- Share

The Often-Ignored Regional Banking Sector

With the focus of financial reform placed on reducing the risks associated with being "too big to fail," it is the nation’s largest banks that have been subject to the most scrutiny.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Most Americans probably think of the banking industry as having a “barbell” shape—with many Jimmy Stewart-type community banks at one end and a few giant, national household names at the other. But in between lies the important class of regional banks, a class with unique characteristics that are only recently being studied and understood.

Regional banks are so called because they have historically operated within geographical regions larger than those covered by community banks but smaller than the country at large. Traditionally, they have taken deposits from within a defined geographic area and made loans to individuals and businesses in that region.

However, regulatory changes have blurred this definition. Though still referred to as regional banks, they can perhaps best be thought of as banks in the mid-size tier of depository institutions. The Federal Reserve classifies regional banks as those with consolidated assets of between $10 billion and $50 billion at the holding company level. This range spans smaller banks that are similar to a super-sized community bank and banks that are large enough to have far-reaching market power.

As a result of changes in financial regulations that were introduced after the financial crisis, large banks, as systemically important institutions, are now subject to stricter regulations, while small community banks are subject to less. Regulations for regional banks are still evolving, and the question is what kind of approach is appropriate? Requirements should not be over burdensome, but they need to reflect the potential for contagion and the impact regional banks could have on the financial system as a whole.

Answering this question depends on knowing more about regional banks. This Commentary reports the results of an analysis conducted to that end, which identified several factors related to the health of regional banks between 2008 and 2013.

The Changing Regional Bank Landscape

The Riegle Neal Act of 1994 allowed banks to operate across state lines, thus permitting greater geographic diversification of their portfolios. This allowed regional banks to expand operations and sources of funding to those outside of strict geographic locations. Since then, regional banks have become less restricted in their lending, and as a result, their collective market power has increased, as has their significance in the economy.

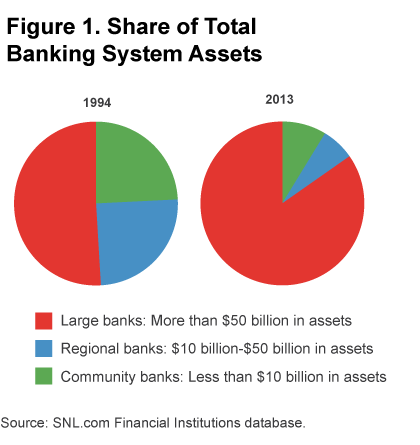

Since the 1990s regional banks have grown more slowly than large banks and lost market share to them. In 1994, the combined assets of all regional bank holding companies accounted for roughly 25 percent of the banking market, while large banks (those with consolidated assets greater than 50 billion at the holding company level) accounted for 50.9 percent. By 2013, regional banks accounted for only 6.5 percent of the market and large banks for about 85 percent. See figure 1.

Source: 2000 US Census

Regional banks have not been plagued by too-big-to-fail issues; however, they are not without vulnerabilities. Research has shown that regional bank health is heavily correlated with the economic health of the region. Regional downturns in real estate prices, housing, or important industries such as autos or oil can have a disproportionate impact on regional bank health. Since regional banks are a source of credit for households and firms, the decline in their condition can then further worsen regional economic conditions.

Though this susceptibility to regional economic conditions weakened when the limits on the geographic diversification of regional bank portfolios were lifted after 1994, it surfaced again during the housing market crisis of 2008. The uneven economic impacts of the housing market crash across regions disproportionately impacted the health of banks in the most-affected regions.

Analyzing Bank Health

To investigate the factors that explain the health of regional banks, we conducted an exploratory analysis using confidential supervisory data (bank examiner ratings) as a measure of bank health. For potential influences on bank health, we examined the correlation between these ratings and various measures of local economic conditions and bank activities and management. Measures reflecting bank activities included the sort of loans they make and the type of deposits they take. Variables such as the return on assets and the efficiency ratio gauged differences in management. Measures of economic conditions included growth in housing prices, the unemployment rate, and the yield curve on Treasury securities. The yield curve—the spread between interest rates on long- and short-maturity securities—is often interpreted as a measure of future economic conditions, with positive spreads implying growth. The analysis included all banks and bank holding companies that met the asset-size threshold of $10 billion to $50 billion, and it covered the period 2008-2013.

Assessing the health of banks has some similarities with the approach doctors use in assessing the health of their patients. There are objective measures, such as blood pressure, weight, and pulse, but there are subjective measures as well, such as muscle tone and mood. Likewise, supervisory ratings include both objective and more subjective measures.

