- Share

Sizing Up Systemic Risk

Regulators now use a framework for identifying systemically important banking institutions that is based on five broad measures of bank structure. Though size is only one of these equally weighted measures, it seems to be the focus of most attention. This Commentary explores whether the other measures contribute unique information or whether size is all one needs to identify all the institutions whose failure could bring down the financial system.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

What makes a bank “too big to fail”? Some banks seem so large and important that their failure could bring down the financial system. But decades of financial problems, from the debacle at Long-Term Capital Management in 1998 to the problems with Bear Stearns, Lehman Brothers, and AIG in 2008, have shifted the focus from mere size to a broader notion of systemic risk. Regulators around the world now consider other measures of systemic importance in addition to size, such as complexity and interconnectedness. Size still seems to get more than its share of the attention, however. In the United States, for example, the Dodd–Frank Wall Street Reform and Consumer Protection Act, which was enacted after the 2007 financial crisis, explicitly states that it aims “to end ‘too big to fail.’”

How important are these other criteria, and how much useful information do they add to that provided by size in determining an institution’s systemic importance? This Commentary explores the extent to which size is—and is not—the dominant category in determining systemic status. We argue that size does account for most of an institution’s designation as systemically important, but the other criteria used now also contribute unique information. We find that in some cases, the use of the additional criteria leads to the classification of institutions as systemically important that would not have been identified had size been the only criterion used in the risk assessment.

Who’s in the Club, and What Do They Get?

The Basel Committee on Banking Supervision, a group of banking supervisors from around the world, has established a framework to identify and assess global systemically important banks or G-SIBs, those banks whose failure would potentially pose a threat to the international financial system. It is up to the individual countries to implement the framework. In the United States, adaptation of the framework has taken the form of rules based on the Dodd–Frank Act that call for enhanced prudential standards to mitigate the risk posed by systemically important financial institutions (SIFIs) and in particular for those designated G-SIBs.

The framework for G-SIBs as outlined by the Basel Committee has two main purposes: deciding which firms are globally systemically important, and thus deserve G-SIB designation, and then determining how much extra capital each G-SIB needs to hold. The framework is based on five broad measures of bank structure that reflect channels through which a bank’s failure could impact the world financial system: size, interconnectedness, substitutability, cross-jurisdictional activity, and complexity. To apply the framework, banking regulators calculate each firm’s score from these categories and designate as G-SIBs those firms with scores above a certain threshold (in the United States, there are currently eight institutions classified as G-SIBs).

The first indicator, size, is calculated as the total leverage exposure of the bank, including not only assets such as loans and investment securities, but also derivatives, valued at their replacement cost, and off-balance-sheet items adjusted by the appropriate credit conversion factor (for example, an unused loan commitment with a maturity of less than 14 months gets a zero weight, while a commitment with a maturity of greater than 14 months is weighted at 5 percent; a commitment of $1 million at the longer maturity would thus add $50,000 to total exposure).1

The second indicator, interconnectedness, looks at how closely a bank is connected to other financial institutions. It measures what the bank has deposited at other financial institutions, borrowings from such institutions, and related items such as investments in other banks’ stock or bonds. The fear is that problems at a closely connected bank may easily spread to other banks, perhaps creating problems for the entire system.

