- Share

The Fed’s Yield-Curve-Control Policy

The recent global financial crisis left governments in many advanced countries with very heavy debt burdens and their central banks with huge portfolios of government bonds. With many central banks today still facing policy rates that are uncomfortably close to zero, some may follow the example of Japan, which recently added a new long-term interest-rate target to its short-term target to give itself “yield-curve control.” The Federal Reserve’s foray into similar territory around the Second World War suggests that combining yield-curve control with quantitative easing when government borrowing needs are substantial can create constraints on monetary policy that are not easily removed.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

On September 21, the Bank of Japan modified its quantitative easing program, combining a new long-term interest rate target with its existing short-term interest rate target to give the bank “yield-curve control.” The Bank of Japan currently sets its short-term policy target—a rate paid on bank reserves—at –0.1 percent and now promises to cap its long-term target rate—that on 10-year government bonds—at approximately zero for the time being. Ideally, yields on all other maturities will line up with these two policy rates, allowing the bank to determine the shape and location of the yield curve (Kuroda 2016).

The ultimate objective of recent quantitative easing programs in Japan, the United States, and elsewhere has been to lower long-term interest rates when policy rates are at their effective lower bound. In the current slow-growth, low-inflation environment, many central banks remain uncomfortably close to that situation. Consequently, the Bank of Japan’s example of adding a long-term-rate target to its quantitative easing programs certainly looks attractive (Bernanke 2016 a,b).

Combining a yield-curve-control policy with large-scale asset purchases is not without precedent. The Federal Reserve adopted such a policy framework during the Second World War. Because the particulars of the program and the economic circumstances surrounding its implementation were different from modern situations, many might simply dismiss any comparisons as passé. The Fed’s experience, however, suggests that combining yield-curve control with quantitative easing when government borrowing needs are substantial can create constraints on monetary policy that are not easily removed. Moreover, a central bank’s heavy involvement in a market can distort the behavior of private market participants to the detriment of market efficiency.

Wartime Yield-Curve Control

The Fed adopted its own yield-curve-control policy in April 1942 to assist the Treasury’s financing of the Second World War. In some respects, the US economic environment at the time was similar to today’s. The economy had been recovering from the 1937–38 recession, and by late 1941, output had caught up to where it likely would have been had the Great Depression never occurred. Likewise, the unemployment rate fell sharply in 1941, but some slack remained in the labor market at the start of 1942. Deflation had been a problem throughout much of the Great Depression, similar to today, but here the economic parallels between then and now stop.

