- Share

The Failure of the Bank of the Commonwealth: An Early Example of Interest Rate Risk

This Economic Commentary describes the collapse and subsequent bailout of the Detroit-headquartered Bank of the Commonwealth in 1972. Commonwealth failed because it invested heavily in long-duration, fixed-rate municipal securities in the mid-1960s in a bet that interest rates would decline. Instead, with the beginning of the Great Inflation of 1965–1980, rates rose. Liquidity problems then ensued, and the bank approached failure. Unable to find an acquirer because of Michigan’s banking restrictions, regulators instead bailed out the bank because of fears of contagion. This article also compares the collapse of Commonwealth with the spring 2023 failures of Silicon Valley Bank and First Republic. In particular, I discuss structural changes in banking that impacted the speed of the runs and the pools of potential acquirers.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Introduction

In 1970, the Bank of the Commonwealth was in severe trouble. The bank, headquartered in Detroit, Michigan, had grown fast since 1964, roughly tripling in size to $1.5 billion in assets. It had invested in long-duration municipal securities under the belief that interest rates would decline, as they had in previous cycles, and with the aim of earning a large capital gain. Instead, long-term interest rates increased, and the market value of the securities dropped. Furthermore, the recession of 1969–1970 reduced the bank’s income. As the market became aware of its weakening condition, wholesale funding dried up. Sales of its securities to meet liquidity needs would have forced Commonwealth to recognize the losses, thus making it insolvent. Faced with Commonwealth’s impending failure, unable to find an acquiring bank because of state branching restrictions, and unwilling to allow a bank of Commonwealth’s size to fail, the Federal Deposit Insurance Corporation (FDIC) bailed out the bank in 1972.

If this pattern looks familiar, it should. Other than the speed of its failure and the details of how it was resolved, Commonwealth’s path looks similar to that of Silicon Valley Bank (SVB). Both tripled in size in just a few years; both invested in long-duration, fixed-rate securities; and both had unstable funding bases. SVB was dependent on uninsured deposits, while Commonwealth was dependent on wholesale sources of funding and price-sensitive out-of-market time deposits.1 Each failed during a period of increased inflation and interest rates that followed a long period of low inflation and low rates. Finally, in both cases, uninsured depositors were protected. In Commonwealth’s case, it was through the use of the discount window to keep the bank operating until the FDIC recapitalized it; in SVB’s, it was through use of explicit guarantees of uninsured depositors by federal regulators.

The first goal of this Economic Commentary is to provide a more complete picture of Commonwealth’s rise and fall than exists in the literature. The main analyses of Commonwealth in the economic literature is the description by Irvine Sprague (1986), who was on the FDIC’s board of directors when Commonwealth was bailed out, and the analysis of the origins in the 1970s of too-big-to-fail policies in the United States by Nurisso and Prescott (2017, 2020). The second goal is to compare the 1972 failure of Commonwealth to the spring 2023 failures of SVB and, to a lesser extent, First Republic.2,3 As during the 2021–2023 period, the late 1960s were marked by increased inflation and tight monetary policy, so comparisons of bank failures across these two periods is of particular interest.

The Bank of the Commonwealth

The Bank of the Commonwealth was a bank that operated in Detroit, Michigan. In the early 1960s, it was a minor bank and conservatively run. In 1964, it was acquired by Donald H. Parsons, who was at the center of a network of partnerships that acquired banks, mainly in Michigan. He used the partnership structure to get around Michigan laws that limited bank branching to within 25 miles of a bank’s headquarters and that forbid bank holding companies (Sprague, 1986).4 While the partnerships mainly operated banks, the partners were also involved in commercial real estate and other projects under the umbrella of COMAC, a company that Parsons and some of his partners created in 1967. COMAC operated like a management consulting company that provided management services mainly to the various banks controlled by Parsons, but also to real estate projects controlled by people in the bank partnerships and to a few outside firms (Gies, 1975). While COMAC was also a partnership, Parsons was chair, and, according to Gies (1975), COMAC embodied Parsons’ management goals. Parsons, at his peak, directed a network of 19 banks, including two overseas banks, through the various partnerships that owned the banks and COMAC (Gies, 1975).

