- Share

Are the New Basel III Capital Buffers Countercyclical? Exploring the Option of a Rule-Based Countercyclical Buffer

Countercyclical capital regulation can reduce the procyclicality of the banking system and dampen aggregate economic fluctuations. I describe two new capital buffers introduced in Basel III and discuss why their countercyclical effects may be small. If over time regulators want to increase the degree of countercyclicality of capital regulation, they might consider adopting a rule-based countercyclical buffer, that is, a buffer that is automatically lowered during recessions according to a rule. I present a conservative example of such a rule and its effects on capital requirements over the business cycle.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Since the last financial crisis, there has been increasing interest in the idea of setting bank capital regulation in a countercyclical way, that is, in a way that helps dampen business cycle fluctuations. To have countercyclical effects, capital regulation policy would tighten banks’ capital requirements during expansions and loosen them during recessions. In other words, banks would be required to maintain a higher capital-to-asset ratio during expansions and a lower one during recessions.1

Countercyclical capital regulation can help stabilize the aggregate economy by attenuating procyclical features of the banking system—those features that amplify business cycle fluctuations. For instance, during recessions, banks sustain capital losses that decrease their capital-to-asset ratios. To restore their capital-to-asset ratios, banks may contract their lending, leading to more severe recessions and to larger capital losses in the banking sector. By lowering required capital-to-asset ratios during recessions, countercyclical capital regulation can relieve some of the pressure on banks to contract their lending. A similar argument was set forth in one of the recommendations by the Financial Stability Forum, an international group that included financial regulators of several advanced economies:

“The capital framework should be enhanced to produce higher capital buffers during strong economic conditions that can be drawn down to a credible minimum requirement during periods of economic and financial stress. Such a countercyclical capital buffer will make the banking sector more resilient to stress and contribute to dampening the inherent procyclicality of the financial system and broader economic activity.” (FSF 2009, page 14)

More generally, research suggests that countercyclical capital regulation can dampen aggregate economic fluctuations and thus enhance social welfare, although there may be circumstances in which it may make the financial system less stable. Most research papers find that countercyclical capital regulation can help stabilize the macroeconomy and enhance social welfare in various contexts.2 A few papers, however, suggest that countercyclical capital regulation may amplify bank failures during recessions and may reduce social welfare under certain circumstances, specifically, when the social cost of bank failures is high, when the level of bank capital is low, or when the driver of the recession is an increase in the risk of bank failures.3

In this Commentary, I describe two new policy tools—the capital conservation buffer (CCB) and the countercyclical capital buffer (CCyB)—that have the potential to make capital regulation countercyclical. However, for reasons described in this article, their countercyclical impact may be small. If over time regulators want to increase the degree of countercyclicality of capital regulation, they might consider adopting, for internationally active banks, a rule-based countercyclical capital buffer (RBCCyB), that is, a buffer that automatically increases during expansions and decreases during recessions according to a rule. I present an example of such a rule and its effects on capital requirements over the business cycle.

The Capital Conservation Buffer

The CCB is a capital buffer introduced by Basel III “to ensure that banks build up capital buffers outside periods of stress which can be drawn down as losses are incurred” (BIS 2011, page 54). Internationally active banks need to maintain the CCB on top of their minimum capital requirements (MCRs).4

The MCRs are set by Basel III as follows. A bank’s Common Equity Tier 1 (CET1) capital, which includes common stock and retained earnings, must be at least 4.5 percent of its risk-weighted assets. A bank’s Tier 1 capital, which includes CET1 capital and noncumulative preferred stock, must be at least 6 percent of its risk-weighted assets. And a bank’s total capital, which includes Tier 1 capital and long-term subordinated debt, must be at least 8 percent of its risk-weighted assets.5

The CCB is set by Basel III as follows. After a transition period that will end this year, banks will be required to maintain an additional 2.5 percent buffer of CET1 capital (1.875 percent in 2018). Summing up the MCRs and the CCB, a bank’s CET1 capital will be required to be at least 7 percent of its risk-weighted assets. A bank’s Tier 1 capital will be required to be at least 8.5 percent of its risk-weighted assets. And a bank’s total capital will be required to be at least 10.5 percent of its risk-weighted assets.

