- Share

The Role Bank Branches Play in a Mobile Age

With the increasing use of Internet and mobile banking, some analysts have been predicting the end of brick-and-mortar banks. But others maintain that branches provide bankers with invaluable information about borrowers and conditions in the local economy and are not likely to be done away with any time soon. To shed some light on the issue, I study whether financial institutions were able to make better loans during the financial crisis when they had a bank branch in the area. I find they were, which suggests their local presence gave them financially valuable information.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

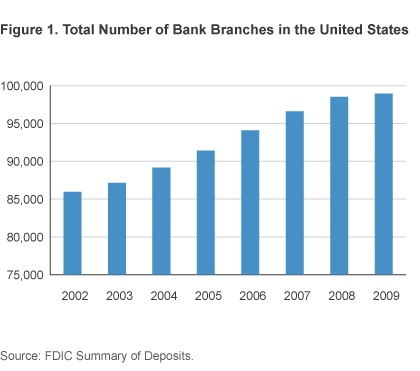

With the growth of mobile banking services, some very vibrant debates have arisen about the future of physical bank branches and their role in mortgage lending. Even though more and more bank branches have been built over the past 25 years (figure 1), the apparent cost efficiencies of virtual banking suggest to many that the days of bank branches are numbered. But on the other side are those who claim that having a physical bank branch provides banks with advantages that may seem less tangible but which impact the bottom line nonetheless.

A branch makes it possible for a bank to engage in a style of banking called relationship banking. Research has shown that relationship banking can provide financial institutions with soft information about their customers. In contrast to hard information, such as FICO scores and income, soft information relies on knowledge that a loan officer has about the local economy and subsequently the potential default probabilities of the borrower. Loan officers working out of a branch office interact with local real estate agents, lawyers, and others, which gives them better information overall when it comes time to extend a loan to a borrower.

I investigate whether having a branch provides this sort of soft information about local economic conditions by studying mortgage lending around the time of the housing crisis. I analyze whether lending behavior or outcomes such as foreclosure or defaults were different in areas with and without a branch presence. Using bank branches to test if banks can benefit from better information about their local economies allows us to understand what role bank branches might play in the future of various financial institutions.

Mortgage Lending during the Financial Crisis

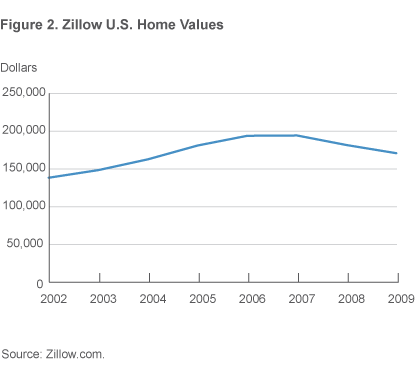

The recent financial crisis provides a particularly dramatic setting in which to study the knowledge of local lenders. From 2002 to 2006, home prices rose steeply across the United States, and that increase was followed by a period of sharp decline (figure 2). On average, house prices fell 15 percent from 2006 to 2009. Over that same period, foreclosure rates rose to their worst level in the history of the modern mortgage. California, Nevada, Arizona, and Florida bore the brunt of the damage in regards to foreclosures, but the crash of housing prices was felt far and wide.

In some areas, the increase in house prices during the boom can be attributed to fundamentals, such as rising costs for construction materials and labor. In other areas, housing prices were increasing beyond values warranted by fundamentals. My study investigates whether lenders with branches could tell the difference. If they could, they should have made fewer mortgage loans in markets that were overheating than other lenders, and their loans should have suffered lower rates of default and foreclosure.

I look at data on loan originations, the location of the lender, loan retention rates, housing prices, and foreclosure rates from 1998 to 2009. The Zillow Home Value Index is used for housing prices, RAND Corporation is the source of the foreclosure data, and Home Mortgage Disclosure Act (HMDA) data is used for information on lending (location and levels) and loan and lender characteristics.

I separate all the loans made over this period into two types. One I call a local loan and define it as a loan that is made by a lender that has a branch in the county where the property is located. All other loans are nonlocal. I then create a local loan share by counting up all of the local loans in a ZIP code and dividing by all of the loans originated in that ZIP code.

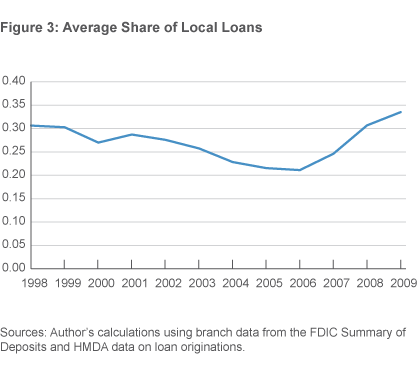

Figure 3 shows how the average local loan share has changed over time. During the boom years, fewer local loans were originated, but during the bust the level returned to what it had been before the boom, such as in 1998.

I test whether local lenders were more informed about the housing market in the run-up to the crisis and during it, in a few ways. First, I look at the relationship between house prices and mortgage originations. Next I look at the tendency to sell loans, and finally I look at the correlation between foreclosures and of local and nonlocal loans.

