- Share

The 1970s Origins of Too Big to Fail

In 1972, bank regulators bailed out the $1.2 billion Bank of the Commonwealth partly because they viewed it as “too big to fail.” We describe this bailout and subsequent ones through that of Continental Illinois in 1984 and use the descriptions to draw lessons about too-big-to-fail policy. We argue that some of the same issues that motivated bailouts during this earlier period, particularly worries about banking concentration, are relevant today.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The too-big-to-fail problem in banking is the unwillingness of regulators to close a large troubled bank because of a belief that the short-term costs of a bank failure are too high. The social costs of this policy are that it encourages banks to get inefficiently large and subsidizes risk taking.1 While the term “too big to fail” was first associated with the well-known bailout of Continental Illinois National Bank and Trust Company in 1984, there were actually several earlier bank bailouts motivated by too-big-to-fail-concerns.2 These were the bailouts of the Bank of the Commonwealth in 1972, Franklin National in 1974, First Pennsylvania in 1980, and the near bailout of Seafirst in 1983.

In this Commentary, we describe these earlier bailouts and draw lessons about too-big-to-fail policy.3 We argue that too-big-to-fail bailouts were an outgrowth of a deposit insurance system in which the de facto way to resolve all but the smallest troubled banks was through an acquisition, often assisted by the Federal Deposit Insurance Corporation (FDIC), by a healthy bank. In each of these bailouts, a timely assisted acquisition was not possible. Other than Franklin, the reason for the lack of acquirers was the combination of high levels of bank concentration within each of the states and restrictions on interstate banking.

Resolution of a Failing Bank

The FDIC has three methods for dealing with a failing bank: it can liquidate the bank and pay off the depositors, it can arrange for a sale of all or part of a bank and provide funds to help with the purchase, or it can bail out the bank and keep it open. During the 1970s and early 1980s, the law stated that a payoff had to be done unless a sale was less costly to the FDIC, and a bailout could only be done if the bank was essential to the community (Sprague, 1986).

This latter requirement, referred to as the essentiality doctrine, originated in a 1951 amendment to the 1950 Federal Deposit Insurance Act. The essentiality doctrine seems to have been created to deal with cases in which a failing bank was the only bank in a small rural town.4 However, it was instead used to bail out several too-big-to-fail banks during the 1970s and early 1980s by broadly interpreting the term “community.”5 In our descriptions of the bailouts, we will see how the FDIC first tried to find a healthy bank to acquire the troubled bank and that it then used the essentiality doctrine to justify a bailout when none could be found.

Bank of the Commonwealth

The first bailout of a too-big-to-fail bank was that of the Bank of the Commonwealth in 1972. Just eight years earlier, in 1964, Commonwealth was a mid-sized bank based in Detroit with $540 million in assets. That year, it was acquired by Donald Parsons and started to grow at an extraordinary rate.6 Between 1964 and 1970, its size in assets nearly tripled ($540 million to $1.49 billion). Part of Parsons’s growth strategy was to invest heavily in high-yield, long-term municipal securities with the hope that rates would drop and thus deliver a large capital gain. Commonwealth’s holdings of municipals rose from 7 percent of assets in 1964 to 22 percent in 1969.7 Unfortunately for Parsons, interest rates rose in 1969, and the value of the municipal securities plummeted.8

Parsons used wholesale funding markets to fuel his growth, but as funding problems developed, he tried to enter the international Eurodollar markets as an alternative (Sprague, 1986). However, the Federal Reserve, which was aware of Commonwealth’s poor financial condition, denied its application for a branch in the Bahamas. Application decisions are publicly released, so this denial revealed Commonwealth’s weakness to the market.

As a result, the bank saw its funding sources disappear, and it was forced to borrow from the Federal Reserve Bank of Chicago’s discount window to stay liquid. The bank’s borrowings reached a peak of $335 million in the summer of 1970 (Sprague, 1986).

Commonwealth was a large institution, with total assets of around $1.2 billion, and regulators were concerned that its failure would have serious consequences for the economy. The FDIC’s preferred course of action was to arrange a merger, but bank concentration in Detroit along with state banking rules limited the pool of acquirers. At the time, Michigan law prevented out-of-state banks from acquiring Michigan banks. However, the three largest banks in Detroit already controlled 77 percent of deposits, a situation which led FDIC Director Irvine Sprague to believe that the market would become too concentrated if one of them added Commonwealth’s 10 percent share (Sprague, 1986).

