- Share

New Rules for Credit Default Swap Trading: Can We Now Follow the Risk?

Credit default swaps, a useful but complex financial innovation of the 1990s, were traded over the counter before the financial crisis. Because of this infrastructure, a very opaque market emerged, and from it, the severe risk imbalances that helped fuel the crisis. Reforms are now being worked out and put in place which will move the majority of credit default swaps transactions to more transparent exchanges. Market participants will be able to see pre-trade and post-trade pricing, and regulators will have access to information that will allow them to monitor risk concentrations as they develop and take actions before they become of systemic concern.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Developed only in the 1990s, credit default swaps (CDSs) are a relatively recent financial innovation. Though they play a useful and important role in managing risk exposure, a critical weakness in their market infrastructure contributed to and amplified the financial crisis of 2008-2009. This weakness is now being addressed in some of the reforms that are in the works as a part of the Dodd-Frank Act. Successful implementation of reforms that serve to increase transparency in CDS markets is essential for avoiding future financial crises.

Before the financial crisis, CDSs were traded over the counter (OTC), where parties arranged their own individual contracts bilaterally. Unlike markets with exchanges, such as the stock market, the CDS market did not provide participants with readily available information on prices or volumes of trading activity. Furthermore, regulators were unable to follow the transfer of risk among counterparties. The market’s opacity led to extreme risk imbalances—some firms holding more risk than they were able to handle and other firms falsely confident that they were protected from risk—which were at the heart of the crisis.

Reforms, originally agreed to by the Group of Twenty (G-20) nations in August 2009 and later incorporated into the Dodd-Frank Act, aim to address the opacity of OTC markets. These reforms should help strengthen the CDS market and enable regulators to follow the risks as they are transferred from institution to institution. To assure that CDSs are transferring rather than propagating risk, regulators must be able to trace the path of risks to verify that all risks

Risk Sharing and Management

A credit default swap (CDS) is most easily understood as a form of insurance against a default on a credit, such as a bond or loan. The buyer of the protection enters into a contract with a seller—typically a financial institution that seeks a payment for taking on the risk of having to make a payment in the future. When used prudently, a CDS is an important tool that allows portfolio managers and financial institutions to share risk, and thereby manage their individual levels of risk exposure.

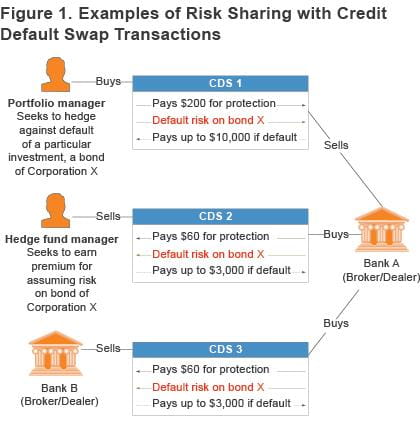

Figure 1 provides some illustrative examples of how CDSs have been used in risk management. The first example is that of a portfolio manager concerned about the increasing potential for a default on a $10,000 bond held in a fund. In an OTC market, the portfolio manager typically calls several broker-dealers for a quote for protection on the principal value and unpaid coupons of the bond in the event of a default.

In this example, the portfolio manager finds an agreeable price at Bank A. The CDS contract calls for a payment (or premium) of $200 to pay up to $10,000 if the bond defaults (the difference between the remaining obligation and the amount recovered in any settlement). In a sense, the portfolio manager swaps the CDS premium for a promise by the seller to make the specified payment to the buyer if the bond defaults.

In managing their own risk, broker-dealers typically buy and sell CDS contracts in trades with a variety of portfolio managers, including those at hedge funds, private equity firms, and pension funds. They also trade with other broker-dealers. In our example, after assessing its own exposure to Corporation X, Bank A decides to keep only part of the risk exposure acquired from the portfolio manager. In turn it transfers 30 percent of that risk exposure to a hedge fund and 30 percent to a broker-dealer at Bank B by buying comparably priced CDSs from each of the two sellers. This leaves Bank A with only 40 percent of the risk exposure it acquired in its first CDS contract.

In our simple examples, the cumulative amount of debt insured by outstanding CDS contracts—the gross notional amount—is $16,000. The net notional amount, by contrast, is $10,000, since it nets the offsetting of risk exposures. To give some perspective on the extensive use of CDSs to manage risk, the gross notional value of debt covered by CDSs outstanding increased dramatically from 2004 to 2007, rising from $6 trillion to $60 trillion. As of May 2, 2014, the gross notional amount of CDSs stood around $10.8 trillion for the top 1,000 reference entities, while the net notional amount was about $848 billion, indicating that over 90 percent of those CDS contracts were offset.

