- Share

New-Tenant Rent Passthrough and the Future of Rent Inflation

New-tenant rent inflation rose sharply during the COVID-19 pandemic, subsequently falling. Concomitantly, consumer price index (CPI) tenant rent, which measures rent increases for both new and continuing renters, rose more gradually and, after falling somewhat, has remained elevated. To illustrate why CPI rent inflation has remained elevated, we combine a measure of new-tenant rents and annual renter mobility rates to create a simulated CPI tenant rent inflation measure. We use this simulation to define a “rent gap” that represents the difference between actual CPI tenant rent inflation and rent inflation we would observe if every tenant experienced new-tenant rent inflation. This gap has declined since hitting its peak at the end of 2022 but remains high, implying that existing rents for continuing renters may still be notably below new-tenant rent levels and that rent inflation may remain elevated. However, the future path remains uncertain because it depends on future mobility rates, future passthrough rates, and future new-tenant rent inflation.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

As of September 2024, consumer price index (CPI) shelter inflation has remained stubbornly elevated. While year-over-year CPI inflation excluding shelter—both core and headline, the latter of which includes food and energy—is below 2 percent, year-over-year CPI shelter inflation is 4.8 percent.1 Shelter is the largest component of overall CPI inflation, with a weight of about 32 percent,2 and is therefore a principal reason why overall headline and core CPI inflation remain relatively high, with the August 2024 year-over-year readings at 2.4 percent and 3.3 percent, respectively. For this reason, policymakers are keenly attuned to shelter inflation developments.

CPI shelter inflation consists primarily of inflation in owners’ equivalent rent and tenant rent. The main input to calculating both of these series is rents paid by tenants. The CPI is designed to measure inflation for the average consumer and therefore measures rent increases for all tenants, whether for new or continuing tenancy. However, a number of alternative rent inflation measures exist that capture rent increases solely for new tenants who have recently moved into a unit. These have exhibited different dynamics from CPI tenant rent inflation. For example, year-over-year inflation from the CoreLogic single-family rent index (SFRI)—a new-tenant repeat rent index for single-family homes—rose sharply during the pandemic but then fell in early 2022, declining to below prepandemic levels by mid-2023.3 Conversely, year-over-year CPI shelter inflation rose much more gradually, peaking much later (in March 2023), and its downward progress has been much slower.

