- Share

Measuring the True Impact of Job Loss on Future Earnings

The effect of job displacement on future earnings losses has often been calculated by comparing the earnings of individuals who suffer a displacement at some point in their career with the earnings of those who never lose a job. I show this approach leads to an overstatement of the earnings losses following displacement and discuss an alternative that can ascertain the true effects of displacement in some instances.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Losing a job is harmful not just in and around the time it happens; the event can also affect a worker negatively, and permanently, into the future. Economists have documented that the loss of some jobs leads to large and long-lasting reductions in a person’s lifetime earnings and wages.1 However, these long-term losses may have been overstated. In much of this literature on displaced workers, changes in earnings after a job loss have been estimated by comparing workers who lose their jobs with workers who never lose their jobs.2 I find that this standard approach, which uses a “control group” of never-displaced workers, implies earnings losses associated with displacement that exceed the true earnings reductions resulting from the initial displacement.

I propose an alternative approach that uses a control group of individuals who, instead of never losing a job over their lifetime, do not lose a job in the year of interest. Individuals who are displaced in future periods are still included. In simple simulated environments, where displacement events are independent, I show that this alternative approach correctly captures the true effect of the initial displacement on individuals’ earnings. Moreover, when using observed data from the Panel Study of Income Dynamics (PSID), my analysis documents a systematic tendency for the standard approach to yield estimates that, relative to the alternative approach, dramatically overstate the earnings losses following displacement.

Simulated Environments

To investigate the accuracy of the alternative approach, I first compare its estimates of earnings losses to those of the standard approach in a simulation. For the simulation, I construct a simple model of earnings as follows. Suppose that all workers receive an identical wage w when employed, and a wage zero when not employed. Suppose further that unemployed workers find a job with certainty but have to wait until the next period to begin employment. Individual employment risk is governed by an exogenous separation shock that occurs with probability δ every period. In this context, I define “displacement” as the exogenous separation shock.

Next, I obtain wage and employment data in this simple environment for 10,000 agents in a total of 200 periods. The probability of separation in a given period, δ, is set to 0.15, and the wage, w, is set to 10.

It should be clear that the “true” earnings losses in this environment are −10 at the time of displacement and 0 in all other periods. This is because there is no permanent wage reduction from job loss; unemployment events are completely random and, when workers find a job, their wage is the same as before the separation event. For both the alternative and standard approaches, I estimate the following equation:

(1) ![]() ,

,

where wit are earnings of individuals i at time period t and α is an intercept. In the standard approach, ![]() is a dummy variable that refers to the first displacement event and is equal to 1 if individual i, at time period t, was displaced for the first time k periods ago. Since the dummies refer to only one displacement event, only one dummy can be “on” at a particular time. In the alternative approach,

is a dummy variable that refers to the first displacement event and is equal to 1 if individual i, at time period t, was displaced for the first time k periods ago. Since the dummies refer to only one displacement event, only one dummy can be “on” at a particular time. In the alternative approach, ![]() is a dummy variable that refers to any displacement event and is equal to 1 if individual i, at time period t, was displaced k periods ago. Notice that in the alternative approach, since the displacement dummies refer to any displacement event, an individual who is displaced twice can have more than one dummy “on” at a particular time. For example, suppose someone gets displaced in periods t = 5 and t = 10. In period 8, the individual has

is a dummy variable that refers to any displacement event and is equal to 1 if individual i, at time period t, was displaced k periods ago. Notice that in the alternative approach, since the displacement dummies refer to any displacement event, an individual who is displaced twice can have more than one dummy “on” at a particular time. For example, suppose someone gets displaced in periods t = 5 and t = 10. In period 8, the individual has ![]() = 1 and

= 1 and ![]() = 1. Also notice that the specification pools the last dummy to include periods 10 or more years after a displacement. The θk coefficients capture how earnings change, on average, around a displacement event using the two different approaches.

= 1. Also notice that the specification pools the last dummy to include periods 10 or more years after a displacement. The θk coefficients capture how earnings change, on average, around a displacement event using the two different approaches.