Counterparty Risk and Market Reforms

Given the explosion of CDSs and the OTC structure, the market became extremely complex and interconnected. Much of the academic research in the wake of the crisis has worked to explain how such complex interconnections among financial institutions can contribute to financial instability (see Yellen 2014). A common finding is that the OTC market in CDSs lacked the transparency that market participants and regulators needed to see the financial imbalances that were building.

To appreciate the economic motivation for the CDS market reforms now being implemented under the authority of Dodd-Frank, we focus on an academic contribution that directly addresses the elusive concept of counterparty risk. Acharya and Bisin (2014) emphasize that the risk that one’s counterparty will not fulfill its obligation needs to be evaluated at the time a CDS is contracted. In our examples presented in figure 1, Bank A’s ability to perform on its obligation, that is, to pay the portfolio manager any loss in the event of a default by Corporation X, depends on the abilities of the hedge fund manager and Bank B to also perform.

Counterparty risk is difficult, if not impossible, to evaluate in an opaque and complex market such as the OTC market in 2007. Counterparty risk exposures had become embedded in a tangled network of bilateral connections that could not be readily assessed by either market participants or regulators. No trading party had full knowledge of the aggregate risk positions of all other traders.

Acharya and Bisin examine the consequences of this issue in a theoretical setting that compares the efficiency of an OTC market relative to a market with a central clearing party. In their model, a market imperfection arises in the OTC market that is not present in the centrally cleared market. More specifically, in the OTC market, sellers of CDSs have an incentive that makes them more likely to take on excessive risk exposures without the full knowledge of other market participants. Acharya and Bisin refer to this market imperfection as a counterparty risk externality because the social cost of the excessive risk is not fully priced into the CDSs.

This precisely explains what happened with AIG during the crisis. AIG had assumed a large number of substantial risk exposures that were not known by its counterparties. More significantly, these risk exposures were not secured with adequate collateral, and AIG lacked a sufficient capital buffer to assuage fears that it would remain solvent. Because AIG was the counterparty to trades with several systemically important financial institutions, when AIG’s risk exposures were revealed, it further amplified market stress, leading to a seizure in capital markets. Lacking information on the full extent of the exposures, no private institution had the risk appetite to acquire AIG given the uncertainty of what would be left after liquidating some of AIG’s assets at fire-sale prices. Without a private offer looming and confidence continuing to erode, the US Treasury deemed it necessary to assume an equity position in AIG to prevent a total collapse of the financial markets.

The near total financial collapse demonstrated that an unregulated OTC market structure was not robust, but rather prone to catalyze a panic. A buildup in systemic risk went unchecked largely because neither regulators nor market participants could follow the risk being transferred. Thus, without reforms, neither policymakers nor market participants can be assured that default risk ends up at financial institutions with capital or collateral sufficient to absorb the loss, particularly at times when financial markets are under extreme stress.

The Reforms

Perhaps more than any other aspect of the crisis, the revelation of AIG’s unknown risk exposure crystallized the consensus on reforms agreed to by the G20 in 2009. The reforms involve four primary mandates to improve market transparency.

- OTC contracts that can be standardized are required to be cleared at a central counterparty.

- Standardized CDS contracts must trade on regulated exchange-like platforms called swap execution facilities (SEFs).

- All trade information on CDSs is required to be reported to a central data repository.

- CDS market participants must hold cash in margin accounts as a buffer against changes in CDS valuations.

We now discuss the implications of these mandates.

