Average Inflation Targeting in a Low-Rate Environment

The Federal Reserve’s Monetary Policy Framework Review

The Federal Reserve began a public review of its monetary policy framework in early 2019. After a series of Fed Listens events that engaged a wide range of participants, research conferences, and internal discussions, Federal Reserve Chair Jerome Powell, at the 2020 Jackson Hole symposium, announced the adoption of a revised monetary policy framework (Powell, 2020).1 Details of the framework are explained in the revised Statement on Longer-Run Goals and Monetary Policy Strategy (Board of Governors, 2020).

The statement points out two main changes that the Federal Open Market Committee (FOMC) will take to better achieve its dual mandate of maximum employment and price stability. First, the FOMC has emphasized that the goal of maximum employment is “broad and inclusive” and that future policy decisions will address shortfalls, rather than deviations, of employment from its maximum level. In other words, unlike the previous framework that calls for policy responses when employment is too high or too low, the new policy framework calls for policy responses only when employment is lower than its maximum level. Second, regarding price stability, the FOMC will change from the previous strategy based on inflation targeting (IT) that seeks to stabilize inflation in every single period to a new approach based on average inflation targeting (AIT) that targets the average inflation rate over longer periods.

In this Commentary, I discuss the motivation for the change in the monetary policy framework’s treatment of inflation, why AIT is a more effective policy framework than IT in the current US economy, and what selected economic theories imply for the optimal flexible implementation of AIT.

Motivation for AIT: A Low-Rate Environment

By the early 2000s, the Federal Reserve, along with many central banks around the world, had adopted inflation targeting as its policy framework to achieve price stability. In January 2012, the FOMC announced an explicit numerical inflation objective of 2 percent as measured by the annual change in the index of personal consumption expenditures, or PCE (Board of Governors, 2012).

As a practical matter, the Federal Reserve takes a balanced approach known as “flexible inflation targeting” as it considers both maximum employment and the inflation target. As explained by Vice Chair Richard Clarida, when the inflation target conflicts with the maximum employment goal, “neither one takes precedence over the other” (Clarida, 2019). In other words, the aim is not necessarily for inflation to remain at 2 percent during every period, but, rather, this commitment to specified inflation targeting anchors the public’s expectations of future inflation at 2 percent in general.