Parsons’ partnerships would finance the acquisition of these banks by taking a note from a large bank, investing the funds into an acquired bank, and then repaying the note with income from the same acquired bank. Once Parsons’ partnership acquired the bank, Parsons’ strategy was to grow it fast and increase both its return and risk. On the asset side, his banks reduced their shares of Treasuries and cash and increased their shares of tax-exempt municipal securities, including lower-rated securities and loans (Rose, 1968). On the liability side, Parsons’ banks funded their growth by using time and savings deposit incentive programs and wholesale borrowing, mainly in the fed funds market, but in some cases also from the Eurodollar market (Gies, 1975).

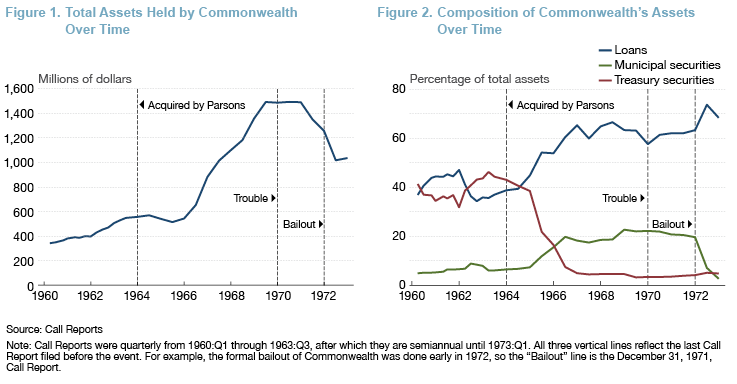

The largest and most important bank in this network was the Bank of the Commonwealth. In 1964, prior to Parsons’ gaining control, Commonwealth had $540 million in assets. After Parsons acquired it, Commonwealth grew rapidly, reaching $1.5 billion in assets in 1970.5 Parsons also changed the mix of assets held by the bank. Holdings of Treasury securities dropped from 40 percent to around 5 percent, loans increased from around 40 percent of assets to around 70 percent, and municipal securities increased from 7 percent to 23 percent. In contrast, for the commercial banking sector as a whole, Treasury holdings dropped only from 18 percent to 10 percent of domestic assets, and municipal holdings grew only slightly, increasing from 10 percent to 11 percent of domestic assets.6 For 1960 through Commonwealth’s bailout in 1972, Figure 1 shows the growth in Commonwealth’s assets, and Figure 2 shows the change in the composition of these assets.

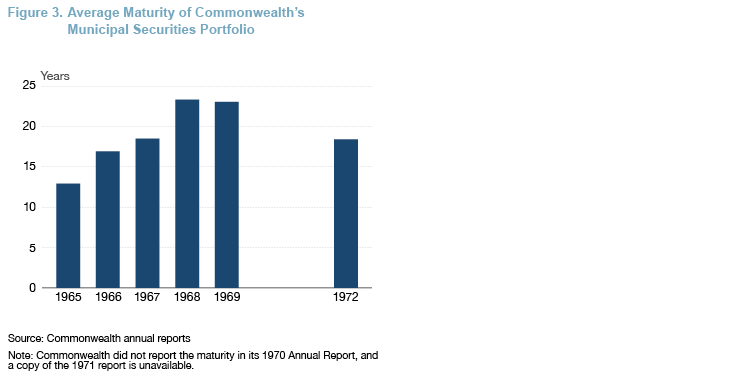

The biggest risk in Commonwealth’s portfolio was the duration of its municipal securities portfolio. The interest rates on most municipal securities and loans were fixed, so the value of these obligations would drop if rates increased. Figure 3 reports the average duration of Commonwealth’s municipal security portfolio. It nearly doubled from 12 years and 11 months in 1965 to 23 years and 4 months in 1968. Commonwealth’s strategy was to bet that interest rates would decline, and if this happened, Commonwealth would earn a large capital gain on the securities.