The FDIC decided to use its essentiality powers to bail out Commonwealth. It ruled that Commonwealth was essential because of its “service to the black community in Detroit, its contribution to commercial bank competition in Detroit and the upper Great Lakes region, and the effect its closing might have had on public confidence in the nation’s banking system” (FDIC, 1972). The final deal required Commonwealth to reduce the par value of all outstanding stock from $45.5 million to $7.9 million in order to absorb the losses from the sale of its municipal securities. The FDIC also lent the bank up to $60 million to replenish its capital (Sprague, 1986). While the FDIC’s assistance kept Commonwealth open, the bank continued to struggle after the bailout. The FDIC extended the loan in 1977, but Commonwealth never recovered fully and was eventually acquired by Comerica Bank in 1983 (Sprague, 1986).

From Commonwealth to Continental

The Commonwealth bailout was followed by a handful of other bailouts before Continental’s failure in 1984. We discuss these, along with one near-bailout, to show how a policy of too-big-to-fail bailouts was established.

Franklin National Bank

After Commonwealth, the next large bank bailout was for Franklin National Bank, a $5 billion bank based in Long Island that was active in foreign exchange markets. It was bailed out because regulators were worried that with its large foreign exchange portfolio and presence in Eurodollar markets, its failure would risk financial instability in international financial markets. Unlike the other too-big-to-fail bailouts, the lack of acquirers was not a result of interstate branching restrictions, but, rather, the uncertainty about the risk associated with the bank’s foreign exchange portfolio (Spero, 1980). Regulators handled this resolution by having the Federal Reserve Bank of New York acquire Franklin’s foreign exchange portfolio and open its discount window (lending up to $1.7 billion at one point). Later, once the bank was reduced in size, the FDIC sold it to the European-American Bank & Trust Company.9

First Pennsylvania Bank

The $8 billion First Pennsylvania Bank was bailed out in 1980 after poor loan performance and bad bets on interest rates. As with Commonwealth and Franklin, the FDIC’s preferred solution was to find an acquirer for the failing bank. Unfortunately, this was difficult because Pennsylvania did not allow acquisitions by out-of-state banks. The only in-state bank large enough to purchase First Penn was the Pittsburgh-based Mellon bank, but such a transaction would have given Mellon an unacceptable 26 percent market share in Pennsylvania.

The FDIC decided that First Penn could not be allowed to fail for reasons relating to the bank’s size and the negative impact that its failure would have on international financial stability (FDIC, 1998). The FDIC and a consortium of banks provided subordinated debt to First Penn and acquired stock warrants in the bank. The Federal Reserve Bank of Philadelphia also provided a $1 billion line of credit. These actions stabilized the bank.

Seafirst Bank

Seafirst was a $9.6 billion bank holding company based in Seattle and the largest bank in the Northwest. Its troubles stemmed from bad energy loans that it originated and bought participations in.10 When losses accrued from these loans, Seafirst saw its sources of funding in the money markets disappear.

Regulators were worried about a panic in money markets, so the Federal Reserve Bank of New York organized a 15-bank consortium to lend funds to Seafirst. When several banks dropped out, the difference was made up by discount window loans from the Federal Reserve Bank of San Francisco (Brimmer, 1984). Meanwhile, the FDIC prepared the papers to do a bailout in case an acquirer could not be found. Finding a buyer was difficult because Seafirst’s market share in the state of Washington was 37 percent, and state law prohibited out-of-state acquisitions. Fortunately, the Washington legislature met in an emergency session and removed the acquisition restriction at the last minute, which allowed the California-based Bank of America to buy Seafirst.

Continental Illinois

Continental Illinois was a $42 billion bank holding company based in Chicago. It was a large corporate lender, a correspondent bank for many small banks, and a bank heavily dependent on short-term funding from the wholesale market. Continental Illinois suffered a run in 1984 when its customers realized that the bank had serious problems with its loan quality.11 It borrowed $3.6 billion from the Federal Reserve Bank of Chicago to stay liquid. The FDIC never seriously considered letting the bank fail because of its extensive correspondent relationships and the impact that its failure might have had on the funding lines for other big banks. Additionally, a merger would have been difficult because of Continental’s size and the presence of interstate branching restrictions.12 This left a bailout as the only option.