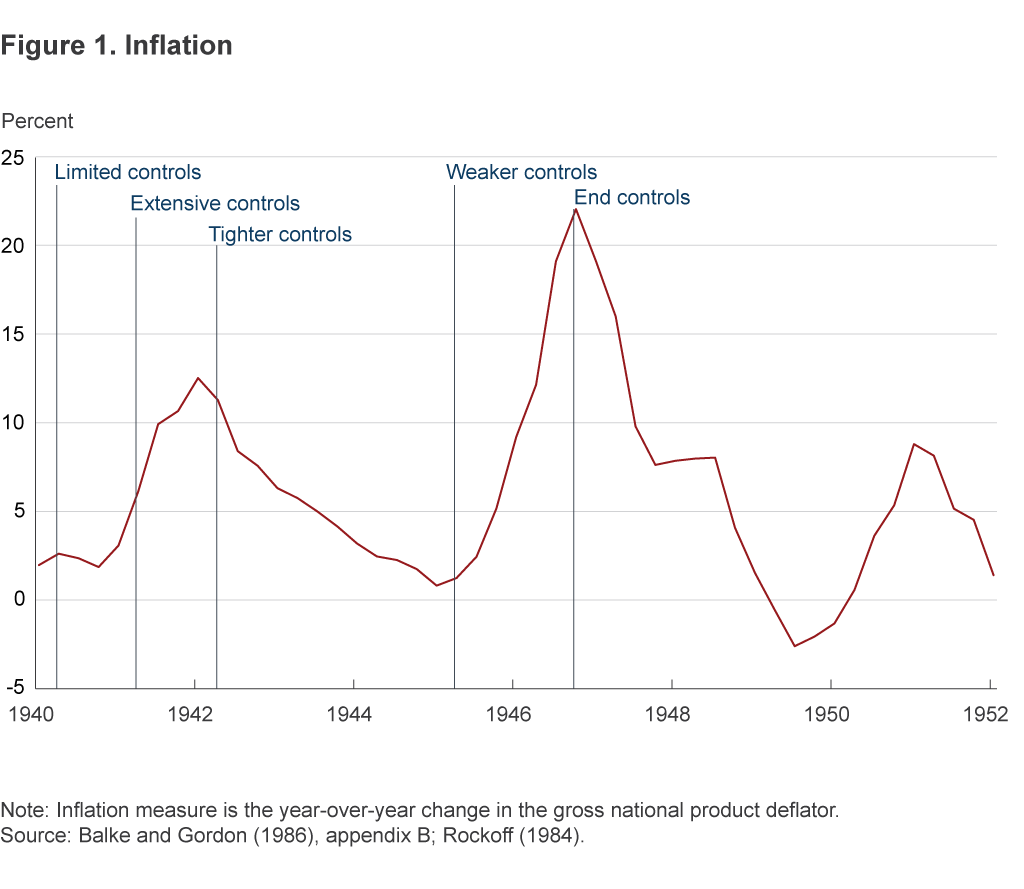

Unlike today, Fed policymakers in the early 1940s worried about the prospects of rapidly rising inflation. Gold had generally been flowing into the United States since Franklin D. Roosevelt devalued the dollar in 1934. From 1938 through 1940, huge amounts of gold poured over the border, reflecting both capital flight and payments for war materials. As a result, commercial banks held record levels of excess reserves in 1940, and the Federal Open Market Committee (FOMC) fretted that reserves “had risen beyond the System’s power to restrain an inflationary credit expansion should one develop” (Annual Report 1941, 2). By mid-1941, price levels began to climb quickly (figure 1).

In early 1942, shortly after the United States declared war, the Fed effectively abdicated its responsibility for monetary policy despite its concern about inflation and focused instead on helping the Treasury finance the conflict. After a series of negotiations with the Treasury, the Fed agreed to peg the Treasury-bill yield at 0.375 percent, to cap the critical long-term government bond yield at 2.5 percent, and to limit all other government securities’ yields in a consistent manner. The Fed would maintain a yield curve that was both low and relatively steep. The low rates kept the Treasury’s borrowing costs down, while the firmly harnessed term structure convinced investors that waiting for higher yields was pointless and that the risk of capital loss from holding longer-term securities was small. Setting interest rates in this manner, however, allowed the Treasury to expand bank reserves by issuing more securities than the public wished to hold when yields reached their caps, because the Fed then had to purchase them. Both the Treasury and the Fed understood the mechanism.

At the time, however, no one really knew if this yield-curve-control policy would work. Treasury Secretary Henry Morgenthau, the only official with authority to announce the program to the public, never did so. He seemed to prefer a quantitative (excess-reserves) target. The program could indeed collapse if investors, fearing inflation, sought higher interest rates than the yield-curve-control program offered. In that case, the Fed would either have to buy every security that the Treasury issued—an unlikely prospect, given the massive government spending that must accompany the war—or simply allow yields to rise.

To tamp down measured inflation and inflation expectations, the Roosevelt Administration began introducing limited price controls as early as May 1940 (Rockoff 1984, 85–126). The controls grew thereafter and by June 1942 were both far-reaching and rigorously enforced. The public—including the business sector—generally approved of price controls, despite frequent complaints about specific mandates and their administration. The controls remained in place until November 1946 and generally seemed to contain inflation expectations.

By mid-1943, banks and other investors apparently understood the still-unannounced rate structure and thought it credible. They sold bills and certificates to the Fed and used the funds to buy higher yielding, longer-term Treasury securities. These securities were now virtually as liquid as Treasury bills. The Fed worried about banks climbing the yield curve in this manner. Whereas selling bonds to the nonbank public tapped existing income and savings, selling them to banks tapped their excess reserves, potentially leading to a multiple expansion of the money stock and stoking inflation (Annual Report 1945, 3). Nevertheless, despite attempts to prevent it, banks acquired substantial amounts of long-term securities. Excess reserves, already declining from their 1940 peak as economic activity picked up during the war, continued to fall through mid-1944.