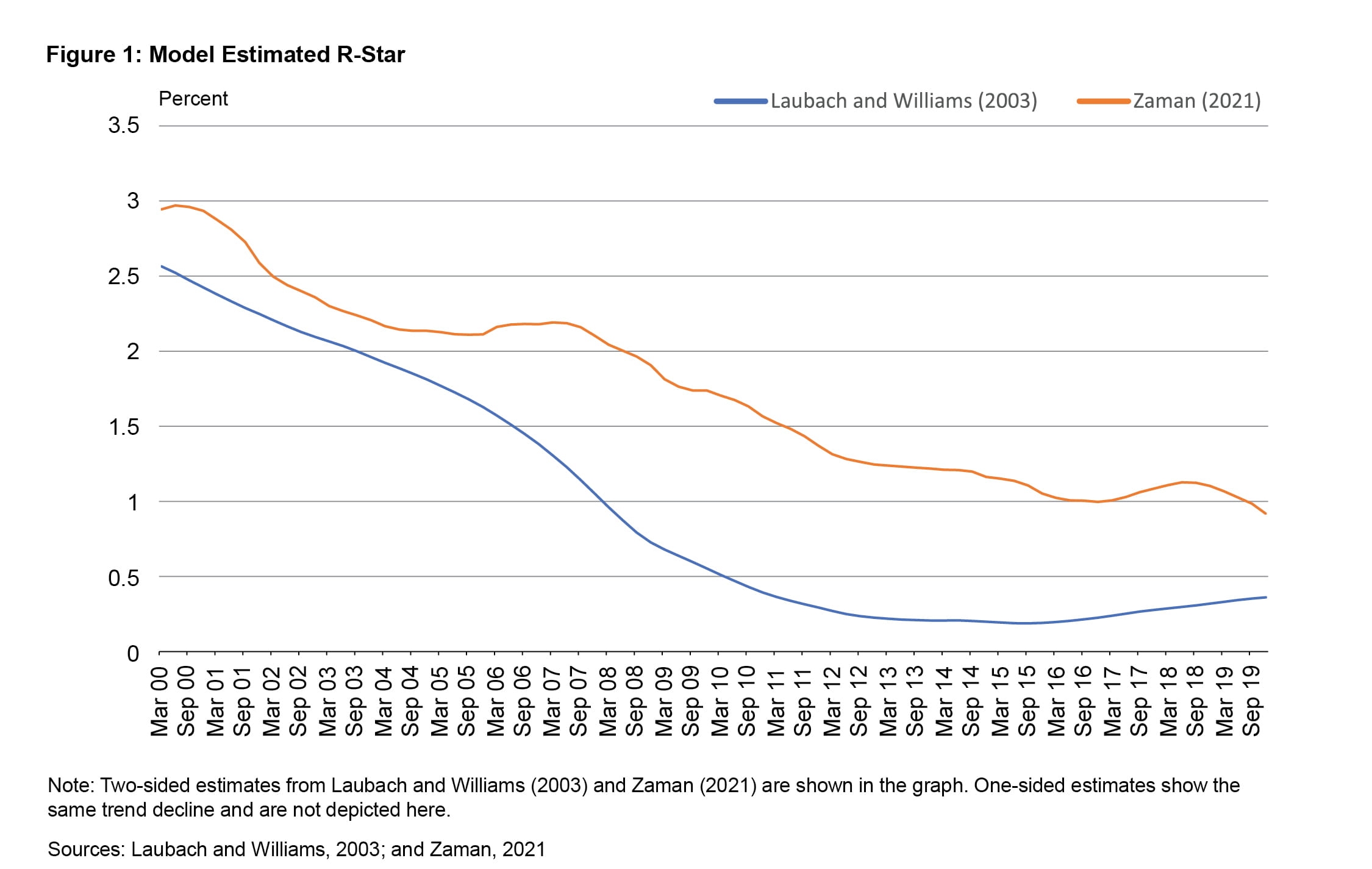

Over the last 20 years, however, there has been a significant change in the US economy that presents a challenge for the Fed: The decline in the natural real rate of interest, often called “r-star.”2 This is the real interest rate that would prevail when the economy is at maximum employment, inflation is stable, and monetary policy is neutral (neither accommodative nor restrictive). This rate reflects the fundamental drivers of economic growth in the United States independent of monetary policy accommodation. According to a well-known model from Laubach and Williams (2003), the estimated r-star has shown a significant decline since 2000, particularly after the Great Recession, falling to below 0.5 percent (Figure 1). Many other estimates, including one developed by an economist at the Federal Reserve Bank of Cleveland (Zaman, 2021), also show a trend decline in r-star. This decline is believed to reflect low productivity growth, an aging population, and a desire for safe assets in the US economy.

The decline in r-star reflects the trend in the real rates. The Federal Reserve sets nominal interest rates, and nominal interest rates are determined by real rates and expected inflation. The nominal policy rate set by the central bank cannot drop below zero, commonly referred to as the zero lower bound (ZLB) or the effective lower bound (ELB).3 When an adverse shock affects aggregate demand, the central bank wants to cut the nominal policy rate to encourage spending. However, an r-star already near zero leaves less room for the central bank to further decrease nominal policy rates. The decline in r-star increases the probability that the nominal policy rate is constrained by the ELB, in which case conventional monetary policy methods are less able to offset adverse shocks, and the economy enters into a recession with rising unemployment and declining inflation. The expectations of declining inflation, in turn, put downward pressure on actual inflation.

In this case, higher expected future inflation is desirable. However, under IT, the central bank has trouble boosting expected future inflation because inflation above 2 percent in the future is inconsistent with IT strategy, which seeks to stabilize future inflation at 2 percent.

