- Share

What Is Behind the Persistence of the Racial Wealth Gap?

Most studies of the persistent gap in wealth between whites and blacks have investigated the large gap in income earned by the two groups. Those studies generally concluded that the wealth gap was “too big” to be explained by differences in income. We study the issue using a different approach, capturing the dynamics of wealth accumulation over time. We find that the income gap is the primary driver behind the wealth gap and that it is large enough to explain the persistent difference in wealth accumulation. The key policy implication of our work is that policies designed to speed the closing of the racial wealth gap would do well to focus on closing the racial income gap.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Black households in the United States have, on average, considerably less wealth than white households. In 2016, the average wealth of households with a head identifying as black was $140,000, while the corresponding level for white-headed households was $901,000, nearly 6.5 times greater.1 The fact that blacks, on average, have considerably less wealth than whites is troubling, not just because it is an inequality of outcomes, but also because it strongly suggests inequality of opportunity. The economic opportunities provided by wealth range from insuring consumption against disruptions to a household’s disposable income (such as surprise medical expenditures or unemployment spells) to enabling access to housing, good public schools, and postsecondary education.

Given the importance of wealth and the persistence of racial inequality in the United States, economists have had a long-standing interest in the racial wealth gap. A focus of economic research has been on understanding which factors contribute to the racial wealth gap and by how much. In this Commentary, we review existing evidence and literature on the wealth gap between blacks and whites in the United States. We then present new research showing that although differences in savings rates, inheritances, and rates of return on investments have all been suspected as playing a large role in maintaining the racial wealth gap, the gap is primarily the result of a sizeable and persistent income gap.

The History of Racial Income and Wealth Gaps

The current racial wealth gap is the consequence of many decades of racial inequality that imposed barriers to wealth accumulation either through explicit prohibition during slavery or unequal treatment after emancipation. Examples of postemancipation barriers include legally mandated segregation in schools and housing, discrimination in the labor market, and redlining, which reduced access to capital in black neighborhoods.

