- Share

How Should Monetary Policy Respond to a Contraction in Labor Supply?

Conventional wisdom holds that a central bank should tighten monetary policy after a surprise decline in labor supply to offset the inflationary effects of the decline. However, this policy prescription comes from models of monetary policy that abstract from labor force participation. We examine the policy implications of worker entry into and exit from the labor force. We find that cyclical changes in labor force participation call for a less restrictive policy response to a decline in labor supply. The less restrictive policy response is appropriate because policy tightening reduces the labor force and thus raises wage growth. The optimal policy response dampens the reduction in the labor force and brings about a period of higher inflation.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

The recovery of the US economy from the COVID-19-induced recession was distinguished by weak labor force participation and strong wage growth and inflation relative to prepandemic levels. Survey evidence indicates that the pandemic made some people less willing to work and had detrimental effects on labor force participation. Indeed, survey respondents who were not active in the labor force reported a reduced desire to participate in the labor force during the pandemic (for the evidence, see Faberman et al., 2022, and Barrero et al., 2022). While COVID-19 may have lessened some people’s willingness to participate in the labor force for a variety of reasons, such as concern about illness or a lack of childcare, the apparent reevaluation of the costs of labor force participation is a good example of what is known in macroeconomics as a “labor supply shock.”

This apparent shift in attitudes raises a question for central banks: How should monetary policy respond to a labor supply shock? The standard framework for monetary policy analysis has a ready answer. The conventional wisdom obtained from these models—known as New Keynesian models—is that the central bank should tighten its policy stance to offset the inflationary effects of the shock. However, this basic framework assumes that everyone participates in the labor market, even though the choice of entering or leaving the labor force must surely be a key consideration for workers who experience a labor supply shock. In recent research, we remedy this shortcoming by allowing for labor force entry and exit in an otherwise standard model for monetary policy analysis in order to examine the optimal policy response to a labor supply shock (see Kurozumi and Van Zandweghe, 2022).

Including labor force entry and exit in the model alters the model’s policy prescription for dealing with labor supply shocks. The recognition that labor force participation is an economic choice implies that monetary policy actions affect the labor supply. While an adverse labor supply shock makes work less attractive for people in and out of the labor force, the policy response to the shock shapes by how much the labor force eventually shrinks because the policy response can dampen or exacerbate the shock’s initial effect on the labor force. Overall, for reasons explained in more detail below, it is appropriate to tighten policy. The tighter policy stance lowers inflation and wage growth by reducing demand in product and labor markets. However, the resulting smaller labor force offers less variety of labor services for firms, whose reduced workforce specialization lowers labor productivity and thereby tends to raise wage growth and inflation. With the more complex way in which monetary policy influences inflation, fully offsetting the inflationary effects of a labor supply shock is no longer optimal. Instead, the optimal policy response to a labor supply shock calls for a more cautious policy tightening that mitigates the decline in the labor force. This less forceful policy response entails a period of higher inflation.