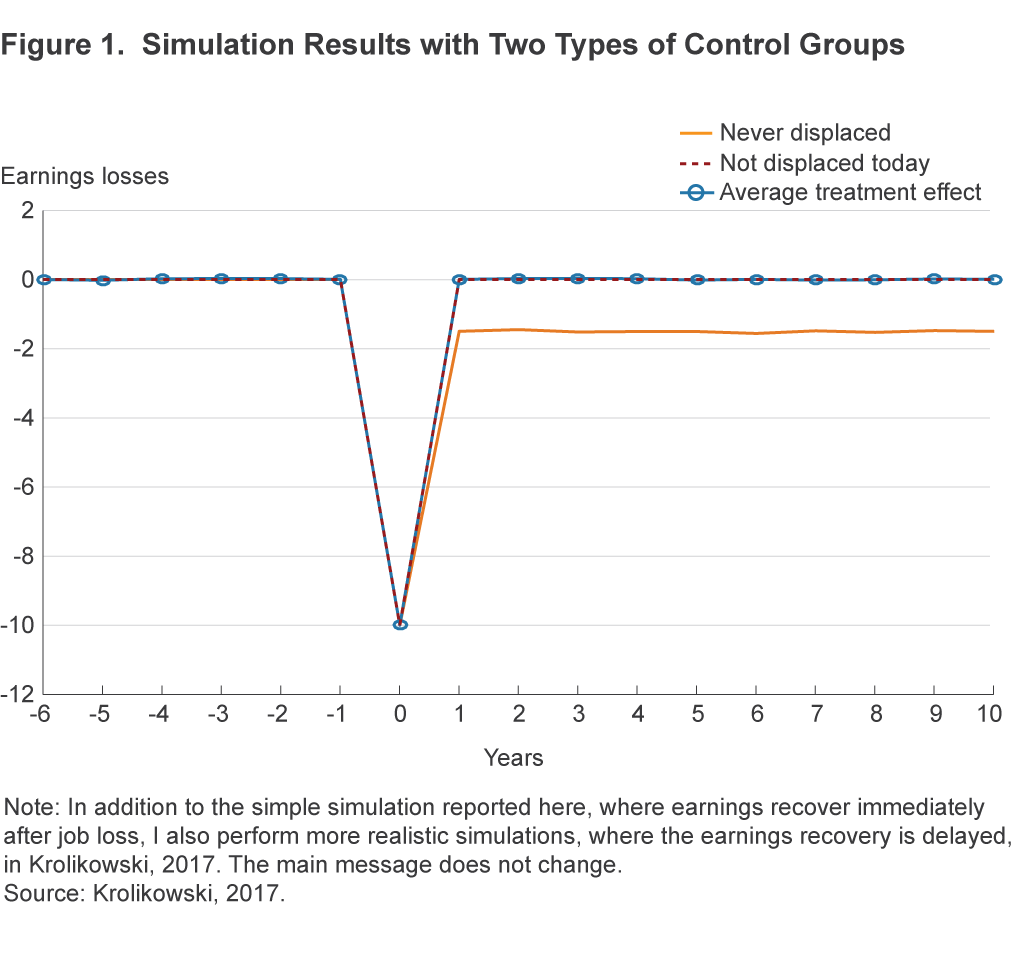

Figure 1 shows the results of using each control group. The “not-displaced-today” and the “never-displaced” lines present the θk coefficients from estimating equation (1) with the alternative and standard approaches, respectively; that is, the figure captures the estimated earnings losses associated with displacement for the two approaches. The figure also shows the true effect of displacement (the average treatment effect, or ATE). One can see that the alternative approach correctly predicts an effect of −w = −10 on impact and no effect before and after the displacement event. Intuitively, this approach takes into account all displacements and hence estimates the effects of an average displacement instead of the first displacement, as in the standard approach.

For the standard approach, I estimate equation (1) using only the first displacement event, so that the Dit dummies refer only to the first displacement. With this approach the control group consists of individuals who are at least 6 years before their first displacement and hence implicitly includes no displaced individuals. The “never-displaced” line in the top panel of figure 1 presents the θk coefficients from estimating this specification. Notice that the approach correctly gives −w = −10 as the on-impact effect but incorrectly predicts losses equal to −δw = −0.15 × 10 = −1.5 thereafter. This is precisely because the control group has not experienced displacement yet and the event that is being studied is the first displacement. The intuition is that the treatment group experiences displacement with probability δ every period after its first displacement (and not before), and the control group never experiences separations. As a result, the treated group appears to have permanently lower earnings following their initial displacement event.3

Data and the Probability of Displacement

The next step of the analysis involves comparing estimates of earnings losses using the two control group approaches in actual data. Individual data for this project come from 1968 to 2009 waves of the PSID. Job displacements are determined from a question that asks respondents who have recently joined their employer, “What happened to that employer (job)?” (referring to the individual’s previous job). The two categories of responses used to identify displacement are “plant closed/employer moved” and “laid off/fired.”

