- Share

The Limitations of Foreign-Exchange Intervention: Lessons from Switzerland

Since the mid-1990s, monetary authorities in most large developed countries have backed away from foreign-exchange intervention—buying and selling foreign currencies to influence exchange rates. Switzerland’s recent experience goes a long way to illustrate why: Foreign-exchange intervention did not afford the Swiss National Bank with a means of systematically affecting the franc independent of Swiss monetary policy, and it left the Bank exposed to foreign-exchange losses. To affect exchange rates, central banks must change their monetary policies.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Before the recent international financial crisis, Switzerland’s monetary authority, the Swiss National Bank, had not intervened in the foreign-exchange market since the mid-1990s. The Bank’s hiatus from such operations ended in 2009, as international investors—seeking safe haven against the ongoing financial storm—moved substantial funds into Swiss francs. Their actions caused the Swiss franc to appreciate, particularly against the euro, and threatened an already weakened Swiss economy with deflation.

The Swiss National Bank’s subsequent actions in the foreign-exchange market met with both failures and successes but served, in the end, to illustrate two established, though often-forgotten, facts: Foreign-exchange interventions cannot systematically influence exchange rates independently of a country’s monetary policy; and, less obviously, focusing monetary policy on an exchange-rate objective can potentially conflict with price stability. Appreciating the critical correspondence between foreign-exchange intervention and monetary policy is crucial for any country contemplating intervention.1

Intervention and Monetary Policy

Intervention refers to purchases or sales of foreign currencies that governments undertake to affect currency exchange rates. This definition includes a mechanism—the purchase or sale of foreign exchange—because a lot of different governmental actions influence exchange rates, and a motive—to alter exchange rates—because central banks often transact in foreign exchange for other reasons. Some central banks have routinely conducted their domestic monetary policies using purchases and sales of foreign exchange. Most notably, Switzerland did so before 1998 through foreign exchange swaps, a technique explained below (AR 2009, p. 49).2

When a monetary authority buys or sells foreign exchange, it makes or accepts payment in domestic currency by crediting or debiting commercial banks’ reserve accounts at the central bank. Consequently, except for involving foreign currency, the interventions are functionally equivalent to traditional open-market transactions, in that they both add or drain bank reserves. (Reserves are part of a nation’s monetary base—a narrow definition of money.)

Economists refer to interventions that alter a nation’s monetary base as nonsterilized. Nonsterilized interventions, like monetary-policy operations in general, can, indeed, affect exchange rates, but they also can affect domestic inflation and unemployment rates. Likewise, undertaking open-market operations in securities to affect an exchange rate is much like conducting nonsterilized interventions. Once a monetary authority targets an exchange rate, the key distinction between nonsterilized intervention and traditional monetary policy is that the former transacts exclusively through foreign exchange.

Most advanced-country central banks, however, routinely offset—or sterilize—foreign-exchange interventions to avoid any unwanted impacts on their domestic monetary bases. Central banks do so to prevent foreign-exchange operations from interfering with their inflation and unemployment-rate objectives. They conduct sterilized interventions in the hope that it affords them a means of systematically influencing exchange rates without interfering with their domestic policy goals. The effectiveness of sterilized intervention, however, is highly questionable, as the recent Swiss experience illustrates.

Episode 1: Nonsterilized Intervention

The Swiss National Bank operates with a mandate for price stability, defined as a year-over-year change in the CPI of less than 2 percent. To allow for the inherent lags in monetary operations, the Bank bases its current policy decisions on a forecast of inflation (AR 2009, pp. 15–16).

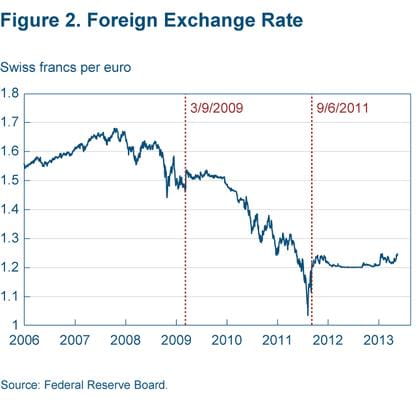

In early 2009, the prospects for continued price stability in Switzerland seemed to ebb. At the time, the Swiss National Bank viewed monetary conditions as inappropriately restrictive, despite strong money growth and recent declines in short-term interest rates, because the Swiss franc had been appreciating sharply against the euro since the fall of 2007 (AR 2009, p. 34). By March, the Swiss franc was hovering near its all-time high against the euro. Import prices were already falling because of the franc’s appreciation and a weak global economy (AR 2009, p. 29). If the franc continued to strengthen, Swiss and foreign demand would shift away from Swiss goods, weakening the economy and putting even more downward pressure on Swiss prices. Moreover, if the franc’s appreciation was indeed an indicator of a too-tight monetary policy, as Bank officials believed, a broad-based deflation might eventually follow.