A second factor behind Commonwealth’s strategy was the treatment of capital losses and capital gains by the federal tax code. While the federal tax code taxed corporate capital gains at a lower rate than corporate income, roughly 25 percent versus 50 percent in the 1960s, capital losses were treated differently for commercial banks. Net realized capital losses could be expensed against income, which was taxed at the high corporate income tax rate of roughly 50 percent.7 And, while income from municipal obligations was tax free, if interest rates went up, a bank could still sell the securities, incur the capital losses to reduce current taxes, and reinvest the proceeds in similar tax-exempt securities at their new lower price to receive roughly the same tax-free income as before. As long as the bank had positive income, the capital losses would be expensed and reduce taxable income. Commonwealth took advantage of this asymmetry by purchasing securities in order to take advantage of cyclical fluctuations in interest rates (Rose, 1968). Of course, this strategy does not work if the bank has losses, and this situation became a problem for Commonwealth.8

According to Irvine Sprague, who was on the FDIC board of directors in 1972 when the FDIC bailed out Commonwealth,

Commonwealth’s pattern, which was repeated at other banks, was to sell off the safe, steady, and staggered federal securities in the bank’s portfolio and load up on low-grade, long-term municipal securities that bore higher interest rates. After almost a decade at low relatively stable levels, interest rates had been drifting upward in the late 1960s, and COMAC was trying to lock them in. COMAC believed the rise was cyclical and that rates were ready to fall. If that happened, all those high-yielding municipals in the 5 percent tax-free range would surge in value and the client banks could sell them at a princely profit. . . .

As early as January 1968, representatives of the Chicago Fed met with Commonwealth’s board and expressed concern to the directors about the course bank management was following. Parsons, as Commonwealth chairman, strongly defended their policy, saying it would produce vast capital gains for the bank. He said the projections of Dr. Gies showed that a downturn in interest rates would occur between July 1, 1968, and July 1, 1969. (Sprague, 1986, pg. 59)

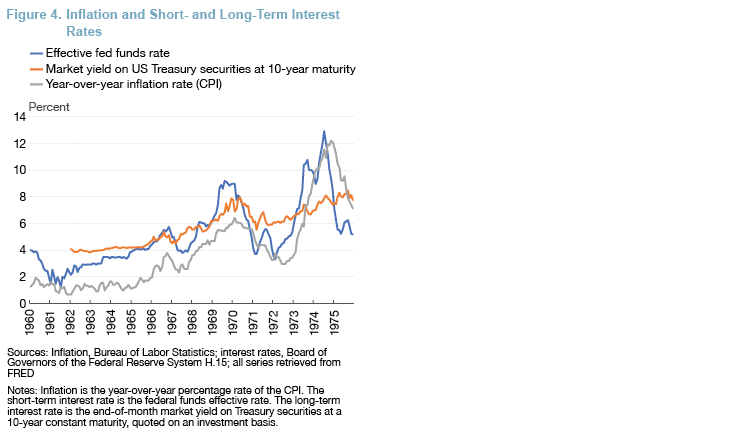

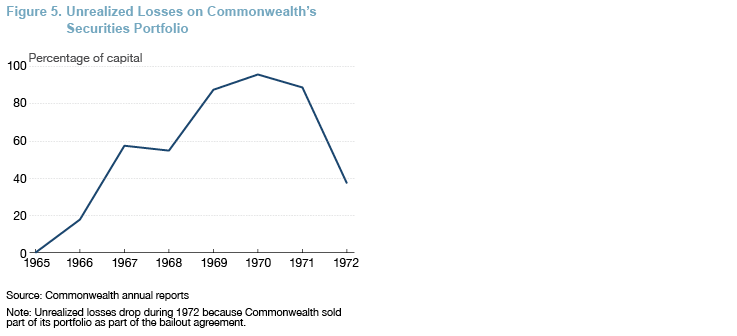

Unfortunately for Commonwealth, Gies’ forecast was wrong. Between July 1, 1968, and July 1, 1969, the yield on 20-year Treasury securities at a constant maturity actually increased from 5.35 percent to 6.29 percent.9 Similarly, short-term rates increased over this period, as well. What had happened was that because inflation continued to increase in this period, the Federal Open Market Committee tightened monetary policy in an attempt to reduce inflation (see Figure 4). Figure 5 reports unrealized losses on Commonwealth’s securities portfolio as a percentage of capital.10 These calculations report losses for the entire portfolio, but most of the losses were from the municipal securities portfolio.11 Commonwealth’s losses by this measure grow as long-term rates stay high, and they nearly reach 100 percent of capital by 1970.