Symptoms of a Labor Supply Shock

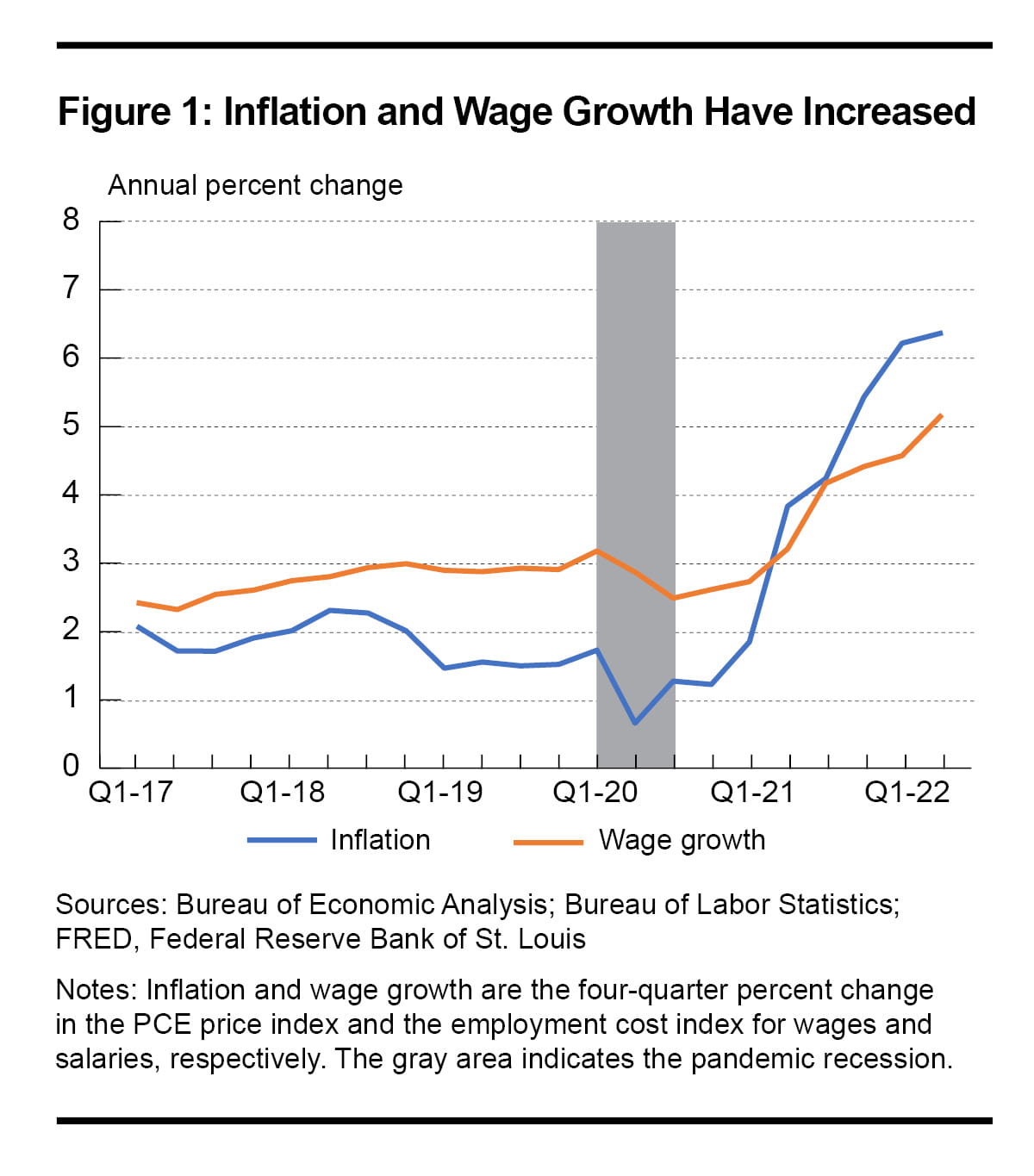

As health risks from COVID-19 have diminished, restrictions on economic activity have been lifted, and macroeconomic policies have been supportive of growth, the US economy has recovered rapidly from the deep recession of 2020. Besides the unusual size and speed of the recession and subsequent recovery, two developments stand out. The first is the surprise increases in inflation and wage growth. In the first quarter of 2021, the Survey of Professional Forecasters forecasted 2021:Q4 inflation of 1.9 percent for the personal consumption expenditures (PCE) price index that excludes food and energy. The actual inflation rate was more than twice the forecast (4.6 percent). As shown in Figure 1, prices and wages began accelerating in the second quarter of 2021.

