- Share

Forward Guidance during the Pandemic: Has It Changed the Public’s Expectations?

In responding to the COVID-19 crisis, the Federal Reserve has both lowered the federal funds rate and provided forward guidance. We study whether the forward guidance given with the April and June 2020 FOMC meetings altered the public’s expectations of future policy rates, GDP growth, and inflation. We find that forward guidance was effective in altering the public’s expectations about future policy rates if it was accompanied by an SEP but not expectations about economic fundamentals. We suggest that the difference might be explained by FOMC statements being interpretable in two different ways and the public not having a dominant view on which interpretation was intended.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

At the onset of the COVID-19 crisis, the Federal Reserve swiftly responded by lowering the federal funds rate to its effective lower bound. It accompanied this cut in the policy rate with forward guidance—a monetary policy tool that consists of giving information to the public about the likely path of future policy rates. The Fed has provided forward guidance at every meeting of the Federal Open Market Committee (FOMC) since mid-March, announcing in its public statement that the rate is expected to remain in a range of 0 percent to ¼ percent until Committee members are “confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

How effective is such forward guidance? In this Commentary, we examine whether the forward guidance provided with the April and June FOMC meetings changed the public’s expectations for the economy and monetary policy. The June meeting was special in that it was the first since the beginning of the COVID-19 crisis at which the Federal Reserve released its Summary of Economic Projections (SEP), a report in which committee members provide their forecasts of future economic variables. June’s SEP revealed that despite having different projections for the real GDP growth rate and the unemployment rate, all 17 committee participants expected to hold the policy rate at its effective zero lower bound through the end of next year. Of those, 15 projected that the rate would stay there through 2022. The publication of the SEP allowed the public to get more quantitative information about the likely path of future monetary policy in addition to the qualitative information given in the post-meeting statements.

Did Forward Guidance Change the Public’s Expectations?

In this section, we study how the public’s expectations about future monetary policy and economic fundamentals were changed by the forward guidance provided by the FOMC in April and June. To avoid capturing the changes in expectations caused by events other than FOMC meetings, we use data with the highest possible frequency. The data we use for expectations of future monetary policy are from the CME Group and provided at a daily frequency. For expectations of GDP and inflation, we use two sources: Blue Chip Economic Indicators from Wolters Kluwer Legal and Regulatory Solutions US, which provides data at a monthly frequency, and the New York Fed Survey of Primary Dealers, which provides data at the same frequency as FOMC meetings (8 times a year).

Expected Future Monetary Policy

The data we use for expected federal funds rates are obtained from the CME FedWatch Tool. They are probabilities of target federal funds rate decisions at future FOMC meetings.1

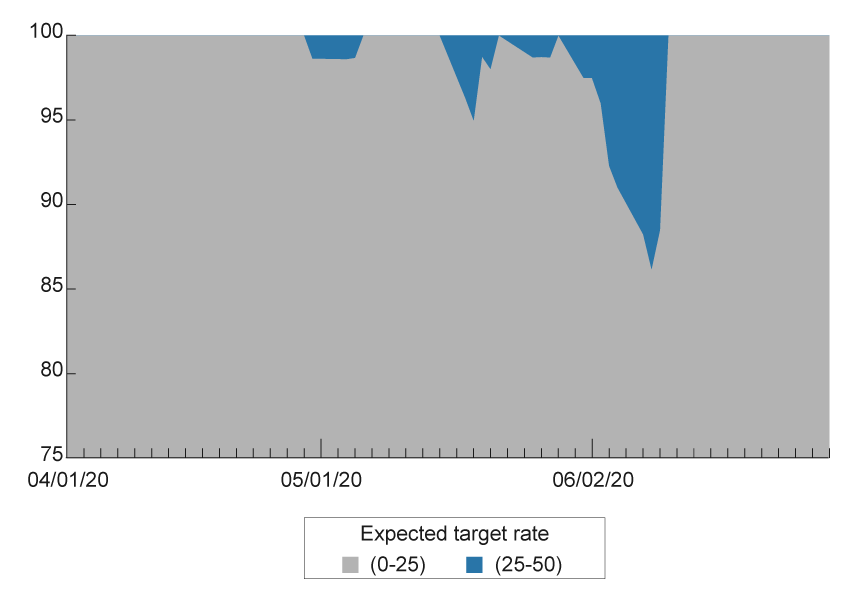

We first consider near-term expectations for monetary policy by looking at the probabilities of policy rate decisions expected at the December 2020 meeting. Figure 1 shows that the market already expected the policy rate to stay at zero with 100 percent probability before the April FOMC meeting, but after the meeting, the probability of a zero policy rate edged down to 99 percent. In contrast, the June FOMC meeting significantly lowered the policy rate expected at the December 2020 meeting. The probability that the policy rate would stay at zero increased from 88 percent on the day before the FOMC meeting to 100 percent on the day after the meeting.

