically, oil prices are hard to forecast that it’s untenable to incorporate future prices into a forecasting model that uses today’s data. But in this exercise, we assume we can and rerun all our forecasting models using actual oil prices for the four quarters following the period for which we are computing our forecast. This is a very strong assumption and definitely inconsistent with reality. However, if it leads to better forecasts, it would indicate that oil prices and inflation could be related in a way we just weren’t capturing previously. If instead oil prices don’t help even under such an unrealistic assumption, it will lend further assurance that oil prices have a very limited to nonexistent role in predicting and explaining these inflation measures. This is what we do in order to generate the CPI and core CPI forecasts shown in figures 4 and 5.

Including leads of oil prices in our CPI forecast models does, for periods after 1990, generate more accurate forecasts than the forecasts shown in figure 2. Oil prices actually do help explain high-frequency CPI movements—when they’re incorporated into the model as leads. For the 1990s the increase in accuracy is rather small, but for the 2000s the improvement is striking. This is because large swings in oil prices occurring then caused CPI inflation to be volatile, especially in short term.

However, improvement on this scale is absent from core CPI forecasts (see figure 5). When we compare the forecasts with leads of oil prices to the forecasts without oil prices, the only improvement is in the 1980s, and it was miniscule. (See all forecasting models with lead variables for the CPI and core CPI in tables 3 and 4 of the online extras.)

Conclusion

Our objective was to test the value of adding oil prices to various models that forecast both CPI and core CPI inflation. Although this exercise was technically rather simple, it yielded some interesting results.

Adding oil prices improved forecast accuracy for a very small number of forecast variations. The only cases where they seem to help are for forecasts of CPI inflation in recent decades, and only when we use leads of oil prices. In contrast, oil prices do not help to forecast core CPI inflation in any model or time period. Our results suggest that higher oil prices today do not necessarily signal higher CPI inflation next year, although they do help explain short-term CPI movements.

Footnotes

- In the regression models we use, we allow up to four lags of oil price changes, and the particular lag length in each regression is determined by the Bayesian information criterion. Return to 1

Further Reading

- “What Are the Implications of Rising Commodity Prices for Inflation and Monetary Policy?” Charles Evans and Jonas Fisher, 2011. Federal Reserve Bank of Chicago, Essays on Issues, no. 286.

- “Peak Oil,” Joseph G. Haubrich and Brent Meyer, 2007. Federal Reserve Bank of Cleveland, Economic Commentary, no. 2007-14.

- “Oil Prices: Backward to the Future,” Joseph G. Haubrich, Patrick C. Higgins, and Janet Miller, 2004. Federal Reserve Bank of Cleveland, Economic Commentary, no. 2004-20.

- “Simple Ways to Forecast Inflation: What Works Best?” Brent Meyer and Mehmet Pasaogullari, 2010. Federal Reserve Bank of Cleveland, Economic Commentary, no. 2010-17.

Suggested Citation

Pasaogullari, Mehmet, and Patricia A. Waiwood. 2014. “Do Oil Prices Predict Inflation?” Federal Reserve Bank of Cleveland, Economic Commentary 2014-01. https://doi.org/10.26509/frbc-ec-201401

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International