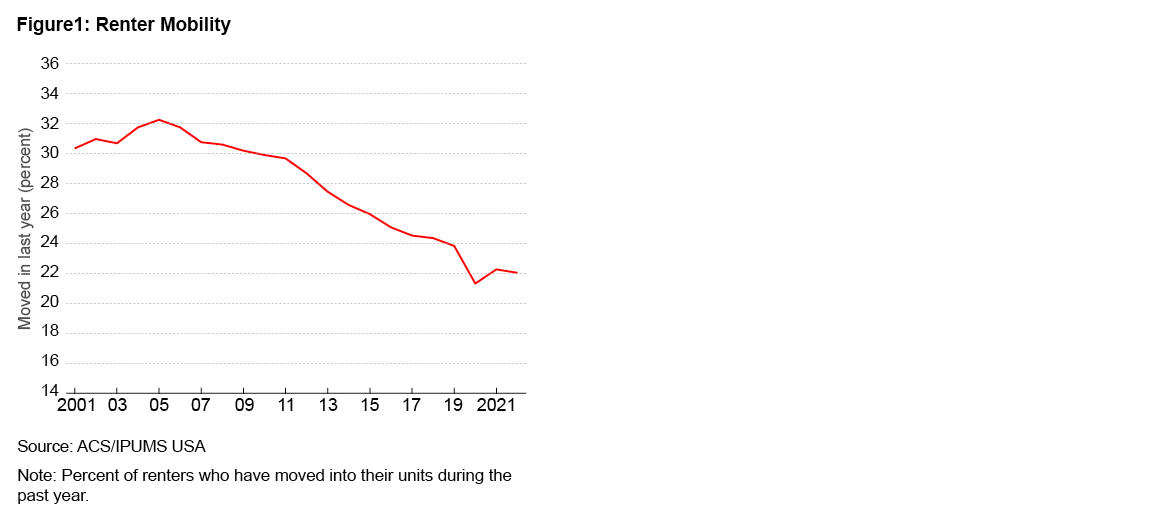

CPI tenant rent inflation and SFRI inflation diverge mainly because the CPI measures rent inflation experienced by all tenants (both continuing and new), while the SFRI (and similar measures) measures rent inflation experienced by new tenants only (Adams et al., 2024). The relatively high level of CPI tenant rent inflation is, therefore, attributable to continuing-tenant rent changes. Moreover, over the past decade or two, continuing-tenant rent inflation has become an increasingly important driver of overall rent inflation. This is because, as noted by Gallin et al. (2024), continuing tenants are a bigger and bigger proportion of the renter population, in part because renter mobility has been declining. The American Community Survey (ACS) implies that renter mobility has declined from about 31 percent in the early 2000s to about 22 percent today (see Figure 1).4

Continuing-tenant rents change less (are “stickier”) than rents for new tenants (Genesove, 2003; Gallin and Verbrugge, 2019). Economic theory has not reached a definitive conclusion as to whether landlords increase rents more for continuing tenants who want to avoid moving costs or provide discounts for reliable tenants in order to keep them in their units and avoid vacancy. That CPI tenant rent inflation rose less quickly than new-tenant rent inflation during the COVID-19 pandemic indicates that, at least in recent history, when new-tenant rent inflation has been high, continuing-tenant rents have risen more slowly, in effect providing the latter group a discount to remain in their units. Evidence from CPI microdata indicates that, on average, rent gaps widen the longer a tenant remains in a rental unit (Gallin et al., 2024).