The Continental assistance package was the most extensive up to that period. Initially, the FDIC guaranteed that all depositors and creditors of the bank would be protected fully. It organized a consortium of banks to provide a$2 billion capital infusion and another consortium to provide $5.5 billion in funding until the FDIC could develop a more permanent plan (FDIC, 1998). Later, the FDIC infused an additional $1 billion of capital and assumed the $3.5 billion of debt that the bank owed to the Federal Reserve Bank of Chicago (FDIC, 1984). The bailout agreement also gave the FDIC the right, in the event of substantial losses on the assets it purchased from Continental Illinois, to acquire the entirety of the common stock in Continental Illinois’s holding company.13

Bank Structure Then and Now

Of the three methods available to the FDIC for dealing with a failing bank during the 1970s and early 1980s, it is clear that the FDIC preferred to find another bank to acquire a troubled bank. Between 1970 and 1984, about 72 percent of commercial bank failures were resolved this way.14 Furthermore, when a payoff was used to resolve a bank, it was usually used on only the smallest banks. The largest bank that was paid off during this period was the $484 million Penn Square Bank in 1982, and that was only done because fraud and poor accounting at the bank made it hard to estimate the FDIC’s liability in the case of an assisted acquisition or a bailout (Sprague, 1986).15 These observations suggest that the essentiality doctrine was used for the unusual cases in which an assisted acquisition was not possible.

One complicating factor in arranging a merger during this period was the presence of restrictive branching laws that prevented out-of-state banks from acquiring in-state banks and in some cases prevented within-state branching. These laws, in combination with the failing banks’ large size, made it hard to find an acquirer for Commonwealth, First Penn, Seafirst, or Continental.

The state branching restrictions in place in the 1970s and early 1980s were gradually removed and finally dismantled by the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994. One benefit of this reform was that the pool of banks able to acquire a troubled bank greatly expanded. If out-of-state acquisitions had been allowed during the 1970s and 1980s, it is possible that Commonwealth, First Penn, and Continental Illinois could have been able to find a buyer, an option which would have allowed regulators to avoid a direct bailout.16

