- Share

Americans Cut Their Debt

The Great Recession brought an end to a 20-year expansion of consumer debt. In its wake is a lively debate about what caused the turnaround. Was it motivated by a decreased appetite for debt by consumers or an unwillingness to lend by banks? Our analysis of Equifax and Mail Monitor data shows that the major cause was most likely consumers.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The availability of credit to consumers and businesses is very important to our way of life. It stimulates economic growth and helps people maintain their lifestyle when their income fluctuates. However, having a lot of debt when an economy is hit by a recession or a crisis can be devastating, as opportunities for repaying that debt may become limited. In fact, some researchers believe that the last U.S. recession was driven by the accumulation of too much debt—especially home equity debt—during the period when house prices were rising. When home prices started falling and the economy was stressed by the financial crisis, more debt translated into greater financial struggles.

American consumers had been significantly increasing the amounts they borrow since the late 1980s. Between 2000 and 2009, for example, the ratio of aggregate debt to consumer income increased from 100 percent to 150 percent. But shortly after the end of the Great Recession, total consumer debt outstanding started declining, which is unusual, as debt did not shrink very much after previous recessions.

For policymakers it is important to know what is driving the reduction in aggregate debt, so that they can target their policies accordingly. Are consumers deleveraging—reducing and consolidating their debt—or are lenders reducing credit—cutting back on lending, cutting credit lines, and closing accounts? It could be either.

We show that much of the debt reduction is being driven by consumers, who started paying off their debts, closing their existing credit accounts, and making fewer inquiries for new credit after 2009. Even though we cannot completely rule out the possibility that lenders contributed to the decline by reducing credit, the evidence points more to consumers playing the bigger role.

Shrinking Credit Limits and Balances

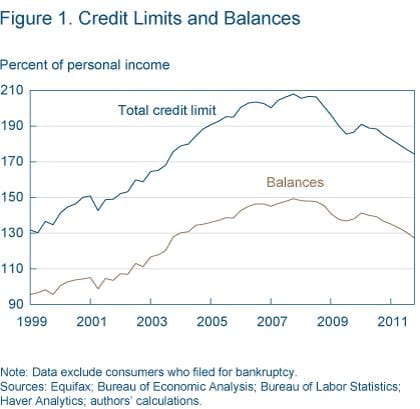

Both credit balances and credit limits were increasing relative to personal income before 2009 and declining afterward (figure 1).

Note: Data exclude consumers who filed for bankruptcy.

Sources: Equifax; bureau of Economic Analysis; Bureau of Labor Statistics; Haver Analytics; authors' calculations.

To investigate why credit limits and balances are shrinking, we analyzed data collected by one of the major credit bureaus, Equifax. The data comprise a random sample of about 10 million Americans who use credit in some form. In these data we observe the forms of credit consumers have used, how many credit cards they have, credit limits and balances for numerous types of credit accounts, etc. Among other things, we know the credit scores of those consumers and whether they pay their credit obligations on time. In addition, we know if they filed for bankruptcy or are in foreclosure. (Individuals remain completely anonymous to protect their privacy.)

We consider several measures of indebtedness: the number of open credit accounts (the combined number of mortgages, home equity lines of credit, credit cards, retail store accounts, etc.), the number of bank card accounts (primarily credit cards), and the total amount of debt. We analyze these measures separately for consumers in different age groups, with different credit scores, and with different levels of indebtedness. In most cases, we remove consumers from the sample who have filed for bankruptcy, since they may have had all of their credit cards closed by the bank as part of the bankruptcy process.

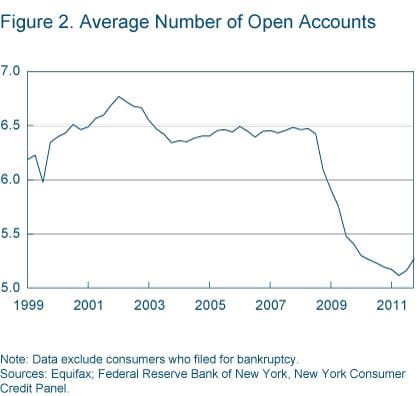

The first thing our analysis shows is that people are holding fewer credit cards. At the beginning of 2011, the number of total open credit accounts per consumer was at its lowest level in the past dozen years (figure 2). Credit accounts include both mortgages and bank cards, but the aggregate pattern is driven by closed bank card accounts and not by closed mortgage loans due to, for example, foreclosure.