In March 2009, the Swiss National Bank eased monetary policy. Its actions included a policy-rate cut, the purchase of Swiss private-sector bonds, and foreign-exchange interventions. Immediately after announcing the policy changes, the Bank aggressively bought euros in the foreign-exchange market. The Swiss franc depreciated sharply from SF1.48 per euro on March 11, 2009, to SF1.54 per euro three days later.

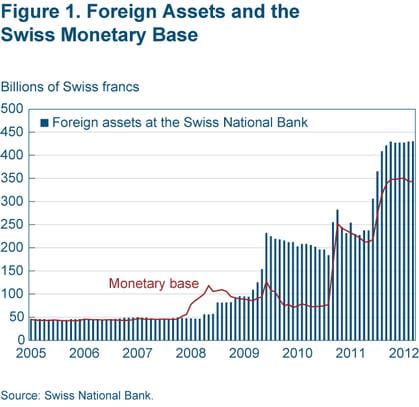

Throughout the month, the Bank’s holding of foreign-exchange reserves—mostly euros, but some dollars—grew by an amount equivalent to SF9.4 billion (AR 2009, p. 72).3 Most of these purchases appeared as an increase in the Swiss monetary base, so for the most part, the operation consisted of nonsterilized interventions (figure 1).

In April, the Swiss monetary base rose even more sharply—absent clear indication of further intervention. By then, the Swiss monetary base had doubled in just six months.

Although the franc’s depreciation stalled after March 16, it did not appreciate further that year, leaving a net depreciation by year’s end (figure 2). As the year closed, the Bank was projecting inflation above 2 percent in early 2012, so with the franc holding steady, the Bank announced that it would henceforth only intervene against an “excessive” appreciation (AR 2009, pp. 40–41).

Episode 2: Sterilized Intervention

Between April 2009 and February 2010, the Swiss monetary base contracted by 30 percent. During this period, foreign-exchange swaps, which the Bank had undertaken in late 2008 and early 2009 to provide foreign banks with Swiss franc liquidity, were automatically rolling off the Bank’s balance sheet. Foreign demand for additional Swiss franc liquidity was evaporating.

When the Bank entered into these swap agreements, it immediately bought foreign exchange with francs under a promise to sell the foreign exchange back to the market for Swiss francs at a specific future date. The contracts were now reversing, shrinking the Swiss National Bank’s balance sheet and pulling Swiss francs from the market (AR 2009, p. 53). The Swiss National Bank took no other monetary policy actions—for example, engaging in liquidity-providing repurchase operations—to offset these swap reversals. In effect, the Swiss interventions were sterilized.

In early 2010, the European sovereign-debt crisis worsened. Safe-haven inflows caused the franc to appreciate sharply in the foreign-exchange market. Swiss foreign-exchange reserves increased by an amount equivalent to SF138 billion between January and May 2010, suggesting heavy intervention, but only about 40 percent of the acquisitions were reflected in the monetary base (AR 2010, p. 32). By and large, these operations were sterilized. Although the Swiss monetary base briefly spiked to a historical high in May 2010, the base had generally been contracting.

By mid-2010, the Swiss National Bank stopped intervening and again began operations to reduce liquidity in the banking system (AR 2010, pp. 32, 41–47). By mid-2011, the Swiss monetary base was smaller than in March 2009, despite the Bank’s substantial accumulation of foreign-exchange reserves. On balance since February 2009, the franc had appreciated nearly 30 percent against the euro, reaching a historic high in early August 2011. Likewise, in August 2011, the Swiss franc reached a historic high on a real trade-weighted basis, implying a substantial loss of overall competitiveness since the Bank had begun intervening. The Swiss foreign-exchange operations, which by design or by happenstance were sterilized, had failed to prevent the Swiss franc’s appreciation.

