- Share

Monetary Policy since the Onset of the COVID-19 Pandemic: A Path-Dependent Interpretation

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

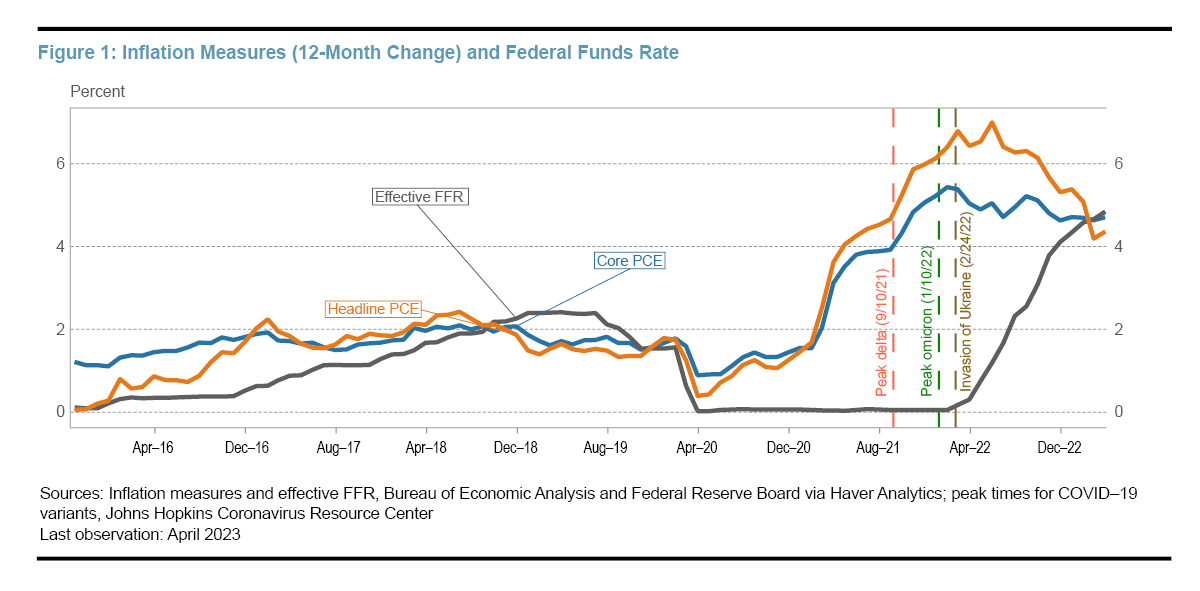

The SARS-CoV-2 (COVID-19) pandemic levied a largely unexpected negative shock to the US economy, and the Federal Open Market Committee (FOMC) quickly responded to that shock by lowering the federal funds rate (FFR) to its effective lower bound (ELB) in March 2020 (Figure 1). Just more than a year later, in the second half of 2021—after the COVID-19 vaccine became widely available and the US economy had progressed in its recovery period—the leading policy question the Fed faced changed from one concerning how to provide extra accommodation to one that examined when the FOMC might lift the policy rate from zero.

In June 2021, inflation in the United States started to rise, with headline PCE at 4.0 percent and core PCE at 3.6 percent year over year (Figure 1). In the June 2021 FOMC meeting, the committee decided not to raise the policy rate. In addition, the Summary of Economic Projections (SEP) released after the meeting shows the median projection of the appropriate policy rate staying at zero through the end of 2021. Chair Jerome Powell explained on several occasions that high inflation was temporary and largely a result of supply chain issues and thus did not yet warrant an adjustment in the FFR.1 Although inflation did not slow as expected, and, in fact, rose instead, the FOMC did not increase the policy rate from zero until its March 2022 meeting, at which time headline PCE inflation had risen to more than 6 percent.

Many people attribute the Fed’s delay in tightening monetary policy to FOMC participants’ underestimating the persistence of inflation. At the March 2022 FOMC post-meeting press conference, Chair Powell also noted that inflation dynamics after the reopening of the economy did not go as anticipated: “The help we’ve been expecting and other forecasters have been expecting from supply-side improvement, labor force participation, bottlenecks, all those things getting better—it hasn’t come” (Powell, 2022).