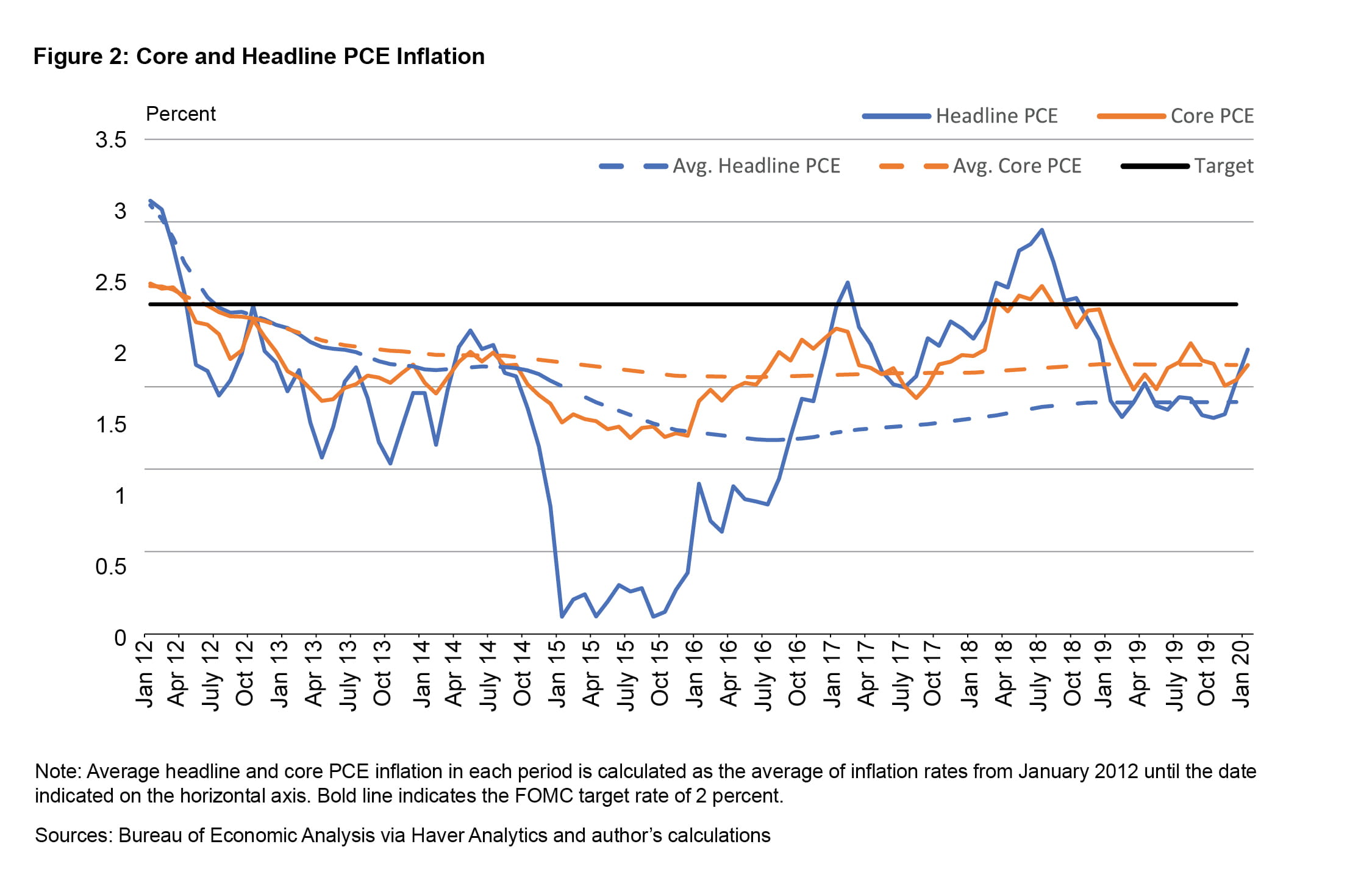

From 2012 through 2019, the period that followed the Great Recession and preceded the outbreak of the SARS-CoV-2 (COVID-19) pandemic, PCE inflation has generally stayed below the FOMC’s 2 percent target (Figure 2), even after the unemployment rate decreased from above 8 percent to below 4 percent in the same period, reflecting a strong recovery in economic activity from the Great Recession.