Figure 1. Implied Probabilities of Target Federal Funds Rate Expected after FOMC Meeting on December 16, 2020

Source: CME FedWatch Tool, CME Group.

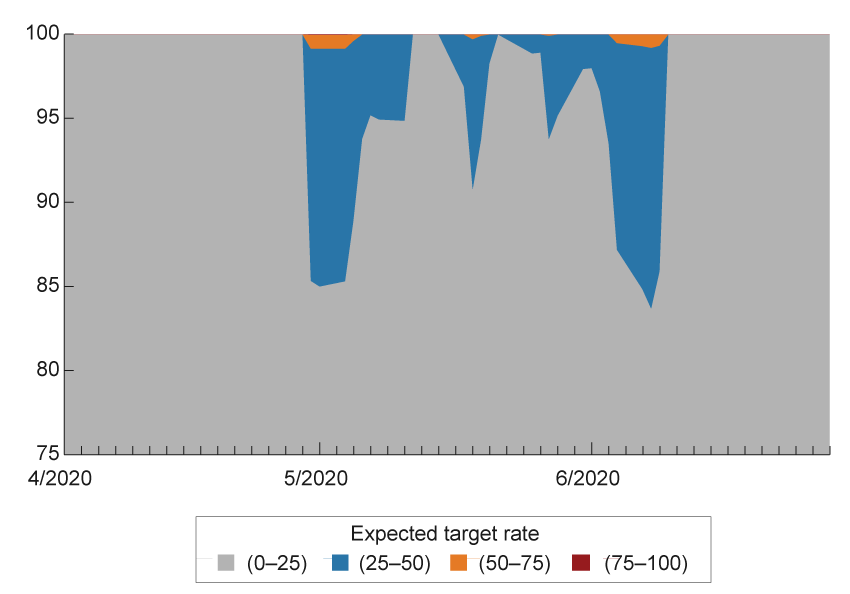

To consider policy expectations at a longer horizon, we look at the probabilities of target federal funds rate decisions expected at the FOMC meeting on September 22, 2021, which is the furthest out the data are available on CME FedWatch Tool. Before the FOMC meeting on April 28–29, 2020, the financial market expected the target policy rate to stay at the zero lower bound with 100 percent probability (figure 2). The day after the meeting, however, this probability decreased to 85.3 percent, suggesting that the public had become less certain about future monetary policy accommodation after the meeting. In contrast, for the FOMC meeting on June 9–10, 2020, the probability of the federal funds rate staying at zero increased from 86 percent on the day before the meeting to 100 percent after it.

Figure 2. Implied Probabilities of Target Federal Funds Rate Expected after FOMC Meeting on September 22, 2021

Source: CME FedWatch Tool, CME Group.

In summary, the June FOMC meeting successfully lowered the market’s expectations of the federal funds rate through 2021, whereas the April FOMC meeting did not.

Expected Future Economic Fundamentals

In this section, we study how the public’s expectations of future economic fundamentals were changed by the forward guidance provided with the April and June FOMC meetings. The two economic fundamentals we consider are real GDP growth and inflation. We look at data from two surveys: Blue Chip Economic Indicators and the New York Federal Reserve Bank’s Survey of Primary Dealers.