Central Counterparties and Standardized Contracts

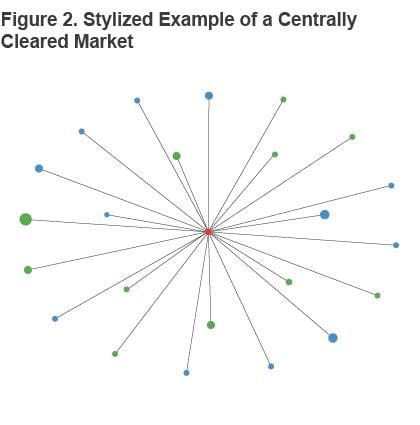

The counterparty risk externality described by Acharya and Bisin does not arise in markets where all trades are cleared through a central counterparty and positions are visible to all other counterparties. The improvement in transparency is evident in the central-counterparty market structure depicted figure 2. Each node (circle) depicts an individual bank. The size of the node represents the relative size of a bank’s risk position. The tan color indicates that it is a net seller of CDSs, while green indicates a net buyer. By replacing each bilateral contract with two new contracts with the central counterparty, the central counterparty becomes the counterparty to matched trades with all counterparties; that is, the risks of default are balanced by offsetting positions. Importantly, the central counterparty can more accurately assess the net risk exposures of all its trading partners and, because the central counterparty nets all counterparty exposures, its own net position is zero.

Standardized contracts are typically written in fixed dollar increments for a specified period of time. For example, a contract for Corporation X might specify protection for $1,000 over a period of 5 years. In figure 1, the portfolio manager would buy ten contracts to achieve the same desired level of protection. Because standardized contracts are precisely defined and can be priced in terms that allow for smaller notional amounts, they typically attract larger numbers of buyers and sellers. This change will thus facilitate the development of a deeper and more liquid CDS market that will, in turn, facilitate greater use of a central counterparty.

Swap Execution Facilities, Data Repositories, and Margin Accounts

In February, swap execution facilities began operating for CDS trading. These facilities allow for an expanded use of central counterparties, and, more importantly, give buyers and sellers broad access to both pre-trade and post-trade pricing information and volumes of trading—greatly enhancing market transparency. Pricing will become more competitive because CDS market participants will be able to see real-time prices for a CDS written on the same entity and for similar entities.

Because the central clearing party has access to the net risk exposures of all its trading partners, it is well positioned to impose initial margin requirement backed by cash or liquid collateral to cushion against a counterparty default. In the OTC market structure, participants cannot efficiently gauge net risk exposures and may misprice margin requirements. And, because a central clearing party will adjust its counterparties’ margin requirements (variation margin) as new information manifests in changes in prices readily available to all participants on swap trading platforms, timely adjustments will work to limit the buildup of systemic risk like that posed by AIG’s inadequate margin holdings.

Some Practical Limitations

These proposed reforms are designed to allow regulators and market participants to have better tools to track and manage their risk exposures and make the pricing of contracts more competitive. Although the reforms intend to bring about greater financial stability, several limitations may impede their efficacy. These limitations include: centralized counterparties becoming a single point of failure for the network, continued OTC trading of nonstandard contracts, and regulatory constraints making business costly.

It is important to recognize that the migration of trading to a central clearing party in the CDS market makes the central clearing party a critical link, and its vulnerability could contribute to financial instability. For example, Marshall and Steigerwald (2013) raise a concern about the time-critical liquidity that might be needed to pay a variation margin.

Failure to make a required variation margin payment constitutes a default, which makes it a potential source of additional risk. Resources will need to be employed to assure that the central clearing party has adequate risk management capabilities. Thus, the Intercontinental Exchange—the central clearing party for cleared CDS trades in the United States—has been designated as a systemically important financial institution. As such, it will be supervised by the Securities and Exchange Commission.

The continued trading of customized CDS contracts, those which do not lend themselves to being traded on exchanges, is another risk that will remain despite the reforms. Not every risk hedge fits the cookie-cutter requirements of a standardized contract. Some risk hedging would still require the flexible arrangement provided by a customized CDS available only in the OTC market. The Bank of International Settlements estimates that about one-third of CDSs would remain traded bilaterally once reforms are implemented.

Also an important implication of the work of Acharya and Bisin is that to achieve perfectly-competitive CDS pricing, all counterparties would need to know the net risk exposure of all other counterparties. Such an arrangement would allow price setters to internalize aggregate counterparty risk in their pricing schedules. But banks are reluctant to share such data because it could reveal proprietary information. Revealing full positional transparency to all participants could discourage a large number of institutions from participating in the market, limiting the depth and liquidity of the market.

Dealers originating CDSs argue that customized CDSs serve a socially useful purpose and that they make markets for illiquid securities. If regulatory constraints become too costly, hedging opportunities may be sacrificed. Whether or not this is true cannot be assessed without some means for regulators and market participants to follow the risk. If a CDS contract price does not account for all the counterparty risk, then the arrangement could entail some social cost if it manifests in a crisis. The mandates are designed to mitigate these risks. All CDS contracts are to be reported to a trade repository, so that even bilateral positions will be visible to regulators. These reforms should minimize the social cost.

