- Share

Trend Inflation and Implications for the Phillips Curve

This Economic Commentary estimates trend PCE inflation and a Phillips curve with time-varying parameters while allowing for trend inflation to affect the frequency at which firms change prices. Since the beginning of 2021, trend PCE inflation has risen well above the FOMC’s 2 percent long-term inflation target, and the most recent estimate of trend inflation in 2022:Q4 is 3.4 percent. With the increase in trend inflation, the Phillips curve slope has risen above its prepandemic level. At the same time, the relationship between current inflation and inflation expectations has strengthened. Together, these results imply that even though a slowing economy would help to bring down inflation through the steeper slope of the Phillips curve, high short-term inflation expectations could put upward pressure on inflation to a larger extent than they had prior to the pandemic.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Since the middle of 2021, inflation has been running well above the Federal Open Market Committee’s 2 percent long-term target. The starting point for economists when thinking about inflation dynamics is usually the Phillips curve, which describes the relationship between inflation and economic activity, expectations about future inflation, and expectations about future economic activity, along with other factors. The parameters of the Phillips curve determine the role that each of these factors plays in explaining inflation. For example, expectations of future inflation typically play a prominent role in modeling current inflation. With various sources showing that consumers and firms expect that inflation will be elevated even a year from now, these high inflation expectations risk becoming self-fulfilling. The slope of the Phillips curve quantifies the relationship between inflation and economic activity. To bring down inflation, monetary policy actions contribute to slowing economic activity and then to declining inflation depending on the magnitude of the Phillips curve slope.

Estimating the parameters of the Phillips curve is challenging because they are not necessarily stable over time. Research suggests that the parameters of the Phillips curve depend on the inflationary environment, especially trend inflation, or where inflation is likely to settle in the longer run. Time-varying trend inflation thus can have key implications for the dynamics of current inflation.1

In this Economic Commentary, I estimate the evolution of trend PCE (personal consumption expenditures) inflation using data from 1960:Q3 through 2022:Q4 based on the technique proposed in Cogley and Sargent (2005). I embed these trend inflation estimates into the estimation of a Phillips curve with potentially time-varying parameters, as in Cogley and Sbordone (2008). Different from that work, however, my estimation allows trend inflation to have an effect on the flexibility of firms’ prices and can thus further affect the Phillips curve.

I highlight three main results for the period from 2021:Q1 through 2022:Q4. First, trend PCE inflation has risen above the 3.3 percent historical average for quarterly annualized PCE inflation, and hence it is well above the 2 percent long-term inflation target, with the most recent estimate of trend inflation in 2022:Q4 being 3.4 percent. Second, with the increase in trend inflation, the Phillips curve slope has risen slightly above its prepandemic level, implying that monetary policy is able to have slightly more powerful effects on inflation than in the prepandemic period. Third, with a high level of trend inflation, the relationship between inflation and inflation expectations is stronger than its historical average, but I find that short-term inflation expectations matter more for current inflation than do longer-term inflation expectations.

The main takeaway of this Economic Commentary is that slowing economic activity can contribute to decreasing inflation through the somewhat steeper slope of the Phillips curve, but in the meantime, heightened short-term inflation expectations would continue to be an upward risk for current inflation even if long-term inflation expectations are anchored around the long-term inflation target of 2 percent.

Methodology

I first estimate trend PCE inflation over the period from 1960:Q3 through 2022:Q4 using the methodology of Cogley and Sargent (2005), and then I estimate the parameters of the Phillips curve relying on the methodology of Cogley and Sbordone (2008). To compute the inflation trend, I estimate a time-varying vector autoregressive model with two lags (VAR(2)) in four variables: real output growth, PCE inflation, the federal funds rate, and unit labor costs. Trend inflation in every period is defined as the level to which inflation is expected to settle after short-term fluctuations die out.