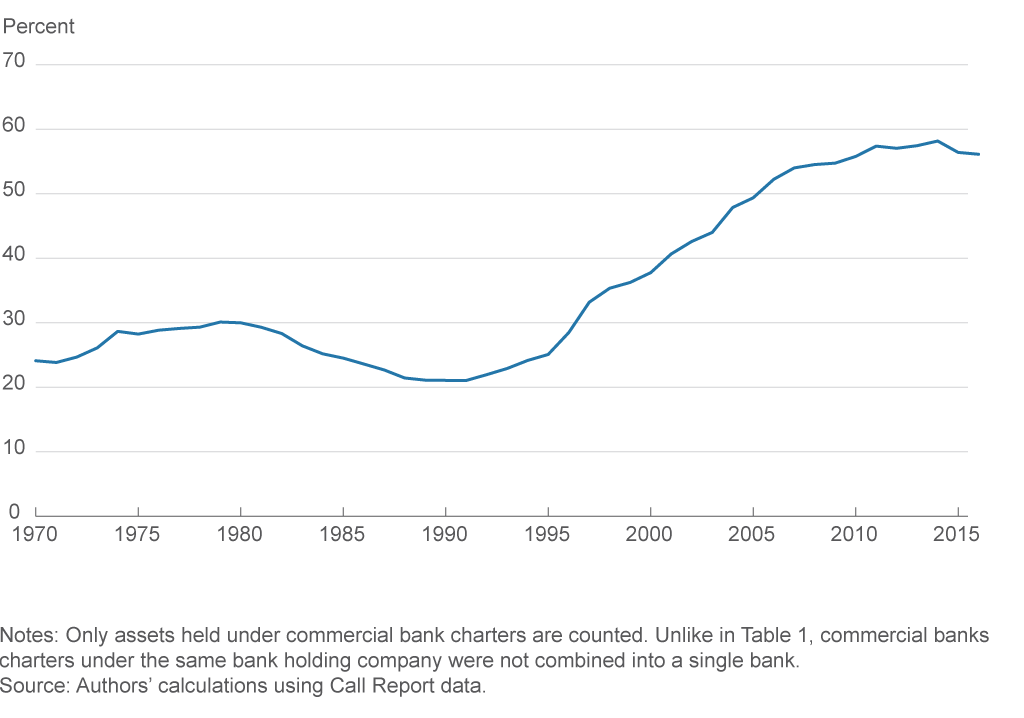

Unfortunately, this benefit from the Riegle-Neal reform is likely not a permanent one. Since the end of branching restrictions, there has been an enormous amount of consolidation in the banking industry17 Figure 1 shows that the market share of the largest 10 commercial banks has increased since the early 1990s. Table 1 shows the market share of the 10 largest banks in 2016. At the end of 2016, the market share of the four largest commercial banks in the United States is 45 percent, a figure that is not too different from what the within-state market shares were during the bailouts described in this Commentary. For example, in 1971, the four largest banks in Michigan held 44 percent of within-state banking assets. Similarly, the four largest banks in Pennsylvania held 39 percent in 1979, while the four largest banks in Illinois held 55 percent in 1983.18 Therefore, if one of the nation’s top four banks got into trouble today, regulators would face the same problem they faced earlier, namely, that an acquisition by another large bank could create a possibly unacceptable level of concentration.

Figure 1. Percentage of Total Banking Assets Belonging to the Ten Largest Banks

Table 1. Ten Largest US Commercial Banks, 2016

| Rank | Bank | Assets ($ billions) | Percent of national assets |

|---|---|---|---|

| 1 | JP Morgan Chase | 2,219.0 | 14 |

| 2 | Wells Fargo | 1,755.5 | 11 |

| 3 | Bank of America | 1,701.5 | 11 |

| 4 | Citibank | 1,350.1 | 9 |

| 5 | US Bank | 441.0 | 3 |

| 6 | Capital One | 399.2 | 3 |

| 7 | PNC | 356.0 | 2 |

| 8 | TD Bank | 292.3 | 2 |

| 9 | Bank of New York Mellon | 284.3 | 2 |

| 10 | State Street | 239.2 | 2 |

Notes: Only assets held under commercial bank charters are counted. Commercial bank charters under a common bank holding company are added together and treated as a single bank, though only the name of the largest commercial bank is listed above. Finally, no adjustment is made for off-balance-sheet activities done under commercial bank charters. With that adjustment, these shares would be higher. See McCord and Prescott (2014).

Source: Authors’ calculations using Call Report data.

Limited Commitment

Regulators during the 1970s and 1980s struggled with the tradeoffs involved in doing a bailout. Do the short-term costs of a failure, particularly if a panic ensues, outweigh the long-term costs of increased moral hazard and a decline in market discipline? If we bail out this bank, what stops us from bailing out other banks in the future? This tradeoff underlies the well-known time-consistency problem identified by Kydland and Prescott (1977), which implies that if well-meaning policymakers cannot stick with a strategy in the face of short-term costs, then policies that are harmful in the long run may be implemented.

In the context of bank resolution, the time-consistency problem suggests two questions: How much of these short-term costs are worth bearing in return for reducing the long-term moral hazard costs of doing bailouts, and can the regulatory and political institutions actually commit to imposing those short-term costs? With bank failures, the short-term costs of a panic and the potential shutdown of the payment system are viewed to be potentially very high, and these concerns suggest why it can be hard to credibly commit (or even be undesirable) to not bail out large banks. During the 1970s and 1980s, the commitment device was the legal constraint on the FDIC imposed by the essentiality doctrine, which limited bailout assistance to banks that were essential to the community. As it turned out, the essentiality doctrine was not limiting for large banks.

One implication of the commitment problem is that the too-big-to-fail size threshold is smaller than it would be otherwise; that is, banks that are smaller than is socially desirable will be bailed out on too-big-to-fail grounds. Table 2 lists three different measures of size for each bailed out bank: its assets in the year before it failed, its assets relative to gross domestic product, and its size in 2016 dollars deflated by the growth in banking industry assets. For example, Commonwealth had $1.25 billion in assets at the end of 1971, a figure which makes it comparable to a bank with $25.8 billion in assets today. By the GDP measure, its assets in 1971 were only 0.1 percent of GDP. First Penn, while larger, was also not as large as one would expect. Its assets at the end of 1979 were $8.4 billion, roughly equivalent to a $72.7 billion bank today. By the GDP measure, its assets were only0.3 percent of GDP. Those 2016 figures would make Commonwealth and First Penn the fifty-third and thirty-second largest commercial banks in the United States today, respectively.19 As such, we find it hard to believe that financial markets could not have handled a failure by First Penn, let alone one by Commonwealth, so we take these bailouts as evidence that the lack of commitment does indeed lower the too-big-to-fail threshold.20