Admittedly, there were unexpected factors that prevented supply-side conditions from improving, such as the emergence of the COVID-19 delta variant and the omicron variant outbreak. However, one might wonder whether the underestimation of inflation persistence is the only explanation for the delay in policy response. Alternatively, could the delay reflect a systematic and deliberate policy underreaction to inflation? To answer this question, we study the Fed’s expected policy adjustments conditional on its own expectations of inflation dynamics. In this approach, by strictly looking at the Fed’s own expected policy response based on its own forecasts of economic conditions, we abstract from the forecast errors and unexpected economic shocks that led to the possible underestimation of inflation persistence.2 In doing so, we find evidence that in 2021 the FOMC thought it would be appropriate to hold the FFR at its ELB rather than raise rates in response to the anticipated increase in inflation in 2021, but, at the same time, the FOMC expected to raise the FFR over a two-year period by more than inflation was expected to increase. We posit that the Fed chose this gradual approach because the pandemic recession was a negative demand shock to the economy, one that pushed the policy rate to its ELB. This is consistent with the economic literature, which suggests that optimal monetary policy includes an inertial response when moving away from the ELB.

The Conditional Reaction of Monetary Policy

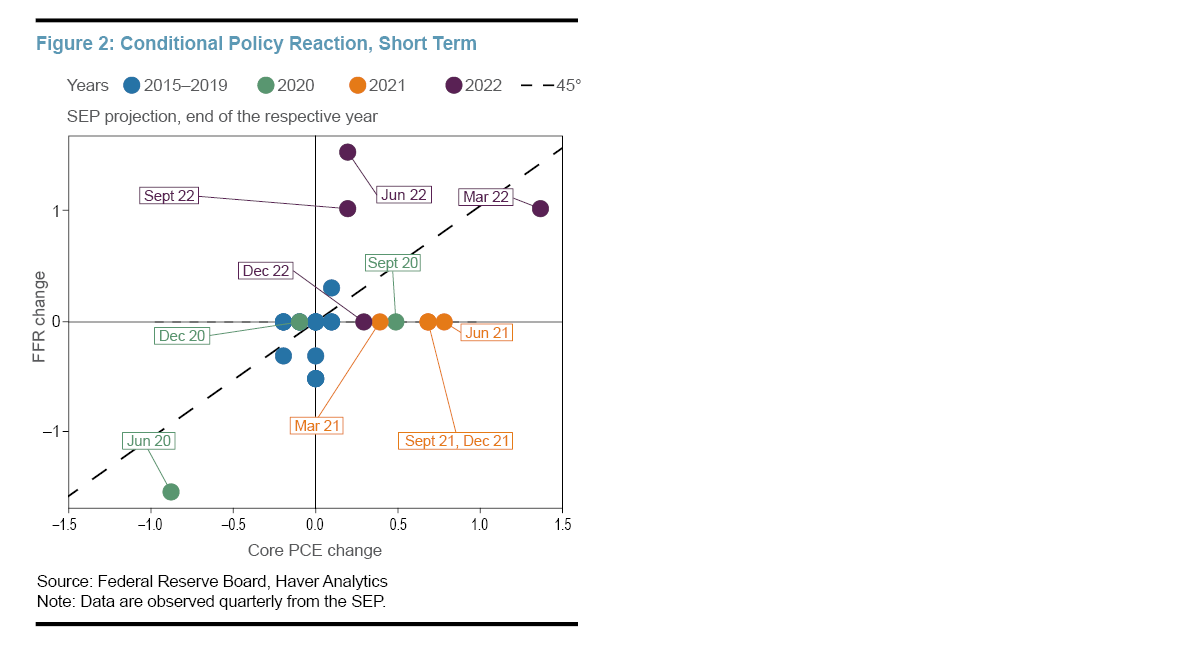

According to the canonical model of the economy and monetary policy widely used in macroeconomic research, under a policy framework that targets inflation, when inflation rises (or falls), the central bank needs to raise (or lower) its policy rate at least one for one (for example, if core PCE inflation goes up by 0.5 percentage points, the FFR responds with at least a 0.5 percentage point increase) in order to ensure the stability of the economy over time.3 In this section, we use this guideline to investigate how US monetary policy responded to changes in inflation rates in recent years compared to the model-implied policy response under inflation targeting.