Note: Data exclude consumers who filed for bankruptcy.

Sources: Equifax; Federal Reserve Bank of New York, New York consumer credit Panel.

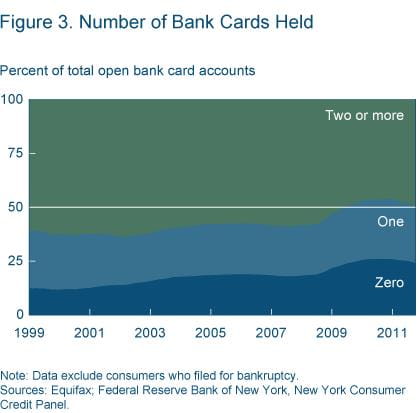

Note: Data exclude consumers who filed for bankruptcy.

Sources: Equifax; Federal Reserve Bank of New York, New York consumer Credit Panel.

More than half of consumers now have just one credit card or none at all. Consumers with no credit card or with just one card appear to be driving the overall reduction in the number of bank cards. Over the last four years, the fraction of people with zero bank cards increased from about 18 percent to 24 percent (figure 3). Since 1999, the fraction has doubled. [Note: This fraction was reported as 16% in 2010 when first posted and was changed on 8/24/2012.]

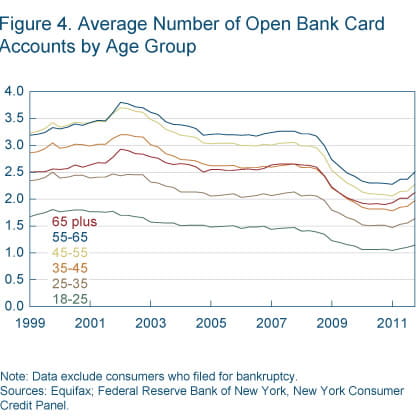

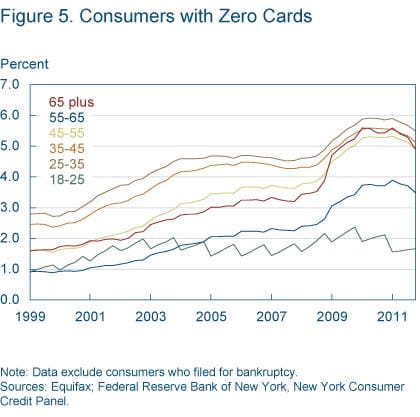

One might worry that our random sample of consumers is picking up changing population demographics. If so, the observed aggregate pattern may be explained by a disproportionately large number of either very young adults (who typically have no credit cards) or senior citizens (who may be getting rid of cards they no longer use). However, we found that the trend toward fewer cards is happening in all age groups (figures 4 and 5). Also, the number of people with zero cards has increased in all age groups as well, though more so for people older than 25.

Note: Data exclude consumers who filed for bankruptcy.

sources: Equifax; Federal Reserve Bank of New York, New York consumer Credit Panel.

Note: Data exclude consumers who filed for bankruptcy.

Sources: Equifax; Federal Reserve Bank of New York, New York consumer Credit Panel.

For insight into whether banks or consumers are closing these credit card accounts, we looked at card activity for consumers with different credit scores. A differential trend in the number of cards for these two groups would suggest that banks are behind the closure of credit accounts. Consumers with low credit scores are less creditworthy, and lenders may close existing accounts or decline to open new ones for consumers with low scores. Borrowers with high credit scores, on the other hand, will be the most likely to obtain new card accounts or maintain existing ones.

