- Share

Intelligent Routing via Payment Hubs

Payment Hubs are Gaining Traction1

A payment hub is a centralized technology platform that acts as a financial institution’s center for payment processing and connectivity. Payment hubs are an increasingly popular upgrade for financial institutions, helping them accelerate their modernization journey and connecting them to new payment types that settle payments around the clock in real time. Many financial institutions have core banking systems that are based on older technologies, are batch rather than real-time oriented, and support limited rather than round-the-clock operating hours. Institutions are pursuing a variety of approaches to modernize these systems (Alcazar et al., 2024a). Implementing a payment hub that bridges the gap between an older core banking system and new or recently established payment types is one such modernization approach (Alcazar et al., 2024b).

Payment hubs take advantage of the convergence of multiple trends such as the emergence of new payment types (instant payments and digital currencies, for example), the move toward newer technologies (cloud and application program interfaces), and the modernization of payments systems with round-the-clock availability, real-time settlement, and open banking techniques, for instance (Capgemini Research Institute, 2025).

Intelligent Routing is a Key Feature of Payment Hubs

There are several potential benefits of payment hubs, including more efficient orchestration of different payment types across various payment rails (that is, payment clearing and settlement systems), reduction in payment processing costs, increased automation rates, and decreased compliance incidents (Chinnapa, 2025). A key advantage of payment orchestration is allowing customers to focus on the needed attributes for a particular payment while leaving the precise choice of payment mechanism and payments system operator to the discretion of the provider or other parties to the transaction, a process often referred to as “intelligent routing.” Intelligent routing differs from the common alternative approach in which customers and their financial institution make explicit choices (rather than attribute-driven choices) of payment mechanism and payment system operator earlier in the process.