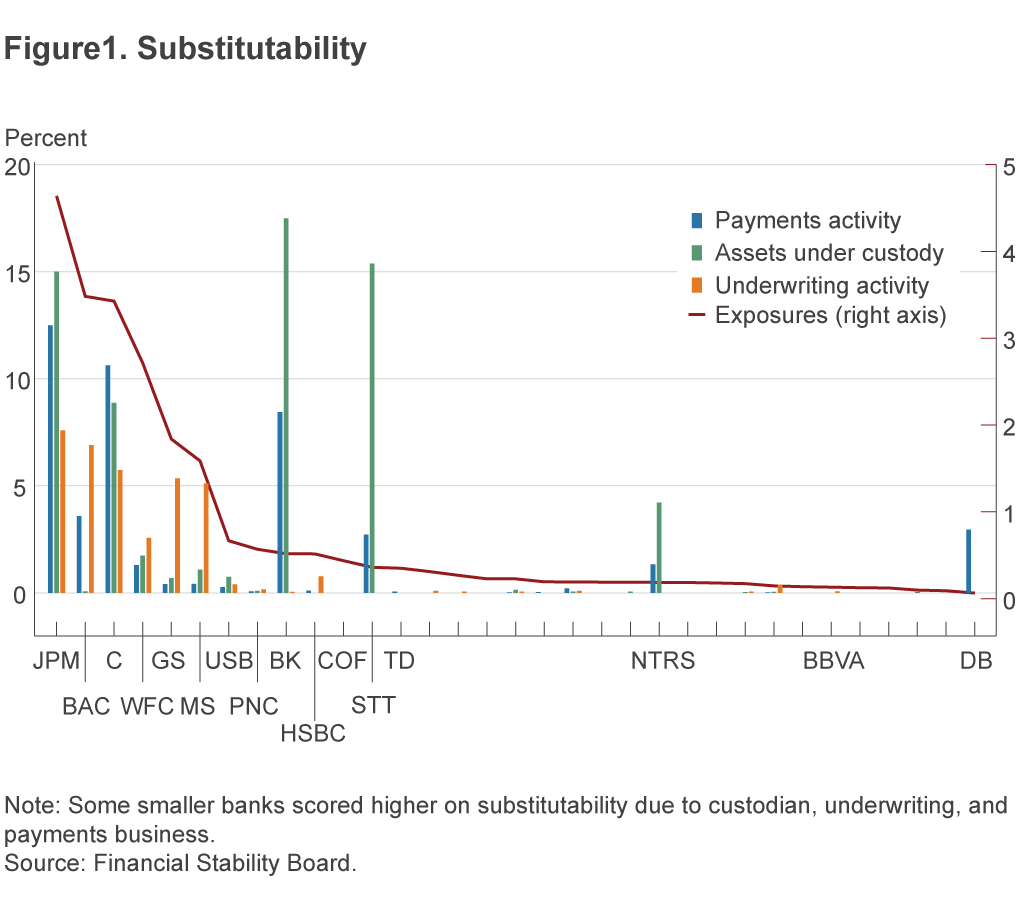

The third indicator, substitutability, measures the extent to which other banks or firms can take up the slack if a bank fails. Some important financial functions are concentrated in just a few banks, and this resulting lack of substitutability increases these banks’ systemic importance. This indicator combines data from three areas often dominated by a few banks: assets under custody, payments activities, and securities underwriting. The assets-under-custody category is particularly important for those banks that hold assets on behalf of other institutions. While the substitutability indicator correctly ranks most banks, a few banks are so dominant in one of these three areas that the indicator raises their systemic importance scores above what most regulators would consider reasonable. As a consequence, unlike the other indicators, there is a cap on the level of the substitutability indicator above which the score does not go in order to limit the impact of this number.

The fourth indicator, complexity, as its name suggests, attributes systemic importance to the complexity of the bank. It depends on three inputs: the notional amount of over-the-counter (OTC) derivatives, the amount of “level 3” assets, and the organization’s trading and available-for-sale assets (AFS). The notional value of a derivative is the value of the underlying security on which the derivative is based. For example, an interest rate swap is a derivative whereby two parties exchange, or “swap,” interest payments on a bond; one side might get a constant 3 percent each payment period, while the other gets the LIBOR rate (a benchmark rate that some banks charge each other for short-term loans). The underlying value of the bond is the notional value of the derivative. Level 3 assets are generally illiquid investments that are difficult to value, both because there is no easily observable market price (level 1), nor is there a reliable pricing model (level 2). Trading securities and AFS securities are those the bank has explicitly designated as ready for trading and not being held to maturity; they are thought most likely to cause fire sales in the financial markets because they are often the first to be sold.

The final of the five indicators, cross-jurisdictional activity, captures the idea that banks active in many areas of the globe are more difficult and expensive to resolve than those based in a single country. This indicator is measured by tallying up the assets and liabilities a bank has outside of its home country.

Computing the firm’s G-SIB score involves first converting the raw values of each of these indicators to an index. This conversion is done by taking a value for a bank, say, its total exposures, and dividing it by the aggregate value for the 75 largest US and foreign banking organizations. The resulting index for each indicator is then given a 20 percent weight, all the separate indexes are added together, and the result is multiplied by 10,000 (to give the composite index in basis points, which are hundredths of a percent). Those banks with a score of 130 or above are declared G-SIBs. This demarcation is a natural dividing line, with a large gap on either side.2

The score is then used to determine how much extra capital each G-SIB needs to hold, and different countries determine their own procedures for doing so. The US strategy for the enhanced regulation of G-SIBs is to have them hold enough capital so that their failure would have the same impact as a large but not systemically important bank. Thus, the higher the score (the greater the systemic risk), the more extra capital the bank must hold.

