- Share

The Souk al-Manakh Crash

From 1978 to 1981, Kuwait’s two stock markets, one the conservatively regulated “official” market and the other the unregulated Souk al-Manakh, exploded in size, growing to the point where the amount of capital actively traded exceeded that of every other country in the world except the United States and Japan. A year later, the system collapsed in an instant, causing huge real losses to the economy and financial disruption lasting nearly a decade. This Commentary examines the emergence of the Souk, the simple financial innovation that evolved to solve its rapidly increasing need for liquidity and credit, and the herculean efforts to solve the tangled problems resulting from the collapse. Two lessons of Kuwait’s crisis are that it is difficult to separate the banking and unregulated financial sectors and that regulators need detailed data on the transactions being conducted at all financial institutions to give them the understanding of the entire network they must have to maintain financial stability. If Kuwaiti officials had had transaction-by-transaction data on the trades being made in both the regulated and unregulated stock markets, then the Kuwaiti crisis and its aftermath might not have been so severe.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

In 1980 Kuwait was the financial center of the Arabian Gulf. At that time, other centers such as Saudi Arabia, with its broker-based stock market, and Bahrain (which was a satellite market of Kuwait’s) were not the sophisticated trading centers that Kuwait was. Kuwait had more trading and more stocks on its markets than any other Gulf country (Darwiche, 1986). The banking sector was robust, with 10 large banks, and these were regulated by agencies using modern (for the time) prudential practices (Al-Yahya, 1993). Kuwait’s stock market, the Boursa, had been established in 1977 on lessons learned from a steep stock price rise and fall in over-the-counter trading the previous two years. Regulation of the stock market was based on modern (by 1980s standards) principles of financial caution and good sense.

However, side by side with the formal banking sector and stock exchange existed a less regulated market, the Souk al-Manakh,1 where new and innovative stocks, which were not traded on the Boursa, could be traded in an air-conditioned parking garage that had been built over the old camel trading market. Regulators had made a prudent effort to ensure that the banking sector was not too exposed to the risky financial innovation of the Souk al-Manakh exchange, for example, by prohibiting banks from lending for the purpose of buying stock on it. Both the Boursa and the Souk al-Manakh were not thinly traded: The amount of capital actively traded in these markets during this period of high oil prices was the third-highest in the world, after the United States and Japan, exceeding even the capital traded on the London markets.2

Yet in August 1982 the entire financial structure collapsed. The collapse was so severe that nearly every major participant in the financial sector took a hit and so quick that most participants weren’t sure if they were solvent or what they owned if they were. In September 1982, the financial authority ordered all debts incurred on trades in the Souk al-Manakh to be turned over to it so regulators could sort the debts out; in doing so, they determined the amount of worthless obligations totaled $93 billion (in 1982 US dollars), an amount equivalent to $90,000 (US) for every Kuwaiti—woman, man, or child. By comparison, the annual per capita American income at that time was about $14,000. The disarray of the collapse went on for many months, and some of the disputes that arose over the distribution of whatever could be recovered from the losses were still in process when Kuwait was invaded by Iraq eight years later.

In the end, all but one of Kuwait’s banks were technically insolvent (United Nations, 1989). The reputation of the Boursa was so ruined by the loss in value of its stocks that the government chose to resurrect the exchange in a brand new building and with a new name several years later, and the innovative Souk al-Manakh was completely shut down. The entire Gulf region went into recession.3

Using the Kuwaiti experience as an example, I show how collapses can unfold with terrifying rapidity, with consequences that last for decades in modern economies with sophisticated financial structures. I argue that to manage and help prevent such catastrophes, financial data must be collected at a transaction-by-transaction level of detail from all financial institutions, in both the traditional financial sector and the shadow sectors—that is, sectors that operate with little or no regulation though they perform some of the functions of those that are regulated. Such data collection would have helped prevent the Kuwaiti crisis by exposing the enormity of the potential financial problems of the unregulated sector and its connection to both the banking sector and the stock market. It would have also eased the nation’s recovery from its stock market meltdown, in that it would have facilitated the fair distribution of the remaining assets from the collapse so that growth could occur.

Before the Collapse

The Souk al-Manakh essentially started in 1978 as traders met informally to trade stocks that were not covered by the strict regulatory requirements of Kuwait’s official stock market, the Boursa. By 1981, nearly 40 stocks of companies in non-Kuwaiti Gulf countries were trading on the Souk.

Authorities permitted the Souk al-Manakh to form and operate with little regulation because they viewed it as a place where economic innovation could occur in a way that was separated from the rest of the financial sector.4 They hoped the Souk could fund speculative and innovative projects that would attract investment from the entire Gulf region.

