- Share

National Preferences for Bank or Market Financing

This article examines the reasons some countries favor bank-based financial systems and others favor markets-based financial systems. We show that when societies are more accepting of ambiguity—and by extension are more trusting—market financing is favored over relationship-based collateral financing by banks.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

A key function of any national financial system is channeling funds from the savers and investors who have them to borrowers and businesses who need them. How that process takes place differs from country to country; some countries have systems that rely more on banks (or bank-like organizations), while others rely more on financial markets, such as the stock and bond markets.

Very little is known about why countries tend toward a bank-oriented or a markets-oriented system. This paper argues that a country’s preference for bank- or markets-based financing is associated with the culture’s tolerance for ambiguity. Cultures that are less comfortable with ambiguity are more likely to rely on bank-oriented financing systems.

Financial System Orientation

In some countries, such as Germany and Japan, businesses rely a great deal more on banks for financing than do businesses in other countries, such as the United States, Canada, or the United Kingdom, which rely more on financial markets, such as the stock and bond markets. Most countries lie at various points along a continuum between bank-oriented and markets-oriented countries (table 1). Bank financing is based mostly on relationships and collateral, while market financing is based mostly on social trust among strangers, high levels of disclosure, and faith in contracts (Rajan, 1992; Ergungor, 2004).

| Country | Mean, 1996–2003 | Country | Mean, 1996–2003 | |

|---|---|---|---|---|

| South Africa | 2.47 | Greece | 0.69 | |

| United States | 2.35 | Israel | 0.64 | |

| Finland | 2.00 | Korea | 0.60 | |

| Hong Kong | 1.93 | Indonesia | 0.59 | |

| Sweden | 1.72 | Spain | 0.58 | |

| Chile | 1.52 | Brazil | 0.58 | |

| Singapore | 1.47 | Norway | 0.57 | |

| Russia | 1.40 | Hungary | 0.57 | |

| Switzerland | 1.36 | Ireland | 0.57 | |

| Argentina | 1.31 | Belgium | 0.56 | |

| Malaysia | 1.20 | New Zealand | 0.51 | |

| United Kingdom | 1.15 | Pakistan | 0.49 | |

| Australia | 1.11 | Italy | 0.48 | |

| Philippines | 0.99 | Poland | 0.45 | |

| Canada | 0.92 | Thailand | 0.41 | |

| India | 0.87 | Czech Republic | 0.41 | |

| Mexico | 0.87 | Japan | 0.40 | |

| Netherlands | 0.75 | Germany | 0.33 | |

| Denmark | 0.72 | Portugal | 0.31 | |

| France | 0.72 | Austria | 0.18 | |

| Turkey | 0.71 |

Source: World Bank, Financial Structure Database.

The orientation of a country’s financial system to banks or markets is a fundamental characteristic of the system, and it has important implications. Orientation may influence the access that different types of industries have to financing and, as a result, affect economic growth. For instance, Rajan and Zingales (2001) suggest that bank financing is more suitable for physical industries that are well understood, in contrast to more technology-oriented industries, which benefit more from market financing due to the high levels of uncertainty that characterize such firms. Bank-oriented systems are considered better at financing smaller companies and companies that traditionally have high levels of tangible assets, while markets-oriented systems are considered better at financing larger, innovative, faster-growing, and low-tangible-asset companies.

It is also easier for governments to direct capital allocation in a bank-oriented system, while markets-oriented systems direct capital to its best (highest-return) uses. In terms of system stability, bank-oriented systems are more prone to crony capitalism and episodes of unsustainably high levels of bad loans, while markets-oriented systems are prone to speculative bubbles. A given financial system may be more prone to financial crises and another may better promote economic growth.

Insight into the factors underpinning why nations develop one type of financing system over another is important to policymakers. Until we understand the soil from which these financial systems spring, regulating or reforming either type of system could be difficult, ineffective, or even counterproductive.

Finance, Information, and Contracts

Because a financing contract transfers the control of savers’ funds to borrowers, savers need some assurance that the funds will be managed properly and that the contract terms can be enforced. That assurance is inherently difficult to provide. For one thing, all the parties to the contract have access to different information. They are also motivated by different incentives. It is unfeasible to monitor every decision and event affecting the outcome of the agreement. In the end, it is impossible to specify in a contract all the possible contingencies that might arise; in this sense, all optimal contracts are “incomplete.”

