- Share

The Winners and Losers from Trade

Although increased international trade is widely viewed as beneficial to the economies of the participating countries, the benefits are not distributed evenly across individuals within those countries, and indeed some individuals may bear a cost. We discuss two channels through which trade can affect individuals differently depending on their skill and income levels and assess the combined impact of those channels. We find that the effects of trade on the labor market and the effects of trade on prices go in opposite directions and are of similar magnitude.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

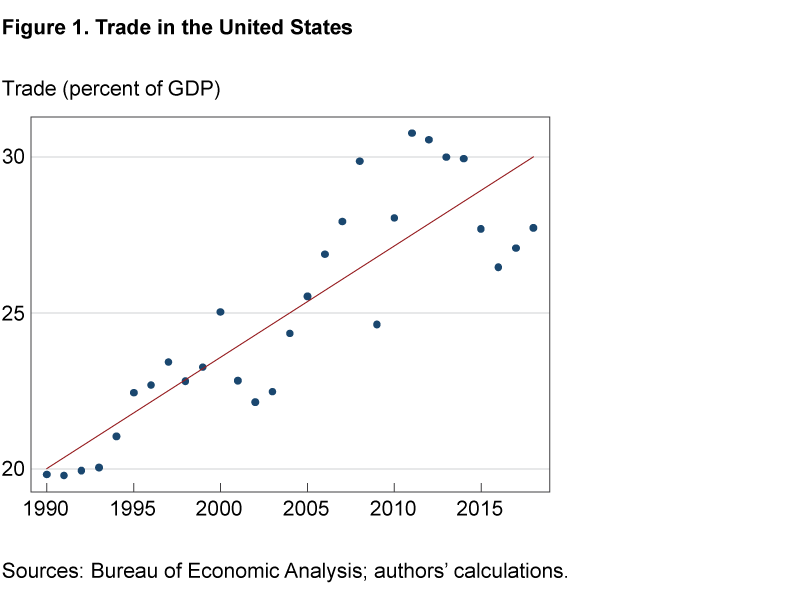

Economists widely agree that this has been a positive development for the economy as a whole.1 Opinions among the broader public, on the other hand, have been more mixed. In 2018, 56 percent of respondents to a Pew Research poll asserted that “free trade agreements between the U.S. and other countries have generally been a good thing for the U.S.,” while 30 percent claimed they had generally been a “bad thing” (Jones, 2018) [note: this citation was corrected after initial publication (was Bradley, 2018)]. These differences of public opinion may reflect the fact that trade affects different types of households—for example, households in different parts of the income or wealth distribution—differently. Trade affects households through two primary channels, adjustments in the labor market (both job losses and gains) and reductions in prices of goods and services. A growing literature has explored how the effects of labor market adjustments are distributed across households, but less attention has been given to the distribution of benefits arising from price reductions.

In this Commentary, we examine how the consequences of international trade are distributed across households through both channels. The labor market effects are well-documented, and we start by summarizing these. Then we turn to the price effects and highlight our own new research into how these benefits are distributed. We find that lower-income households, though possibly more exposed to the labor market costs, benefit more than do higher-income households from the reduction in prices that trade induces. This is because low-income and low-wealth households use a larger fraction of their expenditures on tradable goods and services. Furthermore, we find that the differences in the price effects across the income and wealth distribution are nonnegligible; rather they are commensurate with the differences in labor market costs measured in other papers. Overall, this suggests that the gains from trade are more equally distributed than previously thought.

Effects of Trade on Labor Markets

How trade affects labor markets depends on how much those markets are exposed to import competition or export opportunities. For firms with exporting opportunities, (such as those producing aircrafts, optical and medical instruments, and soybeans) increased trade can lead to revenue and job growth, while firms that face competition from less expensive imports (such as those producing furniture, toys and sporting equipment, and plastics) may be forced to downsize or exit the market. Although the effect on individual firms does vary, recent research suggests that the net effects of trade on employment may be positive. For instance, Feenstra and Sasahara (2018) find that between 1995 and 2011 the growth in total US exports led to a net rise in job demand even after accounting for job losses from the growth in imports.