The penalty for failing to satisfy the CCB requirement is less severe than the one for failing to satisfy the MCRs. If a bank does not satisfy the MCRs, the bank is considered undercapitalized and is subject to supervisory constraints on its distributions and operations; it can be closed if the capital is critically low. If a bank does not satisfy the CCB requirement, the bank faces constraints only on its discretionary distributions of earnings, which include dividend payments, share buybacks, and staff bonus payments; no supervisory action is triggered, and the bank does not face any constraint on its operations, so it retains its ability to conduct business as normal. The smaller the capital held by the bank to satisfy the CCB requirement, the more stringent the constraints on its earnings distributions. Table 1 lists the percent of earnings that is unavailable for discretionary distributions depending on the percent of capital held by the bank in excess of the MCRs.

Table 1. Constraints Associated with the CCB

| Common Equity Tier 1 capital-to-asset ratio in excess of 4.5 percent | Percent of earnings unavailable for discretionary distributions |

|---|---|

| Above 2.5% | 0% (No constraint on discretionary distributions) |

| 1.875% – 2.5% | 40% |

| 1.25% – 1.875% | 60% |

| 0.625% – 1.25% | 80% |

| 0% – 0.625% | 100% (Discretionary distributions are not allowed) |

Note: This table refers to the case in which the CCyB is equal to zero.

Sources: BIS (2011, page 56); author’s calculations.

In principle, the CCB could help reduce the procyclicality of the banking system and have a countercyclical effect. If the CCB works as intended, banks will build up their buffers during expansions. During recessions, banks that sustain capital losses and fail to satisfy the CCB requirement face less severe penalties than if they were failing to satisfy the MCRs. They may choose to incur the penalty rather than contract their lending and restore their capital-to-asset ratios.

In practice, however, the CCB’s countercyclical impact may be small. The constraints for failing to maintain the CCB—on dividends, share buybacks, and bonuses—are still rather restrictive. To avoid these constraints, banks may aim to satisfy the CCB requirement at all times, effectively treating the introduction of the CCB as equivalent to an increase in the MCRs. During recessions, in particular, banks that sustain capital losses may still contract their lending in order to rebuild their CCB as soon as possible. This is the argument set forth by Armour et al. (2016, page 307):

“In theory, banks will be able to maintain their previous levels of lending in the downturn by allowing the CCB to absorb the temporarily higher level of losses. In practice, it is doubtful whether the CCB will work in this simple way. Given the restrictions on distributions, both management and shareholders will prefer to restore the buffer as soon as possible and so are likely to eschew a routine policy of going below the buffer in hard times. So, the private interests of shareholders and managers will probably still favour the traditional policy of reducing assets in a downturn.”

The Countercyclical Capital Buffer

The CCyB is an additional capital buffer introduced by Basel III “to achieve the broader macroprudential goal of protecting the banking sector in periods of excess aggregate credit growth” (BIS 2011, page 7). Notice that the word “countercyclical” in the CCyB’s name refers to the notion of credit cycles, while elsewhere in this Commentary it refers to the notion of business cycles.

National regulators can set the CCyB with discretion in the range of 0 percent to 2.5 percent after a transition period that will end this year (the range is between 0 percent and 1.875 percent in 2018). While decreases in the CCyB take effect immediately, increases in the CCyB are preannounced by up to one year, to give banks time to adjust to the higher buffer level. National regulators will deploy the CCyB “when excess aggregate credit growth is judged to be associated with a build-up of systemwide risk to ensure the banking system has a buffer of capital to protect it against future potential losses” (BIS 2011, page 57). The national regulators should monitor credit growth and assess whether such growth is excessive and is leading to the buildup of systemwide risk.6

The CCyB works as an extension of the CCB: Failing to satisfy the CCyB requirement triggers constraints on discretionary distributions of earnings, but no supervisory action or constraint on operations. As an example, Table 2 lists the percent of earnings that is unavailable for discretionary distributions depending on the capital held by the bank in excess of the MCRs, in the case that the national regulator sets the CCyB at 2.5 percent (so the sum of the CCB and the CCyB is 5 percent).

Table 2. Constraints Associated with the CCB and CCyB

| Common Equity Tier 1 capital-to-asset ratio in excess of 4.5 percent | Percent of earnings unavailable for discretionary distributions |

|---|---|

| Above 5% | 0% (No constraint on discretionary distributions) |

| 3.75% – 5% | 40% |

| 2.5% – 3.75% | 60% |

| 1.25% – 2.5% | 80% |

| 0% – 1.25% | 100% (Discretionary distributions are not allowed) |

Note: This table refers to the case in which the CCyB is equal to 2.5 percent.