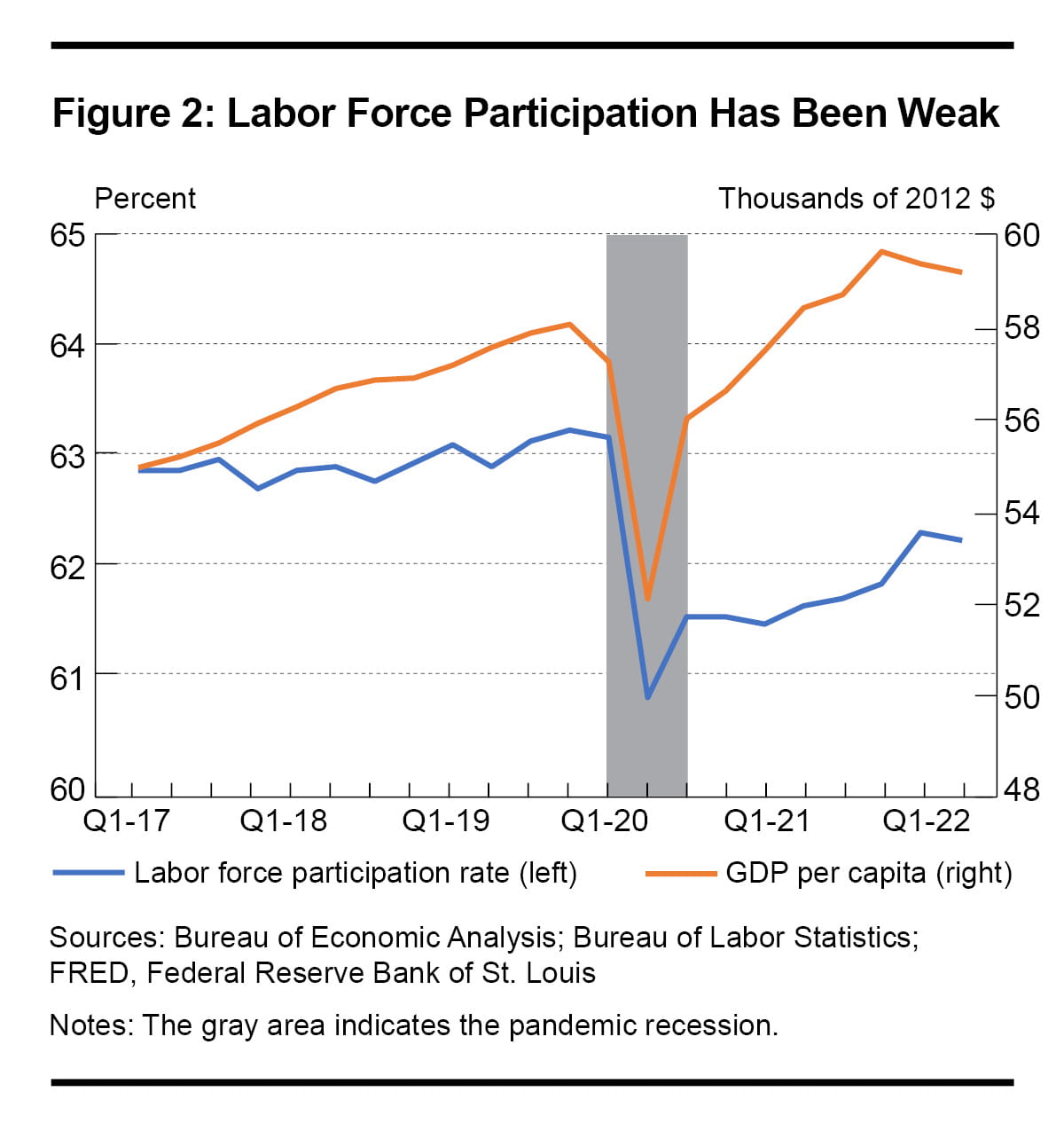

The second notable development is the weak recovery of the labor force. Figure 2 displays the labor force participation rate along with real GDP per capita, the latter of which surpassed its pre-recession level in 2021:Q2. As real activity recovered, cyclical labor market indicators, including the number of job openings, were at historically high levels, and anecdotes about labor shortages were widespread. Nevertheless, the labor force participation rate remained well below its prepandemic level. The rate fell sharply during the recession in 2020:Q2, rebounded partially in the next quarter, but edged up only slightly thereafter. The weak recovery could reflect a declining trend in the participation rate, because of the aging of the population, that could mask its cyclical recovery. Since the effects of population aging on the labor force participation rate are predictable, prepandemic forecasts of the participation rate should incorporate such downward effects. The labor force participation rate in 2021:Q4 (61.8 percent), after the GDP recovery was complete, remained well below the Bureau of Labor Statistics’ prepandemic forecast for 2021 (62.4 percent), indicating that a declining trend in the participation rate alone does not account for the weakness of labor force participation (for the forecast, see Dubina et al., 2020).

How might we interpret the recent US macroeconomic developments? The rebound in economic activity and the increase of inflation in isolation could be viewed as the reversal of the recessionary dynamics unleashed by COVID-19, the ebb and flow of the business cycle, especially considering the global supply chain disruptions caused by the disease that pushed up production costs and hence output prices. However, the conjunction of these developments with the weak labor force recovery and the survey evidence of people who indicated a lessened desire to participate in the labor force during the pandemic suggest another interpretation of the recent macroeconomic developments: As the symptoms of an adverse labor supply shock. Of course, the two interpretations are not exclusive, so both can be useful ways to interpret the data. In the remainder of this Commentary, we explore the policy implications of the latter view.

The Conventional Wisdom

As is evident from Figures 1 and 2, the US economy evolves in ways that are often difficult to predict. It is impossible to grasp how policy actions affect a complex economy without making simplifying assumptions about how that economy works.