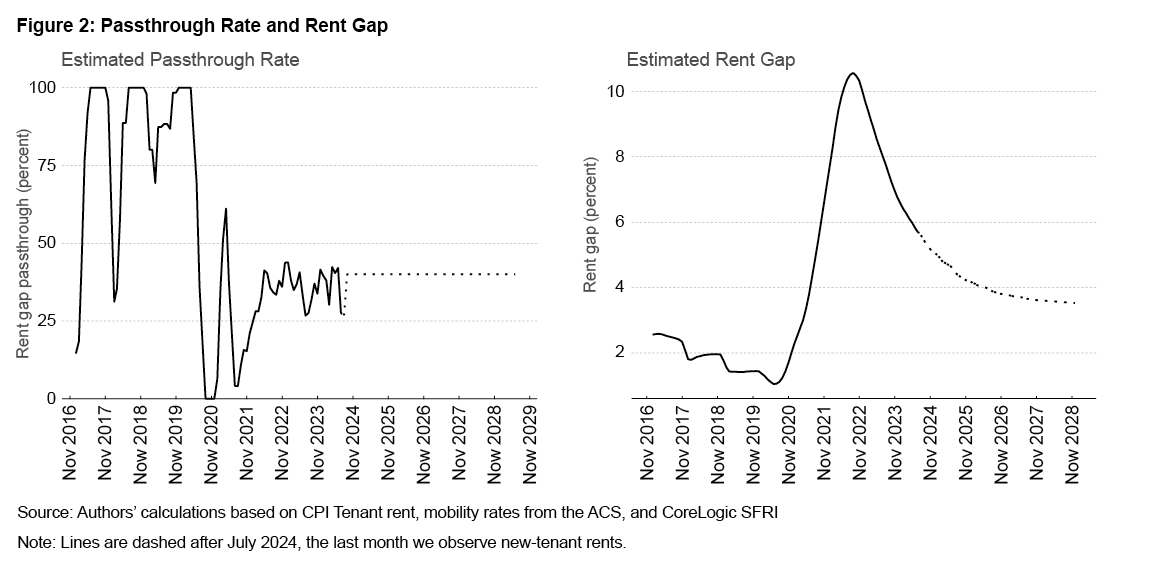

In this Economic Commentary, we demonstrate a simple simulation of all-tenant rent inflation that takes as inputs rates of renter mobility, rents of new tenants, and a rate at which changes in new-tenant rents pass through to continuing-tenant rents. We assume that when a continuing tenant experiences a rent change, the “rent gap”— the difference between the current rent level and the rent level that the unit would command if it were occupied by a new tenant—is only partially eliminated. We call the fraction of the rent gap that is closed the “passthrough rate.” This rent adjustment mechanism implies that continuing-tenant rent inflation is less volatile and slower moving than new-tenant rent inflation and is one reason why CPI shelter inflation has remained elevated despite the decline in new-tenant rent inflation.5 Our simulation allows us to match the historical path of CPI tenant rent inflation based upon historical new-tenant rent inflation, historical mobility, and a passthrough parameter that changes over time. This simulation indicates that passthrough was low during the first two years of the COVID-19 pandemic, before rebounding back to some extent. Our estimated rent gap in September 2024 is just under 5.5 percent, suggesting that there remains a substantial amount of potential rent inflation to be passed through to continuing tenants.

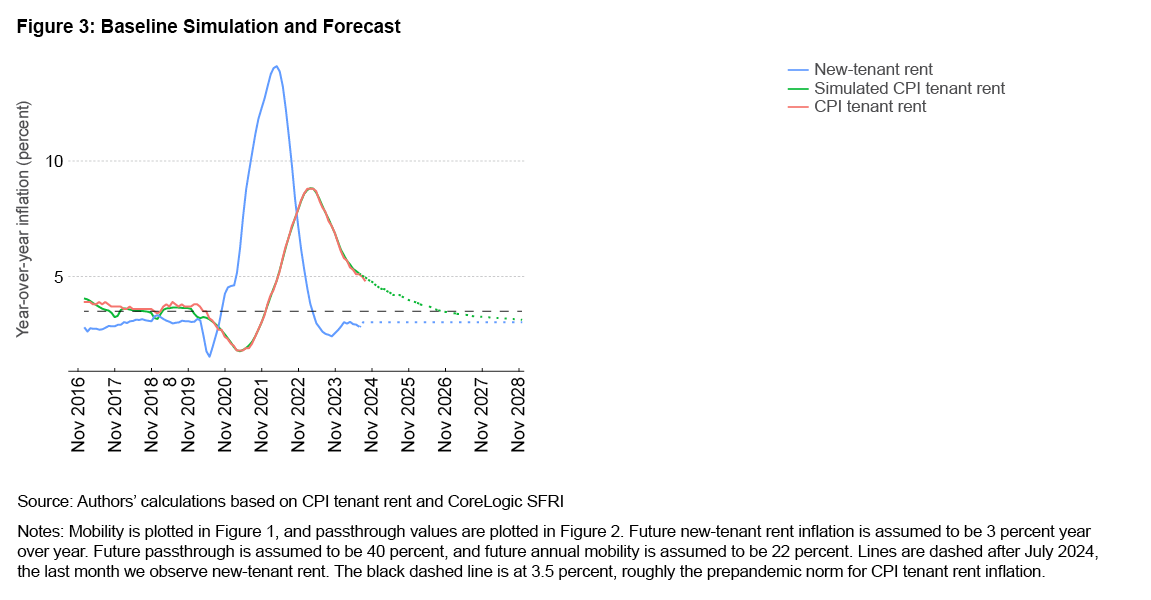

Our simulation allows us to forecast all-tenant rent inflation. Our baseline assumption is that mobility and passthrough remain at their last observed and estimated values and that new-tenant rent inflation stays constant at 3 percent. In this case, our model implies that CPI rent inflation will remain above its prepandemic norm of about 3.5 percent until mid-2026. This path, however, depends on how new-tenant rent inflation, mobility, and passthrough evolve over the next few years. We illustrate the role of these factors by providing alternative forecasts that use different assumptions. These alternative forecasts give a sense of the range of uncertainty around our baseline projection and highlight that the future path for rent inflation will depend importantly on future mobility rates, future passthrough rates, and future new-tenant rent inflation.