Trade may increase job growth on net; however, the gains are not evenly distributed across the labor market. While some workers will find new jobs or stay employed, others will experience earnings disruptions when their employers downsize or exit. The cost to these workers depends on the duration of their displacement and the change in compensation once they find new employment, and these factors depend on how exposed their industry is to trade as well as characteristics of the individual workers.

Autor et al. (2014) compares earnings and employment outcomes from 1992 to 2007 across workers with different levels of exposure to the rise in Chinese imports after China joined the World Trade Organization in 2001.2 Workers who had initially worked in industries with higher exposure suffered a difference in cumulative earnings equivalent to almost half of one year’s income relative to the earnings of similar workers with less exposure. Moreover, the relative losses were greater for workers with low wages and low tenure. In addition, when the authors proxied for skill (education) with relative predisplacement wages among peers, they found evidence that high-skilled workers were much more mobile across industries and sectors and consequently suffered lower income losses. In contrast, low-skilled workers were more likely to stay in the same industry and thus remained exposed to import competition. This attachment to the same industry also affects their geographic mobility: workers with the ability to cross industries and sectors can move to locations with less trade exposure, increasing their potential to find a new job with similar or better wages.

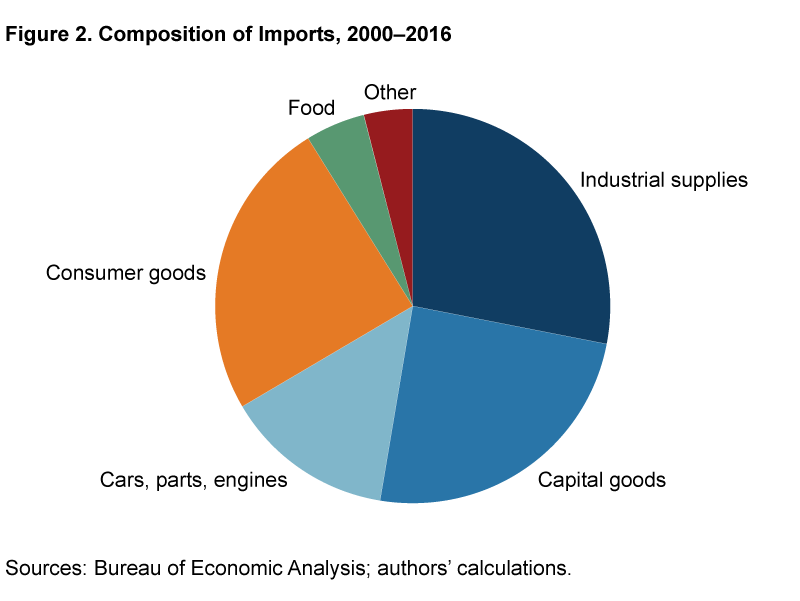

A worker’s skill level can also affect how his or her wage responds to increased trade. If trade makes capital goods (such as computers and other equipment used in production) cheaper, then firms may purchase more of these capital goods. Krusell et al. (2000) suggest that this may be more advantageous for high-skill workers than for low-skill workers because these capital goods require skills to operate. This is a phenomenon economists call “skill-bias”: workers with higher levels of education tend to benefit from higher levels of capital. Capital goods make up a significant portion of imported goods, about one-quarter (figure 2).3 Parro (2013) estimates that, for the United States, 14 percent of the change in the wage premium commanded by skilled labor from 1990 to 2007 was a result of a decline in trade costs.

Effect of Trade on Prices

When economists advocate for more open trade, they usually point to lower consumer prices as a major benefit. These price decreases may be less salient to the public than, for example, a plant closure, but the magnitude of the effect can be very large because the benefit is enjoyed by many households. Increased trade leads to lower prices through a variety of channels. First, consumers have the option to purchase imports from countries that produce at a lower cost. Second, when faced with cheaper competition, domestic producers may lower their prices to remain competitive. Third, domestic producers may import less expensive inputs and charge lower prices. Because of these last two channels, rather than restrict attention exclusively to imports, we analyze household expenditures on tradables, which in addition to imports also includes goods and services that either face substantive foreign competition or use significant shares of imported inputs in production.