The combination of a low r-star and low inflation further increases the chance that monetary policy’s capacity to provide accommodation by lowering the federal funds rate will be constrained by the ELB. The Federal Reserve’s policy framework review sought to determine if a new policy framework could better help the FOMC achieve its objectives of maximum employment and price stability in the current low-rate environment. A switch from flexible IT to flexible AIT is the framework intended to achieve this goal.

How Can AIT Help Price Stability in a Low-Rate Environment?

In general, the central bank influences inflation and economic activity by adjusting the current policy interest rate. For simplicity of analysis, let us focus on inflation’s role in determining the course of monetary policy and suppose that current inflation is below the target. In a standard New Keynesian model, the central bank would respond by decreasing the current interest rate, a tactic which encourages household spending. As a result, firms would increase prices as they face a higher demand for their products. However, when the current policy rate is already at the ELB, the central bank cannot decrease the interest rate as much as it would if the interest rate were higher, as it usually is, making this traditional policy tool less effective.

In a low interest rate environment, inflation expectations hold the key to improving price stability. As firms and households are forward-looking in making pricing and spending decisions, respectively, inflation expectations play a key role in determining current inflation and real output. For example, if a consumer plans to purchase a vehicle and expects inflation to rise in the next quarter, the consumer would prefer to buy the vehicle now rather than a few months later. In this way, expectations of forthcoming higher inflation increase consumption today. Similarly, if a firm typically updates the price of its product at the beginning of a year and expects the inflation rate to go up in the middle of the year, the firm will increase its product price at the beginning of the year so that its price will match the changes in the aggregate price level at the end of the year. Therefore, as implied in New Keynesian economic models, if current inflation is below the target and the central bank wants to increase current inflation, one way to achieve this is to make the public expect higher inflation in the future. This approach works through lowering the real interest rate by raising the expected future inflation rate instead of lowering the current nominal interest rate.

AIT is better able to produce changes in inflation expectations that help the central bank achieve price stability in a low interest rate environment. Using AIT, the central bank adjusts monetary policy to keep inflation averaged at 2 percent over longer periods than when using IT. If inflation falls below 2 percent for a while, the central bank seeks to achieve a period of inflation exceeding 2 percent so that inflation averages 2 percent over time. In this way, AIT works as an automatic expectation stabilizer. Namely, when current inflation is running below the target, the public should expect inflation to go above the target in the following periods. This channel is especially important when the current monetary policy rate is at the ELB because the central bank cannot boost inflation by lowering the current policy rate. Instead, the central bank can nudge expected future inflation up for a time, reducing the real interest rate in the current period.

The Horizon of AIT

Additional information on the FOMC’s AIT policy is available in the 2020 Statement on Longer-Run Goals and Monetary Policy Strategy (Board of Governors of the Federal Reserve System, 2020). Specifically, to achieve inflation that “averages 2 percent over time” when inflation has been “running persistently below 2 percent,” the FOMC is expected to promote inflation “moderately above 2 percent for some time.” According to this description, 2 percent is no longer the target rate of inflation the policy seeks to achieve in each individual period. Instead, the public should expect future inflation to go above 2 percent when current and past inflation has been below 2 percent. In addition, the FOMC takes a balanced approach to achieving this goal by considering both employment shortfalls and inflation deviations.

However, one important piece of information that is not explicitly given in the strategy statement is the horizon of the AIT policy. To illustrate the extremes of possible choices, one might ask, for example, whether the target is to make the two-quarter average inflation rate 2 percent or the ten-year average inflation rate 2 percent. The average horizon determines how the public would form inflation expectations. Suppose the horizon of AIT is two quarters and the inflation rate in this quarter is 1.5 percent, which is lower than the 2 percent target. In this case, the public would expect the inflation rate in the next quarter to be 2.5 percent so that the average of inflation rates between the current quarter and the next quarter is 2 percent. However, if the horizon of the AIT policy is 10 years, the public would expect inflation in the next quarter to be much lower than 2.5 percent because the central bank will use the next 10 years to make up for the 0.5 percent deviation in the current period.