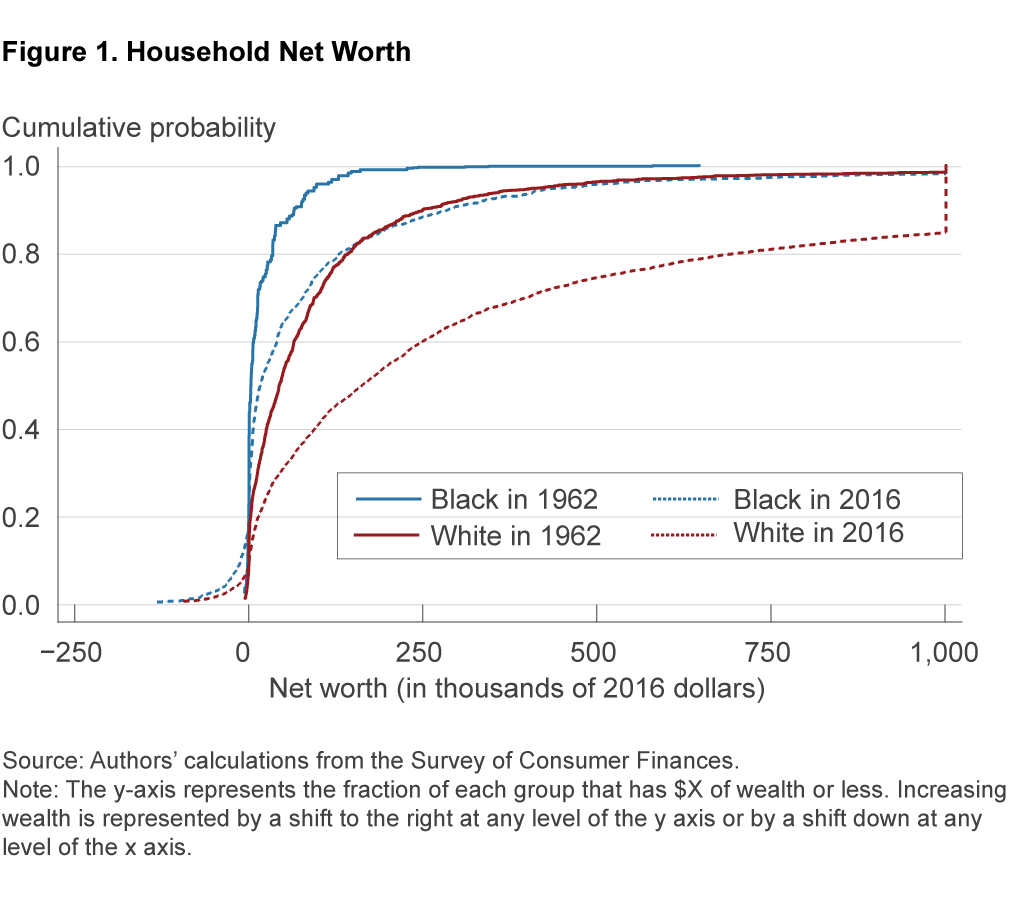

And while the existence of a racial wealth gap may not be altogether surprising, it may be surprising how little the racial wealth gap has changed over the past half century, even after the passage of civil rights legislation. In fact, the 2016 wealth gap is roughly the same as it was in 1962, two years before the passage of the Civil Rights Act of 1964, according to data from the Survey of Consumer Finances (SCF). Average white wealth in 19622 was 7 times that of average black wealth. The persistence of the racial wealth gap can be seen in figure 1, which plots the distributions of wealth in 2016 dollars for black and white households in the years 1962 and 2016. While there has been growth in wealth over time for both racial groups (as evidenced by the rightward shift between the solid and dashed lines), notice that the dashed line corresponding to black households in 2016 is still to the left of the solid line for white households in 1962. Simply put, over the past 50 years, the distribution of black wealth has not even “caught up” to the distribution of white wealth in 1962.

