- Share

SORCE Insights: Tariff-Related Uncertainty and Pass-Through to Pricing

The Cleveland Fed’s Survey of Regional Conditions and Expectations (SORCE) administered in June 2025 asked respondents from across the Fourth District a set of special questions about the impact of tariffs and tariff-related uncertainty on their businesses’ costs and prices. This District Data Brief analyzes their responses.

The views authors express in District Data Briefs are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Harrison Markel.

Introduction

In the Survey of Regional Conditions and Expectations (SORCE) fielded in June 2025, the Cleveland Fed asked respondents a set of special questions about the impact of tariffs and tariff-related uncertainty on costs, selling prices, staffing, and capital expenditure plans. Most respondents (64 percent) said that they were incurring costs caused by uncertainty over tariff rates, the direct expenses of paying tariffs, or both. Of these respondents, 68 percent expected to pass through at least some of those costs to their customers. About one in five firms said that they had scaled back plans to hire staff or make capital expenditures because of uncertainty over tariff rates.

Analysis

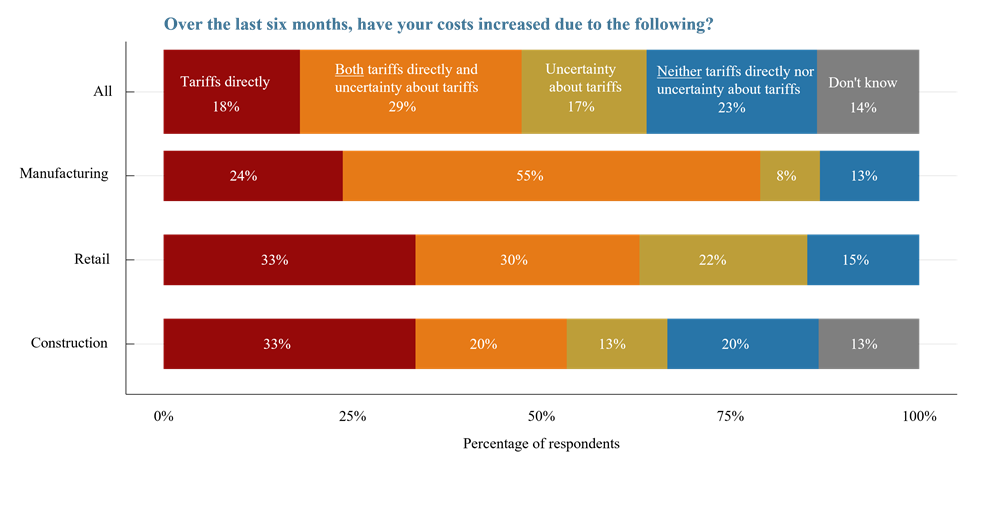

In numerous conversations this spring, business leaders stated that, in addition to the higher tariff rates themselves, the uncertainty caused by the frequent changes to these rates was also elevating their costs. Thus, one of the special questions in the June 2025 SORCE aimed to quantify how widespread these uncertainty-related costs had been. Forty-six percent of respondents said that uncertainty about tariff rates was causing increases in their costs. This includes 17 percent of respondents who reported that, over the last six months, their costs had increased because of uncertainty about tariffs but not because of tariffs directly.

Figure 1. Cost Increases Caused by Tariffs and Tariff-Related Uncertainty

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “Over the last six months, have your costs increased due to the following?” There were 133 responses, including 38 from manufacturing contacts, 27 from retail contacts, and 20 from construction contacts. The other 48 respondents included in the “All” estimates are in other industries including professional and business services, financial services, and transportation. Totals may not sum to 100 because of rounding.

In open commentary, some firms reported that suppliers had increased prices ahead of anticipated tariffs, even before any new duties had been enforced. Many firms said that they had to use staff time to investigate what tariffs their suppliers would be paying and then negotiate with their suppliers to keep price increases in line with specific tariff rates.

Manufacturing had the largest proportion, 55 percent, of respondents that saw increased costs because of both tariffs and tariff-related uncertainty. Several contacts in this sector mentioned that uncertainty over trade policy had made it difficult to reliably budget for changes in input costs.