Evidence of the impact of trade openness on consumer prices can be found in Flaaen et al. (2019), which examines the effect of tariff increases (a reduction in trade openness) on foreign washing machines on the retail prices of washing machines in the United States. The study finds that the tariffs led to an increase in the price of washing machines, both foreign and domestically produced, commensurate with the size of the tariff. Moreover, the price of dryers, a complementary good to washers, increased by roughly the same amount. There are also numerous papers that document a decline in prices in response to an increase in trade openness (Amiti et al., 2018; Bai and Stumpner, 2019; and Jaravel and Sager, 2018).

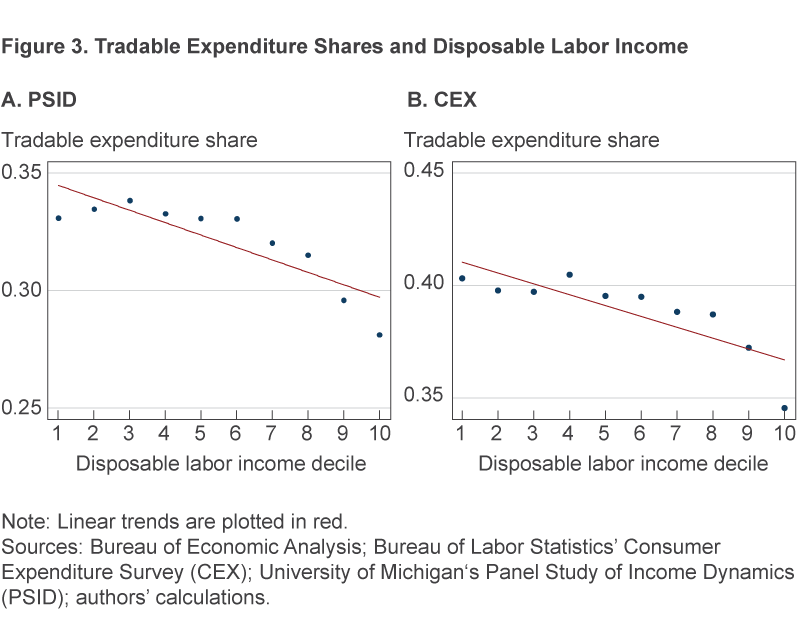

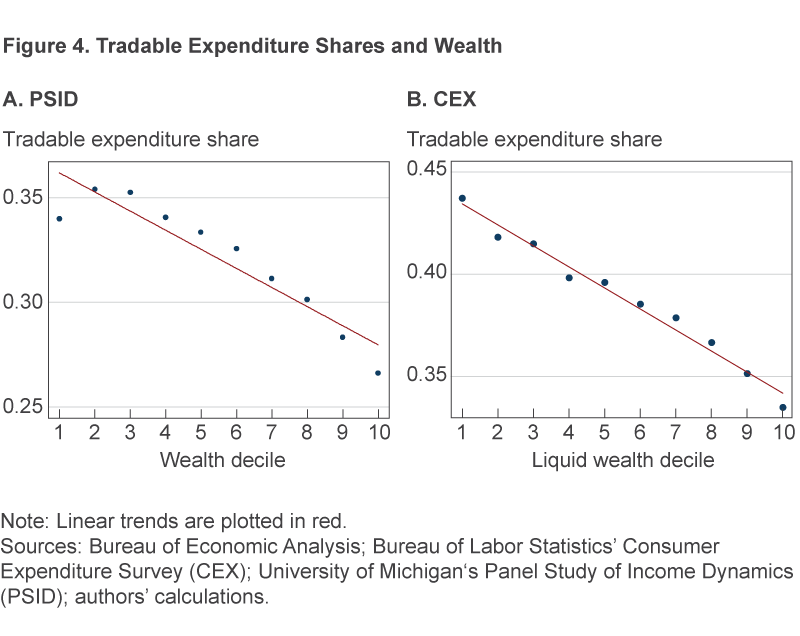

As with the labor market effects, the price effects from trade are not shared equally across households either, because households of different incomes buy somewhat different bundles of goods and services. In a recent Federal Reserve Bank of Cleveland working paper, we show that the consumer gains from price declines in tradables are unequally distributed across households (Carroll and Hur, 2019). We do so by documenting that the share of consumption expenditures that are tradable is higher for households with low income and wealth (Carroll and Hur, 2019). We use two complementary datasets for this study, the Consumer Expenditure Survey (CEX) and the Panel Study of Income Dynamics (PSID). Compared to the PSID, the CEX has the advantage of providing more disaggregated expenditures. The PSID, however, has much more information on household wealth. Thus, we use both data sources to document our findings. In the CEX, we categorize an item as tradable if the percentage of the total output of that category represented by either exports or imports exceeds 11 percent.4 In the PSID, we categorize as tradable expenditures on clothing, food at home, prescriptions, home furnishings, the purchase and lease of cars and trucks, and a fraction of expenditures on entertainment, vacation, housing, and vehicle repairs. In both data sets, we restrict the sample to working age households (between the ages of 25 and 64) with positive amounts of wealth and disposable labor income.5, 6

Figure 3 plots the relation between tradable expenditure shares and disposable labor income in the (a) PSID and the (b) CEX. While the tradable expenditure shares are higher in the CEX than in the PSID, the pattern is the same across both data sets. Households with lower disposable labor income spend a larger share of their consumption expenditures on tradable goods and services. The lowest and highest income deciles have average tradable expenditure shares of 37 percent and 31 percent, respectively, across the two data sets. One way in which poor and rich households differ in their expenditure is on food consumption. The food category food at home (primarily groceries) is classified as a tradable good. As a share of expenditures, poor households spend more on food, a relation known as “Engel’s Law.”