We can model the economy as a system in which economic agents—consumers, workers, firms, and the government—interact in various markets and institutions in pursuit of individual objectives. For example, firms produce goods and services that are purchased by households for consumption, while workers and firms exchange labor effort and wages in the labor market. The textbook model for monetary policy analysis is intended to capture realistic aspects of labor supply and wage setting despite abstracting from labor force participation. Intuitively, individual workers differ in their talents and skills. In the parlance of the model, that is, workers provide “differentiated labor services.” Firms prefer to hire workers with differentiated labor services because the variety of labor services increases the productivity of their labor input. For example, it takes a crew of specialized tradespeople to build a house. Individual wages are adjusted infrequently in the model, in line with the common practice in US labor markets.

The model economy is continually buffeted by unforeseen external changes to economic conditions, or shocks. For example, as noted earlier, a labor supply shock is a sudden shift in people’s attitudes to work. These shocks lead to cyclical fluctuations in economic activity and inflation.

Monetary policy can mitigate the fluctuations in economic activity and inflation. Policy actions in the model are transmitted to the real economy and inflation through an aggregate-demand channel. An increase in interest rates induces more saving and less spending and thus reduces product demand. Lower demand for output, by reducing firms’ labor demand, dampens wage growth. In this way, monetary policy can cool down economic activity and reduce inflationary pressures. In setting monetary policy, two key guideposts for a central bank are its inflation target and the natural rate of output, which is the output level for which a central bank concerned with households’ well-being should aim. Higher output is not always better. For example, an adverse labor supply shock lowers the natural rate of output as people are willing to forgo some labor earnings and consumption in order to work less.

The textbook model prescribes how monetary policy should respond to a labor supply shock. The desire to work less—in our study, this desire is induced by the pandemic—implies that the natural rate of output declines. If the actual output level does not fall while people want to work less, wages will have to rise to continue motivating workers, and the higher labor costs will feed into higher inflation. Therefore, the central bank should tighten policy to reduce output until it meets the natural rate of output. Closing the gap between actual output and its natural rate results in the desired decline in labor supply and removes the upward pressures on wages and prices induced by the labor supply shock.