Both the Boursa and the banking sector were heavily regulated following a Kuwaiti stock market crash in 1977, and the Ministry of Commerce and Industry recognized that the conservative nature of the regulation could stifle innovation. While the ministry allowed the Souk al-Manakh to operate, it did introduce rules intended to prevent any interactions between the unregulated exchange and the regulated sectors. For example, banks were strictly forbidden from trading on the Souk or from lending for the purpose of purchasing stocks on it, and issues on the Boursa were not to compete with the stocks issued on the Souk. New issues on the formal exchange were heavily vetted, and the firms were required to provide public information about their revenue sources, business model, and capital structure. The unregulated Souk was allowed to trade only stocks that capitalized offshore firms, not domestic firms. Neither the formal financial sector nor firms on the Boursa were permitted to borrow from or provide financing to the Souk. In this way, the Kuwaitis hoped to reap the benefits of an innovative financial sector while insulating the conservative financial sectors from any risks introduced in the Souk.

By mid-1982 the Souk had expanded so quickly that new trading technologies evolved to meet its liquidity and financing needs. Because the banking sector was specifically prohibited from providing credit for trades on the Souk, a system was required to facilitate the exchange of future delivery of equity whose price was so rapidly rising. In response, traders evolved a method of postdating checks. Many of the transactions were forward contracts.