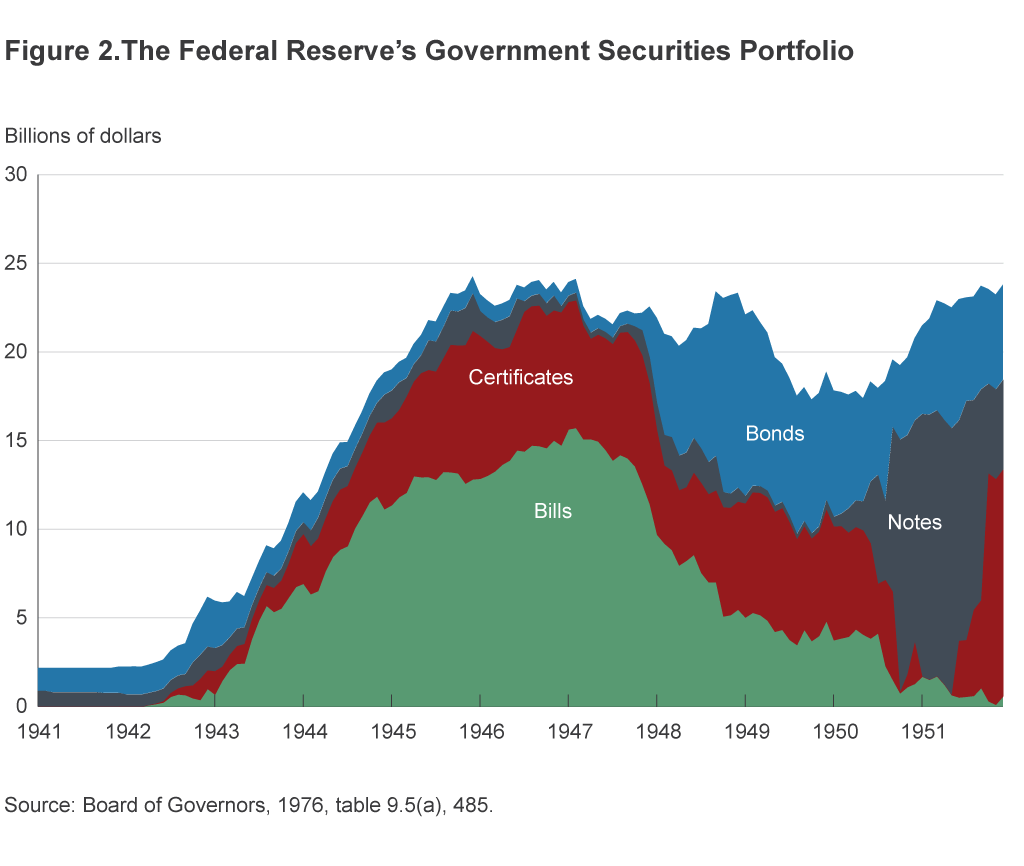

Under its yield-curve-control program, the Fed bought $20 billion worth of Treasury securities or approximately 10 percent of the debt that the Treasury issued between March 1942 and August 1945 (figure 2). This included $13 billion worth of Treasury bills or 87 percent of the total issued. The System also bought a considerable amount of longer-term Treasury notes and bonds, but after 1942, the Fed did not have to support the bond market because private demand for Treasury bonds remained sufficiently strong. Through the duration of the war, the Fed generally reduced its holdings of long-term Treasury bonds (Board 1976, tables 9.5 and 13.2).

