Gaps versus Growth Rates in the Taylor Rule

There are many possible formulations of the Taylor rule. We consider two that use different measures of economic activity to which the Fed could react, the output gap and the growth rate of GDP, and investigate which captures past movements of the fed funds rate more closely. Looking at these rules through the lens of a partial-adjustment Taylor rule, we conclude that the gap rule does a better job of explaining the actual funds rate data, and provides a better rule-of-thumb for understanding historical monetary policy.

A large part of any Federal Open Market Committee (FOMC) meeting consists of a review of the current state and outlook of the U.S. economy. This is because the essence of monetary policy is to respond to economic conditions with the tools the central bank has at its disposal. The standard FOMC policy tool is the interest rate on federal funds (overnight loans made between banks).

Although the Fed must react to myriad economic developments, its dual mandate suggests that it should respond principally to the inflation rate and some measure of real economic activity. Nowadays, a common way to think of the Fed’s federal funds rate adjustments is in terms of a Taylor rule. First posited in 1993 by economist John Taylor, this “rule” suggests that the Fed generally responds to movements in inflation and the level of the output gap (deviations of output from potential). Of course, policymakers do not respond mechanically to any such rule, but the Taylor rule can be thought of as a useful rule-of-thumb, or an illustrative way to capture some general principles that guide policy.

There are many possible formulations of the Taylor rule. For example, there are many measures of economic activity to which the Fed could react. We consider two prominent candidates, the output gap and the growth rate of GDP, and investigate which captures past movements of the fed funds rate more closely. An output gap Taylor rule is similar in spirit to an unemployment-driven rule.

Having a rule that accurately captures the results of FOMC policymaking decisions matters for (at least) two reasons. First, if historical policy has been judged as successful in terms of inflation and real activity, then the natural inference is that such a policy should and probably will be continued going forward. In that case, an accurate Taylor rule could help us benchmark the future behavior of the federal funds rate. Second, the rule might also be helpful in anticipating when the Fed will employ policy tools other than the federal funds rate—which it has been doing since the rate hit zero in 2008.

We find that the Taylor rule with the output gap gives a better description of the historical data than the growth rate rule. The gap rule we estimate is also consistent with the Fed’s policy announcement that it expects to keep the funds rate at zero until late 2014 (see, for example, the remarks by Vice Chair Janet Yellen, April 11, 2012).

Estimating the Historical Taylor Rule

The original formulation of the Taylor rule says that the current level of the federal funds rate should be equal to the long-run target for the rate, plus adjustments for deviations in inflation and economic activity from their long-run targets. The long-run target for the fed funds rate is set to the sum of the long-run targets for the inflation rate and the real rate of interest. As for responding to deviations from the targets, the rule suggests that the nominal funds rate target should be increased whenever inflation or real activity are above target. The idea is that such movements in the policy rate will move inflation and real activity back to their long-run targets. Taylor suggested certain values for the size of these policy responses to deviations. But instead of using his numbers, we statistically estimate the rule using historical data.

One of our versions of the Taylor rule uses the output gap as its measure of economic activity, as Taylor did originally. The output gap is the difference between actual GDP and a measure of potential GDP. Our second version uses the growth rate of GDP. We’ll refer to them as our “gap” and “growth” rules, respectively.

When evaluating historical monetary policy, it is important to consider the data the Fed actually had available at the time of its policy decision. This is particularly important with measures of economic activity such as real GDP, which are revised several times after their initial estimates. For example, the real-time estimate of the output gap in the first quarter of 2001 was 0.1 percent. After many subsequent revisions, the final measure of the output gap for that period was −1.5 percent. Hence, in early 2001, the data available to the FOMC suggested that the economy was operating fairly close to its potential, although we now think that output was significantly below potential. It is for this reason that our analysis considers only real-time data on inflation and output, since this is the information that policymakers had when they set the policy.