Abstracting from the effects of unanticipated shocks and policy underreaction that may be attributed to errors in forecasting inflation and the strength of the labor market and economy, we measure the Fed’s policy response function by the relationship between the expected policy rate and the expected inflation rate of FOMC participants. The SEP surveys each FOMC participant’s forecast of economic fundamentals and his or her view of the appropriate path of the FFR, information which offer insights into the committee’s policy decisions. Throughout, we refer to the median forecast and median view of the FFR. For simplicity, hereafter we will sometimes refer to the “expected” FFR, recognizing that the SEP reports participants’ views of the appropriate stance of policy, not their best forecasts or expectations of what policy will be.

Short-Term Projections

We first study the relationship between the expected policy rates and expected inflation in the short run, defined as the end of the current year (that is, the end of the year in which a given meeting’s SEP was published). We compute the changes in projections by calculating the differences between the end-of-year expectations of the corresponding variable (FFR or core PCE) of one release and that of the previous release. When going into a new year, we compare the expectations for the end of the current year in the Q1 SEP to the one-year ahead expectations in the previous year’s Q4 SEP.4 Figure 2 plots the changes in the median projections of the FFR against that of core PCE inflation rates from September 2015 (first release) to December 2022. As a benchmark, the figure includes a dotted line to represent one-for-one movements of the expected FFR with expected inflation.

This article focuses on the policy response for the three years following the onset of the COVID-19 pandemic, and we highlight data points during this period in green (2020), orange (2021), and purple (2022). Data points colored in blue refer to the earlier period of 2015–2019.5 6

Figure 2 shows two phases of policy intentions. The first one is the low-for-long period from the beginning of the COVID economic crisis to the end of 2021, a period of policy underreaction (at least in the short run) relative to the canonical model guidepost described above. Specifically, except for the June 2020 SEP,7 all data points are on the horizontal axis. Points on the horizontal axis reflect the cases in which the median expectation of core PCE inflation rises or falls while at the same time the median expectation of the FFR remains unchanged.8 During this period, policymakers expected to hold the federal funds rate at its ELB while inflation was expected to increase.

The second phase is the expected policy “catch-up” period in 2022. For example, the median expectation of the end-of-year FFR is 1.5 percentage points higher in the June 2022 SEP than in the previous SEP, whereas the median expectation of the end-of-year core PCE inflation rate was only 0.2 percentage point higher than in the previous SEP. As we entered 2022, it became clear that inflation was more persistent than previously thought, and policy pivoted and began to move the FFR target up rapidly.

