Technology Shocks and Unemployment in the Last Recession

In the latest recession, unemployment rates in the United States increased at a faster pace than in the average OECD country. Since the unemployment rate has been more sensitive to technological shocks in the United States in the past than in other OECD countries, I investigated whether increased sensitivity to such shocks was the reason for the recent relative increase in the U.S. unemployment rate. I find this was not the case.

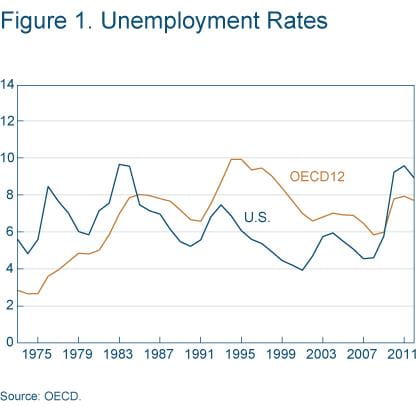

From the mid-1980s to the start of the most recent recession, the U.S. unemployment rate was consistently below that of the average OECD country. (Member countries of the OECD, or Organization for Cooperation and Economic Development, are similar economically in that they are developed and democratic.) However, during the last recession, U.S. unemployment climbed to historically high levels and surpassed the OECD’s average.

When thinking about what drives unemployment rate behavior, economists usually think of two broad classes of factors: labor market institutions and external shocks to labor supply and demand. In this Commentary I explore whether a particular class of technological shocks, known as total factor productivity (TFP) shocks, might be behind the recent relative increase in the U.S. unemployment rate.

I find that while the unemployment rate has been historically more sensitive to TFP shocks in the United States than in other OECD countries, such shocks were actually less adverse in the United States during the last recession than in those countries. Moreover, while practically all the growth in the OECD’s unemployment rate can be attributed to TFP shocks, the opposite is true of the United States. These findings cannot rule out either of the two leading explanations for the unemployment rate increase in the U.S.: adverse (product) demand shocks and structural changes such as employer-employee mismatches.

Unemployment Rates in the OECD since the 1970s

As the 1970s were coming to an end, unemployment rates in the United States were substantially above those in a sample of OECD countries—Australia, Austria, Canada, Finland, France, Germany, Italy, Japan, Norway, Spain, Sweden, and the United Kingdom (which I will refer to as the OECD12). From then on, U.S. unemployment rates started to decrease, while average OECD12 rates continued their upward momentum and remained above their U.S. counterpart for roughly 25 years (figure 1). This fact, especially as it pertained to a comparison of Europe and the United States, spurred a large body of literature on the root causes of cross-country differences in unemployment behavior. Most research focused on three possible categories of explanations.

The first explanation suggested differences in labor market institutions. Compared to most OECD countries, the United States has a more flexible labor market, where employment protection is less stringent, collective bargaining agreements are less prevalent, union coverage is smaller, and labor-related taxes are lower. To the extent that more rigid labor markets result in higher unemployment, we should expect to see lower unemployment rates in the United States. The problem with this line of reasoning is that many of the labor market institutions were already present in the 1970s in European OECD countries when unemployment rates were low in those countries.

The second line of research considered the effect of external shocks, such as an increase in import prices (namely oil) or a decrease in the rate of technological progress. These shocks would operate by moving the whole labor demand schedule down, either because operating costs had become higher or because labor and capital had become less productive. In any case, at any given wage rate, firms would be willing to hire fewer workers. While these external shocks have the potential to explain increases in unemployment, it is hard to argue that they differed enough between the United States and other countries to justify such a difference in the behavior of unemployment rates.

The third line of research is a hybrid of the first two and focuses on interactions between labor market institutions and external shocks. In particular, it argues that shocks might have different effects on unemployment depending on those institutions. For example, consider two countries that differ solely on the generosity of their unemployment benefits. Following the same adverse shock, unemployment may initially increase by a similar amount. As time goes by though, workers in the country with more generous benefits will be more reluctant to get back to work, delaying the decrease in unemployment. In addition, their skills depreciate by more, reducing the pressure on wages and further delaying the recovery. Olivier Blanchard and Justin Wolfers (2000) argue that these kinds of interactions go a long way in explaining the different cross-country behavior of unemployment rates, at least until the early 2000s, while Stephen Nickel and his colleagues (2005) present contrary evidence.