Can Regulators Follow the Risk?

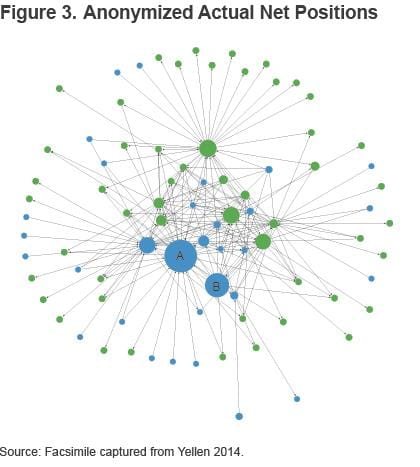

An important perspective on position transparency is in the process of being made available to regulators. Fed Chair Yellen (2014) recently presented an informative graphic of the network of CDS trades based on preliminary data available from the Trade Information Warehouse, a repository for CDS data (see figure 3). The nodes (circles) represent institutions. As in figure 2, the size of the node and its color indicate the size and type of exposure. Chair Yellen noted that the network information is useful for the domestic supervision of banks, allowing supervisors to identify outsized net positions of large institutions such as those as designated by A and B.

Source: Facsimile captured from Yellen 2014.

Chair Yellen also cautioned, however, that much work had to be done to harmonize rules across jurisdictions. In the global marketplace there will be several central clearing parties. Common rules will be needed to prevent regulatory arbitrage, a concern causing tension across jurisdictions. Such negotiations are sensitive because of the confidential nature of the information involved. The onus is now most concentrated with the regulators to assure that the central clearing parties will have adequate capital and margins to avoid becoming a single point of failure. This will require that these systemically important organizations share net exposures across jurisdictions.

Wrapping Up

The crisis revealed the importance of improved market functioning in the OTC market for CDSs. We have recently seen the implementation of reforms that will improve transparency and make CDS pricing more competitive. Market participants will be able to see pre-trade and post-trade pricing.

These reforms will also give regulators access to information that will allow them to follow the risks as they are transferred. This will enable them to monitor risk concentrations as they develop and take actions before they become of systemic concern.

Critics of the Dodd-Frank reforms have raised concerns that the legislation does not effectively alter incentives for systemically important financial institutions to become too big to fail. Although the main goal of the reforms for CDS markets in the Dodd-Frank Act is to prevent the accumulation of risk by a single entity, this financial stability initiative will consequently curb the ability of financial institutions to become too big to fail. Although it remains to be seen if risk is being transferred to those who are capable of absorbing that risk in a crisis, the reforms will go a long way toward assuring that it is, by providing the information needed to gauge the situation.

Suggested Readings

- Acharya, Viral and Alberto Bisin, (2014) “Counterparty Risk Externality: Centralized Versus Over-the-Counter Markets, Journal of Economic Theory. Vol. 149, 2014, 153-182.

- Acharya, Viral, Menachem Brenner, Robert F. Engle, Anthony Lynch, and Matthew Richarson, “Derivatives: The Ultimate Financial Innovation,” Chapter 10 in Viral V. Acharya and Matthew Richardson, eds., Restoring Financial Stability: How to Repair a Failed System, (2009) Wiley.

- Heckinger, Richard, David Marshall, and Robert Steigerwald, 2009. “Financial Market Utilities and the Challenge of Just-in-time Liquidity,” Federal Reserve Bank of Chicago, Chicago Fed Letter, no. 268a.

- Marshall, David, and Robert Steigerwald, 2013. “The Role of Time-critical Liquidity in Financial Markets,” Federal Reserve Bank of Chicago, Economic Perspectives, Quarter 2.

- Yellen, Janet. “Interconnectedness and Systemic Risk: Lessons from the Financial Crisis and Policy Implications,” American Economic Association/American Finance Association Joint Luncheon. San Diego, California. January 4, 2013.

- Data on the size of the CDS market is available at http://www.dtcc.com/market-data/section-1/table-6.aspx.

Suggested Citation

Carlson, John B., and Margaret Jacobson. 2014. “New Rules for Credit Default Swap Trading: Can We Now Follow the Risk?” Federal Reserve Bank of Cleveland, Economic Commentary 2014-11. https://doi.org/10.26509/frbc-ec-201411

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International