- Share

Warehousing: A Historical Lesson in Central Bank Independence

This Economic Commentary explains how warehousing—a seemingly innocuous institutional arrangement between the Federal Reserve and the US Treasury—came to threaten the Fed’s independence. Warehousing began as an arcane procedure designed to help the Treasury cover a specific type of foreign-exchange exposure. It then grew into a supplemental source of funding for the Treasury’s foreign-exchange interventions. Eventually the procedure morphed into a sizeable off-budget source of funding for other Treasury activities and seemed an inappropriate subversion of the congressional appropriations process, a development that raised concerns within the Fed about its ability to conduct monetary policy free from political concerns.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

[10.13.2017: This piece has been revised since it was first posted. Changes to clarify text were made in 2 sections: the first and fourth paragraphs of Warehousing: How It Changed and the last paragraph of A Road Less Traveled.]

Federal Reserve warehousing—where the Fed and the US Treasury swap foreign-currency holdings—was one of the most controversial aspects of US foreign-exchange operations in the late twentieth century and a key factor in their termination. In the mid-1990s, as the Federal Open Market Committee (FOMC) worried about its reputation for price stability, warehousing reached its apogee. Many FOMC participants then feared that the operations jeopardized the Fed’s independence—vital for policy credibility—because the transactions resembled a loan from the Fed to the Treasury, undertaken at the latter’s behest and outside of the congressional appropriations process. Although the Fed has carried out no warehousing operations since 1992, the FOMC routinely renews the authorization (FOMC 2017, 5-7) that would allow such operations to resume.

This Economic Commentary explains how a seemingly innocuous institutional arrangement, one designed to assist the Treasury, came to threaten the Fed’s independence.1

Warehousing: How It Works and Why It Matters

In a typical warehousing operation, the Treasury’sExchange Stabilization Fund (ESF) sells foreign currency to the Fed and simultaneously repurchases it for delivery at a specific future date, generally within one year.2 The Fed pays for the foreign exchange by crediting an ESF account with newly created dollar reserves, which the Fed then extinguishes when the swap reverses. Because both the spot and forward legs of the transaction are done at the same exchange rate, neither party incurs foreign-exchange risk from warehousing. The Fed places the warehoused foreign exchange in an interest-earning asset for the term of the swap and sterilizes (offsets) any unwanted changes in bank reserves that result from the ESF’s use or repayment of the dollar funds. The Fed has no legal obligation to comply with a Treasury request to warehouse foreign exchange; it does so in a spirit of collegiality. The Treasury, for its part, can use the dollar proceeds in any manner that it chooses—not solely for foreign-exchange operations—by having the ESF invest the dollars in US Treasury securities, whose proceeds finance general expenditures.

Much of the controversy surrounding warehousing materialized because the swap resembled a loan to the US Treasury collateralized with foreign exchange. The Banking Act of 1935 prohibited the Federal Reserve from purchasing government obligations except in the open market, that is, the secondary market for government securities. The Fed was not to buy debt instruments directly from the Treasury. Exactly why Congress put the prohibition in place is uncertain (Garbade 2014). It may have hoped to restrict fiscal spending and borrowing or to constrain the Fed’s balance sheet. Howard Hackley, the Board of Governors’ general counsel from mid-1957 through mid-1973, suggested that Congress did not want the Fed to lend to the Treasury in a manner that might be inconsistent with monetary policy (Hackley 1961, 18). If so, Hackley’s opinion could have applied equally to warehousing. Between the Second World War and 1981, Congress did allow a $5 billion exemption to the Banking Act’s prohibition, primarily to cover emergency situations, so a precedent for warehousing may have existed. The exemption, however, ended in 1981 in part because the Treasury used it to avoid the debt ceiling (Garbade 2014).

The FOMC’s authority for warehousing hinged on what constituted the open market for foreign exchange. In 1961, Hackley argued that foreign currency—unlike Treasurysecurities—was not a liability on the Treasury’s balance sheet. The Treasury did not create foreign currency; it was merely a participant in the open market for foreign exchange. If the Fed bought foreign currency outright or through a swap with the Treasury, it was transacting in the open market. Backed with this interpretation, the FOMC extended authority to the Foreign Exchange Desk at the Federal Reserve Bank of New York in 1962 to buy or sell foreign exchange with the ESF. Hackley’s interpretation, however, never sat comfortably with some FOMC participants for reasons that took 30 years to come to the fore.