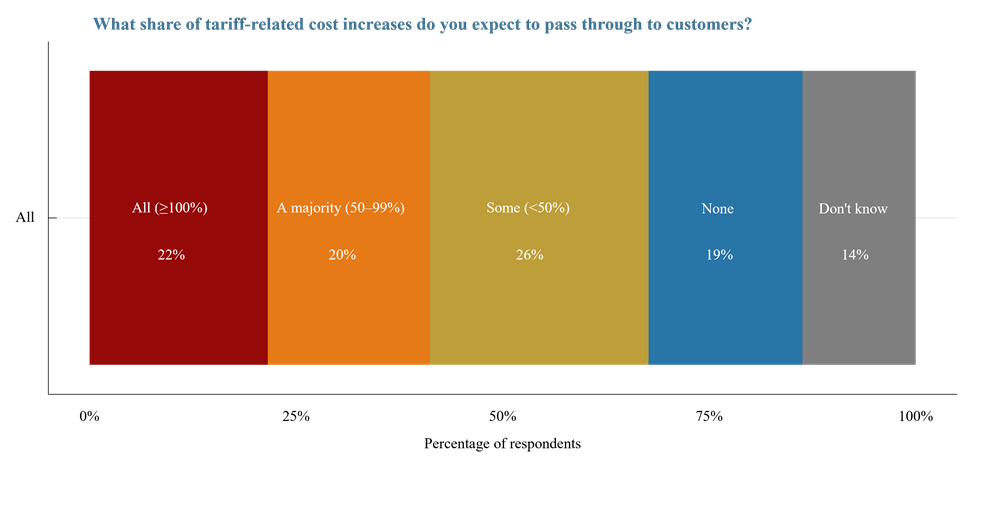

In response to SORCE special questions from earlier this year, a majority of respondents reported that they planned to pass tariff-related cost increases on to customers. However, the earlier surveys did not capture what fraction of the higher costs might be passed on rather than absorbed by firms.1 In the June 2025 SORCE, we asked firms that had reported tariff-related cost increases if they planned to pass on all (100 percent or more), a majority (50 to 99 percent), some (less than 50 percent), or none of these increases.

Figure 2. Percentage of Tariff-Related Cost Increases Expected to Be Passed On

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What share of tariff-related cost increases do you expect to pass through to customers?” There were 102 responses. Respondents were asked this question only if they did not answer “neither tariffs directly nor uncertainty about tariffs” to the question “Over the last six months, have your costs increased due to the following?” Totals may not sum to 100 because of rounding.

Of the contacts who reported tariff-related cost increases, 68 percent expected to pass at least some of these increases through to customers, while 42 percent expected to pass through at least half. Only 19 percent planned to absorb all these increases.