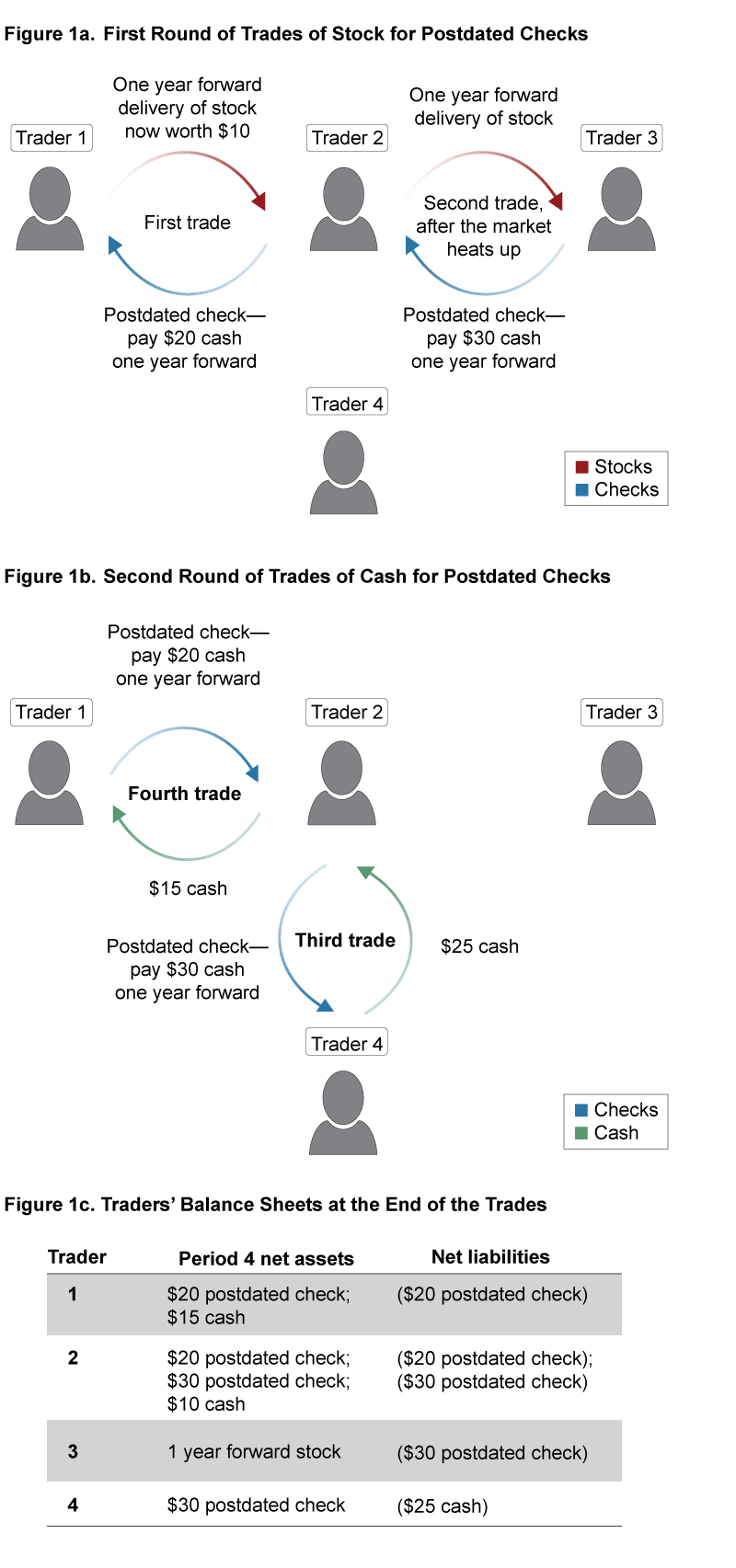

Figures 1a and 1b graph a hypothetical example that might arise when traders use postdated checks to pay for a future delivery of an equity share when prices are expected to rise. The example calls attention to several observations that were salient to the Kuwait markets at that time. First, a postdated check is a form of credit, and in this case it is collateralized by the future delivery of a stock. If the expected value of the stock falls, the probability of a default rises because the value of the collateral has fallen. Second, although a postdated check is a credit exposure to a trader who accepts it, it is harder to assess the credit risk. It is an exposure to a trader who may also have issued postdated checks and therefore is exposed to other traders, who, in turn, are exposed to other traders and so forth. Unlike a simple loan that a bank might make to a firm, the postdated checks are “passed on” by a trader who writes a postdated check based on a postdated check that was passed on to him. Third, a postdated check is not only a form of credit, it is a form of liquidity. A trader holding a postdated check as an asset can use that same check to make a new purchase of a future stock delivery or, alternatively, issue a new postdated check based on his asset. The postdated checks are used for these trades as cash. Finally, because these postdated checks are issued on the spot by one trader to another, the expansion of credit, liquidity, and complexity happened incredibly quickly.

The postdated checks were like bills of exchange in that they could be passed on to a third party at a discount, but they differed in that a bill of exchange is intermediated by a bank. Because the Souk was pushed out of the regulated sector, the postdated checks were bilateral contracts written between just the two parties, and the collateral was only the future delivery of the stock. Because there was no intermediary bank, there was no institution performing the usual bank functions of monitoring the value of the collateral and keeping track of those checks passing through its offices. The bilateral nature of the postdated check also disposed of other intermediaries, such as an exchange or a clearinghouse that could also have ensured that the exposures were netted, could have imposed early margin requirements, and could have tracked the explosive amount of risk within the market.

To go into the details of the example, after the fourth trade, Trader 1 and Trader 2 come out ahead whether the price of the equity rises or falls because, in addition to canceling postdated checks, Trader 1 has $15 cash and Trader 2 has $10 cash (figure 1c). As long as the postdated checks are not defaulted on (as in the case where Trader 1 just hands back the original postdated check and Trader 2 passes on Trader 3’s postdated check to Trader 4) neither Trader 1 nor Trader 2 bears any risk. Trader 3 and Trader 4, however, bear risk: If prices do not rise above $25, Trader 3 will have equity worth less than the postdated check that could be cashed against it. In addition, Trader 4 runs the risk of a default on the $30 postdated check.5

Even at an individual transaction level, this example has some complications, although it is nothing that contract law cannot handle. For example, suppose the stock does not rise as fast as anticipated or falls in value by the future date. If, in the first trade, Trader 2 fails to provide the cash in the future for delivery, then he is in default, and one could imagine a standard credit default procedure wherein Trader 1 goes after Trader 2’s assets, including the now-due delivery of the stock. If the stock is less in value than previously thought, then the courts would decide which of Trader 2’s assets could be claimed by Trader 1. If the trader could not provide enough assets to cover the debt, then standard bankruptcy procedures could be applied to Trader 2’s assets. Such a trading scenario is still complicated, and often futures exchanges use formal margin requirements to prevent large bankruptcy losses. Indeed, the Souk evolved a system in which the postdated check could be presented early at a discount to mitigate problems of forward default in a declining market.

At a system level, however, the situation becomes enormously more complex. Although the postdated checks could be countersigned and passed along to other traders (a practice that creates its own complications), often the postdated checks were held by their original receiver, who issued a new check. In this case, the balance sheet for just these four trades is shown in the figure. If Trader 3 defaults in a falling stock market, the default might trigger other defaults, and sorting out who owed what to whom would be very difficult.

The entire network of the system matters more than just the sum of its bilateral transactions. Trader 3 and Trader 4 are never directly connected through a trade, and yet they are intimately exposed to each other’s risk. The risk of the Souk was at the level of a systemic network implied by all of the transactions and not just a matter of large numbers of traders conducting dangerous trades. On this systemic level, the Souk network was built from many thousands of such interconnected transactions. Even if all the data of the transactions had been available to Kuwaiti authorities (they were not), it would have been very complex to calculate the creditworthiness of the system and how much liquidity had been created.

