- Share

How Small Banks Deal with Large Shocks

After a natural disaster such as a hurricane, tornado, or flood, banks in the affected area experience a sharp rise in the demand for loans as property owners look to repair the damage. Recent research has focused on such events to study how small community banks adjust their typical way of doing business to respond to large shocks. The research finds that banks strategically adjust their business in three ways to meet the increased demand. Two adjustments increase the funds available for lending, while one shifts lending from areas unaffected by the disaster to the affected area, a strategy that extends the negative impact of large shocks to distant areas otherwise untouched by the disaster.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Natural disasters cause destruction and devastate the affected areas in many ways. Banks are affected when their borrowers demand capital, whether it be withdrawing deposits or requesting new loans. But while an increase in financing activity can be beneficial for the area hit by a disaster, it comes at a cost to small banks. Because small banks rely heavily on their deposits and do not access capital markets readily, they are more likely to be capital constrained, so it is difficult for them to absorb the increased demand for loans.

Drawing on a recent research study, this Commentary discusses how small banks respond to natural disasters (Cortés and Strahan 2014). The study finds that banks respond to the increased demand for capital after a disaster in three ways. The first is that banks reduce their mortgage lending in markets in which there was no disaster. This economically significant negative spillover effect of natural disasters is previously unexplored. Secondly, banks securitize more of the loans they originate in the affected markets, and thirdly, banks increase the rates they pay on short-term deposits. I will explain in detail how each of these strategies is used to deal with the shock of the natural disaster.

Disasters and the Demand for Bank Financing

Cortés and Strahan (2014) study how banks alter their lending decisions in response to the sudden increase in loan demand caused by a natural disaster. Their study focuses on large disasters and banks that operate in multiple markets. Using multimarket banks allows the researchers to track a given bank’s lending activity in markets that are directly affected by the disaster as well as in those that are not. Cortés and Strahan dub the latter type of market “connected” because while the market is not directly affected by a disaster, it may be indirectly affected through its connection to a bank that serves both markets.

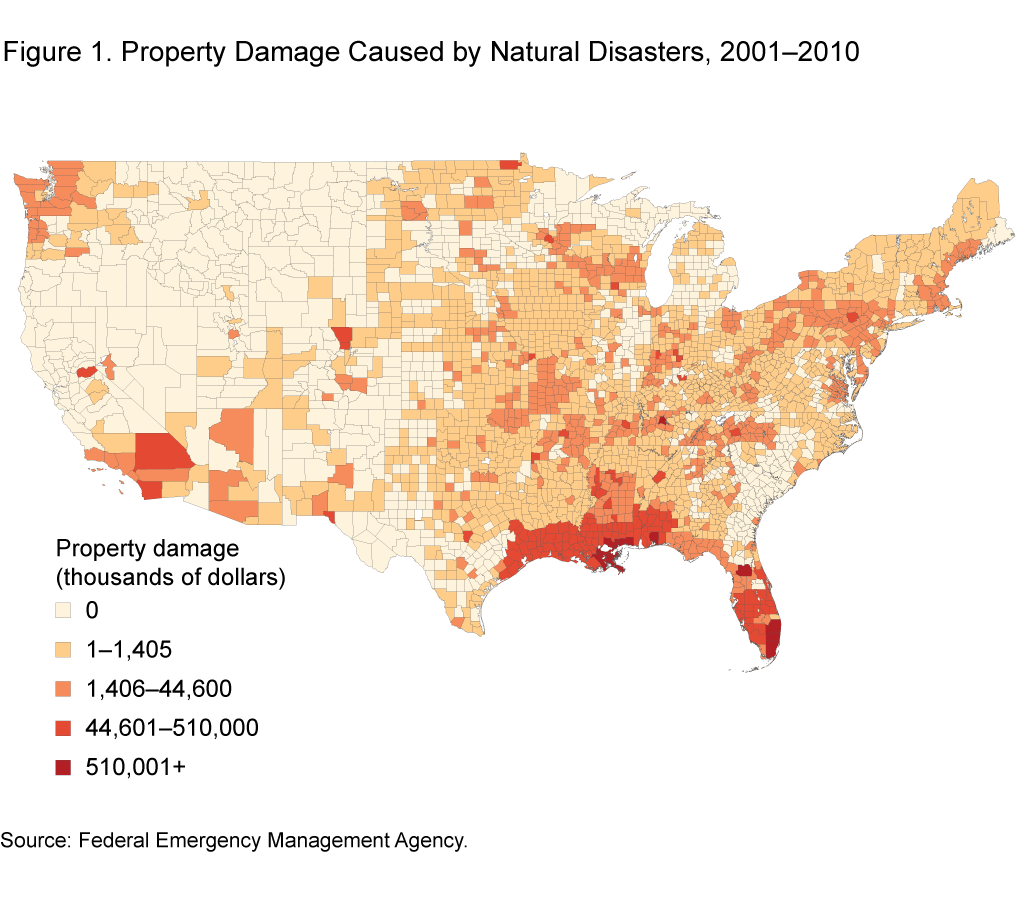

A disaster is defined as large if the area that experiences it receives Federal Emergency Management Agency (FEMA) funding to offset some of the costs of the property damage. The types of disasters qualifying for FEMA funding include hurricanes, coastal erosion, wildfires, earthquakes, floods, tornadoes, blizzards, and severe thunderstorms. While disasters hit all areas of the country, the most costly kind—hurricanes—occur mainly along the southeast coastline (figure 1).