Consequently, two mechanisms have evolved to solve the financial intermediation problems associated with incomplete financing contracts, financial institutions and financial markets. Both mechanisms must perform the essential functions involved in financial intermediation, namely, collecting deposits, selecting recipients for the funds, designing the financing contracts, monitoring recipients, and collecting returns from the financing activity. In fact, institutions and markets usually coexist in each country and are both complementary and competing channels for financing economic activity.

Bank-oriented systems rely on relationships to enforce financing contracts. For example, in Japan, banks provide the lion’s share of capital to businesses through their integration in business networks (“keiretsu”). Being part of such a network gives banks access to information about the profitability and other financial details of the firms that are part of the network. For entities outside the network—other banks, investors, or the public in general—such information is more costly to obtain.

By contrast, investors and savers in markets-based systems expect contracts to be enforced by means of efficient investor protection laws that are effectively enforced. In addition, greater disclosure levels, business expectations, business behavior, and reputational concerns further strengthen enforcement of contracts in a markets-based financial system.

Culture and Financing

In a theoretically ideal financial system, it makes no difference whether financing is privately done through banks or publicly done through markets. In practice, countries tend toward one or the other, and researchers have found that the direction in which they tend is associated with various characteristics of their society.

Our recent research investigated a number of these characteristics. As no contract can specify all possible contingencies, some ambiguity always exists in contract enforcement, and some societies may naturally demand more reconciliation of these ambiguities than others. The level of reconciliation required could be associated with many factors. Industrial structure, legal traditions, political structure, regulatory quality, and economic inequality are some that have been identified (Guizo, Sapienza, and Zingales, 2004).

For example, when a society’s contract enforcement regime is not adequate, bank financing is favored, and the binding of transactions shifts to being more private, away from the public eye, via long-term relationships with banks. Banks are also favored when reliable market signals and other information about firms are too difficult or costly for the public to obtain—for example, if accounting standards are weak. By contrast, when there is a good legal environment and governance, market signals are better able to provide this sort of information to public investors, and markets-oriented systems are preferred.

We argue that the level of reconciliation required also depends on national culture, specifically, the society’s level of social trust and ethical norms.1 National culture has been defined by Hofstede (1980) as the norms and values that guide behavior and beliefs, the collective programming of the mind that distinguishes the members of one group or category of people from another. Other scholars describe “subjective culture” as a society’s “characteristic way of perceiving its social environment” (Triandis, 1972). Another way to think about culture is that culture is to society what memory is to individuals (Kluckhohn, 1954). This can include conscious memory as well as, more ubiquitously, subconscious memory of how to do things and how to behave. More succinctly, Beugelsdijk and Maseland (2011) conclude that culture is a subset of institutions related to societal collective identity, and behavioral and ideational structures that are the formation of the identity of a community. Thus, culture includes unstated assumptions and habits regarding how people actually behave—particularly with respect to how information is processed.

One such cultural norm is the avoidance of uncertainty, defined as the extent to which people in a country do not like uncertainty or ambiguity. Hofstede (1980) measured uncertainty avoidance in a wide array of countries and found that it varied widely. We surmise that uncertainty avoidance is likely to play a role in a society’s preference for a markets- or bank-oriented financial system. People with greater tolerance for ambiguity and uncertainty are more likely to place a higher priority on their country’s legal and regulatory quality when deciding whether to trust in the type of contracts that are the basis of market financing.

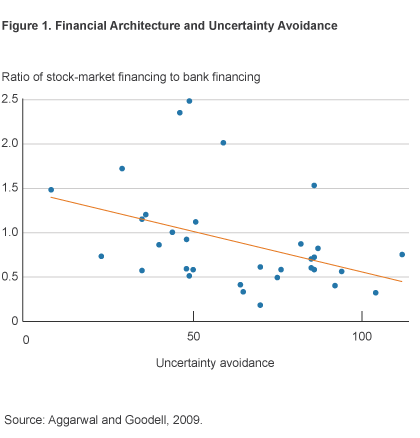

In figure 1, we plot various nations’ tendencies toward a financial architecture (the ratio of stock-market financing to bank financing) against their degree of uncertainty avoidance (UCA). We see a clear negative association between a markets-based financial architecture and uncertainty avoidance. When societies are more accepting of ambiguity—and by extension are more trusting—market financing is favored over relationship-based bank financing. For example, the US and the UK, with UCAs of 46 and 35, respectively, have a low need to avoid uncertainty and so rely more on market financing than Germany or Japan, which have a higher need for avoiding uncertainty, with UCAs of 65 and 92.