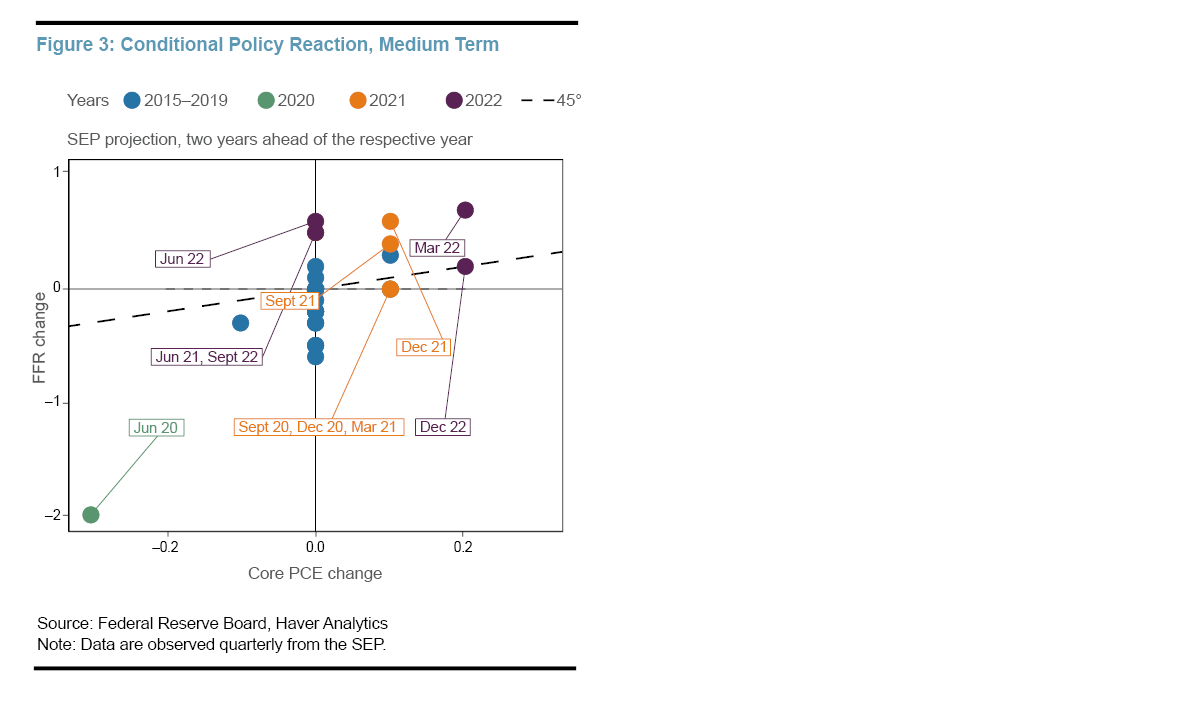

Medium-Term Projections

Next, we examine whether this policy pivot from policy underreaction to aggressive rate hikes was already part of the policy plan before 2022 by studying the Fed’s medium-term expectations. Figure 3 plots the changes in medium-term projections of PCE inflation and the FFR for the two years after each FOMC meeting.

Compared to the placement of data points in Figure 2, there are fewer data points on the horizontal axis in Figure 3. Rather, almost all the points from 2021 and 2022 are either on the vertical axis or above the 45-degree line, indicating that the FOMC expected to raise the FFR by more than it expected inflation to rise over the following two years.

More importantly, comparing the short-term expectations and the medium-term expectations in the June, September, and December 2021 SEPs, it appears that while the FOMC thought it was appropriate to keep the policy rate unchanged by the end of 2021, it also thought that from 2021 to 2023 the FFR should be raised by more than inflation was expected to increase.

In summary, we show two key findings from the FOMC’s short-term and medium-term projection in the SEP. First, during 2020 and 2021, there are frequent occurrences in which projected end-of-year core PCE inflation increases but the expected end-of-year FFR does not. Second, while the FFR was expected in the short term to underreact to rising inflation before 2022, the FOMC participants had expected a gradual approach to fight inflation because it expected to make the policy rate catch up to inflation in two years.

Was the Conditional Monetary Policy Reaction Anticipated by the Private Sector?

We use the Survey of Primary Dealers (SPD) to gauge the private-sector’s expectations for future monetary policy. The SPD is conducted by the Federal Reserve Bank of New York in advance of each FOMC meeting. The SPD is especially useful to compare with the SEP because it asks what respondents believe the median projections will be in the SEP. We focus on the period from the start of the COVID-19 pandemic until December 2022.9

