- Share

Preliminary SORCE Insights: An Overview of Firms’ Capital Expenditure Plans and Inventories

The Cleveland Fed’s Survey of Regional Conditions and Expectations (SORCE) administered in August 2025 asked respondents from across the Fourth District a set of special questions regarding their planned capital expenditures and inventories. This District Data Brief discusses the top-line results from these questions.

The views authors express in District Data Briefs are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Harrison Markel.

Introduction

The Cleveland Fed’s latest edition of the Survey of Regional Conditions and Expectations (SORCE), administered during August 7–14, included a set of special questions alongside the standard question set that informs the SORCE indexes. These special questions focused on capital expenditure plans and inventories.

More than half of Fourth District business contacts said that “uncertainty and the potential impact on demand” was the most important factor influencing their capital expenditure plans for the rest of 2025. Contacts most often reported that their inventory levels were the same as they were one year ago, though more firms reported lower inventory levels than higher ones. More than half of firms anticipated that they would work through their current inventories in one to three months. Most survey respondents said that one-fourth or less of their current inventory had been subject to additional duties in 2025 because of changes to trade policy. Below is a summary of the top-line results from each of the special questions. Totals may not sum to 100 because of rounding.

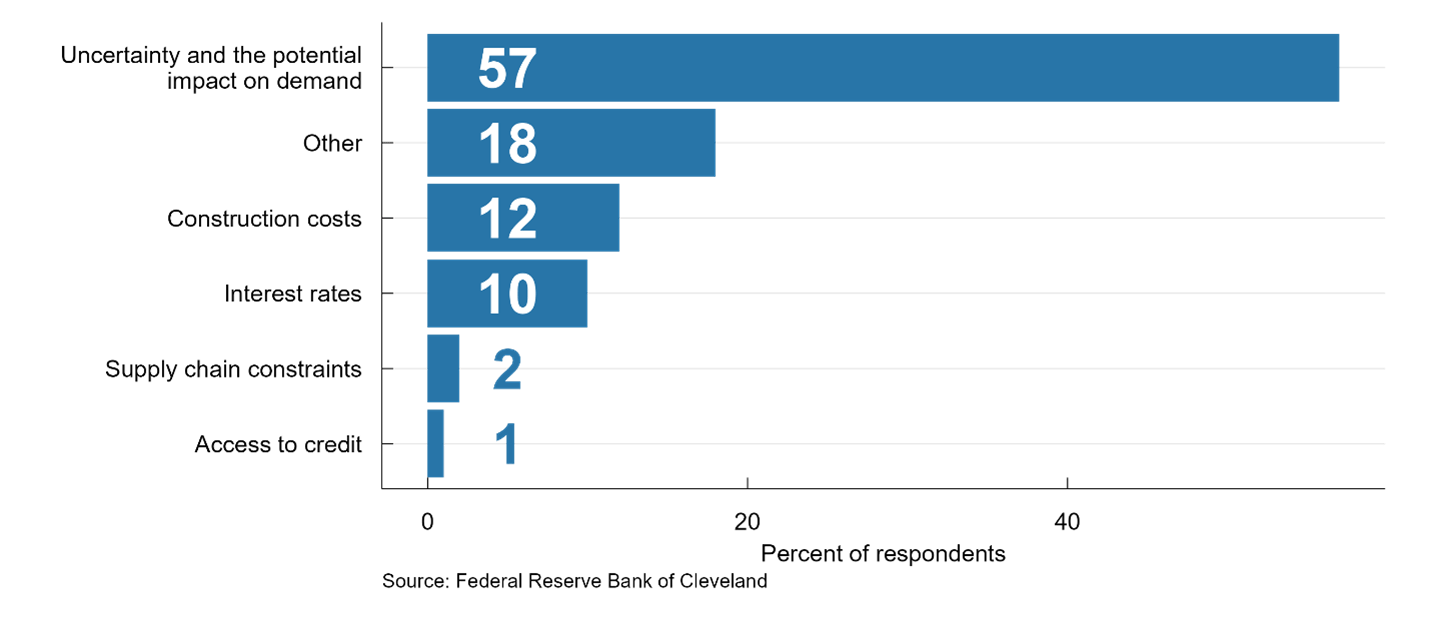

What is the most important factor influencing your capital expenditures for the remainder of the year? (n = 153)

Respondents most frequently cited uncertainty and the possible impact on demand.