Blue Chip Economic Indicators

The Blue Chip Economic Indicators (BCEI) survey solicits forecasts from business economists during the first few days of every month. BCEI then publishes a “consensus” average forecast of respondents as well as the top 10 and bottom 10 averages. We use April and May survey results to study changes in expectations for the economy due to the April FOMC meeting, and we use June and July survey results to compare changes in expectations due to the June FOMC meeting.2

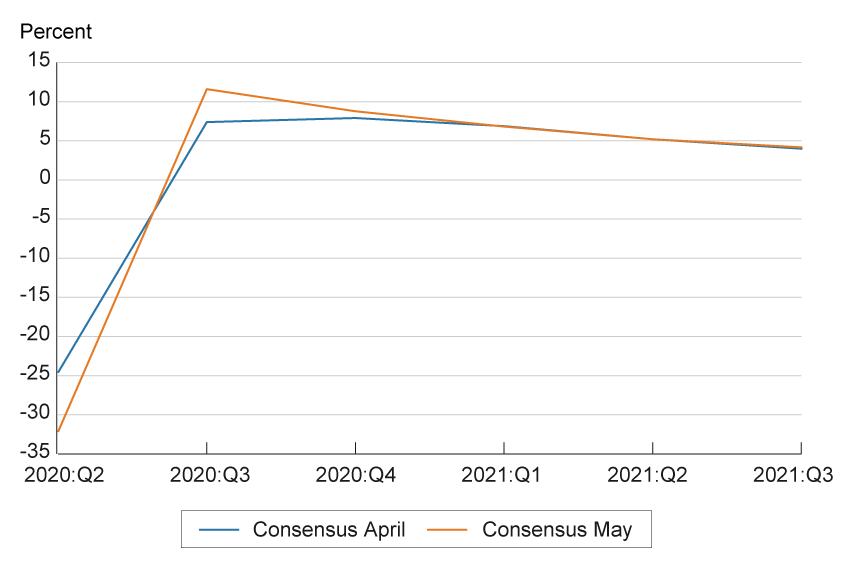

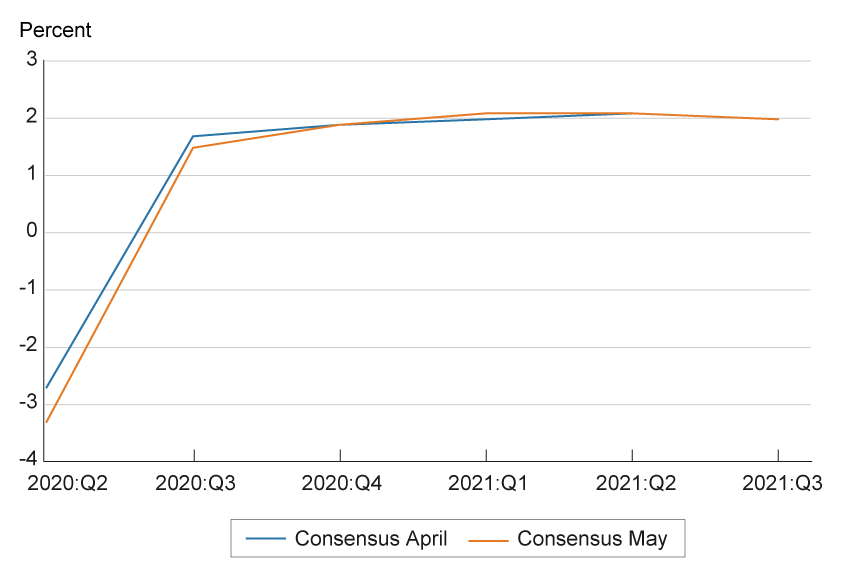

Figure 3 shows how expectations for real GDP growth from 2020:Q2 through 2021:Q3 changed after the April FOMC meeting, and figure 4 shows the same for expectations of inflation as measured by the consumer price index (CPI). From April to May, both the consensus forecasts of real GDP growth and the consensus forecasts of CPI inflation were revised down through 2020:Q2. The consensus forecasts of real GDP remained slightly higher through 2020:Q3. There were essentially no changes in expectations of real GDP growth or CPI inflation for 2020:Q4 and onward.

Figure 3. Expectations of Real GDP Growth before and after April FOMC Meeting (BCEI)

Source: Blue Chip Economic Indicators.

Figure 4. Expectations of Consumer Price Index before and after April FOMC Meeting (BCEI)

Source: Blue Chip Economic Indicators.