Simulation and Baseline Forecast

To understand how changing mobility and passthrough can impact CPI tenant rent inflation, we construct a model that allows us to recreate the path of historical rent inflation, and to provide forecasts of future rent inflation, under different assumptions about what will happen to new tenant rent inflation, mobility, and passthrough rates going forward. The underlying new-tenant rent series for our simulation is the national CoreLogic single-family rent index (SFRI) for single-family homes, both detached and attached. We make two simplifying assumptions in our model: First, we assume rents on units are updated only once per year. Second, we assume that units change tenants only once per year (there are no leases that are for less than one year) and that the probability of moving each year is independent of whether a tenant moved the previous year. In reality, these assumptions do not always hold, a fact which may affect results. For example, a notable proportion of rents remains unchanged when a new lease is signed (Gallin et al., 2024; Genesove, 2003; Gallin and Verbrugge, 2019). In addition, renters also do not always move at annual increments, and whether they move in a given year may in part depend on whether they moved the previous year. We set the mobility rate using annual moving rates from the ACS. We then estimate values of the passthrough of new-tenant rents to continuing tenants to best match actual CPI tenant rent inflation. We describe this process in greater detail in the appendix. To the extent that our model is a reasonable approximation of reality, we can use it to generate forecasts based upon assumptions about how mobility, passthrough, and new-tenant rent inflation evolve going forward.

In Figure 2 we plot the estimated passthrough rate and the associated historical rent gap that is implied by our simulation. To match the level of CPI tenant rent inflation prior to the COVID-19 pandemic, our simulation approach implies volatile, but relatively high, passthrough from 2016 through 2019. However, to match the dip in overall CPI tenant rent inflation during the initial months of the pandemic, the passthrough parameter falls in the first half of 2020 and is just above 0 percent for the latter half of the year. Thereafter, the passthrough parameter rises again. It remains somewhat volatile, but it is much more stable than during the pre-COVID-19 period, hovering around 40 percent. Figure 2 also plots the assumptions we make for our baseline forecast (in dotted lines). We assume that values remain effectively at their current levels. In particular, we assume that future passthrough is 40 percent and that SFRI inflation stays constant at 3 percent (approximately its average value prior to 2020). We also assume that our latest mobility reading (22 percent annually) continues into the future.

Our simulation data allow us to compute the rent gap for each unit. The path of the average value of this gap is plotted in the bottom panel of Figure 2. Prior to the COVID-19 pandemic, the rent gap was just above 1 percent, meaning that on average, outstanding observed contract rents had a rent 1 percent below what a new tenant would be asked to pay. During the pandemic, when new-tenant rent inflation rose and passthrough declined, the rent gap rose to almost 11 percent before starting to fall. In our simulation data, the rent gap in July 2024 is currently just below 5.7 percent, implying that there is still an appreciable amount of rent inflation to be passed through to existing leases.

Our baseline simulation and forecast is plotted in Figure 3. The red line is actual year-over-year CPI tenant rent inflation. The blue line is year-over-year SFRI inflation. The green line is year-over-year inflation based on our simulation. The black dashed line indicates 3.5 percent year-over-year inflation, a number which is approximately the average CPI tenant rent inflation rate before COVID-19. Figure 3 also provides our baseline assumption about new-tenant rent inflation going forward—namely, we assume that it continues at 3 percent—and our baseline forecast. In this forecast, tenant rent inflation does not reach its prepandemic norm until mid-2026.