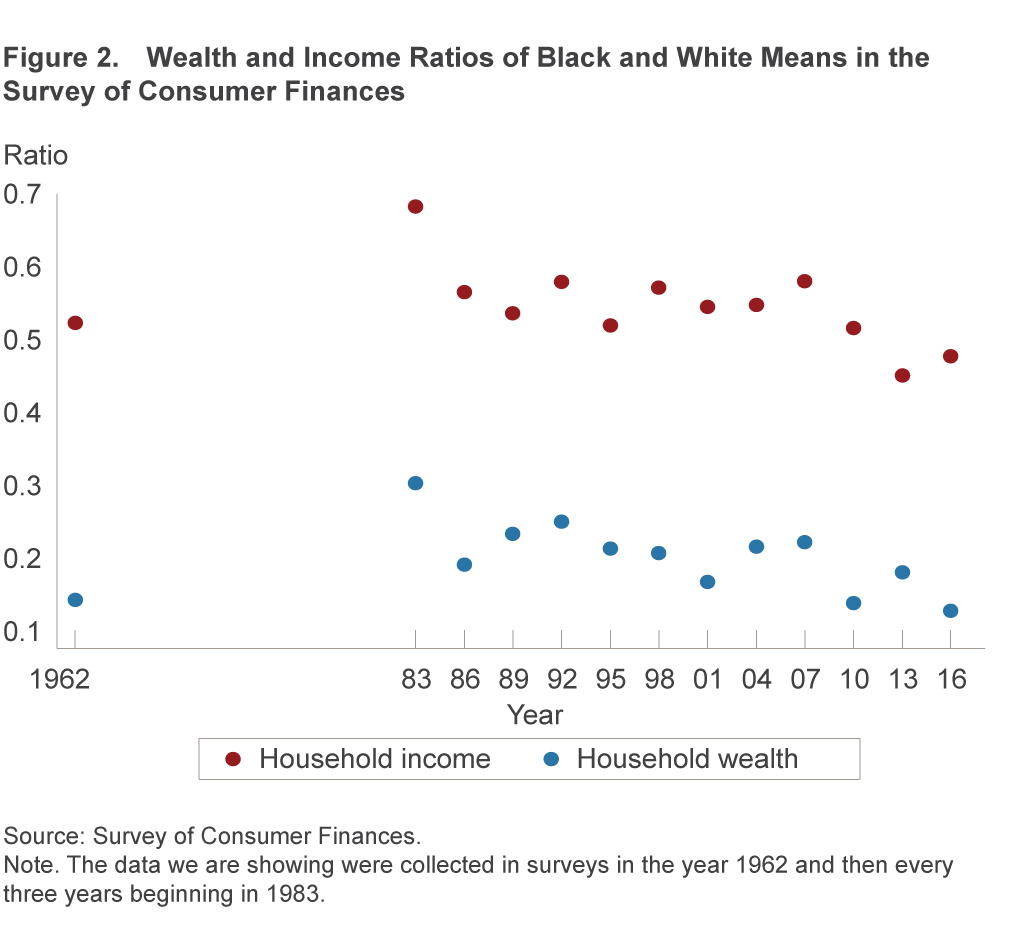

Some of the similarity in wealth ratios between 1962 and 2016 relates to timing. The Great Recession had a larger impact on average black wealth than on white wealth. Figure 2 plots black wealth as a fraction of white wealth for different years of the SCF. There is a noticeable drop in the ratio after 2007, a dip that has not fully been undone even 10 years later. However, the wealth gap is far from closing even if we focus only on the years leading up to the Great Recession: The wealth ratio rose only from 14 percent to 22 percent between 1962 and 2007.

What Could Be Behind the Wealth Gap?

The wealth gap might simply be the result of a historical wealth gap that was so large it hasn’t yet had time to close. As we have seen from the 1962 data, black households were much poorer than white households at that time. Even if all racial discrimination had ended in the 1960s, these wealth differences would not have disappeared instantly. Wealth takes time to accumulate. However, it is possible that other factors have kept the wealth levels of blacks and whites from converging, and researchers have investigated the influence of several of these. Specifically, the possible obstacles to wealth equalization that have been studied are savings rates, inheritances, rates of return on investments, and income. If blacks and whites differ on any of these dimensions, it could explain the persistence of the wealth gap.

Differences in Rates of Return on Investments

If white households earn more from their savings than do black households, the different rates of return could contribute to the persistence of the wealth gap. Over time, initial differences in wealth would be compounded, assuming not all additional gains are consumed. Gittleman and Wolff (2004) examine three survey years of the Panel Study of Income Dynamics (PSID), 1984, 1989, and 1994, and find little evidence that black households earned lower returns on the same assets as white households. However, they do find that the portfolios held by black households were more concentrated in low-average-return assets.

Table 1 displays the average share of asset types held across race and years from 1984 to 1994. First, we might compare the percentages of black and white households that hold each type of asset (columns 1 and 2). Notice that white households hold a larger fraction of each asset category than do black households. For example, 64 percent of white households hold home equity, while only 38 percent of black households have wealth in the form of home equity.

| Percent holding asset | Average percent of assets | |||

| White | Black | White | Black | |

| Home equity | 64 | 38 | 31 | 49 |

| Other real estate | 21 | 7 | 17 | 9 |

| Farm or business | 13 | 2 | 17 | 9 |

| Stock | 32 | 8 | 13 | 5 |

| Checking and savings | 85 | 45 | 14 | 12 |

| Vehicles | 87 | 58 | 6 | 14 |

| Other savings | 26 | 14 | 5 | 9 |

| Debt | 49 | 44 | 3 | 6 |

Source: Maury Gittleman and Edward N. Wolff. 2004. “Racial Differences in Patterns of Wealth Accumulation.” The Journal of Human Resources, 39(1): 193–227.

Note: Gittleman and Wolff average data from the Panel Study of Income Dynamics across the years 1984, 1989, and 1994.

Second, we might compare the types of assets black and white households hold (columns 3 and 4). This comparison shows that the assets of white households are more concentrated in real estate, business, and stocks. These assets tend to be riskier than the other categories, but they also provide a higher average return.