Policy Implications of Labor Force Entry and Exit

The textbook model, however, abstracts from labor force participation by assuming that every individual in the model is active in the labor market. In this model, variations in aggregate hours worked result from individuals’ working fewer hours; all individuals remain employed and work some hours. In contrast, the aforementioned survey evidence suggests that the pandemic has altered the extent to which people want to work and thereby dampened the rebound in the labor force participation rate during the economic recovery. In light of the evidence, we extend the textbook model by allowing for labor force entry and exit. In the extended model, individuals who choose not to work enjoy a benefit of nonparticipation that can vary over time. Typical benefits of nonparticipation are home production and child-rearing for families, investments in education for students, and leisure for retirees. But as the pandemic highlighted, there can be other benefits to staying out of the labor force. A labor supply shock increases the benefits of nonparticipation, thus leading fewer workers to participate in the labor market.

Allowing the labor force to fluctuate provides a different perspective on the transmission of monetary policy actions to the real economy and inflation. Once we recognize that labor force participation varies with economic conditions, we can see that this variation implies that policy actions also affect labor supply. An adverse labor supply shock, by increasing the benefit people receive from nonparticipation, lowers the natural rate of output that is the reference point for a central bank aiming to maximize household well-being. The fluctuations in employment imply a similar reference point for employment—the natural rate of employment—that also falls after a labor supply shock. The central bank can tighten policy in order to lower actual output and employment in line with their lower natural rates, but doing so also reduces the size of the labor force.

A smaller labor force provides less variety of labor services for firms, whose labor productivity depends on worker specialization. For example, a manufacturing process might be executed most efficiently with a specific type of welding, but in a smaller labor force, a firm may have to hire a welder without that specialized skill, a situation leading to longer production times. Thus, the decline in labor supply, by lowering labor productivity, partially offsets the downward pressure of policy tightening on employment demand and thus on wage growth as firms have to replace the labor services of workers who left the labor force with imperfect substitutes. This crosscurrent in the transmission channel of policy—the upward pressure on wages and hence on prices by a policy tightening—implies that a more restrictive policy may not prevent wage and price pressures from emerging after a labor supply shock.