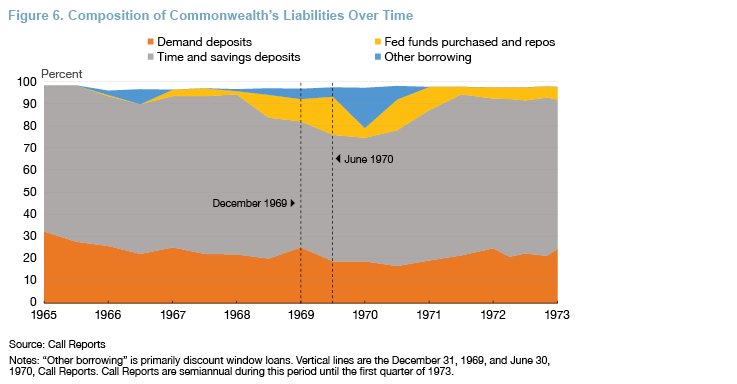

At the time, all securities were accounted for at book value, so the losses would only get recognized through earnings if a bank sold its underwater securities. Unfortunately, Commonwealth was faced with selling the securities because of loan losses during the 1970 recession and liquidity problems. Part of Parsons’ strategy for Commonwealth and the other banks he controlled was to fund their growth with a mix of high-interest certificates of deposit and wholesale borrowing from other banks in the fed funds market. Figure 6 shows the liability mix of Commonwealth and the growth in borrowing in the fed funds market. What the figure does not show, however, is that much of the time deposits were being funded by interest rate sensitive depositors who did not live in Detroit (Rose, 1968). Furthermore, Regulation Q interest rate caps were not raised in 1969 (Cook, 1978; Gilbert, 1986), a situation which made it harder for Commonwealth to raise funds with price-sensitive time deposits.12 These reasons prompted Commonwealth’s difficulty in raising funds. As a result of this challenge, Commonwealth applied to open a branch in the Bahamas to raise funds in the Eurodollar market, but the Federal Reserve Board denied the application on March 31, 1970. Furthermore, in its denial, the Board noted that “the general character of management and the bank’s financial history and condition, including the liquidity and capital positions, mitigate against approval” (Sprague, 1986, pg. 62). As Sprague (1986) reports, it was very unusual for the Federal Reserve Board to issue such a scathing statement about the character of an applicant. After the release of this statement, Commonwealth’s demand deposits declined by around 18 percent from January 1, 1970, to April 30, 1970 (Gies, 1975). As Figure 6 illustrates, Commonwealth initially replaced these lost deposits with borrowing in the fed funds market, but that source of funding declined in the second half of 1970 and then was replaced by discount window loans. Commonwealth’s ongoing problems meant that it could no longer continue.

Resolving Commonwealth

As Commonwealth’s decline continued, in July of 1970 the Federal Reserve used the threat of removing access to the Fed’s discount window in order to force Parsons and several of his partners to resign as directors and officers of the bank and to agree to a cease and desist order in which, among other things, Commonwealth had to cut ties with COMAC, stop paying dividends, and reduce its size (Sprague, 1986).

With Commonwealth being kept alive via Fed lending, the next step was to determine how to deal with the bank. For regulators, the preferred way of handling a failing bank is to find a strong bank to acquire it. Unfortunately, there was no such bank available in Commonwealth’s case. Michigan’s banking laws did not let out-of-state banks operate in Michigan, so only a Michigan bank could acquire it. Furthermore, Michigan’s banking laws also prevented banks from opening a branch more than 25 miles from its headquarters, so only a Detroit-based bank could legally acquire Commonwealth. According to Sprague (1986), the three largest banks in Detroit had a 77 percent share of deposits, and letting one of them acquire Commonwealth’s 10 percent share would have increased the concentration within the Detroit banking market to an unacceptable level (Sprague, 1986).