Sources: BIS (2011, page 60); author’s calculations.

The overall countercyclical impact of the CCyB, as with the CCB, may also be small. This is because national regulators are not likely to deploy the CCyB frequently during expansions, since they are supposed to deploy it only in case of excess credit growth: “This focus on excess aggregate credit growth means that jurisdictions are likely to only need to deploy the buffer on an infrequent basis” (BIS 2011, page 57). All national regulators, except the UK, appear to expect that the CCyB will be equal to zero in normal times: “The United Kingdom expects that when risks are considered to be neither subdued nor elevated, its CCyB rate will be in the region of 1%. Although too early to know, other jurisdictions appear to expect 0% to be the modal point over time” (BIS 2017, page 7). Even though we are still in the introductory period of the CCyB, it is instructive that, out of 28 jurisdictions, only 4 (Hong Kong, Norway, Sweden, and the United Kingdom) have set a positive CCyB during the current economic expansion (BIS 2017, page 10).

A Rule-Based Countercyclical Buffer

It is too early to know what the overall impact of the two new Basel III buffers will be, as they have just been introduced and they have not been fully tested yet. The discussion so far, however, has indicated that their countercyclical impact may be small. If over time regulators want to increase the degree of countercyclicality of capital regulation, they might consider adopting a different form of buffer, one explicitly designed to increase during expansions and decrease during recessions.

In particular, regulators could consider a buffer that varies over the business cycle automatically according to a rule. Compared to a discretion-based approach, a rule-based approach could help regulators achieve the desired degree of countercyclicality in capital regulation. With discretion, regulators may be tempted to avoid raising the buffer during expansions, perhaps to avoid adverse consequences on banks’ lending. As a result, the buffer may be set too low too often, and may not generate the desired degree of countercyclicality. A rule-based approach could help regulators commit to raising the buffer during expansions and achieve a greater degree of countercyclicality. As Arjani 2009 points out, a rule-based approach “serves as an effective precommitment device, in that supervisors will not be put in the difficult and unpopular position of requesting on an ad hoc basis that banks raise their capital in the middle of an economic boom.”

Like Basel III, the buffer could apply to internationally active banks. The buffer, consisting of CET1 capital, could work as an extension of the existing Basel III MCRs, so the total MCRs (TMCRs) for internationally active banks would be the sum of the existing Basel III MCRs and the new RBCCyB and would inherit the countercyclical properties of the RBCCyB itself.

Given the uncertainty about the impact of countercyclical buffers—or time-varying buffers more broadly—on macroeconomic and financial stability, it would be prudent to consider a conservative rule that prescribes small changes in TMCRs relative to historical experience. Such a rule could prescribe small changes in two respects.

First, the rule could be specified to make the change in TMCRs in response to a change in real GDP small relative to historical experience. For example, the standard deviation of the quarterly change in the ratio of CET1 to risk-weighted assets for US banks has been 0.27 percentage points since 2001 (based on consolidated data from FRBNY 2017). Over the same period, the standard deviation of the quarterly percent change of real GDP has been 0.60 percentage points. The ratio of these two standard deviations is 0.45, so the rule could prescribe that the buffer changes by less than 0.45 percentage points for each percentage point change in real GDP.

Second, the rule could be specified to make the overall change in TMCRs small relative to historical experience. For example, in the 2001–2009 business cycle, the ratio of CET1 to risk-weighted assets dropped from a peak of 8.56 percent in 2002 to a trough of 6.14 percent in 2008. The rule, then, could prescribe that the buffer range is less than 2.42 percentage points (the peak-to-trough change).