Alternate Forecasts of Tenant Rent Inflation

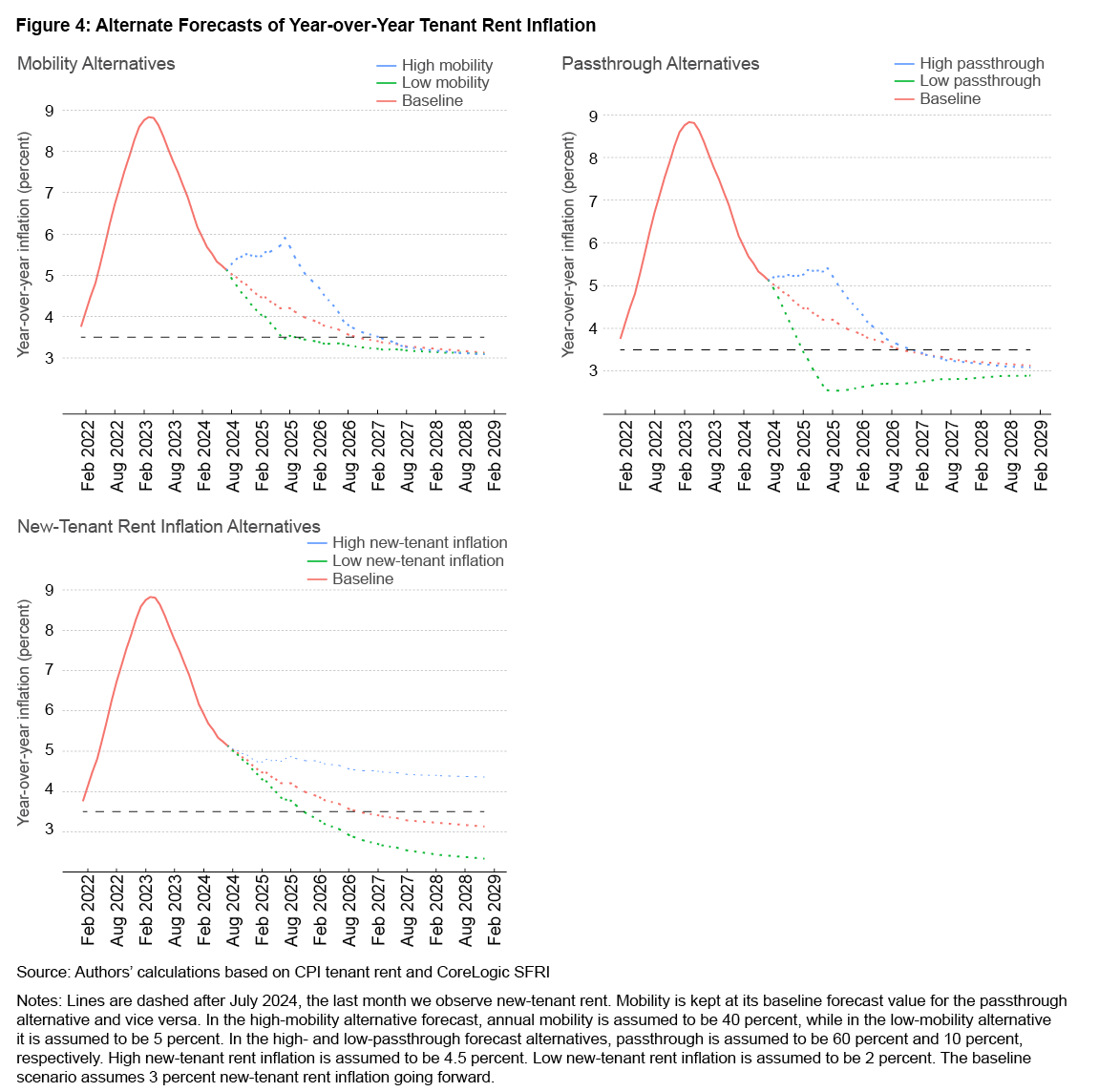

Our baseline forecast assumes that new-tenant rent inflation, mobility, and passthrough will remain effectively at their current values. But it is useful to investigate the sensitivity of our forecast to these assumptions and to get a sense of upside and downside risks to this baseline forecast. Thus, we provide forecasts that are based on some alternative assumptions. The alternative assumptions we investigate involve setting the three conditioning variables to high and low values relative to their historical behavior.

The results of our alternative forecast scenarios are in Figure 4. In the top two panels, we explore high- and low-mobility assumptions (40 percent and 5 percent, respectively) and high- and low-passthrough assumptions (60 percent and 10 percent, respectively). In the bottom panel, we have plotted alternative forecasts assuming high and low assumptions for future new-tenant rent inflation (4.5 percent and 2 percent, respectively).