In the absence of an acquisition, this meant that Commonwealth would fail. When a bank fails, it is not put into bankruptcy, but, instead, into FDIC resolution. The two primary ways the FDIC resolves a failed bank is to provide assistance to an acquiring bank (a purchase and acquisition) or to liquidate it. The criteria set by law for how to resolve a failing bank has changed over time, but, historically, a purchase and acquisition is the most commonly used method. Liquidation typically has been used for only the smallest banks (Horvitz, 1986).

Given the concentration in the Detroit market referred to above, the FDIC ruled out a purchase and acquisition, but it was not willing to liquidate the bank. At the time, regulators believed that a $1.2 billion bank—Commonwealth’s size in 1972—was too big to fail (Nurisso and Prescott, 2017, 2020). Instead, the FDIC invoked the rarely used essentiality clause of the Federal Deposit Insurance Act of 1950 that let the FDIC assist a bank in order to keep it operating if the FDIC deemed it “essential” to the local community. The FDIC’s assistance to Commonwealth was only the second use of this power.13 The FDIC forced Commonwealth to sell much of its municipal securities portfolio and recognize the losses and lent the bank $60 million to replenish its capital. Commonwealth then limped along until it was acquired by Comerica in 1984.

Comparison with SVB and First Republic

Silicon Valley Bank got into trouble for the same reason Bank of the Commonwealth did. It bought large quantities of long-duration, fixed-rate securities in a period of low interest rates and low inflation, and then both rates and inflation increased.

A second similarity was that both banks had unstable funding bases. For SVB, the unstable funding came from its uninsured deposits, which were 94 percent of its domestic deposits at the end of 2022.14 A third similarity was that SVB’s uninsured depositors ended up being protected by financial regulators, just like Commonwealth’s, albeit by different means. Since the Great Depression, uninsured depositors of a failing large bank have rarely lost their funds (Horvitz, 1986; Stern and Feldman, 2009), and despite the many changes to banking law since Commonwealth’s failure, the outcome for uninsured depositors at these two banks was the same.

One difference between the two banks was the degree and speed of the withdrawals and how that affected the failing bank’s resolution. Historically, most banks have enough insured and stable deposits that a combination of discount window lending and other sources of lending can keep a bank operating until a solution is found. This was the case with Commonwealth and for the other too-big-to-fail bailouts of the 1970s and 1980s (Nurisso and Prescott, 2017, 2020). As discussed above, Commonwealth did have several sources of unstable funding, but it also had some stable funding. As indicated in Figure 6, the bank retained a sizeable amount of its demand, time, and savings deposits after 1970. While the Call Report provides no information on the extent to which its deposits were FDIC insured, presumably a sizable fraction of them were insured. As a result, Commonwealth’s run played out over time and gave regulators more time to resolve it.

In contrast, most of SVB’s deposits were uninsured and, as is well-documented, many were held by a small number of depositors who were highly connected to each other and could quickly initiate withdrawals (Board of Governors, 2023). As a result, the speed and size of the run on SVB was so fast and so large that there was not time to borrow from the discount window, let alone to find a buyer. Instead, regulators shut it down and used the systemic risk exception contained in the Federal Deposit Insurance Corporation Improvement Act of 1991 to protect uninsured depositors.15

Instead, the resolution of Commonwealth looks more like that of First Republic, at least in the sense that there was more time to find an acquiring bank. First Republic was a bank based in San Francisco, California, that specialized in catering to a wealthy clientele. Like Commonwealth, First Republic invested in long-duration, fixed-rate assets, though its investments were primarily in residential mortgages. Forty-six percent of its assets were in first-lien, 1–4-family residential mortgages, and most of these mortgages had a long duration. About 47 percent of these mortgages had a rate that was fixed for five to 15 years, and another 31 percent had a rate that was fixed for at least 15 years. First Republic looked much like a savings and loan in the 1970s, but unlike those institutions, it had a large fraction of uninsured depositors: roughly two-thirds of its deposits were uninsured.16