Table 2. Several Measures of Bank Size in Year before Failure

| Bank | Year of failure |

Assets ($ billion) year before failure |

Percent of GDP | Assets in 2016 dollars (billion) | Percent of state assets |

|---|---|---|---|---|---|

| Commonwealth | 1972 | 1.257 | 0.105 | 25.78 | 4.6 |

| Franklin | 1974 | 4.996 | 0.338 | 78.99 | 2.3 |

| First Penn | 1980 | 8.406 | 0.308 | 72.65 | 9.9 |

| Penn Square | 1982 | 0.484 | 0.015 | 3.57 | 1.7 |

| Seafirst | 1983 | 9.842 | 0.289 | 68.84 | 37.4 |

| Continental Illinois | 1984 | 40.670 | 1.071 | 256.25 | 24.8 |

Notes: Only assets held under the commercial bank charter are counted. Assets in 2016 dollars are calculated by deflating bank assets by the growth in total bank assets.

Source: Authors’ calculations using Call Report data.

Conclusion

The Bank of the Commonwealth bailout in 1972 was the first too-big-to-fail bailout of the modern era. It was then followed by a sequence of too-big-to-fail bailouts by the FDIC and the Federal Reserve that led to the Continental bailout of 1984 and, ultimately, those of the recent financial crisis. Most of the too-big-to-fail bailouts of this period arose because the preferred way of dealing with a failing bank, an assisted merger, was not possible because of banking concentration and state branching restrictions.

The bailouts of the 1970s and the early 1980s led directly to several reforms, particularly the Federal Deposit Insurance Corporation Act of 1991. This law eliminated the essentiality doctrine and restricted bailouts to cases in which a systemic risk determination was made. This systemic risk determination was not used prior to the fall of 2008 because the banking industry was healthy during this period and because the pool of banks that could acquire a weak bank was large. Nevertheless, systemic risk considerations were used to justify all of the bailouts examined in this Commentary, so we think that this change would not have been significantly constraining in the earlier period.

It is an open question whether the most recent financial reforms, such as those in the Dodd-Frank Act, will effectively deal with the “too-big-to-fail” problem. However, any analysis needs to evaluate how those changes would have handled the problems that regulators faced in the 1970s and early 1980s such as limited commitment and concerns about concentration.

Footnotes

- For an excellent analysis of too big to fail, see Stern and Feldman (2009). Return to 1

- Usage of the term “too big to fail” is first associated with a quote by Congressman Stewart McKinney, who during hearings into the bailout of Continental Illinois said, “We have a new kind of bank. It is called too big to fail …” (Inquiry into Continental Illinois Corp. and Continental Illinois Bank, 1984, pg. 300). Return to 2

- This Commentary is based on our working paper, Nurisso and Prescott (2017). For more details on the bailouts and an expanded analysis see the working paper. Return to 3

- See Heinemann (1971) and Horvitz (1987). Return to 4

- In the 1970s, the essentiality doctrine was also used to bail out three banks that were not too big to fail. See Nurisso and Prescott (2017) for descriptions of these bailouts. Return to 5

- Much of the information on Commonwealth is from Irvine Sprague’s 1986 book Bailout. Sprague served on the FDIC board of directors from 1969 to 1972 and 1979 to 1986 so was involved in all of the bailouts described in this Commentary other than that of Franklin. Return to 6

- Authors’ calculations using Call Report data. Return to 7

- Commonwealth’s bet on interest rates is consistent with banking models of risk shifting. In these models, because of deposit insurance and limited liability, the owners of a bank have an incentive to take excessive risk because the equity owners don’t bear the downside risk of failure and insured deposits don’t price in that excess risk. Return to 8

- For more details on Franklin, see Brimmer (1976), Spero (1980), or Nurisso and Prescott (2017). Return to 9

- These loan participations were originated by the high-flying Penn Square bank of Oklahoma, which failed in 1982 because of its energy loans. Return to 10

- Like Seafirst, it was a heavy purchaser of loan participations from Penn Square, but it also had other loan quality problems. See FDIC (1998), pg. 546. Return to 11

- At this time, not only did Illinois not allow out-of-state banks to acquire Illinois banks (though the state legislature did change this law in 1984), it was also a unit banking state, that is, banks could not have more than one branch. Return to 12