In interpreting these forecasts, it is crucial to recognize that what drives the path of inflation going forward is the current level of the overall rent gap (which is a function of the historical paths of these variables) and how rapidly that rent gap is translated into continuing-tenant rent inflation. Notice that relative to the baseline forecast, either higher mobility or higher passthrough will increase rent inflation (relative to the baseline) going forward, since the current rent gap, which is near 5.7 percent, plays a bigger role in driving continuing-tenant rent inflation in the near term. Conversely, low mobility or low passthrough reduce rent inflation relative to the baseline, bringing it below its prepandemic average much more rapidly since the current rent gap’s role on the inflation path is mitigated in these circumstances.

Unsurprisingly, the path of future new-tenant rent inflation also matters. If new-tenant rent inflation picks up, then rent gaps will rise, and aggregate tenant rent inflation will remain higher for longer. By contrast, if new-tenant rent inflation falls and remains below its prepandemic level, then aggregate tenant rent inflation will fall more quickly and eventually decline to a lower level than we were accustomed to before COVID-19.6

Conclusion

There is intense policy interest in and a high amount of uncertainty about the future path of rent inflation. We propose a simple simulation model whose central tenet is an empirically defensible assumption about the way that continuing-tenant rents respond to the gap between existing rent and the rent that the unit would command if a property owner were to obtain a new tenant. Our simulation provides an explanation of the historical path of CPI tenant rent inflation through historical mobility rates, historical new-tenant rent inflation, and a time-varying passthrough rate that we estimate. To the extent that our model is a reasonable approximation of reality, we can use it to generate forecasts based on assumptions about how mobility, passthrough, and new-tenant rent inflation evolve going forward. We provide forecasts based on different assumptions about renter mobility, passthrough of new-tenant rents onto continuing-tenant rents, and the future level of new-tenant rent inflation. Our baseline forecast implies that CPI rent inflation will remain above its prepandemic norm of about 3.5 percent until mid-2026. Our alternative forecasts highlight both upside and downside risks to this forecast.

References

- Adams, Brian, Lara P. Loewenstein, Hugh Montag, and Randal J. Verbrugge. 2024. “Disentangling Rent Index Differences: Data, Methods, and Scope.” American Economic Review: Insights 6 (2): 230–245. https://doi.org/10.1257/aeri.20220685.

- American Homes 4 Rent. 2024. “Quarterly Reports.” https://investors.amh.com/financials/quarterly-reports/default.aspx.

- Barker, David. 2003. “Length of Residence Discounts, Turnover, and Demand Elasticity. Should Long-Term Tenants Pay Less than New Tenants?” Journal of Housing Economics 12 (1): 1–11. https://doi.org/10.1016/S1051-1377(03)00002-0.

- Basso, Gaetano, and Giovanni Peri. 2020. “Internal Mobility: The Greater Responsiveness of Foreign-Born to Economic Conditions.” Journal of Economic Perspectives 34 (3): 77–98. https://doi.org/10.1257/jep.34.3.77.

- Crone, Theodore M., Leonard I. Nakamura, and Richard Voith. 2010. “Rents Have Been Rising, Not Falling, in the Postwar Period.” The Review of Economics and Statistics 92 (3): 628–642. https://doi.org/10.1162/REST_a_00015.

- Gallin, Joshua, Lara P. Loewenstein, Hugh Montag, and Randal J. Verbrugge. 2024. “Sticky Continuing-Tenant Rents.” Work in progress.

- Gallin, Joshua, and Randal J. Verbrugge. 2019. “A Theory of Sticky Rents: Search and Bargaining with Incomplete Information.” Journal of Economic Theory 183 (September): 478–519. https://doi.org/10.1016/j.jet.2019.06.003.

- Genesove, David. 2003. “The Nominal Rigidity of Apartment Rents.” The Review of Economics and Statistics 85 (4): 844–53. https://doi.org/10.1162/003465303772815763.

- Guasch, J. Luis, and Robert C. Marshall. 1987. “A Theoretical and Empirical Analysis of the Length of Residency Discount in the Rental Housing Market.” Journal of Urban Economics 22 (3): 291–311. https://doi.org/10.1016/0094-1190(87)90029-5.

- Jia, Ning, Raven Molloy, Christopher Smith, and Abigail Wozniak. 2023. “The Economics of Internal Migration: Advances and Policy Questions.” Journal of Economic Literature 61 (1): 144–180. https://doi.org/10.1257/jel.20211623.