At the Time of the Collapse6

Throughout the summer of 1982, most traders were aware that all of Kuwait’s financial markets were due for a correction. Oil prices had fallen in the spring of that year, and with the fall in oil, prices on the Boursa and the Souk had fallen, too. Shares on the Souk were still viewed as overvalued, however, as its prices had risen more than 200 percent from 1980 to 1981, and by the time market trading ceased for the holidays following fasting at Ramadan, the general consensus was that the overvalued shares would fall in price to a more reasonable value. Both regulatory authorities and the traders were concerned about the value of the Souk’s postdated checks. What was not generally known was how overexposed nearly all traders were to the risk of falling values on the postdated checks, given that their collateral was shares whose value was declining.

The trigger for the crash occurred after a few traders presented discounted postdated checks to indebted traders for cash that could not be paid, and authorities announced that there would be no government support for the postdated checks of the Souk al-Manakh. The checks had been presented on August 20, and authorities made the announcement on August 23. One trader recalls the way the crash unfolded, referring to both the Boursa and the Souk: “Its decline was so discontinuous it cannot be called a crash. There were simply no bids.”7 The swiftness of the market’s disappearance is the most terrifying lesson of the Souk al-Manakh. The instant crash took both the authorities and the market participants by surprise. Many had understood that the market was due for a correction, but they had been waiting for more information so they could optimally unravel their positions—a strategy that proved useless. When the crash came, there was no new information and no time to react because abruptly there were no trades.

Records of the crisis are somewhat sparse for a modern crisis, and accounts sometimes differ in details. The timeline of table 1 represents my best effort at reconciling various witness accounts.

| Event |

|

Date |

|---|---|---|

| First Kuwaiti stock market crash occurs (with loss of almost a quarter of its value). This causes regulatory prudential reform in Kuwait. |

|

1977 |

| Souk al-Manakh market begins trading. |

|

1978 |

| Souk al-Manakh grows to nearly 40 non-Kuwaiti Gulf stocks. Prices rise over 200 percent on the Gulf stocks and 50 percent on the Boursa stocks.a The use of postdated checks to pay for Gulf stocks becomes common practice. By the end of 1981, the capitalization of the Kuwaiti markets exceeds that of the London markets. |

|

1980 to 1981 |

| Souk al-Manakh loses 60 percent of its value due to a fall in oil prices and uncertainty over postdated checks, which are due at the end of the year. |

|

May to July 1982 |

| Several traders present postdated checks that cannot be paid.b The Souk al-Manakh experiences extreme volatility but ends slightly up on the day on rumors of a bailout. |

|

August 20, 1982 |

| A committee is formed by the Ministry of Commerce and Industry to analyze the problem of postdated checks. |

|

August 21, 1982 |

| “Crash.” The committee announces that there will be no bailout. All trading stops. |

|

August 23, 1982c |

| Eight dealers of the Souk al-Manakh are arrested. |

|

End of August, 1982 |

| All forward dealing is suspended. |

|

September 7, 1982 |

| Due date for all postdated checks with profits prorated accordingly and the original rate of return retained. |

|

September 20, 1982 |

| A small number of postdated checks are settled bilaterally with committee help. |

|

September to October 1982 |

| Dealers of both exchanges placed under house arrest, and capital is not allowed to leave Kuwait until all is sorted out. |

|

October 1982 |

| Date all postdated checks are due to the committee for any form of settlement. |

|

November 1, 1982 |

| Facts about the size of the Souk al-Manakh debt become known as the clearinghouse company receives 29,000 postdated checks worth about $94 billion (US). |

|

November 1982 |

| Charges brought against 60 dealers on the stock exchanges.d |

|

February 1983 |

| The government establishes the Corporation for the Settlement of Company Forward Share Transactions. |

|

April 1983 |

| A linear programming (LP) solution is adopted to determine the debt settlement ratios (DSRs) to clear the debts.e Timeline for the LP solution includes the following: |

|

July to September 1983 |

| —DSRs are published in the local paper for the largest 18 traders. |

|

October 1983 |

| —DSRs for the largest 254 insolvents without apportionment by asset type are made public. |

|

July 18, 1984 |

| —DSRs for the last traders are determined. |

|

August 1985 |

| —Payments to creditors begin. |

|

September 1985 |

| The Souk al-Manakh is closed permanently. Gulf stocks formerly traded on this exchange are moved to the newly opened Kuwait Stock Exchange, which will be housed in a new building. |

|

November 1984 |

| New Kuwait Stock Exchange building is opened. |

|

1985 |

| Difficult Debt Settlement Programme is launched. |

|

August 10, 1986 |

| United Nations reports more than a quarter of the postdated check debts remain unsettled and all commercial banks but one are under government control. |

|

April 1990f |

| Invasion of Kuwait by Iraqi forces. |

|

August 2, 1990 |

a. Al-Yahya (1993), p. 32.