Another piece of information the strategy statement does not explicitly provide is an exact weight on the goal of maximum employment as compared to the weight on the target of average inflation, and this weight also affects how inflation expectations should be formed. For example, suppose that the last period’s inflation rate is 2.5 percent, and suppose the AIT policy has an averaging horizon of two quarters (between the current and the last period). If the central bank follows AIT, it should tighten monetary policy in this period to help push inflation below the 2 percent target, compensating for the high inflation experienced during the previous period. However, what if the economy also faces a high unemployment rate? If this is the case, a tightening of monetary policy would further dampen real economic activity, a situation which is at odds with the goal of maximum employment. The weights assigned to the goals will play a role in the central bank’s policy choices.

The fact that the FOMC has not been explicit about either the exact horizon or the exact weight on average inflation targeting reflects the flexible nature of the FOMC’s policy strategy. In fact, Chair Powell has explicitly stated that the AIT approach is flexible and that “we are not tying ourselves to a particular mathematical formula” (Powell, 2020).

Why Flexible Implementation of AIT is Desirable

Jia and Wu (2021) developed a macroeconomic model that explains why the flexibility of AIT maximizes the well-being of households. In Jia and Wu’s theoretical framework, the public does not know the exact horizon of AIT and comes to understand the policy horizon most accurately by comparing the accuracy of their forecasts with others’ forecasts. According to Jia and Wu, the best AIT approach that maximizes the well-being of households is characterized as follows. First, the central bank should place more weight on the average inflation target (relative to the employment objective) when the horizon of AIT is longer than when the horizon of AIT is shorter. Second, the central bank should announce the longest feasible horizon when there is a supply shock to the economy4 and should announce the shortest feasible horizon of AIT (two periods, according to Jia and Wu (2021)), when the shock has dissipated and the economic conditions are roughly normal.

The intuition for the benefits of flexibility regarding weighting is as follows. When the central bank cares about the average of inflation over a longer horizon, it means that the central bank cares less about the deviations of inflation from the target in each individual period as long as the deviations average out over the AIT period. However, such policy is not optimal because from the public’s perspective, any deviation from the 2 percent inflation target in any given period is undesirable. All other things being equal, a longer horizon of AIT implies that the central bank puts less weight on inflation stabilization relative to the objective of maximum employment in the current period. To correct this, the central bank should raise the weight on its average inflation target when AIT has a longer horizon as compared to when the horizon is shorter.

The theoretical case for adjusting the horizon of AIT depending on shocks hitting the economy is offered in this example. Suppose a positive supply shock occurs today that pushes inflation above the FOMC’s 2 percent target. For price stability, the central bank should tighten monetary policy, and by doing so, it brings employment below its maximum level. In this case, the Jia and Wu (2021) model implies that to maximize households’ well-being, the central bank should adjust its implementation of AIT and announce the longest feasible horizon for AIT along with increasing the weight on the objective of stabilizing the average inflation rate. Why? AIT policy can reduce inflation caused by the positive supply shock through the expectation channel because of its role as an automatic expectation stabilizer. AIT policy with the longest feasible horizon achieves the largest effect on the public’s inflation expectations. This occurs because with the longest feasible horizon, optimal AIT policy places the greatest weight on the inflation target. In this example, the central bank is expected to compensate for today’s high inflation most strongly by lowering inflation in future periods. Immediately after the positive supply shock, the central bank increases the policy rate by a small amount but is committed to further tightening the monetary policy in future periods. With this commitment, the public expects lower inflation in the future that in turn leads to lower inflation today.

When the supply shock has dissipated, the optimal horizon of AIT in the model reverts to the shortest possible AIT term, which is two periods. When the supply shock has dissipated, the optimal horizon of AIT in the model reverts to the shortest possible AIT term, which is two periods. In the absence of additional shocks, inflation in the next period depends only on inflation in the current period under a two-period AIT. In this case, past inflation does not play a role in determining inflation expectations. When the horizon of AIT is longer than two periods, however, future inflation would depend on inflation further back in time. As such, past deviations from the inflation target would lead to changes in inflation expectations, a situation which is contrary to the goal of anchoring inflation expectations. Therefore, the optimal horizon for AIT in this instance is the shortest feasible horizon to minimize fluctuations in inflation expectations.