The amount of the increase is determined by comparing the calculated G-SIB score to a table of score ranges, or buckets, each of which is associated with a specified percentage of increased capital required (see table 1).3 These higher requirements are to be met with increased CET1, Common Equity Tier 1, which is mainly common stock and retained earnings, with a few adjustments. It is the most loss-absorbing of the various capital measures, or, to put it another way, when the firm loses money, CET1 takes the first hit.

Table 1. G-SIB Buckets

| Score (basis points) | Increased CET1 requirement (percent) |

|---|---|

| 530–629 | +3.5 |

| 430–529 | +2.5 |

| 330–429 | +2.0 |

| 230–329 | +1.5 |

| 130–229 | +1.0 |

Source: Financial Stability Board.

“It’s Not the Size of the Dog in the Fight; It’s the Size of the Fight in the Dog”

Many people think the problem of systemic importance emerges because a bank becomes “too big to fail.” But size is only one of the five criteria now used to determine whether a bank poses a systemic risk, and it accounts for only 20 percent of the final G-SIB score. For instance, in 2015, JPMorgan Chase was more than 10 times larger than State Street, but it had a G-SIB score only 3 times as high.

While many of the criteria are related, in that a large bank is also likely to be connected to a lot of others and to be present in many countries, giving it a high cross-jurisdictional score, some relatively smaller banks (banks that nonetheless still hold hundreds of billions of dollars in assets) score higher in terms of substitutability because they are important in payments activity, underwriting activity, or, in the case of State Street, assets under custody. Figure 1 ranks the G-SIBs by size, plotting their exposure on the right scale and their substitutability score on the left. Note that both State Street (STT) and Bank of New York-Mellon (BK) get high scores for assets under custody, while Deutsche Bank (DB) has higher payments activity than many larger banks.

While figure 1 shows that overall size is not the only factor in determining systemic risk and that some smaller banks can be systemically important in other dimensions, it also suggests that the largest banks, such as JPMorgan Chase (JPM), Bank of America (BAC), and Citibank (C) are systemic in areas other than size alone. So even though it is officially only 20 percent of the G-SIB score, is size, in fact, the dominant component in determining systemic importance? We get at this question by looking at the relation between size and systemic importance from several perspectives.