- Kaplan, Greg, and Sam Schulhofer-Wohl. 2017. “Understanding the Long-Run Decline in Interstate Migration.” International Economic Review 58 (1): 57–94. https://doi.org/10.1111/iere.12209.

- Leifheit, Kathryn M., Sabriya L. Linton, Julia Raifman, Gabriel L. Schwartz, Emily A. Benfer, Frederick J. Zimmerman, and Craig Evan Pollack. 2021. “Expiring Eviction Moratoriums and COVID-19 Incidence and Mortality.” American Journal of Epidemiology 190 (12): 2503–2510. https://doi.org/10.1093/aje/kwab196.

- Molloy, Raven, Christopher L. Smith, and Abigail Wozniak. 2011. “Internal Migration in the United States.” Journal of Economic Perspectives 25 (3): 173–196. https://doi.org/10.1257/jep.25.3.173.

- Molloy, Raven, Riccardo Trezzi, Christopher L. Smith, and Abigail Wozniak. 2016. “Understanding Declining Fluidity in the US Labor Market.” Brookings Papers on Economic Activity 2016 (1): 183–259. https://doi.org/10.1353/eca.2016.0015.

- Olney, William W., and Owen Thompson. 2024. “The Determinants of Declining Internal Migration.” Working paper 32123. National Bureau of Economic Research. https://doi.org/10.3386/w32123.

- Partridge, Mark D., Dan S. Rickman, M. Rose Olfert, and Kamar Ali. 2012. “Dwindling US Internal Migration: Evidence of Spatial Equilibrium or Structural Shifts in Local Labor Markets?” Regional Science and Urban Economics 42 (1–2): 375–388. https://doi.org/10.1016/j.regsciurbeco.2011.10.006.

- Ptacek, Frank. 2013. “Updating the Rent Sample for the CPI Housing Survey.” Monthly Labor Review, August. https://doi.org/10.21916/mlr.2013.25.

- Ruggles, Steven, Sarah Flood, Matthew Sobek, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Renae Rodgers, and Megan Schouweiler. IPUMS USA: Version 15.0 [dataset]. Minneapolis, MN: IPUMS, 2024. https://doi.org/10.18128/D010.V15.0.

Endnotes

- Inflation rates measured using year-over-year log differences in the respective indexes. Return to 1

- Rental housing has 8 percent of the relative importance in the CPI, and its owner-occupied housing component, owners’ equivalent rent (OER), has an additional weight of 24 percent. By comparison, food accounts for approximately 14 percent of the CPI. Return to 2

- We focus on the CoreLogic SFRI as our measure of new-tenant rent inflation because Adams et al. (2024) show it closely tracks the new-tenant rent inflation rate based on the microdata underlying CPI tenant rent. Return to 3

- The decline in renter mobility is part of a longer-run trend of declining internal migration for both homeowners and renters on which much has been written but still relatively little is understood. This literature includes Partridge et al. (2012), Molloy et al. (2011, 2016), Kaplan and Schulhofer-Wohl (2017), Olney and Thompson (2024), Basso and Peri (2020), and Jia et al. (2023), among others. Return to 4

- Mobility rates derives from the ACS, and new-tenant rent inflation is from CoreLogic. Steven Ruggles et al. IPUMS USA: Version 15.0 [dataset]. Minneapolis, MN: IPUMS, 2024. https://doi.org/10.18128/D010.V15.0. Return to 5

- Some rules and regulations regarding rent changes and tenant rights did change during the COVID-19 pandemic. For example, many states and cities (and the Centers for Disease Control and Prevention) issued eviction moratoriums that meant that landlords could not evict tenants for nonpayment of rent (Leifheit et al., 2021). These rule changes may have had an impact on the evolution of continuing-tenant rents. Return to 6

Suggested Citation

Loewenstein, Lara, Jason Meyer, and Randal J. Verbrugge. 2024. “New-Tenant Rent Passthrough and the Future of Rent Inflation.” Federal Reserve Bank of Cleveland, Economic Commentary 2024-17. https://doi.org/10.26509/frbc-ec-202417

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International