Summary statistics from the data suggest that 60 percent of individuals report never being displaced, and 40 percent report at least one displacement. The average annual displacement probability for the sample is around 4.5 percent. Displaced individuals tend to be younger than the never displaced.

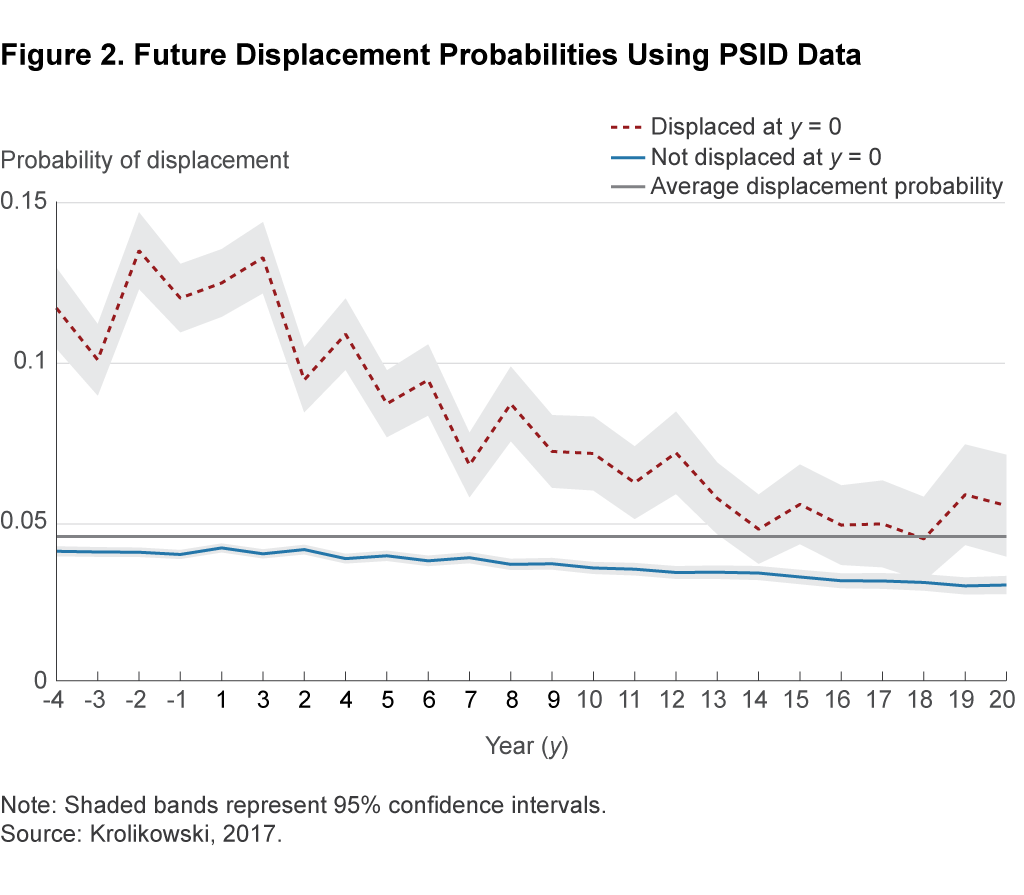

Figure 2 plots, for every year y, the average displacement probabilities for individuals who experienced a displacement y years ago and for those who did not experience a displacement y years ago. The figure shows that those who are not displaced in a particular year are at risk of job loss in future periods. In the years after the event, nondisplaced workers have a persistent 3 percent to 4 percent probability of experiencing displacement. Although this is below the average probability of those who experience a displacement in year y, it is only slightly smaller than the average annual probability of displacement in the sample. The standard approach may give substantively different results from the alternative approach if the probability of displacement in other periods, conditioning on no displacement in the current period, is high.4 Figure 2 serves as evidence that this is the case in PSID data.

