- Share

SORCE Insights: Expected Impacts of Higher Tariffs and Changes to Immigration Policy

The Cleveland Fed’s Survey of Regional Conditions and Expectations (SORCE) administered in May 2025 asked respondents from across the Fourth District a set of special questions about the potential impacts of higher tariffs and changes to immigration policy on their businesses. This District Data Brief analyzes their responses.

The views authors express in District Data Briefs are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Harrison Markel.

Introduction

The Cleveland Fed’s Research Department gathers and analyzes timely economic information from businesses and community contacts to inform our Beige Book contribution and to prepare for Federal Open Market Committee (FOMC) meetings. One way we obtain this information is through the Survey of Regional Conditions and Expectations (SORCE), a business conditions survey sent to firms across the Fourth District, which comprises Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. The SORCE is administered eight times per year. In addition to the set of standard questions asked during each round of the survey, the Cleveland Fed routinely asks a set of “special questions” to explore timely issues that may be impacting businesses across the Fourth District. In the version of the SORCE fielded during May 8–15, 2025, the Cleveland Fed asked respondents a series of special questions regarding the potential impact of tariffs on their businesses and one question about whether changes to immigration policy have affected their ability to hire or retain workers. We analyze their responses below.

Analysis

Source: Federal Reserve Bank of Cleveland

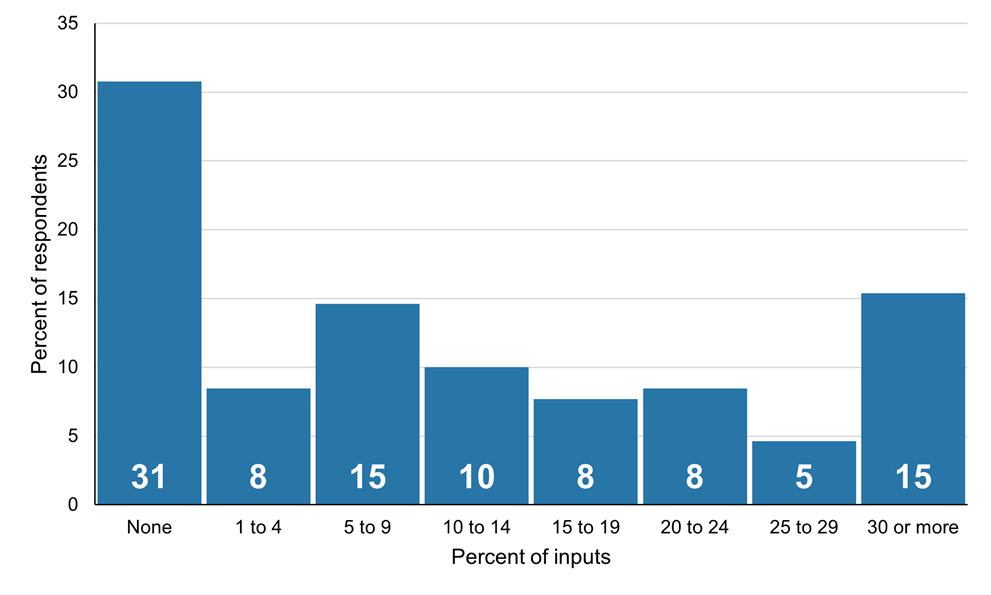

Notes: The data are based on responses to the question “In terms of dollar amounts, approximately what percentage of your inputs are sourced from countries outside the United States?” There were 130 responses.

Contacts’ firms varied in the share of production inputs that they source from outside the United States. The majority of contacts said their firms get less than 10 percent of their inputs from abroad, though some contacts reported much higher shares (up to 95 percent for one large retailer).