We analyzed the average number of bank cards that consumers with different Risk Scores hold. Risk Scores are credit scores produced by Equifax. They range from 280 (lowest credit quality) to 850 (highest). Equifax uses a score of 700 as a threshold to identify individuals with “prime” scores, that is, those who are most likely to be creditworthy borrowers (lenders may be using a different threshold, which is determined by their business lending goals). [Note this paragraph originally referred to VantageScores and cited different cutoff figures. It was amended on 8/29/2012.]

We found almost identical deleveraging behaviors for consumers with different credit scores. According to our results, since the second quarter of 2007, the average number of bank cards held by those with scores above and below the 700 threshold declined by approximately 30 percent. The fact that the number of cards fell by a similar amount for high- and low-risk borrowers suggests that it is consumers who are driving the deleveraging trend, not the banks.

We also found evidence that the decline in credit cards is not being driven by consumers falling into bankruptcy. When we redid our analysis and included bankruptcies, the change in the average number of cards was nearly identical to the result we got when we controlled for bankruptcy.

If people are consolidating their debt by moving debt balances from some cards to others or combining their card and mortgage debt, we would miss it by looking only at the average number of credit cards held. To check for that possibility, we analyzed total consumer debt.

Our results show that total consumer debt has followed a pattern similar to the number of bankcards. We also repeated the exercise of splitting consumers into two credit score groups in this analysis. Overall levels of debt have fallen for both groups.

Finally, we found that the consumers cutting the most debt now are those who accumulated more before the recession. Individuals in the top 25 percent of the debt distribution are those driving the trend to close card accounts. The average reduction in the number of cards was much smaller for people who did not have a lot of debt before the crisis.

Credit Inquiries

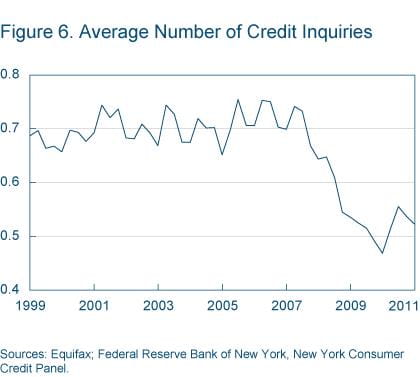

The evidence from the individual debt measures suggests that recent trends in overall consumer debt and the number of bank cards are being driven by consumers. To get further evidence, we analyzed another source of information, consumer-initiated inquiries for new credit.

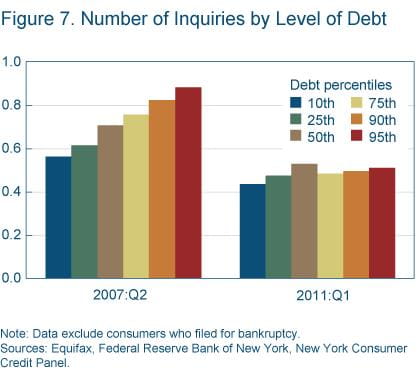

The average number of credit inquiries has fallen significantly (figure 6). Consumers with all levels of debt before the crisis—as of the second quarter of 2007—inquired for credit much less often in the first quarter of 2011 (figure 7). In fact, this observation suggests that at the beginning of 2011 everybody was cutting back on seeking new credit. The most indebted consumers reduced their credit applications by 42 percent, and the least-indebted by 23 percent. [These figures were originally reported as 33.4 percent and 19.7 percent and were changed on 8/24/2012.]

Note: Data exclude consumers who filed for bankruptcy.

Sources: Equifax; bureau of Economic Analysis; Bureau of Labor Statistics; Haver Analytics; authors' calculations.

Note: Data exclude consumers who filed for bankruptcy.

Sources: Equifax, Federal Reserve Bank of New York, New York consumer Credit Panel.

The reduction of inquiries for new credit by all consumers, like the trends in credit balances, suggests that it is mostly consumers, not banks, who are driving aggregate debt reduction. However, these results might be misleading if credit inquiries fell because lenders cut back on solicitations and offered less credit to consumers.