Putting together these pieces, the Jia and Wu (2021) model implies that in absence of any shocks, a central bank that takes an optimal approach of AIT would keep the inflation averaging horizon short to avoid fluctuations in future inflation expectations. Following certain types of shocks, particularly those to the supply side of the economy, it is appropriate for the central bank to extend the inflation averaging horizon while adjusting the weight on inflation relative to employment in order to achieve a desired balance.

Conclusion

The low-rate environment in the United States has pushed the nominal policy rate near the ELB, causing the need for a new monetary policy framework that better achieves the Federal Reserve’s dual mandate of maximum sustainable employment and price stability. This Commentary shows that a change from inflation targeting to average inflation targeting helps achieve price stability in the current low-rate environment. This is because AIT can better anchor inflation expectations when conventional policy tools are less effective near the ELB. In addition, some macroeconomic models suggest that it is desirable to implement AIT in a flexible way, by adjusting both the horizon of AIT and the weight on inflation deviations relative to the weight on unemployment shortfalls based on shocks to the economy.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Footnotes

- For a comprehensive description of the review process and the sequence of papers prepared for the review, see https://www.federalreserve.gov/econres/notes/feds-notes/the-federal-reserves-review-of-its-monetary-policy-framework-a-roadmap-20200827.htm. Return to 1

- This rate is also called the “long-run equilibrium interest rate” or the “neutral rate of interest.” Return to 2

- Conventional monetary policy is constrained by the ZLB on nominal interest rates. There are instances, however, in which a central bank can introduce a negative interest rate policy that goes slightly below the ZLB. In these cases, the ELB is then somewhat below zero. Return to 3

- A supply shock changes the cost of production, leading to fluctuations in inflation, but does not directly affect demand for output. Examples include wage markup shocks and oil price shocks. Return to 4

References

- Board of Governors of the Federal Reserve System. 2012. “Statement on Longer-Run Goals and Monetary Policy Strategy.” https://www.federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals_201201.pdf.

- ———. 2020. “2020 Statement on Longer-Run Goals and Monetary Policy Strategy.” https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm.

- Clarida, Richard H. 2019. “The Federal Reserve’s Review of Its Monetary Policy Strategy, Tools, and Communication Practices : A Speech at ‘A Hot Economy: Sustainability and Trade-Offs,’ a Fed Listens Event Sponsored by the Federal Reserve Bank of San Francisco, San Francisco, California, September 26, 2019.” Board of Governors of the Federal Reserve System. https://www.fedinprint.org/item/fedgsq/22809.

- Jia, Chengcheng, and Jing Cynthia Wu. 2021. “Average Inflation Targeting: Time Inconsistency And Intentional Ambiguity.” Working paper 21-19. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202119.

- Laubach, Thomas, and John C. Williams. 2003. “Measuring the Natural Rate of Interest.” Review of Economics and Statistics 85 (4): 1063–70. https://doi.org/10.1162/003465303772815934.

- Powell, Jerome H. 2020. “New Economic Challenges and the Fed’s Monetary Policy Review: A Speech at ‘Navigating the Decade Ahead: Implications for Monetary Policy,’ an Economic Policy Symposium Sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, August 27, 2020.” Board of Governors of the Federal Reserve System. https://ideas.repec.org/p/fip/fedgsq/88646.html.

- Zaman, Saeed. 2021. “A Unified Framework to Estimate Macroeconomic Stars.” Working paper 21–23. Federal Reserve Bank of Cleveland. https://doi.org/10.26509/frbc-wp-202123.

Suggested Citation

Jia, Chengcheng . 2022. “Average Inflation Targeting in a Low-Rate Environment.” Federal Reserve Bank of Cleveland, Economic Commentary 2022-02. https://doi.org/10.26509/frbc-ec-202202

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

- Share