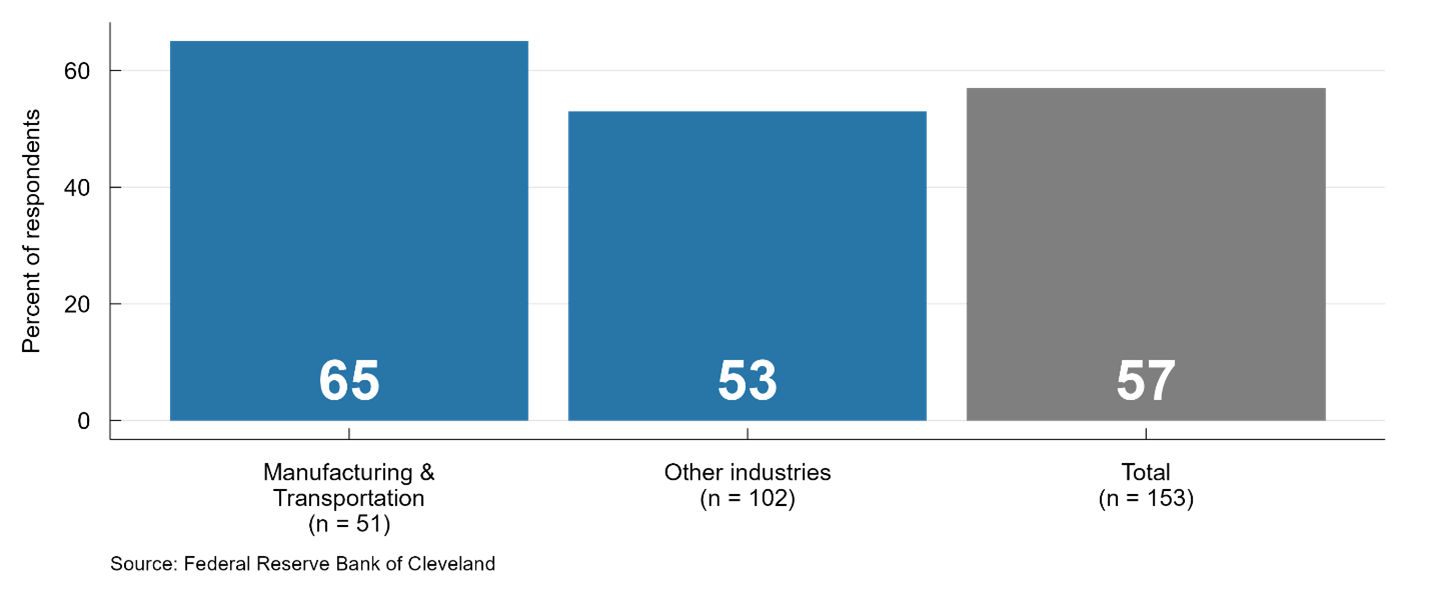

By sector, manufacturing and transportation firms were the most likely to cite uncertainty and the potential impact on demand as the primary factor influencing their capital spending plans for the rest of the year, alongside a smaller majority in other industries.