Source: Federal Reserve Bank of Cleveland

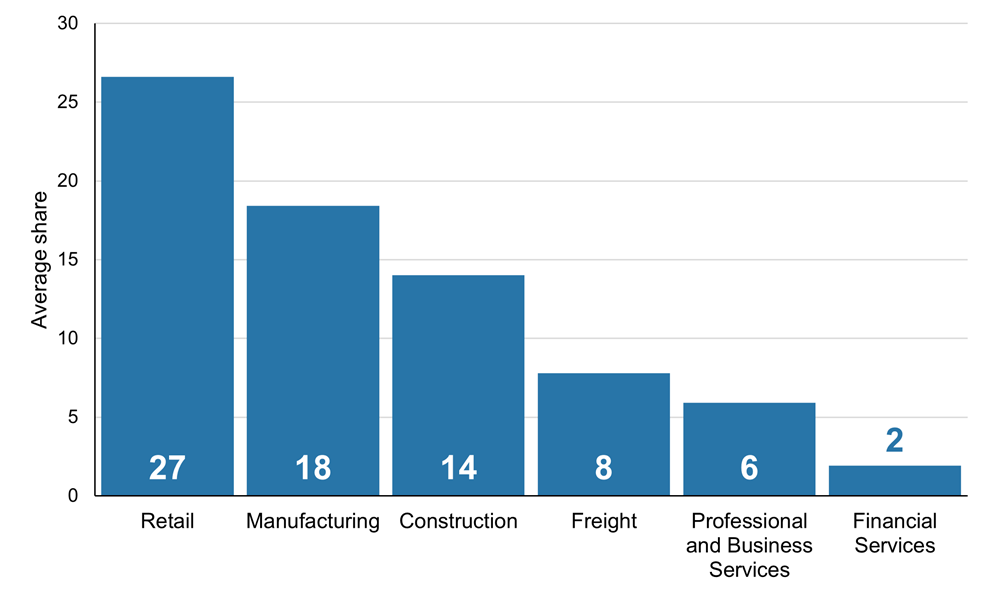

Notes: The data are based on responses to the question “In terms of dollar amounts, approximately what percentage of your inputs are sourced from countries outside the United States?” There were 114 responses. The data exclude industries not classified in one of the major sectors specified here.

Retail contacts reported the highest average share of inputs sourced from outside the United States at 27 percent. Manufacturing and construction firms were the next most dependent on imports, relying on them for 18 and 14 percent of their production inputs, respectively.

Source: Federal Reserve Bank of Cleveland

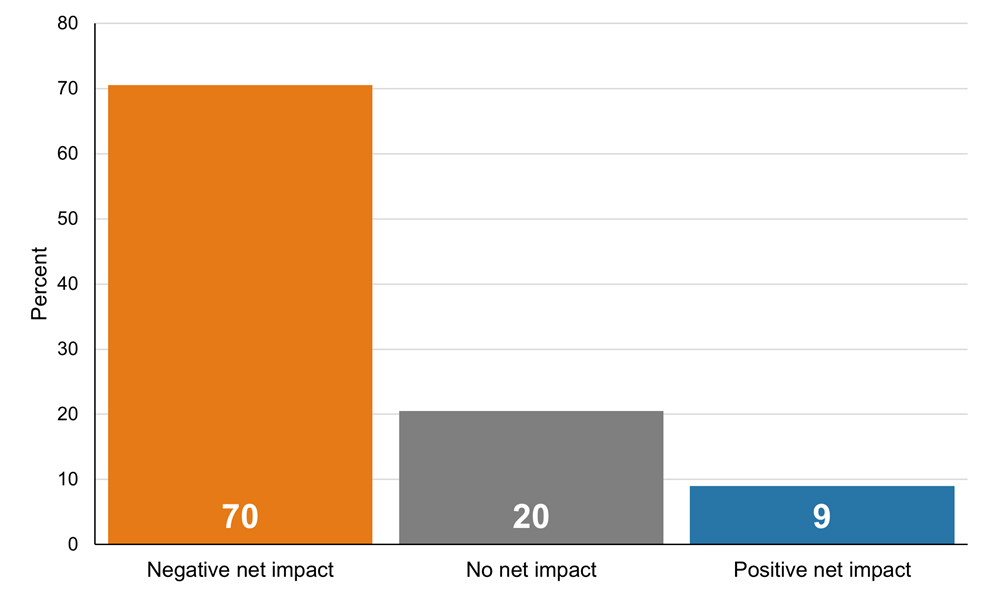

Notes: The data are based on responses to the question “How do you expect higher tariffs to impact your business over the next six months, if at all?” There were 122 responses.

Seventy percent of Fourth District firms surveyed anticipated a negative net impact from higher tariffs over the next six months. Nine percent expected a positive net impact, while 20 percent expected no net impact. In our February survey, 64 percent of respondents said tariffs would impact their businesses in some way (either positive or negative), and 12 percent said they would not.

