Federal funds rates based on 7 simple monetary policy rules and 3 different forecasts are now available from the Cleveland Fed

Simple monetary policy rules provide a relationship between a central bank’s policy rate and a relatively small number of indicators of inflation and real economic activity. Monetary policymakers often use simple policy rules, like the Taylor rule, as an input into their decision-making. However, there are many different simple rules, and there is no agreement on a single “best” rule. In our latest Economic Commentary, “Federal Funds Rates Based on Seven Simple Monetary Policy Rules,” researchers at the Federal Reserve Bank of Cleveland look at the federal funds rates coming from seven simple monetary policy rules and three economic forecasts. They find some commonalities, but also pronounced differences, in the federal funds rates suggested by the rules.

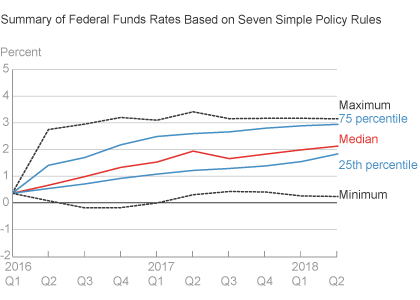

Based on data and forecasts available as of June 23, 2016, the researchers find that the median federal funds rate across the policy rules and forecasts rises from 0.7 percent in 2016:Q2 to 2.1 percent in 2018:Q2.

The chart below highlights differences among the funds rates coming from the various policy rules and forecasts. “In looking across the rules and forecasts over the next two years, the differences between the implied federal funds rates at the 75th percentile and the 25th percentile range from 0.9 to 1.4 percentage points,” say the researchers. “Even for a single forecast, some of the differences among the rules are as large as 3 percentage points.”

The Cleveland Fed’s webpage, Simple Monetary Policy Rules, presents detailed results from the researchers’ analysis and a spreadsheet so users can customize their own simple monetary policy rule and forecast. The results will be updated quarterly, and users can receive e-mail notifications when the updates are posted.

Federal Reserve Bank of Cleveland

The Federal Reserve Bank of Cleveland is one of 12 regional Reserve Banks that along with the Board of Governors in Washington DC comprise the Federal Reserve System. Part of the US central bank, the Cleveland Fed participates in the formulation of our nation’s monetary policy, supervises banking organizations, provides payment and other services to financial institutions and to the US Treasury, and performs many activities that support Federal Reserve operations System-wide. In addition, the Bank supports the well-being of communities across the Fourth Federal Reserve District through a wide array of research, outreach, and educational activities.

The Cleveland Fed, with branches in Cincinnati and Pittsburgh, serves an area that comprises Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia.

Media contact

Doug Campbell, doug.campbell@clev.frb.org, 513.218.1892

- Share