Recently, most industrialized economies suffered large GDP contractions that were accompanied by substantial increases in their unemployment rates. In the United States, in particular, rates more than doubled between the start of 2007 and the end of 2009, jumping above the OECD12 average to levels not seen since the early 1980s. This turn of events will, no doubt, bring some attention back to this research, not only because the relative ranking of the unemployment rate has changed, but also because the dispersion in cross-country unemployment rates has decreased.

Eliminating Labor Force Participation as a Factor

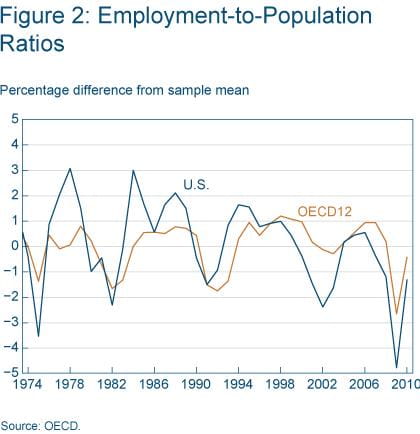

At times, workers move in significant numbers into and out of the labor force. In such periods, the unemployment rate may fail to accurately reflect changes in labor market activity. It is important to check whether the recent changes in unemployment rates truly reflect what is happening in the labor market before drawing conclusions from those changes.

Consider the following two examples. If an individual who has been out of the labor force finds a job, the unemployment rate falls, but by less than it would have if that individual had been unemployed and consequently in the labor force to start with. Alternatively, suppose the same individual starts to search more actively for a job, so that now he is classified as unemployed instead of out of the labor force. In this case, the unemployment rate would increase even though very little had changed, other than the increased

effort in the job search.

These sorts of movements were very prevalent in the last recession, when the labor force participation rate decreased 2 percentage points (a big move as far as the labor force participation rate is concerned). But do these movements mean that the changes we have identified as important in the unemployment rate are misleading?

To answer that question, we can look at an indicator that ignores the labor force, like the employment-to-population ratio. When we compare the yearly percentage changes in employment-to-population ratios relative to the sample mean for the United States and the OECD12 countries, we see that our observations of the unemployment rate are robust to the change in indicators (figure 2). Since at least 2006, the employment-to-population ratio has been falling faster in the United States than in the OECD12, confirming the tendency we found when we looked at the unemployment rate.

A full examination of all the possible explanations detailed above in the context of the latest recession is not yet possible. The institutional labor market data necessary for such a study is not available at this time. We can, nonetheless, examine two hypotheses for why the increase in the U.S. unemployment rate was so pronounced relative to the OECD12 countries. First, it is possible that the United States faced more adverse technological shocks than other countries. Or it could be that in recent times the unemployment rate has become more sensitive to these shocks in the United States than in other countries.

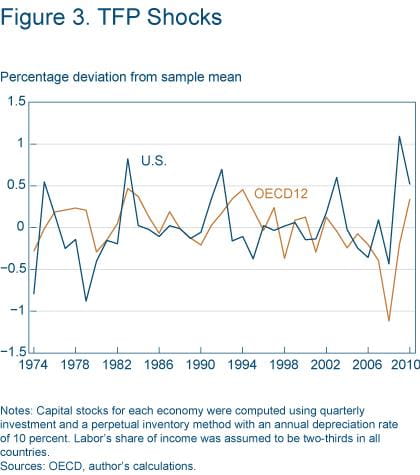

TFP shocks refer to changes in GDP that cannot be accounted for by changes in the measured factors of production: labor and capital. Being a statistical construct, it captures all sorts of things that are not technologically-related in a strict sense. For example, if a manufacturing plant decides not to use all of its capital stock in production, this decision shows up as a negative technological shock—output goes down, while the capital stock measured by the statistical agency is the same.

Although the financial crisis that started in 2007 eventually spread to other countries and gave rise to a worldwide recession, it arguably had some of its more severe effects in the United States, where at some point the stability of the financial system was in the balance. To the extent that financial intermediation problems may show up as negative TFP shocks, it seems reasonable to think that such shocks might have been higher in the United States, leading to a larger increase in the unemployment rate.

To examine whether this is true, I compute TFP shocks for the United States and for the OECD12 countries, from the first quarter of 1975 to the last quarter of 2010. I do that by subtracting the growth rates in hours worked and the capital stock (multiplied by their respective income shares) from the growth rates of GDP. Figure 3 shows TFP growth rates as percentage deviations from their sample mean and puts to rest the notion that TFP shocks were more adverse in the United States than elsewhere in the OECD. While in the OECD12 TFP shocks went as low as 1 percent below their mean, in the United States they decreased only half as much and recovered substantially more.