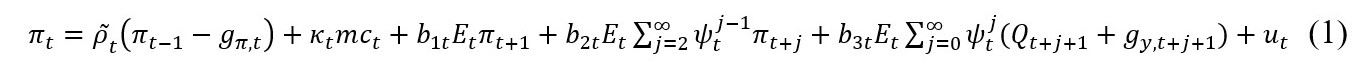

With those estimates of trend inflation, I next estimate a potentially time-varying Phillips curve that takes the following form:2

where πt is inflation measured by the PCE growth rate; mct is the marginal cost, measured through unit labor costs; Qt denotes the stochastic discount factor between period t – 1 and period t, measured by the federal funds rate; gy,t denotes real output growth; gπ,t denotes innovations in trend inflation; and ut is a measurement error.3 In this equation, κt measures the relationship between current inflation and marginal costs, also known as the Phillips curve slope; b1t measures the link between current inflation and one-quarter-ahead inflation expectations; b2t measures the link between current inflation and longer-term inflation expectations; b3t measures the link between current inflation and longer-term expectations about output growth and the federal funds rate; and ψt is a discount factor. I note that all parameters have a t subscript and thus can depend on the estimated trend inflation. If one assumes instead that the trend is fixed over time, then the Phillips curve parameters would also be constant over time. Expectations about future realizations of the different variables are disciplined using the estimated time-varying VAR(2), which was briefly described previously.

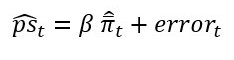

Different from Cogley and Sbordone (2008), when estimating the dynamic parameters of the Phillips curve, I allow for a link between trend inflation and the flexibility of firms’ prices, relying on a strategy similar to that in L’Huillier and Schoenle (2022). More specifically, taking advantage of the US price change frequency data from 1978 through 2014 constructed by Nakamura et al. (2018), I separately estimate the correlation between price stickiness and trend inflation, and I account for that relationship in the estimation process of the remaining the parameters.4 Indeed, I find that a 1 percentage point increase in quarterly trend inflation is associated with a 2.8 percentage point decline in the quarterly probability that firms do not adjust their price.

Results

In the first stage, I estimate trend PCE inflation. Figure 1 exhibits the evolution of quarterly annualized PCE inflation (in solid black) jointly with the dynamics of the estimated quarterly annualized trend PCE inflation rate (in solid red), the historical mean of quarterly annualized PCE inflation (in dotted black), and the 2 percent inflation target (in dashed blue). Clearly, the estimate of trend inflation has been above the historical average for PCE inflation of 3.3 percent since the beginning of 2021. As of 2022:Q2, trend inflation has started to dip slightly downward, but its value in 2022:Q4 remained high at 3.4 percent.5 The elevated trend inflation suggests that some of the recent rise in inflation is expected to persist for a while and thus may have implications for the Phillips curve.

Using the estimates of trend inflation, I next estimate the parameters of the time-varying Phillips curve in the equation above. Figure 2 plots the evolution of the estimated Phillips curve slope (in solid blue) jointly with the estimated quarterly annualized trend inflation (in dotted red), with the y axis on the left-hand side showing the scale of the Phillips curve slope and the y axis on the right-hand side showing the scale for trend inflation. Figure 2 reveals that the Phillips curve slope, κt increases when trend inflation goes up. Compared to that in the historical past and prepandemic era, the slope is now higher, but not as high as it was during the 1970s. The slope of the Phillips curve quantifies the relationship between inflation and economic activity. Since monetary policy actions transmit to economic activity, the slope of the Phillips curve also determines the extent to which monetary policy affects inflation through its impact on economic activity. It is worth noting that, consistent with other evidence in the literature, the magnitude of the Phillips curve slope has remained low over time.6 The latest estimate of the Phillips curve slope in 2022:Q4 is around 0.1, and it is only slightly higher than the estimate in 2020:Q1.

That the Phillips curve slope comoves with trend inflation is a consequence of the fact that the flexibility of firms’ prices is positively correlated with trend inflation. The intuition is that as trend inflation increases, firms change prices more frequently, and, therefore, inflation becomes more responsive to economic activity.7

Next, I turn to the relationship between current inflation and inflation expectations. Figure 3 shows the evolution of two of the coefficients from the Phillips curve: the relationship between inflation and short-term inflation expectations, b1t in panel (a), and the relationship between inflation and longer-term inflation expectations, b2t, in panel (b). The most recent estimates of b1t and b2t in 2022:Q4 are around 0.8 and 0.1, respectively. It is important to note that as trend inflation increases, the relationship between inflation and inflation expectations becomes stronger. The estimated coefficients exhibited in Figure 3 peak in the 1970s, early 1980s, and the 2020s, when trend inflation was high. The same coefficients are estimated to be lower in the 1990s and 2010s, when trend inflation was low.