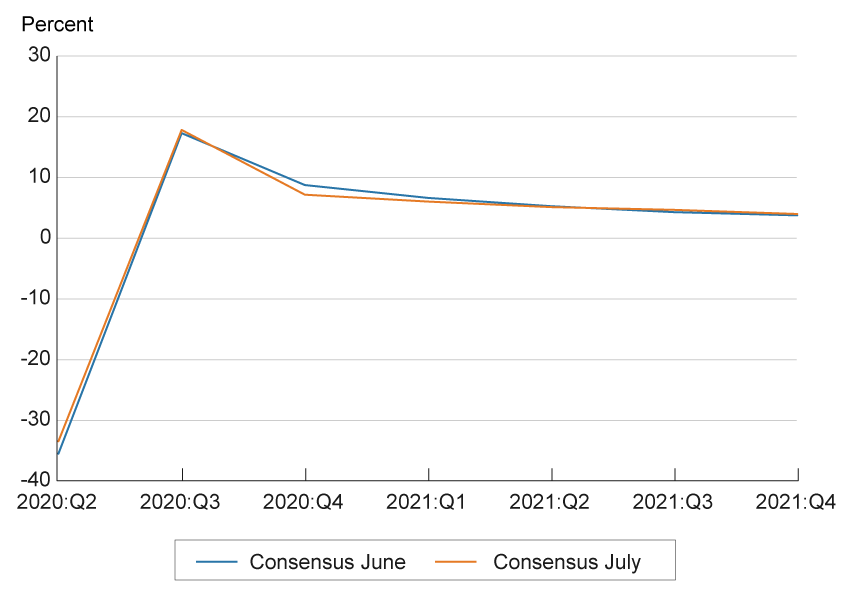

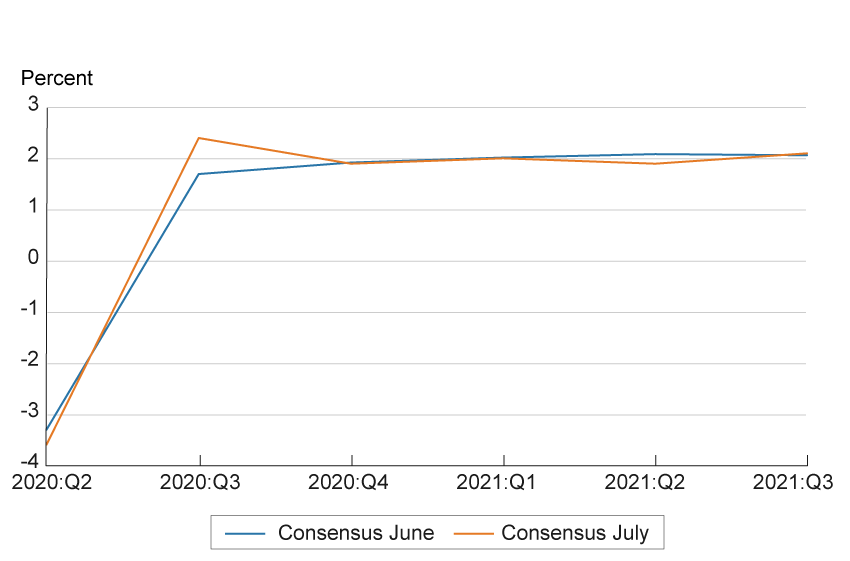

Next we look at how expectations changed after the June FOMC meeting (figure 5 and figure 6). From June to July, there were essentially no changes in expected real GDP growth. There was an increase in the expected inflation rate for 2020:Q3. However, the increase in expected inflation died down for 2020:Q4 and onward.

Figure 5. Expectations of Real GDP Growth before and after June FOMC Meeting (BCEI)

Source: Blue Chip Economic Indicators.

Figure 6. Expectations of Consumer Price Index in June and July (BCEI)

Source: Blue Chip Economic Indicators.

New York Fed Survey of Primary Dealers

For the Survey of Primary Dealers (SPD), the New York Fed asks primary dealers approximately two weeks ahead of each FOMC meeting about their expectations of the future economy.3 We use April and June survey results to measure changes in expectations due to the April FOMC meeting, and we use June and July survey results to measure changes in expectations due to the June FOMC meeting.4

Figure 7 shows how expectations of real GDP growth (measured on a Q4/Q4 basis for 2020, 2021, and 2022) changed after the April FOMC meeting. By the time primary dealers were surveyed in June, they had become more pessimistic about future GDP growth through the end of 2020 than they had been before the April FOMC meeting. The median projection of real GDP growth in 2020 was lower in June than it was in April. However, primary dealers were slightly more optimistic in June about the economy in 2021 than they had been in April.

