- Share

The Fed’s Term Asset-Backed Securities Loan Facility, explained

FULL TEXT

The Fed’s Term Asset-Backed Securities Loan Facility, explained

America needs a bridge—a bridge that will get households, communities, and businesses over the unanticipated challenges created by the COVID-19 shutdown. In helping to build that bridge, the Federal Reserve, with authorization from Congress, has created and revived a number of rare lending programs, each providing targeted assistance to the needs of those impacted.

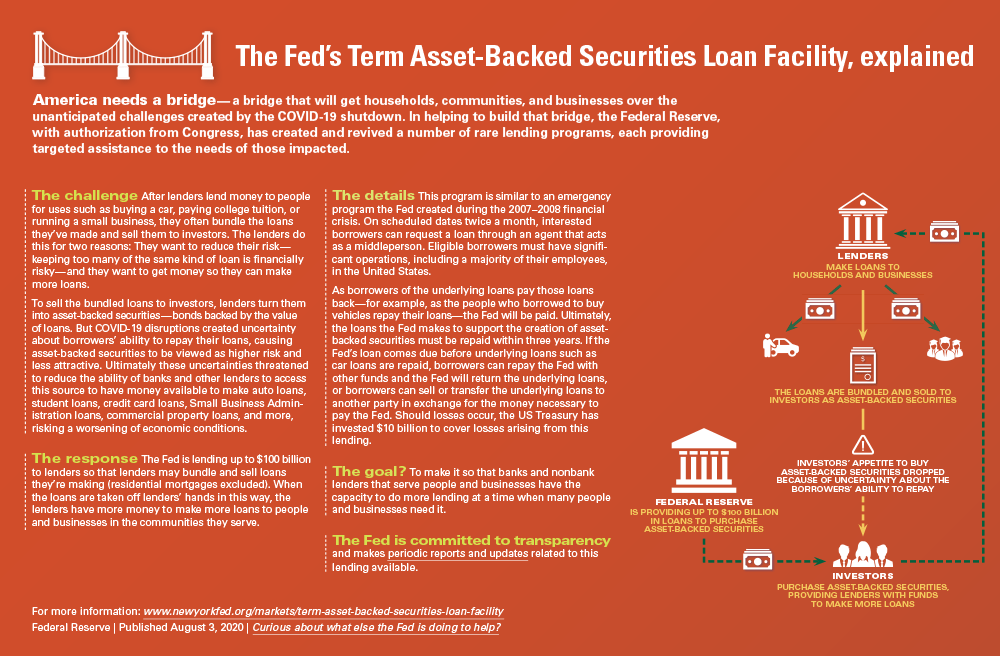

The challenge: After lenders lend money to people for uses such as buying a car, paying college tuition, or running a small business, they often bundle the loans they’ve made and sell them to investors. The lenders do this for two reasons: They want to reduce their risk—keeping too many of the same kind of loan is financially risky—and they want to get money so they can make more loans.

To sell the bundled loans to investors, lenders turn them into asset-backed securities—bonds backed by the value of loans. But COVID-19 disruptions created uncertainty about borrowers’ ability to repay their loans, causing asset-backed securities to be viewed as higher risk and less attractive. Ultimately these uncertainties threatened to reduce the ability of banks and other lenders to access this source to have money available to make auto loans, student loans, credit card loans, Small Business Administration loans, commercial property loans, and more, risking a worsening of economic conditions.

The response: The Fed is lending up to $100 billion to lenders so that lenders may bundle and sell loans they’re making (residential mortgages excluded). When the loans are taken off lenders’ hands in this way, the lenders have more money to make more loans to people and businesses in the communities they serve.

The details: This program is similar to an emergency program the Fed created during the 2007–2008 financial crisis. On scheduled dates twice a month, interested borrowers can request a loan through an agent that acts as a middleperson. Eligible borrowers must have significant operations, including a majority of their employees, in the United States.

As borrowers of the underlying loans pay those loans back—for example, as the people who borrowed to buy vehicles repay their loans—the Fed will be paid. Ultimately, the loans the Fed makes to support the creation of asset-backed securities must be repaid within three years. If the Fed’s loan comes due before underlying loans such as car loans are repaid, borrowers can repay the Fed with other funds and the Fed will return the underlying loans, or borrowers can sell or transfer the underlying loans to another party in exchange for the money necessary to pay the Fed. Should losses occur, the US Treasury has invested $10 billion to cover losses arising from this lending.

The goal? To make it so that banks and nonbank lenders that serve people and businesses have the capacity to do more lending at a time when many people and businesses need it.

The Fed is committed to transparency and makes periodic reports and updates related to this lending available.

For more information: https://www.newyorkfed.org/markets/term-asset-backed-securities-loan-facility