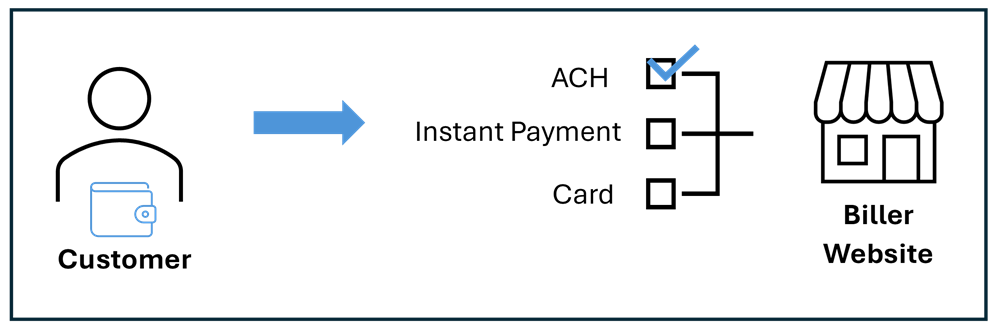

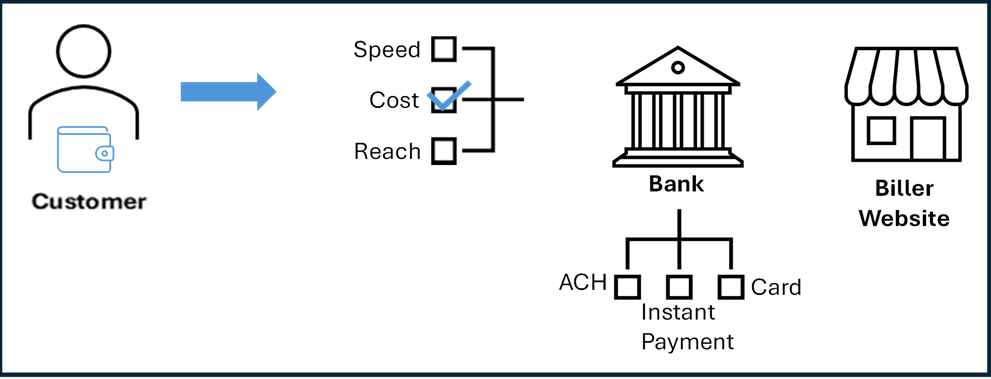

Depending on design, intelligent routing can cascade as a transaction moves through the end-to-end payment process. Depending on the use case, the payee’s preference for certain payment attributes may come as the first factor in selecting the payment method, followed by the payor’s preference, then the financial institution’s preference, and then, finally, the market infrastructure provider’s preference. Each party satisfies the needs of the one prior and then optimizes what is important to meet their own need. Consider, for example, a typical bill payment in today’s world in the absence of intelligent routing. A biller may offer on its website three ways to pay: automated clearinghouse (ACH), instant payment, or card. The customer can select a method and then schedule the payment by entering their payment credentials on the biller website or the biller’s payment credentials on their bank’s website. The customer makes their choice of payment method based on their own personal needs and preference, and the details of the customer’s decisionmaking are unavailable to the other parties to the transaction. The customer implements their choice of payment method by entering the selected payment credentials in the right place. If the payor chooses to pay by ACH direct debit because, for example, they want to use a method that is both free and expedient—it gets credited by the biller immediately—then the precise payment method has been fixed at that point in the process. The biller’s provider will originate the ACH direct debit, and all the subsequent parties to the payment must carry out the payor’s specific payment method instructions. Other than the payor, the parties have limited freedom to additionally optimize the payment route in a way that benefits them.

Now imagine the same transaction taking place with the benefit of intelligent routing. Suppose the biller’s bank provides a customer portal that allows the biller to prioritize getting paid quickly for a particular payment (on the same day at a minimum). Behind the scenes, the payment portal supports several payment methods that satisfy the biller’s needs, such as instant, wire, and same-day ACH payments. This allows the biller’s customer (that is, the payor) to further optimize based on their preferences for particular payment attributes. Since the customer prefers to use the lowest-cost method that achieves the biller’s need, in this example, for speed, the portal provider identifies same-day ACH as an appropriate payment method for this transaction. With the payment type established, the portal moves to the preferences of the next party in the chain, the biller’s bank. The biller’s bank has a choice to settle the ACH transaction over FedACH or Electronic Payments Network (EPN), two competing ACH operators that are both capable of settling for the endpoints in question. Suppose the biller’s bank is currently being offered a pricing incentive to use EPN and therefore chooses EPN accordingly. The portal then moves to the preferences of EPN as ACH operator. In certain situations, the operator of EPN may be able to make additional choices for settlement of that transaction that optimize additional elements of the process that still satisfy the needs of all the other parties.

“Payment Agnosticism” Gaining Momentum

Consistent with the mechanism of intelligent routing, many financial institutions are working toward a future in which customers can choose desired payment attributes while remaining indifferent to the specific payment method used. Indeed, at a recent Federal Reserve bank of Cleveland Pay-4th Payments Roundtable discussion, payment agnosticism was a prominent theme of the conversation (Federal Reserve Bank of Cleveland, 2024). Several roundtable participants identified it as a future goal, while others said they already have payment hubs in place that could facilitate this move. Some financial-service providers are additionally changing their organizational structure to become more payment-method agnostic. For example, in 2021 Federal Reserve Financial Services named a chief payments executive who manages Federal Reserve payment services more holistically across payment methods rather than managing each payment product independently (Mester, 2022).

Implementation Challenges

However, there are a variety of challenges that may need to be overcome to intelligently route payments:

- Making technology changes to the front-end customer interface to focus on payment characteristics rather than payment method (see, for example, Stripe, 2025).

- Making technology changes to the hub to dynamically route based on criteria (Stripe, 2025).

- Overcoming legal or policy hurdles that could limit the ability to offer payment services that, on customer initiation, are agnostic to the payment method. As an example, Reg E was amended in 2006 to allow for the conversion of checks to ACH payments while still protecting consumers (Board of Governors, 2006). Conversions between other payment types would need to be investigated to see if changes to laws, regulations, or payments system operating rules would be required.