Earnings Losses in the PSID Data

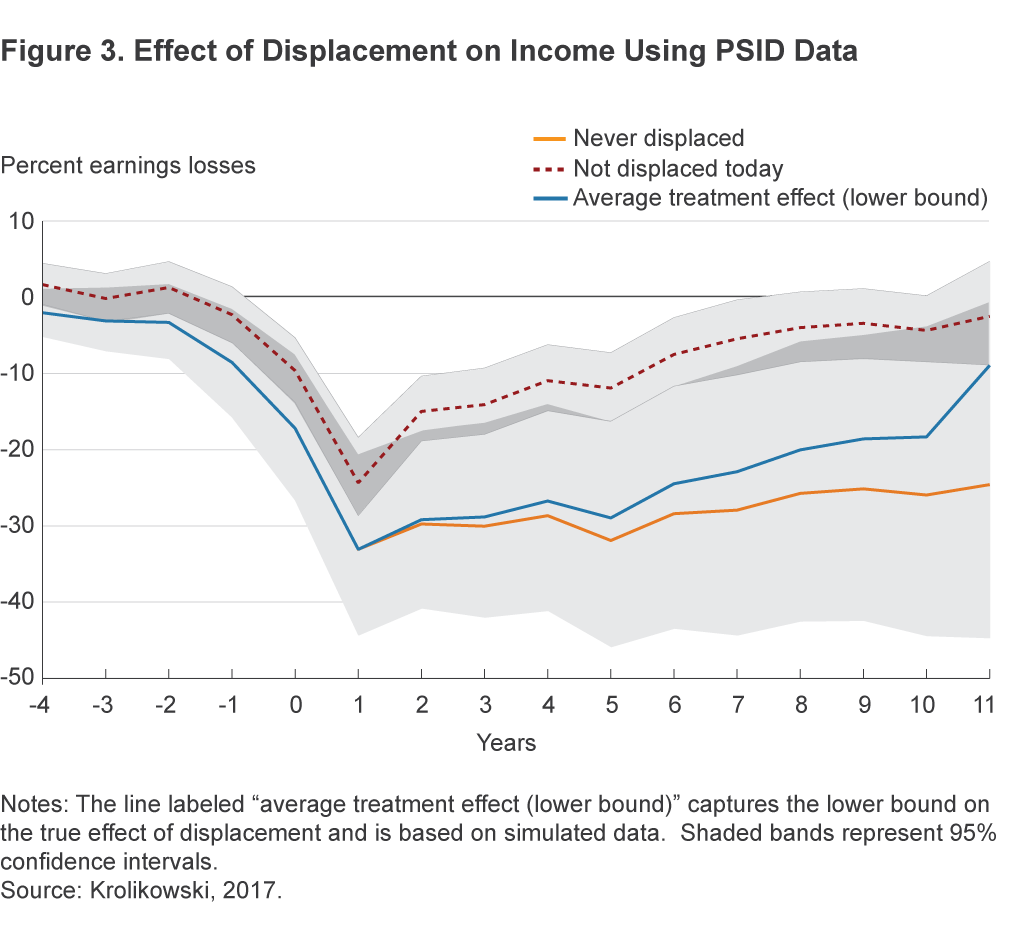

To estimate the earnings losses experienced by individuals in the PSID, I estimate an equation similar to equation (1) but controlling for additional factors that may vary among survey respondents. Figure 3 presents the results of this exercise. This figure plots the θk coefficients divided by the average earnings of the displaced group in the years before their displacement; that is, it plots how, on average, earnings change after the job displacement event.5

As in the simulated environment, the two specifications paint a different picture of the earnings consequences for displaced workers. On impact, the standard and alternative approaches yield comparable estimates of earnings losses: around 30 percent. This suggests that the choice of the empirical model is not crucial for estimating the on-impact effect of displacement on earnings.

The recovery, however, is strikingly different for the two specifications. The alternative approach suggests a 20 percentage point earnings recovery in the 10 years following displacement, with the earnings losses being indistinguishable from zero eight years after the displacement event. In contrast, the standard specification suggests that earnings remain permanently lower after displacement, showing almost no recovery even 10 years following the initial displacement event. Although both empirical specifications point to tremendous costs associated with job displacement, the not-displaced-today approach depicts a healthy recovery in earnings in the decade following displacement, whereas the never-displaced approach suggests a permanent decline in earnings.

Policy Implications

The standard approach to measuring the earnings losses associated with job displacement uses a control group of never-displaced individuals. I show that, in simple environments this approach leads to an overstatement of the earnings losses following displacement, and that a proposed alternative approach estimates the true effects of displacement. Using data from the PSID I show that, although both approaches imply large and long-lasting effects of displacement on earnings, the never-displaced approach significantly overstates these losses relative to the alternative approach.