Table 2 displays the same information for 2015 and shows that, despite some improvement in the fractions of asset ownership by black households, the same portfolio imbalances exist in the recent data. One explanation for the higher concentration of low-average-return assets in black households’ portfolios could be those households’ lower wealth levels. Higher returns are associated with higher risk, and the less wealth a household has, the less risk it may be willing to take with its investments.

| Percent holding asset | Average percent of assets | |||

| White | Black | White | Black | |

| Home equity | 65 | 42 | 27 | 23 |

| Other real estate | 17 | 6 | 6 | 2 |

| Farm or business | 9 | 3 | 4 | 1 |

| Stock | 20 | 2 | 6 | 1 |

| Checking and savings | 86 | 56 | 15 | 10 |

| Vehicles | 87 | 76 | 20 | 32 |

| Other savings | 17 | 10 | 3 | 4 |

| Debt | 49 | 54 | 19 | 27 |

Source: Panel Study of Income Dynamics, 2015.

While portfolio differences are real and impactful, these data suggest that portfolio differences are not the most significant factor contributing to the racial wealth gap. Gittleman and Wolff estimate that over 1984–1994 the wealth gap would have closed by only an additional 4 percentage points if black households had held the same portfolios as white households.

Differences in Intergenerational Transfers

Another mechanism that could explain the large gap between black and white wealth is inheritances. If white households had more wealth in the past than did black households and bequeathed their estates to their children, we should expect the wealth gap to persist for several generations.

The magnitudes of differences in inheritances have been found to be large. Avery and Rendall (2002) use the 1989 SCF to document that far fewer black households reported receiving an inheritance than whites and that, of those who did, the average value was about five times smaller than that of their white counterparts. Other studies find that differences in intergenerational transfers, like differences in returns, are not the largest driver of the racial wealth gap.3 Menchik and Jianakoplos (1997) estimate that between 10 percent and 20 percent of the racial wealth gap can be accounted for by inheritances, while Gittleman and Wolff (2004) find that if black households had the same inheritances as white households, the wealth gap would have closed by an additional 5 percentage points. However, differences in inheritances do not appear to drive the racial wealth gap simply because so few households, whether black or white, receive what could be considered “large” inheritances (Hendricks, 2001).

Differences in Labor Income

Returning to figure 2, notice that there is also a sizeable gap between the average income earned by white households and the average earned by black households: The ratio of labor income between black and white households is roughly 52 percent in 1962, and it reaches only 58 percent in 2007 before falling steeply after the Great Recession.

Early studies hypothesized that this income gap could be the principal factor responsible for keeping the wealth gap large (Terrell, 1971, Blau and Graham, 1990, Altonji and Doraszelski, 2005, Barsky et al., 2002). However, those studies generally concluded that the wealth gap was “too big” to be explained by the income gap (based on statistical methods that predict wealth as a function of observable characteristics). It seems difficult to imagine that the observed income gap could support such a large wealth gap: Whites’ having twice the income of blacks does not seem to imply that whites should have five to ten times the wealth of blacks.

A Different Approach

The studies cited above use statistical models to predict wealth based upon observable characteristics. The studies then decompose the drivers of the wealth gap by predicting the wealth of white households using the expected wealth equation for blacks.

Because the relationships between observable characteristics and wealth are estimated over short periods of time in those studies, they are likely underestimating the importance of initial conditions and income disparities for future wealth. However, the way these initial conditions and disparities interact with other factors over time—referred to as “dynamics”—is likely to matter a great deal. To see why, consider that current labor income (or a measure of several recent observations of labor income) may not be strongly related to the current amount of wealth a household owns. Typically, wealth takes a considerable amount of time to accumulate, and so it could be many years before a household has a high level of wealth even if it earns a high income now. Thus, the degree to which labor income should be related to wealth over a short time horizon is not clear.