- Changing payment participant behavior. The end-to-end payment process can be explored for each use case to identify exactly when and where a specific payment method is chosen. Parties to the payment process may need to adjust their mindset and procedures to explicitly make decisions based on the payment attributes needed while remaining agnostic to the choice of payment mechanism. In some cases, this change can be implemented entirely within an organization’s domain, while in other cases this change may require coordination among the organizations involved in the end-to-end payment process.

Service Provider Landscape and Industry Adoption

Many financial institutions are implementing payment hubs to connect to and process instant payments. Payment hubs help financial institutions with legacy or batch-oriented core banking systems more quickly adopt round-the-clock real-time payment services (Alcazar et al., 2024c). Once a financial institution is using a payment hub to connect to instant payments, it is plausible that they may choose to use the payment hub to connect to additional payment methods beyond instant payments. But how close are we to a future in which intelligent routing across different payment types or payments system providers is prevalent and end users can focus solely on characteristics needed for a payment rather than the payment method used?

To help answer this question, we surveyed the FedNow® Service Provider Showcase, a registry of service providers that advertise an ability to help financial institutions and businesses innovate and implement instant payments. The showcase indicates 82 of its 146 vendors have self-identified in the category of “payment hubs/platforms/gateways” to connect financial institutions to the FedNow Service (FedNow, 2025). Service providers listed in the showcase are sometimes, but not always, explicit about whether their products support intelligent routing. We reviewed the vendor descriptions provided in the showcase and the referenced vendor websites to see if we could quantify their readiness to support intelligent routing. From this review, we surmised the following.

- Seventy-nine percent of payment hub/platform/gateway providers in the showcase appear to have cross-rail presence, meaning that their payment hub, platform, or gateway provides connectivity into more than one payment rail: instant payments, wire, ACH, or card. A platform with more than one payment rail does not necessarily mean it can support intelligent routing across payment rails; but having a single place at which connectivity to different payment methods exists may position the vendor well to intelligently route to the optimal payment mechanism based on criteria.

- Twenty percent appear to reference a cross-rail routing capability, meaning that the vendor’s description in the showcase or on its website suggests that its customer can select a preferred payment method based on payment attributes without explicitly having to choose a payment rail.

- Seventy percent appear to have competitive solution presence, meaning that the product connects customers to more than one provider of a particular payment type. For instant payments, for example, this may mean that the provider connects to FedNow and at least one other instant payments system such as the Clearing House’s real time payments or Zelle. For wire, this may mean that the provider connects to both the Fedwire Funds Service and CHIPS®. For ACH, this may mean that the provider connects to both FedACH and EPN. A platform offering more than one competing payment rail does not necessarily mean it can intelligently route across those competitors; but having a single place with connectivity to competing payments systems may position the vendor well to intelligently route to the most competitive provider based on criteria supplied by the hub’s customer.

- Twenty-four percent appear to reference a competitive solution routing capability, meaning that the vendor’s description in the showcase or on its website suggests that its customer can select a preferred payments system operator (FedNow versus RTP, for example) based on competitive criteria, without explicitly choosing the provider.

We made the following additional observations about service providers in this category on the showcase.

- Providers are overwhelmingly cloud based (89 percent).

- Solutions are overwhelmingly API-centric (96 percent).

- Solutions are overwhelmingly core agnostic (92 percent).

- Providers are focused on a variety of use cases, with business-to-business (B2B) account-to-account (A2A), business-to-consumer (B2C), and consumer-to-business (C2B) being among the most common.

- Provider models range from those focused on a specific use case (bill payment) to a specific payment type (instant payments) to a specific technology challenge (helping to modernize their customer’s core banking system).

The emergence of a broad range of payment hubs, gateways, and platforms to connect financial institutions and corporations to instant payments appears to be substantial. We remain in the early stages of industry adoption of payment hubs and intelligent routing, but many vendors have entered this space, offer connectivity to multiple payments systems, and are gaining traction as the industry modernizes and seeks adoption of instant payments.