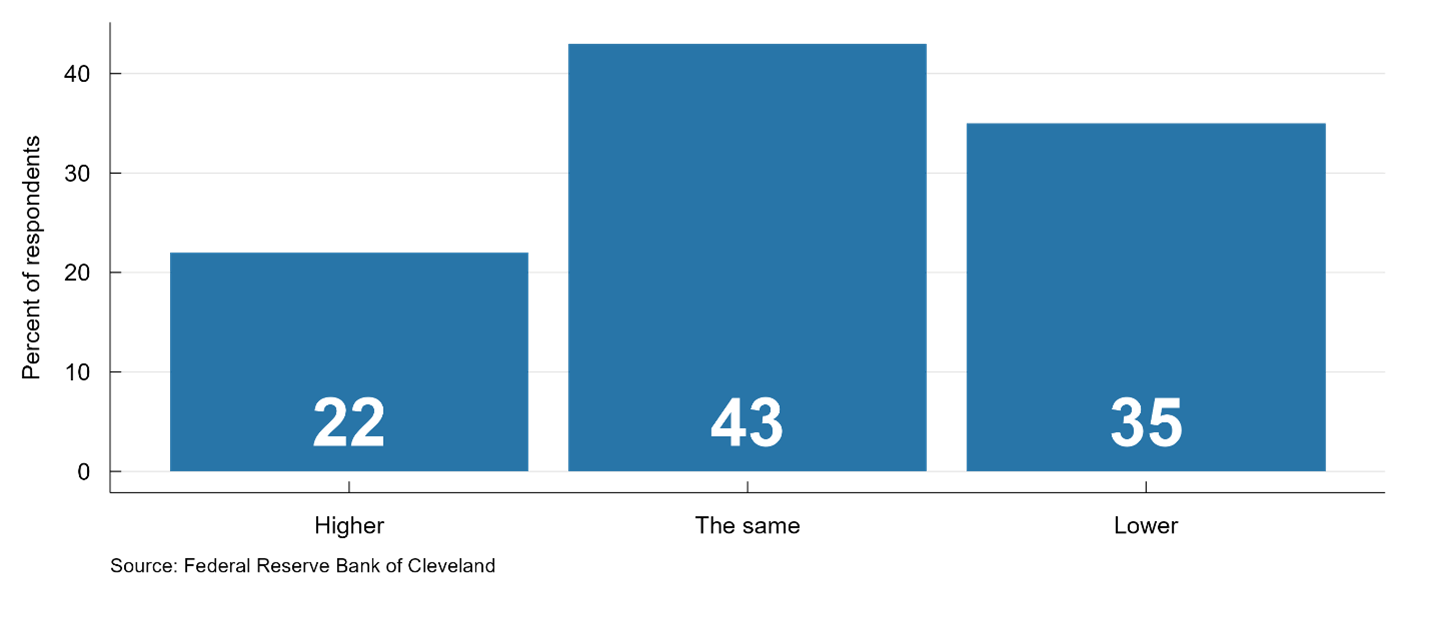

How do your current inventory levels compare to those from this time last year? (n = 54)

Manufacturers and retailers were asked a set of questions focused on inventories. Forty-three percent of these firms said that their current inventory levels were equal to those from a year ago, 35 percent said that their inventories were lower, and 22 percent said that their inventories were higher. Among those who noted higher inventories, two-thirds said that their decision to carry higher inventories was influenced by recent changes to trade policy.

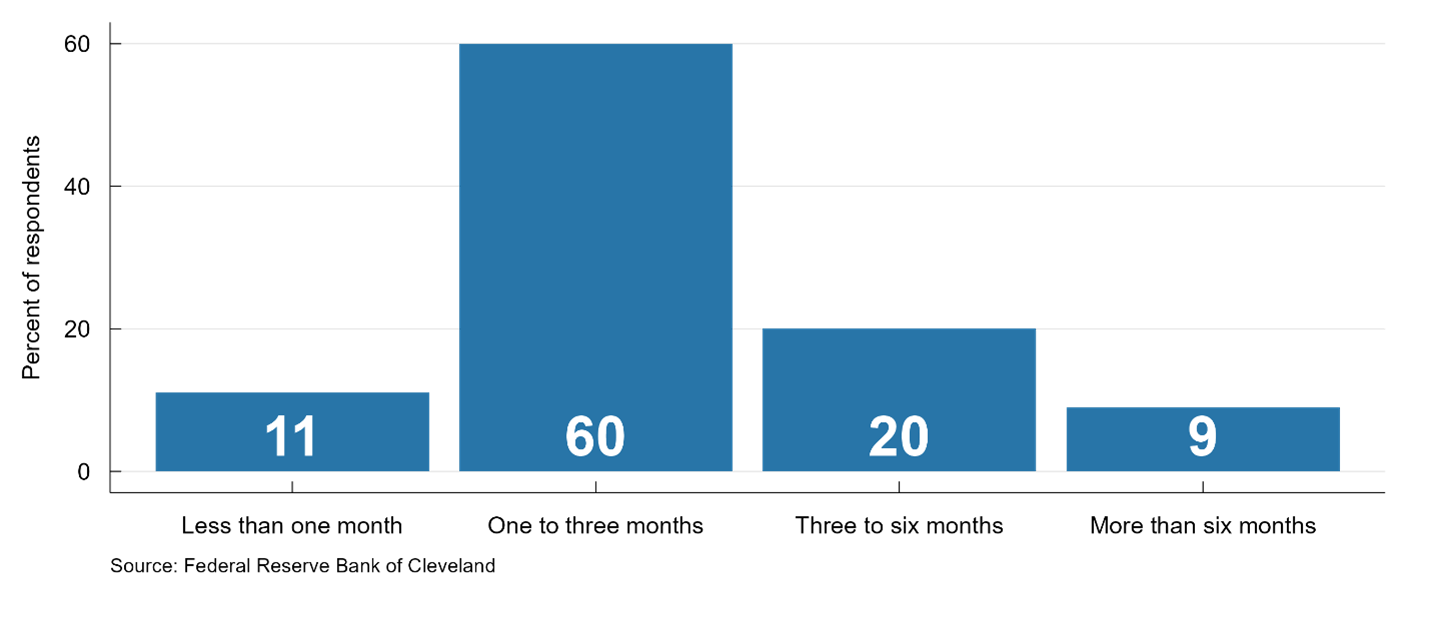

How many months do you anticipate it will take to work through your current inventory levels? (n = 55)

Most manufacturers and retailers (60 percent) said it would take one to three months to work through their firms’ current inventories, while smaller shares expected faster or slower turnarounds.