The Accord

As the war in Europe began to wind down, monetary policy needed to shift from managing government debt to preventing inflation. With the move away from a wartime economy, private demand for goods and services would naturally rise. To finance their spending, bond holders would liquidate their government securities, forcing the Fed under its yield-curve-control policy to create reserves (Annual Report 1952, 98). Any abrupt shift in policy to forestall the creation of reserves, however, could affect bank balance sheets. By 1945, banks’ holdings of government securities equaled more than half of their total assets, and a substantial proportion of these matured beyond five years (Board 1976, table 2.1). The Fed’s immediate strategy called for gradually increasing the yields on Treasury bills and certificates, yields which the Fed had viewed throughout the war as too low. Besides offering an initial step toward a tighter policy, higher short-term rates would encourage banks to shift their portfolios back to a more traditional configuration of mostly shorter-term securities. Their portfolios would then be less sensitive to the interest rate consequences of a tighter policy.

The Treasury, however, did not wish to relinquish its control over Fed monetary policy and only acquiesced to small increases in short-term interest rates starting in July 1947, after inflation had been hovering around 18 percent for a year. The Treasury believed that it could not possibly finance its unprecedented levels of public debt at reasonable interest rates without the Fed’s continued participation in the government-securities market; in its view, only unrealistically high interest rates could coax enough private-sector savings to finance the debt.

As short-term interest rates eventually nudged higher, cooperation between the Treasury and the Fed deteriorated. Any Fed policy move required Treasury permission and risked affecting the long-term bond rate, which remained capped at 2.5 percent. If the Fed moved on its own and a subsequent bond offering was not fully subscribed, the Fed would be blamed. In 1950, an inflation scare associated with the Korean War and growing congressional support for the Fed’s position led to a Treasury–Fed accord in March 1951, largely freeing monetary policy from its subordinate status vis-à-vis the Treasury’s debt-management operations (Hetzel and Leach 2001).

Collateral Damage

The federal debt shrank significantly after its 1946 peak but still equaled 73 percent of GDP in 1951. The Treasury continued to worry about the costs of financing this debt. Sensitive to its precarious political position, the Fed continued to support Treasury funding operations by offering advice about security prices, security types, and maturity dates. According to the manager of the System Open Market Account at the time, the Treasury’s acceptance of this advice implied that the Fed would see “the financing through, more or less regardless of the effect on bank reserves or other aspects of general credit conditions” (Rouse 1958, 16). Moreover, the FOMC had directed its trading desk to maintain orderly conditions in government securities markets, and so the desk—at least through September 1952—purchased substantial amounts of securities during Treasury refinancing operations, fearful that absent such support, investors might not take up the entire offering (government bond Report 1954, 8).

Federal Reserve Chairman William McChesney Martin wanted to end these practices. He worried that observers might interpret them as suggesting that the Fed was still setting yields on long-term Treasury securities. Moreover, he feared that the System’s current practices distorted the financial market by creating a “disconcerting degree of uncertainty” about when, how much, and where on the yield curve the Fed might intervene (FOMC, March 4–5, 1953, 31).

Martin believed that the Fed’s frequent interventions in the longer-term government securities market during and immediately after the war had robbed the market of its “depth, breadth, and resiliency,” characteristics he associated with market efficiency (FOMC Report 1952, 265). As a result, Martin maintained, long-term government bond yields did not necessarily reflect a fundamental equilibrium between savings and investment and might adversely affect conditions in broader capital markets. To provide the market with the needed depth, breadth, and resiliency in the post-accord world, Martin wanted to confine open market operations to the short-end of the yield curve—preferably Treasury bills. He maintained that conducting open market operations only in Treasury bills would still affect the entire yield curve in a manner consistent with the Fed’s policy goals.

“Bills preferable” was very controversial both within the Fed and within the economics profession more broadly. Many economists observed that the connection between changes in short-term rates and long-term rates—the link “bills preferable” relied on—was generally weak and often not dependable. They contended that open market operations in longer-term securities offered a viable mechanism for affecting the yield curve’s shape, which was as important as the level of interest rates. After a controversial tenure, the Fed abandoned bills only in 1961 for balance-of-payments purposes but maintained a strong preference for conducting open market operations in the short-term end of the government-securities market until the recent financial crisis.

