- Share

The Fed’s Commercial Paper Funding Facility, explained

FULL TEXT

The Fed’s Commercial Paper Funding Facility, explained

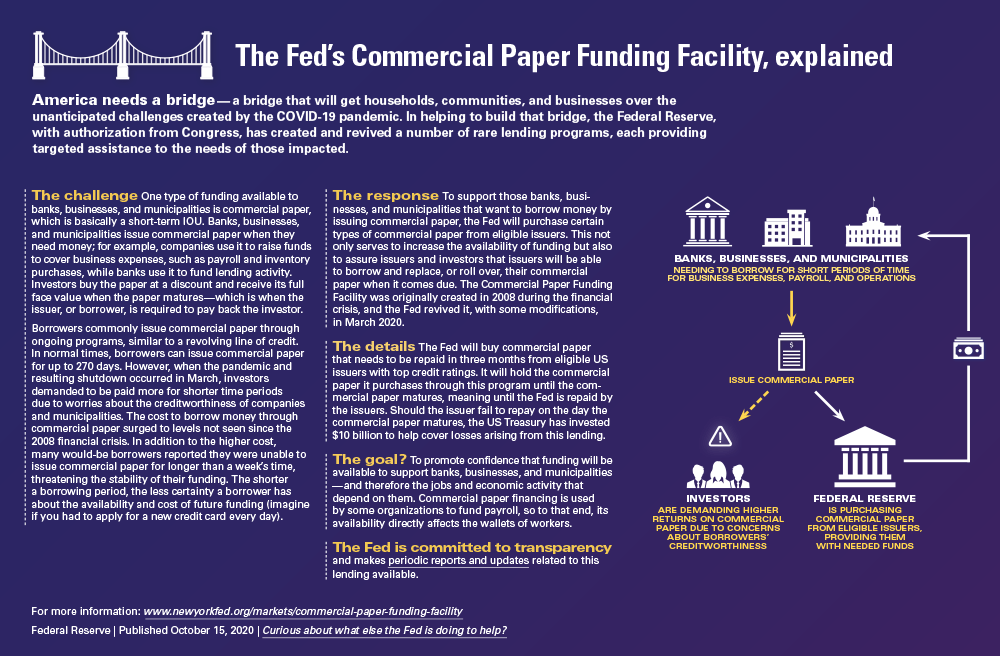

America needs a bridge—a bridge that will get households, communities, and businesses over the unanticipated challenges created by the COVID-19 pandemic. In helping to build that bridge, the Federal Reserve, with authorization from Congress, has created and or revived a number of rare lending programs, each providing targeted assistance to the needs of those impacted.

The challenge: One type of funding available to banks, businesses, and municipalities is commercial paper, which is basically a short-term IOU. Banks, businesses, and municipalities issue commercial paper when they need money; for example, companies use it to raise funds to cover business expenses, such as payroll and inventory purchases, while banks use it to fund lending activity. Investors buy the paper at a discount and receive its full face value when the paper matures—which is when the issuer, or borrower, is required to pay back the investor.

Borrowers commonly issue commercial paper through ongoing programs, similar to a revolving line of credit. In normal times, borrowers can issue commercial paper for up to 270 days. However, when the pandemic and resulting shutdown occurred in March, investors demanded to be paid more for shorter time periods due to worries about the creditworthiness of companies and municipalities. The cost to borrow money through commercial paper surged to levels not seen since the 2008 financial crisis. In addition to the higher cost, many would-be borrowers reported they were unable to issue commercial paper for longer than a week’s time, threatening the stability of their funding. The shorter a borrowing period, the less certainty a borrower has about the availability and cost of future funding (imagine if you had to apply for a new credit card every day).

The response: To support those banks, businesses, and municipalities that want to borrow money by issuing commercial paper, the Fed will purchase certain types of commercial paper from eligible issuers. This not only serves to increase the availability of funding but also to assure issuers and investors that issuers will be able to borrow and replace, or roll over, their commercial paper when it comes due. The Commercial Paper Funding Facility was originally created in 2008 during the financial crisis, and the Fed revived it, with some modifications, in March 2020.

The details: The Fed will buy commercial paper that needs to be repaid in three months from eligible US issuers with top credit ratings. It will hold the commercial paper it purchases through this program until the commercial paper matures, meaning until the Fed is repaid by the issuers. Should the issuer fail to repay on the day the commercial paper matures, the US Treasury has invested $10 billion to help cover losses arising from this lending.

The goal? To promote confidence that funding will be available to support banks, businesses, and municipalities —and therefore the jobs and economic activity that depend on them. Commercial paper financing is used by some organizations to fund payroll, so to that end, its availability directly affects the wallets of workers.

The Fed is committed to transparency and makes periodic reports and updates related to this lending available.

For more information: http://www.newyorkfed.org/markets/commercial-paper-funding-facility