In a recent research paper, we approach the problem from a different angle (Aliprantis et al., 2018a). We construct and calibrate an economic model of savings to understand the role each of the above mechanisms plays in maintaining the racial wealth gap. Our modeling approach is different from the previous literature because it accounts for dynamics. This approach contrasts with the statistical techniques typically employed in the literature, as these tend to represent a snapshot at one point in time.

In our model, households have many motivations for saving. They save for retirement and to leave an inheritance for their children; they save to insure against sudden fluctuations in their labor income; and they save to earn returns from the market. Households also save to insure their ability to consume if they live for an unexpectedly long time.

We first carefully calibrate our model, which means that we find parameters for our model such that the predictions it makes about each of the above mechanisms matches important statistics we observe in the data. Having made sure that our model makes reasonable predictions about the mechanisms believed to contribute to the wealth gap, we then allow our model to make predictions about the types of wealth gaps we should observe if one mechanism is changed at a time or if multiple mechanisms are changed together. We focus on the following questions: Are the observed racial income and wealth gaps compatible with each other? Which factors make the largest contribution to the racial wealth gap?

We answer these questions by starting black and white households in our model with the wealth observed in the 1962 data. From these initial conditions of high wealth inequality between racial groups, we then input into the model a labor income gap taken from the data, assuming that the income gap will close in the future at the rate observed between 1962 and 2007.

We find that one factor accounts for the racial wealth gap almost entirely by itself: the racial income gap. Our results stand in contrast to the results of earlier studies that focus on a single point in time and find that the wealth gap is too large for the income gap to explain. The reason that our study comes to a different conclusion is that it takes into account the dynamic nature of wealth accumulation.4 What do we mean when we say that the labor income gap can account for the racial wealth gap? First, our model predicts that income and wealth will have a relationship in the future like the one we observe today. Our model predicts that, starting from 1962, it would take 259 years for the ratio of black and white mean wealth to reach 0.90.

Second, changing the labor income gap in the model changes the wealth gap dramatically. For example, when we remove the labor income gap in our model, meaning black and white households immediately earn the same income from their labor from 1962 onward, the black-to-white wealth ratio reaches 90 percent by 2007.

Third, other factors we might have suspected as playing major roles in maintaining the racial wealth gap pale in comparison to the role of the labor income gap. For example, when our model makes predictions under a gap in returns to investment as large as the gap in labor income, we find little change. The same is true for equalizing the inheritance process.