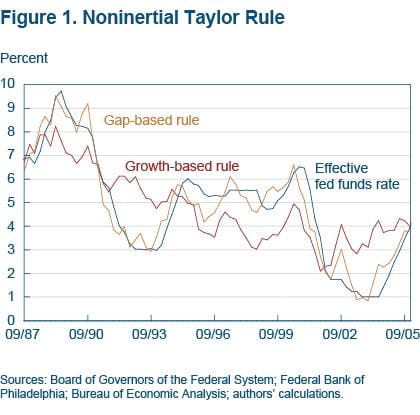

Figure 1 presents the federal funds rate that is predicted by both of our versions of the Taylor rule. To calculate these rates, we first use data over the entire time period that we are investigating (1987 to 2002) to estimate the reaction of the funds rate to movements in inflation and real activity. We then use this estimated reaction and the historical data to generate estimates for the funds rate at each point in time according to each version of the Taylor rule. Both the gap and growth rules track the broad tendencies in the behavior of the funds rate. But the gap rule fits the data much better. In the case of the gap, the average residual is about 69 basis points, compared to 151 basis points for the growth rule.

Sources: Boeard of Gevernors of the Federal System; Federal Bank of Philadelphia; Bureau of Economic Analysis; authors' calculations.

The FOMC most likely adjusts the funds rate more slowly than either of the estimated rules in figure 1 suggests. There are many reasons why the Fed might want to temper its policy moves with a dose of gradualism. First, interest rate volatility might be costly for market participants, and a policy of slowly moving the funds rate up over several FOMC meetings might be preferred to a policy in which the entire movement occurs at once. Second, since new data are constantly arriving, the Fed might want to move slowly so that abrupt policy reversals can be avoided. Such reversals might undermine the credibility of the central bank.

If the FOMC does move the policy rate gradually, including a lagged funds rate in the estimated Taylor rule should help it fit the historical data better. The size of the coefficient on the past funds rate will tell us how much the past funds rate figures into funds rate decisions. A larger coefficient would imply that the FOMC responds more to what the funds rate was yesterday than incoming economic information.

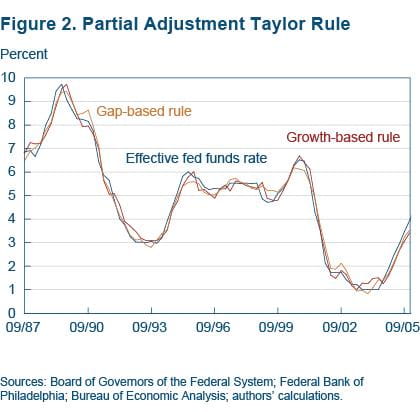

To quantify this, figure 2 shows re-estimates of the two rules. In the re-estimated rules, the Fed responds to inflation and economic activity (the output gap or the GDP growth rate) as before, but recent values of the funds rate have been added. For example, if the inflation rate increases above target, both the gap and growth rule call for an increase in the funds rate. But with the addition of the past funds rate to the rules, the increase will take effect in smaller increments and, as a result, more slowly.

Sources: Boeard of Gevernors of the Federal System; Federal Bank of Philadelphia; Bureau of Economic Analysis; authors' calculations.

It is clear from figure 2 that the data strongly support this gradualism in Fed behavior. Adding the past funds rate improves the fit significantly. The estimated rules now track actual funds-rate behavior very closely. The average prediction error is only 26 basis points for the gap rule and 30 basis points for the growth rule. Evidently, assuming that the Fed desires gradual adjustment in policy rates helps to understand FOMC policy during this time period.

Medium-Run Targets

One way to think about rules that incorporate the past funds rate is that they don’t represent where the Fed wants the funds rate to be today necessarily, but where it wants the rate to head over the course of the next several meetings (which we will refer to as the “medium-run target”). In other words, the rules imply that the FOMC moves only a fraction of the way at each meeting toward the target rate suggested by the original Taylor rule. In general, the rules suggest that the FOMC moves in 25–50 basis point steps until the funds rate reaches the target. (For this reason, this type of rule is also called a partial-adjustment rule.)