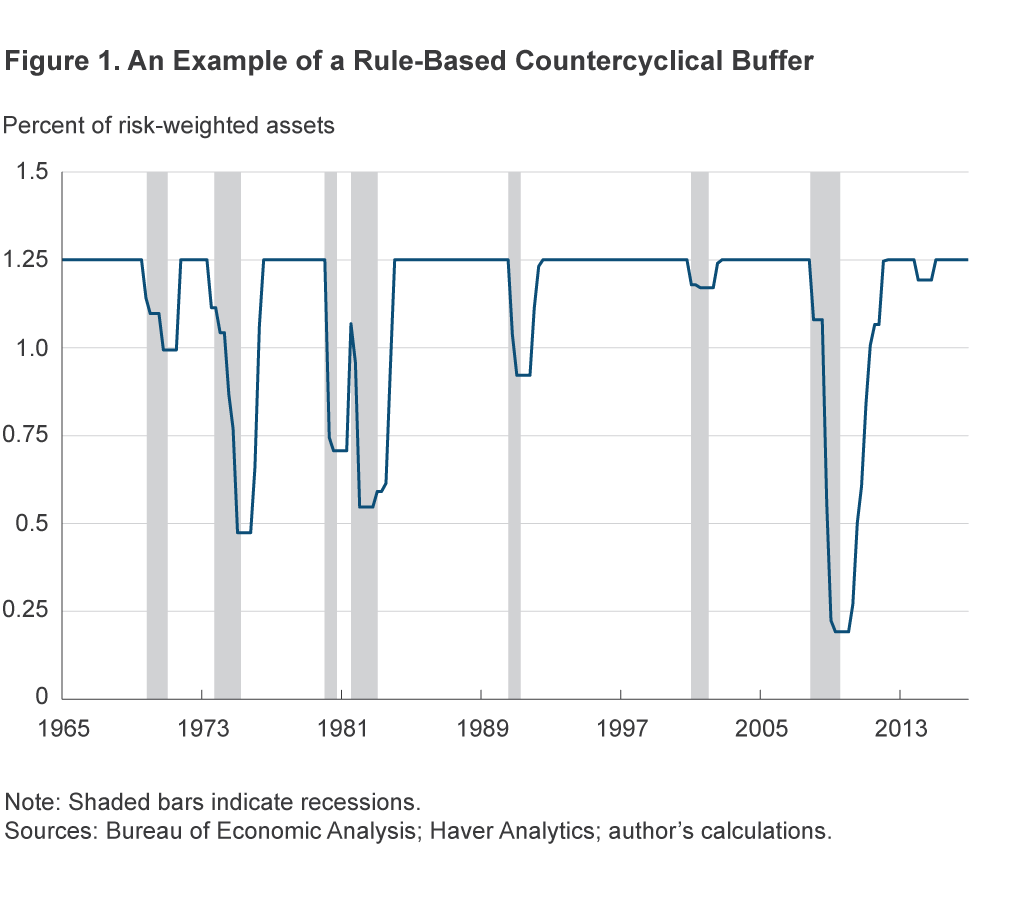

To illustrate a possible rule with these conservative features, consider the following example of an RBCCyB. The RBCCyB ranges between 0 percent (during severe recessions) and 1.25 percent (during expansions). This is half the range of the CCB and the CCyB. During expansions, as real GDP grows, the RBCCyB remains constant and equal to 1.25 percent. During economic contractions, as real GDP declines, the RBCCyB decreases by 0.25 percentage points for each percentage point of real GDP decline relative to its previous peak; however, whenever real GDP drops by more than 5 percent, the RBCCyB remains at zero. In addition, to give banks time to adjust after an increase in the buffer, any increase in the RBCCyB takes effect with a one-year delay, like in the case of the CCyB.7

To illustrate how historical fluctuations in US real GDP and this rule would have affected capital requirements, figure 1 below shows the rule-implied level of the RBCCyB. As is evident from the figure, the buffer level is the same during expansions regardless of the strength of the expansion, while it varies during recessions depending on the severity of the recession.

Were regulators to adopt such a buffer, internationally active banks would be required to hold during economic expansions CET1 capital equal to 5.75 percent of their risk-weighted assets, that is, the sum of the RBCCyB (1.25 percent) and the existing Basel III MCRs (4.5 percent). In recessions, the capital requirements would fall. In a severe recession, such as that of 2007–2009, the required CET1 capital would drop to about 4.75 percent. In a less severe recession, such as that of 1990–1991, it would drop much less, to about 5.5 percent.

