- Share

Rising Interest Rate Risk at U.S. Banks

Average interest rate risk in the banking system has been increasing since the end of the financial crisis and is almost back to its pre-recession level. But the increase has not occurred uniformly at large and small banks. At big banks, risk, while increasing, hasn’t yet reached its pre-recession high. It’s in small banks where we see a steep rise in interest rate risk. The big banks’ exposure is being driven mainly by their liabilities. At small banks, it is coming from both their assets and liabilities.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Banks borrow short and lend long. They often borrow, for example, by taking demand deposits, such as checking and savings deposits, which must be paid back whenever depositors ask for them. On the other hand, most of the money they lend out is tied up in long-term loans, such as mortgages. Since the long-term interest rates at which banks lend and the short-term interest rates at which they borrow can fluctuate, banks run the risk of losing money if unexpected differences between the two arise. As a result, they need to effectively manage any exposures they have to interest rate risk.

Many policymakers have raised concerns about the current levels of interest rate risk in the financial system. Governor Jeremy Stein of the Federal Reserve Board recently warned that “A prolonged period of low interest rates, of the sort we are experiencing today, can create incentives for agents to take on greater duration risk.” Back in 2010, Donald Kohn, then the vice chairman of the Federal Reserve Board, said: “intermediaries need to be sure that as the economy recovers, they aren’t also hit by the interest rate risk that often accompanies this sort of mismatch between asset and liability maturities.”

The memory of such a mismatch and its devastating consequences is probably still fresh in these policymakers’ minds: An interest rate spike was one of the contributing factors to the 1980s savings and loan crisis. Although today’s financial landscape is very different from the financial environment under which thrifts and savings and loans operated back then, financial institutions are still vulnerable to interest rate shocks today, and it is important to continually monitor levels of risk exposure.

Interest rates are currently exceptionally low, but at some point, they are expected to rise. The question is: Are banks prepared for the return to a more normal environment? This Commentary estimates the level of interest rate risk at commercial banks and finds it has risen at banks both large and small since the end of the financial crisis. However, the increase is much greater at small banks. The higher level of interest rate risk could be a problem once interest rates start rising, and banks and regulators need to closely monitor that risk.

Potential Effects of Rising Risk

Interest rate risk is a catchall phrase for the effect of changes in market interest rates on banks’ financial conditions. These changes affect financial institutions in at least two main ways. One is through the balance sheet and the other is through the income statement.

The balance sheet is affected when rising interest rates alter the value of liabilities and assets and reduce the net worth of the bank. Because of their differing maturities, bank assets and liabilities would be affected differently by an interest rate spike. If assets lose value while the liabilities keep theirs, the net worth of the bank drops. In the end, this drop affects the bank’s capital levels. (We focus on the impact of a spike in interest rates, since that scenario is more likely in our current circumstances than a drop.)

The income-statement effect is related to the different frequencies at which the interest rates on bank assets and liabilities can be adjusted, and the differing impact those adjustments have on revenues and expenses. When a financial instrument matures, the money invested in that instrument is available to be reinvested at current market prices. Because revenues from assets (like fixed-rate mortgages) reflect market prices more slowly than the expenses paid on liabilities (like demand deposits), a spike in interest rates could shrink a bank’s margins, making it less profitable.

Through these two channels, interest rate risk can impact the financial condition of banks in many ways.

- The Value Interest Rate Risk. The value of a financial instrument throughout its life reflects market prices. For example, a fixed-rate mortgage of 3.5 percent has a higher value when market interest rates are 2.5 percent than when market rates are 5 percent. This variability reflects what investors are willing to pay for that mortgage at the current market interest rate, should the bank wish to sell the loan in the open market. Therefore, some of the bank’s assets are affected by market interest rates, declining in value when market interest rates go up. When this happens, it shrinks the capital banks have on hand to absorb losses on their market-priced assets. Not all bank assets are affected by this kind of risk. In particular, whatever the bank plans on holding till maturity is not affected.

- Opportunity Cost. Interest rate risk might lead a bank to be locked into a lower-rate investment than the market interest rate. For example, if a bank holds a 30-year mortgage with a fixed-rate of 3.5 percent and 28 years remaining on it and mortgage rates rise to 4.5 percent, the bank is foregoing the extra 1 percent it could have earned if it was not locked into the mortgage. (Economists refer to the foregone return on this alternative investment as the opportunity cost). If that same bank had instead made an adjustable-rate mortgage (ARM), its opportunity cost would be close to zero. The interest rate on the ARM is periodically adjusted to reflect market rates.

- Income Interest Rate Risk. Generally, liabilities, which fuel a bank’s expenses, can be repriced much faster than assets. Bank profitability is expected to fall when interest rates go up because expenses reflect market interest rates faster than revenues.