Figure 4 shows that the pattern is even stronger for wealth. The lowest and highest wealth deciles have average tradable expenditure shares of 39 percent and 30 percent, respectively, across the two data sets. In Carroll and Hur (2019), we demonstrate that the negative relationship between tradable expenditure shares and disposable labor income and wealth is robust to controlling for age and education of the household head, household size, and home ownership.

Because poorer households spend a greater proportion of expenditures on tradable goods and services, they are more sensitive to the price effects of trade. In particular, all other things being equal, they benefit more when tradables’ prices fall in response to increased trade openness. Increased trade disproportionately lowers the costs of the bundle of goods and services purchased by a lower-income household compared to a higher-income household.

Putting Things Together

So far we have presented evidence of two channels that may affect low- and high-income households differently and that work in opposite directions. Labor market effects tend to differentially harm low-income households, but the price effect disproportionately benefits them. On net, how important is each channel? To shed some light on the answer to this question, in Carroll and Hur (2019) we quantify the price effect within a model and relate the magnitude of this channel to that of the labor market effect quantified in other papers.

To do this, we take a standard model of household consumption and savings that produces different income and wealth levels across households, and we augment it to include trade. Then, using optimization and simulation techniques, we compare the size of the price effects of trade on utility for the households within the model to those from similar exercises with labor market effects. We find that the difference in the price effect for low-income and low-wealth households and that for high-income, high-wealth households is of roughly the same magnitude as the difference in the labor market effect for similar households from other studies (Caliendo, Dvorkin, and Parro, 2019; Lyon and Waugh, 2019). In interpreting this result, it is important to note that the size of the effects are measured as averages across certain income and wealth groups and so this does not imply that the magnitudes will offset for every household. For instance, a household that experiences a long spell of unemployment may not be fully compensated by the price effects. Thus, there may still be differences in opinion regarding free trade.

Conclusion

Economists overwhelmingly view the benefits of trade as outweighing the costs. In this Commentary, we have discussed how trade can affect households differently depending on their position in the labor market and the pattern of their consumption expenditures. The effects from these two channels go in opposite directions: low-skill or low-wage households that are exposed to the most risk from labor market effects may also gain the most from less expensive tradables. Differences in the overall effects of trade across households may contribute to the disagreement among the public as to the benefits of trade openness. In future research, we will include both the labor market channel and the price channel to better measure the distribution of the net gains and losses from trade.