While such a rule for countercyclical capital regulation could dampen economic fluctuations and enhance social welfare, some downsides are possible. In particular, there may be circumstances in which the rule, by lowering the TMCRs during recessions, could amplify bank failures and make the financial system less stable. When the risks to financial stability outweigh the benefits of macroeconomic stabilization, national regulators should consider not lowering the TMCRs during recessions, disregarding the decrease in the RBCCyB. For instance, in Occhino 2017, I show that banks’ capital requirements should be lowered during economic contractions caused by macroeconomic shocks, but not during economic contractions caused by banking system shocks that have a relatively large impact on banks’ credit spreads. More research is needed to identify the additional indicators and circumstances that point to large risks to financial stability and suggest not lowering banks’ capital requirements during recessions.

Conclusions

Countercyclical capital regulation can enhance social welfare by reducing the procyclicality of the banking system and by dampening aggregate economic fluctuations. In this Commentary, I have described two new capital buffers introduced in Basel III, the CCB and the CCyB, and I have discussed why they may have small countercyclical effects. The CCB’s countercyclical impact may be small because banks are averse to constraints on their discretionary distributions to shareholders and managers, and they may treat the introduction of the CCB as equivalent to an increase in minimum capital requirements. The CCyB’s countercyclical impact may be small because national regulators are supposed to deploy it only in cases of excess credit growth, and they are not likely to raise it frequently during expansions. If over time regulators want to increase the degree of countercyclicality of capital regulation, they might consider adopting, for internationally active banks, a rule-based countercyclical buffer, that is, a buffer that is automatically lowered during recessions according to a rule. I have presented a conservative example of such a rule that is likely to make capital regulation more countercyclical.

Footnotes

- In policy and research documents about countercyclical capital regulation, the word “countercyclical” may refer to the notion of business cycles or to the notion of credit cycles. In this Commentary, it refers to the business-cycle notion. In addition, following convention, we refer to a policy tool (such as a capital buffer or a capital-to-asset ratio requirement) as countercyclical if it helps dampen business-cycle fluctuations regardless of how it covaries with real GDP. With this convention, a capital buffer that increases during expansions and decreases during recessions is countercyclical even though it covaries positively with real GDP. Return to 1

- This work includes Covas and Fujita, 2010; Darracq Pariès, Kok Sørensen, and Rodriguez-Palenzuela, 2011; Angeloni and Faia, 2013; Repullo, 2013; Angelini, Neri, and Panetta, 2014; Rubio and Carrasco-Gallego, 2016; Aliaga-Díaz, Olivero, and Powell, 2017; Hollander, 2017; Malherbe, 2017; and Davydiuk, 2017. Return to 2

- For further information, see Repullo and Suarez, 2013 on the high social cost of bank failures; Clerc at al., 2015 on the low level of bank capital; and Occhino, 2017 on the risk of bank failures as the driver of recessions. Return to 3

- Basel III applies to internationally active banks only, but national regulators can extend the Basel III requirements to other banks. In the United States, in particular, regulators have extended the CCB requirement to most banking organizations (including all national and state banks and all federal and state savings associations, but excluding federal credit unions) and they have extended the CCyB requirement to large banking organizations (those that are subject to advanced approaches capital rules). Return to 4

- The MCRs for global systemically important banks are higher (see Haubrich and DeKoning, 2017). In addition, banks are subject to a leverage ratio constraint: Tier 1 capital must be at least 3 percent of a measure of total exposure, which includes a measure of total assets that is not risk-weighted (see BIS 2011, pages 61–64). Return to 5

- Accordingly, the Federal Reserve plans to use the CCyB to increase the resilience of the financial system “when there is an elevated risk of above-normal losses, [which] often follow periods of rapid asset price appreciation or credit growth that are not well supported by underlying economic fundamentals” (FRS Board 2016, page 21). To set the CCyB, the Federal Reserve considers “a number of financial system vulnerabilities, including but not limited to, asset valuation pressures and risk appetite, leverage in the nonfinancial sector, leverage in the financial sector, and maturity and liquidity transformation in the financial sector,” and monitors “a wide range of financial and macroeconomic quantitative indicators including, but not limited to, measures of relative credit and liquidity expansion or contraction, a variety of asset prices, funding spreads, credit condition surveys, indices based on credit default swap spreads, option implied volatilities, and measures of systemic risk” (FRS Board 2016, page 26). Return to 6

- More precisely, let y(s) be the level of real GDP in quarter s and let Y(t) = max {history of y(s) in the five years up to and including quarter t} be the peak of real GDP during the previous five years.