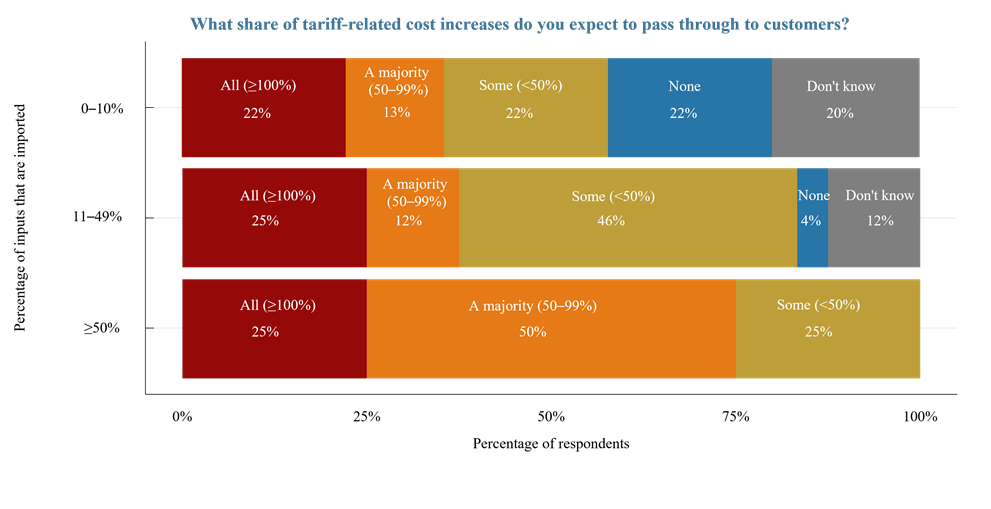

Figure 3. Pass-Through by Import Share

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to two questions; the same set of respondents (77 in total) replied to these two questions. The first was asked in the May 2025 survey round: “In terms of dollar amounts, approximately what percentage of your inputs are sourced from countries outside the United States?” The second was asked in the June 2025 survey round: “What share of tariff-related cost increases do you expect to pass through to customers?” Respondents were asked the latter question only if they did not answer “neither tariffs directly nor uncertainty about tariffs” to the question “Over the last six months, have your costs increased due to the following?” Totals may not sum to 100 because of rounding.

As shown in Figure 3, 75 percent of firms that import at least 50 percent of their inputs expected to pass at least 50 percent of their tariff-related cost increases on to customers. By comparison, only 35 percent of firms that import 10 percent or less of their inputs expected to pass on at least 50 percent of their tariff-related cost increases. In open comments, many firms said that they will try to find other items in their cost structure to save money on to offset tariff-related cost increases. Firms that use mostly imported inputs typically have fewer options for cost reductions.

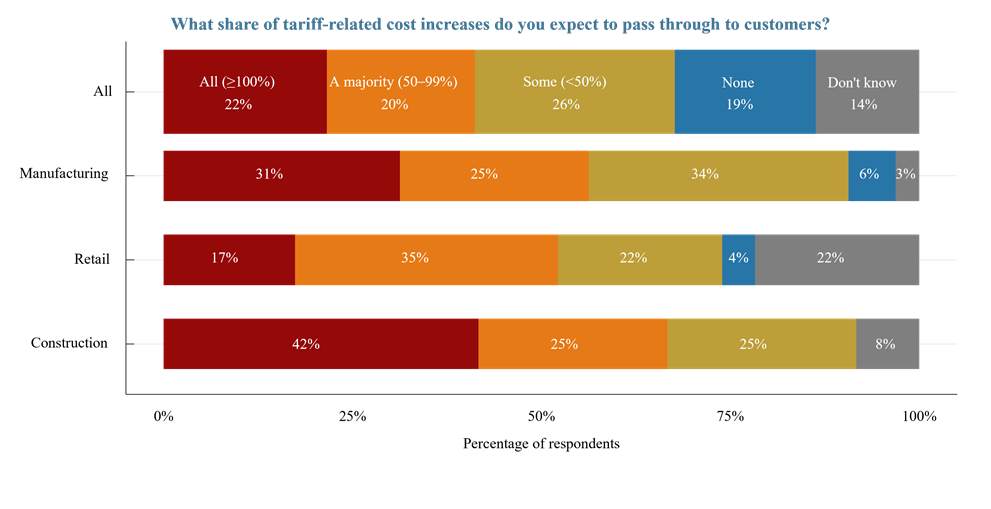

Figure 4. Pass-Through by Sector

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What share of tariff-related cost increases do you expect to pass through to customers?” There were 102 responses. Respondents were asked this question only if they did not answer “neither tariffs directly nor uncertainty about tariffs” to the question “Over the last six months, have your costs increased due to the following?” The “All” estimates include respondents in the industries displayed and those in other industries including professional and business services, financial services, and transportation. Totals may not sum to 100 because of rounding.

When disaggregated by sector, respondents in construction were the most likely (67 percent) to expect to pass all or most of their tariff-related cost increases on to their customers. Slim majorities of respondents in manufacturing (56 percent) and retail (52 percent) also expected to pass on all or most of their tariff-related cost increases.