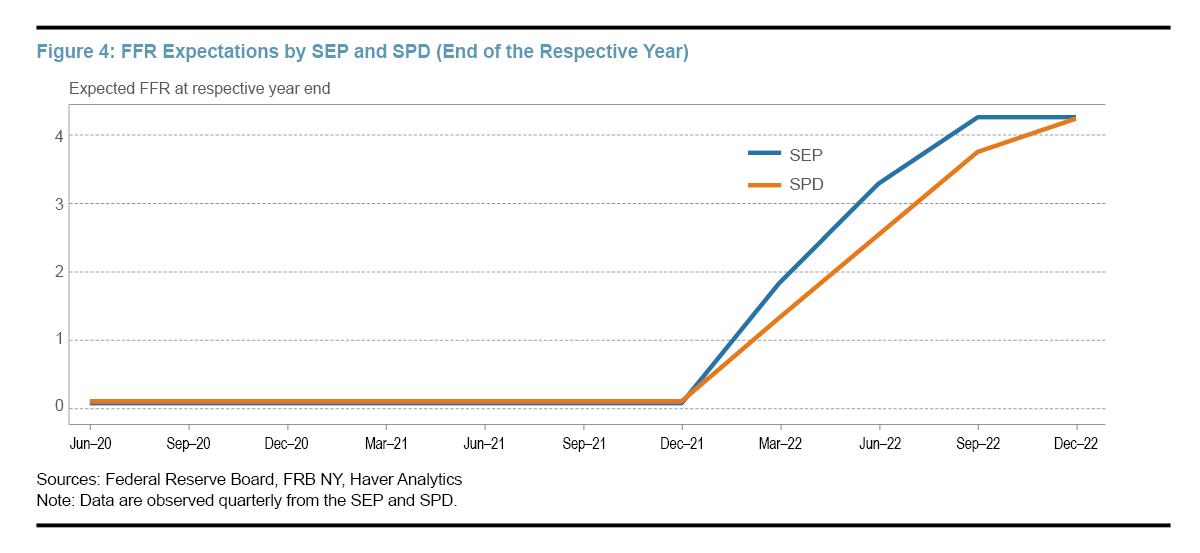

In Figure 4, we plot each SEP’s median expectation of the appropriate FFR at the end of the respective year and the SPD’s median forecast of the same variable.10 The SEP’s median projection of the appropriate FFR and the SPD’s corresponding projection are closely aligned until the end of 2021. This alignment may indicate that the private sector expected that, on average, SEP participants did not think it would be appropriate to lift the policy rate from zero before the end of 2021. After December 2021, we see that the difference between these two expectations starts to widen. From the first through the third quarter of 2022, the private sector expected that the SEP’s median projection of the appropriate policy rate would be lower at the end of 2022 compared to the median of the SEP participants’ views.

While not shown in the figure, the median SPD projections for core PCE inflation for the year were also lower than the projections in the SEP from the end of 2021 through the third quarter of 2022.11 So, one possibility for the private sector’s underprediction of the FFR might be that the private sector understands the conditional policy rule but underpredicted the inflation rate compared to the predictions of FOMC participants on average.