Then,

where B = 1.25 percent and b = 0.25. If desired, the degree of countercyclicality could be increased by proportionally raising the constants B and b. Return to 7

X(s) = max {B − b [1 − y(s)/Y(s)] , 0}

RBCCyB(t) = min {history of X(s) in the year up to and including quarter t},

References

- Aliaga-Díaz, R., M.P. Olivero, and A. Powell. 2018. “Monetary Policy and Anti-Cyclical Bank Capital Regulation.” Economic Inquiry, 56(2): 837–858.

- Angelini, P., S. Neri, and F. Panetta. 2014. “The Interaction between Capital Requirements and Monetary Policy.” Journal of Money, Credit, and Banking, 46(6): 1073–1112.

- Angeloni, I., and E. Faia. 2013. “Capital Regulation and Monetary Policy with Fragile Banks.” Journal of Monetary Economics, 60: 311–324.

- Arjani, N. 2009. “Procyclicality and Bank Capital.” Bank of Canada Financial System Review, 33–39 (June).

- Armour, J., D. Awrey, P. Davies, L. Enriques, J.N. Gordon, C. Mayer, and J. Payne. 2016. Principles of Financial Regulation. Oxford University Press, Oxford, UK.

- BIS. 2011. “Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems.” Basel Committee on Banking Supervision, Bank for International Settlements, December 2010 (revised June 2011).

- BIS. 2017. “Range of Practices in Implementing the Countercyclical Capital Buffer Policy.” Basel Committee on Banking Supervision, Bank for International Settlements (June).

- Clerc, L., A. Derviz, C. Mendicino, S. Moyen, K. Nikolov, L. Stracca, J. Suarez, and A.P. Vardoulakis. 2015. “Capital Regulation in a Macroeconomic Model with Three Layers of Default.” International Journal of Central Banking, 11(3): 9–63.

- Covas, F., and S. Fujita. 2010. “Procyclicality of Capital Requirements in a General Equilibrium Model of Liquidity Dependence.” International Journal of Central Banking, 6(4): 137–173.

- Darracq Pariès, M., C. Kok Sørensen, and D. Rodriguez-Palenzuela. 2011. “Macroeconomic Propagation under Different Regulatory Regimes: Evidence from an Estimated DSGE Model for the Euro Area.” International Journal of Central Banking, 7(4): 49–113.

- Davydiuk, T. 2017. “Optimal Bank Capital Requirements.” Unpublished manuscript.

- FRBNY. 2017. “Quarterly Trends for Consolidated U.S. Banking Organizations.” Federal Reserve Bank of New York (Second Quarter).

- FRS Board. 2016. “The Federal Reserve Board’s Framework for Implementing the Countercyclical Capital Buffer.” Board of Governors of the Federal Reserve System, Regulation Q, 12 CFR part 217, Appendix A (September).

- FSF. 2009. “Recommendations for Addressing Procyclicality in the Financial System.” Financial Stability Forum (April).

- Haubrich, J., and C. DeKoning. 2017. “Sizing Up Systemic Risk.” Federal Reserve Bank of Cleveland, Economic Commentary, no. 2017-13.

- Hollander, H. 2017. “Macroprudential Policy with Convertible Debt.” Journal of Macroeconomics, 54(Part B): 285–305.

- Malherbe, F. 2017. “Optimal Capital Requirements over the Business and Financial Cycles.” Unpublished manuscript.

- Occhino, F. 2017. “The Optimal Response of Bank Capital Requirements to Credit and Risk in a Model with Financial Spillovers.” Federal Reserve Bank of Cleveland, Working Paper no. 17-11.

- Repullo, R. 2013. “Cyclical Adjustment of Capital Requirements: A Simple Framework.” Journal of Financial Intermediation, 22(4): 608–626.

- Repullo, R., and J. Suarez. 2013. “The Procyclical Effects of Bank Capital Regulation.” Review of Financial Studies, 26(2): 452–490.

- Rubio, M., and J.A. Carrasco-Gallego. 2016. “The New Financial Regulation in Basel III and Monetary Policy: A Macroprudential Approach.” Journal of Financial Stability, 26: 294–305.

Suggested Citation

Occhino, Filippo. 2018. “Are the New Basel III Capital Buffers Countercyclical? Exploring the Option of a Rule-Based Countercyclical Buffer.” Federal Reserve Bank of Cleveland, Economic Commentary 2018-03. https://doi.org/10.26509/frbc-ec-201803

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International