Since the beginning of 2021, the coefficients capturing the link between inflation and inflation expectations have been elevated above their historical averages. It is important to emphasize that the relationship between current inflation and short-term inflation expectations is much stronger than the relationship between current inflation and longer-term inflation expectations in this model. Finally, the estimated link between current inflation and expectations about future economic activity is weak (to the order of three decimal digits), and hence the evolution of the series is not exhibited here.

The finding of an amplified relationship between current inflation and short-term inflation expectations is important, given the continuously elevated levels of short-term inflation expectations of consumers and—most importantly for this exercise—firms. For more context, Table 1 provides a list of firms’ and consumers’ 1-year-ahead inflation expectations from various sources at the end of 2022:Q4 or beginning of 2023.8

As the table shows, short-term inflation expectations have been elevated at the end of 2022, all of them remain well-above the 2 percent target, and—other than the Atlanta Federal Reserve’s business inflation expectations—all of them are above the estimated trend inflation rate of 3.4 percent in 2022:Q4. These data imply that heightened short-term inflation expectations (above trend inflation) can feed into higher inflation, and this channel has become even stronger recently (as shown in panel (a) of Figure 3). From a policy perspective, this finding further implies that there might be added benefits to responding aggressively to current inflation so that trend inflation cools more substantially. In that case, even if inflation expectations remain elevated for some time in the near future, they will not be contributing as much as they are now to current inflation because the link between the two would weaken.

Conclusion

This Economic Commentary sheds some light on the behavior of the Phillips curve when trend inflation is allowed to be time-varying. Building on the research literature, I start by estimating trend inflation using a VAR(2) model with time-varying parameters. In a second step, I estimate the parameters of the Phillips curve.

The Economic Commentary highlights three results. First, trend PCE inflation started rising noticeably in 2020, and since the beginning of 2021 trend PCE inflation is measured to be above the historical average of PCE inflation of 3.3 percent (above the long-term inflation target of 2 percent). Second, the Phillips curve slope has moderately increased, implying that monetary policy actions to influence economic activity can have slightly more powerful effects on inflation, but the slope remains low in absolute terms. Third, with the rise in the estimated inflation trend, the linkages between current inflation and inflation expectations, as captured by the Phillips curve, have strengthened. The main takeaway of this Economic Commentary is that while a slowing economy would help to bring down inflation through the steeper slope of the Phillips curve, elevated short-term inflation expectations—which are estimated to have a larger impact on inflation in this model than longer-term inflation expectations—could keep boosting inflation to a larger extent than they had during the prepandemic period.

Endnotes

- See Ascari and Sbordone (2014) for a thorough review of this branch of the literature. Return to 1

- As in Cogley and Sbordone (2008), the Phillips curve is optimally derived from the firms’ profit maximization problem, in partial equilibrium, that is, taking demand-side fluctuations as given. Firms’ problem is subject to Calvo price stickiness; that is, in each period, firms cannot reset their prices with some probability. Moreover, the assumption of full-information rational expectations has been relaxed for tractability reasons. This assumption generally implies that longer-term expectations of various variables become important for current inflation, as emphasized in papers such as Preston (2005), Eusepi and Preston (2018), Werning (2022), and Hajdini (2023), among many others. Return to 2

- All variables except the measurement error term ut are expressed in log-deviations from their steady-state values. Return to 3

- In particular, I estimate the following regression separately:

where is quarterly price stickiness in deviations from its historical mean;

is quarterly price stickiness in deviations from its historical mean;  is the estimated trend PCE inflation in deviations from its historical mean. The OLS estimate of β is equal to -2.8 with standard error 0.503.*

Return to 4

is the estimated trend PCE inflation in deviations from its historical mean. The OLS estimate of β is equal to -2.8 with standard error 0.503.*

Return to 4

- The estimated trend inflation of 3.4 percent in 2022:Q4 is smaller than the Multivariate Core Trend estimate of 3.7 percent in December 2022 (see Almuzara and Sbordone (2023)), but it is higher than some other estimates in the literature; for instance, the methodology of Zaman (2022) estimates trend inflation to be 2.4 percent in 2022:Q4. Return to 5