b. Al-Yahya (1993), p. 33, relates a trigger from a trader trying to front-run the expected crash by presenting his postdated checks before the end of Ramadan. However, the timing of this disagrees with all other accounts of the crash. See footnote 9 in the text. Babington (1983) is the only account that I have found that dates the events and is generally consistent with all other accounts.

c. I follow the sequence of events of Babington (1983), pp. 77–78.

d. Epstein (1983), pp. 17–19.

e. Elimam, Girgis, and Kotob (1997), pp 89–106, table 1.

f. United Nations (1989), p. 12.

Sources: Dates from Darwiche (1986) and Pomeranz and Haqiqi (1985). I have also footnoted citations for specific dates or events.

The Response to the Crash

A wide range of normal safety measures can be irrelevant if the collapse is far reaching and sudden enough. For example, the presence of a simple margin requirement at the time of the Souk al-Manakh crash could not have prevented the crash because the instantaneous lack of a market with which to cash out the short positions meant that the margin requirement would have been ineffective.

In some ways, the Ministry of Commerce and Industry’s response to the shock (listed in table 1), as well as the response of other Kuwaiti financial regulatory authorities, was a model of a modern regulator’s possible response. The response to the initial shakiness in the market prices in the Souk was an announcement that the Kuwaiti government would not bail out the markets in order to prevent the extension of risks due to moral hazard incentives. The Friday before all Souk trading ceased on August 23, all of the ministries in the cabinet issued a joint resolution. Amid statements that the markets were still “strong and intact” the ministries also formed an offset committee to review the claims and settlements of the holders of the defaulted checks and determine the new balances. The goal of the response at this point was to calm the markets while at the same time to set up a mechanism to ensure that both the Boursa and the Souk had adequate liquidity to function. All outstanding postdated checks had to be submitted to a newly formed committee by November 1, 1982, for some kind of settlement or they would be invalidated and not redeemable by the counterparty.

Only in November when the checks were submitted—10 weeks after the crash—were the authorities aware of the enormity of the disaster. It was clear that with unfunded debts totaling more than five times the GDP of Kuwait and more than the outstanding debt owed to the IMF by all countries in 1981, the crisis would not be solved by simple bailouts from the Kuwaiti government or international agencies. At this time, all dealers were placed under house arrest and not allowed to leave the country. This action was probably not so much punitive as it was an effort to keep all of the relevant information available.8

Further, in spite of the efforts of the Ministry of Commerce and Industry to isolate the Boursa and commercial banks from the innovative Souk, the complexity of claims and counterclaims of the participants had heavily involved the banks in the crash. Banks were exposed indirectly to the risk of the Souk by their borrowers’ exposures: Many of the banks’ most important borrowers had written checks for forward delivery in the Souk, and as a result of the crash, these important bank customers were now unable to meet their loan payments to the bank until their assets and liabilities could be sorted out. In the end, only one bank in Kuwait’s robust commercial banking system was solvent. The remaining banks all had to be bailed out. At the end of 1983 the Central Bank of Kuwait deposited nearly KD 200 million in the failed banks, roughly 30 percent of the banks’ capital.