- The FDIC took a similar step in the First Penn bailout and was challenged in court by a First Penn shareholder who believed that the FDIC did not have the right to hold stock in a bank. However, a federal judge ruled in favor of the FDIC and confirmed a broad interpretation of the FDIC’s assistance powers. See FDIC (1998), pg. 553. Return to 13

- Authors’ calculations from FDIC Historical Statistics on Banking. Return to 14

- For failed commercial banks, a payoff on a bank with over $1 billion in assets was not done until 2009, when the First Bank of Beverly Hills failed. For savings institutions, larger payouts were done earlier. In 1991, a payoff was done for the $5 billion Columbia Savings and Loan Association. The largest to date is the resolution of IndyMac Savings Bank, which had about $30 billion in assets when it failed in 2008 (authors’ calculations from FDIC Historical Statistics on Banking). IndyMac was resolved by creating a depositor national bank that the FDIC operated until it was able to sell a much reduced version of the bank to OneWest Bank. Return to 15

- Sprague mentions that FDIC Chairman Frank Wille told him that “we probably would have avoided the bailout [of Commonwealth] if Michigan had allowed statewide branching.” See Sprague (1986), pg. 70. Return to 16

- See Janicki and Prescott (2006) and McCord and Prescott (2014). Return to 17

- In 1982, the four largest banks in Washington State held 74 percent of within-state banking assets. Seafirst alone had 37 percent. (Authors’ calculations using Call Report data.) Return to 18

- Federal Reserve Board: Large Commercial Banks 2016:Q2. Return to 19

- The Dodd-Frank Act set $50 billion as its threshold for a bank to be considered systemically important. By this standard, First Penn would be considered systemic, while Commonwealth would not. Return to 20

References

- Brimmer, Andrew F., 1976. “International Finance and the Management of Bank Failures: Herstatt vs. Franklin National.” Paper presented before a joint session of the American Economic Association and the American Finance Association, Atlantic City, New Jersey.

- Brimmer, Andrew F., 1984. “The Federal Reserve as Lender of Last Resort: The Containment of Systemic Risks.” Paper presented before a joint session of the American Economic Association and the Eastern Economic Association, Dallas, Texas, December 29.

- Federal Deposit Insurance Corporation, 1972. Annual Report.

- Federal Deposit Insurance Corporation, 1984. Annual Report.

- Federal Deposit Insurance Corporation, 1998. Managing the Crisis: The FDIC and RTC Experience 1980–1994. Washington, DC.

- Heinemann, H. Erich, 1971. “Black Banking,” New York Times, August 4.

- Horvitz, Paul M., 1987. “Fear of Failing,” Yale Journal on Regulation, 4: 503-511.

- Inquiry into Continental Illinois Corp. and Continental Illinois National Bank. Hearings before the Subcommittee on Financial Institutions, Supervision, Regulation, and Insurance of the House Committee on Banking Finance and Urban Affairs, September 18, 19 and October 4, 1984.

- Janicki, Hubert P., and Edward Simpson Prescott, 2006. “Changes in the Size Distribution of U.S. Banks: 1960–2005,” Federal Reserve Bank of Richmond Economic Quarterly, 92(4) 291–316.

- Kydland, Finn, and Edward C. Prescott, 1977. “Rules Rather than Discretion: The Inconsistency of Optimal Plans,” Journal of Political Economy, 85: 473–490.

- McCord, Roisin, and Edward Simpson Prescott, 2014. “The Financial Crisis, the Collapse of Bank Entry, and Changes in the Size Distribution of Banks,” Federal Reserve Bank of Richmond Economic Quarterly, 100(1): 23–50.

- Nurisso, George C., and Edward Simpson Prescott, 2017. “Origins of Too-Big-to-Fail Policy,” Federal Reserve Bank of Cleveland Working Paper, no. 17-10.

- Spero, Joan Edelman, 1980. The Failure of the Franklin National Bank: Challenge to the International Banking System. Columbia University Press, New York.

- Sprague, Irvine H., 1986. Bailout. Basic Books.

- Stern, Gary H., and Ron J. Feldman, 2009. Too Big to Fail: The Hazards of Bank Bailouts. Brookings Institution Press.

Suggested Citation

Nurisso, George C., and Edward S. Prescott. 2017. “The 1970s Origins of Too Big to Fail.” Federal Reserve Bank of Cleveland, Economic Commentary 2017-17. https://doi.org/10.26509/frbc-ec-201717

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International