Episode 3: Nonsterilized Intervention Returns

During August 2011, the Bank announced a series of new measures to inject liquidity into financial markets, with the objective of stemming the Swiss franc’s appreciation against the euro and the dollar. The Bank now viewed the Swiss franc as “massively overvalued” and a renewed downside threat to price stability (AR 2011, p. 36). The Bank would undertake foreign-exchange swaps in which it would sell Swiss francs spot and repurchase them forward. In addition, the Bank would repurchase Swiss National Bank bills, which it had sold to drain liquidity from financial markets, and would undertake liquidity-providing repurchase agreements (AR 2011, p. 51).

The announcements did not indicate whether or not the Bank intended to purchase foreign exchange outright, but the Bank’s holdings of foreign-exchange reserves increased substantially in August 2011. The Swiss monetary base began to expand, indicating that the Bank had not sterilized its recent foreign-exchange purchases, and the Swiss franc immediately began to depreciate against the euro.

After depreciating nearly 14 percent between August 10 and August 29, 2011, the franc underwent a stunning temporary reversal, climbing more than 6 percent in four days. In response, on September 6, 2011, the Bank announced that it would “no longer tolerate” the franc exchange rate below SF1.20 per euro and that it was “prepared to buy foreign currency in unlimited quantities” to maintain this floor (AR 2011, p. 38).

After acquiring SF71.5 billion worth of foreign-exchange reserves in August, the Bank added an additional SF26.9 billion worth of foreign-exchange reserves in September 2011. The Swiss monetary base increased by even more in both months, indicating that the monetary authorities had not sterilized these foreign-exchange purchases, but had reinforced the interventions’ monetary impact. Since September 2011, the Swiss National Bank has successfully maintained its exchange-rate floor against the euro, often through heavy nonsterilized purchases of foreign exchange (AR 2012, p. 34). In doing so, the Bank has allowed its monetary base to more than double since early 2011.

Despite the sharp increase in the monetary base, Switzerland has experienced a mild deflation since then, while the euro area has seen prices rise. Under the current program, the Swiss franc has depreciated approximately 13 percent on a real basis against the euro, suggesting some improvement in Switzerland’s competitive position vis-à-vis the euro area. Still, the Swiss franc remains about 12 percent stronger on a real basis against the euro as compared with early 2009.

Lesson #1: Sterilized Intervention Does Not Work

The Swiss National Bank’s experience since 2009 illustrates the most basic lesson about central banks’ foreign-exchange intervention: Sterilized transactions—that is, interventions that leave the monetary base unchanged—do not provide central banks with a way to systematically influence their exchange rates independent of their monetary policies. The interventions in March 2009, which increased the monetary base and, therefore, were nonsterilized, affected the exchange rate, as did the operations in, and after, August 2011 when the Swiss National Bank allowed a quadrupling of the monetary base to maintain the Swiss franc-euro floor.

In contrast, the interventions after April 2009 and before August 2011, which did not raise the monetary base, failed to guide the Swiss franc lower against the euro. Instead, the franc appreciated substantially, but unsurprisingly. At best, sterilized intervention can sometimes bump exchange rates onto alternative paths, but only ones that are still consistent with unchanged fundamentals. To alter their exchange rates in a persistent manner, central banks must change money-growth rates.

Lesson #2: Nonsterilized Intervention Can Create Policy Dilemmas

Since the Swiss National Bank linked its initial interventions in early 2009 with broader monetary-policy actions and a concern for deflationary pressures, observers initially wondered what the operations truly represented. Were they, first and foremost, designed to affect the exchange rate, or were they quantitative easing via foreign-asset purchases intended to maintain price stability?

In one respect, the distinction is more illusionary than real. A sharp expansion of the Swiss monetary base caused the Swiss franc initially to depreciate and has proven necessary to maintain a floor on the franc’s exchange rate with the euro. But how the Swiss National Bank produces this monetary expansion does not matter. There is no theoretical or empirical reason to believe that creating money through the purchase of foreign exchange affects exchange rates any differently than doing so through traditional channels. Conducting monetary policy through foreign-currency operations would only seem necessary if an alternative Swiss franc asset market is not available. Indeed, prior to 1998, the Swiss National Bank conducted monetary policy primarily through foreign-exchange swaps for exactly that reason (AR 2011, p.46).