Figure 7. Expectations of Real GDP Growth in April and June (SPD)

Source: Federal Reserve Bank of New York, Survey of Primary Dealers.

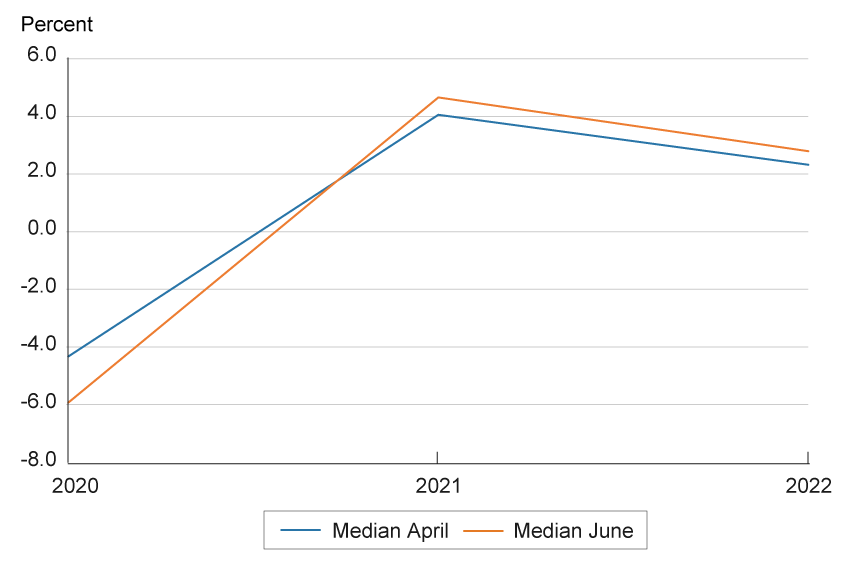

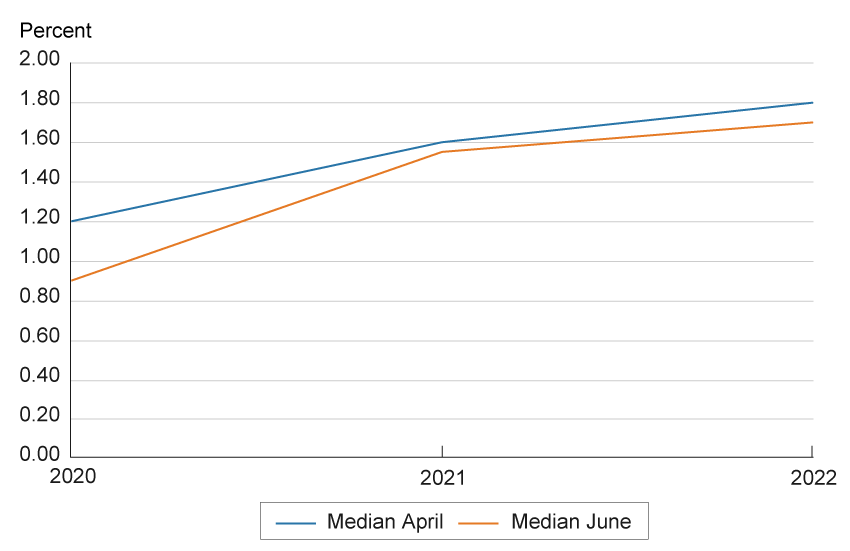

Figure 8 shows how expectations of the future inflation rate as measured by the index of personal consumption expenditures prices excluding food and energy prices (core PCE price index) changed after the April FOMC meeting. Similar to what business economists forecasted about the CPI, primary dealers’ expectations for future core PCE through the end of 2020 were lower after the April FOMC meeting. For expectations of core PCE through the year-end of 2021 and 2022, the differences between the two meetings were smaller.

Figure 8. Expectations of Core PCE in April and June (SPD)

Source: Federal Reserve Bank of New York, Survey of Primary Dealers.