The Federal Reserve System and the Office of the Comptroller of the Currency assign confidential supervisory ratings to banks. Ratings are deduced from a system commonly known as the CAMELS rating system. In this system, there are six components of bank safety and soundness:

- Capital adequacy (C)

- Asset quality (A)

- Management administration (M)

- Earnings (E)

- Liquidity (L)

- Sensitivity to market risk (S)

The ratings scale ranges from 1 through 5 whereby a rating of 1 is the strongest rating and a rating of 5 is the weakest. A rating of 1 or 2 in this system is typically considered strong, while 3 through 5 indicate increasing degrees of concern. The ratings used to measure bank health are determined through numerous hours of meticulous bank examinations that inevitably encompass an element of judgment.

Bank holding companies, which are supervised by the Federal Reserve, are rated differently. The confidential rating system used is similar to CAMELS and known as the RFI/C. Like CAMELS, this is a 1 through 5 rating system whereby examination staff give an overall rating (called a composite rating) based on several aspects of the bank’s operations.

In the composite (C), risk is evaluated by the BHC’s

- Risk management (R)

- Financial conditions (F)

- Impact of the holding company on its subsidiaries (I)

Whereas CAMELS data reflect the health of individual banks, RFI/C data reflect information for all banks and subsidiaries within a holding company’s control. Thus, a BHC’s data reflects the consolidated health of the holding company.

Health Factors Identified

The analysis identified several factors affecting the health of regional banks. Some were related to the types of loans banks held, but deposit type, management factors, and economic conditions were also significant. Results were very similar for banks and bank holding companies.

Loans. On the loan side, three types of lending were associated with weaker supervisory ratings for banks and BHCs in the 2008 to 2013 period:

- commercial real estate

- residential real estate

- commercial and industrial (C&I) loans

C&I loans finance a wide range of business operations over both short and longer terms. Higher proportions of these three types of loans in the lending portfolios of banks and BHCs over the time period examined reduced the likelihood of better ratings. Exposure to real estate markets meant that banks were harmed when the housing bubble burst.

Deposits. On the deposit side, an increase in the amount of “hot funds” held increases the likelihood of receiving a better rating.

Hot funds are highly liquid, short-term funds that can be withdrawn quickly by investors seeking high returns. At first glance, attracting hot funds may not seem to make the bank safer, as hot funds may be an unstable source of funding, which quickly leaves for higher-yielding investments. However, hot funds are indicative of banks that have strong lending opportunities, which attract the funds in the first place.

Economic conditions. Factors in the broader economy also have an impact on bank health. The analysis showed that as the unemployment rate increases in the state, banks and BHCs are less likely to be favorably rated. An increasing unemployment rate indicates that the economy is performing poorly and as a result, banks are more likely to be in poor health.

The yield curve, which can be viewed as a general indication of economic conditions, was also related to supervisory ratings. Banks were more likely to be rated favorably when the term spread increased and less likely following a decrease in the spread. For this analysis, the term spread was defined as the difference between 10-year and 3-month Treasury securities.

A positive spread (when the 10-year rate is higher than the 3-month rate) suggests that investors expect favorable economic growth. As this spread increases, the degree of optimism is also increasing. In the same way, a negative spread is indicative of pessimism about future economic conditions.

Conclusion

Using one measure of bank health—confidential supervisory ratings—we have seen that a number of factors were correlated with the health of regional banks in the years prior to and during the financial crisis. On the loan side, increases in residential real estate, commercial real estate, and C&I loans are associated with a lower ratings, and on the deposit side, decreases in hot funds are negatively correlated. External factors such as a falling term spread (that is, a flatter or inverted yield curve) and a rising unemployment rate go along with poor regional bank health.

An abundance of research involving financial conditions and banking policy has been concerned with ever-important “too big to fail” financial institutions. Regional banks are not large enough to have warranted comparable attention. Still, in the evolving supervisory landscape, where the goal is tailoring regulatory and reporting requirements to the risk posed by the type of the financial institution, more needs to be learned about the potential risks posed by regional banks.

For Further Reading

Lakshmi Balasubramanyan and Joseph G. Haubrich, 2013. “What Do We Know about Regional Banks? An Exploratory Analysis,” Federal Reserve Bank of Cleveland, working paper no. 13-16.

Suggested Citation

Balasubramanyan, Lakshmi, and Timothy Bianco. 2015. “The Often-Ignored Regional Banking Sector.” Federal Reserve Bank of Cleveland, Economic Commentary 2015-01. https://doi.org/10.26509/frbc-ec-201501

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International