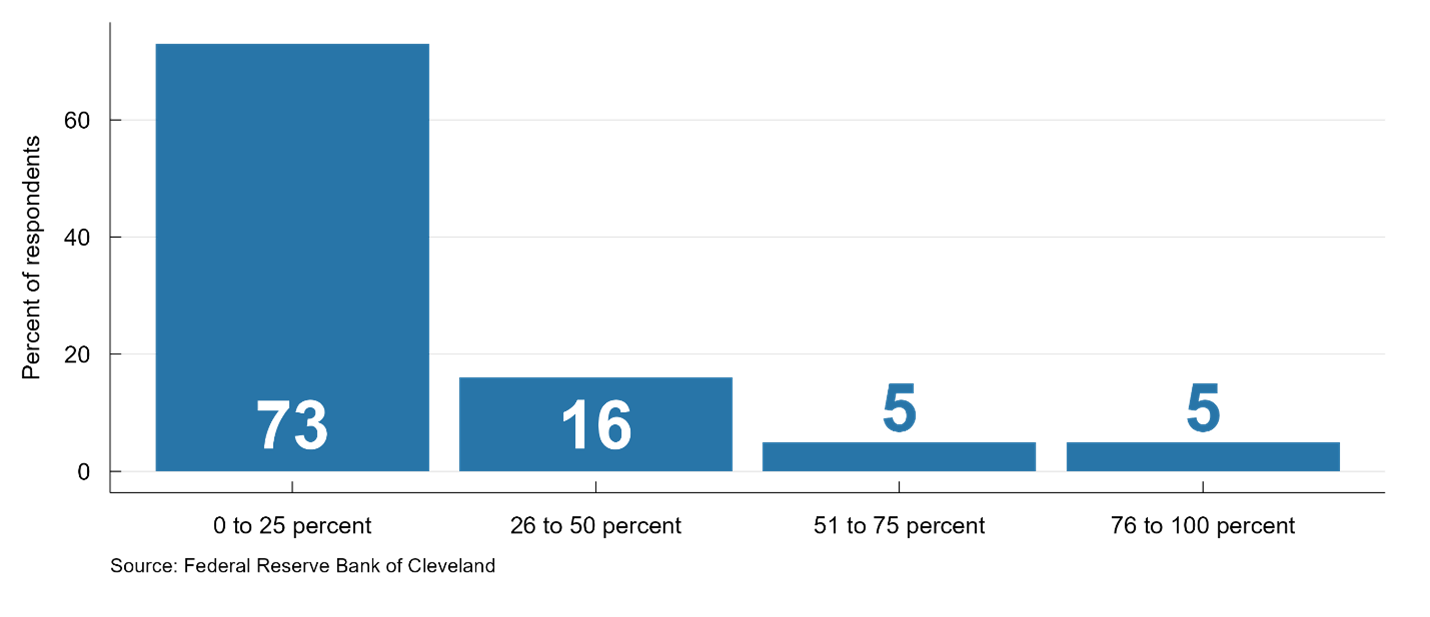

What percentage of your current inventory would you estimate has been subject to additional duties as a result of changes to trade policy in 2025? (n = 55)

Most manufacturers and retailers (73 percent) said that 25 percent or less of their inventories had been subject to additional duties because of recent changes to trade policy.

The Cleveland Fed’s Research Department gathers and analyzes timely economic information from businesses and community contacts to inform our Beige Book contribution and to prepare for Federal Open Market Committee (FOMC) meetings. One way we obtain this information is through the Survey of Regional Conditions and Expectations (SORCE), a business conditions survey sent to firms across the Fourth District, which comprises Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. The SORCE is administered eight times per year. In addition to the set of standard questions asked during each round of the survey, the Cleveland Fed routinely asks a set of “special questions” to explore timely issues that may be impacting businesses across the Fourth District. The SORCE Insights District Data Briefs share the results from the “special questions.” For more information on SORCE, visit https://www.clevelandfed.org/indicators-and-data/survey-of-regional-conditions-and-expectations.

*[09.23.2025. This article has been modified to correct the description of SORCE in the final paragraph.]

Suggested Citation

Huettner, Brett, and Mitchell Isler. 2025. “Preliminary SORCE Insights: An Overview of Firms’ Capital Expenditure Plans and Inventories.” Federal Reserve Bank of Cleveland, Cleveland Fed District Data Brief. https://doi.org/10.26509/frbc-ddb-20250828

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

Regional Data, Analysis, and Engagement

Explore economic trends and the circumstances impacting the economy and diverse communities of the Federal Reserve’s Fourth District, which includes all of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia.

About Us

The Federal Reserve Bank of Cleveland (commonly known as the Cleveland Fed) is part of the Federal Reserve System, the central bank of the United States.