Source: Federal Reserve Bank of Cleveland

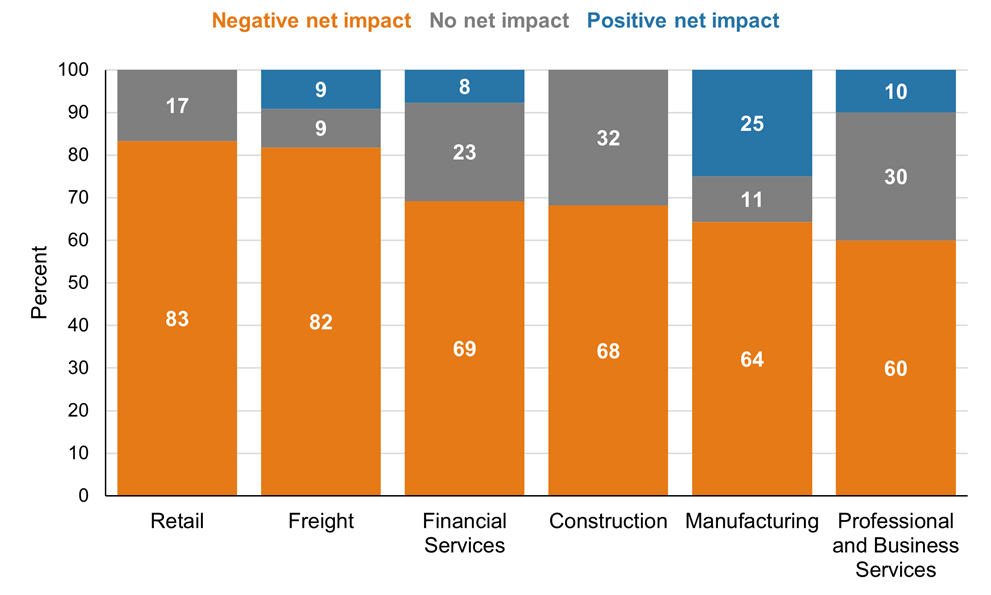

Notes: The data are based on responses to the question “How do you expect higher tariffs to impact your business over the next six months, if at all?” There were 108 responses. The data exclude industries not classified in one of the major sectors specified here.

Retail and freight industry contacts were the most likely to anticipate a negative net impact from higher tariffs over the next six months. One-fourth of manufacturing contacts expected a positive net impact, the largest share of any sector. Freight and manufacturing contacts were the most likely to expect any net impact (either positive or negative). In our February survey, retail and manufacturing contacts were the most likely to expect an impact from higher tariffs. Moreover, a much larger share of freight contacts expected no impact in our February survey compared to in our May survey.

Source: Federal Reserve Bank of Cleveland

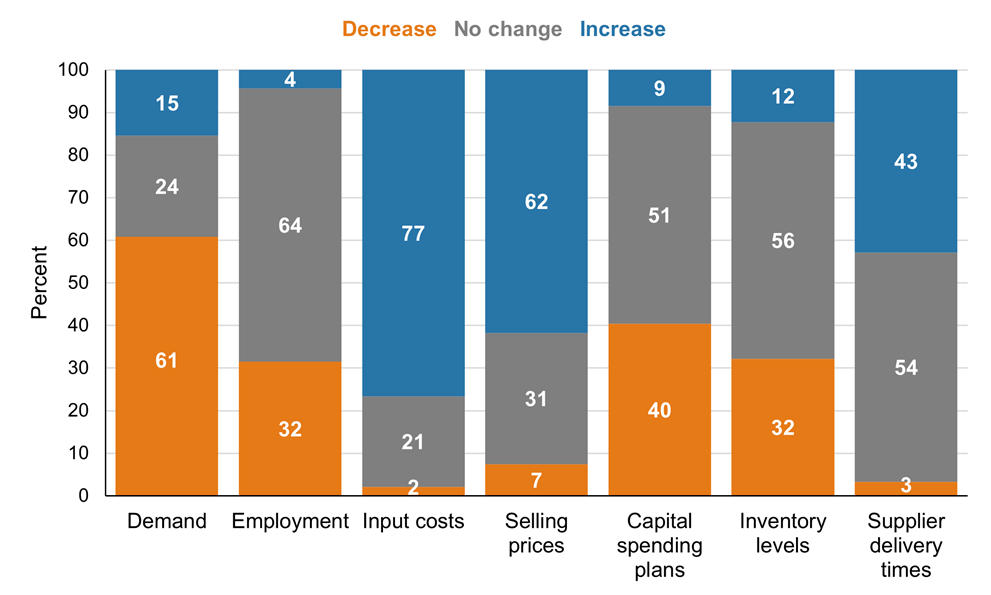

Notes: The data are based on responses to the question “What net impact do you expect higher tariffs to have on the following aspects of your firm's business over the next six months?” Response counts for each item were as follows: demand, 97; employment, 92; input costs, 94; selling prices, 94; capital spending plans, 94; inventory levels, 97; and supplier delivery times, 91. This question excluded respondents who—in response to the previous question discussed in Figures 3 and 4 (“How do you expect higher tariffs to impact your business over the next six months, if at all?”)—said their firm would experience no net impact from tariffs.

Contacts who indicated that tariffs would have either a positive or negative net impact on their firm received additional questions asking for more detail. Figures 5 through 11 explore the results obtained from responses to these questions.