When First Republic experienced a run starting in March 2023, several large banks lent to it to keep it operating, and this lending gave the FDIC time to find an acquirer. On May 1, 2023, the FDIC resolved First Republic by arranging a purchase and acquisition in which JP Morgan bought all of First Republic’s deposits and most of its assets, and the FDIC contributed funds to the purchase.17 The assisted purchase by JP Morgan raises another similarity with Commonwealth. As discussed earlier, concentration concerns along with Michigan banking law limited the pool of acquirers for Commonwealth. In the case of First Republic, the pool of acquirers was slightly limited because the Riegle–Neal Interstate Banking and Branching Efficiency Act of 1994 prevents a bank from acquiring another bank if the acquisition would give the acquiring bank more than a 10 percent market share of deposits nationwide. Indeed, the eventual acquirer, JP Morgan, already exceeded this threshold before the acquisition. There is an exception to the law, however, if the acquired bank is failing, and the exception was used in this case (Eisen and Ackerman, 2023).

A difference between Commonwealth and both SVB and First Republic is the source of interest rate risk. Unlike Commonwealth’s, both SVB’s and First Republic’s interest rate risk exposure came primarily from residential mortgages.18 In SVB’s case, the risk was from holding mortgage-backed securities, while for First Republic it was from directly holding residential mortgages. In the late 1960s, however, the commercial banking sector did not hold many residential mortgages. Instead, most were held by the thrift industry, that is, savings and loan associations, mutual savings banks, and savings banks, rather than by commercial banks. Unlike today, the thrift industry in the 1960s was sizable, holding half of the assets of the commercial banking industry. Thrifts were required by law and regulation to mainly hold residential mortgages, many of which were fixed rate and of a long duration at the time. Indeed, the thrift industry held around 57 percent of residential mortgages during the late 1960s, while commercial banks only held about 15 percent.19 Unrealized losses on the thrifts’ residential mortgages, along with regulatory forbearance and then deregulation in the early 1980s, led to the Savings and Loan Crisis, which played out over two decades. For histories of that important event, see Kane (1989) and White (1991).

Conclusion

As in the recent episode of inflation, the inflation of the late 1960s was preceded by a long period of low interest rates and low inflation. In both periods, some commercial banks extended the duration of their assets, betting that rates would decrease or at least not increase. Instead, rates increased, and several of these banks failed. The details of how Commonwealth, SVB, and First Republic were resolved differ as a result of changes in banking law, bank structure, and payments technology. Nevertheless, in all three cases the response of regulators was similar, and uninsured depositors were protected.

References

- Bank of the Commonwealth. “Annual Reports, 1965–1970, 1972.” Annual Reports at Academic Business Libraries (Purdue University). https://apps.lib.purdue.edu/abldars/index.php.

- Board of Governors of the Federal Reserve System. 2023. “Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank, April 28, 2023.” https://www.federalreserve.gov/publications/2023-April-SVB-Key-Takeaways.htm.

- Brimmer, Andrew F. 1984. “The Federal Reserve as Lender of Last Resort: The Containment of Systemic Risks.” Paper presented before a joint session of the American Economic Association and the Eastern Economic Association, December 29, 1984. Dallas, TX.

- Congressional Research Service. 2023. “Bank Failures: The FDIC’s Systemic Risk Exception.” In Focus, no. 12378 (April). https://crsreports.congress.gov/product/pdf/IF/IF12378.

- Cook, Timothy Q. 1978. “Regulation Q and the Behavior of Savings and Small Time Deposits at Commercial Banks and Thrift Institutions.” Economic Review (Federal Reserve Bank of Richmond) 64 (November/December). https://fraser.stlouisfed.org/title/960/item/477291/toc/501617?start_page=12.

- Eisen, Ben, and Andrew Ackerman. 2023. “Why Washington Let JPMorgan Buy First Republic.” Wall Street Journal, May 2, 2023, sec. Finance. https://www.wsj.com/articles/how-washington-got-on-board-with-a-big-bank-deal-for-first-republic-609188aa.

- Federal Deposit Insurance Corporation. 2023. “FDIC’s Supervision of First Republic Bank.” https://www.fdic.gov/news/press-releases/2023/pr23073a.pdf.