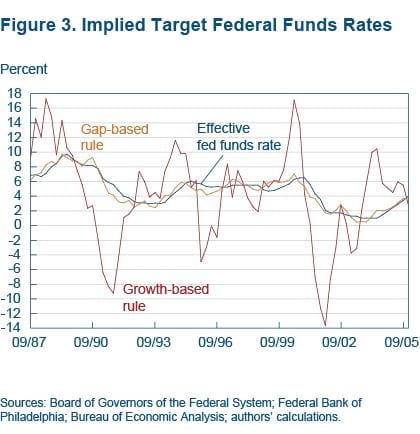

While the results in figure 2 show that the past funds rate is important for Fed policy, they don’t tell us why. Suppose it is the case that the Fed desires a gradual adjustment of the funds rate to some desired “medium-run” target. Under this assumption, we can use our empirical estimates to decompose the funds rate into a medium-run target and the partial adjustment to this target. Figure 3 presents the implied estimates of this medium-run funds rate target implied by the gap and growth rate rules.

Sources: Boeard of Gevernors of the Federal System; Federal Bank of Philadelphia; Bureau of Economic Analysis; authors' calculations.

The medium-run target implied by the gap rule is quite sensible and tracks the actual funds rate remarkably well. In fact, it looks very similar to the original gap Taylor rule without the gradualism. In contrast, the growth rule is erratic, even delivering negative values for some time periods. It looks nothing like the original growth Taylor rule without gradualism. The medium-run target from the gap rule also does a much better job of capturing policy changes.

As for the gradual adjustment part of the decomposition, the coefficient on the lagged funds rate is much smaller for the gap rule than it is for the growth rule. The estimates imply that with the gap rule, the Fed moves 28 percent of its way toward its “medium-run target” in each period, compared to only 5 percent of the way for a growth-based rule. Thought of in another way, with the gap rule the central bank has moved three-quarters of its way toward its “medium-run target” in only four quarters, but for the growth-based rule it would take over 26 quarters to move three-quarters of the way to its medium-run target. Over six and a half years seems unreasonably long.

In summary, looking at the rules through the lens of a partial-adjustment Taylor rule, we conclude that the gap rule does a better job of explaining the actual funds rate data, and provides a better rule-of-thumb for understanding historical monetary policy.

What the Rules Say about Future Policy

The funds rate has been held near zero since 2008, and the FOMC has indicated that given current forecasts, it will likely remain there until late 2014. Is a gap or growth rule more consistent with that policy?

Under a growth rule, the funds rate would start to rise when growth rates are significantly positive. In contrast, under a gap rule the funds rate would stay low until there had been enough positive growth rates so that the gap had been nearly eliminated. This necessarily means that the funds rate will stay low longer if the FOMC follows a gap rule. This is consistent with the Fed’s statements that rates will be kept low until late 2014.

We can back out the medium-run fed funds rate target for both the gap and growth-based rules. The growth-based rule suggests that the medium-run target funds rate in 2012 would be 1.2 percent. But in 2013 it quickly rises to 2.1 percent. Thus a growth-based rule suggests the funds rate would be increased some time next year. For the gap-based rule things are much different. In 2013 the medium-run fed funds target rate would be −64 basis points. But by the close of 2014 this target would be 75 basis points, only slightly above zero. This is roughly consistent with the Fed’s recent policy announcement that rates will likely be at zero until late 2014. Because the gap rule predicts a much later exit from a zero fed funds rate, the use of alternative monetary policy tools is likely to continue longer than if policymakers were using a growth-based Taylor rule.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Suggested Citation

Carlstrom, Charles T., and Timothy S. Fuerst. 2012. “Gaps versus Growth Rates in the Taylor Rule.” Federal Reserve Bank of Cleveland, Economic Commentary 2012-17. https://doi.org/10.26509/frbc-ec-201217

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

- Share