The most common expected impact of higher tariffs over the next six months was an increase in input costs, with more than three-fourths of respondents anticipating increases; this was slightly lower than the 85 percent who said the same in our February survey. Sixty-two percent of respondents indicated that they would increase their selling prices in response to higher tariffs over the next six months (compared to 75 percent in February), and 61 percent anticipated that tariffs would result in lower demand for their products or services (similar to the 60 percent who said the same in February). More firms were expecting to decrease employment, capital spending, and inventory levels than increase them because of higher tariffs. The share of firms expecting to decrease employment rose to 32 percent compared to 22 percent in our February survey.

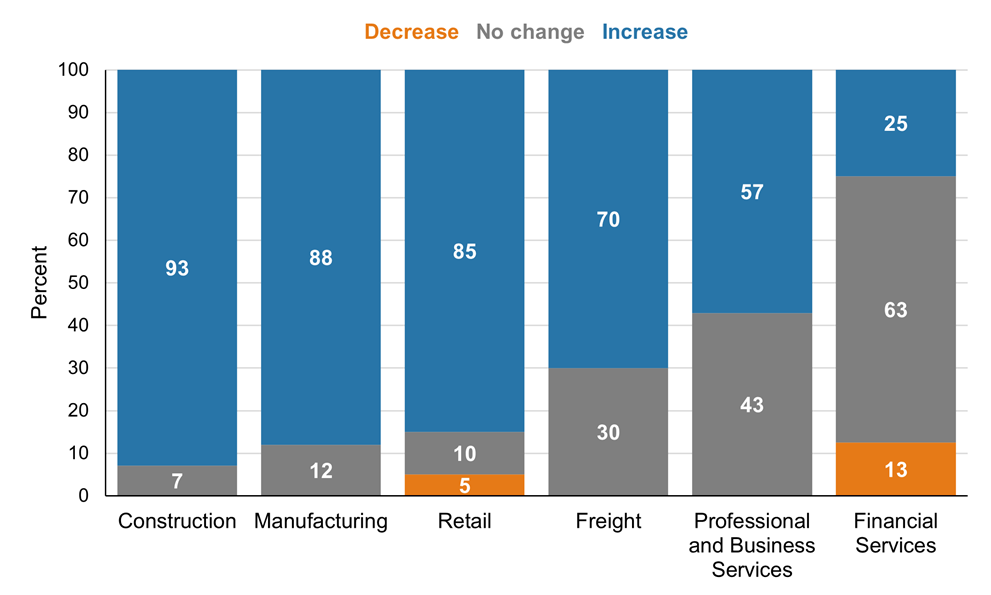

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What net impact do you expect higher tariffs to have on the following aspects of your firm's business over the next six months?” (input costs). There were 84 responses. The data exclude industries not classified in one of the major sectors specified here. This question excluded respondents who—in response to the previous question discussed in Figures 3 and 4 (“How do you expect higher tariffs to impact your business over the next six months, if at all?”)—said their firm would experience no net impact from tariffs.

Of those respondents who expected a net impact from higher tariffs, more than half in all sectors except financial services indicated that the tariffs would increase their input costs over the next six months. The industries in which contacts were most likely to say that their input costs would rise were construction, manufacturing, and retail (93 percent, 88 percent, and 85 percent, respectively).

