- Share

What Caused the Housing Supply Crisis? And What Could Solve It?

Policy Summit panelists say zoning reform, housing preservation, and modular homes could boost affordable housing supply.

Lance George says he’s nothing without his maps.

Thus, from his seat on stage at Policy Summit 2025 in downtown Cleveland, he pulled up a slide showing the United States.

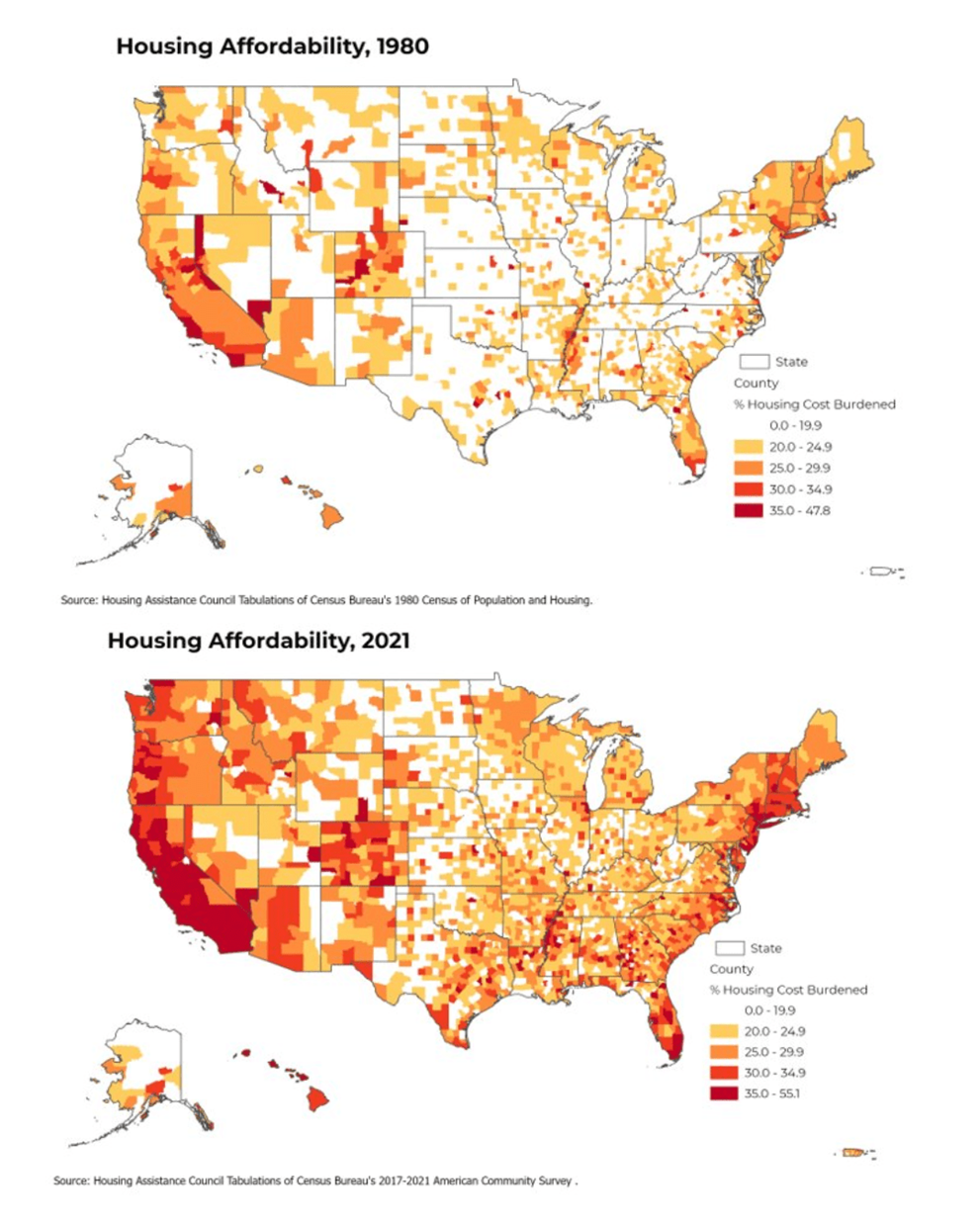

Along the coasts, the map displayed many counties highlighted in red or dark orange, indicating that affordable housing was a major issue in those areas.

By contrast, states in the middle were mostly white, with some light orange counties sprinkled throughout.

But that map was from 1980.

Then he flipped to the 2021 map. The country turned almost entirely orange and red.

“It’s spread across the entire United States and to many rural communities,” said George, director of research and information at the Housing Assistance Council, a nonprofit that supports affordable housing efforts in rural areas.

The trend hasn’t spared the region served by the Federal Reserve Bank of Cleveland, which consists of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia.