Another way to put this is to note that since the fall in output in the United States was not very different from that in the average OECD country (see Tasci and Zenker, 2011), the fact that the labor input declined more in the United States means TFP shocks were less adverse.

Unemployment’s Response to TFP Shocks

The other hypothesis we can address with these data is whether the U.S. unemployment rate became more sensitive to TFP shocks in the recent recession relative to the OECD12 countries, and if so, whether the difference is enough to account for the difference in the behavior of the unemployment rates.

To answer this question I run a simple linear regression to find out how much of the fluctuation in unemployment rates can be accounted for by fluctuations in TFP shocks in the United States and in the rest of the OECD countries as a group, while allowing for the importance of TFP shocks to be different in the last recession. I also allow for changes in unemployment rates to be different in the last recession for reasons that are not connected to TFP shocks—the difference may be due to other, unmodeled, shocks. In doing this, I consider two-year averages of both unemployment rate changes as well as TFP shocks, so as to gloss over quarter-to-quarter movements and focus more on a medium-term trend.

I find that, throughout the whole sample period, unemployment rates respond more strongly to TFP shocks in the United States than in the average OECD12 country. But this fact, by itself, cannot explain the recent behavior of the U.S. unemployment rate relative to its foreign counterpart. For TFP shocks to be behind this change, it would have to be the case that the response of the unemployment rate to these shocks increased more in the United States than in the OECD12 countries in the last four years, and that this difference in magnitude was enough to account for the difference in unemployment rate behavior.

The unemployment rate did become more sensitive to TFP shocks during the last recession in the United States. But the increase was not enough to account for any meaningful fraction of the difference in the behavior of unemployment rates. Another way to state this result is that while TFP shocks can account for changes in unemployment rates during the last recession in OECD12 countries, the same cannot be said for the United States. Other shocks, or institutional changes particular to the recession period, account for the bulk of this difference.

While economists have proposed many explanations for the unusually high U.S. unemployment rates during the last recession and recovery, the two that have gained the most traction are a cyclical decrease in aggregate (product) demand and a structural mismatch between the skill mix in the labor force and the one employers are looking for. This distinction is important because while monetary policy can, in principle, do something about the former, it is powerless against the latter. Unfortunately, the analysis here cannot categorically rule out either of these explanations.

Consider the cyclical explanation first. Faced with an adverse aggregate demand shock, firms in the U.S. reduced their employment substantially. To the extent that they kept the more productive workers on their payrolls, this would be consistent with TFP decreasing less than output.

As for the structural explanation, workers that were released from hard-hit sectors like construction were presumably less productive than workers in other sectors. After all, from an economy-wide perspective, there was too much construction. Again, this is consistent with a situation in which employment is decreasing relatively more than output and therefore TFP is decreasing relatively less. The analysis here is silent on why these workers do not get reabsorbed into employment, which the structural story attributes to eroding skills.

In conclusion, the recent paths of unemployment rates in the United States and the OECD seem to have disparate proximate causes. While TFP shocks can account for most of the increase in the average unemployment rate in the OECD, this is not the case in the United States, where other shocks, institutional changes, or interactions of each of these, must be the root cause.

The views authors express in Economic Commentary are theirs and not necessarily those of the Federal Reserve Bank of Cleveland or the Board of Governors of the Federal Reserve System. The series editor is Tasia Hane. This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. This paper and its data are subject to revision; please visit clevelandfed.org for updates.

Recommended Reading and References

- “The Role of Shocks and Institutions in the Rise of European Unemployment: The Aggregate Evidence,” Olivier Blanchard and Justin Wolfers, 2000. Economic Journal (Conference Papers), vol. 110, pp. C1–33.

- “Unemployment in the OECD since the 1960s. What Do We Know?” Stephen Nickell, Luca Nunziata, and Wolfgang Ochel, 2005. Economic Journal, vol. 115, pp. 1–27.

- “Labor Market Rigidity, Unemployment, and the Great Recession,” Murat Tasci and Mary Zenker, 2011. Federal Reserve Bank of Cleveland, Economic Commentary, no. 2011–11.

Suggested Citation

Amaral, Pedro S. 2012. “Technology Shocks and Unemployment in the Last Recession.” Federal Reserve Bank of Cleveland, Economic Commentary 2012-07. https://doi.org/10.26509/frbc-ec-201207

This work by Federal Reserve Bank of Cleveland is licensed under Creative Commons Attribution-NonCommercial 4.0 International

- Share