- See, for instance, Nakamura et al. (2022) and references therein. Return to 6

- By contrast, in Cogley and Sbordone (2008) the flexibility of firms’ prices is assumed to remain constant over time, and, as a result, their estimated Phillips curve slope is negatively associated with trend inflation. However, as shown in footnote 4, the frequency at which firms do not change their prices is negatively correlated with trend inflation (or, equivalently, the frequency at which firms change their prices is positively correlated with trend inflation). Return to 7

- The Survey of Firms Inflation Expectations (SoFIE) is a new source of firms’ inflation expectations, see Candia et al. (2021). For a detailed theoretical and empirical analysis on the novel measure of Indirect Consumer Inflation Expectations (ICIE), see Hajdini et al. (2022a, 2022b). Return to 8

References

- Almuzara, Martin and Argia M. Sbordone. 2023. “Inflation Persistence—An Update withDecember Data,” Federal Reserve Bank of New York Liberty Street Economics. https://libertystreeteconomics.newyorkfed.org/2023/02/inflation-persistence-an-update-with-december-data/

- Ascari, Guido, and Argia M. Sbordone. 2014. “The Macroeconomics of Trend Inflation.” Journal of Economic Literature 52 (3): 679–739. https://doi.org/10.1257/jel.52.3.679.

- Candia, Bernardo, Olivier Coibion, and Yuriy Gorodnichenko. 2021. “The Inflation Expectations of US Firms: Evidence from a New Survey.” Working paper 28836. National Bureau of Economic Research. https://doi.org/10.3386/w28836.

- Cogley, Timothy, and Thomas J. Sargent. 2005. “Drifts and Volatilities: Monetary Policies and Outcomes in the Post WWII US.” Review of Economic Dynamics, Monetary Policy and Learning, 8 (2): 262–302. https://doi.org/10.1016/j.red.2004.10.009.

- Cogley, Timothy, and Argia M. Sbordone. 2008. “Trend Inflation, Indexation, and Inflation Persistence in the New Keynesian Phillips Curve.” American Economic Review 98 (5): 2101–26. https://doi.org/10.1257/aer.98.5.2101.

- Hajdini, Ina. 2022. “Mis-Specified Forecasts and Myopia in an Estimated New Keynesian Model.” Working paper 22-03. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202203.

- Hajdini, Ina, Edward S. Knotek, II, John Leer, Mathieu Pedemonte, Robert W. Rich, and Raphael S. Schoenle. 2022. “Indirect Consumer Inflation Expectations: Theory and Evidence.” Working paper 22-35. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202235.

- Hajdini, Ina, Edward S. Knotek II, Mathieu Pedemonte, Robert Rich, John Leer, and Raphael Schoenle. 2022. “Indirect Consumer Inflation Expectations.” Economic Commentary, no. 2022-03 (March). https://doi.org/10.26509/frbc-ec-202203.

- Hazell, Jonathon, Juan Herreño, Emi Nakamura, and Jón Steinsson. 2022. “The Slope of the Phillips Curve: Evidence from U.S. States.” The Quarterly Journal of Economics 137 (3): 1299–1344. https://doi.org/10.1093/qje/qjac010.

- L’Huillier, Jean-Paul, and Raphael S. Schoenle. 2022. “Raising the Inflation Target: What Are the Effective Gains in Policy Room?” Working paper. https://people.brandeis.edu/~schoenle/research/raising_the_target.pdf.

- Nakamura, Emi, Jón Steinsson, Patrick Sun, and Daniel Villar. 2018. “The Elusive Costs of Inflation: Price Dispersion during the U.S. Great Inflation.” The Quarterly Journal of Economics 133 (4): 1933–80. https://doi.org/10.1093/qje/qjy017.

- Zaman, Saeed. 2022. “A Unified Framework to Estimate Macroeconomic Stars.” Federal Reserve Bank of Cleveland, Working Paper No. 21-23R. https://doi.org/10.26509/frbc-wp-202123r

Suggested Citation

Hajdini, Ina. 2023. “Trend Inflation and Implications for the Phillips Curve.” Federal Reserve Bank of Cleveland, Economic Commentary 2023-07. https://doi.org/10.26509/frbc-ec-202307

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International