In fact, affordable housing has become such a big issue that the Cleveland Fed decided to make it one of the main focus areas of this year’s Policy Summit, a national community development conference that took place on June 26 and 27, 2025.

Hence the name of the summit’s first panel discussion: “Closing the Gap: Tackling the Housing Supply Crisis to Boost Affordability.”

What caused the lack of affordable housing?

Seated next to George on that panel, Jenny Schuetz noted that the United States is roughly four million homes short of what it should have.

Home construction hasn’t been keeping up with population growth since the 1970s, said Schuetz, a housing policy expert at Arnold Ventures, a philanthropic foundation.

Why not? The Great Recession played a role. Housing construction fell off a cliff and “took a very long time to start climbing back up,” Schuetz said.

But there are longer-term problems as well: Zoning regulations in the United States make it very hard to build multifamily housing, which tends to be less expensive per unit than single-family housing, she said.

Three-fourths of all land in US cities is zoned for single-family homes. If a developer wants to build duplexes or apartments, that often means getting land rezoned and jumping through a bunch of hoops, Schuetz said.

“They will often have to go through an environmental review process that asks them to estimate how many cars are going to be needed, how many more kids are going to go to school and is this a historic district?” she said.

Such rules are well intended: Local governments create them because residents naturally want to have a say over what sort of development happens in their city, she said.

“But what we've done is create these layers and layers and layers of review that gives an enormous amount of power to people who currently live in a community who often don't want any change at all. And so what that means is that people who are moving into a city for the first time to get a new job or moving from another part of the country would benefit from having more housing, but they're not part of the political process that allows that housing to get built,” she said.

What actions could increase the supply of affordable housing?

Some ideas for fixing the problem address those root causes, while others attack the problem from different angles. Here are a few ideas mentioned by the panelists (their views are their own and don’t necessarily represent those of the Cleveland Fed or the Federal Reserve System):

- Zoning experimentation: Minneapolis made it legal to build duplexes and triplexes in all residential neighborhoods, Schuetz said. The city also made it easier to build large apartment buildings in commercial corridors and near transit stations. Additionally, several states—including Arizona, Montana, Rhode Island, Texas, and Washington state—have passed reforms designed to make it easier to build all types of housing.

- Housing preservation: Schuetz noted that the median US house is more than 40 years old. Programs to maintain those older homes provide a way to boost the housing supply without new construction. In some cases, it makes sense for philanthropic capital to partner with private capital on preservation, as it “often stretches your dollars farther than doing ground-up construction,” she said.

- Manufactured and modular homes: Manufactured homes, also known as mobile homes, are “an important source of housing across the United States, but particularly in rural areas,” George said. But he said other forms of factory-built housing are “the next frontier.” That includes modular homes, which are built in sections that are assembled on site. He described how, in North Carolina, a nonprofit is working with a manufacturer to build modular homes “at a much more efficient and affordable rate.” (For more on this topic, check out the article on fedcommunities.org.)

- Incentivizing nonprofit ownership: There are many small “mom and pop” owners of affordable housing who for various reasons “just want to get out of it,” George said, responding to a question from the audience. Nonprofits are often in a good position to preserve affordable housing, but sometimes there are barriers, such as tax liabilities, that prevent them from purchasing properties. “I do think there could be a whole set of incentives to help transfer those properties from the existing for-profit owners to nonprofit ownership. That's what we've been working on,” George said.

- Raising awareness: Knowledge of these issues must go beyond the “policy wonk community” so it reaches local decisionmakers, Schuetz said. She noted that the Affordable Housing Alliance of Central Ohio made a documentary about duplexes that shows the human side of the problem.

More than any other issue, affordable housing resonates with people who work with lower-income communities, regardless of geography, said panel moderator Theresa Singleton, who leads the Philadelphia Fed’s Community Development Department.

But the issue is also important to the broader economy. To highlight that point, she quoted a community banker who recently attended a Federal Reserve event:

“We cannot have economic vitality in our communities if we don't have affordable housing. If people cannot afford to live near where they work, we cannot have the growth we need. And if they are spending too much on housing, they cannot afford the other things in life,” she said.

Want more content focused on lower income communities? Sign up for the Cleveland Fed's quarterly community development newsletter.

Community Development

Supporting low- and moderate-income communities in the Fourth District is a cornerstone of our mission at the Cleveland Fed. Find out how our Community Development team is promoting access to good jobs, housing, and credit for the residents within our district.

Housing and Neighborhoods

We examine and report on housing market trends, housing affordability, neighborhood dynamics, and issues impacting neighborhood quality.

The Policy Summit

Since the early 2000s, the Cleveland Fed has hosted its now-biennial Policy Summit to explore key topics in community and economic development. View past conferences and learn more about the Policy Summit.