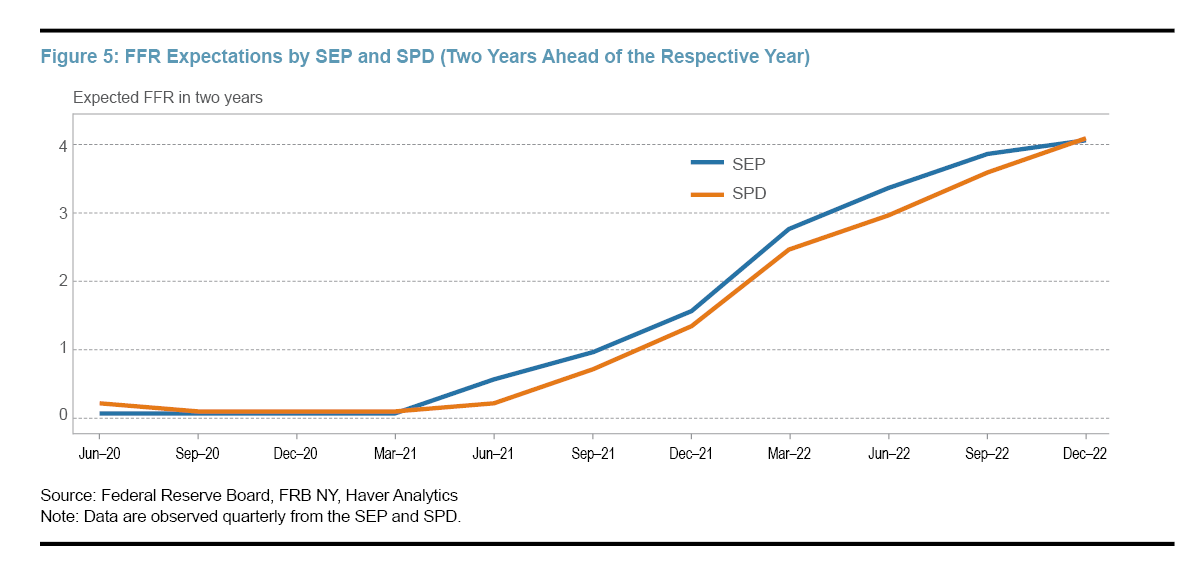

In Figure 5, we plot each SEP’s median FFR projection two years ahead of the respective year along with the SPD’s forecast of the SEP’s FFR median expectation. The private sector’s expected medium-term FFR in the SEP closely matches the actual median of SEP participants’ views of the appropriate level of the medium-term FFR until March 2021. After that, the private sector expected the medium-term FFR in the SEP to be only slightly lower than the median of projections in the SEP. This relative parity suggests that the FOMC’s intention to tighten monetary policy over two years is generally understood by the private sector.

Thus, data from the SPD and SEP show that, in 2021, although the FOMC did not tighten policy immediately after it expected inflation to rise, the committee on the whole thought it would be appropriate over the medium term to gradually increase the policy rate to keep pace with inflation, and this intention was largely understood by the private sector.

A Path-Dependent Interpretation

In this section, we take up the question of how monetary policy decisions in the three years following the outbreak of the pandemic may be interpreted. Economic literature on optimal monetary policy has examined various possible approaches to the conduct of monetary policy. Under one approach, a central bank can adjust its policy rate on a meeting-by-meeting basis, sometimes making large changes in the rate, in an effort to keep inflation at target in every single period. Alternatively, a central bank can take a systematic, gradual approach to policy adjustments.12 The gradual approach can yield better outcomes in maximizing employment and maintaining price stability in two situations: The first occurs when the policy rate is at the effective zero lower bound (ELB) (Eggertsson and Woodford, 2003); the second occurs when the economy is hit by a supply shock that pushes up production costs, commonly referred to as a “cost-push shock” (Clarida, Gali, and Gertler, 1999). The first case, the ELB, is particularly relevant for the period of difficult policy decisions in 2021 because the pandemic led the FOMC to reduce the policy rate to its ELB in 2020.13

Using a canonical theoretical model of the economy and monetary policy, Eggertsson and Woodford (2003) describe the optimal monetary policy plan when the ELB is reached. Consider the situation when the economy is hit by a negative demand shock and the central bank wants to encourage economic activity and spending by consumers but cannot further reduce the policy rate below zero. In this case, the central bank can still affect the economy by committing to an extended period of accommodative policy in future periods. That is, the central bank will set future monetary policy lower than the optimal policy that keeps inflation on target. If such a policy plan is communicated by the central bank to the private sector, informed households would expect inflation to rise in the future. This pushes down real (inflation-adjusted) interest rates, a shift which in turn reduces the return on savings. In response, some households boost their current spending, and therefore current aggregate demand increases. The effectiveness of this policy strategy rests on the public credibility of the central bank’s commitment to keep rates lower in the future than it otherwise would.14

Although this policy plan improves the economic outcomes at the time when the ELB binds, it comes with a cost to the economy in future periods. When the economy has recovered from the negative shock and inflation starts to rise, the central bank needs to keep its commitment by not raising the policy rate; otherwise, the next time the economy hits the ELB on interest rates, the lower-for-longer policy commitment would not be credible to the public. Although not raising the current policy rate is not optimal when inflation is above the FOMC’s 2 percent target, it is part of the optimal policy plan that, earlier in time, helped the economy at the ELB. In fact, it is the commitment made at the ELB not to raise the policy rate in the future period that raised expected future inflation, an expectation that, in turn, brought down the real interest rate at the ELB and stimulated spending. In other words, the optimal policy is “path dependent”: previous economic conditions may require a central bank to implement policy decisions according to a previous commitment instead of targeting a 2 percent inflation rate every period.

The Fed’s new policy framework, adopted in late 2020, further confirms that it is desirable to make monetary policy path dependent.15 Under the previous framework, commonly characterized as “flexible inflation targeting,” the FOMC set policy to achieve maximum employment and an inflation target of 2 percent over time. When inflation deviated from 2 percent, policy sought to return inflation to the target without compensating for past overruns or shortfalls. The new framework features a flexible approach to average inflation targeting. Under this approach, the FOMC has indicated it will consider past inflation in making policy decisions. In particular, when inflation has been “running persistently below 2 percent,” the FOMC is expected to promote inflation “moderately above 2 percent for some time” (Board of Governors, 2020). This new framework is designed to reduce the chances that the economy will be stuck at the ELB with inflation running below 2 percent for an extended period of time.