Warehousing: How It Changed

The initial warehousing transactions of the early 1960s were not foreign-currency swaps, as outlined above, and they lacked the loan-like quality of the later transactions. They were instead a clever way for the Fed, as fiscal agent for the Treasury, to help the ESF avoid losses on its foreign-exchange portfolio. In the early 1960s, the Treasury issued securities denominated in foreign currencies and used the proceeds for various types of foreign-exchange operations. The outstanding obligations, however, exposed the ESF to losses should these foreign currencies appreciate. (Although exchange rates were fixed at the time, they could fluctuate within 1 percent of their central parities.) The ESF could have covered its exposure by immediately buying and holding the foreign currencies until the securities matured, but this would have drained its limited dollar assets and often would have proven counterproductive given market conditions. To help out, the FOMC specifically authorized the Foreign Exchange Desk at the New York Fed to purchase outright any foreign currency in which the Treasury had debt and to sell that currency forward to the ESF. The Desk typically bought the currency off market, that is, directly from foreign central banks, or in the market when the dollar fortuitously strengthened. Essentially then, the Fed financed the cover. The FOMC undertook a separate and explicit authorization, despite Hackley’s open-market definition, because the transactions were not, strictly speaking, foreign-exchange-market transactions. The forward sales gave the ESF ready access to the foreign currency at a fixed price when it needed to repay its obligations. In using a forward sale, the Fed effectively was “warehousing foreign currencies” until the time the Treasury needed them (FOMC Historical Minutes, November 12, 1963, 7).

In November 1967, as part of an international aid package to Britain, the United States agreed to buy $500 million worth of British pounds, whose value was guaranteed in gold. Although riskless, the large purchase would deplete the ESF’s dollar funds. To help finance any acquisition of pounds, the Fed agreed to warehouse up to $150 million equivalent of foreign currencies from the Treasury on a swap basis. The traditional warehousing operation was born, but the Treasury did not draw on the facility until June 1968. Because the Treasury did not have outstanding obligations in British pounds, the FOMC obligingly dropped the provision in the authorization that restricted warehousing to foreign currencies in which the ESF was indebted. They were now relying solely on Hackley’s definition of open market; the Treasury was part of the secondary market for foreign exchange.