The Fed’s accord with the Treasury and Martin’s adoption of “bills preferable” facilitated a shift in Fed policy away from helping the Treasury finance the government’s debt toward the traditional objectives of monetary policy—price stability and full employment. Nevertheless, the Fed remained wary of the political consequences of appearing to interfere with the Treasury’s debt-financing operations and from 1954 through mid-1975 engaged in “even keel” operations. Under “even keel,” the Fed postponed any policy operations that might affect yields and added a small amount of reserves beginning just before the Treasury announced the terms of its operation and lasting until brokers had an opportunity to sell their inventories to the public. This typically lasted about three weeks. By mid-1975, when the Treasury began auctioning all of its securities, the Fed dropped “even keel” and ended its involvement in Treasury debt operations.

Passé?

Nearly 75 years ago, the Fed adopted a yield-curve-control policy to address an emergency. The policy was successful in terms of managing the yield curve, and that’s certainly good news for those central banks today contemplating monetary policy at the zero lower bound. The Fed’s wartime operations, however, proved dangerously difficult to reverse once the war had passed. Yield-curve control gave the Treasury substantial influence over monetary policy and highlighted the major effect that monetary policies had on the cost of financing the government’s huge debts.

The Treasury was loath to reverse the situation despite rising inflation. Even after reaching an accord with the Treasury, the Fed worried about the political ramifications of appearing to interfere with the Treasury’s financing operations and delayed policy adjustments when the Treasury was coming to the market. The recent global financial crisis left governments in many advanced countries with very heavy debt burdens—amounts exceeding 100 percent of GDP—and left many central banks with huge portfolios of government bonds. Japan’s gross governmental debt, for example, equals approximately 250 percent of its GDP. The Bank of Japan has greatly expanded its portfolio of government bonds and has become a major factor in the government bond market, much like the Fed in 1945. The Fed’s old, seemingly passé, experience has lessons to offer today.

References

- Annual Report, various issues. Board of Governors: Washington DC at: https://fraser.stlouisfed.org/title/117#!2403.

- Balke, Nathan, and Gordon, Robert J., 1986. The American Business Cycle: Continuity and Change. Chicago: The University of Chicago Press.

- Bernanke, Ben 2016a. “The Latest from the Bank of Japan,” at: https://www.brookings.edu/blog/ben-bernanke/2016/09/21/the-latest-from-the-bank-of-japan/.

- Bernanke, Ben 2016b. “What Tools Does The Fed Have Left? Part 2: Targeting Longer-Term Interest Rates,” at: https://www.brookings.edu/blog/ben-bernanke/2016/03/24/what-tools-does-the-fed-have-left-part-2-targeting-longer-term-interest rates/.

- Board of Governors, 1976. Banking and Monetary Statistics, 1941–1970. Washington DC: Board of Governors of the Federal Reserve System.

- FOMC. 1953. Historical Minutes (March 4–5) at: http://www.federalreserve.gov/monetarypolicy/files/FOMChistmin19530305.pdf.

- FOMC Report. 1952. Federal Open Market Committee Report of Ad Hoc Subcommittee on the Government Securities Market, November 12, 1952. found in: Hearings before the Subcommittee on Economic Stabilization of the Joint Committee on the Economic Report, 1954. 83rd Congress; 2nd Session. (December 6–7): 257–331.

- Hetzel, R. L. and Leach, R. F., 2001. “The Treasury-Fed Accord, A New Narrative Account,” Federal Reserve Bank of Richmond, Economic Quarterly, 87(1): 33–55.

- Kuroda, Haruhiko, 2016. “Comprehensive Assessment of the Monetary Easing and QQE with Yield Curve Control,” Speech at a meeting with business leaders in Osaka (September 26) at: https://www.boj.or.jp/en/announcements/press/koen_2016/data/ko160926a1.pdf.

- Rockoff, Hugh, 1984. Drastic Measures, A History of Wage and Price Controls in the United States. Cambridge: Cambridge University Press.

- Rouse, Robert G., 1958. “The Ad Hoc Report—After Five Years,” Internal report to the special committee of the Federal Open Market Committee.

Suggested Citation

Humpage, Owen F. 2016. “The Fed’s Yield-Curve-Control Policy.” Federal Reserve Bank of Cleveland, Economic Commentary 2016-15. https://doi.org/10.26509/frbc-ec-201615

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International