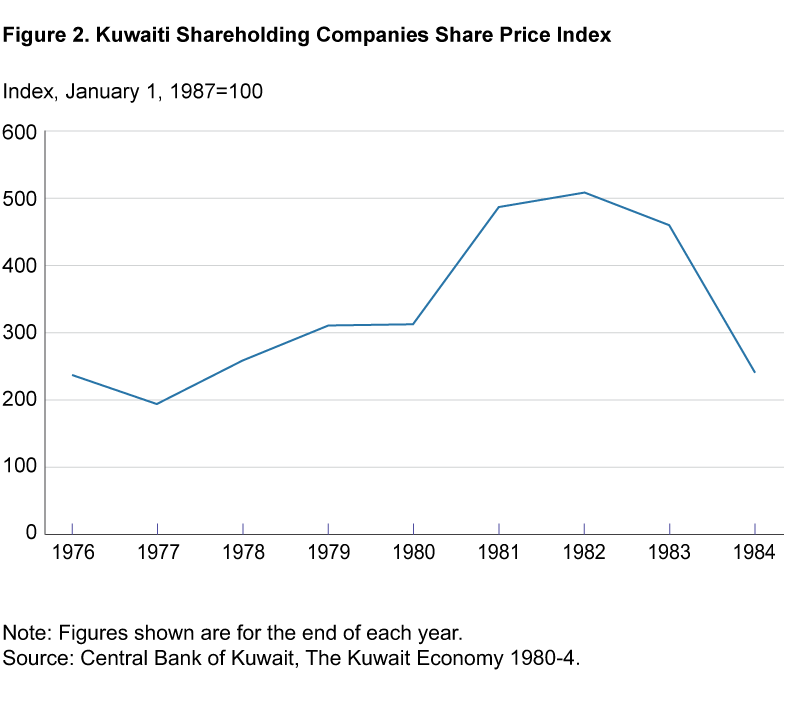

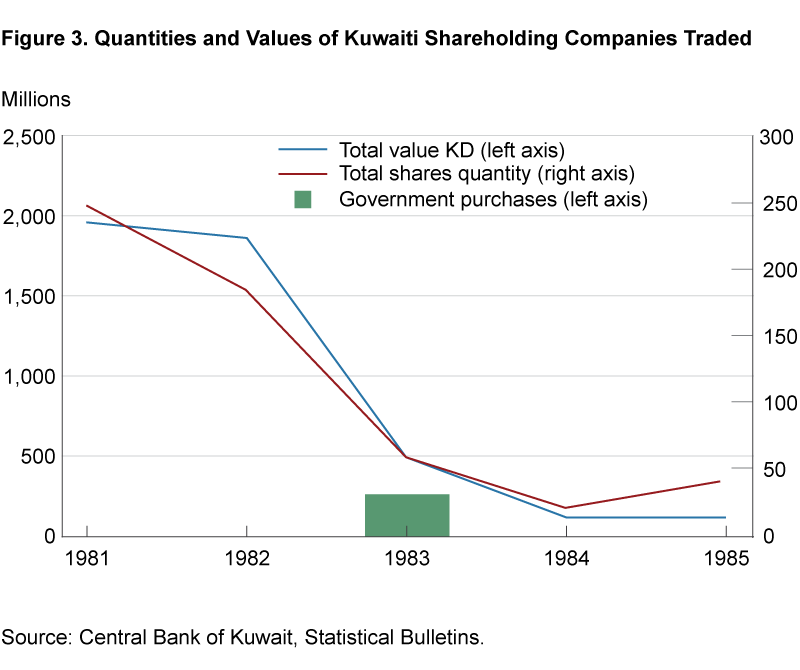

Similarly, the Boursa had its own crash with its attendant bankruptcies. Figure 2 shows stock prices, and while the price drop doesn’t seem bad—the high prices of 1981–1982 are nearly matched by the prices of 1983—the figure vastly understates the Boursa crash because more than half the volume of stocks traded on the Boursa in 1983 had been purchased by the Kuwaiti government in an effort to make the price fall gradual. In 1984, when the program was discontinued, the average yearly price fell to less than 50 percent of its value of 1982. Further, figure 3 shows how devastating the crash was for the Boursa. From an actively traded and robust market in 1982 before the crash, the formal stock exchange essentially stopped actively trading stocks. More than half of the KD 480 million of value in 1983 traded was the government purchases of KD 270 million. When these measures were removed in 1984, the value of traded shares was 8 percent of what it had been only three years earlier.

Various branches of the Kuwaiti government, sometimes in collaboration with the Kuwaiti Chamber of Commerce and Industry, passed a series of strong laws and resolutions from September 20, 1982, onward to deal with the crisis. Most of the laws, because they dealt with only one element of the crisis, were ineffective. In April 1983, the Corporation for the Settlement of Company Forward Share Transactions (the Corporation) was formed to develop a comprehensive and acceptable distribution for the multitude of claims and counterclaims to assets throughout the economy. These included not only claims among the dealers in both the Souk al-Manakh and Boursa, but also in the commercial banking system and among many of the firms in the entire region.

The Corporation decided to use a mathematical linear programming (LP) solution that required detailed data from all of the traders.9 Principles were formalized of a “fair” final division that were implemented using a linear program. For example, the principle that the assets of a defaulting party had to be divided among the nondefaulting parties in a way that was proportional to their original state and the principle that stakeholders’ losses were limited to their original stake in the system became constraints in an optimization problem.

It took the Corporation and three financial engineers until August 1985 to solve the problem of what was considered a fair distribution of the assets. The majority of holders of the massive debt were not compensated until September, more than three years after the collapse.10 The financial tangle was still a mess even seven years after the crisis. At the end of 1989, one year before the Iraqi invasion made the tangle irrelevant, all of Kuwait’s banks but one were still under government supervisory control and more than a quarter of the obligations of the crash still had not been resolved. For eight years after the collapse, beneficial potential investments and trades were not conducted because the ownership of assets that might have been traded or used as collateral was not resolved.