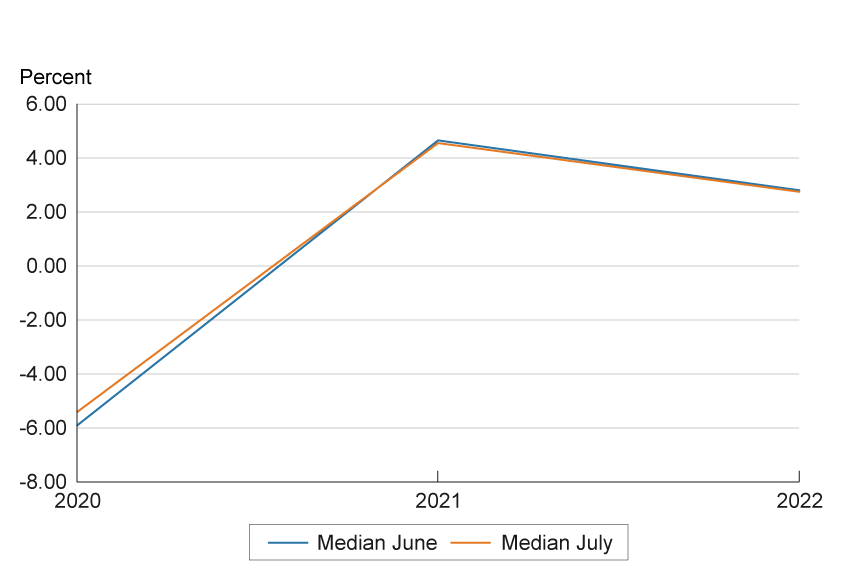

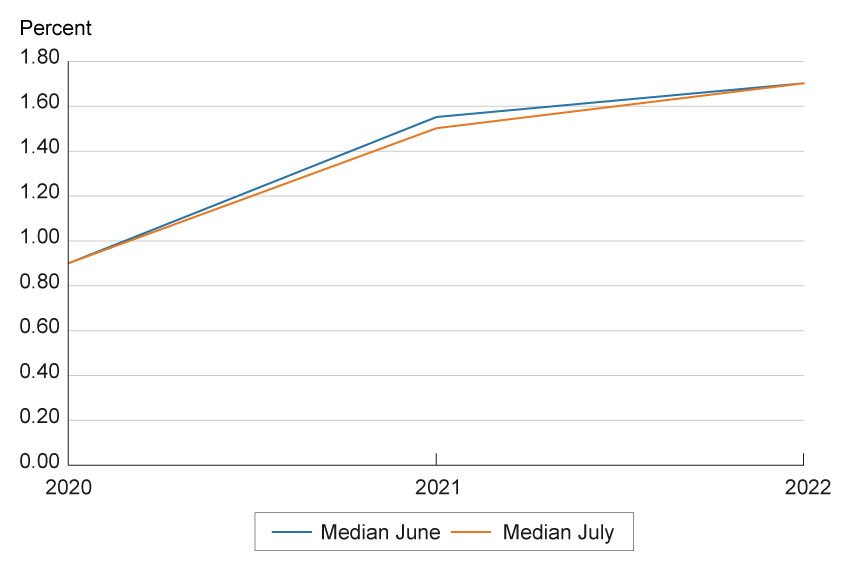

Figures 9 and 10 show how expectations about the future economy changed in the SPD after the June FOMC meeting. Similar to the patterns exhibited in the BCEI, there were essentially no changes in the expected real GDP growth rate or the expected core PCE inflation rate through the year-end of 2022 from June to July.

Figure 9. Expectations of Real GDP Growth in June and July (SPD)

Source: Federal Reserve Bank of New York, Survey of Primary Dealers.

Figure 10. Expectations of Core PCE in June and July (SPD)

Source: Federal Reserve Bank of New York, Survey of Primary Dealers.

In summary, the publication of the SEP following the June meeting successfully reduced the public’s expectations about future policy rates. However, neither the April FOMC meeting nor the June FOMC meeting significantly improved the public’s expectations about the future economy. There were some marginal changes in expectations of near-term real GDP growth and inflation by the end of 2020, but no essential changes in expectations for either fundamental in 2021 and onward.

What Explains the Different Effects of Forward Guidance?

The previous section shows that when accompanied by the publication of the SEP (which occurred with the June FOMC meeting but not the April meeting), forward guidance was able to successfully shape expectations about future monetary policy. However, it did not lead to much change in expectations of future economic fundamentals. One possible explanation could be that, because the changes in policy expectations were modest, the resulting changes in economic expectations were also small, and such changes are difficult to detect in economic forecasts, especially when the survey data are monthly. Here we focus on a different possibility: The public could have interpreted the forward guidance in one of two ways. The first interpretation is that the forward guidance reflects the Fed’s commitment to keeping the policy rate anchored at its effective zero lower bound through at least 2022.5 The second interpretation is that the forward guidance is the Fed’s projection of the most appropriate future policy rate conditional on its projection of the future economic trajectory.