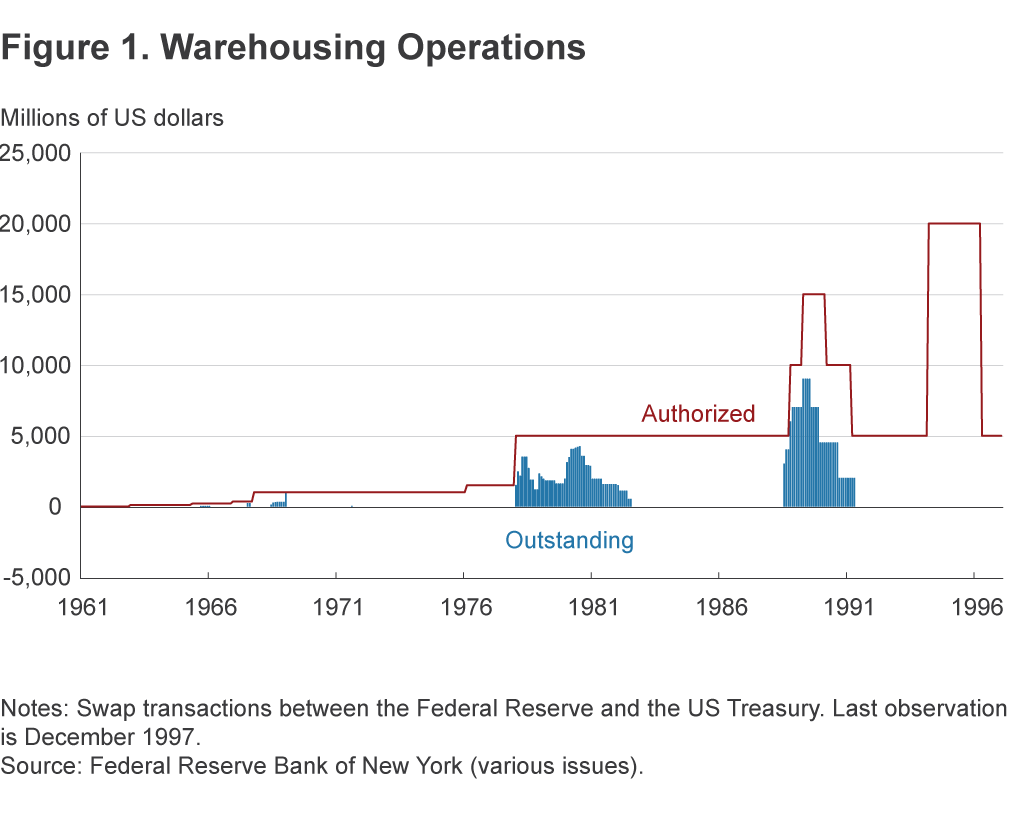

Warehousing solved another problem. The Fed at the time wanted to participate in all US foreign-exchange operations because doing so would give it leverage over developments that generally fell within the sphere of central banking.3 The Federal Reserve Act and FOMC authorizations, however, only allowed foreign-exchange transactions to stabilize short-term exchange-market disturbances, not to extend aid to a foreign country, even if doing so might safeguard the dollar. By agreeing to warehouse British pounds for dollars, the Fed enabled the ESF to purchase more pounds and effectively extended credit to the Bank of England without violating its mandate. Accordingly, the FOMC expanded the overall authorization for warehousing to $1 billion, but no transactions took place for nearly a year (see figure 1).

Notes: Swap transactions between the Federal Reserve and the US Treasury. Last observation is December 1997.Source: Federal Reserve Bank of New York (various issues).

After the British pound stabilized, warehousing operations went dormant for more than nine years. Then, in November 1978, the Carter Administration and the Fed undertook a massive program to stop the dollar from depreciating in the foreign-exchange market. To acquire the necessary foreign exchange for a dollar defense, the Treasury drew on funds available through the International Monetary Fund and sold foreign-currency bonds. The Fed agreed to warehouse any proceeds from the bonds that the Treasury did not immediately need for intervention. The Fed raised its warehousing authorization to $5 billion, sufficient to eventually provide the Treasury $4.2 billion for intervention by warehousing German marks and Swiss francs. Similarly, between mid-1989 and early 1990, the Fed helped finance large, persistent ESF purchases of foreign exchange by raising the authorization for warehousing to $15 billion. This gave the ESF more than enough room to eventually obtain $9 billion by swapping German marks with the Fed. The Fed was now a major source of financing for the interventions, enabling the ESF, an arm of the Treasury subject to congressional appropriations, to avoid asking Congress for additional funds.

A Road Less Traveled

As noted, the Treasury could use the dollar proceeds from a warehousing operation for anything that it desired. The ESF invests any dollars not used for foreign-exchange operations in Treasury securities. These, unlike publicly held debt, are not subject to a congressional ceiling.

In January 1969, Alan Holmes, the manager of the System Open Market Account at the Federal Reserve Bank of New York, recommended using warehousing to help the Treasury avoid breaching its debt limit. At the time, government debt outstanding was within 1 percent of the ceiling. No legal restraints prevented the Fed from doing this. The transactions were in the open market, and the Treasury’s use of the funds had no bearing on their legality. Hackley, however, understood that such operations could open the Fed to the criticism that warehousing constituted an extension of credit to the Treasury, which was “contrary to the spirit if not the letter of the law” (Hackley 1969, 4).

No warehousing was undertaken in January 1969, but 10 years later, when the federal debt level was again within 1 percent of its limit, the outcome was different. The Fed helped out “by taking foreign exchange acquired by the Treasury that was not immediately needed to finance foreign exchange intervention in return for dollars that were needed by the Treasury in its own domestic operations” (Holmes 1979, 219). The objective remained opaquebecause the Fed warehoused the unneeded proceeds from Treasury foreign-currency bonds, which the Treasury acquired for interventions to support the dollar. Still, it seems a dangerous precedent had been set.

Peso Problems

On December 20, 1994, Mexico devalued the peso and precipitated a financial crisis. The US Congress denied the Clinton administration’s request to offer $40 billion in loan guarantees to its new NAFTA partner. Fearing the disruptive consequences of heavy financial flight from pesos, the Treasury fell back on its own contingency plan for financial aid, which quickly involved the Fed’s warehousing facility. The Treasury envisioned a package totaling some $20 billion, but at that time the ESF held only $5 billion in dollar-denominated assets and $19.5 billion in German marks and Japanese yen. To acquire the necessary dollars, the administration asked the Fed to warehouse up to $20 billion worth of marks and yen for as long as 10 years if necessary (FOMC Transcripts January 31 and February 1, 1995, 125). (The Fed would also double its existing $3 billion swap line with Mexico.) On January 31, 1995, the Clinton administration announced a $50 billion Mexican aid package, consisting of $20 billion in US loans and nearly all of the rest in International Monetary Fund and Bank for International Settlements aid.