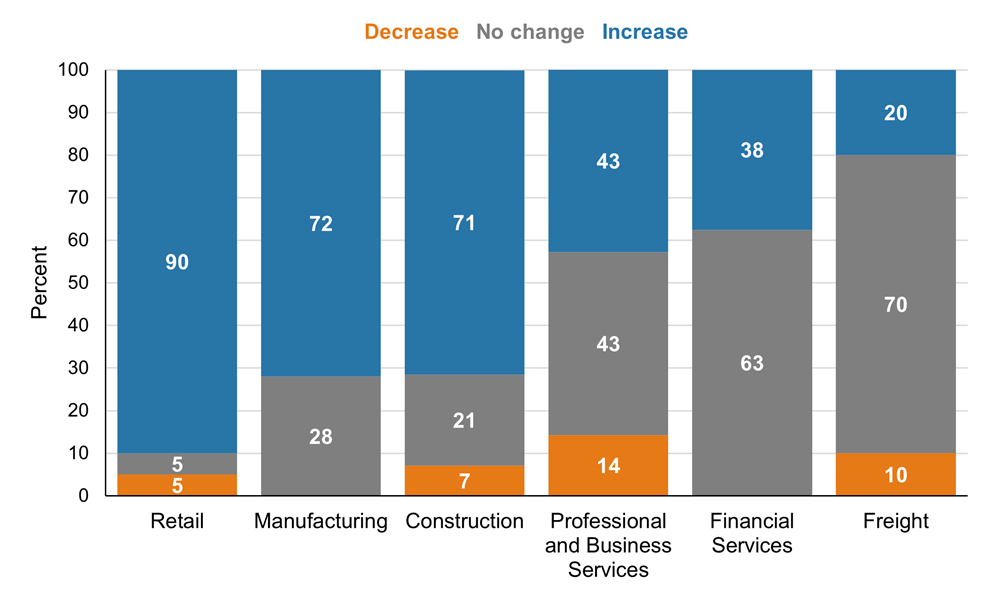

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What net impact do you expect higher tariffs to have on the following aspects of your firm's business over the next six months?” (selling prices). There were 84 responses. The data exclude industries not classified in one of the major sectors specified here. This question excluded respondents who—in response to the previous question discussed in Figures 3 and 4 (“How do you expect higher tariffs to impact your business over the next six months, if at all?”)—said their firm would experience no net impact from tariffs.

Clear majorities of respondents in the retail, manufacturing, and construction sectors who expected a net impact from higher tariffs said they would increase their selling prices in response to higher tariffs over the next six months, while smaller shares of respondents in the professional and business services, financial services, and transportation sectors said the same. Notably, a larger share of retail contacts expected to increase selling prices than expected to see increased input costs, suggesting that some contacts would increase prices along with their competitors, regardless of their own input costs. While most respondents in the freight sector expected input costs to rise because of higher tariffs, few anticipated that they would be able to pass those costs on to customers.

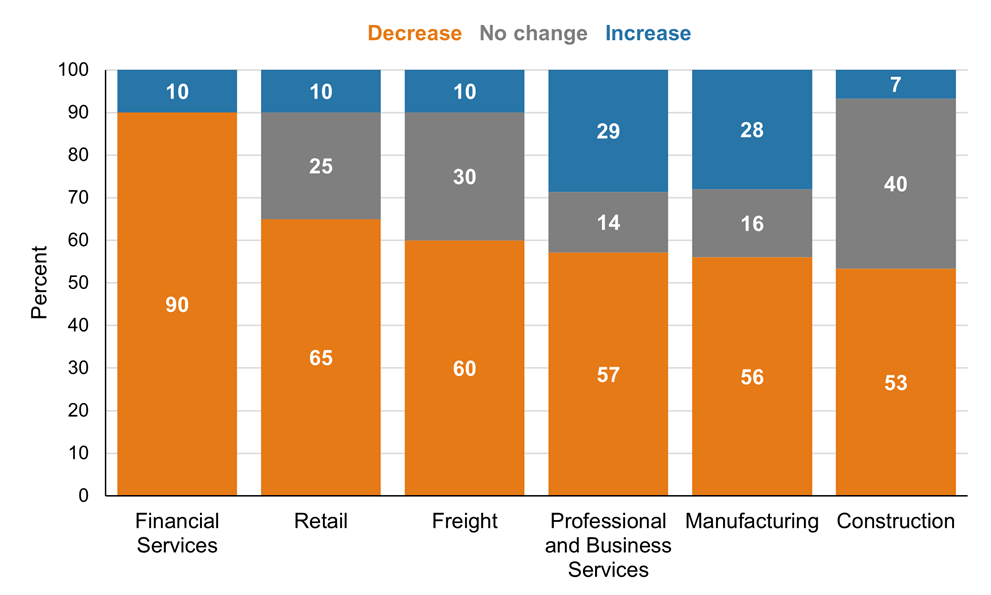

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What net impact do you expect higher tariffs to have on the following aspects of your firm's business over the next six months?” (demand for your goods or services). There were 87 responses. The data exclude industries not classified in one of the major sectors specified here. This question excluded respondents who—in response to the previous question discussed in Figures 3 and 4 (“How do you expect higher tariffs to impact your business over the next six months, if at all?”)—said their firm would experience no net impact from tariffs.

Of those contacts who anticipated any net impact from tariffs, most across all sectors expected higher tariffs to decrease demand for their goods or services over the next six months. Contacts in the financial services industry were by far the most likely to expect a decrease in demand (90 percent of respondents), while the share of respondents in other sectors expecting reduced demand ranged from 53 to 65 percent.