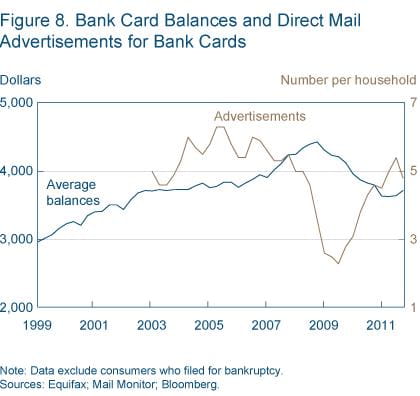

Data from Mail Monitor show that the number of card solicitations from banks to households actually rose while consumer credit balances and inquiries were falling. Mail Monitor tracks bank card solicitations by collecting credit card mailings from consumers and surveying them about their current card usage, card terms, statement activity, payment history, and satisfaction.

From the fourth quarter of 2007 to the second quarter of 2009, card solicitations plummeted from 1.2 million solicitations to 270,000 solicitations. However, solicitations are up nearly 250 percent to 940,000 solicitations in the fourth quarter of 2011. The growth in solicitations occurred over the same period that consumers were decreasing their credit inquiries and overall debt holdings (figure 8).

Note: Data exclude consumers who filed for bankruptcy.

sources: Equifax, Mail Monitor; Bloomberg.

Note: Data exclude consumers who filed for bankruptcy.

sources: Equifax, Mail Monitor; Bloomberg.

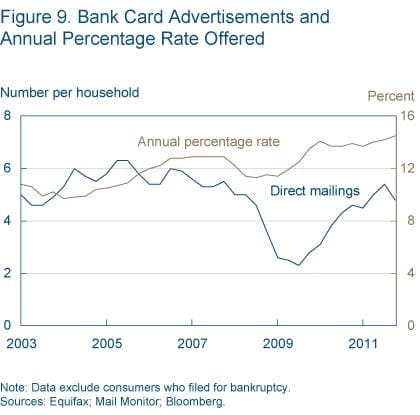

It seems that banks wanted to provide more credit (in the form of credit card offers) to households, but consumers did not want to ask for that credit. There may be numerous reasons why consumers acted this way. One possible reason is the rising advertised interest rate offered by banks on those credit card offers. Interest rates were increasing together with the number of direct mail credit card offers (figure 9).

Conclusion

The Great Recession brought an end to a 20-year expansion of household balance sheets. In the recession’s wake, an active debate has sprung up about whether the decline in consumer credit was motivated by consumers’ decreased appetite for debt or banks’ unwillingness to lend.

For policymakers, knowing what is driving the overall debt reduction is crucial. If lenders are tightening lending standards and making credit less available when consumers need it, appropriate policies—supervisory or monetary—could help.

Banking supervisors, for example, could address the issue through the supervisory guidance they provide to banks. Supervisors from various agencies including the Federal Reserve have in fact been providing such guidance in the past few years, encouraging banks to lend. However, banking supervisors cannot compel banks to lend, let alone compel consumers to borrow. Monetary policy has also provided support for consumer debt markets by holding short-term interest rates close to zero and by working to lower long-term rates.

On the other hand, if consumers are choosing to deleverage and repair their balance sheets, then regulators cannot do much to change it. They still need to understand what’s happening, however, since the actions of consumers with respect to their borrowing and spending do have direct implications on monetary policy.

Our analysis shows that consumers have likely played a larger role in the credit decline than banks have. While this result could mean slower prospects for economic growth—consumers who are borrowing less could also be spending less, and spending is needed for growth—the implications of such behavior are not necessarily bad. Deleveraging of consumer balance sheets should increase private savings during a period in which saving by the public reached record lows. This should allow for more capital formation and, hence, economic growth. So as long as consumers do not dramatically reduce their spending, the rehabilitation of consumer balance sheets should not be a material drag on growth.

Suggested Citation

Demyanyk, Yuliya, and Matthew M. Koepke. 2012. “Americans Cut Their Debt.” Federal Reserve Bank of Cleveland, Economic Commentary 2012-11. https://doi.org/10.26509/frbc-ec-201211

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International