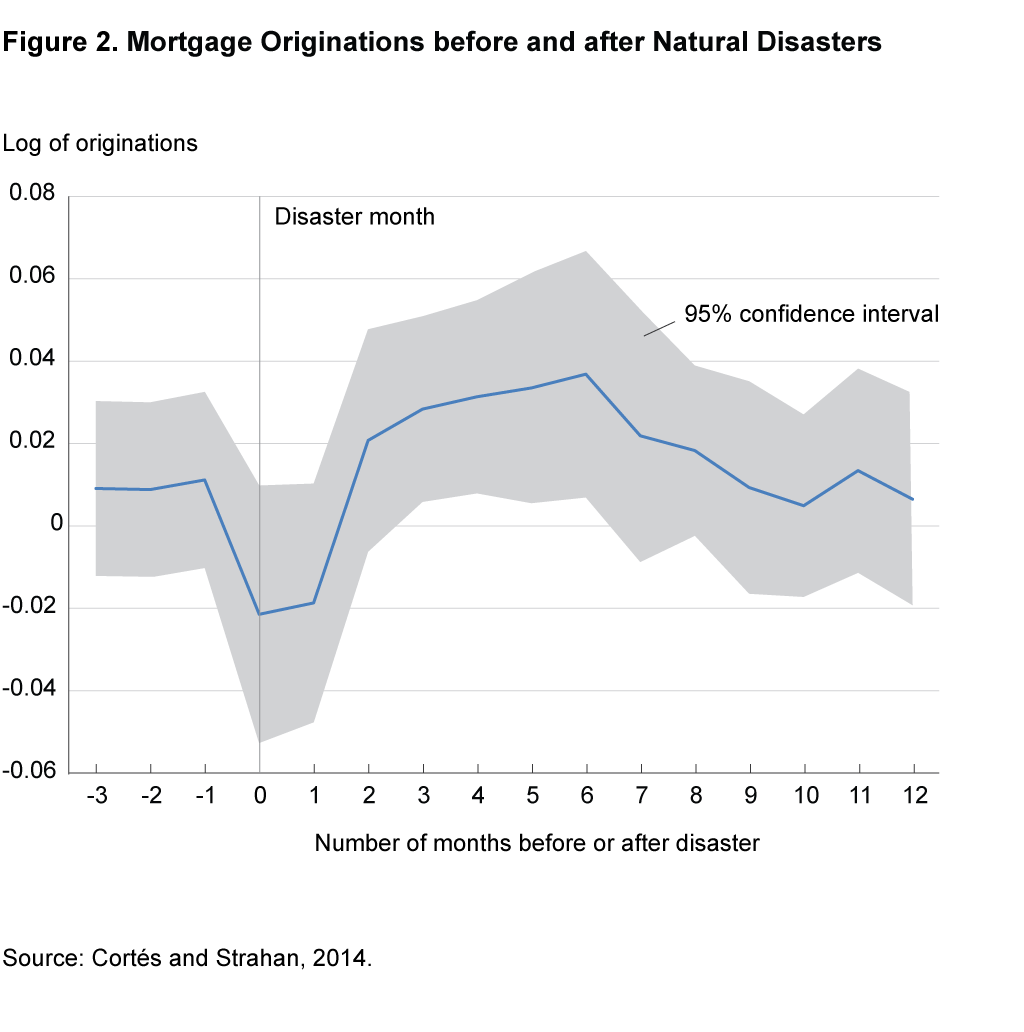

Disasters are associated with an increase in the demand for financing from local banks, but the increase is not immediate. Right after a disaster strikes, lending falls off (figure 2). But then, mortgage lending activity increases, and the uptick lasts for the next 6 months. The decline likely reflects the time it takes for the local economy to recover from the initial shock of the disaster, and the increase begins as the economy slowly rebuilds.

Local banks increase their total lending at least 25 percent in the year following a disaster. Most of this lending occurs within the two quarters immediately after the disaster,1 and most of it specifically reflects an increase in the demand for mortgage loans. Local banks respond to the increase in demand, but for banks that are capital constrained, this means having to adjust other aspects of their business.

How Capitally Constrained Banks Meet Demand

When banks that are capital constrained experience an increase in loan demand, they need to adjust their normal lending activities to meet the increase effectively. Cortés and Strahan investigate the ways in which banks adjust. Using data from the FDIC Summary of Deposits, they map the branch networks of banks, and using Home Mortgage Disclosure Act (HMDA) data, they explore where banks are lending. They document three ways in which small banks change their lending behavior in order to meet the financing needs of the areas hit by natural disasters.