Conclusion

Payment hubs can help financial institutions modernize their payments infrastructure, centralize payment processes, and orchestrate connectivity to multiple payment rails. Many financial institutions are implementing payment hubs to accelerate their ability to connect to modern payment services such as instant payments. There is a broad range of technology vendors that offer payment hubs to connect financial institutions to various payments systems or operators. When a hub offers access to more than one connected system, there is potential for intelligent routing of a payment, in other words, the ability for payment participants to establish payment-method agnostic criteria that the hub can use to direct the payment to the optimal rail. While it is difficult to quantify how prevalent intelligent routing is, at least some financial institutions aspire to it, and more than 20 percent of payment hub/platform/gateway providers in the FedNow Service Provider Showcase appear to already offer it. As payment methods continue to evolve and expand, becoming faster and more continuously available around the clock, intelligent routing through payment hubs will remain an important potential tool for financial institutions to adapt to these trends.

Footnotes

- The authors thank Terri Bialowas and Elle Benak for their valuable assistance. Return to 1

References

- Alcazar, Julian, Sam Baird, Emma Cronenweth, Fumiko Hayashi, and Ken Isaacson. 2024a. “Core Banking Systems and Options for Modernization.” Payments System Research Briefing. Federal Reserve Bank of Kansas City. February 28, 2024. kansascityfed.org/research/payments-system-research-briefings/core-banking-systems-and-options-for-modernization/.

- Alcazar, Julian, Sam Baird, Emma Cronenweth, Fumiko Hayashi, and Ken Isaacson. 2024b. “The Role of Core Banking Services Providers in Facilitating Instant Payments.” Payments System Research Briefing. Federal Reserve Bank of Kansas City. May 8, 2024. kansascityfed.org/research/payments-system-research-briefings/the-role-of-core-banking-services-providers-in-facilitating-instant-payments/.

- Board of Governors of the Federal Reserve System. Rules and Regulations. 2006. “Electronic Fund Transfers, 12 CFR Part 205.” Federal Register 71, no. 6 (January 10, 2006): 1638. govinfo.gov/content/pkg/FR-2006-01-10/pdf/06-145.pdf.

- Capgemini Research Institute. 2025. World Payments Report 2025. Accessed June 6, 2025. capgemini.com/insights/research-library/world-payments-report/.

- Chinnapa, Reddy Yeruva. 2025. “The Central Role of Payment Hubs in Managing Multiple Payment Rails: Achieving Operational Efficiency and Compliance.” International Journal of Research in Computer Applications and Information Technology 8(1): 459–469. doi.org/10.34218/IJRCAIT_08_01_038.

- Federal Reserve Bank of Cleveland. 2024. “Engaging Our District’s Business, Civic, and Community Leaders.” clevelandfed.org/about-us/advisory-councils/.

- FedNow® Service. 2025. “Service Provider Showcase.” explore.fednow.org/explore-the-city?id=10. Accessed June 6, 2025.

- Mester, Loretta J. 2022. “An Update on the Federal Reserve’s Efforts to Modernize the Payment System,” Keynote Speech, 2022 Chicago Payments Symposium: Building Customer-Centered and Adaptive Networks, Federal Reserve Bank of Chicago, Chicago, IL, October 4, 2022. clevelandfed.org/collections/speeches/2022/sp-20221004-an-update-on-the-federal-reserves-efforts-to-modernize-the-payment-system.

- Stripe. 2025. “Dynamic Payment Methods.” Accessed June 6, 2025. docs.stripe.com/payments/payment-methods/dynamic-payment-methods.

Payments Systems Research and Engagement

Cleveland Fed payments experts conduct research in support of the Federal Reserve System’s advancement of safe, efficient, inclusive, and innovative payments systems.

About Us

The Federal Reserve Bank of Cleveland (commonly known as the Cleveland Fed) is part of the Federal Reserve System, the central bank of the United States.