In an economic model with forward-looking households, firms, and financial markets, these two interpretations have the opposite impact on expectations of the future economy. If the forward guidance is a policy commitment, households understand there is a possibility that the future economy will recover faster but the future policy rate is pegged at zero due to the Fed’s policy commitment. In this case, the forward guidance increases their expectations of future output growth and inflation. If the forward guidance is a policy projection that the most appropriate policy rate will be near zero through the end of 2022, this projection should reflect the Fed’s projection that the economy cannot recover until then. In this case, households will also revise their expectations to be more pessimistic and decrease their expectations of inflation and output growth. If the public did not have a dominant view on whether the forward guidance offered during the COVID-19 crisis was one form or the other, forward guidance might not be able to significantly change the public’s expectations of the future economy.

Narrative Evidence from Media Coverage

Newspapers offer narrative evidence on the public’s interpretation of forward guidance. We find that newspaper reporting after the June FOMC meeting, which focused on forward guidance, suggests that the public interpreted the guidance in different ways. Some articles seemed to interpret the forward guidance as a policy commitment, some seemed to interpret it as a policy projection, and some seemed to interpret it both ways.

For example, an article in Forbes (“Federal Reserve Will Keep Rates near Zero until 2022 As Recession Continues”) indicated that the author interpreted the forward guidance as a policy commitment to future low rates. To support his view, the author quotes Fed Chair Jerome Powell saying “We are not even thinking about thinking about raising rates” after being asked in the press conference after the FOMC meeting what the Fed would do “if things end up better.” In contrast, a journalist writing in the New York Times (“Fed Leaves Rates Unchanged and Projects Years of High Unemployment”) appeared to interpret the forward guidance as a policy projection conditional on the Fed’s expectation of the future economy, emphasizing the “grim assessment” about the economic trajectory in the SEP. Writing in the New York Post (“Fed Officials See No Interest Rate Increases through 2022”), the author seemed to interpret the forward guidance both as a commitment to an accommodative future policy and as the Fed’s projection of a slow economic recovery, describing the forward guidance as a “pledge to keep monetary policy loose” but also emphasizing the projections of the decline in GDP and the high unemployment rate given in the SEP.

Narrative evidence from newspapers suggests that the public was trying to interpret the meaning of forward guidance using information not only from the policy statement but also from the press conference and the SEP. However, in the case of the forward guidance provided at the June meeting, this narrative evidence suggests alternative interpretations were made, one consistent with forward guidance as a policy commitment and the other consistent with forward guidance as a policy projection. It is possible that because June’s forward guidance was seen as one or the other type, it did not yield notable changes in the public’s expectations of the future economy.

Enhancing the Efficacy of Forward Guidance

In the research literature on forward guidance, economists find that forward guidance of either type might be effective, but at the same time, each type might also have its own limitations.

For example, Eggertsson and Woodford (2003) study the use of forward guidance as a commitment device. They show that when a central bank’s ability to combat current deflation is constrained by the zero lower bound of the interest rate today, it can still affect the economy by communicating its commitment to setting future interest rates at a lower rate than it would have under the historically normal conduct of policy. In their analysis, the historically normal rate is guided by an inflation-targeting rule, and the central bank commits to keeping future rates below the prescriptions of that rule. In this way, households will expect a higher inflation rate and a higher rate of real output growth in the future. Due to forward-looking behaviors, households will start to increase consumption today, which will increase current inflation and real demand.

However, the effectiveness of forward guidance as a policy commitment is hindered by a time-inconsistency problem: When the future arrives, sticking to the previous commitment of extra policy accommodation might contradict the policy action now prescribed by the central bank’s inflation-targeting rule. Because the public is aware of this time-inconsistency problem, the central bank might have a hard time convincing the public that any forward guidance is a policy commitment.

Statements made after the approval of updates to the Statement on Longer-Run Goals and Monetary Policy Strategy in August 2020 suggest the Fed is attempting to address this problem of time inconsistency. The FOMC indicated that its policy is now guided by flexible average inflation targeting, a change from its previous approach of flexible inflation targeting. Under this new approach, 2 percent inflation is not a ceiling in each period. Instead, following periods of inflation running persistently below 2 percent, the Fed is expected to promote inflation “moderately above 2 percent for some time,” so that inflation averages 2 percent over time.