Both the economic theory of optimal monetary policy at the ELB and the Fed’s new policy framework are applicable for interpreting the policy decisions made by the FOMC in the three years following the onset of the COVID-19 pandemic. Initially, when the pandemic struck the US economy in March 2020 by way of business closures and other strict social distancing measures that affected the overall economy, the Fed swiftly responded by lowering the policy rate to the ELB. In addition, the FOMC provided explicit forward guidance of an extended period of accommodative policy.16 Following such forward guidance, the Fed kept the FFR at the ELB until the end of 2021, several months after inflation started to rise rapidly. As noted previously, evidence from the SEP shows that the Fed’s approach to post-pandemic policy included two parts. First, in the short term, the FOMC expected to commit to keeping the FFR near zero. In the context of the theory of optimal policy, it could be argued that doing so would prove beneficial to the Fed’s credibility the next time the economy is at the ELB. Second, in the medium term, the FOMC expected to raise the FFR at a rate faster than that of inflation. Eventually, in 2022, once the committee realized inflation’s persistence, the FOMC adjusted course and implemented a pace of rate hikes faster than the committee had anticipated in 2021. Under this approach, the adjustments in the FFR would keep pace with changes in inflation on average over time.

Conclusion

In this Economic Commentary, we examine the Fed’s policy response in the three years following the onset of the COVID-19 pandemic in March 2020 with a focus on the period during which some observers believe the FOMC was slow to raise the FFR in response to rising inflation. We show evidence from the SEP that although the FOMC decided not to tighten monetary policy immediately after it expected inflation to rise, the committee expected to increase the policy rate over a two-year period. We further show that this gradual approach was largely understood by the private sector, as demonstrated in the SPD.

Why did the Fed choose this gradual approach rather than an immediate response to rising inflation? We argue that the Fed did so because the COVID-19 economic recession was a negative demand shock to the economy that pushed the policy rate to its ELB. The economic literature on optimal monetary policy suggests a gradual approach to lifting the policy rate from its ELB, because although such an approach leads to an inflation rate higher than the target, a circumstance that is suboptimal in the moment, such an approach provides the central bank with an alternative tool to stimulate the economy at the ELB, such as in the case of the pandemic. The combination of the delay of rate increases in the short term and the catch-up policy in the medium term helps the Fed maintain policy credibility after providing forward guidance during the COVID-19 pandemic and anchor inflation expectations in the long run. In 2022, once inflation’s persistence at a high level became clear, the Fed pivoted from underreaction to an aggressive policy response to rising inflation.

Endnotes

- For example, Chair Powell stated in a testimony to the US House of Representatives that “Those are things that we would look to to stop going up and ultimately to start to decline as these situations resolve themselves.” See https://www.govinfo.gov/content/pkg/CHRG-117hhrg45368/pdf/CHRG-117hhrg45368.pdf. Return to 1

- Gordon and Clark (2023) find that both demand and supply shocks, including supply chain disruptions, have contributed significantly to unexpected inflation from 2020 through 2022. Return to 2

- The canonical model is known as the New Keynesian model and features price or wage setting frictions that allow monetary policy to have real effects on output in the short run. The benchmark for the inflation-targeting policy framework is known as the Taylor rule (Taylor, 1993), which describes how the FFR should respond to the difference between the actual and targeted inflation rates and the deviation of real gross domestic product from potential output. Return to 3

- See the online appendix for more details. Return to 4

- The onset of the COVID-19 pandemic occurred in March 2020, when COVID-19 was declared a pandemic by the World Health Organization. Return to 5

- Data points may overlap each other, in which case multiple datapoints are represented by one blue dot. Return to 6

- The June 2020 SEP is the first SEP release since the onset of the COVID-19 pandemic. Therefore, it reflects the changes in FOMC participants’ expectations from December 2019 to June 2020, including the effects of the Fed’s immediate rate cut in March 2020. Return to 7