First, small banks that operate in more than one market decrease their lending in the markets that did not directly experience the disaster. The HMDA data show that between 2001 and 2010, for every dollar banks lent in counties that were affected by a disaster, they lent 42–50 cents less in all of their other markets. However, the decrease in lending is not equal across all of their unaffected markets. Typically, banks lend both in areas in which they have branches (their core markets) and those in which they do not. The effect of disasters on lending is strongest in those unaffected markets that were also noncore markets. Banks seem to shield their core markets from the negative spillovers of natural disasters.

Specifically, banks shield their core markets when they have a high market share in those markets. A bank is considered to have a high market share if it originates more than the median number of loans in that market. This effect shows that banks lend strategically when they are hit by a large demand from borrowers to which they need to react quickly and adjust their normal lending behavior to meet all of the demand.

Secondly, banks securitize more of the loans they originate in the affected markets. Many mortgages are sold after origination, and the income from the sale can help a bank to lend again even if there is a potential shortfall of funding. Loans made below a certain amount (the “conforming loan limit” set by the Federal Housing Finance Agency) are easier to sell because they qualify for a credit guarantee from the government-sponsored enterprises (GSEs) Freddie Mac and Fannie Mae. Analyzing the HMDA data on loan sales, Cortés and Strahan find that after a disaster, banks make more conforming loans and retain them less often. Additionally, small banks make fewer large loans above the conforming loan limit. Nonconforming loans, often referred to as “jumbo” loans, are more difficult to sell because the GSEs cannot purchase them. Small banks thus make more of the kinds of loans that allow them to recoup their investment quickly by selling the loans after origination.

By providing guarantees through the GSEs, the government supports a stable secondary market for mortgages. The secondary market helps banks deal with the risk of holding long-term mortgage loans that are funded with short-term deposits. The role of the secondary market is even more useful in cases of financial turmoil.2 In the case of natural disasters, the existence of the market enables banks to meet the increased demand for mortgage loans resulting from the property damage caused by the disaster.

The third way banks respond to the increased loan demand after a disaster is to increase the interest rate they pay on deposits in connected markets. In addition to reducing lending in their noncore markets, banks can meet an increased demand for new loans by increasing their deposits, which they achieve by paying a higher rate. Cortés and Strahan analyze branch-level deposit data collected by RateWatch and find that following a disaster, banks increase the 3-month CD rate in their connected markets (markets in which they operate but which were not hit by the disaster) in an economic and statistically significant manner. For example, a disaster that is one standard deviation above the average with respect to property damage would lead to about a 15 basis point increase in deposit rates in the connected markets. This increase represents roughly 20 percent of the variation typical in short-term rates once other factors are taken into account. This finding shows that banks use their deposit rates to attract additional funding so that they can continue to lend in markets hit by disaster.

Conclusion

Natural disasters are extremely negative events, but they allow us to study how banks adjust their typical way of doing business to respond to large shocks. Recent research finds that banks experience an increase in loan demand after natural disasters, and they strategically adjust their business in three ways to meet the demand.

First, banks reduce their mortgage lending in markets unaffected by the disaster, and this reduction is more pronounced in markets in which the banks have no branches. This shift in lending volume represents a negative spillover effect of the disaster to economies not actually hit by the disaster.

Second, banks originate more mortgage loans that qualify for the housing GSEs’ credit guarantees, and then they sell more of the loans they originate in the secondary market. This practice allows banks to recoup their capital when they package and sell the loan to one of the housing GSEs. Since the housing crisis, mortgage securitization has been generally considered dangerous, but this instance shows that securitization can play a positive role in the banking industry. In this case, securitization helps banks continue to lend when there is an increase in demand.

Third, to attract more deposits, banks increase the rates they pay on them. In addition to helping banks meet the increased loan demand caused by a disaster, the increase in deposit rates, although short-lived, would also help consumers who are able to earn a better yield on their savings.

Taken together, these findings help economists, policymakers, banking supervisors, and elected officials appreciate the toll that disasters have both on areas that are directly affected and those that are connected via their financial institutions.

Footnotes

- Cortés (2014) defines local to mean at least 65 percent of branches in one market and uses Call Report data that are reported at the level of the bank. Return to 1

- https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/12-23-fanniefreddie.pdf. Return to 2

References

- Cortés, Kristle Romero, (2014). “Rebuilding after Disaster Strikes: How Local Lenders Aid in the Recovery,” Federal Reserve Bank of Cleveland, Working Paper 14-28.

- Cortés, Kristle Romero and Philip E. Strahan, (2014). “Tracing Out Capital Flows: How Financially Integrated Banks Respond to Natural Disasters,” Federal Reserve Bank of Cleveland, Working Paper 14-12.

Suggested Citation

Cortés, Kristle Romero. 2017. “How Small Banks Deal with Large Shocks.” Federal Reserve Bank of Cleveland, Economic Commentary 2017-08. https://doi.org/10.26509/frbc-ec-201708

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International