Many FOMC participants objected to the Fed’s participation in the Treasury’s program. They worried that Congress, which had already rejected Mexican loan guarantees, might view warehousing on the proposed scale as a subversion of its will and an end-run around the appropriations process. The Federal Reserve Bank of Richmond illustrated the fiscal-policy connection (Broaddus and Goodfriend 1996): If the Treasury had to finance the operation, it would have to obtain a congressional authorization and borrow from the private sector by issuing Treasury securities. When the Fed finances it through warehousing, it must also issue Treasury securities from its own portfolio to the private sector inorder to sterilize the injection of dollars needed to take on the Treasury’s foreign exchange. Both operations increase the government debt held by the private sector and the interest payments to the general public. The transactions were similar, except that warehousing was off-budget. Many FOMC participants realized that the operations would threaten the Fed’s independence if they raised congressional ire. Although sympathetic to this view, Chairman Alan Greenspan argued that, as fiscal agent for the Treasury, the Fed had little choice but to participate (FOMC Transcripts March 28, 1995, 5).

In the end, the Fed dodged a bullet. Mexico borrowed far less than the aid package allowed, and the ESF never had to warehouse any foreign currencies with the Fed during the peso crisis. The episode, however, had two lasting effects. The Fed has stopped warehousing foreign currencies for the Treasury, although the authority to do so remains on its books, and it has terminated its active participation in other foreign-exchange operations with the Treasury (Bordo, Humpage, and Schwartz 2015).

Lessons

Institutional arrangements are rarely static and can evolve in unforeseen directions. Warehousing began as an arcane procedure designed to help the Treasury cover a specific type of foreign-exchange exposure. It then grew into a supplemental source of funding for the ESF’s foreign-exchange interventions, a development which was not too disconcerting at the time because the Fed was undertaking joint operations for its own account. Eventually, however, warehousing morphed into a sizeable off-budget source of funding for other Treasury activities and seemed an inappropriate subversion of the congressional appropriations process. Warehousing then became a threat to the Fed’s desire to avoid involvement in political issues. Such entanglements could compromise its ability to conduct monetary policy.

Footnotes

- See Bordo, Humpage, and Schwartz (2015) for further information about warehousing. Return to 1

- The ESF is the arm of the Treasury that undertakes most foreign exchange operations, including emergency loans to foreign governments. See Schwartz (1997). Return to 2

- See Bordo, Humpage, and Schwartz (2015, p. 138). Return to 3

References

- Bordo, Michael D., Owen F. Humpage, and Anna J. Schwartz, 2015. Strained Relations US Foreign-Exchange Operations and Monetary Policy in the Twentieth Century. Chicago: University of Chicago Press.

- Broaddus, J. Alfred, and Marvin Goodfriend, 1996. “Foreign Exchange Operations and the Federal Reserve,” Federal Reserve Bank of Richmond, Economic Quarterly, 82(1): 1-20.

- Federal Reserve Bank of New York, various issues. Annual Report on Operations in Foreign Currencies. Unpublished report submitted by the Special Manager of the System Open Market Account for Foreign Currency Operations to the Federal Open Market Committee.

- FOMC. 1963. Historical Minutes of the Federal Open Market Committee. Board of Governors of the Federal Reserve System. (12 March). https://www.federalreserve.gov/monetarypolicy/fomchistorical1963.htm.

- FOMC. 2017. Minutes of the Meeting of January 31-February 1, 2017. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170201.pdf.

- FOMC. various issues. Transcripts of the Federal Open Market Committee. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/monetarypolicy/fomchistorical1995.htm.

- Garbade, Kenneth D., 2014. “Direct Purchases of U.S. Treasury Securities by Federal Reserve Banks,” Federal Reserve Bank of New York, Staff Reports No. 684. https://www.newyorkfed.org/research/staff_reports/sr684.html.

- Hackley, Howard, 1961. “Operations in Foreign Currencies.” Board of Governors Internal Memorandum. (November).

- Hackley, Howard, 1969. “Legal Aspects of Proposals for Assisting Treasury in Connection with Cash and Debt Ceiling Problems.” Board of Governors Internal Memorandum (January).

- Holmes, Alan R., 1979. “Treasury and Federal Reserve Foreign Exchange Operations,” Federal Reserve Bulletin 65(3): 201-20. https://fraser.stlouisfed.org/files/docs/publications/FRB/1970s/frb_031979.pdf.

- Schwartz, Anna J., 1997. “From Obscurity to Notoriety: A Biography of the Exchange Stabilization Fund,” Journal of Money, Credit, and Banking, 29(2): 135-53.

Suggested Citation

Humpage, Owen F. 2017. “Warehousing: A Historical Lesson in Central Bank Independence.” Federal Reserve Bank of Cleveland, Economic Commentary 2017-12. https://doi.org/10.26509/frbc-ec-201712

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International