- Gies, Thomas G. 1975. “Competition and Entry in Banking Markets.” Working Paper 99. Graduate School of Business Administration, University of Michigan. https://hdl.handle.net/2027.42/35637.

- Gilbert, R. Alton. 1986. “Requiem for Regulation Q: What It Did and Why It Passed Away.” Review (Federal Reserve Bank of St. Louis) 68 (22–37). https://doi.org/10.20955/r.68.22-37.zge.

- Golembe, Carter H., Associates. 1969. “Report on the Michigan Banking Structure: Prepared for the Joint Senate-House Bank Study Committee of the Michigan Legislature.”

- Hall, George R. 1965. “Bank Holding Company Regulation.” Southern Economic Journal 31 (4): 342–55. https://doi.org/10.2307/1055764.

- Horvitz, Paul. 1987. “Fear of Failing: Review of Bailout: An Insider’s Account of Bank Failures and Rescues by Irvine H. Sprague.” Yale Journal on Regulation 4: 503–511. http://hdl.handle.net/20.500.13051/8358.

- Kane, Edward J. 1989. The S&L Insurance Mess: How Did It Happen? Washington DC: The Urban Institute Press.

- Maisel, Sherman J. 1981. “The Theory and Measurement of Risk and Capital Adequacy.” In Risk and Capital Adequacy in Commercial Banks, edited by Sherman J. Maisel. NBER Monograph. University of Chicago Press. https://www.nber.org/system/files/chapters/c13518/c13518.pdf.

- Mengle, David L. 1990. “The Case for Interstate Branch Banking.” Economic Review (Federal Reserve Bank of Richmond) 76 (November/December). https://fraser.stlouisfed.org/title/960/item/477363/toc/501811.

- New York State Department of Financial Services. 2023. “Internal Review of the Supervision and Closure of Signature Bank, April 28, 2023.” https://www.dfs.ny.gov/system/files/documents/2023/04/nydfs_internal_review_rpt_signature_bank_20230428.pdf.

- Nurisso, George C., and Edward S. Prescott. 2017. “The 1970s Origins of Too Big to Fail.” Economic Commentary, no. 2017-17 (October). https://doi.org/10.26509/frbc-ec-201717.

- Nurisso, George C., and Edward S. Prescott. 2020. “Origins of Too-Big-to-Fail Policy in the United States.” Financial History Review 27 (1): 1–15. https://doi.org/10.1017/S0968565020000013.

- Rose, Sanford. 1968. “Is This Any Way to Run Ten Banks?” Fortune, December 1968.

- Sprague, Irvine H. 1986. Bailout: An Insider’s Account of Bank Failures and Rescues. New York: Basic Books.

- Staff of the Joint Committee on Internal Revenue Taxation. 1970. “General Explanation of the Tax Reform Act of 1969, H.R. 13270, 91st Congress, Public Law 91-172.” JCS-16-70 (December 03, 1970). Washington: US Government Printing Office. https://www.jct.gov/publications/1970/jcs-16-70/.

- Stern, Gary H., and Ron J. Feldman. 2009. Too Big to Fail: The Hazards of Bank Bailouts. Washington DC: Brookings Institution Press.

- White, Lawrence J. 1991. The S&L Debacle: Public Policy Lessons for Bank and Thrift Regulation. New York: Oxford University Press.

Endnotes

- The securities on which SVB took most of its losses were mortgage-backed securities. For details on SVB’s history and failure, see Board of Governors of the Federal Reserve System (2023). Return to 1

- For information on the failure of First Republic, see Federal Deposit Insurance Corporation (2023). Return to 2

- The other large domestic bank to fail in the spring of 2023 was Signature Bank. Signature failed because it was associated with the crypto industry and had a large fraction of uninsured depositors who ran it when Silvergate and SVB, both of which had some connections to the crypto and tech industry, were run (New York State Department of Financial Services, 2023). Return to 3