In another respect, however, the distinction is crucial. Whereas the method for achieving a monetary expansion matters little, the target of the monetary expansion is critical. Pursuing an exchange-rate target with monetary policy can sometimes conflict with a central bank’s mandate for price stability. In general, if an inappropriate domestic-monetary-policy stance is causing the exchange rate to rise or fall, adjusting policy to offset that movement creates no conflict with price stability. Since early 2009, the Swiss National Bank has often interpreted the franc’s appreciation as evidence that Swiss monetary policy was too tight and that deflation could follow. In such a case, expanding the monetary base to prevent a franc appreciation poses no policy dilemma.

If, however, “real” factors—for example, productivity differentials—or foreign monetary developments are driving exchange rates, then offsetting them through domestic monetary policy can indeed conflict with price stability. In 2010, when capital flight from the euro area drove the Swiss franc’s appreciation, the Swiss National Bank nevertheless allowed the monetary base to contract out of concern for future inflation. Policymakers then seemed to subordinate their concern for the franc’s appreciation to their long-term policy goal of price stability. In general, the more a central bank concentrates on exchange-rate stability, the greater are the risks to price stability.

Lesson #3: Collateral Damage Is Possible

A profit motive generally does not drive central banks’ interventions. Profits, moreover, can be an imprecise metric for evaluating the success of such operations. Still, central banks typically hope to come out ahead, especially if they believe that their currencies are fundamentally overvalued in relation to the foreign currency that they subsequently acquire.

In early 2011, following heavy sterilized interventions, the Swiss National Bank announced substantial valuation losses on its foreign-exchange portfolio, stemming primarily from the protracted depreciation of the euro against the Swiss franc (AR 2010, p. 112). At this time, foreign assets accounted for approximately 76 percent of the Bank’s balance sheet, and roughly 55 percent of these were denominated in euros (AR 2010, p. 66). The Bank’s profits are a revenue source both for the Swiss federal government and, especially, for the cantons (the states into which Switzerland is divided). Hence, the inability of sterilized intervention to stem the Swiss franc’s appreciation against the euro inflicted collateral damage on governmental budgets.

Still, the fundamental problem after April 2009 and before August 2011 was not that the Bank’s intervention left it with an exposure to foreign-exchange losses; the fundamental problem was the inability of sterilized intervention to stem the Swiss franc’s appreciation. Nonsterilized intervention stood a better chance of creating the desired outcome but would have left a foreign-exchange exposure on the Bank’s balance sheet. Expanding the monetary base to stabilize exchange rates through the acquisition of domestic assets—if they are sufficiently available—can affect the exchange rate while avoiding an exposure.

Losing Favor

Since the mid-1990s, monetary authorities in most large developed countries have backed away from foreign-exchange intervention. Switzerland’s recent experience goes a long way to illustrate why: Foreign-exchange intervention did not afford the Swiss National Bank with a means of systematically affecting the franc independent of Swiss monetary policy, and it left the Bank exposed to foreign-exchange losses. To affect exchange rates central banks must change their monetary policies. Any monetary authority contemplating intervention should consider the recent Swiss experience.

Footnotes

- My thanks to Katrin Assenmacher at the Swiss National Bank for comments on an earlier draft. Return

- Specific references throughout the text are designated AR with a year and page numbers within parentheses. These refer to pages in the Swiss National Bank’s Annual Reports for years 2009, 2010, 2011, or 2012 as indicated. Swiss National Bank Annual Reports are found the Bank's website. Return

- I did not have access to official Swiss intervention data, but instead inferred intervention activity primarily by comparing large changes in Swiss foreign-currency reserves often with official—but general—statements in the Swiss National Bank’s Annual Reports about intervention. I also considered changes in the “relevant foreign currency position,” a component of the Swiss monetary base. Return

This Commentary also draws on:

- “On the Evolution of U.S. Foreign-Exchange-Market Intervention: Thesis, Theory, and Institutions,” Michael D. Bordo, Owen F. Humpage, and Anna J. Schwartz, 2011. Federal Reserve Bank of Cleveland Working Paper, no. 11-13.

- “Epilogue: Foreign-Exchange-Market Operations in the Twenty-First Century,” Michael D. Bordo, Owen F. Humpage, and Anna J. Schwartz, 2012. Federal Reserve Bank of Cleveland Working Paper, no. 12-07.

Suggested Citation

Humpage, Owen F. 2013. “The Limitations of Foreign-Exchange Intervention: Lessons from Switzerland.” Federal Reserve Bank of Cleveland, Economic Commentary 2013-13. https://doi.org/10.26509/frbc-ec-201313

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International