The Collapse of the Souk and Regulatory Information

Collapses based on financial innovation recur throughout history. Innovation often occurs to finance rapid change, where, at least at the time, it is widely seen as having huge benefits in providing needed liquidity that outweigh the innovation’s potential costs to financial stability. Most of the participants in the markets in Kuwait were neither con men nor stupid. They were aware that the postdated checks they were using carried the potential for financial instability, and they were hoping that their makeshift liquidity system would be replaced by something more secure.11 What the Kuwaiti authorities did not anticipate was the instant collapse of both the nonregulated and regulated sectors and the severity of its consequences.

The Souk al-Manakh crash emphasizes the value to regulating authorities of detailed information from all participants in both the traditional and innovative financial sectors. This financial crisis, like many other crises, derived its destructive power from the individual connections of dealers and investors. Detailed data would have helped both before and after the crash, and a lack of such data greatly magnified the damage.

The crash also emphasizes the difficulty (if not impossibility) of isolating the unregulated financial sector from the regulated sector. The lack of regulation might foster innovation. However, innovation can proceed while providing detailed information to the authorities about how the new sector is connected to the conventional sector.

Bilateral data would have alerted the authorities to the immense size of the Souk exposure and that the more traditional Boursa and commercial banks were neither isolated from the Souk nor was the exposure trivial. It was a lack of data that also prevented the Kuwaiti authorities from seeing the risks of financial instability of the system.

Immediately after the crisis, the authorities spent several months pursuing a policy that was ineffective because they were unaware of the scale of the crisis or how pervasive it was throughout the financial system. After trying out several approaches to distributing the assets of the insolvent dealers and firms to those still solvent, which failed, regulators finally turned to traders’ knowledge of most of the bilateral exposures in the economy. Data then had to be collected and entered into a format that could be used in the computation of an acceptable solution.

Kuwait used policies in fighting the crisis that a modern western authority does not have access to. Instead of placing all dealers under house arrest as Kuwait did, resolving a crisis in a western democracy must rely on rapid knowledge of which dealers and institutions are central to a solution and which data might be important in a complex reallocation that gets the financial structure back on its feet. Regulatory authorities in Kuwait were not bound by traditions in English common law that strictly regulate the provision of information, and yet even their settlement of the reallocation was incomplete seven years later, delaying a return to normalcy in the financial structure. In a western democracy, complete data of the history and structure of financial obligations could be housed in a regulatory authority to prevent collapse if the data held in the private sector are accidentally or intentionally destroyed. Good data can be required as a condition for doing business in an innovative financial domestic sector so that in the event of market corrections or crises, delays resulting from data’s being extradited from foreign entities can be avoided.

Conclusion

We live in an exciting period of financial innovation, when immense markets in new derivatives, new markets for collateral, and even new cryptocurrencies are invented with such a frequency that they often do not even make the front page of the financial news. It is clear that the potential for welfare gains from new technologies exists, and that regulating these technologies effectively requires a delicate balance of not stifling their development while protecting the economy from possible financial instabilities that might result from them.

In maintaining this balance, the importance of good data is paramount. Regulators of financial stability in all of the western democracies have made important strides in this. New information requirements in the United States make it unlikely that any future collapse in the CDS market would be met with the ignorance about the total size of net positions that financial regulators faced during the 2008 crisis. Financial authorities at both the European Central Bank and the Bank of England now have access to transaction-based records of loans and some derivatives executed by commercial banks. There are plans to expand that access to include more derivatives, more loans, and more institutions. Mexico collects daily records of loans from its entire financial sector. There is new awareness that data on individual transactions are needed for an understanding of the entire network. However, important markets such as Eurodollar loans remain somewhat opaque to authorities at a systemic level, which could mask stability risks. Kuwait’s experience should teach us that information on all important financial markets is vital to the maintenance of financial stability, before and after a financial collapse.

Footnotes

- Souk al-Manakh means literally “the market at the resting place for camels,” derived from the cry Nakh, which a driver says to his camel when he wants it to rest. It is not al-Manakh, “the weather,” from which we derived the English word “almanac.” Return

- This was a temporary phenomenon, of course, caused by the rapid expansion of liquidity, described below, the high price of oil in 1980, the flight of capital due to the fall of the Shah of Iran in 1978, and the Iran–Iraq war. Return

- The recession for these economies, which were so dependent on oil exports and where the government had huge cash reserves, played out differently than a typical recession in a more complex, developed economy. Measurement of the extent of the recession caused by the financial collapse is further complicated by the fact that after the crisis, oil prices fell steeply in 1985. For this reason, I focus on the effects of the collapse on the financial, as opposed to the real, sector. See Greenwald and Hildenbrand (1983). However, the US State Department reports that the “financial sector was badly shaken by the crash, as was the entire economy” (US State Department, 1994). Return