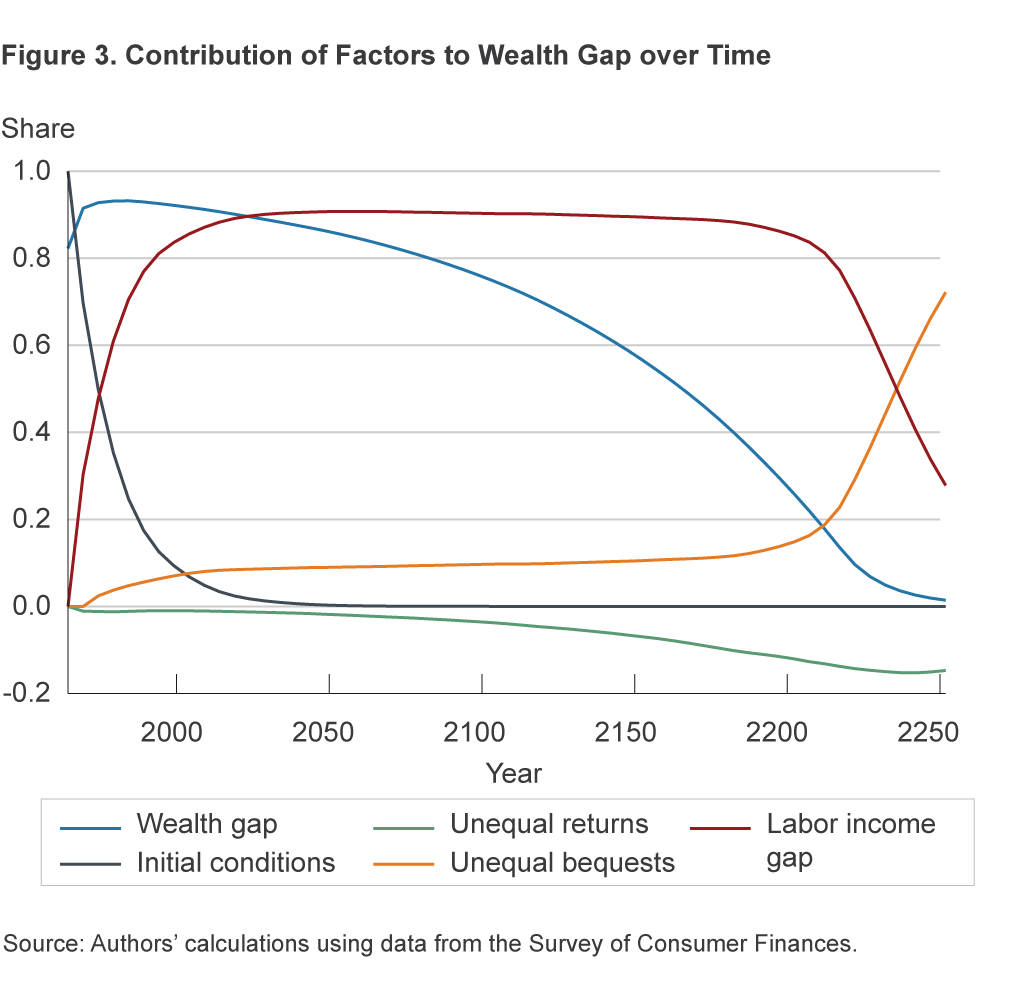

Figure 3 decomposes the wealth gap at each point in time into its contributing factors as generated by our model. As one would expect, initial conditions play an important role early on. Regardless of the different factors we test, it takes time to undo the extreme racial wealth inequality present in 1962. Over time, however, the model puts less weight on the initial disparity for propagating the racial wealth gap and more weight on persistent systemic differences in economic opportunity. Our model predicts that by 1977 the gap in labor income is a larger contributor to the wealth gap than initial inequality, and by 1990 the labor income gap accounts for more than 80 percent of the wealth gap. The labor income gap remains the dominant factor until far in the future, when the racial wealth gap is nearly closed.

Policy Implications and Conclusion

Our study offers a new perspective on the racial wealth gap by capturing the dynamics of wealth accumulation. While our study is only one contribution in the broader literature on the racial wealth gap, our analysis supports the conclusion that the racial labor income gap is the primary driver behind the large and persistent difference in average wealth between black and white households.

The key policy implication of our work is that policies designed to speed the closing of the racial wealth gap would do well to focus on closing the racial income gap. Of course, this focus leads to another broad set of questions surrounding the racial income gap. For example, what is the relative importance of factors such as racial discrimination in the labor market (Bertrand and Mullainathan, 2004), incarceration policies (Neal and Rick, 2014), and skills (Neal and Johnson, 1996) in maintaining the racial income gap? Even more broadly, social scientists since Wilson (1997) have focused on the role of factors such as deindustrialization, neighborhoods, and schools in the persistence of the racial income gap. Recent findings that the intergenerational transmission of income is lower for blacks than for their white counterparts at all levels of income (Chetty et al., 2018), and that the same is true for neighborhood quality regardless of wealth (Aliprantis et al., 2018b), suggest that policies successfully addressing the racial labor income and wealth gaps will have to address a broad set of issues.

Footnotes

- Survey of Consumer Finances. The difference in median wealth was even starker: $16,000 compared to $163,000, or 10 times greater. Return to 1

- The 1962 data are a merger of two other data sets, the 1962 Survey of Financial Characteristics of Consumers and the 1963 Survey of Changes in Family Finances. These data are available from the Board of Governors of the Federal Reserve System. Return to 2

- The studies in this literature were conducted on data from roughly the same time period as the studies on returns. Return to 3

- See O’Flaherty (2015) for a summary of this area of the literature and Ashman and Neumuller (2018) for a related analysis. Return to 4

References

- Aliprantis, Dionissi, Daniel Carroll, and Eric Young. 2018a. “The Dynamics of the Racial Wealth Gap.” Unpublished manuscript, Federal Reserve Bank of Cleveland.