All these factors combined have an effect on the market value of banks and their capital levels, which in turn can affect the financial stability of the whole financial system.

Analyzing the Risk

To assess the current level of interest rate risk borne by banks, we conduct an analysis using an economic value model and data from “call reports,” financial statements that banks are required to file. The economic value model estimates changes in the value of assets and liabilities at banks, and nets these changes to derive the effect of an interest rate change on bank capital. Capital is crucial because it is a cushion against a decrease in the value of assets, which we often see during recessions and crises. Call reports contain the maturity information on assets and liabilities that we need for our analysis. We focus on US domestic commercial banks and exclude nondepository institutions, like investment banks, since call reports do not contain the data we need for these institutions.

In the call reports, bank assets and liabilities are classified according to maturity. The model we use assigns each category of maturity a risk weight. The weights estimate the effect of a 2 percent increase in market interest rates on the present value of the items in the category. Longer maturities have higher sensitivity to interest rate changes, and the model assigns them a higher risk weight. We then multiply the value of the bank’s holdings in these categories by their respective risk weights. Eventually, each bank is represented at every period with a single number that sums up its weighted assets and liabilities. This number represents the change in the value of the bank’s equity in response to the 2 percent rise in interest rates. Finally, individual bank numbers are aggregated into a number representing the commercial banking system’s average level of interest rate risk.

It is important to stress that we focus on changes in this number over time. These changes should be informative even though the model measures interest rate sensitivity very crudely. An increase in this measure approximates an increase in interest rate risk.

Rising Risk

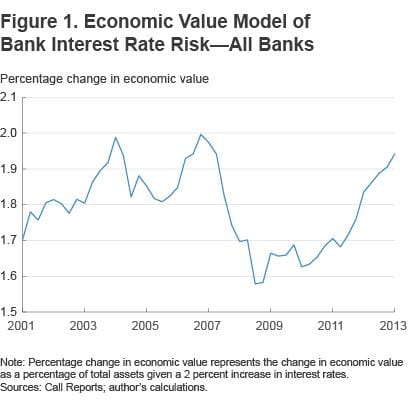

Figure 1 shows that interest rate risk is climbing. Since bottoming out in mid-2008, the average interest rate risk measure has risen sharply. We are currently pretty close to where we were on the eve of the Great Recession.

Note that this average is constructed without weighting each bank’s risk by the size of its assets, relative to the banking industry as a whole. When each bank’s risk is weighted, the resulting graph is almost identical to the interest rate risk of big banks, because small banks are trivial in size compared to the largest 50 banks. The unweighted measure treats banks of different sizes similarly, which gives more importance to the trends at small banks. Small banks, despite their smaller overall size, could affect financial stability, if they share exposures to similar kinds of risk. In such a case, when problems arise, they can spread farther, wider, and more deeply because they affect a larger number of banks.

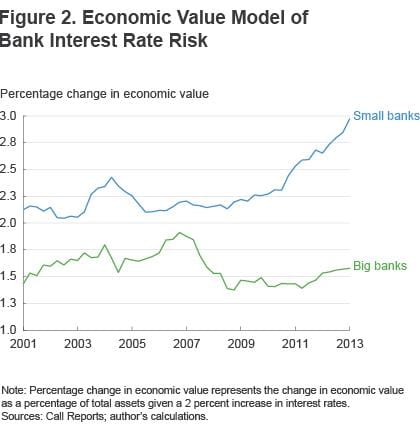

Analyzing interest rate risk in large and small banks separately yields surprising results. Average interest rate risk has risen in the 50 largest commercial banks since 2011 (figure 2). But, surprisingly, the current level is still significantly lower than the peak before the crisis. It does not seem that the big banks are the ones responsible for the return to the pre-crisis levels of risk that we saw in the average of all banks in figure 1. (Our measure is likely to understate the risk at big banks because it ignores derivative positions. Although derivative positions can be used to hedge against interest rate risk, recent research by Begenau, Piazzesi, and Schneider (2013) analyzed data from 1995 to 2012 and showed that derivatives actually increased interest rate risk exposures at big banks.)