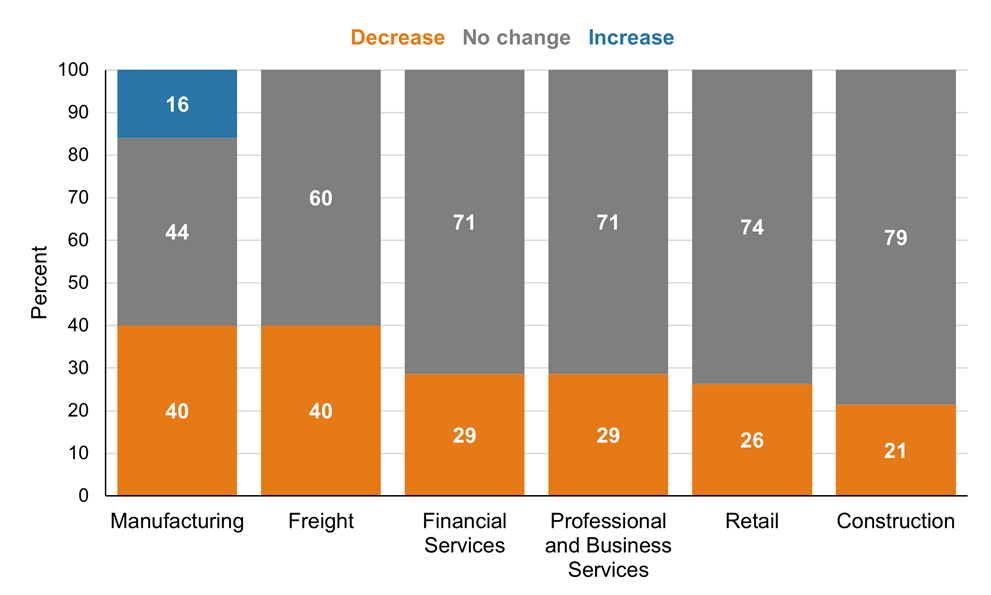

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What net impact do you expect higher tariffs to have on the following aspects of your firm's business over the next six months?” (employment). There were 82 responses. The data exclude industries not classified in one of the major sectors specified here. This question excluded respondents who—in response to the previous question discussed in Figures 3 and 4 (“How do you expect higher tariffs to impact your business over the next six months, if at all?”)—said their firm would experience no net impact from tariffs.

Most firms that anticipated any net impact from higher tariffs said they did not expect higher tariffs to affect their employment levels over the next six months. This was true for a majority of respondents in all industries except manufacturing, though it was also true for 44 percent of manufacturers. Between 21 and 40 percent of respondents across sectors expected to decrease headcounts in response to tariffs. Sixteen percent of manufacturers said they would increase staffing levels because of tariffs, though this was a smaller share than the 40 percent in the industry who anticipated staffing cuts.

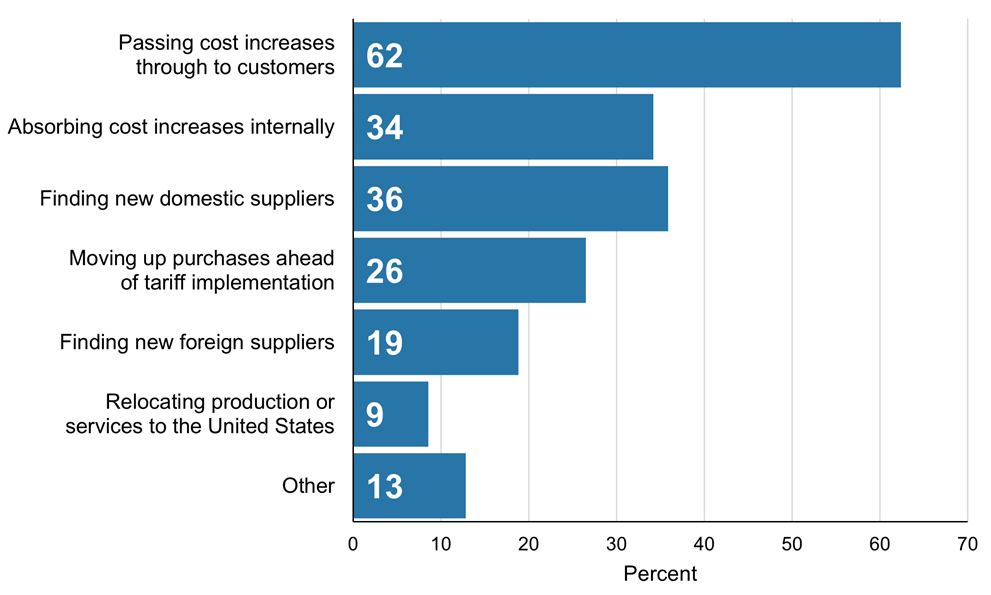

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “What actions, if any, are you taking or planning to take in response to higher tariffs? Please select all that apply.” There were 117 responses. This question excluded respondents who—in response to the previous question discussed in Figures 3 and 4 (“How do you expect higher tariffs to impact your business over the next six months, if at all?”)—said their firm would experience no net impact from tariffs.