House Prices and Local Mortgage Originations

I find that on average, banks that had branches in markets with swiftly rising house prices reduced their lending, while mortgage lenders without branches did not reduce their lending. In areas where banks had branches and continued to make loans, home prices actually increased. The decrease in local loans occurred mainly in areas where house prices subsequently fell, not in areas that simply experienced rising home prices. That is, local lending decreased more often in overheated markets.

It is important to note that while outside lenders did make loans in overheated housing markets, the absolute level of lending increased as well. This means it was not just the case of local lenders being crowded out, but rather the lenders with branches could pick the loans they wanted to originate more selectively. In fact, the lenders without branches consistently lent more in markets where house prices would eventually fall, especially in areas where the bust would be the greatest.

Since the distinction for being local is defined at the level of the loan, the same lenders could be making smart loans in some areas (where they had branches) and uninformed loans in other areas (where they had no branches). Since large national banks lend to many markets, many without branches, the distinction is very important because it helps to illustrate how crucial the actual physical presence is in the local economy.

Local Mortgage Lending and Securitization

Securitization increased during the run-up to the financial crisis, and its future in the mortgage finance sector is now a topic of hot debate. While securitization increased the credit available to borrowers, it caused instability when financial institutions did not properly manage the risks involved. One way risks got out of hand, for example, was when firms gave loans to ill-qualified borrowers because those loans could be immediately sold to government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac. The loan originator could earn a profit while bearing none of the risk of a loan not being repaid.

The degree to which firms sold the loans they originated during the housing boom offers another opportunity to test the information advantage of a bank presence. When banks did make loans in housing markets that appeared (later) to be overheated, they sold them more often to the GSEs. In areas where the prices could have been above the levels explained by fundamentals, the fact that lenders sold the loans when they did in fact originate them, shows that the lenders had better information about the true value of the home, and the probability that the loan would not be repaid in full.

Local Mortgage Lending and Foreclosures

Comparing the foreclosure rates of local and nonlocal loans is the third way I test the value of the information a branch can provide. Lenders benefit by making more loans, if those loans don't default. I use California to study the effects of local lending on foreclosures before and during the crisis. Since there are many different types of markets in California, it is an excellent microcosm of the United States. For example, there are wealthy and low-income neighborhoods. There are areas that experienced the boom and bust cycle of housing prices, while others only slowly increased and never decreased.

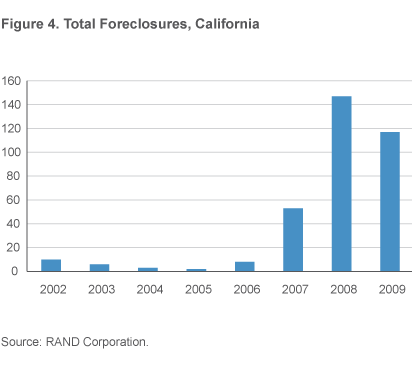

Historically, California experiences one foreclosure for every 1,000 homes. During the bust, the rate climbed more than a hundredfold (figure 4). Some areas experienced up to 213 foreclosures per thousand homes. Home prices are affected when there is even a single foreclosure in a neighborhood, so these local economies would take many years to recover from so many foreclosures.

My study finds that in areas where more loans were made by lenders with branches there were fewer foreclosures during the bust. It is difficult to discern whether these lenders restructured the loans once the borrowers could no longer make the originally specified payments or just avoided problematic borrowers to begin with. Whichever is the case, considering that foreclosures can be costly to a neighborhood, it is an important finding that there were fewer foreclosures when the lenders were directly affected and would experience the negative effects of the foreclosures as well.

Conclusion

My study shows that local lenders reduced their lending in areas where house prices were potentially above what would be acceptable based on fundamentals. They originated fewer loans in areas where prices eventually fell, and sold many of the loans they did originate in those areas. These results show that banks behaved differently during the run-up to the financial crisis when they had a bank branch in the area where the property was located.

These findings show that bank branches allow financial institutions access to better information about the local economy, which in turns allows them to make better lending decisions. In general, conditions of the local economy are public information, but as banks weigh the costs and benefits of maintaining a branch network, it is important that they recognize the need to invest in obtaining the type of information available to them when they have a physical presence in the market.

It is important to understand the role of a bank's branching network as the banking industry introduces new technology that could potentially replace bank branches. As my findings show, even the largest banks can benefit from soft information in areas where they have branches and do in fact behave differently when they have a branch in a market.

Further Reading

Cortés, Kristle Romero. “Did Local Lenders Forecast the Bust? Evidence from the Real Estate Market,” Federal Reserve Bank of Cleveland, working paper 12-26.

Suggested Citation

Cortés, Kristle Romero. 2015. “The Role Bank Branches Play in a Mobile Age.” Federal Reserve Bank of Cleveland, Economic Commentary 2015-14. https://doi.org/10.26509/frbc-ec-201514

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International