- The above result is robust if we assume the Fed takes a balanced approach (for example, 0.5 weight on inflation and 0.5 weight on unemployment). See Figure A.1 in the appendix. Return to 8

- The first SEP release since the start of the COVID-19 economic crisis in US occurred in June 2020. Return to 9

- This is question 1b) in the SPD and asks, “What are your expectations for the most likely levels of the medians of FOMC participants’ target federal funds rate projections in the SEP?” Return to 10

- The SPD asks respondents to provide their “estimate of the most likely outcome for output, inflation, and unemployment.” Figure A.2 in the appendix shows the results. Return to 11

- The first approach is often called a “discretionary policy” and the second a “policy rule” in the economic literature. See Kydland and Prescott (1977) for one of the earliest discussions of these two types of monetary policy. Return to 12

- The case of a cost-push shock may also be relevant for the current situation, although there may not be agreement as to whether the high inflation rate after the COVID-19 crisis is demand driven (because of demand shocks such as fiscal policy changes) or supply driven (because of cost-push shocks such as oil price shocks or supply-chain shocks). Return to 13

- A caveat is that it might be hard for central banks to effectively communicate their policy plans to households, as shown by Coibion et al. (2022). Return to 14

- The Fed’s new policy framework was announced by Chair Powell at the 2020 Jackson Hole symposium, with details explained in the revised “Statement on Longer-Run Goals and Monetary Policy Strategy” (Board of Governors, 2020). Return to 15

- For example, in June 2021, the FOMC announced in its public statement that “With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.” Return to 16

References

- Board of Governors of the Federal Reserve System. 2020. “2020 Statement on Longer-Run Goals and Monetary Policy Strategy.” https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm.

- Clarida, Richard, Jordi Galí, and Mark Gertler. 1999. “The Science of Monetary Policy: A New Keynesian Perspective.” Journal of Economic Literature 37 (4): 1661–1707. https://doi.org/10.1257/jel.37.4.1661.

- Coibion, Olivier, Yuriy Gorodnichenko, Edward S. Knotek II, and Raphael S. Schoenle. Forthcoming. “Average Inflation Targeting and Household Expectations.” Journal of Political Economy Macroeconomics. https://doi.org/10.1086/722962.

- Eggertsson, Gauti B., and Michael Woodford. 2003. “The Zero Bound on Interest Rates and Optimal Monetary Policy.” Brookings Papers on Economic Activity 34 (1): 139–233. https://doi.org/10.1353/eca.2003.0010.

- Gordon, Matthew V., and Todd E. Clark. 2023. “The Impacts of Supply Chain Disruptions on Inflation.” Economic Commentary, no. 2023-08 (May). https://doi.org/10.26509/frbc-ec-202308.

- Kydland, Finn E., and Edward C. Prescott. 1977. “Rules Rather than Discretion: The Inconsistency of Optimal Plans.” Journal of Political Economy 85 (3): 473–91. https://doi.org/10.1086/260580.

- “Lessons Learned: The Federal Reserve’s Response to the Coronavirus Pandemic.” 2021. Hearing before the Select Subcommittee on the Coronavirus Crisis of the Committee on Oversight and Reform, House of Representatives, 117th Congress, First Session, June 22 Document 117-30. http://www.congress.gov/event/117th-congress/house-event/LC67052/text.

- Powell, Jerome H. 2022. “Transcript of Chair Powell’s Press Conference, March 16, 2022.” Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220316.pdf.

- “Press Release: Federal Reserve Issues FOMC Statement.” 2020. Board of Governors of the Federal Reserve System. June 10, 2020. https://www.federalreserve.gov/newsevents/pressreleases/monetary20200610a.htm.

- Taylor, John B. 1993. “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Conference Series on Public Policy 39 (December): 195–214. https://doi.org/10.1016/0167-2231(93)90009-L.

Suggested Citation

Healy, Christopher, and Chengcheng Jia. 2023. “Monetary Policy since the Onset of the COVID-19 Pandemic: A Path-Dependent Interpretation.” Federal Reserve Bank of Cleveland, Economic Commentary 2023-12. https://doi.org/10.26509/frbc-ec-202312

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International