Nearly two-thirds of contacts who expected to see a net impact from higher tariffs planned to pass tariff-related cost increases on to their customers, while about one-third planned to absorb cost increases internally. On the supply chain side, more than one-third of respondents said they planned to find new domestic suppliers, 19 percent anticipated looking for new foreign suppliers, and nine percent planned to reshore portions of their businesses in the United States. About one-fourth of respondents planned to move purchases forward ahead of tariff implementation. Thirteen percent of respondents planned to take other actions in response to higher tariffs. Explanations for a response of “Other” were wide-ranging, but they included slowing capital expenditures and negotiating set contract prices for the year ahead.

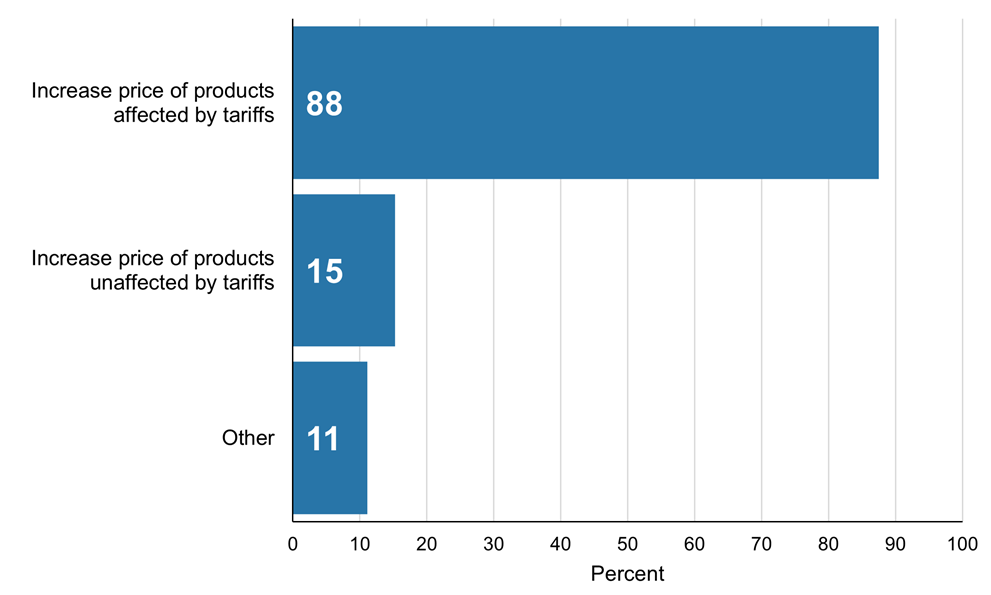

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “How are you adjusting or planning to adjust your selling prices in response to higher tariffs? Please select all that apply.” There were 72 responses. This question included only those respondents who said they would pass cost increases through to their customers.

Of those contacts who planned to pass cost increases through to their customers, most said they would increase the price of goods and services directly affected by tariffs. There was less evidence that firms would spread costs around: only 15 percent anticipated increasing the price of goods and services not directly affected by tariffs.

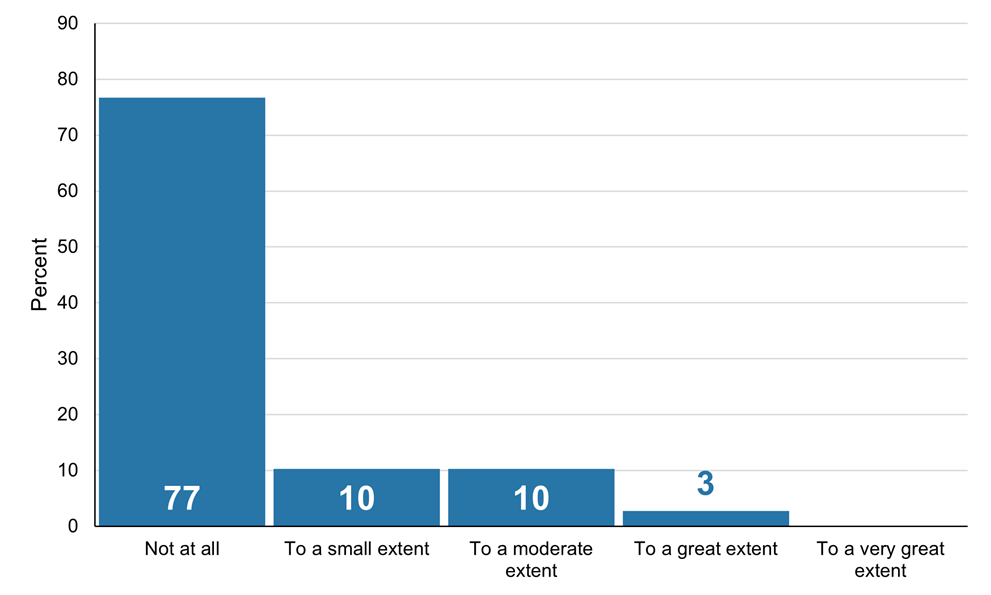

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “To what extent, if at all, have changes to immigration policy impacted your firm’s ability to hire or retain workers since the start of the year?” There were 146 responses.