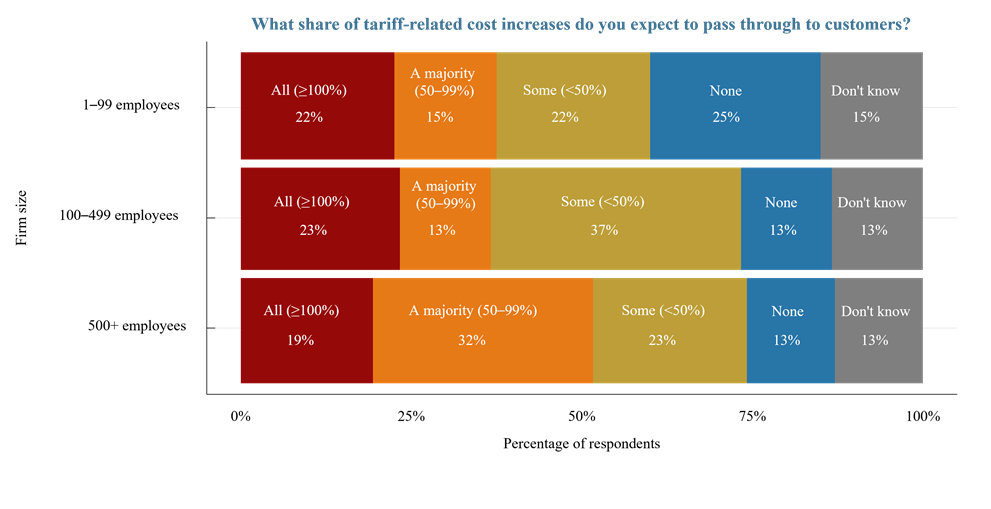

Figure 5. Pass-Through by Firm Size

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What share of tariff-related cost increases do you expect to pass through to customers?” Although there were 102 total respondents for this question, Figure 5 is based on answers from the 101 respondents who were able to be classified in one of the three firm-size groupings shown on the y-axis. Respondents were asked this question only if they did not answer “neither tariffs directly nor uncertainty about tariffs” to the question “Over the last six months, have your costs increased due to the following?” Totals may not sum to 100 because of rounding.

Respondents’ plans to pass on tariff-related cost increases differed depending on firm size. Among respondents from firms with fewer than 500 employees, around 35 percent expected to pass all or most of their tariff-related cost increases on to their customers. Among those respondents from firms with 500 or more employees, 51 percent expected to pass on all or most of these increases.

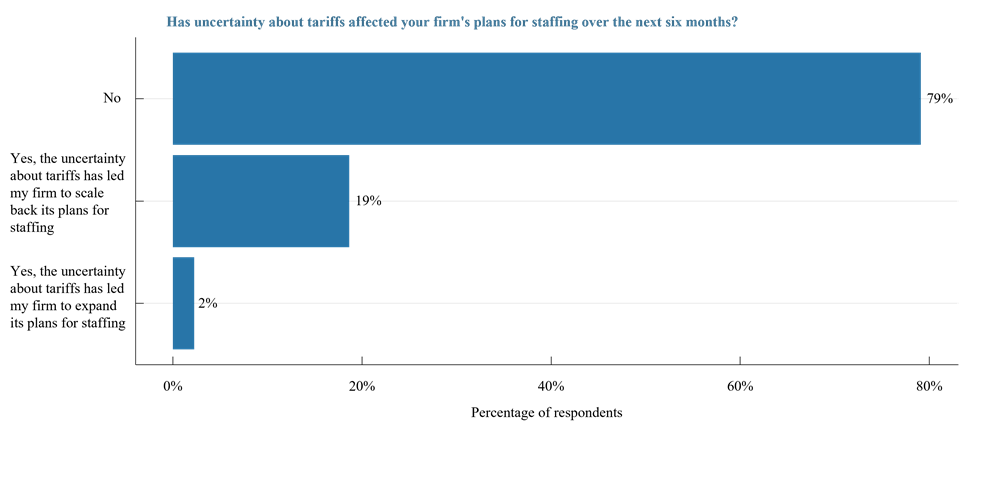

Figure 6. Tariff-Related Effects on Staffing

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “Has uncertainty about tariffs affected your firm’s plans for staffing over the next six months?” There were 134 responses.