- Aliprantis, Dionissi, Daniel Carroll, and Eric Young. 2018b. “What Explains Neighborhood Sorting by Income and Race?” Unpublished manuscript, Federal Reserve Bank of Cleveland.

- Altonji, Joseph G., and Ulrich Doraszelski. 2005. “The Role of Permanent Income and Demographics in Black/White Differences in Wealth.” Journal of Human Resources, XL(1): 1–30.

- Ashman, Hero, and Seth Neumuller. 2018. “Can Income Differences Explain the Racial Wealth Gap? A Quantitative Analysis.” Unpublished manuscript.

- Avery, Robert B., and Michael S. Rendall. 2002. “Lifetime Inheritances of Three Generations of Whites and Blacks.” American Journal of Sociology, 107(5): 1300–1346. https://doi.org/10.1086/344840

- Blau, Francine D., and John W. Graham. 1990. “Black–White Differences in Wealth and Asset Composition.” The Quarterly Journal of Economics, 105(2): 321–339. https://doi.org/10.2307/2937789

- Chetty, Raj, Nathaniel Hendren, Maggie R. Jones, and Sonya R. Porter. 2018. “Race and Economic Opportunity in the United States: An Intergenerational Perspective.” NBER Working Paper No. 24441.

- Barsky, Robert, John Bound, Kerwin Ko’ Charles, and Joseph P. Lupton. 2002. “Accounting for the Black–White Wealth Gap: A Nonparametric Approach.” Journal of the American Statistical Association, 97(459): 663–673. https://doi.org/10.1198/016214502388618401

- Bertrand, Marianne, and Sendhil Mullainathan. 2004. “Are Emily and Greg More Employable Than Lakisha and Jamal? A Field Experiment on Labor Market Discrimination.” American Economic Review, 94(4): 991–1013.

- Gittleman, Maury, and Edward N. Wolff. 2004. “Racial Differences in Patterns of Wealth Accumulation.” The Journal of Human Resources, 39(1): 193-227. https://doi.org/10.2307/3559010

- Hendricks, Lutz. 2001. “Bequests and Retirement Wealth in the United States. Unpublished manuscript, Arizona State University.

- Menchik, Paul L., and Nancy Ammon Jianakoplos. 1997. “Black–White Wealth Inequality: Is Inheritance the Reason?” Economic Inquiry, 35(2): 428–442. https://doi.org/10.1111/j.1465-7295.1997.tb01920.x

- Neal, Derek, and William Johnson. 1996. “The Role of Premarket Factors in Black–White Wage Differences.” Journal of Political Economy, 104(5): 869–895.

- Neal, Derek, and Armin Rick. 2014. “The Prison Boom and the Lack of Black Progress after Smith and Welch.” NBER Working Paper No. w20283.

- O’Flaherty, Brendan. 2015. The Economics of Race in the United States. Harvard University Press.

- Panel Study of Income Dynamics, public use dataset. Survey Research Center, Institute for Social Research, University of Michigan, Ann Arbor, Michigan. (accessed 2018).

- Survey of Consumer Finances. Board of Governors of the Federal Reserve System. http://www.federalreserve.gov/econresdata/scf/scfindex.htm

- Terrell, Henry S. 1971. “Wealth Accumulation of Black and White Families: The Empirical Evidence.” Journal of Finance, 26(2): 363–377. https://doi.org/10.1111/j.1540-6261.1971.tb00904.x

- Wilson, William Julius. 1987. The Truly Disadvantaged: The Inner City, the Underclass, and Public Policy. University of Chicago.

Suggested Citation

Aliprantis, Dionissi, and Daniel R. Carroll. 2019. “What Is Behind the Persistence of the Racial Wealth Gap?” Federal Reserve Bank of Cleveland, Economic Commentary 2019-03. https://doi.org/10.26509/frbc-ec-201903

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International