- See Darwiche (1986), p. 61, for example. Return

- The example in figure 1 graphs text in Azzam (1988), although it is explored in a slightly different way here. Return

- Information about the crash is somewhat sparse and anecdotal. Some of this information void is due to the fact that records of transactions and daily prices on the Souk al-Manakh were not kept. Some of the anecdotes surrounding the crash differ. The most common trigger related in the discussions of the crisis is that a “well-known business woman” tried to cash a postdated check, which brought down the entire system.” This is first related in Darwiche (1986), p. 88, who cites “verbal information from a business man…Oct. 1984.” I have rather followed the discussion in Babington (1983). Return

- From Veneroso (1998). Also in Business Recorder (2005), p. 3: “There were simply no bids for many years thereafter.” Return

- Finance Minister Sheikh Khalifa is quoted as stating, “Even though in my opinion some people deserve punishment, I cannot have 50 percent of the business community and private investors going bankrupt and so start a chain reaction affecting the whole economy.” (Al-Yahya, 1993).Return

- Elimam, Girgis, and Kotob (1997) describe the technical solution.Return

- Legitimate claims to the remaining assets were phased in starting in October 1983. Although the payment was not disbursed as cash until two years later, the claim could have been in principle used as collateral for a transaction for those dealers for whom an announced distribution was made.Return

- Indeed, prior historical experience had suggested that they might have been correct. For example, nineteenth century banks in the United States realized that interbank checks had a complexity that could be mitigated if the gross obligations between banks could be netted out, and they created institutions such as the New York Clearinghouse Association to handle the netting out. However, this clearinghouse had decades (and several panics) to evolve and sort out institutional details so that interbank checks did not destabilize the entire system. Tallman and Gorton (2018) describe the institutional evolution of the New York Clearinghouse, including stability innovations such as clearinghouse loan certificates that are additional to simple netting of the interbank obligations.Return

References

- Al-Yahya, Mohammed A. 1993. Kuwait: Fall and Rebirth, Chapter 2. Routledge. https://doi.org/10.4324/9780203038451

- Azzam, Henry. 1988. The Gulf Economies in Transition, p. 211. Palgrave McMillan. https://doi.org/10.1007/978-1-349-08970-3

- Babington, Charles. 1983. “The Art of Survival in the Kuwaiti Souk.” Euromoney (January), pp. 77–78.

- Business Recorder. 2005. “Stock Market Crash: Collapse of Souk al-Manakh 1982—A Lesson to Learn.” (March 19). https://fp.brecorder.com/2005/03/20050319212559/

- Darwiche, Fawda A. 1986. The Gulf Stock Exchange Crash: The Rise and Fall of the Souq Al-Mankh. Croom Helm, Ltd.

- Elimam, A. A., M. Girgis, and S. Kotob. 1997. “A Solution to Post-Crash Debt Entanglements in Kuwait’s al-Manakh Stock Market.” Interfaces, 27(1): 89–106. https://doi.org/10.1287/inte.27.1.89

- Epstein, E.J. 1983. “Kuwait Cables.” Atlantic (May): 17–19.

- Greenwald, J., and B. Hildenbrand. 1983. “A Very Special Recession.” Time, 122(23):73, (November 28).

- Pomeranz, Felix, and Abdul Haqiqi. 1985. “The Collapse of the Souk al-Manakh: A Chronicle.” In Zimmerman, V.K., The Recent Accounting and Economic Development in the Middle East. Center for International Research in Accounting, University of Illinois, pp. 161–166. http://www.worldcat.org/oclc/17477170

- Tallman, Ellis, and Gary Gorton. 2018. Fighting Financial Crises, Learning from the Past. University of Chicago Press.

- United Nations, Economic and Social Council. 1989. “Review of Developments and Trends in the Monetary and Financial Sectors in the ESCWA Region,” p. 12. https://digitallibrary.un.org/record/159734

- US State Department. 1994. “Persian Gulf States, Country Studies.” Library of Congress, Federal Research Division, p. 70. https://www.loc.gov/item/93046476/

- Veneroso, Frank. 1998. “Memories of the Souk al Manakh.” Veneroso Associates (blog), June 1. http://www.gold-eagle.com/gold_digest_98/veneroso060198.html

Suggested Citation

Craig, Ben R. 2019. “The Souk al-Manakh Crash.” Federal Reserve Bank of Cleveland, Economic Commentary 2019-20. https://doi.org/10.26509/frbc-ec-201920

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International