Footnotes

- In the 2012 Economics Experts Panel (EEP), produced by the Initiative for Global Markets at the University of Chicago Booth School of Business, 94 percent of respondents agreed with the statement “Freer trade improves productive efficiency and offers consumers better choices, and in the long run these gains are much larger than any effects on employment.” The other 6 percent were uncertain. Contrast this level of agreement with those from other polls of the EEP on education, tax rates, or the minimum wage. Return

- Autor et al. (2014) define an industry’s trade exposure as the change in imports from China over the period 1991 to 2007, normalized by a measure of domestic production in 1991.Return

- Bureau of Economic Analysis Table 2.1. “U.S. International Trade in Goods.” This is a conservative estimate. If we include industrial supplies and automotive vehicles, parts, and engines, the fraction rises to about two-thirds.Return

- We follow Johnson (2017) who finds that the 11 percent threshold minimizes the number of industries that change tradability classifications due to a 1-percentage-point increase or decrease from the threshold.Return

- Disposable labor income is defined as the sum of earnings, one-half of business and farm income, and transfers less taxes.Return

- While our results are not sensitive to these restrictions, we focus on working age households since they are more likely to be affected by the labor market effects of trade.Return

References

- Amiti, Mary, Mi Dai, Robert Feenstra, and John Romalis. 2018. “How Did China’s WTO Entry Affect US Prices?” Federal Reserve Bank of New York, Staff Reports, 817.

- Autor, David H., David Dorn, Gordon H Hanson, and Jae Song. 2014. “Trade Adjustment: Worker-level Evidence.” The Quarterly Journal of Economics, 129(4): 1799–1860.

- Bai, Liang, and Sebastian Stumpner. 2019. “Estimating US Consumer Gains from Chinese Imports.” American Economic Review: Insights.

- Caliendo, Lorenzo, Maximiliano A. Dvorkin, and Fernando Parro. 2019. “Trade and Labor Market Dynamics: General Equilibrium Analysis of the China Trade Shock.” Econometrica, 87(3): 741–835.

- Carroll, Daniel R., and Sewon Hur. 2019. “On the Heterogeneous Welfare Gains and Losses from Trade.” Federal Reserve Bank of Cleveland, Working Paper no. 19-06R2.

- Feenstra, Robert C., and Akira Sasahara. 2018. “The ‘China Shock,’ Exports and US Employment: A Global Input–Output Analysis.” Review of International Economics, 26(5): 1053–1083.

- Flaaen, Aaron B., Ali Hortacsu, and Felix Tintelnot. 2019. “The Production Relocation and Price Effects of US Trade Policy: The Case of Washing Machines.” National Bureau of Economic Research, Technical Report.

- Jaravel, Xavier, and Erick Sager. 2018. “What Are the Price Effects of Trade? Evidence from the US and Implications for Quantitative Trade Models.” Unpublished manuscript.

- Jones, Bradley. 2018. “Americans Are Generally Positive about Free Trade Agreements, More Critical of Tariff Increases.” Pew Research Center, FacTank (May 10). https://www.pewresearch.org/fact-tank/2018/05/10/americans-are-generally-positive-about-free-trade-agreements-more-critical-of-tariff-increases/. [Note: This reference was omitted when the Commentary was first published. It was added on 11/19/2020.]

- Johnson, Noah N. 2017. “Tradable and Nontradable Inflation Indexes: Replicating New Zealand’s Tradable Indexes with BLS CPI Data.” Monthly Labor Review.

- Krusell, Per, Lee E. Ohanian, Jose-Victor Rios-Rull, and Giovanni L. Violante. 2000. “Capital–Skill Complementarity and Inequality: A Macroeconomic Analysis.” Econometrica, 68(5): 1029–1053.

- Lyon, Spencer, and Michael E. Waugh. 2019. “Quantifying the Losses from International Trade.” Unpublished manuscript.

- Parro, Fernando. 2013. “Capital–Skill Complementarity and the Skill Premium in a Quantitative Model of Trade.” American Economic Journal: Macroeconomics, 5(2): 72–117.

Suggested Citation

Carroll, Daniel R., and Sewon Hur. 2019. “The Winners and Losers from Trade.” Federal Reserve Bank of Cleveland, Economic Commentary 2019-15. https://doi.org/10.26509/frbc-ec-201915

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International