Research by Angeletos and Sastry (2020) relates to the other potential use of forward guidance, that of providing information on the Fed’s projection of the most appropriate future policy rate in the absence of commitment. That use of forward guidance is associated with a different type of obstacle. The value of this type of forward guidance is to provide the public with the information the Fed has about the future economy. However, revealing information to the public is not necessarily welfare-improving. In the current environment, for example, telling the public that the most appropriate policy rate into at least 2022 is one near zero reflects the Fed’s projection that the economy will not sufficiently recover by then to warrant any reduction in monetary policy accommodation. If this projection is more pessimistic than what most households believe, forward guidance in the form of a policy projection will make the public become more pessimistic, potentially hurting the current economy.

Angeletos and Sastry (2020) argue that forward guidance should be a target-based policy commitment. That is, instead of focusing on future policy rates, forward guidance communications should focus on the macroeconomic variables targeted by the central bank, such as the unemployment rate and the inflation rate. The authors argue that a target-based policy commitment can manage expectations about the economic fundamentals better when the public has imperfect information about the aggregate economy.

In the policy statement released at the conclusion of the FOMC meeting on September 15–16, 2020, the Fed began to talk specifically about the target that the forward guidance is aiming to achieve. Specifically, it said in the policy statement that “the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.” In theory, this change in language should make forward guidance more effective in shaping the public’s expectations of future economic fundamentals. But the magnitude of the results remains to be empirically tested as more information becomes available.

Footnotes

- A detailed explanation of methodology and data can be found at https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html. Return

- As this is a monthly survey, the window between surveys is long enough that other macroeconomic events could also influence the forecast changes. Therefore, changes in this survey’s results are less statistically significant compared to the changes in expected monetary policy, which we measure using daily data. Return

- The New York Fed also conducts a survey of market participants (SMP). We use SPD because only the SPD asks survey participants for their estimates of the most likely outcome for output, inflation, and unemployment through the year-end of 2022. Return

- Since this survey is conducted ahead of each FOMC meeting, the window between surveys is roughly six weeks. Similar to the BCEI, we cannot eliminate the influence of other macroeconomic events on the forecast changes. Therefore, changes in this survey’s results are less statistically significant compared to the changes in expected monetary policy, which we measure using daily data. Return

- In the FOMC policy statement, it also mentions that it will continue to assess economic conditions to determine if future adjustments to the stance of monetary policy are needed. Return

References

- Angeletos, George-Marios, and Karthik A. Sastry. 2020. “Managing Expectations: Instruments vs. Targets.” Updated version of National Bureau of Economic Research, Working Paper No. 25404. http://economics.mit.edu/files/16534.

- Eggertsson, Gauti B., and Michael Woodford. 2003. “The Zero Bound on Interest Rates and Optimal Monetary Policy.” Brookings Papers on Economic Activity, 1: 139-233. https://doi.org/10.1353/eca.2003.0010.

- Reuters, 2020. “Fed Officials See No Interest Rate Increases through 2022.” As published in the New York Post (June 10). Retrieved October 24, 2020, from https://nypost.com/2020/06/10/federal-reserve-sees-no-interest-rate-increases-through-2022/.

- Klebnikov, Sergei. 2020. “Federal Reserve Will Keep Rates Near Zero Until 2022 As Recession Continues.” Forbes (June). Retrieved October 24, 2020, from https://www.forbes.com/sites/sergeiklebnikov/2020/06/10/federal-reserve-will-keep-interest-rates-near-zero-until-2022/.

- Smialek, Jeanna. 2020. “Fed Leaves Rates Unchanged and Projects Years of High Unemployment.” The New York Times (June 10). Retrieved October 24, 2020, from https://www.nytimes.com/2020/06/10/business/economy/federal-reserve-rates-unemployment.html.

Suggested Citation

Janson, Wesley, and Chengcheng Jia. 2020. “Forward Guidance during the Pandemic: Has It Changed the Public’s Expectations? .” Federal Reserve Bank of Cleveland, Economic Commentary 2020-27. https://doi.org/10.26509/frbc-ec-202027

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International