How Monetary Policy Should Respond to a Labor Supply Shock

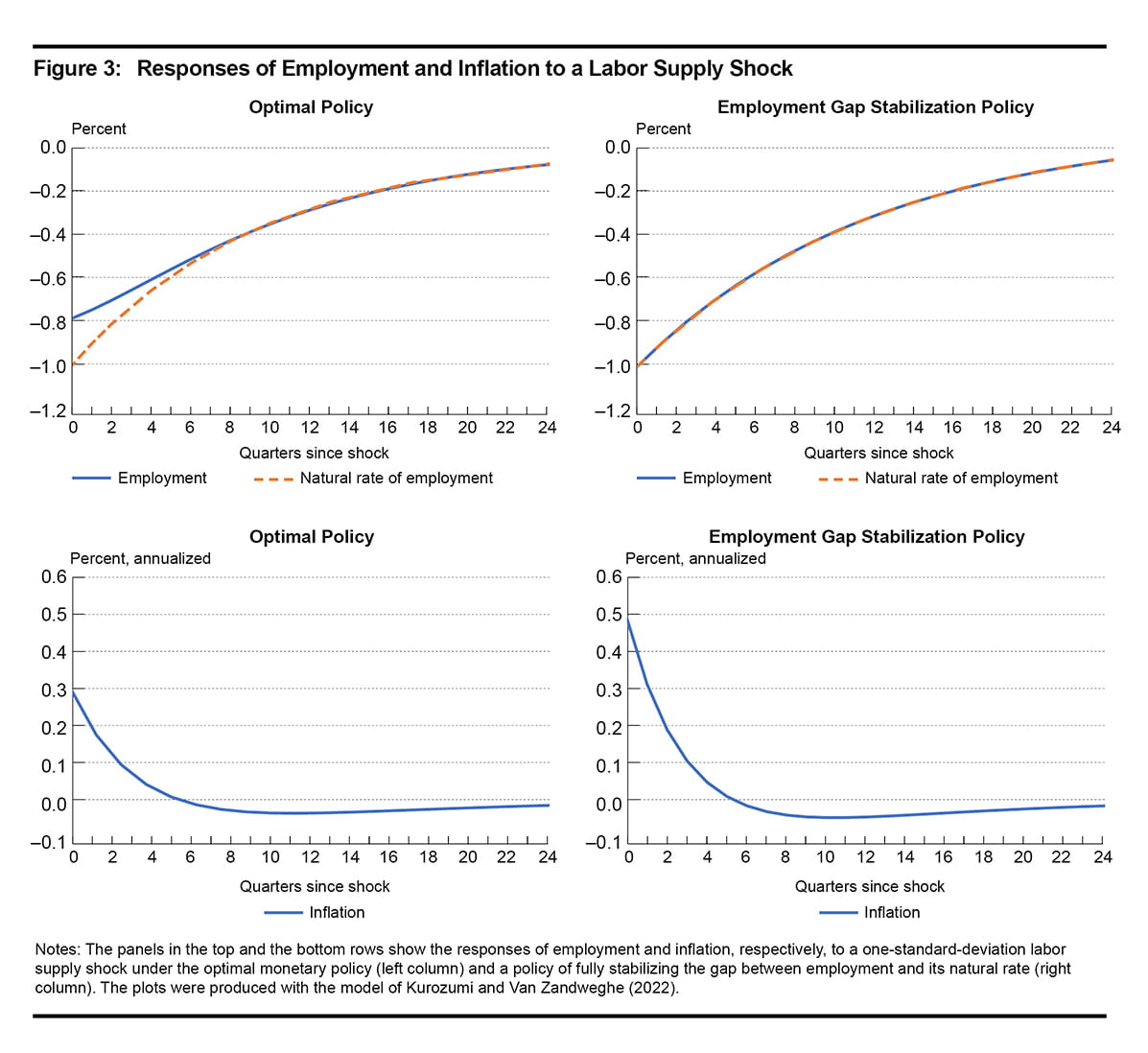

The panels in the left column of Figure 3 plot the responses of employment and inflation to a labor supply shock under an optimal monetary policy in the model with labor force entry and exit. The magnitude of the shock is one standard deviation of a labor supply shock estimated on historical data. A realistic labor supply shock reflecting the COVID-19 pandemic likely exceeded one standard deviation. Without better insight into the magnitude of the shock, we cannot make quantitative inferences from the figure, but we can draw qualitative conclusions. As shown by the dashed line in the top left panel, the shock lowers the natural rate of employment as households desire to supply less labor. The solid line shows that the optimal policy lets employment decline by less than the natural rate for about two years after the shock. The optimal policy leads inflation to rise for about one year, as shown in the lower left panel of the figure. Closing the employment gap, between employment and its natural rate, would result in a smaller labor force, a situation which would raise wage growth that would feed into higher inflation. Indeed, the panels in the right column of the figure show the responses under an alternative, suboptimal policy strategy that fully stabilizes the employment gap. Inflation rises by more than under the optimal policy and the higher inflation lowers households’ well-being. Faced with a trade-off between letting people work less, as they desire after the labor supply shock, and containing accelerating wages and prices, the central bank should choose an intermediate path that displays somewhat stronger labor activity and somewhat higher inflation.

One point to keep in mind when interpreting the plots in Figure 3 is that they assume the economy was initially in a steady state, a resting point at which all previous shocks have dissipated and inflation is at the longer-run target of the central bank. This allows us to easily interpret the plots. In reality, however, the economy is likely buffeted by multiple concurrent shocks. For example, other types of supply shocks, those that give rise to supply chain bottlenecks and higher energy costs, and expansionary fiscal policy shocks may have contributed to higher inflation along with labor supply shocks. Moreover, shocks can hit the economy at random times, so generally the economy will still be adjusting to the effects of past shocks when a new one arrives. For example, real GDP growth was strong during the recovery from the pandemic recession, so labor supply shocks could have resulted in a stalling of the labor force participation rate amid rapidly tightening labor market conditions rather than an outright decline in the participation rate.