For the purposes of policymaking, it may be more appropriate to consider what would happen if one could avoid a single job loss event, as opposed to eliminating an individual’s chance of job loss forever. As such, an alternative approach to constructing the control group, like the one presented in this Commentary and in Davis and von Wachter (2011), may be more useful to researchers and policymakers interested in the effect of displacement on workers’ earnings.

Although this Commentary has focused on the earnings consequences of displacement, the use of the never-displaced control group reaches far beyond this scope. In particular, the vast majority of papers studying the effects of adult displacement on divorce, health-related measures, and even infant health and children’s academic achievement uses a control of never-displaced workers.6 Moreover, the present paper may speak to a broader body of work using the popular event-study methodology with a control group of individuals who never experience the event. The evidence presented here suggests that particular attention is warranted in event studies that estimate the long-run impact of treatment.

Footnotes

- Earlier literature reviews include Hamermesh (1989), Fallick (1996), and Kletzer (1998). Recent work includes von Wachter, Song, and Manchester (2009) and Davis and von Wachter (2011). Return to 1

- For a more thorough review of the recent displaced worker literature, see Section 2 of Krolikowski (2017). Return to 2

- In Krolikowski (2017), I consider other environments where the alternative approach does not necessarily recover the true effect of displacement on earnings. In all of these simulations, however, the standard approach overstates the earnings losses associated with displacement and the alternative approach provides a lower bound on these losses. Return to 3

- See Jacobson, LaLonde, and Sullivan (1993, Section 4.1) for more details. Return to 4

- See Krolikowski (2017) for more details. Return to 5

- For an example studying divorce, see Charles and Stephens (2004); for health-related measures, see Sullivan and von Wachter (2009); for infant health, see Lindo (2011); and for children’s academic achievement, see Stevens and Schaller (2011). Important exceptions when looking at health-related outcomes are Browning, Dano, and Heinesen (2006) and Eliason and Storrie (2009). Return to 6

References

- Browning, Martin, Anne Moller Dano, and Eskil Heinesen, 2006. “Job Displacement and Stress-Related Health Outcomes,” Health Economics, 15(10): 1061–1075.

- Charles, Kerwin Kofi, and Melvin Stephens, Jr. 2004. “Job Displacement, Disability, and Divorce,” Journal of Labor Economics, 22(2): 489–522.

- Davis, Steven J., and Till M. von Wachter, 2011. “Recessions and the Costs of Job Loss,” Brookings Papers on Economic Activity, (Fall): 1–72.

- Eliason, Marcus, and Donald Storrie, 2009. “Does Job Loss Shorten Life?” Journal of Human Resources, 44(2): 277–302.

- Fallick, Bruce C., 1996. “A Review of the Recent Empirical Literature on Displaced Workers,” Industrial and Labor Relations Review, 50(1): 5–16.

- Hamermesh, Daniel S., 1989. “What Do We Know about Worker Displacement in the U.S.?” Industrial Relations, 28(1): 51–59.

- Jacobson, Louis S., Robert J. LaLonde, and Daniel G. Sullivan, 1993. The Costs of Worker Dislocation. Kalamazoo, Michigan:W.E. Upjohn Institute for Employment Research.

- Kletzer, Lori G., 1998. “Job Displacement.” Journal of Economic Perspectives, 12(1): 115–136.

- Krolikowski, Pawel, 2017. “Choosing a Control Group for Displaced Workers,” Federal Reserve Bank of Cleveland, Working Paper no. 16-05R.

- Lindo, Jason M., 2011. “Parental Job Loss and Infant Health,” Journal of Health Economics, 30(5): 869–879.

- Stevens, Ann Huff, and Jessamyn Schaller, 2011. “Short-Run Effects of Parental Job Loss on Children’s Academic Achievement,” Economics of Education Review, 30(2): 289–299.

- Sullivan, Daniel, and Till von Wachter, 2009. “Job Displacement and Mortality: An Analysis Using Administrative Data,” The Quarterly Journal of Economics, 124(3): 1265–1306.

- von Wachter, Till, Jae Song, and Joyce Manchester, 2007. “Long-Term Earnings Losses due to Job Separations during the 1982 Recession: An Analysis Using Longitudinal Administrative Data from 1974 to 2004,” Department of Economics, Columbia University.

Suggested Citation

Krolikowski, Pawel M. 2017. “Measuring the True Impact of Job Loss on Future Earnings.” Federal Reserve Bank of Cleveland, Economic Commentary 2017-11. https://doi.org/10.26509/frbc-ec-201711

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International