Risk at Large Banks

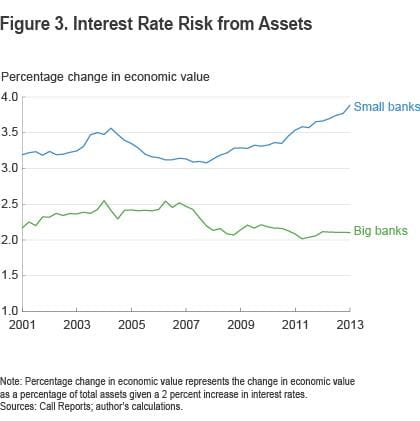

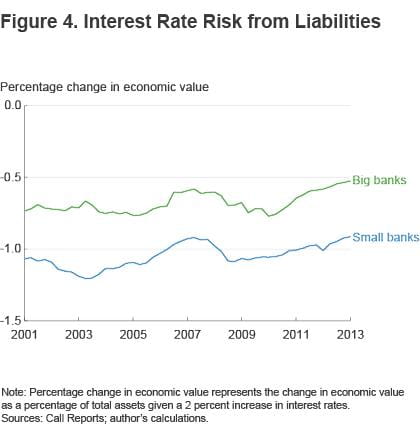

When we decompose the average bank risk measure at the big banks into the contributions of assets and liabilities (figures 3 and 4), it becomes clear that the uptick in average risk at the 50 largest banks is the result of an increase in interest rate risk from liabilities (the number associated with liabilities is becoming less negative). The contribution of assets to total risk has remained steady.

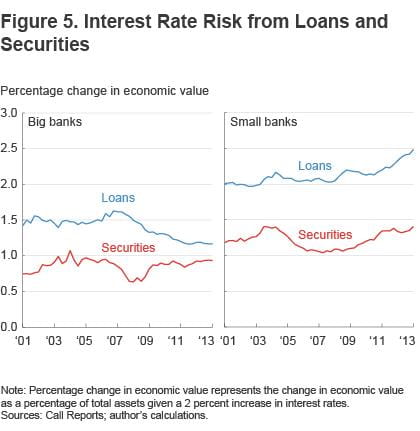

Although the interest rate risk associated with the assets of big banks seems to be holding steady, the two major types of assets are in fact behaving quite differently. The contribution of loans to interest rate risk is actually declining, while the contribution of security holdings is increasing, offsetting that decline (figure 5).

Risk at Small Banks

Smaller banks, on the other hand, exhibit a big spike in interest rate risk. Risk did not rise visibly during the crisis, but after 2009 it started a very steep ascent (figure 2).

One of the more troubling aspects of this spike is the fact that it is coming from both assets and liabilities (figures 3 and 4). However, comparing the magnitudes of the spike in assets and liabilities shows that the risk associated with

assets seems to be greater than that of liabilities.

In contrast to the situation at big banks, the spike in the contribution of assets to overall risk at small banks was driven by both loans and securities. Interest rate risk has increased in both loans and securities since the financial crisis (figure 5). This combined effect is what is captured in figure 4.

Conclusion

Mitigating risks is always a story of looking ahead into the future, and assessing the states of the world where risks might arise. Once the economy strengthens, and the Federal Reserve starts raising interest rates, banks will have a significant exposure to interest rate risk.

Banks should be forward-looking and focus on mitigating this risk now. We document that interest rate risk is rising, at banks both small and big, but the increase at small banks is more dramatic. An increase could mean many things, including the substitution of assets that are less sensitive to risk with ones that are more sensitive, a larger maturity mismatch, or a drop in the value of assets. Subsequent work will look at which of these stories is most consistent with the data provided here.

References

- Kohn, Donald, 2010. “Focusing on Bank Interest Rate Risk Exposure,” Federal Deposit Insurance Corporation’s Symposium on Interest Rate Risk Management.

- Stein, Jeremy, 2013. “Overheating in Credit Markets: Origins, Measurement, and Policy Responses,” Federal Reserve Bank of St. Louis symposium. “Restoring Household Financial Stability after the Great Recession: Why Household Balance Sheets Matter.”

- Sierra, Gregory E. and Timothy J. Yeager, 2004, “What Does the Federal Reserve’s Economic Value Model Tell Us about Interest Rate Risk at U.S. Community Banks?” Federal Reserve Bank of St. Louis, Review, vol. 86, no. 6, pp. 45-60.

- Houpt, James V., and James A. Embersit, 1991. “A Method for Evaluating Interest Rate Risk in U.S. Commercial Banks,” Board of Governors of the Federal Reserve System, Federal Reserve Bulletin, August issue, pp. 625-637.

- Begenau, Juliane, Monika Piazzesi, and Martin Schneider, 2013. “Banks’ Risk Exposures,” manuscript.

- Carayiannis, Andrew, 2013. “Importance of Effective Interest Rate Risk Management,” Federal Deposit Insurance Corporation, Supervisory Insights, vol. 10, no. 2.

Suggested Citation

Bednar, William, and Mahmoud Elamin. 2014. “Rising Interest Rate Risk at U.S. Banks.” Federal Reserve Bank of Cleveland, Economic Commentary 2014-12. https://doi.org/10.26509/frbc-ec-201412

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International