Simple Rules

Actual central banks cannot dictate the paths of real activity and inflation. Rather, they adjust policy interest rates like the federal funds rate to mitigate fluctuations in economic activity and inflation in pursuit of their goals, which for the Federal Reserve are maximum employment and price stability. Researchers have shown that the interest rate adjustments of central banks can be captured reasonably well by simple policy rules. Hence, models like those used in this Commentary commonly represent the behavior of monetary policy with such rules. For example, the well-known Taylor rule requires that the central bank adjusts the short-term interest rate to deviations of inflation from its long-run target and to fluctuations in the gap between output and its natural rate. Alternatively, a policy rule could adjust the interest rate to fluctuations in the employment gap instead of the output gap.

Which simple rule, if any, would achieve the smallest loss in household well-being compared to the optimal policy benchmark when the economy is buffeted by labor supply shocks or other supply shocks? According to the model with labor force entry and exit, the Taylor rule is a reasonably good guide for policy, as following the rule generates only a modest loss. A policy rule that requires the central bank to react to the employment gap, instead of reacting to the output gap, as in the Taylor rule, generates a loss three to five times larger than would a policy rule that reacts to the output gap. Intuitively, leaning against fluctuations in the employment gap exacerbates fluctuations in wage growth that feed into inflation and harm household well-being. Leaning instead against fluctuations in the output gap is less harmful because it allows for a positive employment gap after a labor supply shock, since the decline in employment and the ensuing decline in labor productivity both contribute to the decline in output.

Conclusion

Motivated by recent US macroeconomic developments, we have examined how monetary policy should deal with labor supply shocks when the labor force fluctuates with economic conditions and thus responds to monetary policy. Our analysis indicates that central banks should respond to a labor supply shock that lowers the natural rate of employment by letting employment adjust partially, thereby mitigating a decline in labor supply that puts upward pressure on wage growth and inflation. While the optimal policy response that yields a positive employment gap reins in wage growth and inflation, it nevertheless entails a period of higher inflation. The optimal policy overturns the conventional wisdom that central banks can and should completely offset the inflationary effects of such a shock, obtained in textbook models that abstract from labor force entry and exit.

References

- Barrero, Jose Maria, Nicholas Bloom, and Steven J. Davis. 2022. “Long Social Distancing.” WFH Research. https://wfhresearch.com/wp-content/uploads/2022/04/LongSocialDistance_v11_forwebsite.pdf.

- Dubina, Kevin S., Janie-Lynn Kim, Emily Rolen, and Michael J. Rieley. 2020. “Projections Overview and Highlights, 2019–29: Monthly Labor Review: US Bureau of Labor Statistics.” Monthly Labor Review 2020 (September). https://doi.org/10.21916/mlr.2020.21.

- Faberman, R. Jason, Andreas I. Mueller, and Ayşegül Şahin. 2022. “Has the Willingness to Work Fallen during the Covid Pandemic?” Working paper 29784. National Bureau of Economic Research. https://doi.org/10.3386/w29784.

- Kurozumi, Takushi, and Willem Van Zandweghe. 2022. “Labor Supply Shocks, Labor Force Entry, and Monetary Policy.” Working paper 22-17R. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202217r.

Suggested Citation

Kurozumi, Takushi, and Willem Van Zandweghe. 2022. “How Should Monetary Policy Respond to a Contraction in Labor Supply?” Federal Reserve Bank of Cleveland, Economic Commentary 2022-13. https://doi.org/10.26509/frbc-ec-202213

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International