More than three-fourths of Fourth District contacts saw no impact on their hiring and retention efforts from changes to immigration policy. Most of the affected firms said the policy changes impacted their employment to a small or moderate extent.

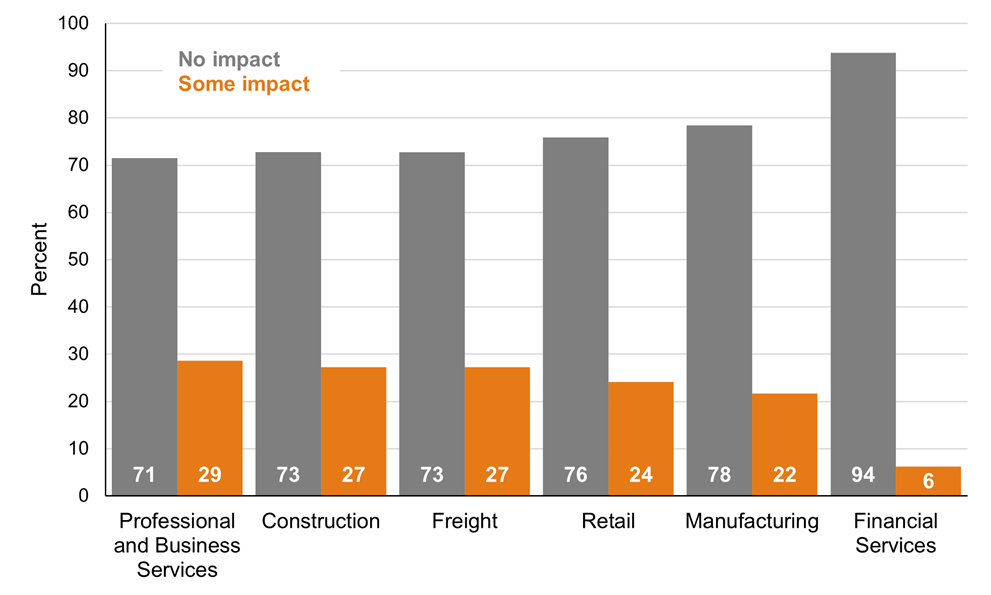

Source: Federal Reserve Bank of Cleveland

Notes: The data are based on responses to the question “To what extent, if at all, have changes to immigration policy impacted your firm’s ability to hire or retain workers since the start of the year?” There were 129 responses. The data exclude industries not classified in one of the major sectors specified here.

Most contacts across sectors reported that changes to immigration policy have not impacted their ability to hire or retain workers since the start of the year. Professional and business services firms were the most likely to report at least some impact from the policy changes; open-ended comments from these firms explained that international candidates for some temporary and seasonal jobs were unavailable because they feared deportation. Some contacts in other sectors reported decreased availability of labor and increased market wages for some positions as immigrants left the workforce.

Conclusion

In the Cleveland Fed SORCE administered in May 2025, most respondents said higher tariffs would negatively impact their business over the next six months. Retail and freight industry contacts were the most likely to anticipate a negative impact from higher tariffs, while manufacturing contacts were the most likely to expect a positive impact. Among those respondents who anticipated any impact, the most common was an increase in input costs, and majorities expected to increase their selling prices and experience reduced demand. Most contacts who expected to be affected by higher tariffs planned to pass tariff-related cost increases on to their customers, while some planned to absorb cost increases internally. Regarding the effects of changes to immigration policy, the vast majority of contacts indicated that such changes had little or no impact on their ability to hire or retain workers.

Suggested Citation

Barrow, Lisa, and Mitchell Isler. 2025. “SORCE Insights: Expected Impacts of Higher Tariffs and Changes to Immigration Policy.” Federal Reserve Bank of Cleveland, Cleveland Fed District Data Brief. https://doi.org/10.26509/frbc-ddb-20250626

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

Regional Data, Analysis, and Engagement

Explore economic trends and the circumstances impacting the economy and diverse communities of the Federal Reserve’s Fourth District, which includes all of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia.

About Us

The Federal Reserve Bank of Cleveland (commonly known as the Cleveland Fed) is part of the Federal Reserve System, the central bank of the United States.