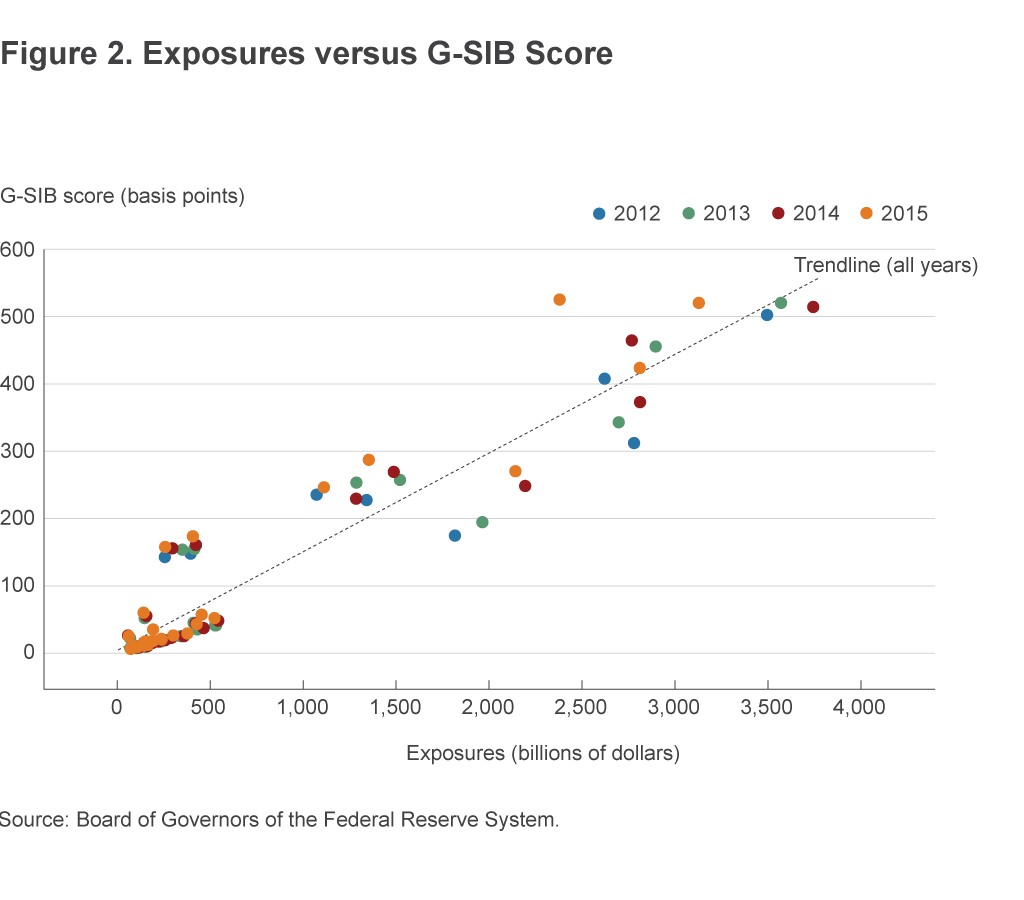

The first way is to look at the data. Figure 2 plots the G-SIB score against exposures, the measure of size used in the calculation. While the dots do not line up exactly on a straight line, it is clear that larger banks also tend to have higher G-SIB scores. A more quantitative way to express the issue is illustrated by the regression line plotted through the data, which is the line that best fits the data.

Table 2 reports the results of the regression. Several things stand out. First, the regression does a good job of explaining the data—the coefficient on size is highly significant, and the R2, which roughly measures how much of the variation in the data is explained by the regression line, is just above 90 percent. The coefficient looks rather small at first, but it is comparing size, measured in billions, with the G-SIB score, which is in basis points. One way to better appreciate what the coefficient means it to consider what it does. The regression line says that a bank with an exposure of $1 trillion would be expected to get a G-SIB score of 147, which would require an additional 1.0 percent of capital. Adding another trillion for an exposure of $2 trillion would double the score to 294, moving the bank up into the next risk bucket, which requires 1.5 percent in additional capital.

Table 2. Results of Regressing G-SIB Score on Exposures

| Coefficient | Standard error | t-stat | p > |t| | R2 |

|---|---|---|---|---|

| 1.47E-07 | 4.61E-09 | 31.98 | 0.000 | 0.9061 |

Source: Authors’ calculations.

Another way of looking at the size indicator is to examine something called a principal component. Instead of looking at size directly as a factor affecting the systemic risk score, this technique looks for a hidden factor that best fits the data. In general, when this is done, the hidden factor may not be easy to interpret, or it may be a combination of factors. For example, the best predictor of a basketball team’s record might be some combination of points scored and total turnovers. But in the case of banks, the hidden factor is mainly related to size. The first hidden factor, which accounts for more than 80 percent of the variation in G-SIB scores, is highly correlated with exposures, with a correlation of 96 percent.

Conclusion

In the end, does any aspect of bank structure other than size really matter in terms of a bank’s designation as a G-SIB? Can we dispense with the other four measures (and their reporting requirements)? Size dominates in determining systemic risk status, accounting for about 80 percent of the systemic risk score. That still leaves one-fifth of the systemic risk score accounted for by other measures, but perhaps the answer is not quite so simple. It shouldn’t be surprising that a bank that is active in markets around the world and engaged in a variety of financial activities would also be considered large in relation to other banks. We noted that the substitutability indicator at times got so large that the regulators capped it. Even with that cap, some smaller banks score high because they dominate some special areas. So determining systemic risk may be largely a matter of size, at least to the extent that G-SIB scores are an accurate measure, but that doesn’t mean it’s safe to ignore the other indicators.

Footnotes

- The data are reported on a special form, the Banking Organization Systemic Risk Report (FR Y-15), which large bank holding companies (BHCs, but we refer to them here as banks) must complete. Return to 1

- For a more detailed discussion of the components behind the indicators, and a discussion of possible alternatives, see “Systemic Importance Indicators for 33 U.S. Bank Holding Companies: An Overview of Recent Data,” by Meraj Allahrakha, Paul Glasserman, and H. Peyton Young, Office of Financial Research OFR Brief Series, 15–01, February 12, 2015. Return to 2

- It is not quite that simple. In calculating the surcharge, another indicator, the use of short-term wholesale funding, is calculated and used in place of the substitutability indicator, and that score is used to calculate a surcharge under a slightly different formula than under method 1. The banking organization then has to hold the higher of the two surcharges calculated by the two methods. This means the US surcharges differ from those in other countries only using the first method. For a discussion of the logic behind the surcharges, see Calibrating the GSIB Surcharge, Board of Governors of the Federal Reserve System, July 20, 2015. Return to 3

Suggested Citation

Haubrich, Joseph G., and Charlotte M. DeKoning. 2017. “Sizing Up Systemic Risk.” Federal Reserve Bank of Cleveland, Economic Commentary 2017-13. https://doi.org/10.26509/frbc-ec-201713

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International