In addition to our question about firms’ passing costs on to their customers, we asked if firms had adjusted their staffing or capital expenditure plans because of uncertainty over tariff rates this year. As shown in Figure 6, 19 percent of contacts said that tariff-related uncertainty had led their firm to scale back staffing plans. In response to a question from the May 2025 SORCE, 32 percent of firms said they expected their employment to decrease because of tariffs, but unlike the question in June 2025, the May question did not focus specifically on tariff-related uncertainty.2

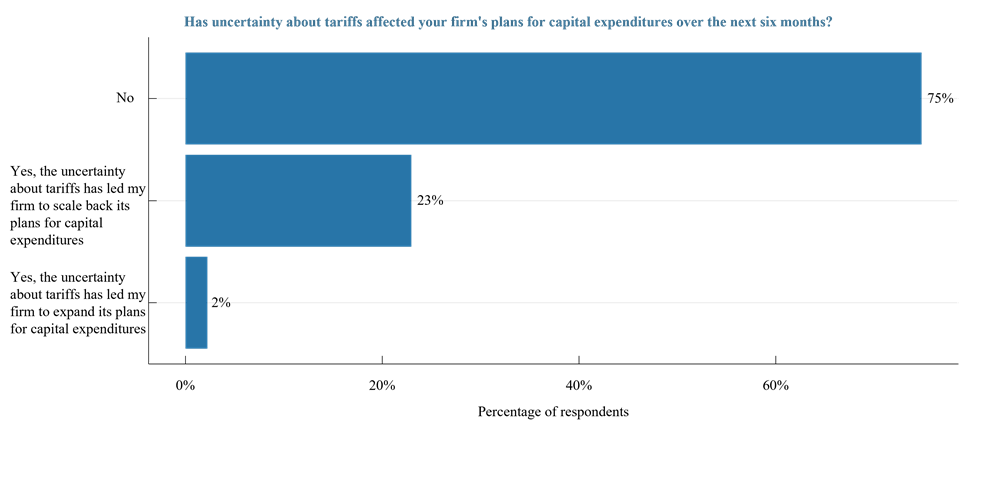

Figure 7. Tariff-Related Effects on Capital Expenditure Plans

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “Has uncertainty about tariffs affected your firm’s plans for capital expenditures over the next six months?” There were 135 responses.

In the June 2025 SORCE, 23 percent of respondents said that tariff-related uncertainty caused their firms to scale back capital expenditure plans (Figure 7). Again, this question focused on the impact of tariff-related uncertainty, while a similar question in May 2025 simply asked about the impact of tariffs. In the May SORCE, 40 percent of firms said that tariffs would cause their firm to scale back capital expenditure plans.

The Cleveland Fed’s Research Department gathers and analyzes timely economic information from businesses and community contacts to inform our Beige Book contribution and to prepare for Federal Open Market Committee (FOMC) meetings. One way we obtain this information is through the Survey of Regional Conditions and Expectations (SORCE), a business conditions survey sent to firms across the Fourth District, which comprises Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. The SORCE is administered eight times per year. In addition to the set of standard questions asked during each round of the survey, the Cleveland Fed routinely asks a set of “special questions” to explore timely issues that may be impacting businesses across the Fourth District. The SORCE Insights District Data Briefs share the results from the “special questions.” For more information on SORCE, visit https://www.clevelandfed.org/indicators-and-data/survey-of-regional-conditions-and-expectations.

Footnotes

- Economists refer to the portions of tariff-related costs that are borne by different parties as the “incidence” of the tariff. The exporter can absorb part of the tariff by lowering their selling price. The importer can absorb a portion by narrowing the difference between their costs (the good’s price plus the tariff) and the price they charge their customers. The portion of the tariff that is passed on to consumers in the form of higher retail prices is the portion that appears in measures of inflation. Return to 1

- The text of May’s question was “What net impact do you expect higher tariffs to have on the following aspects of your firm’s business over the next six months?” Respondents could then answer for the following categories: demand, employment, input costs, selling prices, capital spending plans, inventory levels, and supplier delivery times. Return to 2

Suggested Citation

Gerring, Jayme V., Carol Moseley, and Stephan D. Whitaker. 2025. “SORCE Insights: Tariff-Related Uncertainty and Pass-Through to Pricing.” Federal Reserve Bank of Cleveland, Cleveland Fed District Data Brief. https://doi.org/10.26509/frbc-ddb-20251001

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

Regional Data, Analysis, and Engagement

Explore economic trends and the circumstances impacting the economy and diverse communities of the Federal Reserve’s Fourth District, which includes all of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia.

About Us

The Federal Reserve Bank of Cleveland (commonly known as the Cleveland Fed) is part of the Federal Reserve System, the central bank of the United States.