Other related research has reported results for other variables that may influence the national predilection for bank- versus markets-oriented financing systems (Aggarwal and Goodell, 2009). Controlling for relevant variables and using appropriate multivariate statistical methodology, this research documents that the national tendency toward markets-oriented financing systems increases with political stability, societal openness, and economic inequality and decreases with regulatory quality and aversion to ambiguity.

Conclusion

We show that a country’s preference for bank- or markets-based financing is associated with the culture’s tolerance for ambiguity. Cultures that are less comfortable with ambiguity are more likely to rely on bank-oriented financing systems. We connect these findings to fundamental aspects of markets and banks. Markets involve contracts that largely rely on impersonal trust rather than collateral. In cultures more adverse to uncertainty, trust in such contracts is more costly to establish.

Knowledge of the factors that make a country bank- or markets-oriented is important to policymakers in all countries, but particularly for policymakers in countries where the financial system is still very much in evolution. Further, managers of multinational companies must take an interest in the financial aspects of their host environments.

Overall, insights into how culture shapes financial outcomes and institutions can help form perspectives in contexts and ways not necessarily foreseen—much as fundamental science leads to new developments in engineering that are not easily predicted. This knowledge can form a background of understanding as policymakers, multinational companies, international banks, and global portfolio managers shape strategic plans and regulations.

Footnotes

- However, there is uncertainty regarding the relative influence of culture versus institutions, as current institutions can be seen as path-dependent outcomes of cultural influences and historical events, and at the same time institutions are seen to influence culture (Alesina and Giuliano, 2015). Return to 1

References

- Aggarwal, Raj, and John W. Goodell, 2009. “Markets and Institutions in Financial Intermediation: National Characteristics as Determinants, ” Journal of Banking and Finance, 33:10, pp. 1770-1780.

- Alesina, Alberto, and Paola Giuliano, 2015. “Culture and Institutions,” Journal of Economic Literature, 53:4, pp. 898-944.

- Beugelsdijk, Sjoerd, and Robbert Maseland, 2011. Culture in Economics: History, Methodological Reflections, and Contemporary Applications, Cambridge University Press.

- Ergungor, Ozgur E., 2004. “Market- vs. Bank-based Financial Systems: Do Rights and Regulations Really Matter?” Journal of Banking and Finance, 28:12, pp. 2869-2887.

- Franks, Julian, Colin Mayer, and Hannes Wagner, 2006. “The Origins of the German Corporation—Finance, Ownership, and Control,” Review of Finance, 10:4, pp. 537-585.

- Guiso, Luigi, Paola Sapienza, and Luigi Zingales, 2004. “The Role of Social Capital in Financial Development,” American Economic Review, 94:3, pp. 526-556.

- Guiso, Luigi, Paola Sapienza, and Luigi Zingales, 2006. “Does Culture Affect Economic Outcomes?” Journal of Economic Perspectives, 20:2, pp. 23-48.

- Hart, Oliver D., 2001. “Financial Contracting,” Journal of Economic Literature, 39:4, pp. 1079-1100.

- Hofstede, Geert, 1980. Culture’s Consequences: International Differences in Work-Related Values, Sage Publications.

- Kester, W. Carl, 1992. Note on Corporate Governance Systems: The United States, Japan, and Germany, Harvard Business School, 9-292-012.

- Kluckhohn, C., 1954. “Culture and Behavior,” in G. Lindzey, ed., Handbook of Social Psychology, Addison Esley.

- Rajan, Raghuram G., 1992. “Insiders and Outsiders: The Choice between Informed and Arm’s Length Debt,” Journal of Finance, 47:4, pp. 1367-1400.

- Rajan, Raghuram G., and Luigi Zingales, 2001. “Financial Systems, Industrial Structure, and Growth,” Oxford Review of Economic Policy, 17:4, pp. 467-482.

- Triandis, Harry C., (1972), The Analysis of Subjective Culture, Wiley.

Suggested Citation

Aggarwal, Raj, and John W. Goodell. 2016. “National Preferences for Bank or Market Financing .” Federal Reserve Bank of Cleveland, Economic Commentary 2016-04. https://doi.org/10.26509/frbc-ec-201604

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International