- Until the Riegle–Neal Interstate Banking and Branching Efficiency Act of 1994, most US states imposed numerous limits on interstate and intrastate banking. For an overview of these restrictions, see Mengle (1990). While the main way to get around these restrictions was through corporate ownership of multiple banks by a bank holding company, an alternative structure was for an individual or a small group of individuals to own multiple banks. The latter is usually referred to as “chain banking” (Hall, 1965). Data on the extent of chain banking is limited, but Parsons’ network was the only chain of banks controlled by partnerships in Michigan at the time (Golembe, 1969). Return to 4

- By modern standards, Commonwealth was not a large bank. If scaled by the growth in total commercial banking assets, it would be only a $53.3 billion asset bank as of December 2022. Still, at the time it was the forty-seventh largest commercial bank in the United States. Return to 5

- Calculations are from the Call Report and consider only domestic assets; the Call Report started breaking these out in 1969. Return to 6

- The Tax Reform Act of 1969 eliminated this asymmetric treatment by treating capital gains and losses as ordinary income (Staff of the Joint Committee on Internal Revenue Taxation, 1970). Return to 7

- In practice, corporations can carry forward losses for future tax benefits, but this can be done for only a few years. In 1971 and 1972, Commonwealth was forced to write down some of this deferred tax asset when it was clear that the bank would not be able to use it (Bank of the Commonwealth, 1972). Return to 8

- Board of Governors of the Federal Reserve System H.15, retrieved from FRED. Return to 9

- At the time, banks used book accounting for securities, and the Call Reports contain no information on the market value or duration of securities. However, some banks reported the market value of their securities in their annual reports, and Commonwealth was one such bank. Return to 10

- Prior to 1970, Commonwealth Annual Reports did not report market value separately for municipal, Treasury, and other securities. However, by 1967 municipal securities were about 80 percent of the total book value of its security portfolio, and this percentage does not drop significantly until 1972, when as part of the FDIC’s bailout, Commonwealth liquidated much of its municipal security portfolio. Return to 11

- The Federal Reserve’s Regulation Q originated in the Banking Act of 1933, which gave the Federal Reserve authority to put ceilings on commercial bank time and savings deposits. Regulation Q ended in 1986. For the history of this regulation, see Gilbert (1986). Return to 12

- The “Essentiality Doctrine” refers to Section 13(c) of the Federal Deposit Insurance Act, which allowed the FDIC to provide assistance to keep a bank open if the FDIC finds that the failing bank was “essential to provide adequate banking service in its community.” For more on the history of this doctrine, see Horvitz (1986) or Nurisso and Prescott (2017, 2020). This doctrine was repealed in the Federal Deposit Insurance Corporation Improvement Act of 1991. Return to 13

- Author’s calculations from 12/31/2022 Call Report. Return to 14

- This act created the systemic risk exception that allows the FDIC to waive least cost resolution if certain statutory requirements are met (Congressional Research Service, 2023). It was also used for Signature Bank. Return to 15

- Author’s calculations from 12/31/2022 Call Report. Return to 16

- See Federal Deposit Insurance Corporation (2023) for more details. The lending by other banks to keep First Republic afloat also has earlier precedents. In 1983, when Seafirst got into trouble from energy lending, Seafirst was kept afloat by loans from a consortium of banks until an acquirer could be found (Brimmer, 1984; Nurisso and Prescott, 2017, 2020). Return to 17

- Commonwealth did hold residential mortgages so had some interest rate risk from this source, as well. At the end of 1970, residential mortgages were 17 percent of assets (author’s calculations from 12/31/1970 Call Report). Unfortunately, neither the Call Report nor Commonwealth’s annual reports provide any information on the duration of these loans. Return to 18

- Author’s calculations from the Flow of Funds accounts (now called the Financial Accounts). The Flow of Funds defines “Savings Institutions,” what is referred to in this Economic Commentary as the “thrift sector,” as savings and loans, mutual savings banks, and federal savings banks. Return to 19

Suggested Citation

Prescott, Edward S. 2024. “The Failure of the Bank of the Commonwealth: An Early Example of Interest Rate Risk.” Federal Reserve Bank of Cleveland, Economic Commentary 2024-06. https://doi.org/10.26509/frbc-ec-202406

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International